Quick Verdict

Tapbit's Low fees can’t hide thin depth and opaque metrics. Hidden OI, and an empty P2P book keep Tapbit off our recommended list for real-money trading. Use it for demo mode or small BTC/ETH tickets. Choose tier-1 venues for size, leverage and compliance.

Who It’s For

- Users testing strategies in simulation mode

- Fee-focused traders doing small BTC/ETH tickets

- Casual spot traders trying basic tools and Earn

Who Should Consider Alternatives

- High-volume or institutional traders needing deep books

- Derivatives traders who require visible OI and robust metrics

- Users wanting strong fiat ramps or active P2P

Top Alternatives to Consider

- Binance (Global): Deepest liquidity and widest derivatives set.

- OKX: Strong perps/options suite and transparent PoR.

- Kraken: Security-first, regulated access, responsive support.

Tapbit Quick Facts

| Fact | Details |

|---|---|

| Crypto Support | CoinGecko shows ~412 coins / 425 pairs. Liquidity is concentrated in ETH/USDT and BTC/USDT; verify the live markets page for current listings. |

| Fee Details | Spot: 0.10% maker / 0.10% taker. Perps: 0.02% maker / 0.06% taker. Funding rates, liquidation costs, and spreads apply. On-chain withdrawals: fees & minimums vary by asset/network—check before withdrawing. |

| Funding Methods | Third-party fiat on-ramps (Visa, Mastercard, Google Pay, wide fiat list) to buy USDT/USDC only; provider KYC/fees vary. On-chain deposits on many networks with minimums as low as 5 USDT. P2P page exists but currently has no active orders. |

| Products & Features | Spot trading, USDT perps (pair-specific leverage up to 150×; OI not shown in UI), copy trading (limited metrics), grid trading on perps, simulation/demo mode, and Earn (flexible savings on BTC, ETH, USDT, WEMIX, USDC, CHR, ACH with tiered APYs; no on-chain staking). |

| Country/Fiat Availability | Serves users in 190+ countries (self-stated). Registrations: US MSB (FinCEN), NFA (stated), SVGFSA; operational base Singapore. Fiats via partners: USD, KRW, JPY, TRY, BRL, EUR, IRR, RUB, TWD, AED. Product access is jurisdiction-dependent—verify locally. |

What is Tapbit?

Tapbit began life as Billance in 2021, targeting “stable trading” on majors without mandatory KYC at sign-up. In September 2022, the brand announced a re-name to Tapbit, with the Tapbit.com domain going live; the company frames this as a shift to a broader toolkit that now includes perps and copy/grid trading.

The exchange markets access in 190+ countries and highlight US and Canada MSB registrations (FinCEN/FINTRAC), SVG FSA registration, and NFA-related exemptions/membership notices on its site.

Note: MSB is a registration (not a federal “license”), and the NFA is a US self-regulatory body overseen by the CFTC. Always verify status in the official registries before relying on it.

Tapbit also promotes a $50 million insurance fund to cover platform incidents. They have referenced activating a $50M pool during an outage-related compensation plan. There's also proof of reserve with a 2,341% BTC reserve ratio and 125% USDT reserve ratio. However, there's no Merkle Tree Proof-of-Reserves, which is now the standard for most tier 1 crypto exchanges. Instead, Tapbit publishes a PoR report audited by Hacken. The most recent published report is from October 2024, roughly a year old.

On footprint and entity: public materials list Tapbit LLC (USA), with an App Store listing showing a Denver address, while press communications describe the company as headquartered/operationally based in Singapore.

Company Timeline

- 2021: Launch as Billance (spot focus, no-KYC sign-up).

- 2022: Rebrand to Tapbit; Tapbit LLC formalized; derivatives push.

- 2023–2024: UX upgrades; compliance messaging; insurance fund cited at ~$40M.

- 2025-2026. Exchange trackers show varying live counts, and actual floating listings may vary.

Tapbit positions itself as a feature-rich mid-tier CEX, leveraging perps, copy/grid tools, and an insurance pool while competing on fees and breadth, and still building recognition against top-three venues. Users should weigh the appeal of tools and promotions against jurisdictional access, real-world liquidity depth, and the precise scope of registrations/coverage.

