Stellar is one of the most promising payment cryptocurrencies currently on the market. Forging numerous partnerships and building cutting edge tech.

With Bitcoin historically presenting itself as ultimate trailblazer in the peer-to-peer payment ecosystem, it was indeed only a matter of time before other projects began developing technologies for speedier transactions and lightening-fast digital currency remittances. Stellar Lumens is most definitely one of these projects and, ever since its inception, it has proven to be a rather promising cryptocurrency payment system. As a matter of fact, Stellar has been building some of the most cutting-edge, advanced payment infrastructures in the space and has forged invaluable partnerships with giants in not only the crypto environment, but in traditional financial settings as well.

The goal of the Stellar Lumens project is to make money move like email. They are building a free and open source architecture that will let anyone build low-cost financial apps and redeploy them on their individual platforms. Of course, there are a number of competing projects building similar technologies and this bears the question, how can Stellar compete?

In this Stellar review, we will give you everything that you need to know about the project and will furthermore analyse the long term price and adoption potential of the Stellar Lumens native asset XLM.

What is Stellar?

Stellar is primarily a distributed payments network that is meant to provide a fast, secure and inexpensive cross-border payments solution. It can also be used to issue your own tokens, and as an ICO platform is considerably easier to use when compared with Ethereum.

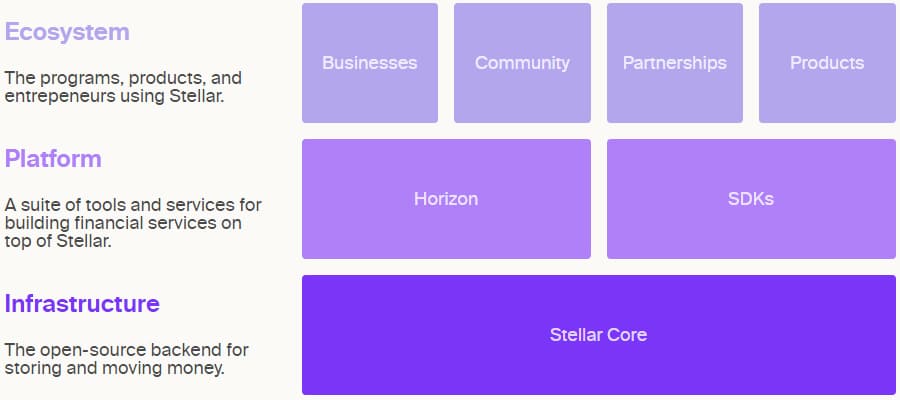

Overview of the Stellar Project. Image via Stellar.org

Overview of the Stellar Project. Image via Stellar.orgThe network and its connected foundation were both launched in 2014, and the network is powered by the native Stellar Lumens (XLM) token. The XLM is the key to making nearly instantaneous transactions between different currencies and making payments across international borders.

The Stellar Network

The Stellar network was created as a decentralized platform to enable fast and inexpensive asset transfers to anywhere in the world.

Stellar Lumens, An Open Network For Storing And Moving Money.

Stellar Lumens, An Open Network For Storing And Moving Money. The Stellar network can connect individuals, banks and payment systems to move currencies securely, reliably and rapidly for a fraction of the cost of traditional payment gateways and currency transfers. Stellar is looking to revolutionise international payments and remittances, making them safer, faster, easier and cheaper for everyone around the world. In essence, Stellar aspires to be the borderless, limitless and most powerful remittance protocol in the world of traditional finance and in that of digital assets, as it makes it possible to create, send and trade representations of all forms of money and value, be it US dollars, Pesos, Euros, Bitcoin or pretty much anything.

Stellar strives to efficiently restructure the concept of money by building a fully interoperable financial ecosystem designed to satisfy the needs of every financial entity out there from its single, all-encompassing platform and by offering a wide array of easily implementable SDKs and APIs to its clientele.

Stellar can also serve as a launchpad for project ICOs, and creating tokens on the Stellar blockchain is much easier than on other competing platforms. The Mobius Network, SureRemit, and Smartlands are just a few of the projects that have held their ICO on Stellar.

What makes Stellar Unique?

