Initially designed as a static store of value secured by a proof-of-work system, Bitcoin has evolved into a dynamic asset within the decentralized finance (DeFi) ecosystem. Today, Bitcoin plays a pivotal role in various DeFi applications across multiple blockchains.

Bitcoin's Integration into DeFi

The integration of Bitcoin into DeFi has led to several innovative use cases:

- Lending and Borrowing: Bitcoin is a significant asset on lending and borrowing platforms. These platforms allow users to earn interest or obtain loans using BTC as collateral.

- Wrapped Bitcoin (WBTC): To facilitate Bitcoin's use in DeFi applications on other blockchains, especially Ethereum, BTC is tokenized into Wrapped Bitcoin (WBTC). This ERC-20 token maintains a 1:1 peg with Bitcoin, enabling seamless interaction with Ethereum-based DeFi protocols.

- Layer 2 Solutions: Bitcoin's Layer 2 ecosystem has expanded, introducing solutions like the Lightning Network, Rootstock (RSK), and Stacks. These platforms enhance Bitcoin's scalability and enable smart contract functionality, thereby securing new blockchains and broadening Bitcoin's utility.

Quantifying Bitcoin's DeFi Presence

The growth of Bitcoin's participation in DeFi is evident through several metrics:

- Total Value Locked (TVL) in DeFi: The overall TVL in Bitcoin across multiple DeFi blockchains reached approximately $9.87 billion in February 2025 (per DeFiLlama).

- Expansion of Layer 2 Projects: From 2021 to 2024, the number of Bitcoin Layer 2 projects increased from 10 to 75, highlighting the rapid development in this sector.

Emergence of Yield Opportunities

These developments have unlocked various avenues for Bitcoin holders to generate yield:

- Staking: Platforms now offer staking opportunities where users can lock up their BTC to support network operations and, in return, earn rewards.

- Liquidity Provision: By providing liquidity in DeFi protocols, Bitcoin holders can earn fees and incentives, enhancing the asset's profitability.

- Yield Farming: Yield farming allows users to earn additional tokens by participating in various DeFi strategies involving Bitcoin.

Introducing Solv Protocol

Amidst this evolving landscape, the Solv Protocol emerges as a DeFi project aiming to create a unified staking layer for Bitcoin. By leveraging existing BTC yield strategies within Web3, Solv Protocol seeks to streamline and enhance the staking experience for Bitcoin holders.

Solv Protocol – A Bitcoin Liquid Staking Primitive | Image via Solv Protocol

Solv Protocol – A Bitcoin Liquid Staking Primitive | Image via Solv ProtocolIn this review, we will explore the workings of the Solv Protocol, guide you through its usage, and understand its underlying mechanisms, shedding light on how it contributes to Bitcoin's dynamic role in the DeFi ecosystem.

Solv Protocol Products and Features

The Solv Protocol's main products include a wrapped Bitcoin and a BTC-backed liquid staking token. Here’s what you need to know about them:

SolvBTC

SolvBTC is the native wrapped Bitcoin token within the Solv Protocol ecosystem. It is engineered to mirror Bitcoin's value while enhancing its utility across DeFi platforms and ensuring interoperability across multiple blockchains.

The Concept of Wrapped Bitcoin

Bitcoin, while being the pioneering cryptocurrency, was not originally designed with the flexibility required for seamless integration into the rapidly evolving DeFi landscape. To bridge this gap, the concept of "wrapped" Bitcoin emerged. Wrapping Bitcoin involves locking BTC in a secure reserve and issuing an equivalent token on another blockchain, such as Ethereum. This tokenized version maintains a 1:1 peg with Bitcoin, allowing holders to utilize their assets in various DeFi applications, including lending, borrowing, and liquidity provision, without directly interacting with the Bitcoin network.

Existing Wrapped Bitcoin Solutions

Several wrapped Bitcoin projects have been introduced to facilitate Bitcoin's participation in DeFi:

- Centralized Solutions: Tokens like Wrapped Bitcoin (WBTC) and Binance's BTCB are managed by centralized entities that oversee the custody of the underlying BTC reserves. While they offer high liquidity and are widely adopted, they rely on trusted custodians, introducing centralization risks.

- Decentralized Solutions: Projects such as tBTC, dlcBTC, and BTC.b (on the Avalanche chain) aim to provide trustless, decentralized alternatives. However, these tokens often face challenges related to liquidity and limited integration within DeFi markets, hindering their widespread use.

