Perhaps the most underrated and under-utilized potential for cryptocurrency is leveraging the benefits of CeFi earning platforms. Why I believe many overlook the opportunities offered here is that the yields don’t always match our expectations when crypto is the topic.

Many get into crypto for those +100% earnings in a couple of weeks rather than earning a consistent and stable 10% or so a year. Another potential reason why crypto investors may be shying away from centralized platforms in recent history may be because the painful memories of lending platforms like Celsius and BlockFi are still fresh in our minds.

However, we shouldn't let a couple of mismanaged platforms that imploded due to irresponsible and risky lending practices taint the entire industry, as there are a handful of centralized platforms out there offering decent APYs and utilizing a myriad of different strategies to generate yield with varying degrees of risk.

In this article, we'll go through the top 6 centralized (CeFi) platforms that are offering yield to users, APY which is generated by lending and/or DeFi utilization.

I know some of you reading this may prefer DeFi platforms to centralized crypto platforms, but seriously, some of these CeFi platforms are great and there are many benefits these platforms offer such as brilliantly designed interfaces, beginner-friendliness, and easy “one-click” access to DeFi protocols, removing the complexity that exists in DeFi. Plus, we still aren't at the level of adoption where everyone is comfortable with self-custody and the responsibility of managing their own funds, so these platforms offer a great alternative.

Quickly before starting, we should point out that not all of these platforms are available globally, and the United States has taken a hard-nosed stance against many crypto companies, including many of those on this list, so you’ll have to check on that before using them.

Before diving into the Top CeFi Platforms, let's quickly cover what CeFi is.

What is CeFi (Centralized Finance)?

Crypto users love shortening terms, I don't know why... Perhaps we are a lazy bunch. CeFi is short for Centralized Finance. The term "centralized" highlights the fact that there is a centralized authoritative body that has ultimate control over the platform and all user funds. It's essentially centralized crypto, similar to how banks operate with full authority over our bank accounts and the funds held within them.

Here are a few features of CeFi:

- Centralized Authority: CeFi systems are controlled by a central entity, such as a bank or financial institution. This central authority oversees all transactions, maintains records, and ensures regulatory compliance.

- Regulation and Compliance: CeFi operates under strict regulatory frameworks set by government agencies and financial regulators. These regulations are designed to protect consumers, ensure transparency, and maintain financial stability.

- Intermediaries: Transactions in CeFi often require intermediaries, such as banks, brokers, and payment processors, to facilitate and secure transactions.

- Custodial Services: In CeFi, financial institutions act as custodians of assets. They hold and manage customer funds, ensuring security and offering services like insurance and fraud protection.

- Established Infrastructure: CeFi benefits from a long-established infrastructure, including extensive banking networks, ATM systems, and global payment systems like SWIFT.

CeFi encompasses a wide range of banking services, including savings and checking accounts, loans, mortgages, and credit facilities. Banks manage deposits and offer interest-bearing accounts.

For all its might, however, CeFi isn't without its shortcomings:

- Lack of Transparency: The operations of centralized financial institutions are often opaque, with customers having limited visibility into how their funds are managed and invested.

- High Fees: CeFi services can come with high fees, including transaction fees, maintenance fees, and penalties, which can be burdensome for customers.

- Centralized Risk: The centralization of financial power in a few large institutions can pose systemic risks. The failure of a major institution can have widespread economic repercussions.

- Limited Access: Despite the reach of CeFi, there are still many underserved and unbanked populations, particularly in developing regions, who lack access to traditional financial services.

- Slow Innovation: Traditional financial institutions can be slow to adopt new technologies and innovations, leading to inefficiencies and limited adaptability in a rapidly changing financial landscape.

All of this stands in stark contrast to DeFi, which is short for decentralized finance. The term "decentralized" highlights the fact that there is no central authority, everyone who participates in the DeFi platform keeps full control over their funds, and their crypto is not handed over to the centralized company for custodianship.

CeFi vs DeFi

CeFi and DeFi represent two contrasting approaches in the financial system, each with its own set of characteristics, advantages and challenges.

| Feature | CeFi | DeFi |

|---|---|---|

| Control | Centralized authority (banks, financial institutions) | Decentralized network (blockchain, smart contracts) |

| Intermediaries | Requires intermediaries (banks, brokers, payment processors) | No intermediaries, peer-to-peer transactions |

| Regulation | Heavily regulated by government agencies | Minimal or no regulation |

| Security | Provided by financial institutions, regulatory oversight | Secured by blockchain technology, user-controlled |

| Transparency | Limited transparency, opaque operations | High transparency, open-source protocols |

| Custody | Custodial services, institutions hold and manage funds | Non-custodial, users retain control of their assets |

| Fees | Higher fees (transaction fees, maintenance fees) | Generally lower fees, gas fees for transactions |

| Innovation Speed | Slower to innovate, traditional infrastructure | Rapid innovation, agile development |

| Market Hours | Limited to business hours | 24/7 market availability |

| Systemic Risk | High systemic risk, interconnected institutions | Reduced systemic risk, decentralized nature |

| User Experience | User-friendly, established infrastructure | Varied user experience, requires technical knowledge |

| Identity Verification | Mandatory KYC/AML procedures | Pseudonymous or anonymous |

CeFi

As noted, CeFi relies on centralized entities, such as banks or financial institutions, to manage and facilitate financial transactions, which often involve intermediaries, leading to a hierarchical structure. Here are the main characteristics of a CeFi platform.

- Trust: Users trust centralized entities to secure and handle their funds and financial activities.

- User-Friendly: CeFi platforms are often user-friendly, providing familiar interfaces and customer support.

- Account Verification: Users typically undergo identity verification (KYC) to use CeFi services.

- Compliance: CeFi entities are subject to regulatory frameworks and must comply with financial regulations.

DeFi

- Peer-to-Peer: DeFi operates on decentralized networks, often using blockchain technology and smart contracts for peer-to-peer transactions. This removed the need for intermediaries.

- Trustless System: DeFi aims to create trust through smart contracts, eliminating the need for trust in centralized entities.