Tapbit Markets

Breadth is only useful if there’s real depth behind it. Here’s what Tapbit’s spot and perps actually look like:

Spot Markets

- Listings and pairs: CoinGecko shows ~412 tokens and 425 pairs. The actual live count hovers closer to ~500; verify the markets page before funding.

- Liquidity concentration: Volume is heavily skewed to ETH/USDT (~45%) and BTC/USDT (~17%).

- Visible reserves/liquidity: Exact exchange liquidity isn’t published. DeFiLlama shows ~$184k on Ethereum and ~$60k on Bitcoin under Tapbit-tagged wallets. For a CEX, that’s dangerously low; even modest orders can incur meaningful slippage on thinner books.

- Trading features/UI: Market, limit, and trigger orders are available on spot, with TradingView charting across markets.

USDT Perpetuals

- Contract set & leverage: USDT-margined derivatives are listed for several assets, with maximum leverage up to 150× (pair-specific).

- OI visibility & UI behavior: Open interest is hidden in the trading UI, which is a major red flag for depth discovery and risk control. The trading interface mirrors Binance almost 1:1, but some copied controls are unsupported on Tapbit and OI widgets are removed.

- Reported turnover vs venue ranking: At the pair level, Tapbit reports ~$6.5B 24h volume for BTC-perps, while top venues like Binance print ~$10B over comparable windows. Yet Tapbit doesn’t appear among the top derivatives venues on CoinGecko, which raises questions about the credibility of its reported breadth and volume.

- Order types & tools: Market/limit/trigger orders are supported on perps, with TradingView charts and the standard TP/SL style workflow.

Tapbit's Trading UI is an Almost Exact Copy of Binance | Image via Tapbit

Tapbit's Trading UI is an Almost Exact Copy of Binance | Image via TapbitMarket Sizes & Volume Quality

- Cross-source mismatch: CoinGecko shows ~$3B 24h volume, while Tapbit’s own site has cited $100B+. With no transparent methodology to reconcile these numbers, the incoherence itself is a risk signal.

- Execution guidance: Assume thin depth outside BTC/ETH. Use ±2% depth checks, limit orders, and small probe trades before scaling size.

Takeaway: Tapbit’s markets can be workable for small tickets on BTC/ETH, but hidden OI, concentrated liquidity, low visible reserves, and inconsistent volume claims mean serious size or high-leverage traders should verify live depth and fills against a top-tier venue before committing capital.

How To Buy/Sell Crypto on Tapbit

Your funding path options exist, but their practicality varies a lot right now. Here’s what actually works and what doesn’t.