- Fragmentation Issues: Multiple wrapped Bitcoin tokens operate on different chains and under varying protocols, making these assets non-fungible. This fragmentation results in market inefficiencies and dispersed liquidity, complicating the seamless transfer and utilization of Bitcoin across diverse DeFi platforms.

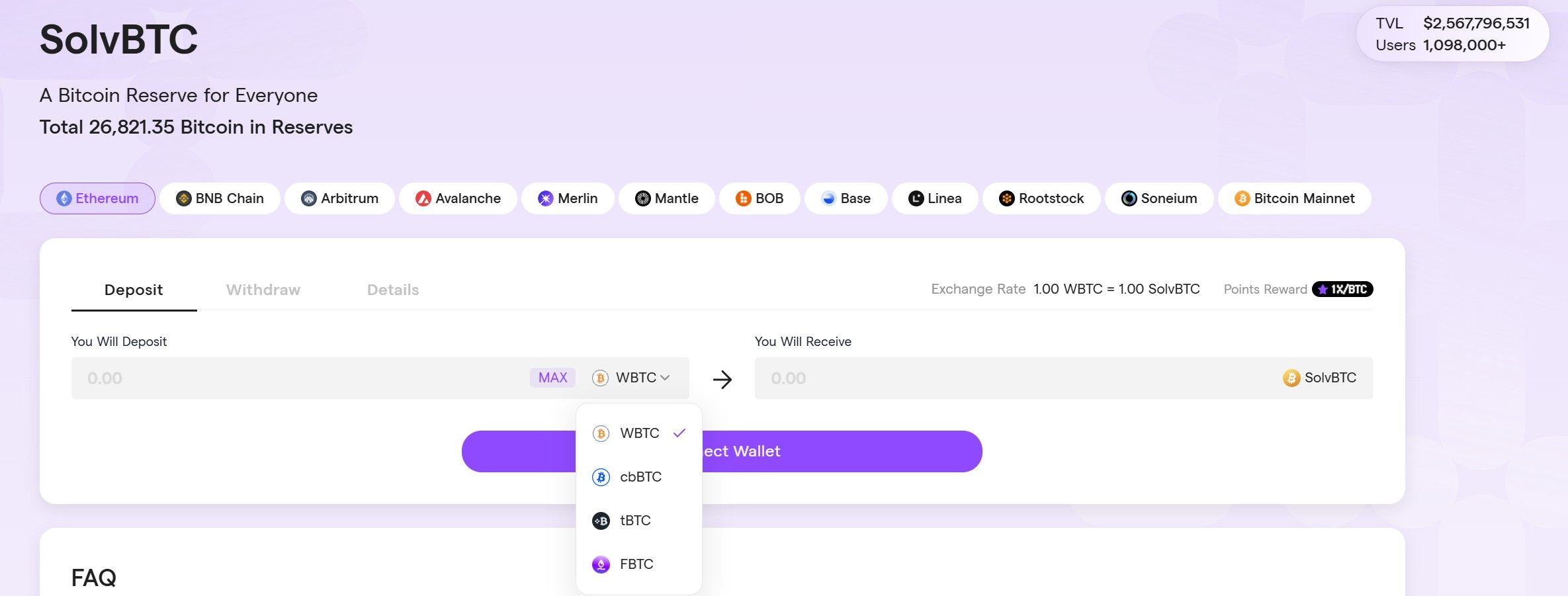

You Can Exchange Other Bitcoin Wrapped tokens for SolvBTC | Image via Solv Protocol

You Can Exchange Other Bitcoin Wrapped tokens for SolvBTC | Image via Solv ProtocolSolvBTC's Approach to Unified Liquidity

Solv Protocol addresses these challenges by introducing SolvBTC, a wrapped Bitcoin token designed to unify liquidity and enhance interoperability:

- Bitcoin Reserve: SolvBTC is backed by a diversified reserve pool comprising native BTC, BTCB (Binance's wrapped Bitcoin), and cbBTC (Base's wrapped Bitcoin). This structure ensures robust backing and trust in the token's value.

- Minting SolvBTC: Users can mint SolvBTC by depositing existing wrapped Bitcoin tokens, including WBTC, cbBTC, tBTC, and FBTC, through the Solv Protocol application. This process consolidates various wrapped Bitcoin assets into a single, more versatile token.

