It’s no longer enough for a blockchain to look good on paper. Real-world usage, from DeFi transactions to payments and gaming, exposes the gaps between a protocol’s ambitions and its real-world capabilities.

Blockchains that once boasted high throughput often buckle under the pressure of peak demand, with slow confirmation times, rising fees, or outright network failures. For developers building consumer-facing apps, that kind of friction can be a dealbreaker. That’s why the race among Layer 1s has shifted from raw innovation to proven execution. Reliability, uptime, and developer support are now just as important as scalability.

Against this backdrop, Solana has emerged as a serious contender, not just because of its speed, but because it’s solving some of crypto’s biggest challenges.

The Coin Bureau first reviewed Solana in 2020. Since then, the network has undergone significant evolution, both technically and culturally. With major upgrades, ecosystem growth, and shifting use cases, Solana today represents far more than just a high-speed alternative to Ethereum. That's why we’re taking a fresh look.

Key Takeaways

- Solana is a high-performance Layer 1 blockchain built for fast, low-cost, and scalable transactions using innovations like Proof of History and Tower BFT.

- Its ecosystem supports DeFi, NFTs, gaming, payments, and memecoins—with tools like Blinks, Firedancer, and Sealevel enhancing UX and performance.

- Solana’s native token SOL powers staking, transactions, governance, and validator incentives, with inflation gradually tapering over time.

- Upgrades like Firedancer and Alpenglow aim to boost stability, decentralization, and sub-second finality for real-time applications.

- Solana continues to gain traction as a leading blockchain for builders and users, offering performance, usability, and developer-friendly tools that go beyond just speed.

What is Solana?

Solana is a high-performance, open-source Layer 1 blockchain built for speed, scalability, and low-cost transactions. Solana was created to push past the limitations of older blockchain platforms like Ethereum, offering an environment where DApps, smart contracts, and crypto assets can thrive without bottlenecks or high gas fees.

Proof of History became the foundation for Solana’s architecture, enabling it to timestamp and sequence transactions with extraordinary speed. This gives Solana its trademark throughput. The network can technically handle up to 65,000 transactions per second (TPS), but you’re not going to see that number flying around every day. That’s a theoretical max, calculated under ideal conditions in a controlled test. In practice, the network hits a few thousand TPS during real usage. As of this writing, Solana is reporting 3,700 TPS, and that’s still impressive.

Compare that to Ethereum’s 15-ish TPS or Bitcoin’s 7, and you start to get why people pay attention.

Unlike blockchains that rely on multiple layers or external scaling solutions, Solana takes a monolithic approach: everything happens on one chain. By leaning on validators and optimized runtime efficiency, the network avoids fragmentation and delivers faster finality. This design has made it a go-to choice for developers building in DeFi, NFTs, and GameFi, with projects like Jupiter, Magic Eden, and Metaplex pushing the boundaries of what’s possible in Web3.

SOL, the network’s native token, plays a key role in this ecosystem. It’s used to pay transaction fees, stake with validators, and secure the network. As Solana’s usage has grown, SOL has also become a core asset in cross-chain infrastructure, with bridges like Wormhole and Circle’s CCTP making it easy to move value between ecosystems.

History of Solana

Solana Founding Timeline

- November 2017 Anatoly Yakovenko publishes the Proof of History whitepaper, introducing a novel way to cryptographically timestamp blockchain events.

- Mid 2018 The project is renamed from “Loom” to “Solana,” inspired by Solana Beach, California.

- 2020 Solana mainnet beta launches, bringing high-throughput capabilities to the public blockchain space.

- 2022 FTX collapses. SOL crashes, key dApps break, and the network enters a period of crisis.

- Early 2018 The first internal testnet is released with Greg Fitzgerald. It processes 10,000 transactions in under half a second.

- 2019 Solana Labs is formally established by Yakovenko, Gokal, Fitzgerald, and Akridge—all with Qualcomm roots.

- 2021 Solana sees explosive growth, fueled by high Ethereum gas fees and early FTX-backed dApps like Serum.

- 2023–2025 Solana rebuilds with a focus on decentralization, Firedancer, and UX upgrades like Blinks and Actions.

Drawing from his work in distributed systems and compression algorithms, Anatoly Yakovenko published a whitepaper introducing a novel concept he called Proof of History (PoH). Unlike traditional consensus mechanisms, PoH offered a cryptographic way to timestamp events, creating a verifiable sequence of transactions that drastically improved execution speed. We’ll touch on this in great detail later in the next section.

Anatoly initially built the prototype in C, working quietly on the idea until he realized that rewriting it in Rust could offer better safety and performance. At the time, Rust was still gaining traction in crypto, and Solana’s embrace attracted a wave of developers eager to work with a modern, high-performance language. To bring the vision to life, Anatoly teamed up with Greg Fitzgerald, a former colleague from Qualcomm, and the two launched the project’s first testnet in early 2018. It processed 10,000 transactions in just 0.5 seconds, a stunning achievement that hinted at Solana’s potential.

Solana Is Built For Speed, Scalability, And Low-Cost Transaction. Image via Solana

Solana Is Built For Speed, Scalability, And Low-Cost Transaction. Image via SolanaInitially dubbed “Loom,” the project had to pivot on branding when it clashed with an existing Ethereum-based project, Loom Network. The team renamed their blockchain “Solana,” inspired by the beach town in California where they’d spent time during their Qualcomm days. With a name locked in and the tech showing promise, Anatoly expanded the founding team by bringing on Raj Gokal and Stephen Akridge, another Qualcomm alum.