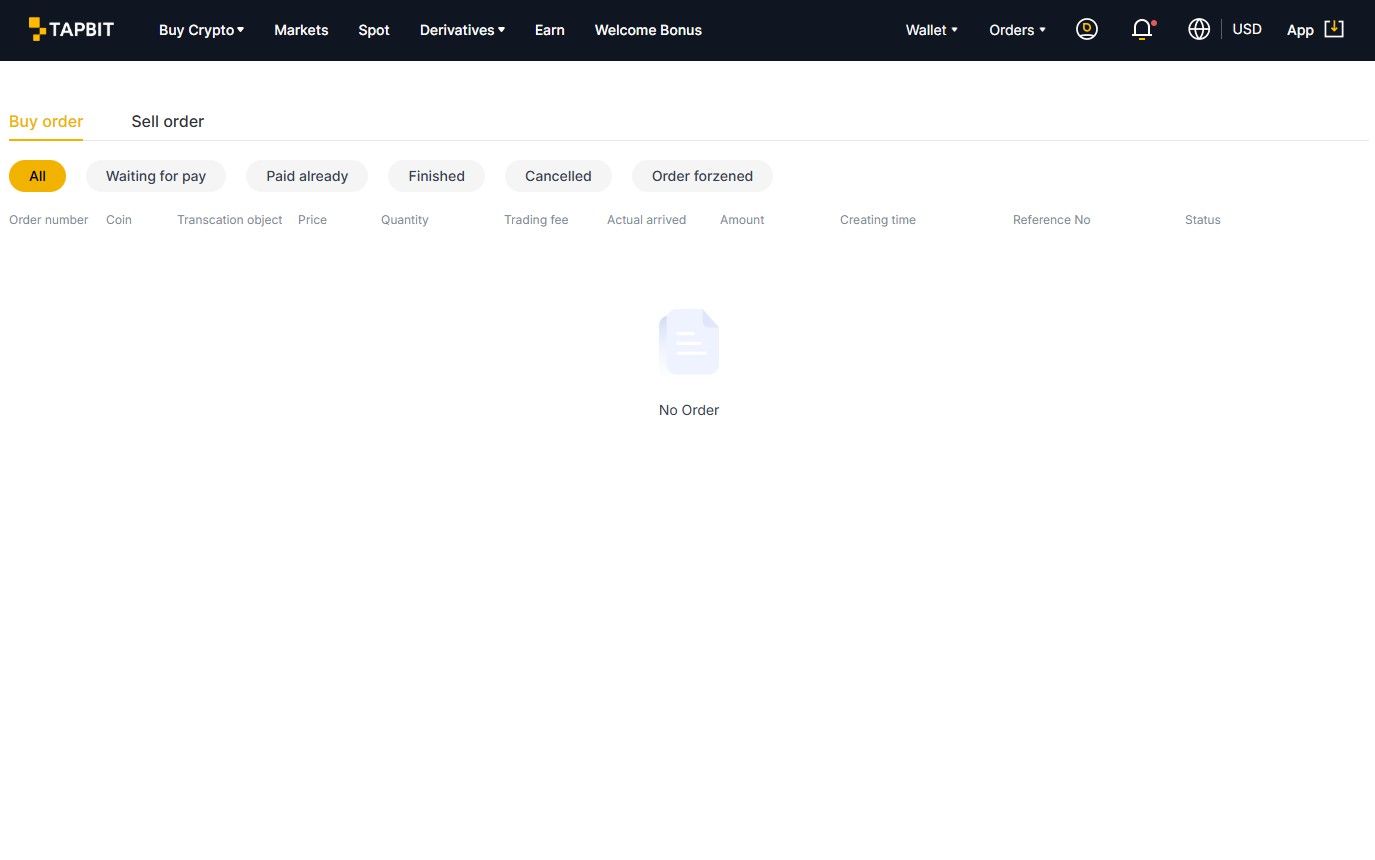

P2P trading

The P2P market page exists, but there are no active buy or sell orders, which makes the feature effectively unusable at present. There’s no escrow information disclosed, so even if liquidity appeared, risk controls are unclear. Until Tapbit publishes escrow mechanics and the book fills with offers, skip P2P and use the alternatives below.

No Active Orders on the P2P Exchange Makes it Unusable | Image via Tapbit

No Active Orders on the P2P Exchange Makes it Unusable | Image via TapbitThird-party fiat purchases

Tapbit integrates multiple fiat on-ramp providers and payment methods: Visa, Mastercard, Google Pay, and a wide list of supported currencies. The current limitation is that you can only purchase USDT or USDC via these providers. Expect provider-level KYC, variable fees/spreads, and settlement times that depend on the partner you choose. Use the live quote screen to compare total cost before you commit.

On-chain deposits (and internal transfers)

Crypto deposits are supported across many networks, with a minimum as low as 5 USDT on eligible chains. Funds sent below the minimum may not be credited, so confirm the asset, network, and min-amount on the deposit page, and start with a small test. Tapbit’s public materials don’t clearly document internal (user-to-user) transfers/withdrawals; assume standard on-chain withdrawals unless you see a clearly labeled internal-transfer option in your account.

Practical path today: Use a third-party on-ramp to acquire USDT/USDC, or on-chain deposit from a self-custody wallet. Avoid P2P until liquidity and escrow details are visible, and always begin with a small test transfer before moving size.

Tapbit Features

Tapbit bundles automation tools for perps and a simple savings product. The tools work, but transparency and risk controls are thinner than in top venues.