- Supported Chains: SolvBTC operates across multiple blockchains, such as Ethereum, BNB Chain, Avalanche, Arbitrum, Base, BOB, Mantle, and Merlin. The protocol employs Chainlink's Cross-Chain Interoperability Protocol (CCIP) to enable seamless bridging of SolvBTC tokens across these networks, promoting unified liquidity and ease of transfer.

- Yield Opportunities: Holders of SolvBTC can stake their tokens within the Solv Protocol app to receive Liquid Staking Tokens (LSTs). These LSTs generate yields derived from various third-party protocols, offering users the potential to earn passive income while maintaining liquidity.

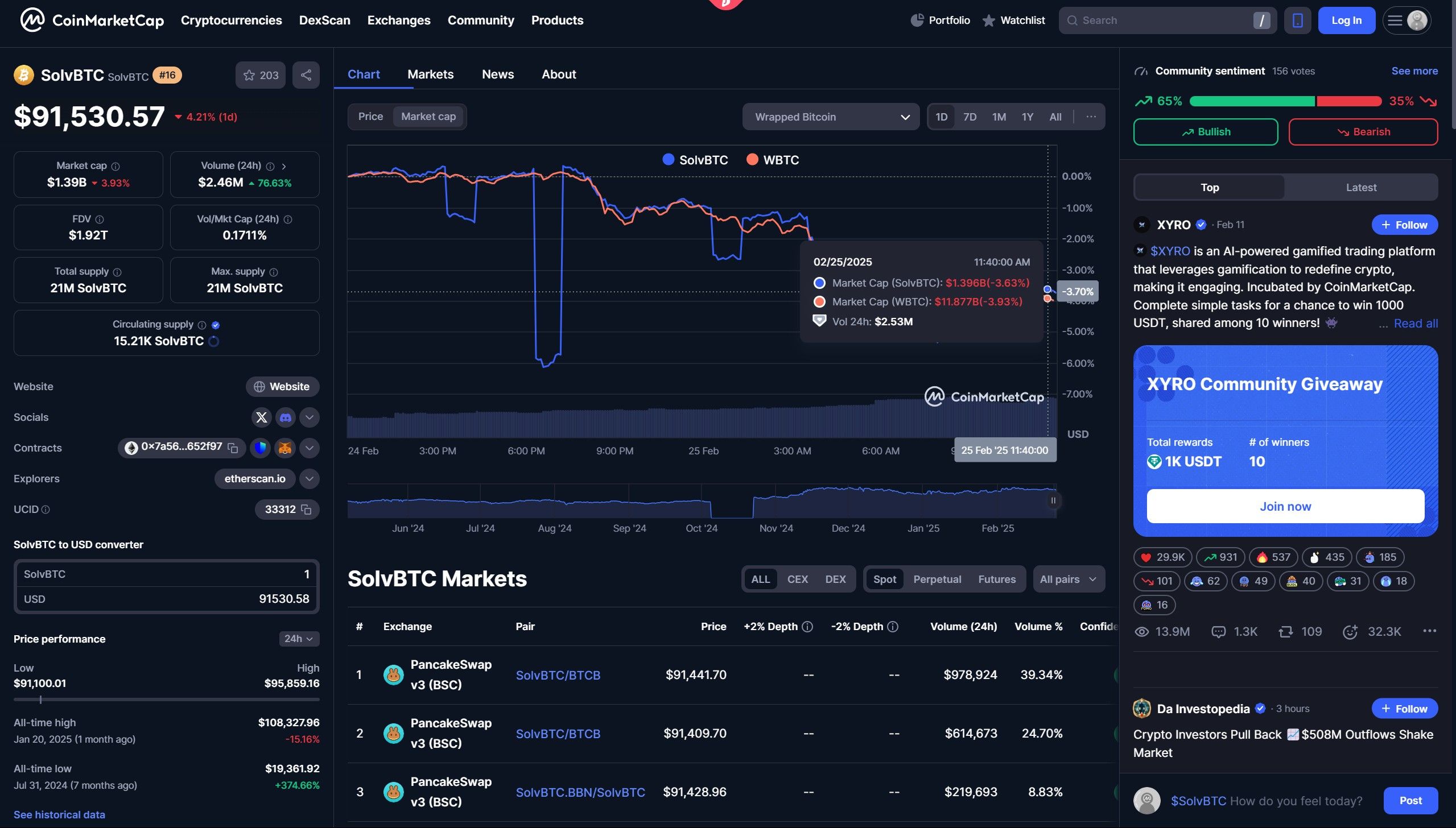

SolvBTC Stats Compared Against WBTC | Image via CoinMarketCap

SolvBTC Stats Compared Against WBTC | Image via CoinMarketCapAs of February 2025, the Solv Protocol has minted approximately 15,171 SolvBTC tokens, with a total market capitalization of around $1.39 billion (per CoinMarketCap data). Wrapped Bitcoin (WBTC), the most prevalent wrapped Bitcoin token, boasts a market cap nearly 10 times larger. SolvBTC's innovative approach aims to streamline the wrapped Bitcoin landscape, address existing inefficiencies, and provide a more cohesive and rewarding experience for Bitcoin holders venturing into the DeFi space.

SolvBTC.LSTs

Solv Protocol has introduced a liquid staking solution for its wrapped Bitcoin token, SolvBTC. To understand this innovation, we must first explore the concept of liquid staking.

Understanding Liquid Staking

In traditional Proof-of-Stake (PoS) networks, staking involves locking up a cryptocurrency to support network operations, earning rewards in return. However, this process renders the staked assets illiquid, restricting their use in other financial activities. Liquid staking addresses this limitation by allowing users to stake their assets while retaining liquidity.