By 2021, Solana had caught the attention of developers and users frustrated with Ethereum’s soaring gas fees. However, a major part of Solana’s early breakout can also be traced back to Sam Bankman-Fried and the FTX/Alameda ecosystem. Through Serum, the high-performance on-chain orderbook, and other affiliated projects like Bonfida, Oxygen, and Maps, FTX became a major driver of Solana's adoption. While some of these projects faded, the network gained momentum.

Solana's rapid rise wasn’t without setbacks. Frequent network outages and questions around centralization dogged the protocol's reputation. Then came the collapse of FTX in late 2022, which dealt a devastating blow. SOL's price nosedived, DApps reliant on Serum broke, and sentiment around the network hit rock bottom. Many declared it dead.

But Solana didn’t stay down. What followed was a remarkable rebuilding phase, one that proved the ecosystem's resilience without relying on FTX's influence.

What Makes Solana Unique

Solana sets itself apart in the crowded blockchain space not just with speed, but with the engineering choices that make that speed sustainable.

Key Points

- Solana is unique for its focus on speed, efficiency, and scalability backed by custom-built architecture rather than standard blockchain frameworks.

- Proof of History (PoH) acts as a cryptographic clock that timestamps transactions before consensus, reducing latency and increasing throughput.

- Solana uses the Rust programming language for its smart contracts, enabling fast, safe, and parallel processing with a large and active developer community.

Proof of History: Solana's Secret To Speed

One of the trickiest problems in distributed systems is time. When you don’t have a centralized clock, how do you prove the order of events without having every participant constantly double-check one another? Most blockchains rely on loosely synchronized timestamps or consensus between nodes, which can slow things down. Solana takes a different approach. Its Proof of History creates a verifiable timeline of events that serves as the backbone for its high-speed performance.

At its core, PoH is a cryptographic clock. It allows the Solana network to record events in a specific, verifiable order without needing all nodes to coordinate in real time. Instead of asking, “When did this transaction happen?,” validators can simply check a historical record that proves when each transaction occurred relative to others. This drastically reduces the time and computational overhead needed to reach consensus.

PoH is powered by a Verifiable Delay Function (VDF), a type of cryptographic process that takes a known amount of real time to compute and is impossible to shortcut. In Solana's case, this function involves running a secure hash function (SHA256) repeatedly, with each output becoming the input for the next round. This continuous hashing process acts like a digital metronome, marking time in the network with every new output.

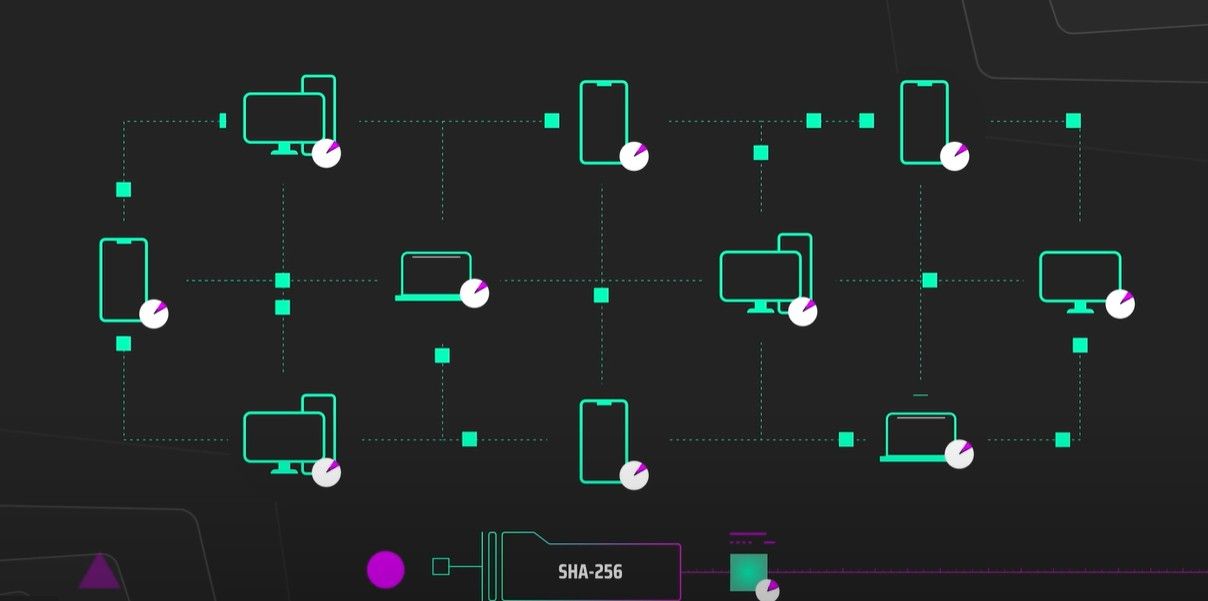

Proof Of History Is Solana's Secret To Speed. Image via YouTube

Proof Of History Is Solana's Secret To Speed. Image via YouTubeEvery so often, the current state of this process, along with a counter, is recorded and published. Because each output depends on the one before it, and because the hash function is both pre-image and collision resistant, it becomes impossible to fake the timeline. You can’t jump ahead, rewrite history, or predict future outputs. Just like taking a picture of today’s newspaper proves when the photo was taken, inserting data into a PoH sequence proves when that data existed.