- Open Access: DeFi is generally more accessible, allowing anyone with an internet connection to participate.

- Permissionless: No mandatory identity verification in many DeFi protocols.

Considerations

- Risk and Security: CeFi may offer traditional security measures, while DeFi introduces smart contract risks.

- Innovation: DeFi is often associated with rapid innovation and the development of new financial instruments.

- Interoperability: CeFi and DeFi can coexist, and efforts are being made to enhance interoperability between the two systems.

- Philosophical Differences: CeFi represents a traditional, centralized approach, while DeFi embodies the principles of decentralization, autonomy, and financial inclusion.

Ultimately, the choice between CeFi and DeFi depends on individual preferences, risk tolerance, and the desired characteristics of the financial ecosystem one seeks to engage with.

Top CeFi Platforms

You may also hear the term CeDeFi which is a bit of an oxymoron standing for Centralized Decentralized Finance. This term is sometimes used for crypto lending companies as they are centralized platforms that offer decentralized crypto products.

Each of the companies mentioned in this article falls under the CeFi or CeDeFi category (interchangeably) as they are centralized entities offering crypto products that were traditionally only available on DeFi platforms.

In no particular order, here are 6 CeFi platforms that have withstood the test of time.

Nexo: Great CeFi Rates

Notice⚠️ In January 2023, Bulgarian authorities announced a raid on Nexo, with allegations of legal misconduct including organized crime affiliations, fraud, tax evasion, money laundering and more, all of which are being actively investigated. Nexo has responded with a counter-suit and denied wrongdoings. The investigations are still ongoing. We recommend users research these allegations for themselves before choosing to sign up for Nexo.

Nexo is a subsidiary of Credissimo that was founded all the way back in 2007. The Nexo platform was deployed in 2018. To date, Nexo has paid over $500 million in interest, gathered over 6 million users in over 200 jurisdictions and supports 60+ different cryptocurrencies. Nexo offers both lending and borrowing as well as a crypto credit card. Nexo also has its own native token called NEXO.

Starting with lending, Nexo has some of the highest rates for almost all tokens they offer, beating out most of the competition from an ROI perspective. However, let's not forget what we've seen happen to previous platforms that offered unsustainably high returns. We aren't saying that Nexo is, but keep the old adage in mind “If it seems too good to be true..”

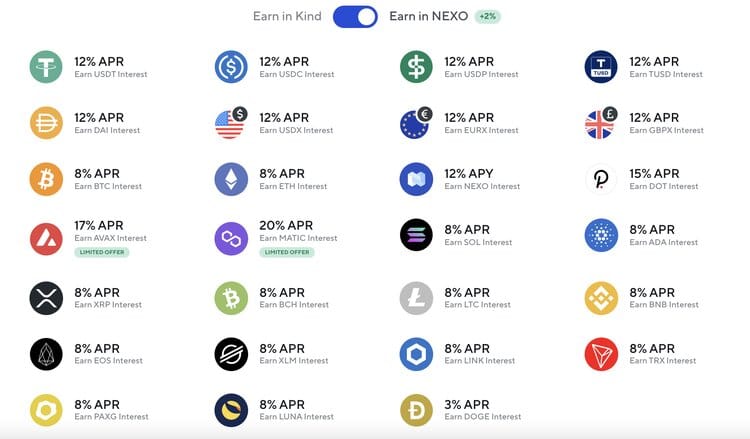

The interest on your Bitcoin and Ether can be as high as 8% if you opt for a fixed term and get paid in Nexo tokens. Other interest rates are also pretty high, DOT at up to 15%, and then we've seen assets such as AVAX and MATIC offer holders limited-time boosted rates of 17% and 20% respectively.

For stablecoins, the rates are up to 16% but what really differentiates Nexo is that you can lend fiat money too. Currently, it’s possible to lend USD, EUR, and GBP, the rates are the same as for stablecoins. What’s also different with the Nexo CeFi platform is that the interest earned is paid daily while some platforms pay weekly. However, while some might enjoy this depending on where you live, I would not since it would be a huge burden to keep up with the taxes, so make sure to check what the reporting requirements in your country are and be sure to follow them.

A look at all the assets and their rates on Nexo. Image via Nexo.

A look at all the assets and their rates on Nexo. Image via Nexo. When it comes to borrowing crypto, you’ll be happy to know that interest rates can be as low as 0% in certain situations, and they never exceed 13.9%.

What caught my eye in borrowing with Nexo is that they’ve deployed the possibility to apply for a loan against your NFTs. Currently, they support two collections, Crypto Punks and Bored Ape Yacht Club. When applying, you can get up to 20% of the floor price. This is something many platforms haven’t yet done and I’m sure there will be good demand for this, especially when the next bull run comes along. Still, when talking about NFTs be careful when lending against them since we have seen how the prices of NFTs have crashed during a bear market and even that 80% buffer might not be enough.

Other features on Nexo include the already mentioned crypto card as well as an exchange for crypto swaps and trading. The Nexo card is issued in partnership with Mastercard so using it pretty much anywhere shouldn’t be a problem. The card earns you up to 2% cashback and additional benefits on the Nexo site. However, before ordering it I suggest reading this piece on Coin Bureau and watching this video, both of them are about the best crypto cards on the market.

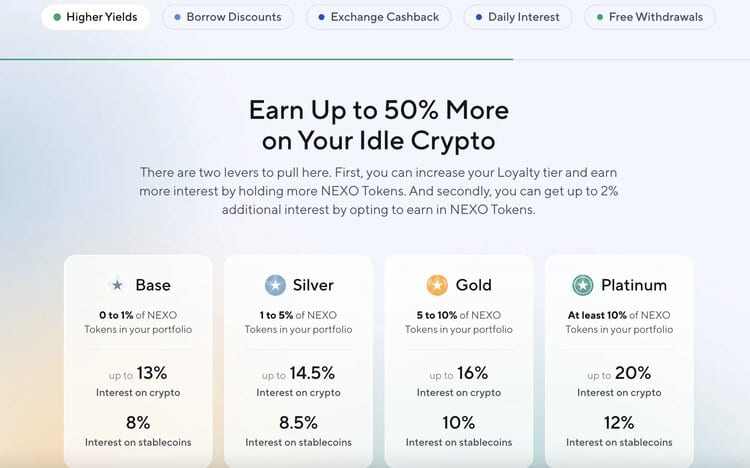

A Look at the Tiers Available. Image via Nexo

A Look at the Tiers Available. Image via Nexo To wrap up Nexo, this platform has become the most popular and widely used lending platform on the market, and for good reason. After competitors Celsius and BlockFi faced liquidity issues, Nexo has proven itself to be the more secure, safe, and sustainable platform, while still providing some of the best rates and features in the industry.

