Price volatility in cryptocurrencies is well known by anyone involved in the markets and ecosystems that have been created by the invention of the blockchain and cryptocurrencies.

Because of the set issuance schedules and speculative demand nearly all cryptocurrencies see wild price fluctuations. This price volatility has been a hinderance in gaining adoption for cryptocurrencies as a medium of exchange or as transactional currencies.

Very few people want to be paid in a currency that could decline by 10-20% or more in a 24-hour period. This problem is made worse when deferred payments are involved like mortgages or employment wages. Using the current volatile digital currencies in these cases is prohibitively expensive and unreliable.

Enter the Terra Protocol

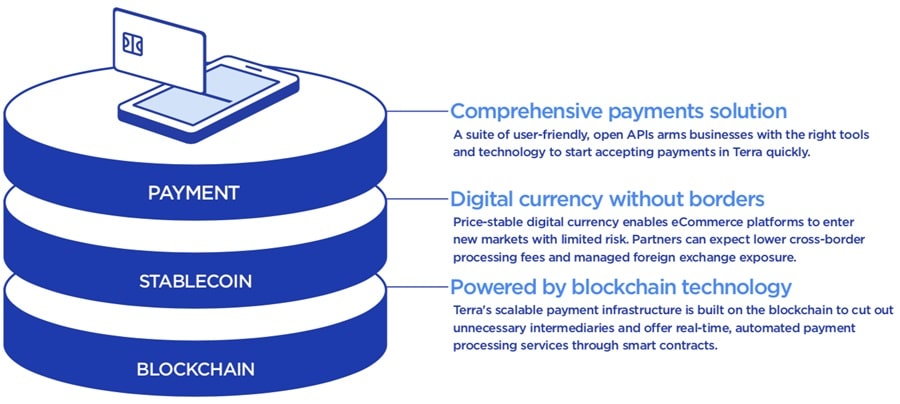

There are some projects working on a resolution to this issue, and one of them is the Terra Protocol. It uses an elastic monetary policy to create price-stable cryptocurrencies that are pegged to a variety of fiat currencies. However the team recognized that price stability alone isn’t enough to foster wide-spread adoption.

The Terra Protocol is an innovative approach to cryptocurrency volatility. Image via Terra blog.

The Terra Protocol is an innovative approach to cryptocurrency volatility. Image via Terra blog. Currencies have well known network effects. A consumer isn’t likely to adopt a new currency unless there are a number of merchants accepting that currency, but at the same time merchants have little or no incentive to accept a new currency unless there’s strong customer demand to do so. This is one explanation for the lack of mainstream adoption of Bitcoin as a transactional currency.

The team at Terra Protocol believe that an elastic monetary policy is the solution to stability for cryptocurrencies, and that a strong fiscal policy can drive adoption of new cryptocurrencies. So they are creating an efficient fiscal spending regime, managed by a Treasury, with multiple stimulus programs competing for financing.

That is, proposals from community participants will be vetted by the rest of the ecosystem and, when approved, they will be financed with the objective to increase adoption and expand the potential use cases. The Terra Protocol with its balance between fostering stability and adoption represents a meaningful complement to fiat currencies as a means of payment and store of value.

What is the Terra Protocol?

Terra is a blockchain protocol that develops and supports stable payments and open financial infrastructures. The entire protocol is supported by a basket of seigniorage style stablecoins pegged to various fiat currencies. All are stabilized algorithmically by the native asset of the blockchain, the LUNA token.

Terra and LUNA make up the dual token ecosystem of the Terra Protocol. Image via CoinCodex.com.

Terra and LUNA make up the dual token ecosystem of the Terra Protocol. Image via CoinCodex.com. By releasing fiat pegged stablecoins Terra is one part digital central bank. Another part of the system helps replace the current complicated and expensive payments chain that includes banks, payment gateways, and credit card networks. Terra is thus providing efficiencies for merchants and consumers, while continually improving on the infrastructure and tools of the ecosystem to eventually reach a transparent, distributed, credibly neutral payments system.