For example, in the Ethereum ecosystem, platforms like Lido facilitate liquid staking by enabling users to stake any amount of ETH without running a personal validator node. In return, users receive stETH tokens representing their staked ETH, which can be freely traded or used in decentralized finance (DeFi) applications. They can also continue to earn staking rewards.

This approach is well-suited for Ethereum, as the staking rewards are derived directly from its native PoS consensus mechanism. However, Bitcoin operates on a Proof-of-Work (PoW) system, which doesn't natively support staking; implementing liquid staking is more complex.

Key Qualities for Effective Liquid Staking

To establish an effective liquid staking mechanism, an asset should possess the following attributes:

- Demand: There must be a strong desire to hold the asset, accompanied by sufficient liquidity.

- Source of Yield: A stable and reliable source of yield is essential; without it, staking lacks financial incentive.

- Demand for Yield: The yield should be attractive enough to encourage holders to invest their assets over the long term.

Ethereum's liquid staking tokens (LSTs) fulfill these criteria:

- Demand: ETH is a widely held and actively traded asset.

- Source of Yield: Staking rewards are generated from Ethereum's PoS consensus mechanism.

- Demand for Yield: The staking rewards provide a compelling incentive for ETH holders to participate in staking.

In contrast, Bitcoin inherently satisfies the demand attribute due to its prominence and liquidity. However, it lacks a native source of yield, necessitating sourcing yield opportunities from secondary markets to create a viable liquid staking token.