At first glance, it seems that Stellar provides many of the same services you can receive from your traditional banking system, but there are some key differences that make Stellar unique.

For one thing, the transactions on Stellar take place on a decentralized blockchain and network that has significantly faster processing and lower fees when compared with the traditional banking systems.

Stellar Compared to other projects. Image via Stronghold

Stellar Compared to other projects. Image via StrongholdWith Stellar payments are processed within 2-5 seconds, and fees are so small as to be almost unnoticed. Unchanging one currency for another on the Stellar network incurs a fee of just $0.00006 per transaction. Compare that to an international wire, which might cost as much as $75.

Stellar is also unique when compared with other crypto and blockchain projects. While many of these popular crypto projects are focused on providing benefits to corporations and businesses, Stellar was founded with the noble goal of creating an inclusive digital economy, and as such it serves individuals.

Stellar wants to use its technology, innovation, and position to help “fight poverty and maximize individual potential.”

Stellar’s Technology

The distributed network of Stellar is comprised of a large number of servers, each running the Stellar Core software, and all owned by different people and organizations spread all across the globe.

The Stellar Core software holds its own local copy of the blockchain and communicates and syncs with all the other computers running the Stellar Core software and connected to the network.

Stellar differs from most other cryptocurrencies in that its consensus mechanism is not Proof-of-Work, nor is it Proof-of-Stake. Instead, it uses something called the Stellar Consensus Protocol (SCP) that gives a method for reaching consensus without reliance on a closed system in order to accurately record transactions.

Stellar Consensus Protocol Architecture

Through its Consensus Protocol (SCP), Stellar seeks to provide a worldwide financial network that is open to everyone so that new organisations and entities can join and extend financial access to unserved communities.

Financial infrastructure is currently a mess of closed systems. Gaps between these systems mean that transaction costs are high and money moves slowly across political and geographic boundaries. This friction has curtailed the growth of financial services, leaving billions of people under- served financially. To solve these problems, we need financial infrastructure that supports the kind of organic growth and innovation we’ve seen from the Internet, yet still ensures the integrity of financial transactions. - David Mazières, Development Foundation

Stellar's Consensus Protocol is a federated Byzantine agreement system that allows decentralised, leaderless computing networks to reach a consensus outcome on some decision more efficiently. The Stellar Lumens network leverages its SCP to ensure and provide a consistent view of the network's transaction history to all its participants.

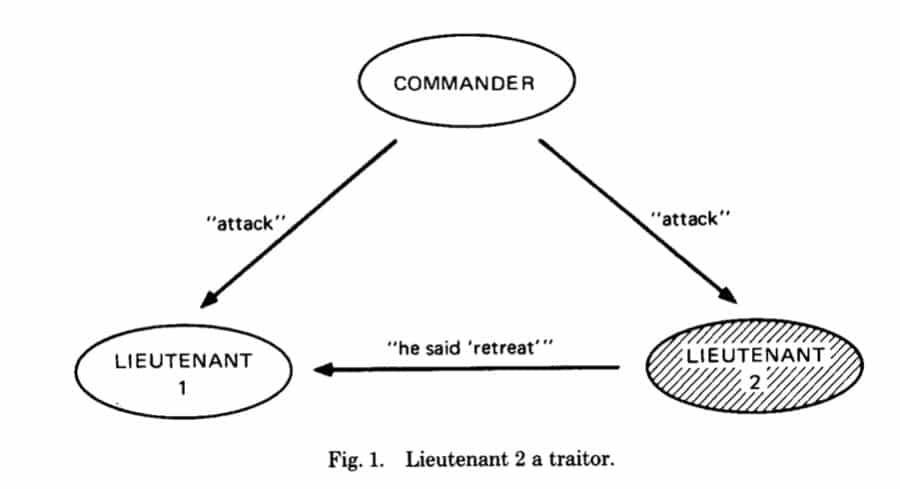

Blockchain Infrastructures Rely On Nodes Reaching Some Sort Of Accumulative Agreement

Blockchain Infrastructures Rely On Nodes Reaching Some Sort Of Accumulative Agreement A blockchain-based agreement system allows a group of users, participants or nodes to reach the same decision about something, and this is of course a rather vital element in the liveliness of blockchain infrastructures. This is due to the fact that nodes in a cryptocurrency network must consistently decide what the complete history of a shared ledger looks like, including those versions that occasionally conflict. Network agreement systems are effectively an essential feature as they allow digital asset or crypto coin recipients to have faith in the fact that the asset they receive is firstly valid, and secondly that is has not been already spent elsewhere.