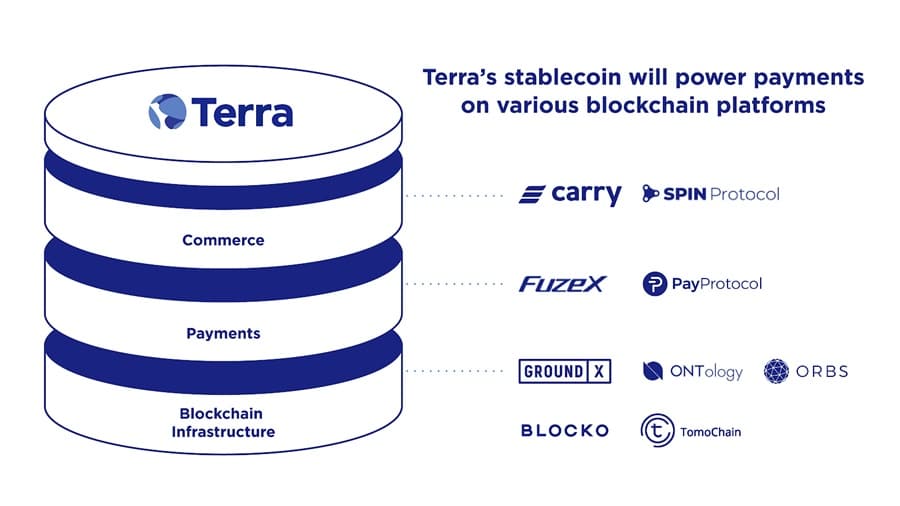

The project is already boosting mass adoption through its partner system CHAI, a South Korean payments gateway that already has over 2 million users. Using that as a springboard the team hopes to create a more widespread system by moving into other areas of Asia.

What is LUNA?

LUNA is the native token of the Terra network, used for staking to secure the network, governance, and collateralization for the price-stability of the stablecoins. LUNA is in essence the backbone and foundation of the entire Terra network and ecosystem.

LUNA Staking Rewards

The primary purpose of LUNA is to protect the network by locking value in the Terra ecosystem though a staking mechanism. Of course at the same time the holders of LUNA are exposing themselves to the price volatility risk of the LUNA token itself. Staking rewards for LUNA holders is a way to incentivize them to take on these risks and to hold LUNA long-term.

Users can stake LUNA tokens for rewards. Image via Terra blog.

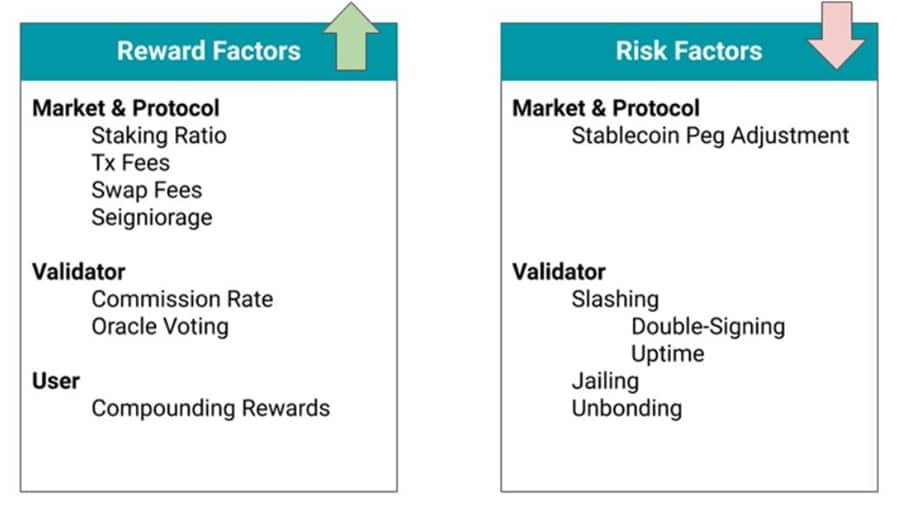

Users can stake LUNA tokens for rewards. Image via Terra blog. Staking rewards are distributed first to network validators, who take a small commission for themselves before passing along the rewards to individual delegators. The size of those rewards are determined by the size of the stake. They also increase as the transaction volume in the network increases, since part of the staking rewards come from transaction fees.