Crypto.com: Crypto Loans and More

Crypto.com has become a go-to platform for users with various different crypto needs. This powerhouse platform supports just about everything crypto-related such as trading, an NFT marketplace, a self-custodial DeFi wallet, their own blockchain network, one of the most popular crypto cards, an attractive Earn program, and of course, crypto loans.

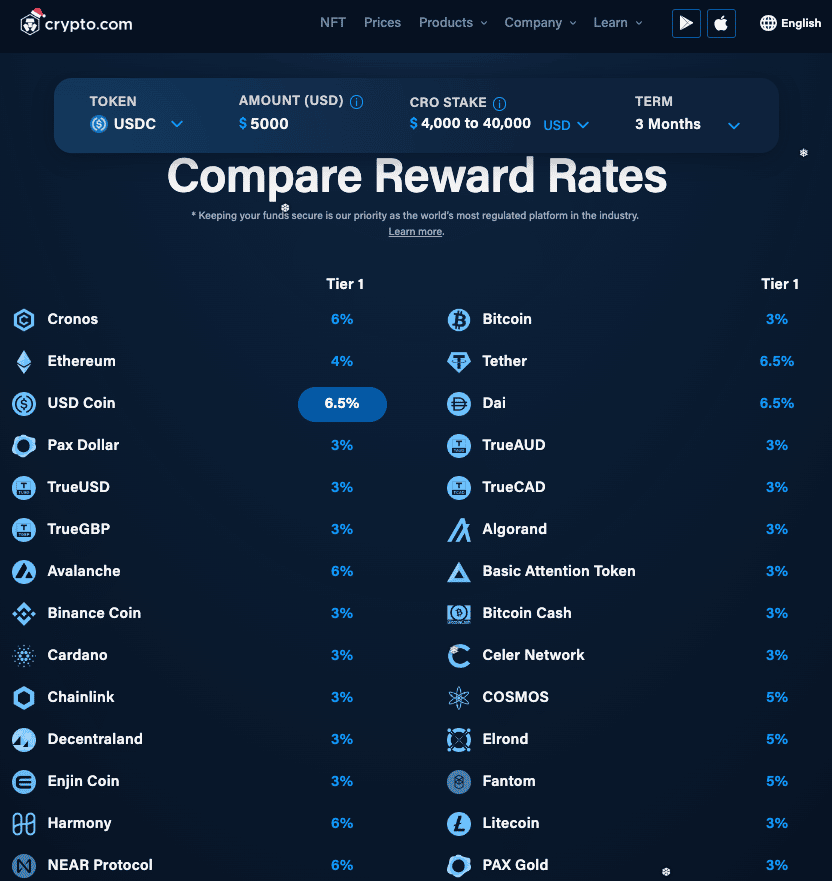

Image via Crypto.com

Image via Crypto.com With Crypto.com, users can earn interest on their crypto holdings up to 12.5% APY through the Earn program, and take out crypto-collateralized loans up to 50% LTV. Interest rates will heavily depend on how many of the platform's CRO tokens a user stakes and the TVL selected. Here is a look at the repayment rates for crypto loans:

Image via Crypto.com

Image via Crypto.com Users who take out crypto loans on Crypto.com can pay the loans back on their own schedule and can deposit 20+ crypto assets as collateral, borrowing PAX, TUSD, USDC, or USDT without credit checks, statement deadlines, or late fees.

As far as the Earn program goes, Crypto.com users can earn passive income on 37+ crypto assets, making this one of the best earn programs available, with up to 6.5% p.a on USDC stablecoin, and some of the highest returns on multiple altcoins depending on how much CRO the user stakes.

Here is a look at some of the returns available:

Image via Crypto.com

Image via Crypto.com You can learn more about Crypto.com and find out why they are considered one of the top crypto platforms in the industry in our Crypto.com Review.