Ultimately, any agreement system must be fault-tolerant, meaning that it needs to produce consistent results despite errors such as slow communication links, unresponsive nodes, and disordered messages. A 'Byzantine' agreement system is also tolerant of Byzantine faults, that is those nodes that give false information by mistake or because they are deliberately looking to subvert the system or gain some form of advantage.

A Visual Representation Of A Deliberate Attack In Byzantine Fault Tolerance - Image via cdemi.io

A Visual Representation Of A Deliberate Attack In Byzantine Fault Tolerance - Image via cdemi.io For instance, let's assume that user X is the holder of a specific token and has to choose between purchasing something for user Y and settling a debt with User Z. User X could decide to go ahead and do both things by fraudulently paying the same token to both Users Y and Z. In order to do this, User X would have to convince User Y's computer that the token was never paid to User Z, and would have to convince User Z's computer that the token was never paid to User Y. A Byzantine agreement system can essentially makes this impossible using a form of majority rule called a Quorum.

In effect, a node could refuse to commit to a particular version of ledger history until it sees that enough of its peers, the quorum, are also prepared to commit. In Stellar's Federated Byzantine Agreement (FBA) architecture, each participant knows of others it considers important and waits for the vast majority of these others to agree on any transaction before considering it settled.

Stellar's SCP-FBA system basically ensures that its network is as secure, open and democratic as possible and it furthermore strives to eliminate the bottlenecks of an enclosed, centralised transaction intermediary.

4 Key Properties Of SCP

Stellar's Consensus Protocol primarily implements 4 main properties simultaneously and these are:

- Decentralised Control. Anyone is able to participate and no central authority dictates whose approval is required for consensus.

- Low latency. In practice, nodes can reach consensus in a few seconds and at timescales humans expect for web or payment transactions.

- Flexible trust. Users have the freedom to trust any combination of parties they see fit. For instance, a small non-profit may play a key role in keeping much larger institutions honest.

- Security. Safety relies on digital signatures that can protect a network from attackers with vast computing power.

How Stellar Works

The first thing anyone who wishes to interact on the Stellar network must do is to create an account, or rather a wallet address. This will include both the public key that can be shared with others and the private key that keeps your account secured. Your public key is the cryptographic method used to ensure transactions made on the network are secure.

Simple Overview of How Stellar Works

Simple Overview of How Stellar WorksOnce you have an account you’ll need to upload some funds to an anchor on the Stellar network. An anchor is a construct that is trusted to hold deposits and to issue virtual credit into Stellar accounts.

The anchor is the connection between the Stellar network and existing currencies. Because of this most of the network anchors are banks, remittance companies, and savings institutions.

After your funds have been uploaded to an anchor you’re ready to take advantage of the near-instant transfers available on the network.

Stellar vs. Ripple

Anyone looking at Stellar is going to automatically try to draw comparisons to Ripple (XRP), since both are payment networks, and both were created by Jeb McCaleb. The two projects do share some similarities, and they are widely seen as competing networks.

That said, there are also key differences between the two platforms, and while some people have called Stellar a fork of Ripple, that isn’t true. Stellar has its own unique code base, and the two have different philosophies.

While Ripple is concerned with the institutional side of financial transactions and has attempted to partner with major global banks to replace global remittance networks, Stellar is focused more on the individual, providing a platform that stresses inclusion and global financial literacy.

Stellar and Ripple Compared

Stellar and Ripple ComparedIt is true that the two projects were much closer in their features and codebase initially, but after 5 years of development on Stellar, that’s no longer the case. Stellar has changed to the Stellar Consensus Protocol for its consensus mechanism, using a model known as Federated Byzantine Agreement.

Ripple remains with a protocol that uses a mechanism known as proof-of-correctness. According to the Ripple whitepaper this PoC consensus mechanism:

“is applied every few seconds by all nodes, in order to maintain the correctness and agreement of the network”.