Solv Protocol's Yield Sources

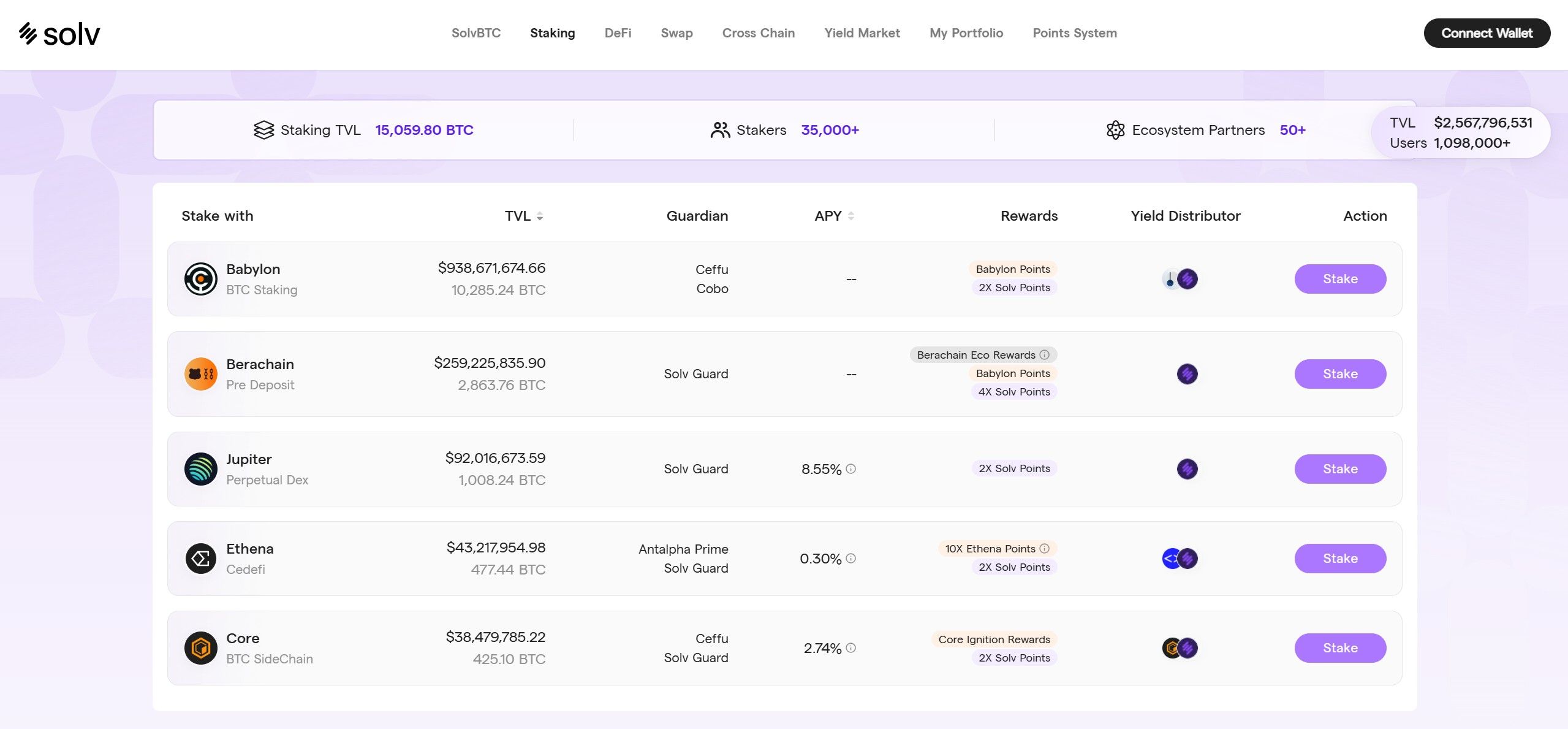

To offer meaningful yields for SolvBTC holders, Solv Protocol collaborates with various third-party platforms that have established Bitcoin yield markets. Key partnerships include:

- Babylon BTC Staking: Babylon enables Bitcoin holders to stake their BTC to secure other PoS blockchains. By leveraging Bitcoin's security, stakers earn rewards in the native tokens of the secured chains, extending Bitcoin's utility beyond its network.

- Berachain Pre-Deposit: Berachain, an EVM-compatible blockchain, offers a pre-deposit phase where users can lock BTC before the mainnet launch. Depositors earn native tokens or points convertible to future rewards, incentivizing early participation.

- Jumper Perpetuals DEX: SolvBTC.JUP allows users to engage in a delta-neutral trading strategy by providing liquidity to the Jupiter Liquidity Provider (JLP) Pool. This approach minimizes market exposure through hedging on centralized exchanges, with yields generated from trading fees and borrowing activities.

- Ethena CeDeFi Protocol: Ethena combines centralized custody with DeFi strategies, utilizing BTC in delta-neutral products. Stakers receive SolvBTC.ENA tokens accrue yields from synthetic USD (sUSDe) farming, Ethena SATs, and Solv Points, all while maintaining Bitcoin exposure.

- Core BTC Sidechain: By staking Bitcoin on the Core Network through Solv Protocol, users mint cBTC on Core's EVM-compatible chain. Stakers earn CORE tokens as rewards for securing the network, with an estimated annual return of up to 4%.

How Liquid Staking Works on Solv Protocol

Within the Solv Protocol app, users can choose from the available LST options corresponding to the partnerships mentioned above. By depositing SolvBTC tokens, users mint the respective LSTs (e.g., SolvBTC.BBN for Babylon). Depending on the yield source, these LSTs may be:

- Value-Accruing Tokens: The token's value increases over time as yields are accumulated.