Perps Toolkit

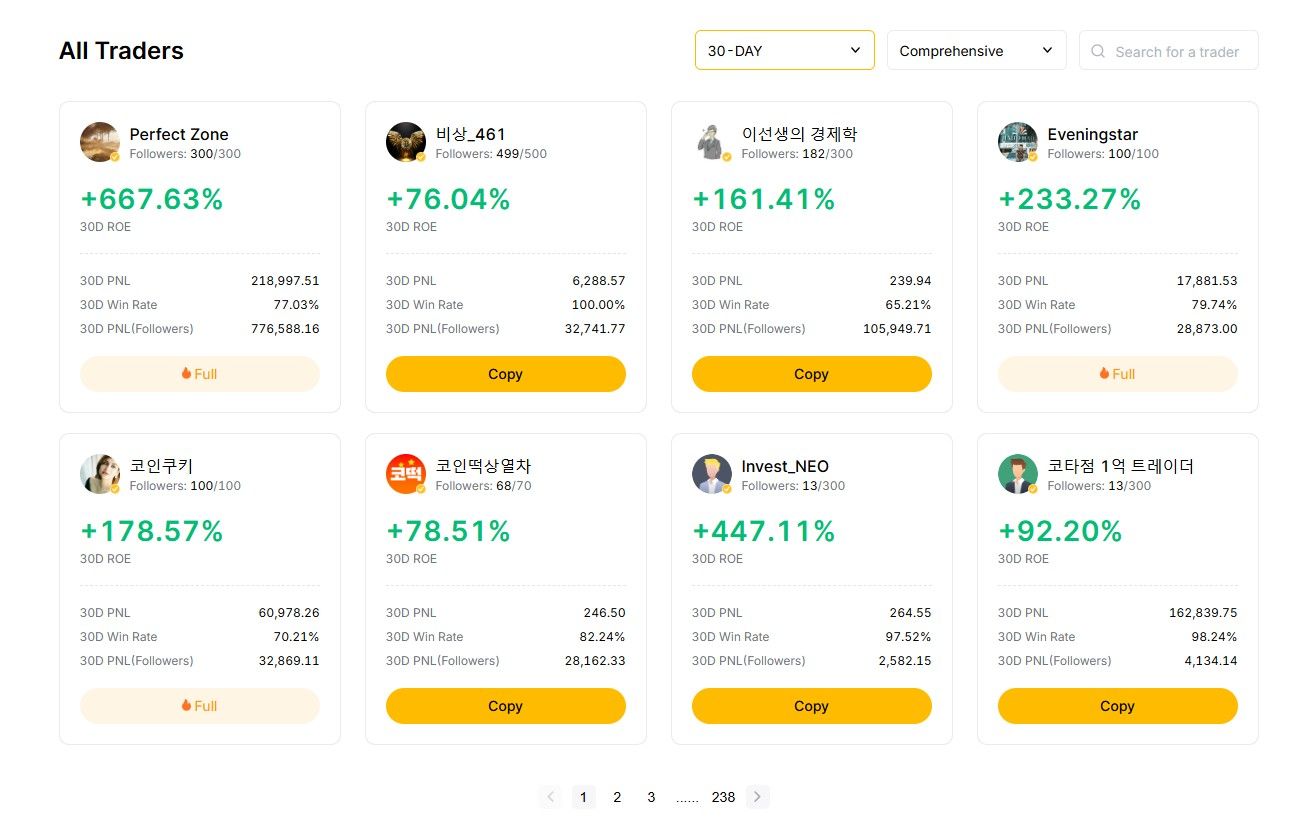

- Copy trading. Multiple verified traders are listed, each with limited seats. Reported results are generally lower than Binance’s copy trading leaderboards. Selection metrics are limited to Win Rate, ROE, and PnL. Unlike Binance, Tapbit does not disclose useful diagnostics such as asset preferences or position mix, so you don’t know the underlying exposures you’ll mirror. Treat the feed as a black box and size conservatively.

- Grid trading. Available on the perpetuals market. You can set grids manually or use Tapbit’s recommended parameters. Keep in mind that grid performance depends on perps market quality, which has hidden OI, thin visible depth outside BTC/ETH, and credibility questions on reported volume. Grid strategies that churn fees on shallow books can underperform quickly.

- Simulation mode (demo trading). Perps offer a demo environment that mirrors the live UI. This is useful for testing entries, exits, and parameter choices before risking real capital. Use it to rehearse risk rules and stress scenarios, then confirm that live spreads, funding, and slippage align with your assumptions.

Copy Trading Features Available with Limited Transparency | Image via Tapbit

Copy Trading Features Available with Limited Transparency | Image via TapbitEarn (flexible savings on select assets)

Tapbit’s Earn is simple, custodial, and flexible. You can subscribe and withdraw anytime. Supported assets on the current page include BTC, ETH, USDT, WEMIX, USDC, CHR, and ACH with indicative headline APYs shown while subscribing. Rates are tiered. The more you deposit, the lower the APY. Example: BTC earns 6% up to 0.03 BTC and drops to 1% for balances above 1 BTC. There are no on-chain staking services available; yields are generated through Tapbit’s internal program, so please evaluate custodial and rehypothecation risks and expect rates to fluctuate.