YouHodler: Unique CeFi Provider

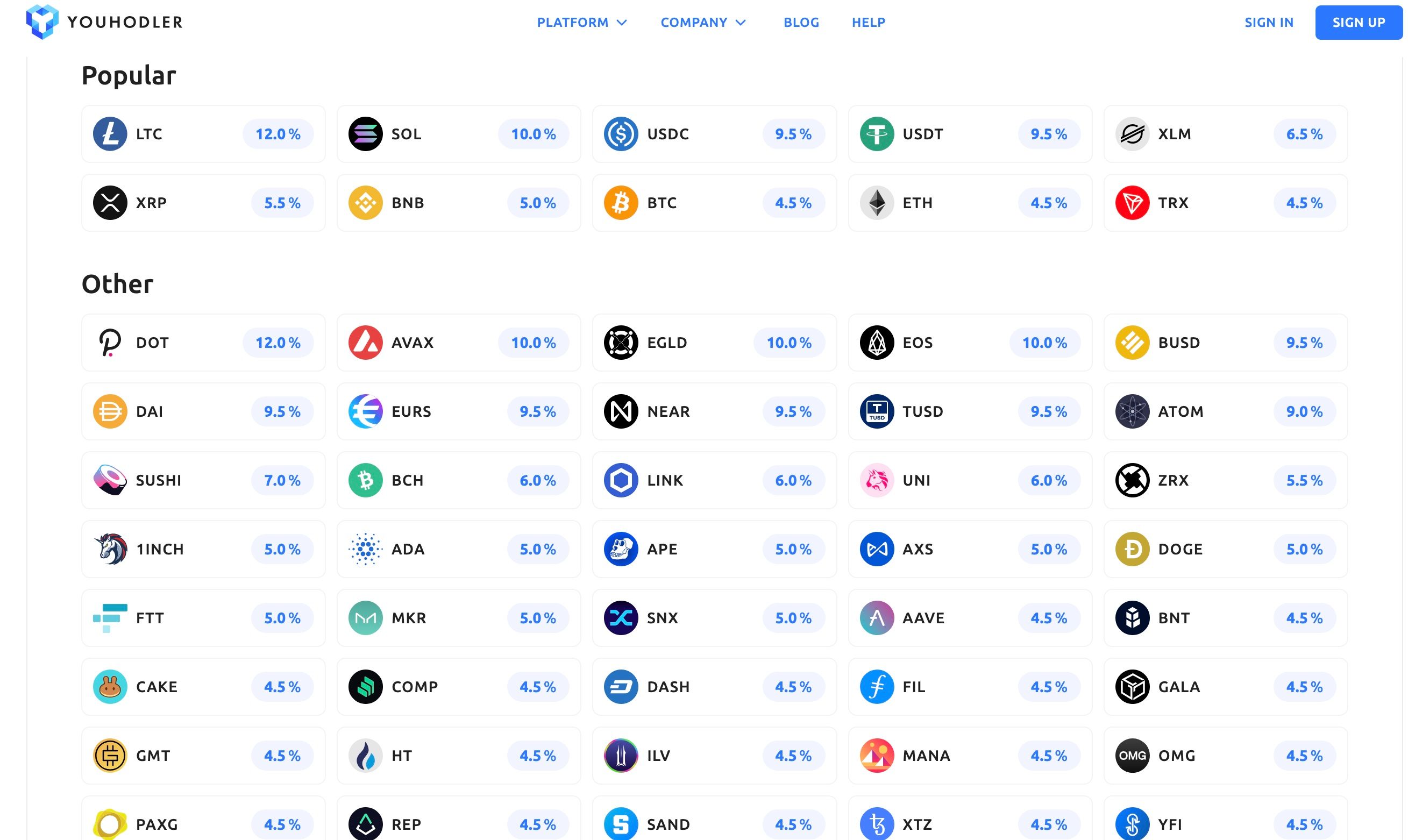

YouHodler was founded in 2018 and differentiates itself by supporting a multitude of different currencies and unique features. Users of YouHodler appreciate that the platform is regulated in the EU and Switzerland.

As with all the others, let’s start with lending. YouHodler offers competitive interest rates of up to 15% on most stablecoins, 4.5% on BTC and ETH. On top of that, they have rates on coins like YFI (4.5%) and Sushi (7%). Altogether YouHodler supports over 50 different cryptocurrencies. The interest is paid weekly in the same currency you deposited, nothing new here.

Couldn't fit all of them in one picture but here's most of them. Image via YouHodler

Couldn't fit all of them in one picture but here's most of them. Image via YouHodlerThe borrowing side is also fairly similar to others excluding one major difference. On other sites, the amount you can borrow on your collateral is around 50% while YouHodler allows as high as up to 90% and you can use all of the top 20 coins as collateral.

Now, while some might think this is great, I find it a bit scary. That’s because cryptocurrencies are extremely volatile, and your collateral might easily drop in value and leave you with a huge amount of debt compared to what’s left of your collateral. Speaking of collateral, YouHodler also offers the possibility to provide NFTs as collateral but that needs to be applied for separately. Now I don’t know which collections are supported but my guess would be that those blue-chip NFTs like BAYC and Punks are among them.

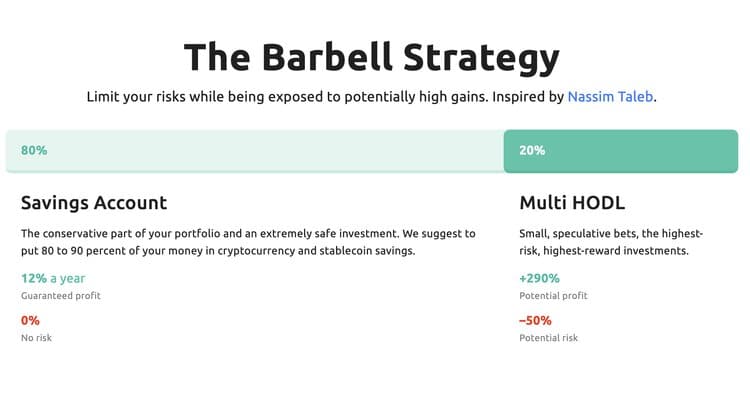

I only agree with the max 20% here (although 0% is what I would prefer), there is risk with "traditional" savings and potential loss in Multi-HODL is higher than 50%! Image via YouHodler.

I only agree with the max 20% here (although 0% is what I would prefer), there is risk with "traditional" savings and potential loss in Multi-HODL is higher than 50%! Image via YouHodler. The two features not offered on other platforms are Turbocharge and Multi-Hodl. These are essentially borrowing, and lending combined with steroids. When using this what happens is that you put your coins as collateral and take a loan with which you’ll buy more crypto which will again be used as collateral for a new loan, and so on (everything is done automatically of course).

What should immediately go through your mind is the extremely high risk of this and as a personal opinion, I wouldn’t suggest this to anyone. The potential gains are nice, but you can lose a lot of money with this which is why YouHodler itself doesn’t suggest allocating more than 20% to this and the rest in traditional savings (traditional meaning the normal crypto lending).

SwissBorg: CeFi and Crypto Exchange

SwissBorg is quite a bit different from some of the other mentions on this list. This centralized finance platform is one of the most user-friendly crypto apps and angles itself as more of a crypto wealth management platform.

Swissborg was founded in 2017, is fully regulated, offers a fiat on and offramp, exchange services, and has since gathered over 1 million users with over $1.6 billion on the platform. Different from lending platforms, SwissBorg doesn’t offer loans, all yield is generated from leveraging DeFi protocols and blockchain-based earning methods such as staking. But how are the yields?