- Rebasing Tokens: The quantity of tokens in the holder's wallet increases periodically to reflect the earned yields.

Additionally, Solv Protocol's LSTs are interoperable across supported networks, facilitated by Chainlink's Cross-Chain Interoperability Protocol (CCIP), ensuring seamless cross-chain functionality.

Solv Protocol Liquid Staking Offerings | Image via Solv Protocol

Solv Protocol Liquid Staking Offerings | Image via Solv ProtocolSolv Protocol effectively brings liquid staking to Bitcoin through these innovative solutions, enabling BTC holders to earn yields while maintaining liquidity and cross-chain interoperability.

Solv Points System

Complementing the Solv staking products is the Solv Points System, designed to reward user engagement within the ecosystem. Participants can earn Reserve Points (RP) through holding SolvBTC, staking, and providing liquidity. The points system operates on a Bitcoin-based model, awarding 1,000 RP per 1 BTC held daily. These points can enhance users' benefits within the platform and may be convertible to SOLV tokens during specific events, such as airdrops.

The SOLV token is central to the Solv Protocol's operations, offering governance rights, staking rewards, and fee incentives. The integrated Solv Points System encourages active user participation, fostering a robust and dynamic ecosystem.

Solv Protocol Products: A Summary

Solv Protocol introduces a structured approach for Bitcoin holders to earn passive yields without engaging in complex DeFi strategies. By integrating a wrapped Bitcoin solution (SolvBTC) with a liquid staking layer (SolvBTC.LSTs), the protocol offers BTC holders an opportunity to generate yield while maintaining asset liquidity.

One of the primary appeals of Solv Protocol is its accessibility for retail Bitcoin holders. Since many BTC investors prefer to hold rather than actively trade or deploy their assets, SolvBTC provides a convenient way to earn yields without requiring them to engage in multiple platforms or technical strategies. Instead of managing Bitcoin across different protocols, SolvBTC simplifies participation in yield generation by consolidating wrapped Bitcoin liquidity and providing staking options.

Potential risks:

However, Solv Protocol’s reliance on third-party projects introduces an element of external dependency. The backing of SolvBTC includes reserves of other wrapped Bitcoin tokens—such as WBTC, BTCB, and cbBTC—that Solv does not govern. Any issues with these underlying assets, including regulatory actions, security breaches, or liquidity crises, could impact the stability of SolvBTC itself. Similarly, the yield generated for SolvBTC.LST holders are entirely sourced from external projects like Babylon, Berachain, and Ethena, each carrying distinct risk factors. The reliance on third-party platforms means that Solv’s staking rewards are only as reliable as the protocols it integrates with.

Another challenge is SolvBTC's current market accessibility and LST variants. While the protocol aims to establish a widely liquid Bitcoin staking token, the existing markets for trading Solv tokens are somewhat limited. Liquidity pools for SolvBTC are primarily available on PancakeSwap (on BNB Chain) and Uniswap (on Ethereum), with fewer options for direct trading on other chains. This limited liquidity could impact the ease of entering and exiting positions, especially for larger holders looking to capitalize on yield opportunities.

Overall, Solv Protocol presents a compelling solution for Bitcoin holders seeking passive income opportunities but is still in the early stages of market adoption. While it offers a streamlined way to earn yield from BTC, its dependence on external projects and the current liquidity landscape are key factors to consider when assessing its long-term sustainability.

SOLV Token

The SOLV token is the native utility token within the Solv Protocol ecosystem, playing a pivotal role in governance, staking, and fee structures.