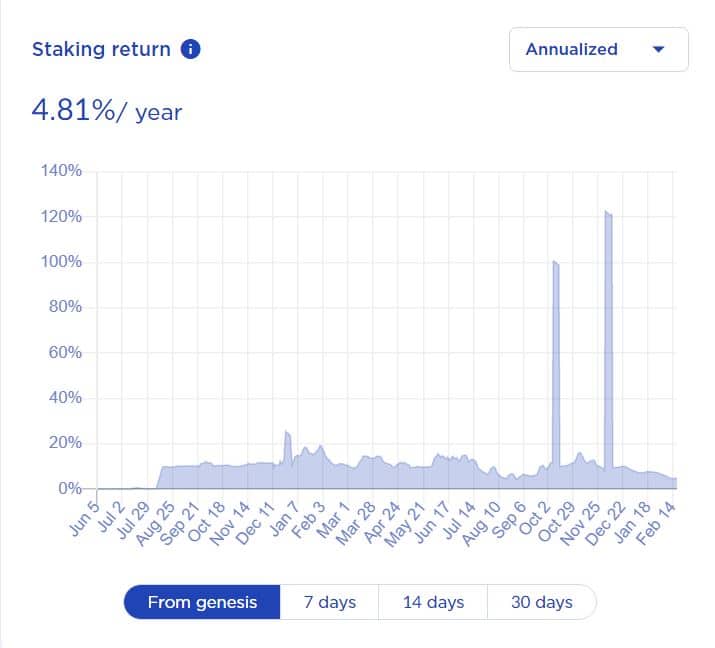

As of mid-February 2021 31.77% of LUNA holders are staking the token and the return is 4.89% annually. The staking rewards come from transaction fees (or gas), taxes on transactions, and seigniorage rewards.

Gas

Gas is a fee that’s added to each transaction to prevent spamming of the network. The validator group sets the minimum gas price and any transactions with implied gas price above this minimum are rejected. At the end of each block the gas fees are released to the validators.

Taxes

The protocol charges a small tax that ranges from 0.1% to 1% on each transaction, but is capped at 1 TerraSDR. These are implemented as a stability fee and can be paid in any Terra currency. The taxes are also disbursed to validators at the end of each block.

Seigniorage Rewards

The group of validators can participate in the exchange rate oracle process and they collect rewards from the seigniorage pool each time their vote falls within the reward band.

Phases of LUNA

LUNA can exist in three states:

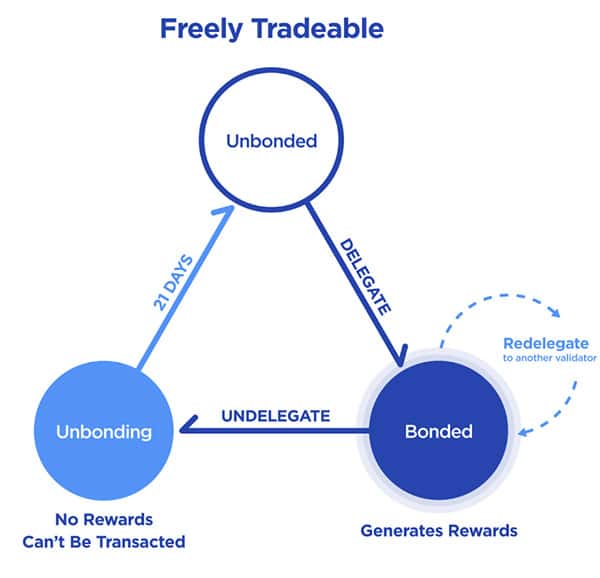

The three bonding phases of LUNA. Image via Terra blog.

The three bonding phases of LUNA. Image via Terra blog. Unbonded - Luna that can be freely transacted as a regular token, with no restrictions.

Bonded – Bonded LUNA is considered staked, and while it is bonded it continues to generate rewards for the validator and delegator it is bonded to. When bonded LUNA cannot be freely traded and remains locked in the ecosystem.