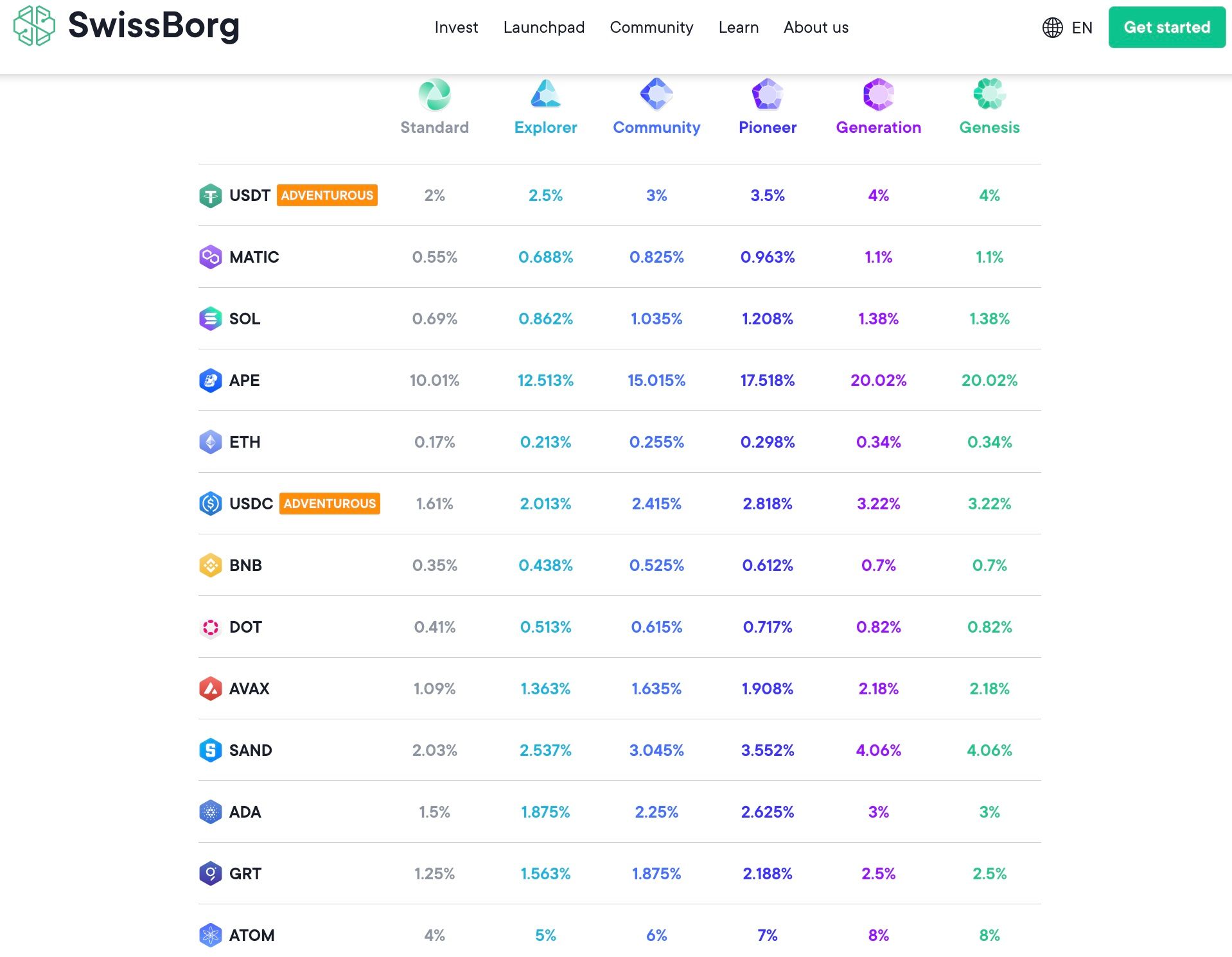

Well, I have good news and bad news. The yields are pretty good IF you have the Genesis premium plan, which boosts your earnings by 2x, but you need to hold 50,000 BORG tokens, which is no small investment. If you have the Genesis premium, you’ll be earning 4% on stablecoins and for BTC and ETH, roughly 1% and 5% respectively. Note that these rates vary dramatically and frequently as the returns fluctuate with DeFi yields. I have seen Solana returns, for example, fluctuate from 9% to 1.3% over the course of a few months as supply and demand economics are in effect.

Now you might be wondering what else you can earn interest on. Sadly, there’s not much to wonder about since including those mentioned above, SwissBorg only supports earning on 14 different cryptocurrencies. The highest yield here is that of the APE token, and currently, the rate is sitting at 20%.

A Look at Some of the Interest Rates. Image via SwissBorg

A Look at Some of the Interest Rates. Image via SwissBorgAlthough the APYs aren't as high as platforms such as YouHodler and Nexo, users have come to appreciate SwissBorg for many of the products that make up the full suite such as the analytical tools, portfolio statistics, swap aggregator, the first launchpad of its kind, and the revolutionary Thematics investment products which we cover in our Swissborg Review.

On top of that, SwissBorg instils confidence in its users thanks to their transparency around product offerings and users have come to respect that SwissBorg does not engage in any such shenanigans that many lending platforms are accused of that resulted in the demise of Celsius, BlockFi and Voyager.