When Solana produces a block, a designated leader node bundles transactions, timestamps them using PoH, and shares the result with the rest of the network. Other validators can then independently and quickly verify the block’s authenticity and order without cross-checking with peers. The result is dramatically faster block times, lower latency, and near-instant finality.

Another benefit of this system is that verification can be parallelized. While generating the PoH sequence requires sequential work on a single core, verifying it can be distributed across multiple cores or even GPUs. This makes the process scalable and secure, even under heavy load.

Rust Programming Language

Unlike Ethereum, which relies on languages like Solidity and Vyper, Solana smart contracts, called “programs,” are primarily written in Rust.

Rust is a low-level programming language built for performance and safety. Originally developed by Mozilla, it was designed to solve common issues found in older languages like C and C++, especially around memory management and concurrency. What makes Rust stand out is that it can achieve the speed of C/C++ while minimizing bugs like memory leaks and data races.

One of Rust’s biggest advantages is that it allows Solana to process transactions in parallel, helping the network scale without sacrificing security. It also has a massive developer community, which lowers the barrier for non-Web3 engineers to start building on Solana without learning a completely new stack.

Thanks to its versatility, Rust is now used beyond Solana, powering operating systems, browser engines, and even newer blockchains like Aptos and Sui through Rust-based languages like Move.

Solana Technology

Outside of the innovative PoH, Solana has a few other tricks up its sleeves.

Key Points

- Tower BFT is a PoH-powered consensus system that reduces validator messaging and accelerates finality.

- Turbine breaks blocks into smaller shreds and distributes them using a tree-like structure for faster propagation.

- Gulf Stream eliminates the mempool by forwarding transactions directly to current and upcoming block leaders.

- Sealevel allows parallel execution of smart contracts that don’t conflict, significantly boosting throughput.

- Pipelining enables Solana to process different stages of multiple transactions simultaneously via the TPU.

- Cloudbreak is a horizontally scalable data storage model that supports fast and efficient reads and writes.

- Archivers are lightweight nodes that store Solana’s full historical ledger using Proofs of Replication.

Tower BFT

Solana doesn’t use a traditional consensus model. Instead, it runs on Tower BFT, a customized system built on top of Practical Byzantine Fault Tolerance (PBFT). The key difference? Solana uses PoH to keep everyone on the same timeline. This removes the need for validators to constantly communicate before reaching consensus, saving time and reducing network overhead.

Here’s how it works: When validators vote on a block, they commit to that vote for a set period, measured in hashes. Each time they vote again on the same chain, the timeout doubles, making earlier votes harder to reverse. Over time, votes accumulate "weight," and rolling them back becomes nearly impossible. It’s a clever system that rewards consistency — one vote might be undoable in seconds, another in years — and helps the network reach finality quickly.

Because PoH provides a tamper-proof timeline, validators don’t need to ask each other what happened when. They can verify everything just by looking at the ledger. If forks happen, and they do, validators naturally follow the chain with the highest accumulated timeouts. That’s also the one where they’re most likely to earn rewards.

Turbine

Ever wondered how Solana manages to confirm and distribute transactions so quickly across its global network? The answer lies in Turbine, Solana’s custom block propagation protocol. Unlike some traditional blockchains, which rely on a “flooding” method where each node blasts new blocks to every peer it can reach, Turbine takes a more structured approach. Flooding may work for smaller networks, but as things scale, it becomes inefficient and bandwidth-heavy. Solana needed a solution that could handle thousands of transactions per second without slowing down.

Turbine solves this by breaking each block into small pieces called “shreds,” which are then passed through the network using a tiered, tree-like structure. The leader node doesn’t send the entire block to every validator; instead, it sends different shreds to a select few peers, who then relay them to others, and so on. This reduces the load on any one validator and dramatically speeds up how quickly the block data spreads.

Solana Is Often Referred To As An “Ethereum Killer.” Image via Shutterstock

Solana Is Often Referred To As An “Ethereum Killer.” Image via ShutterstockGulf Stream

On most blockchains, transactions first enter a “mempool," which is essentially a waiting area where they sit until they are selected for inclusion in a block. Validators typically prioritize the transactions offering the highest fees, which can lead to congestion and long delays during peak usage. It's a system that works, but it's far from efficient. If you've ever watched your transaction hang in limbo, that's the mempool doing its thing.

Solana takes a very different route. Thanks to a protocol called Gulf Stream, Solana skips the mempool altogether. Instead of waiting in a shared pool, transactions are immediately forwarded to the current block producer and even to the next few scheduled leaders because, with Proof of History, Solana knows exactly who’s up next. This foresight allows transactions to be “pre-cached” by the validators who are about to act on them, reducing latency and improving efficiency.

Sealevel

Most blockchains process smart contract transactions one at a time, like cars stuck in a single-lane road during rush hour. Each contract waits its turn, even if it doesn’t interact with the others. This sequential processing creates a bottleneck that slows everything down and pushes fees higher, especially when demand spikes.