Unbonding – Undelegating or unstaking LUNA is also known as unbonding. The unbonding period lasts 21 days and during this time there are no staking rewards, nor can the LUNA be freely traded. After the 21 day unbonding period the LUNA is considered to be back to the unbounded state.

Validators

Terra is powered by Tendermint consensus, which relies on a set of validators to secure the network. Validators run a full nodes and work to provide consensus for the network. They commit new blocks to the blockchain and are compensated for their work by receiving rewards. They also participate in the governance of the treasury and their voting influence is based on the total amount of their stake, including delegations.

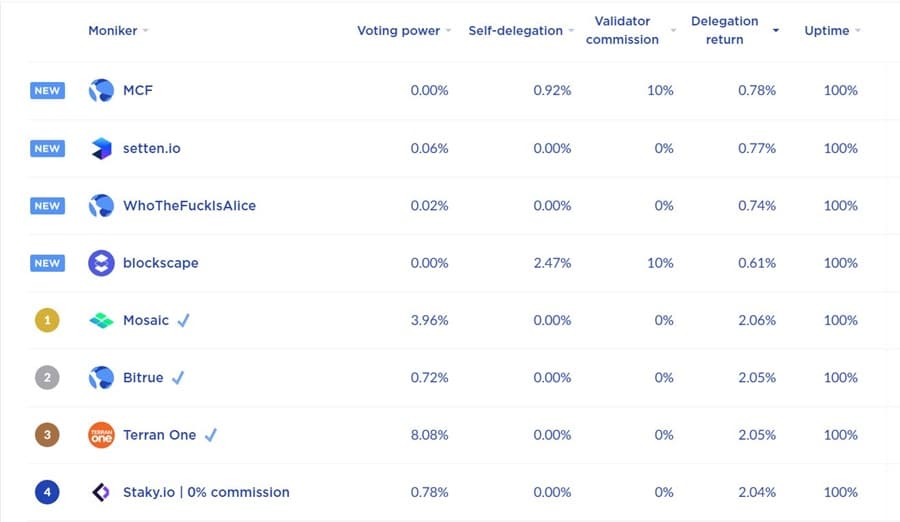

A list of LUNA validators for delegating at Terra Station.

A list of LUNA validators for delegating at Terra Station. Only the top 100 validators with the most weight will be active validators. If validators double-sign, or are frequently offline, they risk their staked Luna (including Luna delegated by users) being "slashed" by the protocol to penalize negligence and misbehavior.

Delegations

Delegators are LUNA holders who either choose not to become validators, or cannot for some reason. Delegators use the online Terra Station website to delegate their LUNA tokens to a validator, and in exchange they receive a proportional amount of staking revenue.

Current staking returns as shown at Terra Station.

Current staking returns as shown at Terra Station. Because delegators share in a portion of the revenues from staking they also share in a portion of the responsibilities of the validators. That means when a validator misbehaves and is slashed, the delegators are also slashed in proportion to their stake. This is why delegators need to choose those they delegate to wisely, and should always spread their stake across multiple validators.

Because delegators are responsible for choosing validators they provide a crucial function within the network. Although it may seem like delegation is passive, it is not. Delegators need to remain aware of the actions of the validators they are delegating to, and be ready to switch whenever the validator is not acting responsibly.

Slashing Risks

Validators have a large responsibility in the network, and because the number of validators is limited to 100 there are liveness and safety guarantees to be met. Validators risk having their stake (and those of their delegators) slashed if they are unable or unwilling to meet these guarantees.

In addition to staking rewards there are some risks. Image via Chorus.one blog.

In addition to staking rewards there are some risks. Image via Chorus.one blog. The three major slashing conditions are:

- Double signing: When a validator signs two different blocks with the same chain ID at the same height;

- Node downtime: When a validator becomes non-responsive or can’t be reached for more than a specified amount of time;

- Too many missed oracle votes: When a validator fails to report a threshold amount of votes that lie within the weighted median in the exchange rate oracle.

Validators are also responsible for watching their peers for misbehavior and one validator is capable of submitting evidence of misbehavior of another validator. If found guilty the misbehaving validator not only has their stake slashed, but they are also “jailed” for a period of time, or excluded from the validator set.