Yield App: Digital Wealth Platform

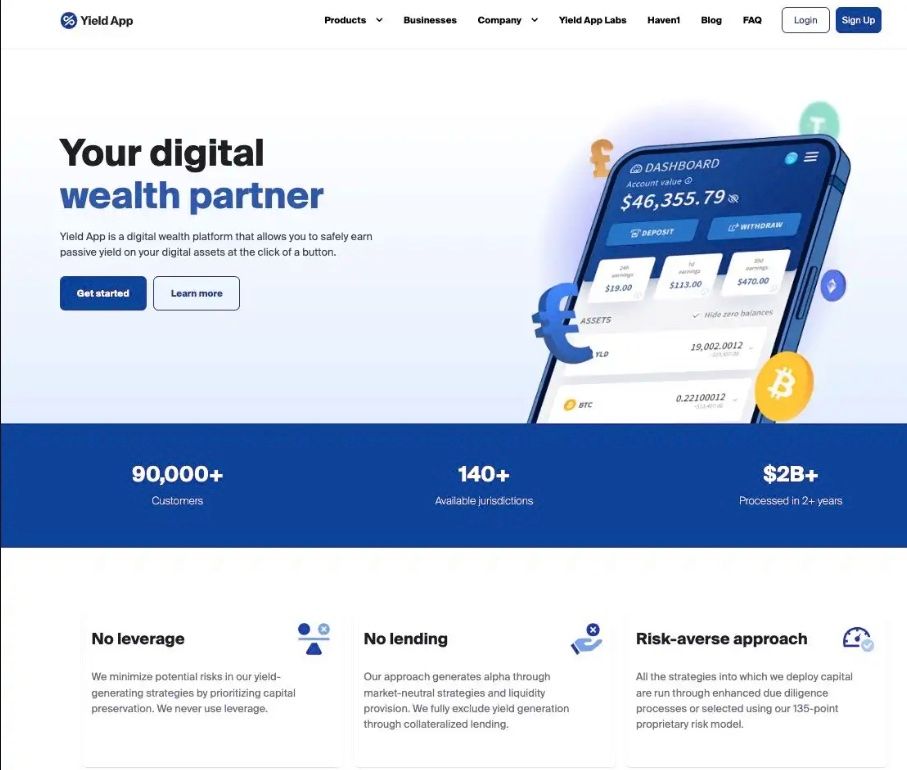

Yield App is a regulated digital wealth platform that offers a good rate of return on many of the leading cryptocurrencies. What sets Yield App apart from many mentioned on this list is its risk-averse approach to yield generation strategies and the high calibre of talented and experienced individuals who founded and currently manage the platform.

Unlike some platforms, Yield App abstains from risky practices like unsecured lending, leveraging, or asset swapping, and takes one of the most robust approaches to the safety and security of users' assets in the industry. Their comprehensive security framework has resulted in the platform running since 2020, surviving bear markets and the events and practices that resulted in the collapse of competing platforms.

Image via yield.app

Image via yield.appThe yield generated by this platform is derived from its access to DeFi protocols and its involvement in arbitrage trading.

Yield App has gained recognition in the European Union as a Virtual Assets Service Provider (VASP), registered by Italy's Organismo Agenti e Mediatori (OAM). Furthermore, Yield App has recently integrated with Fireblocks, a leading wallet service provider that features insurance on all assets in custody and in transit.

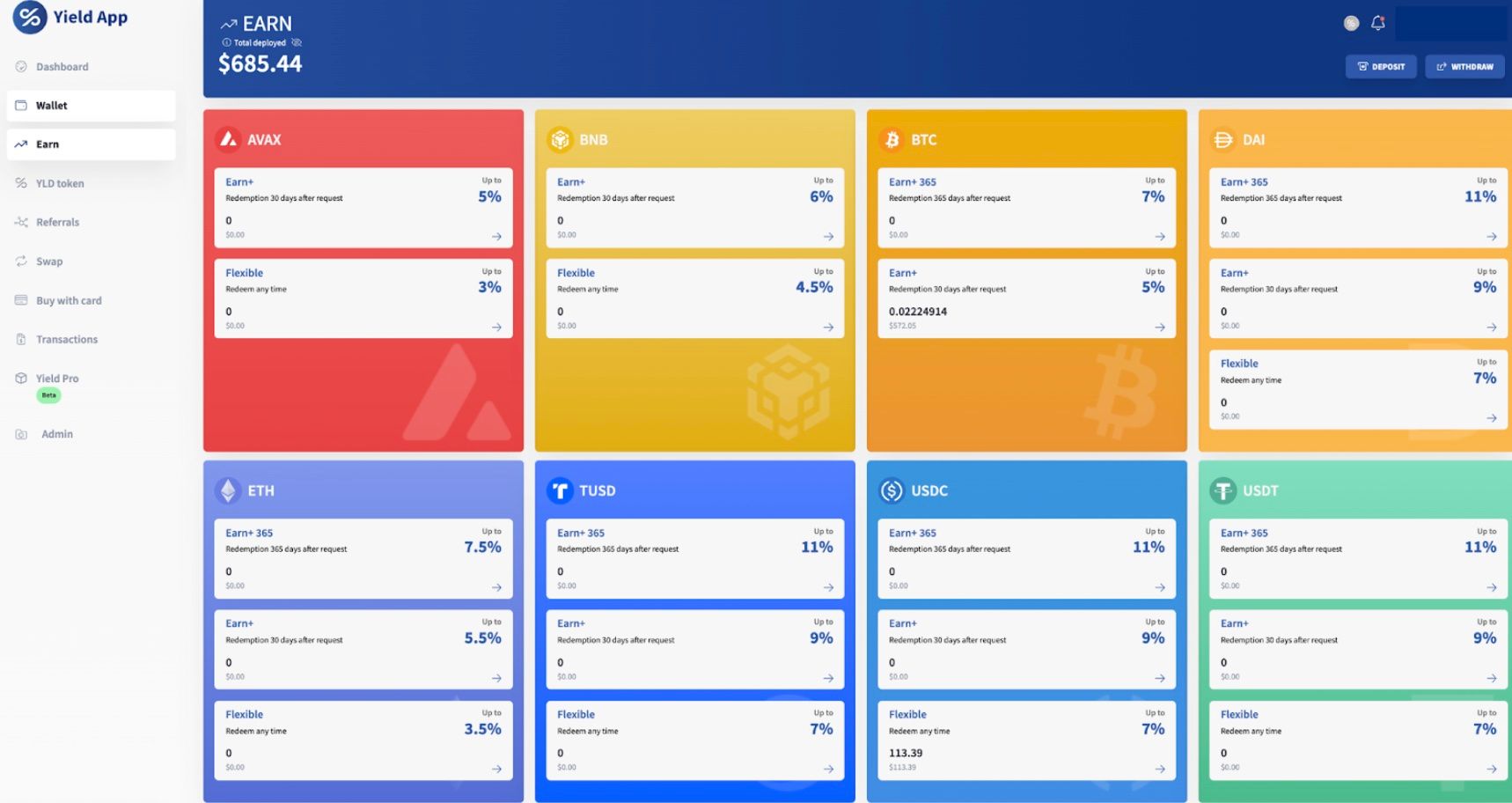

With a user base exceeding 100,000 located in over 140 jurisdictions, Yield App has processed over $2 billion in customer assets, both retail and institutional. Customers on the platform can earn up to 11% on stablecoins and an impressive up to 7% on Bitcoin and 7.5% on Ethereum depending on user loyalty level and lock-in terms.