Solana tackles this with Sealevel, a parallel execution engine that allows multiple smart contracts to run at the same time as long as they’re not touching the same data. Think of it like a multi-lane highway instead of a one-way street. Before execution, Sealevel analyzes what each contract needs and whether its actions will conflict. If there’s no overlap, they’re processed simultaneously. This design massively boosts throughput without compromising safety.

Pipelining

In most blockchains, validating transactions is a step-by-step process; each transaction goes through all the phases of validation in sequence before the next one begins. While this model ensures accuracy, it’s not optimized for speed, especially at scale. To counter this, Solana utilizes Pipelining, inspired by how modern CPUs handle tasks. Rather than processing one transaction at a time, Solana breaks down the validation process into separate stages and processes multiple transactions in parallel, each at a different stage of the pipeline.

This happens inside Solana's Transaction Processing Unit (TPU), the core engine of each validator. As one part of the TPU fetches incoming transactions, another part is verifying signatures, while another is executing smart contract instructions. It's a constant, assembly-line flow where every component stays active and efficiently used.

Solana Utilizes Pipelining, Inspired By How Modern CPUs Handle Tasks. Image via Shutterstock

Solana Utilizes Pipelining, Inspired By How Modern CPUs Handle Tasks. Image via ShutterstockCloudbreak

Storing all account data in a single, ever-growing database might work at a small scale, but as a blockchain grows, it becomes a serious bottleneck. Solana knew that if the network was going to support thousands of applications and global usage, it couldn’t rely on a one-size-fits-all storage model. That’s why it introduced Cloudbreak, a horizontally scalable system that splits data into multiple specialized storage units, more like a well-organized library of filing cabinets than one overloaded drawer. This architecture allows the network to scale efficiently, without older data slowing down newer transactions.

What makes Cloudbreak especially effective is how it handles reads and writes. For quick lookups, like checking a token balance, requests are distributed across many storage units, making responses near-instant. And when updates are needed, like transferring tokens, only the specific accounts involved are temporarily locked, while the rest of the system remains fully accessible. This prevents traffic jams, even during peak usage.

Archivers

By now, you're aware that Solana processes thousands of transactions per second. This generates a massive amount of historical data. Storing every transaction and block ever created would quickly overwhelm validators if they had to carry that full burden. That’s where Archivers come in, specialized nodes tasked with storing Solana’s historical ledger data. Think of them as the network’s librarians: they don’t validate transactions or produce new blocks, but they ensure the entire history of the blockchain remains safe, accessible, and intact.

Archivers are designed to be lightweight. They don’t need powerful CPUs or complex software stacks, just ample storage and a stable internet connection. Solana uses Proofs of Replication to make sure these nodes are actually storing the data they claim to be, without requiring constant checks.

SOL Token

SOL is the native token of the Solana blockchain. You can think of SOL as the fuel, the security deposit, and the economic glue holding the Solana ecosystem together. Whether you’re buying an NFT, swapping tokens, or helping run a validator, SOL is the currency that powers the action behind the scenes.

Key Points

- SOL is the native token of the Solana blockchain and is used for transaction fees, staking, smart contract interaction, and governance.

- It acts as both the fuel and security mechanism for the network, enabling everything from NFT purchases to validator rewards.

- About 86.5% of the total SOL supply is circulating, while the rest is locked or held by the Solana Foundation.

- Solana has a decreasing inflation model, starting from 8% and tapering 15% annually.

- SOL can be bought on centralized exchanges like Binance, Coinbase, OKX, and Bybit, or on decentralized platforms like Orca and Meteora.

- To buy SOL: create an account, complete KYC, fund it with fiat or crypto, and place a buy order through your chosen exchange.

SOL Tokenomics

SOL plays several key roles in keeping the network running. It’s used to:

- Pay for transactions (like gas on Ethereum, but much cheaper)

- Stake with validators to help secure the network and earn rewards

- Interact with smart contracts and decentralized applications (DApps)

- Vote in governance (depending on future network upgrades)

Here's a look at the tokenomics:

- Total SOL supply: ~601.5 million

- Circulating: ~520.3 million (86.5%)

- Non-circulating: ~81.2 million (13.5%)

Circulating supply includes all the SOL actively moving around on exchanges, in wallets, or staked with validators. Yes, staked SOL still counts as circulating because it can be withdrawn with just a short wait.

Non-circulating SOL includes:

- Locked stake accounts (from grants or investments, tied to vesting schedules)

- Foundation-held stake, which isn’t locked but used in delegation programs to help decentralize the network

And a quick clarification: locked ≠ staked. Most staked SOL isn’t locked. Locked SOL just means it can’t be withdrawn or sent elsewhere until a certain date.

Inflation: Where New SOL Comes From

- Current inflation rate: 4.514%

- Starting rate: 8.0% (originally 15%)

- Annual taper: 15% (adjusted per ~180 epochs)

Solana's inflation gradually decreases over time. That means fewer new SOL tokens are minted each year, which helps keep the system sustainable long-term.

Stakers earn rewards from inflation, so if you’re not staking, your holdings are being diluted over time. In addition, half of every transaction fee is burned, while the other half goes to validators. Eventually, the plan is for fee revenue to replace inflation as the main way validators get paid.