Tokenomics

Terra includes a number of stablecoins that are pegged to fiat currencies and are used for e-commerce payments. Terra network payments are posted to merchant accounts within 6 seconds, and there is a small 0.6% fee for using Terra. That compares quite favorably with the current credit card networks who have a 7-day settlement period and charge 2.8% or more in fees.

Terraform Labs created Terra Money. Image via Steemit.

Terraform Labs created Terra Money. Image via Steemit. As of November 2020 Terra processed $330 million worth of payments, which resulted in roughly $3.3 million in revenues. Those revenues are paid out as staking rewards.

Price Stabilization

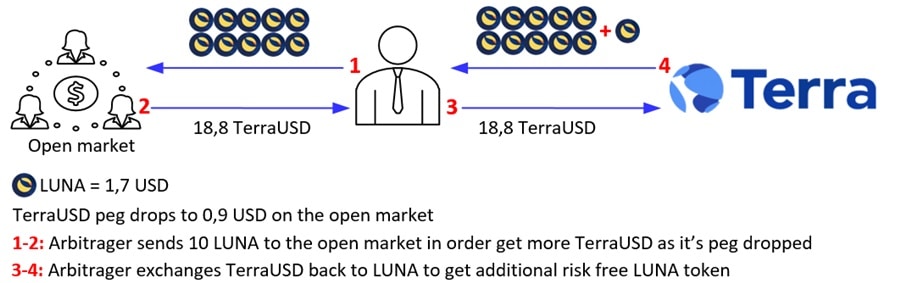

Terra’s stable assets achieve their price stability by adjusting their supply according to fluctuations in demand. So, when a surge in demand causes a surge in the price of Terra stablecoins the system goes into action to apply balancing to ensure the asset doesn’t deviate from its peg. In the case of rising demand the supply of the token needs to increase as well to offset that demand. This is known as fiscal expansion. The protocol handles this by minting and selling Terra to increase the market supply of the token.

Terra is simply taking advantage of efficient market forces, where arbitrageurs step in to collect risk-free profits by purchasing the newly minted TerraSDR (currently worth more than the peg) for 1 SDR of LUNA and then selling it immediately for a profit. The LUNA basically collateralizes the newly minted Terra and the value is then recaptured. This mechanism is known as seigniorage and represents the profit gained from minting Terra (and it costs next to nothing to mint!).

The mechanism for maintaining the Terra peg. Image via Terra blog.

The mechanism for maintaining the Terra peg. Image via Terra blog. If the price of Terra falls below the peg the supply of Terra needs to be reduced to maintain the peg. This is known as contraction and is handled by the protocol by minting LUNA and offering 1 SDR of LUNA for 1 TerraSDR when the Terra is worth less than 1 SDR. The falling value is thus absorbed by LUNA holders and as the Luna supply is diluted, the value is transferred from the Luna collateral to raise the price of Terra.

So, this is the basic mechanism used to maintain price stability in Terra. It is the use of an elastic monetary policy that reacts swiftly to price deviations and to supply/demand imbalances. While Terra does do a good job in maintaining a peg by exchanging value back and forth across currency and collateral it's impossible to design a perfectly stable asset under all conditions, and the Terra protocol does have vulnerabilities.

Miner Incentive Stabilization

The price stability of Terra does require a base level of demand for the token to persist despite any extreme volatility. This is because the entire system fails if there is a drop in the total value of all LUNA that makes it impossible to hold the Terra peg. Terra maintains its price stability due to the stability in mining demand because the miners help to absorb the volatility through the price changes in LUNA.

This means miners must remain incentivized to stake LUNA during all market conditions. Staking has to be a long-term commitment to maintain the economy. However, there is inherent volatility in unit mining rewards, since miner reward is directly correlated with economic cycles of the Terra economy -- the more transactions, the more you make in transaction fees.

Miners must remain incentivized to keep the economy functioning. Image via Terra blog.

Miners must remain incentivized to keep the economy functioning. Image via Terra blog.When mining rewards increase in volatility miners become more reluctant to maintain their stake because it is increasingly difficult to determine if the staking will remain profitable or not since staking requires LUNA to remain locked for a long period of time, and the unbonding process takes 21 days.