There are other differences between the two networks. For example, Ripple has 100 billion total supply of XRP tokens and is deflationary based on a variable burn rate of tokens. Stellar began with a total supply of 100 billion XLM tokens, but currently, the total supply is just over 105.3 billion tokens due to a 1% inflation built into Stellar.

There are also the differences in the target market (institutions for Ripple and individuals for Stellar) that have been discussed already, and the different protocols used to achieve consensus.

The Stellar Team

Stellar was founded in 2014 by Jed McCaleb and Joyce Kim. In addition to being one of the co-founders of Ripple, McCaleb is also the creator of the file sharing site eDonkey as well as the infamous Bitcoin exchange Mt Gox. After two years at Ripple McCaleb felt forced to leave due to a differing philosophy, and he left Ripple to form Stellar.

From Left: Jedd McCaleb, Joyce Kim & Denelle Dixon. Image via Twitter & Creative Summit

From Left: Jedd McCaleb, Joyce Kim & Denelle Dixon. Image via Twitter & Creative SummitThe President, CEO, and Executive Director of Stellar is Denelle Dixon. She is a recent addition to the team, having come to Stellar in May 2019 after spending seven years at Mozilla, where she was most recently the Chief Operating Officer. In the past, she also worked as Senior Legal Director at Yahoo after receiving her J.D. from the University of California.

The rest of the team includes technologists, engineers, entrepreneurs, scientists, designers and others, all interested in building an inclusive global financial system. While the Stellar Foundation has offices in San Francisco and New York City, its team members are spread all across the globe.

Notable Stellar Partnerships

One of the best ways to increase adoption and spread more rapidly is through partnerships with existing organizations. Stellar’s leadership team fully understands this, and has formed partnerships in a number of industries and with a broad variety of companies. Below are some of the most significant partnerships:

The largest and most talked about partnership is the one with IBM. Stellar has been working with the venerable technology company since October 2017, and the most recent development has been the launch of IBM’s World Wire, a real-time global payments system that runs on Stellar.

IBM Using Stellar Technology. Image via Stellar Newsletter

IBM Using Stellar Technology. Image via Stellar NewsletterLaunched in March 2019, it already supports 47 currencies and works in 72 different countries with 44 banking endpoints and over 1,000 unique currency trading pairs. IBM has also signed 6 banks to issue stablecoins based on XLM.

There are many other partnerships Stellar has created, including several with money transfer providers, such as Tempo in France, Remitr in the Americas, SatoshiPay in Europe, SureRemit in Africa and many others.