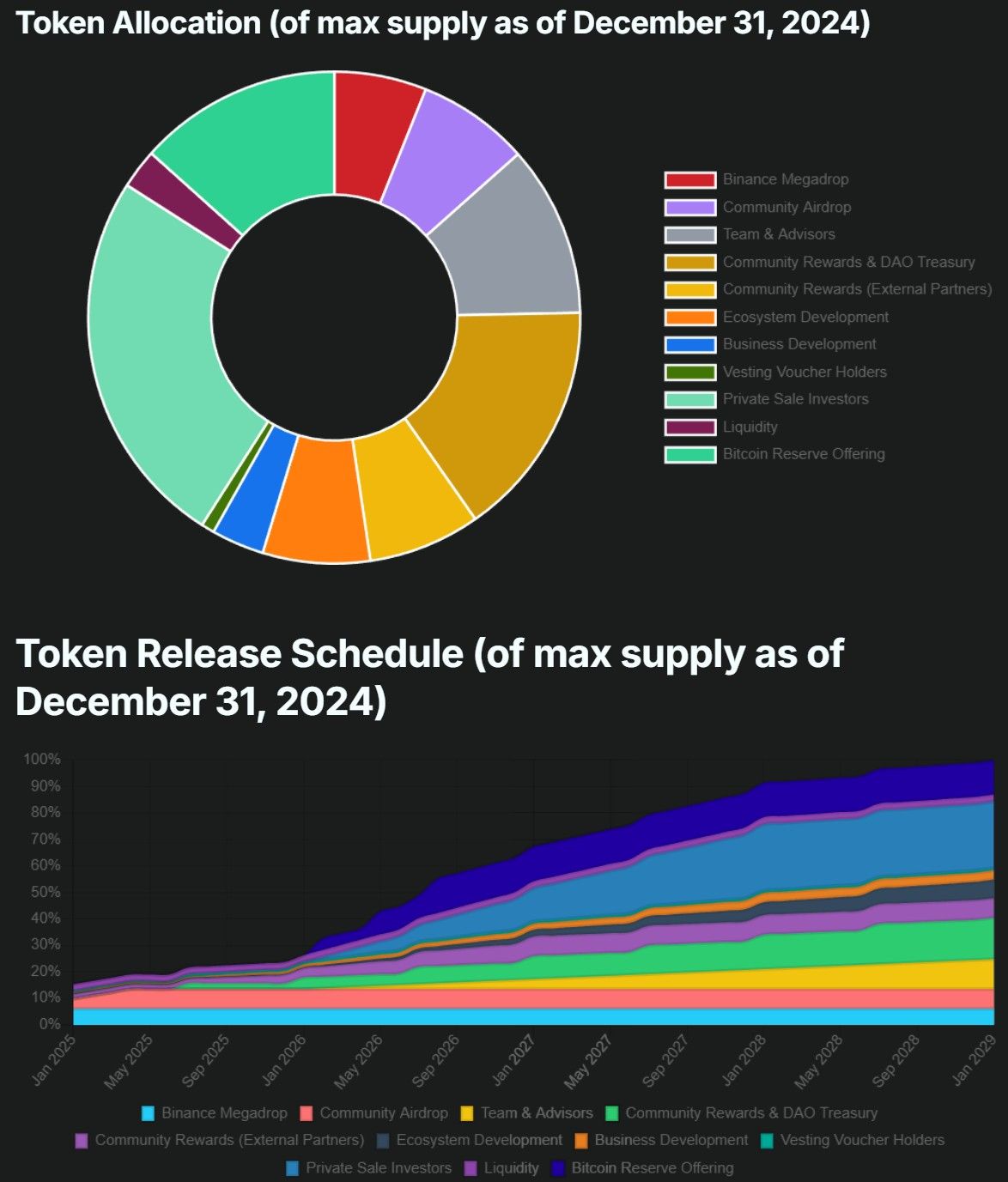

Token Supply and Distribution

- Maximum Supply: 9,660,000,000 SOLV tokens. This dynamic cap may be adjusted through network governance, particularly for initiatives like the Bitcoin Reserve Offering (BRO).

- Genesis Supply: 8,400,000,000 SOLV tokens.

- Circulating Supply at Launch: Upon listing on Binance, 1,482,600,000 SOLV tokens were circulated, representing 17.65% of the genesis supply and 15.35% of the maximum supply.

Allocation Breakdown

The initial distribution of the genesis supply is as follows:

- Private Sale Investors: 28.86%

- Community Rewards & DAO Treasury: 18.00%

- Team & Advisors: 13.00%

- Community Airdrop: 8.50%

- Community Rewards (External Partners): 8.50%

- Ecosystem Development: 8.14%

- Binance Megadrop: 7.00%

- Business Development: 4.00%

- Liquidity: 3.00%

- Vesting Voucher Holders: 1.00%

Notably, 13.04% of the maximum supply is allocated for the Bitcoin Reserve Offering, which was not part of the initial genesis supply.

SOLV Token Supply and Vesting Schedule | Image via Solv Docs

SOLV Token Supply and Vesting Schedule | Image via Solv DocsToken Utility

SOLV tokens are integral to the Solv Protocol, offering several key utilities:

- Governance: Token holders can participate in network governance decisions, influencing the protocol's future by voting on proposals.