You Can Buy Solana On Both Centralized And Decentralized Exchanges. Image via Shutterstock

You Can Buy Solana On Both Centralized And Decentralized Exchanges. Image via ShutterstockWhere To Buy Solana

You can buy Solana on both centralized and decentralized exchanges.

- Centralized: Binance, Bybit, Coinbase, and OKX are just a few centralized exchanges you can use to buy Solana.

- Decentralized: You can buy Solana via Orca, Meteora, and PancakeSwap, among many others.

How to Buy Solana

Let's now walk you through the process of buying SOL.

If you're looking to invest in SOL, our step-by-step guides on how to buy Solana in the UK and how to buy Solana in the US have you covered.

Step 1: Set Up Your Exchange Account

Pick a crypto exchange that supports SOL. Sign up using your email or phone number, then verify your identity by submitting a government-issued ID — it's a quick KYC step that centralized platforms require.

Step 2: Fund Your Account

Deposit money using your preferred method. You can choose from bank transfer, debit/credit card, or crypto. Bank transfers are usually cheaper but slower. Credit cards are fast but may come with extra fees, so check with your bank first.

Step 3: Buy SOL

Once your funds are available, search for Solana (SOL) on the exchange, enter the amount you want to buy, and confirm the purchase.

Solana Use Cases

Solana is a foundational layer powering a wide range of real-world applications. From payments and NFTs to institutional infrastructure and gaming.

Real Applications, Not Just Hype

What sets Solana apart is its traction. It’s not just attracting attention, it’s seeing real usage. The ecosystem now supports billions in DeFi, tens of thousands of daily users, and growing enterprise interest from companies like Google Cloud, Mastercard, and Shopify.

Solana's design allows DApps to scale without the overhead of rollups or multiple execution layers. That performance edge translates into better UX for everything from token swaps to loyalty programs.

For a comprehensive exploration of how Solana is revolutionizing sectors like DeFi, NFTs, gaming, and enterprise solutions, delve into our detailed analysis of Solana's diverse use cases here.

Key Sectors Driving Adoption

- DeFi: Platforms like Jupiter, Orca, and Kamino are leading a DeFi revival, combining high throughput with novel features like MEV optimization and automated vault strategies.

- NFTs & Digital Culture: Solana remains a leader in NFT infrastructure, powering projects like Magic Eden and compressed NFTs at scale.

- Enterprise Integration: Solana Pay is now a plug-in for Shopify merchants. Mastercard is building crypto credentials on Solana. Even Asics and Boba Guys have launched tokenized products and programs.

- Gaming: With hundreds of titles in development, from Star Atlas to Aurory, Solana is pushing forward on-chain gaming via tools like Solana Games Kit and Magicblock’s native engine.

- DApps & Tools: Developer activity continues to grow, thanks to Rust, Anchor, and a rich SDK ecosystem. Total Value Locked has climbed above $9 billion, with new user-facing apps launching weekly.

Firedancer

Firedancer is a new validator client being built for the Solana blockchain by Jump Crypto. Unlike Solana’s current setup, which mostly relies on a single client (Agave), Firedancer is built from scratch as a completely independent system.

Why does that matter? Because relying on just one client means if something breaks, the whole network can stumble. Firedancer fixes that by giving Solana more than one engine to rely on.

Key Points

- Firedancer gives Solana a second, fully independent validator client to reduce reliance on Agave and prevent single points of failure.

- It's engineered for extreme speed, with lab benchmarks exceeding 1 million transactions per second.

- Its modular "tile" architecture allows individual components to operate independently for greater fault tolerance.

- Firedancer features a custom networking stack built for lower latency and more efficient data handling.

- It enhances decentralization by adding client diversity to the validator ecosystem.

- Written in C/C++ for maximum performance and control over system-level operations.

- A hybrid version called Frankendancer is already live, with full mainnet rollout expected later in 2025.

Why Solana Needs Firedancer

Solana’s fast, but not invincible. Here’s what Firedancer is helping to improve:

- Single point of failure: Right now, all validators use the Agave client. If it fails, everything stops.

- Network stability: Firedancer adds redundancy, helping avoid outages.

- Performance ceiling: Solana’s current speed is great, but Firedancer is pushing that ceiling way higher.

What Firedancer Brings to the Table

Firedancer isn’t just a safety net; it’s a performance boost, too. It’s been designed with some ambitious goals:

- Speed: In lab tests, it’s hit over 1 million TPS (yes, really).

- Reliability: Built with a modular “tile” structure, so even if one part goes down, the rest can keep running.

- Security: Multiple validator clients mean fewer risks from bugs or exploits.

- Scalability: Better networking code (built from scratch) means lower latency and more efficient data handling.

- Decentralization: Adds diversity to Solana's validator ecosystem, reducing dependency on any one client.

How It Works

- C++/C Implementation: Firedancer is written in low-level languages known for high performance.

- Modular Design: It splits validator responsibilities into smaller parts (“tiles”), each running separately.

Current Status (as of May 2025)

Frankendancer is already live, a hybrid client combining Firedancer’s networking layer with Agave’s consensus engine.

- Observer Mode: Firedancer is currently running on the mainnet in a non-voting role, tracking activity without influencing consensus.

- Full Launch: The full version of Firedancer is expected to go live sometime in 2025.