A Look at the User-Friendly and Well-Designed User Interface.

A Look at the User-Friendly and Well-Designed User Interface.Yield App is a good choice for those looking for a secure platform to earn yield on idle assets. You can learn more about it in our in-depth Yield App review.

Wirex: CeFi for the Masses

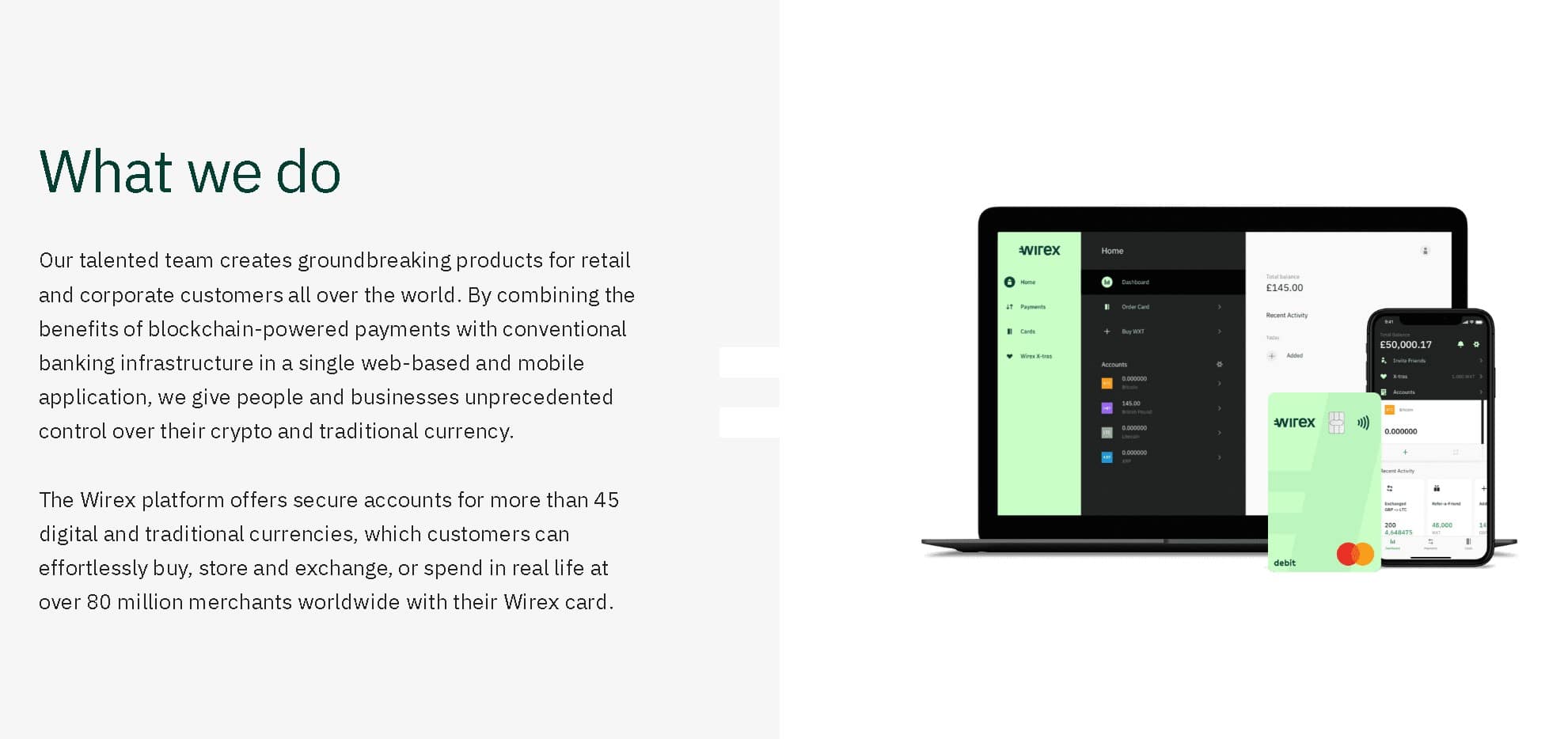

Founded all the way back in 2014, Wirex is a good all-in-one crypto platform for those looking to buy, sell, hodl, borrow, and spend crypto. Wirex is a regulated and trusted platform, founded by three members with over 40 years of experience working in the Fintech industry and is based in the UK, with additional locations in the United States, Ukraine, Ireland, and Singapore.

Wirex has a simple mission, and that is to make traditional money and cryptocurrency equal and accessible to everyone. Wirex launched one of the first crypto debit cards and supports over 45 digital and traditional currencies, allowing users to buy, store, exchange, or spend at over 80 million merchants worldwide.