The way to eliminate miner uncertainty is by ensuring mining rewards remain stable and unaffected by market conditions. So in addition to the price stabilization mechanism there is also demand stabilization for LUNA to help counteract any volatility due to macroeconomic trends in the Terra economy. Miners are more comfortable making a long-term commitment to staking if they know there is a predictable, stable profit rather than volatile rewards.

Powering the Innovation of Money

The Terra ecosystem gathers value through the conversion of fiat to LUNA. In turn, Luna collateralizes Terra because 1 TerraSDR can always be exchanged for 1 SDR of Luna. Luna also stabilizes Terra through the action of arbitrageurs who resolve price differences when they act to extract profits. This is because the profits being extracted are always in Terra and LUNA.

The balancing act involves exchanging value between currency and collateral. Those who invest in collateral (miners / Luna holders) are investing long-term in the network and agree to absorb short-term volatility in exchange for predictable mining profit and steady growth. Terra holders pay transaction fees to miners for them shouldering the price changes. This system continues to work if there is enough value in Terra or Luna to continue the momentum of the balancing act.

More partners means more growth for the Terra network. Image via Terra blog.

More partners means more growth for the Terra network. Image via Terra blog. As more businesses agree to accept Terra stablecoins the value of the entire network will grow. Over time fees will also improve. The value in LUNA is maintained by encouraging staking with stable mining rewards with assured growth.

Who are Terraform Labs

Because Mirror Finance was created by Terraform Labs and runs on the Terra Network it is important to know the background and who Terraform Labs is.

Terraform Labs is a company based in South Korea that was founded in January 2018 by Do Kwon and Daniel Shin. With $32 million backing from large venture capital firms such as Polychain Capital, Pantera Capital, and Coinbase Ventures they soon released the stablecoin LUNA.

The founders of Terra. Image via Coindesk.

The founders of Terra. Image via Coindesk. They also created the Terra Network, which is designed to be a decentralized global payment system. It features minimal transaction fees and is able to settle a transaction in just 6 seconds. While it hasn’t gained traction yet in Europe and the Americas it does have over 2 million monthly unique users generating over $2 billion in monthly transaction volumes.

The bulk of these are through the South Korean payment platform CHAI and the Mongolia-based MemePay. The LUNA token is somewhat unique among stablecoins as it distributes yield back to its holders. That yield comes from the transaction fees, which are returned 100% to LUNA holders. You can learn more in the Terra Money whitepaper.

Terra Governance

Governance in Terra is provided by LUNA token holders and it allows them to make changes in the protocol when demonstrating consensus support for proposals.

Proposals

Proposals are made by Terra community members and are submitted along with a small initial deposit for the consideration of the entire Terra community. Some proposals can be automatically applied when voted to approval by the community. These include changing the tax rate, updating the reward weight, spending from the community pool, and changing the parameters of the blockchain.

Other issues like large directional changes or decisions requiring human involvement (manual implementation) can be also be voted on, through submitting a text proposal. Proposals are submitted on the network through creating a proposal, depositing some Luna tokens, and reaching consensus through a community vote.