Tapbit Fees

Unlike most centralized exchanges that have tiered fees for users with different volumes, Tapbit follows a flat fee structure. Here's what you need to know:

Maker vs Taker:

- Maker orders add liquidity by resting on the book before execution.

- Taker orders remove liquidity by executing immediately against the book.

Baseline schedule (from Tapbit’s fee page):

| Maker Orders | Taker Orders | |

|---|---|---|

| Definition | Orders that enter the order book and fill up the liquidity inside the order book before execution. | Orders that execute immediately by taking liquidity out from the order book. |

| Trading Fees on Spot | 0.10% | 0.10% |

| Trading Fees on Derivatives | 0.02% | 0.06% |

Other Costs to Expect:

- Perpetuals funding: Periodic payments between longs and shorts based on the contract’s premium/discount. Not a platform fee, but it affects PnL. Check each contract’s funding cadence and current rate.

- Liquidation charges / ADL: If your margin is breached, liquidation and auto-deleverage mechanisms may apply fees or slippage beyond the schedule above. Review contract specs.

- Third-party fiat on-ramps: Providers set their own fees/spreads for card, bank, or wallet payments (Visa, Mastercard, Google Pay, etc.). Compare quotes before buying.

- P2P: The marketplace currently lacks active orders; if/when it’s usable, expect spreads and possible posting/settlement costs.

- Conversions/FX: Any in-app conversions or bank FX can add hidden basis points even if a line-item “fee” isn’t shown.

Deposits & Withdrawals

- Crypto deposits: Typically free from the exchange side; network miners/validators still earn fees on the sending chain. Minimum deposit amounts apply by asset/network (e.g., USDT mins can be as low as 5 USDT, depending on chain).

- On-chain withdrawals: Fees and minimums are different for every token and network. You must check the live Withdraw page (or support) for your selected asset/chain at the time you transact. Sending less than the minimum may fail or not credit.

Treat the table above as your baseline, then add funding, liquidation risk, on-ramp spreads, and network withdrawal costs to get your true all-in. Always verify the live fee schedule and asset-specific withdrawal limits before moving a meaningful amount.

Security Analysis: Is Tapbit Safe?

For a CEX, “security” combines governance, custody design, live controls, and what regulators actually recognize. Below is Tapbit’s stack with practical caveats where needed.

Registrations and Regulatory Compliance

Tapbit says it serves users in 190+ countries, is operationally headquartered in Singapore, and supports optional KYC for basic trading with enhanced limits after verification. It presents the following registrations and licenses.

| License | Issuing authority | Details and notes |

|---|---|---|

| MSB registration | U.S. FinCEN | Money Services Business registration under the Bank Secrecy Act. Supports AML and KYC programs. This is a registration, not a prudential “license.” |

| NFA license | U.S. National Futures Association | Described as coverage for derivatives activity. In practice, users should verify the exact membership or exemption status and what it permits for U.S. customers. |

| SVGFSA license | Financial Services Authority, St. Vincent and the Grenadines | Crypto and forex approval reported in July 2023. Scope is jurisdiction specific and not equivalent to U.S., U.K., or EU market permissions. |

| EMI license | U.K. FCA | Electronic Money Institution authorization for payment services as stated. Verify firm name, reference number, and permissions on the FCA register prior to relying on it. |

| Additional compliance | Canada | Referenced as supporting North American operations. Confirm the specific MSB number and province coverage on the Canadian registry. |

Architecture and Platform Controls

- Account protection: Two-factor authentication, withdrawal address whitelist, anti-phishing code, device binding, and real-time risk monitoring.

- Asset storage: The exchange states over 95% of funds are kept in cold storage with hot wallets for operations, plus wallet separation and encryption.

- Operational security: DDoS mitigation, vulnerability scanning, and a fault-tolerant core aggregation engine intended to process high throughput without downtime.

- User tools: 24/7 monitoring with AI-driven anomaly detection, plus standard self-serve controls for withdrawals and login security.

Audits and Proof of Reserves

- Security reviews: Independent assessments are described as being conducted by Hacken, covering infrastructure and wallet processes.

- Proof of Reserves: PoR is presented in collaboration with Hacken, with public reports that assert 1:1 asset backing.