Image via Wirex

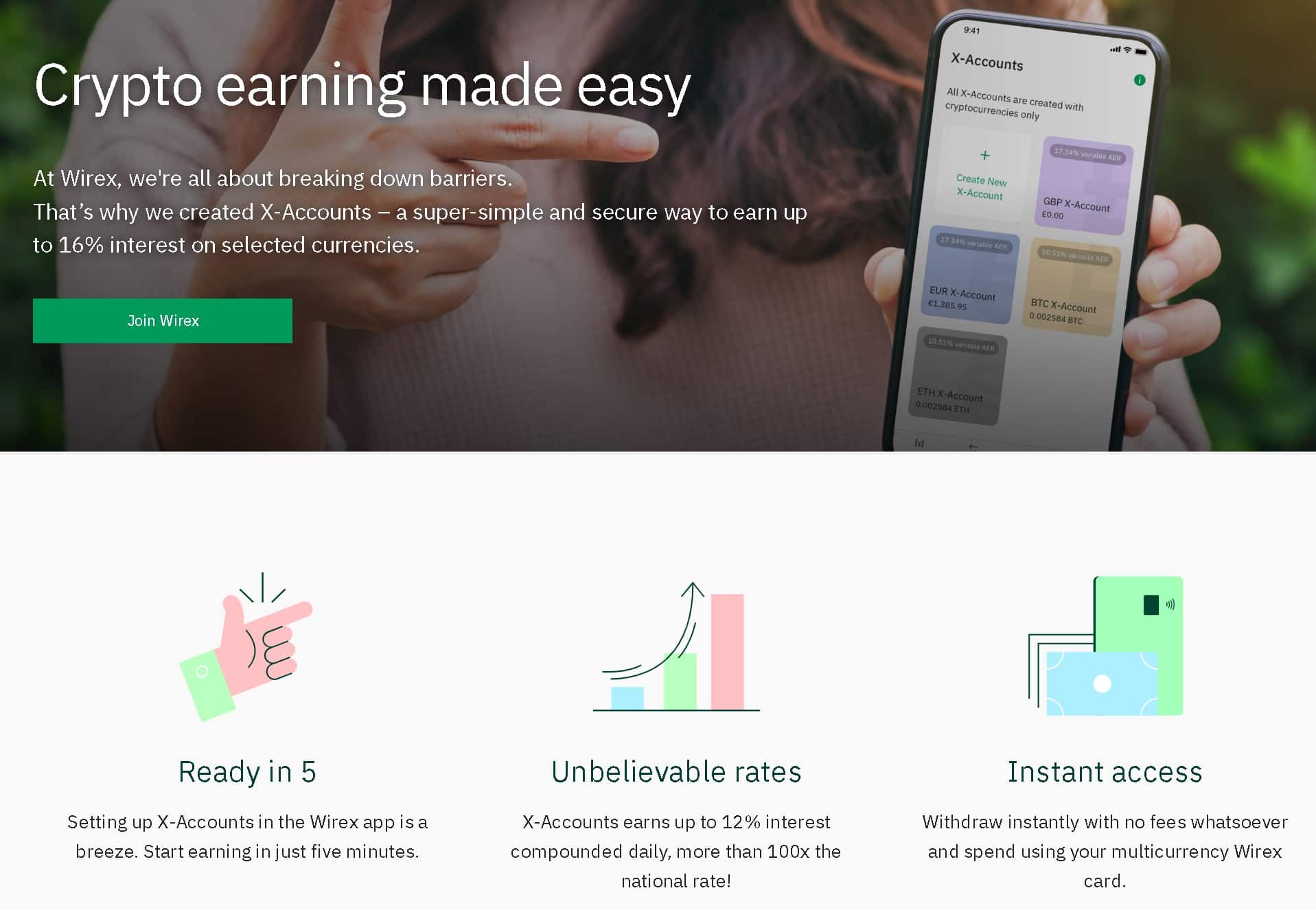

Image via Wirex In addition to their crypto debit card which offers up to 8% cashback on spending and zero exchange fees on FX, the platform also offers what they call X-Accounts. This feature is a simple and secure way to earn up to 12% interest by simply holding a variety of cryptocurrencies and stablecoins. Wirex offers among the highest APYs available for those looking to earn some passive income on their hodl stash.

Wirex X-Accounts Are a Great Way to Earn APY. Image via Wirex

Wirex X-Accounts Are a Great Way to Earn APY. Image via Wirex Following the success of the widely popular crypto card and X-Accounts, Wirex decided to up their game and now offers borrowing services as well. Through Wirex Credit, users can instantly take out a credit line against their crypto so there is no need to sell those moon bags if you need short-term access to funds. Customers can choose to borrow against their BTC, ETH, or Wirex's native WXT token. Here are the benefits of Wirex Credit at a glance:

- Borrow up to 80% of the value of your holdings

- Pay just 10% APR- Interest is calculated daily, so you only pay on the days you have an open credit line. Some currencies can be borrowed with as low as 0% interest.

- Credit line allows users to borrow NXDUSD, USDC, USDT or DAI

- Instant approval of the credit line, funds are made available straight away and can be spent on the Wirex card

Wirex customers feel confident in their platform of choice, as it has a long-standing history and a good security record. Wirex follows industry best practices when it comes to security and boasts the following security features:

Image via Wirex

Image via WirexIf you’re looking to borrow, hodl, spend, earn, or just incorporate crypto more into your daily life, Wirex is a platform worth checking out.

Top CeFi Platforms: Conclusion

Before getting to the conclusion, it's worth another reminder that the rates stated here do fluctuate based on supply/demand. Those high rates for DOT might quickly fade if more people lend them and as interest leaves the industry. Also, the total amount you receive does take a hit if the underlying asset falls in value so don't trust all the calculations you do to a full 100% since your earnings will fluctuate.

Now, when it comes to which you should use there’s no definitive answer and different folks prefer different platforms for different reasons. Those with a security-minded preference will likely opt for platforms like Yield App and SwissBorg, while others who only care about high APY are likely to choose Nexo or YouHodler. All of them come with their own pros and cons, therefore it’s your job to weigh which centralized crypto platform is right for you. However, it is worth mentioning that if you intend to hold your investments passively for an extended time, exploring decentralized crypto storage options is worth exploring over these centralized alternatives, owing to their greater security.

Then if not only picking from these options is hard, there are several more options to take into consideration for great exchange platforms. These include the likes of Binance and KuCoin, which both offer competitive earn features. And to make it just a tiny bit harder, you also have the whole DeFi space to explore, but that’s a topic for another day.