For devs and validators, Firedancer adds peace of mind. A faster network is great, but a resilient network? That’s what people actually want in the long run.

Alpenglow

Solana developers recently dropped a major proposal, and it's not a small tweak. Alpenglow is a brand-new consensus system that could replace Solana’s current core components, Proof of History (PoH) and Tower BFT. According to the devs, this isn’t just an upgrade; it’s a complete rethink of how Solana finalizes transactions and moves data around the network.

Key Points

- Alpenglow is a proposed overhaul of Solana’s consensus, replacing both Proof of History and Tower BFT.

- Votor is the new finalization system that can reach consensus in 100–150ms with just one round of voting if 80% of validators are online.

- Rotor replaces the Turbine relay protocol with smarter node selection and fewer hops for faster data transmission.

- The new system aims to simplify Solana’s architecture and improve responsiveness under heavy network load.

- Sub-second finality opens the door to real-time applications like gaming, finance, and social platforms.

- Faster transaction confirmation could improve UX and increase demand for SOL by enabling more on-chain activity.

- No launch date confirmed yet, but development is in progress and the Alpenglow whitepaper is available.

What's Being Replaced?

Right now, Solana runs on:

- Proof of History (PoH): A cryptographic timekeeper that timestamps transactions before consensus.

- Tower BFT: A Byzantine Fault Tolerant voting system that locks in blocks after multiple rounds of validator voting.

These two systems helped Solana get fast, but they're complex and sometimes slow when the network’s under pressure.

What Alpenglow Introduces

Alpenglow proposes two big replacements:

- Votor: A new block finalization system that can reach consensus in 100–150 milliseconds.

- One voting round is enough if 80% of validators are online.

- Falls back to two rounds if only 60% are responsive.

- One voting round is enough if 80% of validators are online.

- Rotor: A new data relay system that improves on Solana’s Turbine protocol.

- Fewer “hops” between nodes

- Smarter relay selection

- Better bandwidth distribution for faster data delivery

- Fewer “hops” between nodes

Together, these systems are designed to streamline consensus, reduce coordination delays, and increase responsiveness across the network.

Why It Matters

This isn’t just backend optimization. If Alpenglow lands, it changes what Solana can support, especially for real-time, high-frequency apps.

Here’s what that could mean in practice:

- Sub-second finality: Transactions are confirmed in the blink of an eye.

- Real-time use cases: Gaming, finance, and social DApps feel truly live.

- Better UX: Faster confirmations mean less waiting, fewer retries.

- Boost in SOL demand: More apps → more users → more transactions.

When’s It Coming?

There’s no hard release date yet. The Alpenglow whitepaper is live, and community discussions have started. If it works as planned, Solana could be the first major Layer 1 to consistently offer provable finality under a second.

Blinks And Actions

Solana Blinks and Actions are designed to make using blockchain as easy as clicking a link. Seriously. If you’ve ever hit a “Buy Now” button and your info was already filled in, then you already get the idea.

Key Points

- Blinks and Actions make on-chain transactions feel like clicking a link—seamless, fast, and user-friendly.

- Blinks are shareable URLs that open a wallet with a pre-built Solana transaction ready to be signed.

- Actions are the APIs that power Blinks, generating transactions based on user input and preset logic.

- This design removes friction by eliminating DApp navigation, tab switching, and manual inputs.

The Problem They're Solving

Let’s be honest: interacting with blockchain apps can be clunky. You have to find the right DApp, click through pop-ups, switch between tabs, copy-paste wallet addresses, and hope you didn’t mess something up. Blinks cut through that mess.

- They collapse the entire transaction flow into a single link.

- You stay where you are — Twitter, Discord, a website — and complete the action in your wallet.

- It feels natural, fast, and more like using modern web tools than navigating crypto interfaces from 2017.

For a deeper look at how Solana Blinks and Actions are transforming on-chain interactions, check out our full guide here.

Solana Blinks

Here’s what happens when you click a Blink:

- Action URL Detection: Your wallet or client detects the Blink and reads the embedded Action URL.

- Metadata Fetching: It sends a GET request to pull in metadata, like what this action is and what info it needs.

- UI Rendering: A custom UI pops up in your wallet, letting you input info if needed (amount, address, etc.).

- Transaction Generation: A POST request sends your inputs to the Action endpoint, which returns a ready-to-sign Solana transaction.

- Execution: You review and approve the transaction right in your wallet. That’s it.

Where Can You Use Blinks?

Blinks are built to work across platforms—anywhere a link can live:

- Social Media: Platforms like X (Twitter) render them inside posts. Tip someone directly from your timeline.

- Messaging Apps: Discord bots can unfurl Blinks into tappable buttons inside chats.

- Websites and Blogs: Embed Blinks in a post, newsletter, or product page.

- QR Codes: Scan a Blink QR in real life and instantly open a prefilled blockchain action.

Wallets That Support Blinks

Several Solana wallets already support Blinks natively:

- Phantom: Displays and processes Blinks through its browser extension.

- Backpack: Detects and organizes Blinks inside a dedicated interface.

- Solflare: Full support for Blink interactions across platforms.

- OKX Wallet: Integrated support for Solana Blinks and Actions.

Benefits of Using Blinks

- One-click transactions: No hunting down contracts, switching tabs, or guessing what you’re signing.