- CoinGecko Security Rating: 7/10, lower due to a lack of penetration testing.

- CER.live Security Rating: 55/100, lower also due to a lack of penetration testing.

PoR caveats users should know: Most PoR snapshots confirm assets at a point in time. They often do not fully prove liabilities, off-exchange commitments, rehypothecation, or access to third-party custodians. Treat PoR as one signal, not a guarantee.

Insurance fund

- Size: Reported at $50 million USDT today, up from $20 million in 2022.

- Scope: Intended for platform incidents such as exchange-level exploits or operational failure. It does not cover user mistakes like lost credentials or sending to the wrong chain.

- Transparency: Framed as complementary to PoR, so users can assess solvency and incident readiness together.

Tapbit vs. Competitors

Tapbit’s maker/taker is competitive, and its Earn page is straightforward for small balances, but the lack of published SOC2/ISO, hidden OI on perps, and unclear U.S. coverage put it behind top venues for institutional-grade transparency.

If you need the deepest books and the most proven compliance footprint, the incumbents still lead; if fees and basic access are your priority, Tapbit can be workable, provided you verify live depth and regional permissions before funding size.

| Feature | Tapbit | Crypto.com | Coinbase | Binance (US/Global) | Kraken |

|---|---|---|---|---|---|

| Spot Fee Base | 0.10% / 0.10% | 0.25% / 0.50% | 0.40% / 0.60% | 0.10% / 0.10% | 0.25% / 0.40% |

| BTC/ETH Withdrawal | Varies by network; check live page | BTC ~$36; ETH ~$10 | BTC ~$30; ETH ~$12.50 | BTC ~$5–10; ETH ~$3–5 | BTC ~$20; ETH ~$8 |

| Assets Count / Pairs | ~412 coins / 425 pairs (CoinGecko); marketing claims up to ~500–700 | 400+ coins / 480 spot pairs | 318 coins / 463 spot pairs | 414 coins / 1400+ spot pairs | 496 coins / ~1200 spot pairs |

| ACH / Card Fee | Third-party on-ramps; quote-based (Visa/Mastercard/Google Pay) | ACH free; Card 2.99% | ACH free; Card 3.99% | ACH free; Card 1–2% | ACH free / $4; No card |

| Earn APYs Snapshot | BTC/ETH 6%; USDT/USDC 4%; WEMIX 30%; CHR 25%; ACH 13% (flexible, tiered) | Up to 19% (SOL 7%, ETH 5%) | 2–14% (ETH 5%) | Up to 16% | 1–13% (SOL 7%) |

| Card Perks | None | Up to 8% cashback | Up to 4% BTC back | Up to 8% in regions | None |

| US Availability | Limited/unclear; verify per product (registration ≠ license) | Yes (limits) | Full | Restricted | 48 states |

| Derivatives Access | Up to 150× (pair-specific; OI hidden in UI) | Up to 50× | Up to 10× | Up to 125× global | Up to 50× |

| PoR / Certs | PoR with Hacken (claimed, quarterly); insurance fund $40M; no public SOC2/ISO claims | PoR (Mazars); SOC2 Type II, PCI DSS 4.0, ISO 27001 | PoR audited; SOC2, ISO 27001 | PoR audited; SOC2, ISO 27001 | PoR audited; SOC2 Type I, ISO 27001 |

Final Verdict

Tapbit’s headline pitch doesn’t hold up where it matters.

Summary of key points

- Fees are low on paper, but the market quality is inconsistent. Liquidity is concentrated in ETH/USDT and BTC/USDT, reserves visible on trackers look tiny for a CEX, and OI is hidden on perps, making risk assessment hard.

- Volume reporting is incoherent across Tapbit’s own banners vs aggregators, and Tapbit doesn’t appear among top derivatives venues on major trackers.

- P2P is unusable today, fiat buys are USDT/USDC only through third-party providers, and listings counts differ from marketing claims.

- Security messaging includes PoR, audits, and an insurance fund, but users still need to manually verify registrations and scope.

Who is this for?

Not recommended for real-money trading. Minor advantages like low fees don’t help small traders enough, and the markets don’t look big or transparent enough for large traders. The one clear utility right now is demo trading to practice strategies in simulation. For live trading, choose an exchange with verifiable depth, consistent reporting, and clearer compliance.