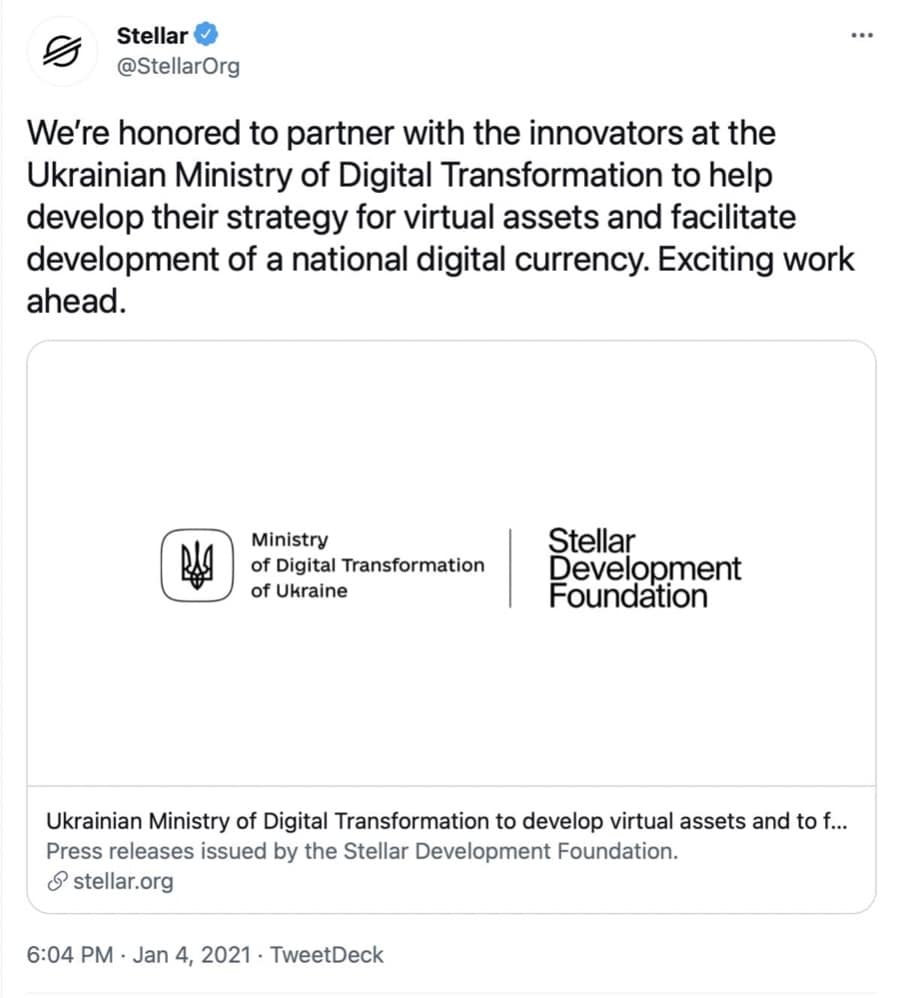

In addition to IBM and its other notable partnerships, Stellar Lumens has recently tied relations with the Government of Ukraine. In fact, Ukraine's government has chosen the Stellar blockchain network as a platform to build a central bank digital currency (CBDC). Announced on January 4th 2021, the Ministry of Digital Transformation of Ukraine and the Stellar Development Foundation (SDF) signed a Memorandum of Understanding to build out a virtual assets ecosystem and national digital currency of Ukraine.

On January 4th 2021, Stellar Lumen Announced Its Partnership With The Ukrainian Government - Image via StellarTwitter

On January 4th 2021, Stellar Lumen Announced Its Partnership With The Ukrainian Government - Image via StellarTwitter Since 2017, the National Bank of Ukraine has been researching the possibility of CBDC implementation and now the Stellar Lumens partnership will be the foundation layer of its virtual currency development. This constitutes a massive stepping stone for Stellar and is moreover a clear sign of its increasing protocol adoption on an international scale.

There have been some recent partnerships as well.

- Crypto exchange Coinbase introduced support for USDC on the Stellar network.

- Its integration with crypto payments infrastructure company MoonPay allows users to buy and sell cryptocurrencies (including XLM) across more than 160 countries.

- Stellar also integrated with the money transfer platform MoneyGram to facilitate deposits and withdrawals of cash from crypto wallets via USDC on Stellar without a bank account.

In another post on X (formerly Twitter), the company announced that Franklin Templeton's OnChain U.S. Government Money Fund was available on the Stellar network through the Benji Investments app. This is the first mutual fund to use public blockchain technology for transactions and share ownership.

In September 2023, Circle announced that its euro-pegged stablecoin EURC launched on the Stellar network. At launch, Stellar was the third chain on which EURC is now available. Ripio, a crypto company in Latin America that is now expanding to Spain, become the first to add EURC on Stellar to their wallet app, enabling euro deposit and withdrawal.

XLM Token (Stellar Lumens)

Lumens, which use the ticker symbol XLM, are the native asset used on the Stellar network. The network launched with 100 billion Lumens, with an annual inflation rate of 1%. In September 2019 there are now 105,323,320,393 XLM. The Lumens serves two purposes on the Stellar network:

- It prevents network spamming by covering the cost of transactions (fees), while also ensuring users maintain a minimum balance. The minimum balance requirement was initiated to keep the network from being spammed with fake transactions. Each transaction on the Stellar network has a fee of 0.00001 XLM.

- It also facilitates multi-currency transactions by acting as a bridge between various currencies and allowing trades to occur even if the direct market isn’t large enough to facilitate trades.