- Frictionless UX: Let users interact with blockchain from the platforms they already know.

- Cross-platform: Works on mobile, desktop, and anywhere that can display a URL.

- Easy integration for devs: Developers just host an API, list it in a JSON file, and link it anywhere.

Blinks And Action Make Web3 Feel Less Like Using Command-Line Software And More Like Browsing The Web. Image via Solana

Blinks And Action Make Web3 Feel Less Like Using Command-Line Software And More Like Browsing The Web. Image via SolanaSolana Actions

If Blinks are the “buttons,” Actions are the engine under the hood. They're APIs that generate ready-to-sign transactions based on user input and preset logic.

Here’s how an Action works step by step:

- GET Request: The client fetches metadata like labels, prompts, and instructions.

- Render UI: Your wallet shows a simple form or button.

- POST Request: After input, the wallet sends a POST request with your wallet address and other data.

- Transaction Ready: The Action replies with a base64-encoded, signable transaction.

All of this happens off-chain, but the transaction itself is 100% compatible with Solana’s runtime.

What Can You Do with Actions?

Here are some real examples of what Actions are being used for right now:

- Tipping or Donations: Send SOL with one click via a tweet.

- NFT Minting: Mint directly from a post, no dApp required.

- Staking: Delegate SOL from a Blink with pre-filled options.

- DAO Voting: Vote on governance proposals via links in chat or dashboards.

- E-commerce: Buy physical or digital goods with embedded payment links.

- Token Swaps: Trigger a DEX trade with preconfigured swap instructions.

These use cases cover DeFi, governance, commerce, and creator tools. They all happen through a single, click-to-confirm experience.

Why It Matters

Blinks and Actions aren't just neat features—they’re a big step toward making crypto usable without needing a tutorial.

- No more bouncing between tabs.

- No more copy-pasting wallet addresses.

- No more guessing which dApp is legit.

Top Solana Wallets

Looking for the best wallet to store your SOL or interact with the Solana ecosystem? Whether you’re staking, trading NFTs, or just tracking your portfolio, picking the right wallet makes all the difference.

Key Points

- Phantom is the most popular Solana wallet, supporting Solana, Ethereum, and Polygon with built-in staking and Ledger support.

- Solflare is a Solana-only wallet that offers mobile and browser apps, live chat support, staking, and Ledger integration.

- Exodus supports 1,000+ cryptocurrencies, updates regularly, offers staking, and integrates with Trezor hardware wallets.

- Atomic Wallet lets users stake 20+ PoS assets across 300+ coins, with full control over private keys and broad device support.

- Ledger Stax is a premium hardware wallet with an E Ink touchscreen, designed for usability and seamless integration with Solana wallets.

Need a secure place to store your SOL? Explore the best options in our guide to the top Solana wallets.

1. Phantom

- Trusted by over 15 million users

- Known as the MetaMask of Solana

- Supports Solana, Ethereum, and Polygon

- Built-in staking with independent validators

- Connects with Ledger for extra security

2. Solflare

- Focused completely on the Solana blockchain

- Available on browser and mobile

- Offers live chat support

- Allows you to stake SOL and connect to Ledger

Non-Custodial Wallets Are The Way To Go. Image via Shutterstock

Non-Custodial Wallets Are The Way To Go. Image via Shutterstock3. Exodus

- Supports 1,000+ cryptocurrencies

- Great for multi-chain investors

- Regular software updates

- Offers staking and connects to Trezor hardware wallets

- Responsive support via chat and email

4. Atomic Wallet

- Supports 300+ coins, including SOL

- Lets you stake over 20 Proof-of-Stake assets

- Available on PCs, Macs, Android, iOS

- You keep full control over your private keys

5. Ledger Stax

- Designed by Tony Fadell (yep, the iPod guy)

- Features a slick E Ink touchscreen

- Manages 5,000+ coins, including SOL

- Integrates smoothly with Phantom and others

- Prices at $399

Solana Ecosystem

Solana isn’t just fast, it’s busy. From DeFi protocols making swaps easier, to compressed NFTs hitting millions of wallets, to real businesses accepting payments via Solana Pay, it’s not theory anymore – it’s actually being used.

In this section, we’ll explore some of the best projects on Solana.

Key Points

- Jupiter, Meteora, Raydium, Pump.fun, Kamino, and Solayer are some of the best-performing and most widely used projects on the Solana blockchain.

- Jupiter evolved from a simple swap aggregator into Solana’s top DeFi hub, offering perpetuals, token launches, and portfolio tools.

- Meteora powers dynamic liquidity for meme tokens via DLMM.

- Raydium is a large DEX on Solana, now expanding with perpetuals and its own token launchpad, LaunchLab.

- Pump.fun drove Solana’s memecoin wave and now routes all tokens to its new native DEX, PumpSwap, with creator revenue features.

- Kamino Finance leads Solana lending with over $2.5B TVL, thanks to smart automation, scam wick protection, and a live token points program.

- Solayer began as a restaking protocol and now runs sUSD, DeFi tools, and is building its own high-performance SVM chain.

For an in-depth look at the most promising projects within the Solana ecosystem, explore our comprehensive guide to the top Solana projects.