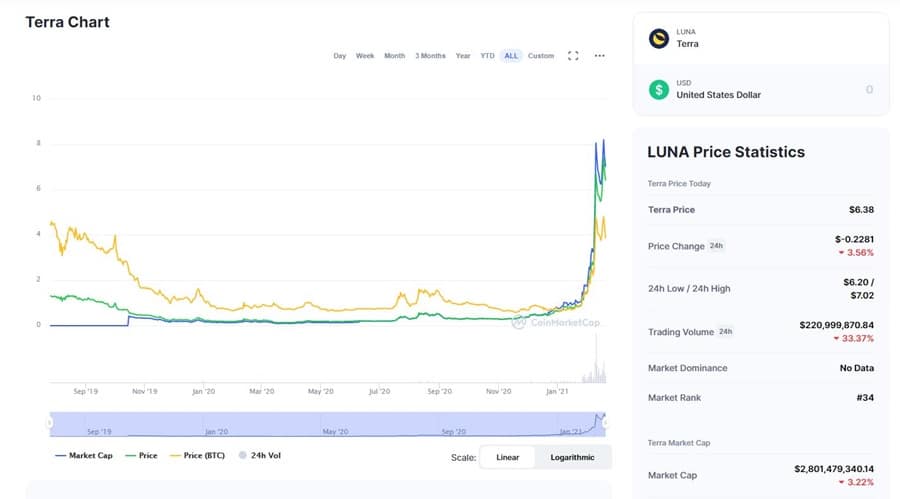

LUNA Token History

The ICO for LUNA finished in February 2019 and saw the team raining $72 million by selling tokens for $0.80 each. That turned out to be profitable for early investors when the LUNA token was listed in September 2019 around $1.30. Subsequently the LUNA token went into a steady decline that took it eventually to its all-time low of $0.1199 in March 2020. The token regained strength, popping higher in July and August of 2020 and nearly reaching $0.60 in the latter rally.

The price history of LUNA. Image via Coinmarketcap.com.

The price history of LUNA. Image via Coinmarketcap.com. December 2020 saw the token begin climbing higher in the altcoin rally that lifted markets broadly. As of February 19, 2021 the LUNA token is still tracking higher, and is trading at $6.39. That is off the all-time high struck the previous day at $7.52.

Mirror Protocol

The Mirror Protocol is a product that was launched in December 2020 and it creates digital representations of real-world assets. Initially it has been launched with representations of U.S. equities and ETFs, as well as Bitcoin and Ethereum. These digital assets can be traded on the Mirror platform, on Uniswap, and most recently on Binance Chain’s PancakeSwap.

Tokenize anything with Mirror. Image via Medium.

Tokenize anything with Mirror. Image via Medium. Using the Mirror Protocol any user can easily buy and sell the synthetic assets, called mAssets, that are created on the platform. It’s also possible to effectively short any asset by locking in collateral and issuing the asset. Currently Terra’s UST is the only stablecoin being accepted as collateral in the system.

There is also a native token for Mirror called MIR and it acts as a governance token for the network and as a staking token. There is a 0.3% transaction fee in the Mirror exchange and MIR token holders receive 0.05% of those transaction fees.

If Mirror is successful, it will drive demand for Terra’s stablecoins. Higher demand for stablecoins is linked to increasing value of LUNA token via the process called seigniorage described further down.

Anchor Protocol

Anchor Protocol allows Terra stablecoin deposits to earn stable yield, powered by block rewards of leading proof-of-stake blockchains. It was created by the same team that created Terra because they believe that a reliable savings protocol is the key to the mass adoption of cryptocurrencies.

Anchor yield is powered by steady staking rewards from multiple PoS blockchains, offering attractive and low-volatile interest rates on stablecoin deposits.

Conclusion

At its core the Terra Protocol is acting like a central bank for digital currencies, providing stability via algorithms and smart contracts.

With a hybrid design that uses both stable coins and a native staking currency it not only provides a stable transactional mechanism, but also the ability for users to earn yields by holding the staking coin. The stake coin also serves to collateralize the reserves.

The design of Terra is quite innovative and different from the approach of many other stable coins that have chosen to peg with a fiat-collateralized mechanism. Terra’s stablecoins also benefit from improved decentralization by its mechanism. As long as there are sufficient transaction fees Terra can easily cover the costs associated with its decentralized mechanism and risk compensation.

Of course there is the risk that the transaction fees will dry up, which would cause the entire ecosystem to collapse, but with the more than 2 million users already transacting the protocol appears to have a solid base to grow out of. The team is already looking to expand from South Korea into other markets, such as Taiwan and Japan. If successful there’s little risk of the ecosystem collapsing due to a lack of transactions.

There was also some concerns over a single user or organization gaining control of 51% of the total Luna tokens, but with the market cap currently near $3 billion that risk is minimal.

The Terra ecosystem has also grown to include the Anchor Protocol and Mirror protocol, both of which serve to drive demand for the Terra stable coin and LUNA native currency, further securing the network and stabilizing the ecosystem.