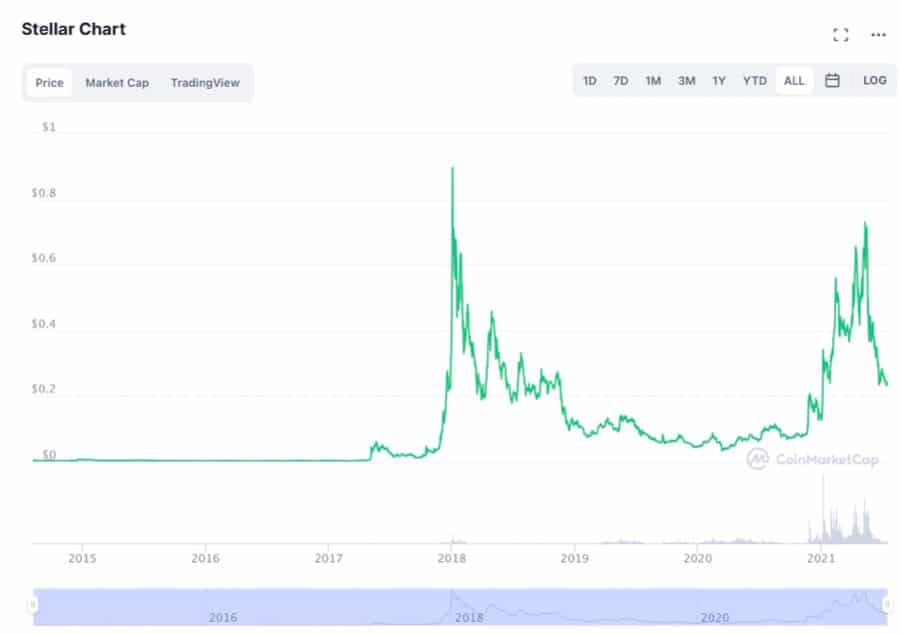

Although Lumens were trading well back in 2014 after they were listed, it remained pretty range-bound for three years after that. XLM traded between $0.001 and $0.006. It was only when the 2017 bull run came around did Lumens pick up steam.

Stellar's Native Token XLM Historical Price Performance - Image via CoinMarketCap

Stellar's Native Token XLM Historical Price Performance - Image via CoinMarketCap April 2017 saw price begin to move higher, and by the end of the month, it was above $0.005. May saw price explode, and XLM traded as high as $0.067443, but for the most part, it remained between $0.04 and $0.05 throughout May and June.

Price dipped again to the $0.02 area and remained there until the broad based cryptocurrency rally that began in November 2017. Price rose rapidly through November and December 2017 and XLM hit a local all-time high of $0.938114 on January 4, 2018. It traded steadily lower from that high, bouncing briefly in April 2018, but remaining between $0.2 and $0.3 for most of 2018. In November 2018 it broke below $0.2 and in January 2019 it broke below $0.1.

At present, XLM is trading at $0.23 and has heavily retraced from its absolute all-time-high of January 2018.

Trading & Storing XLM

XLM is traded on hundreds of different exchanges. These include some well known ones such as Coinbase and Binance. There are also a host of other local fiat gateway exchanges that you can use in specific regions.

When it comes to trading volume, over 50% appears to be concentrated in three different exchanges (Bithumb, Binance and Coinbase). This means that liquidity for XLM is quite contingent on the orders flowing through these exchanges.

Having said that, on the individual order books there appears to be pretty strong liquidity. For example, on Binance’s XLM / BTC market the order books are quire deep and the turnover is extensive. Hence, you would be able to securely place large block orders without that much slippage.

Once you have your Lumens, you will probably want to store them in an offline wallet. We are all well too aware of the risks that come with leaving cryptocurrency on a centralised exchange.

When it comes to storage, there are a plethora of wallets that support XLM. I won't go into them here but if you want the complete list then you can read our overview of the top Stellar XLM Wallets.

Stellar Lumens Distribution Plans

Stellar has a unique plan for distributing Lumens. Because the mission of the Stellar Development Foundation is to promote global financial access, literacy, and inclusion it has an ambitious goal of distributing 95% of all Lumens to the world.