Jupiter

Jupiter started out simple: just a DEX aggregator that helped you get the best deal on swaps. But fast forward to now, and it’s basically the front door to Solana DeFi. The platform now has everything from perpetuals and token launches to a portfolio tracker and its own token terminal.

Its growth? Fueled by acquisitions. Jupiter has picked up platforms like SonarWatch, Coinhall, Solana.FM, MoonShot, and recently, DRiP Haus, an NFT distribution app.

After the memecoin mania cooled off, Jupiter quietly took the top spot for fee generation across the Solana network, pulling in $1.7 million a day, according to the most recent numbers by DeFiLlama.

Meteora

You may not know Meteora by name, but if you’ve been LP’ing or minting tokens on Solana, there’s a good chance you’ve touched it. Owned by the Jupiter team, Meteora runs on a system called DLMM (Dynamic Liquidity Market Maker). Think of it as letting pools adjust dynamically instead of being stuck with one price curve.

It’s become the go-to spot for meme tokens like MELANIA, ME, and PENGU.

For a comprehensive overview of the leading DEXs on the Solana blockchain, explore our detailed analysis of the top Solana DEX platforms.

Solana Boasts A Vibrant Ecosystem. Image via Shutterstock

Solana Boasts A Vibrant Ecosystem. Image via ShutterstockRaydium

In 2025, Raydium dropped its own perpetuals platform, following the footsteps of platforms like Hyperliquid, and recently announced “LaunchLab,” a token launchpad to go head-to-head with Pump.fun.

Pump.fun

Pump.fun launched in early 2024 and immediately set the tone for the next era of Solana: chaotic and creative. It lets anyone spin up a token in seconds, and that’s exactly what people did, with results making headlines for their memes and rugpulls.

Pump.fun has generated over $500 million in revenue, and now it’s evolving into its own mini-ecosystem. It just launched PumpSwap, a native DEX with lower fees and creator revenue sharing. All tokens from Pump.fun now graduate to PumpSwap by default instead of Raydium.

Kamino Finance

After refining its vault system and launching Lend V2, Kamino became the largest lending protocol on Solana, with over $2.5 billion in TVL.

Kamino’s “Vault Layer” automates and optimizes lending across pools, while its Scam Wick Protection helps shield users from sudden fake price spikes during liquidations. It’s basically making lending feel safe again.

Solayer

This is Solana’s version of EigenLayer. It started off as a restaking project but quickly expanded its scope. Now it has its own US Treasury-backed stablecoin (sUSD), a growing DeFi hub, and even its own chain in the works, Solayer InfiniSVM, a hardware-accelerated SVM Layer 1.

The project dropped its LAYER governance token in early 2025, briefly hitting a $300M market cap.

Solana Memecoins

Solana has rapidly become the leading platform for launching and trading memecoins, thanks to a combination of technical strengths and strong community dynamics. While memecoins are often viewed as speculative or playful, their success on Solana is closely tied to the network’s unique capabilities.

Key Points

- Solana has become the go-to blockchain for launching memecoins due to its speed and accessibility.

- 400ms block times enable instant trading and rapid token launches with minimal delay.

- Ultra-low transaction fees make meme participation affordable for everyone.

- Solana’s on-chain architecture removes the need for central servers, allowing fully decentralized token tools.

- An active, meme-driven community helps tokens go viral quickly through platforms like Twitter and Telegram.

Solana’s infrastructure is designed for speed and scale. Transactions confirm in just 400 milliseconds, allowing near-instant execution even during periods of high activity. Fees are extremely low, averaging around 0.0006 SOL per transaction—making it affordable for both developers and everyday users to interact with the network at scale.

Solana Has Proven To Be a Fertile Ground For Memecoins. Image via Shutterstock

Solana Has Proven To Be a Fertile Ground For Memecoins. Image via ShutterstockSeveral core features make Solana particularly well-suited for memecoin activity:

- High throughput ensures the network remains responsive, even during large-scale token launches

- Developers can build fully on-chain programs, eliminating the need for centralized servers or intermediaries

- Near-zero transaction fees lower the barrier to entry for creators and participants alike

While the technical foundation is key, Solana’s memecoin ecosystem is also driven by its highly engaged community. From coordinated social campaigns on Twitter and Telegram to instant meme propagation across NFT circles, Solana’s users play an active role in discovering, amplifying, and trading new tokens.

This grassroots energy has made Solana an ideal testing ground for viral token ideas. In contrast to other blockchains, where high fees or slower confirmation times can discourage experimentation, Solana allows memecoin projects to launch and scale quickly with minimal overhead.

Closing Thoughts

Solana has evolved from a high-speed experiment into a robust, developer-friendly blockchain that’s proving itself in real-world conditions. With innovations like Proof of History, Firedancer, and Blinks, it’s tackling the technical bottlenecks that limit other Layer 1s and offering tools that feel familiar to Web2 users and scalable for Web3 builders.

Despite setbacks in its early years, Solana has shown resilience, community strength, and a relentless drive to improve. Whether it’s powering DeFi, NFTs, payments, or memecoins, Solana isn’t just promising a better blockchain experience, it’s actively delivering one.

As the network continues to grow and evolve with upgrades like Alpenglow and Firedancer, the question isn't whether Solana can keep up with demand, it’s what developers and users will build with all that speed, efficiency, and flexibility.