- Staking: Users can stake SOLV tokens within the Staking Abstraction Layer to earn protocol emissions, providing incentives for active participation.

- Fee Discounts: Holding or staking SOLV tokens grants users discounts on various protocol fees, including redemption fees associated with SolvBTC.

Bitcoin Reserve Offerings

The Bitcoin Reserve Offering (BRO) is a strategic initiative by Solv Protocol to bolster its on-chain Bitcoin reserves while engaging the community through convertible note sales. In 2025, Solv plans to conduct three BROs, each issuing 42 million SOLV tokens designated exclusively for these sales. The primary objective is to acquire additional Bitcoin (BTC) to enhance the protocol-owned reserve.

Mechanism Details:

- Convertible Note Sales: Participants in each BRO purchase convertible notes that mature after one year. These notes can be converted upon maturity into SOLV tokens, with claim periods scheduled for Q1, Q2, and Q3 of 2026, respectively.

- Governance and Supply Adjustments: Following the initial BROs, the Decentralized Autonomous Organization (DAO) overseeing Solv Protocol will govern any subsequent offerings. This governance structure allows for potential adjustments to the token supply through network consensus to support future BROs.

By implementing the Bitcoin Reserve Offering, Solv Protocol aims to expand its Bitcoin reserves transparently and inclusively, providing opportunities for community participation in its growth and sustainability.

Solv Protocol Risk and Security Considerations

Solv Protocol offers innovative solutions for Bitcoin holders to earn passive yields through products like SolvBTC and its Liquid Staking Tokens (LSTs). However, it's essential to recognize the inherent market risks associated with the protocol's reliance on third-party platforms. The backing of SolvBTC involves reserves of other wrapped Bitcoin tokens—such as WBTC, BTCB, and cbBTC—that are not under Solv's direct control. Additionally, the yields generated for SolvBTC.LST holders are sourced from external projects, each carrying its own risk profile. This dependence means that any vulnerabilities or issues within these third-party platforms could directly impact the stability and returns of Solv Protocol's offerings.

Solv Guardian System

Solv Protocol has implemented the Solv Guardian system to enhance security and mitigate potential risks. This intermediary layer operates between the underlying assets and users' holdings, providing an additional security mechanism atop existing smart contracts. Built upon the multi-signature capabilities of the "Safe" smart contract wallet, Solv Guardian enforces tailored permission controls and restrictions for asset managers.

Key features of the Solv Guardian system include:

- Vault Guardians: Each vault is assigned a Vault Guardian who specifies authorized contract addresses and permissible functions. The guardians ensure that assets are only deployed according to approved strategies.

- Governance Mechanism: A distinct governance structure oversees the Solv Guardian, with a Governor entity responsible for managing permissions, executing upgrades, and implementing time-locked changes to maintain transparency and user trust.

By integrating the Solv Guardian system, Solv Protocol aims to provide a robust security framework that safeguards user assets despite the complexities and dependencies inherent in decentralized finance ecosystems.

Closing Thoughts

Solv Protocol presents an innovative approach to addressing a growing market demand for earning yield on Bitcoin. Combining a unified wrapped Bitcoin token (SolvBTC) with a liquid staking mechanism simplifies access to yield-generating strategies for BTC holders who prefer a passive approach.

That said, users considering SolvBTC should evaluate the robustness of its reserves before minting. Since SolvBTC is backed by other wrapped Bitcoin tokens rather than native BTC, understanding the stability of these reserves is essential, additionally, for those seeking to use wrapped Bitcoin in DeFi, checking whether a particular protocol supports SolvBTC before minting is a necessary step.

Users exploring the liquid staking options provided by Solv Protocol need to make a deeper assessment. Since the yield sources for SolvBTC.LSTs come from external projects, each with distinct risk factors. Users should carefully evaluate whether they are comfortable with the potential risks associated with these third-party dependencies.

Liquid staking isn’t the only option for Bitcoin holders purely seeking yield. Traditional strategies, such as lending BTC on DeFi or CeFi lending markets, may offer a more straightforward and potentially lower-risk alternative.

While Solv Protocol is an ambitious and promising solution, users should continually assess their risk tolerance and investment goals before engaging with any financial product.