The Foundation has held 5% of the initial 100 billion XLM in reserve to fund its operations, and the auction them off in small batches to various exchanges. The other 95% are meant to be distributed as follows:

- 50% will be given to individuals. Initially, this was done through a unique sign up link, but the Foundation has put this program on hold. That said, there are other programs being used to airdrop XLM to individuals. The most recent was announced in September 2019 and will distribute 2 billion XLM to users of the messaging service Keybase.

- 25% have been earmarked for partners who contribute to the adoption and growth of the Stellar network. This includes businesses, non-profits, institutions and government agencies.

- 20% were given to BTC and XRP holders back in October 2016 and August 2017. The distribution saw 19% going to BTC holders and 1% to Ripple holders.

Stellar Development

There is no doubt that Stellar has been quite active and they regularly update their community about the latest work that the project is involved in.

But how is raw development output on the project going?

One of the best ways to determine this is to take a look at their code commits in their public code repositories. Hence, I decided to dive into Stellar's GitHub and observe their coding activity.

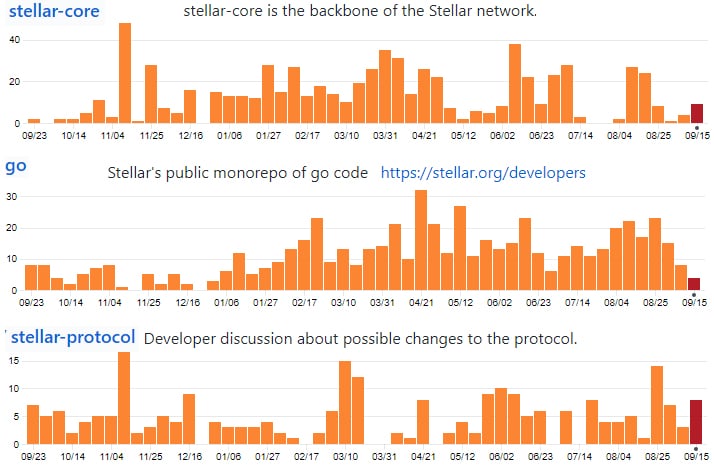

Below are the code commits for the top three pinned repositories over the past 12 months.

Commit History in Top Three Repos. Image via GitHub

Commit History in Top Three Repos. Image via GitHubAs you can see from the above, there has been quite extensive work done on the protocol. I should also mention that this is only three out of a further 73 other repositories.

This is more than I have seen on other projects of a similar size. In fact, if we were to check into code tracking websites, Stellar ranks 36 for total commits and 23 for overall activity.

This frenetic pace of development makes sense when viewed in conjunction with the milestones that they met in their development roadmap. There were a number of important protocol releases that took place over the last year.

Moreover, looking forward there is quite a lot to be excited about on the project. In their comprehensive roadmap, they break down the work being done on the core protocol, the platform, product and broader ecosystem.

If you want to keep up to date with the latest development releases then you can always follow their developer blog. They do quite a good job of keeping their community updated.

In Conclusion

Stellar obviously has plenty of opportunities coming in the months and years ahead, but it will also face challenges of course. One of those challenges will be overcoming competition in its chosen space, not only from Ripple, but also from other platforms such as OmiseGo.

Regarding its aspirations to being an ICO platform, there’s even more challenges. Not only is it up against Ethereum, but it is also now up against new alternatives for crowdfunding such as the Binance Smart Chain Launchpads. Due to regulatory uncertainty and steep competition, it could be a struggle to gain traction in this area.

Also of concern to some is the altruistic philosophy that Stellar is based on. Because it is backed by a non-profit and has global financial inclusion as its goal, there’s little focus on maximizing profits. While this is to be commended as a humanitarian goal, it isn’t a popular stance for businesses who might partner with Stellar. That could hold the XLM token from making its best gains.

There’s no doubt that Stellar is an interesting project, and that it is very popular as well. Even though it is ranked 18th by market cap as I’m writing this, it has been in the top ten several times.

It faces tough competition, but it is a tough competitor itself, with a wide range of use cases, and an impressive feature set. The partnerships with IBM and the Ministry of Digital Transformation of Ukraine are especially noteworthy, and could help boost the fortunes of Stellar.

You should make your own assessment of the Stellar project before making an XLM purchase, but it is pretty obvious the market likes this project, and it has what looks like a bright future.