As interest and popularity in crypto and digital assets continues its impressive upwards trajectory over time, naturally, more and more users are looking for exchanges to pick up their favourite tokens. Of course, most crypto users are familiar with centralized custodial exchange giants such as Binance, Crypto.Com, OKX etc., who provide convenient exchange services, but what about those looking for a non-custodial exchange?

If that sounds like you, you have stumbled across the right article. This article will cover the top 5 non-custodial exchanges, why someone may want to consider using one vs a traditional custodial centralized exchange, and which user each non-custodial exchange is best suited for, in my opinion.

Why use a Non-Custodial Exchange?

If you have been kicking around the crypto space for a while, you have probably heard the term, “not your keys, not your crypto.” This saying refers to a crypto holder’s private keys. Each crypto wallet comes with a unique set of keys that allow the crypto holder access to their crypto. Whoever has access to these keys has access to the crypto assets associated with that wallet address, so it is imperative for crypto users to keep these keys private and stored somewhere safe.

When someone uses a custodial exchange like Coinbase or Binance, the exchange has custody of the private keys. Therefore, all the funds on the platform and anyone who keeps their crypto on the exchange does not actually “own” that crypto. In reality, the customer owns an “IOU” from the exchange.

This works the same way as a bank, the money in your bank account is not owned by you, the bank ultimately has custody and control over the funds, and they can lock you out of your account and deny you access to the funds in “your” account at any time.

We saw this happen in 2022 with the protestors in Canada; the government did not like the peaceful protests and were accused of abusing their authority when they blocked many Canadians from accessing their bank accounts. We also saw a similar instance with sanctions against Russians where sanctions wholly denied bank and crypto customers access to the funds in their bank and crypto accounts.

Canadian Protestors had Their Bank Accounts Frozen Image via CBC

Canadian Protestors had Their Bank Accounts Frozen Image via CBC Many crypto enthusiasts will opt to use decentralized exchanges (DEXs) such as Uniswap or SundaeSwap, or non-custodial exchanges such as the ones on this list because these platforms provide a way to swap assets without having to jump through KYC hurdles, plus there are no custodians who hold onto the crypto on the user’s behalf. These non-custodial exchanges can also often provide users with the best prices and save on costly fees (more on that later).

Not having to go through a custodial entity allows users to keep control of their crypto truly. By using a non-custodial service, no centralized authority can deny users access once the transaction has been completed, which is one of the main attractions to these services.

The ability to make transactions without the need to provide personal information for KYC purposes is a huge plus, as many crypto users value anonymity and speedy convenience. Unfortunately, regulation has hit most centralized exchanges hard. Because of that, users are forced to provide personal information for KYC nearly everywhere they go for crypto services.

When I first started using Binance, I could do it without providing any information at all; it was quick and easy. However, over time, KYC requirements progressed, and I now feel like I have had to provide them with my entire life story, an autobiography, a list of my likes and dislikes, my favourite colour and name of my first pet, uploads of my ID, blood samples, what I had for breakfast, fingerprints and eye scans just to make a transaction… Obviously, this is a huge exaggeration, but you get the point.

Gone are the Days of Rocking in the Crypto World Without KYC Image via forkast.news

Gone are the Days of Rocking in the Crypto World Without KYC Image via forkast.news The Downsides of Custodial Exchanges

As alluded to above, the most significant risk with keeping your funds on a custodial service like a custodial exchange or lending platform is that you do not own that crypto. You can be denied access to it at any time. The crypto regulatory landscape is constantly changing, and we have seen a few instances where global authorities demanded that crypto exchanges lock people out of their crypto accounts.

Centralized exchanges need to comply with regulatory lawmakers and the authorities, so if you find yourself on the wrong side of an issue, such as taking part in a peaceful protest that the government decides they do not like, or you live in a country that is suddenly sanctioned, you could be frozen out of your account indefinitely. For example, Coinbase took swift action against Russian-based users amidst the Russia-Ukraine conflict and froze 25,000 Russian-linked crypto addresses.

Image via coindesk.com

Image via coindesk.comI am not here to say these actions were right or wrong, just stating the simple fact that centralized entities can block accounts at any time. We see the same thing with Twitter and YouTube banning accounts, banks blocking user funds and crypto exchanges locking users out of their accounts. Anytime there is a centralized entity, there is a centralized authority who can play judge, jury, and executioner over the customers on the platform.

Rapidly changing global laws and regulatory landscapes are a risk as well. I would hate to have 100% of my Bitcoin held on one exchange if that exchange was targeted and shut down by the authorities due to some breach of a new law or regulation that popped up overnight.

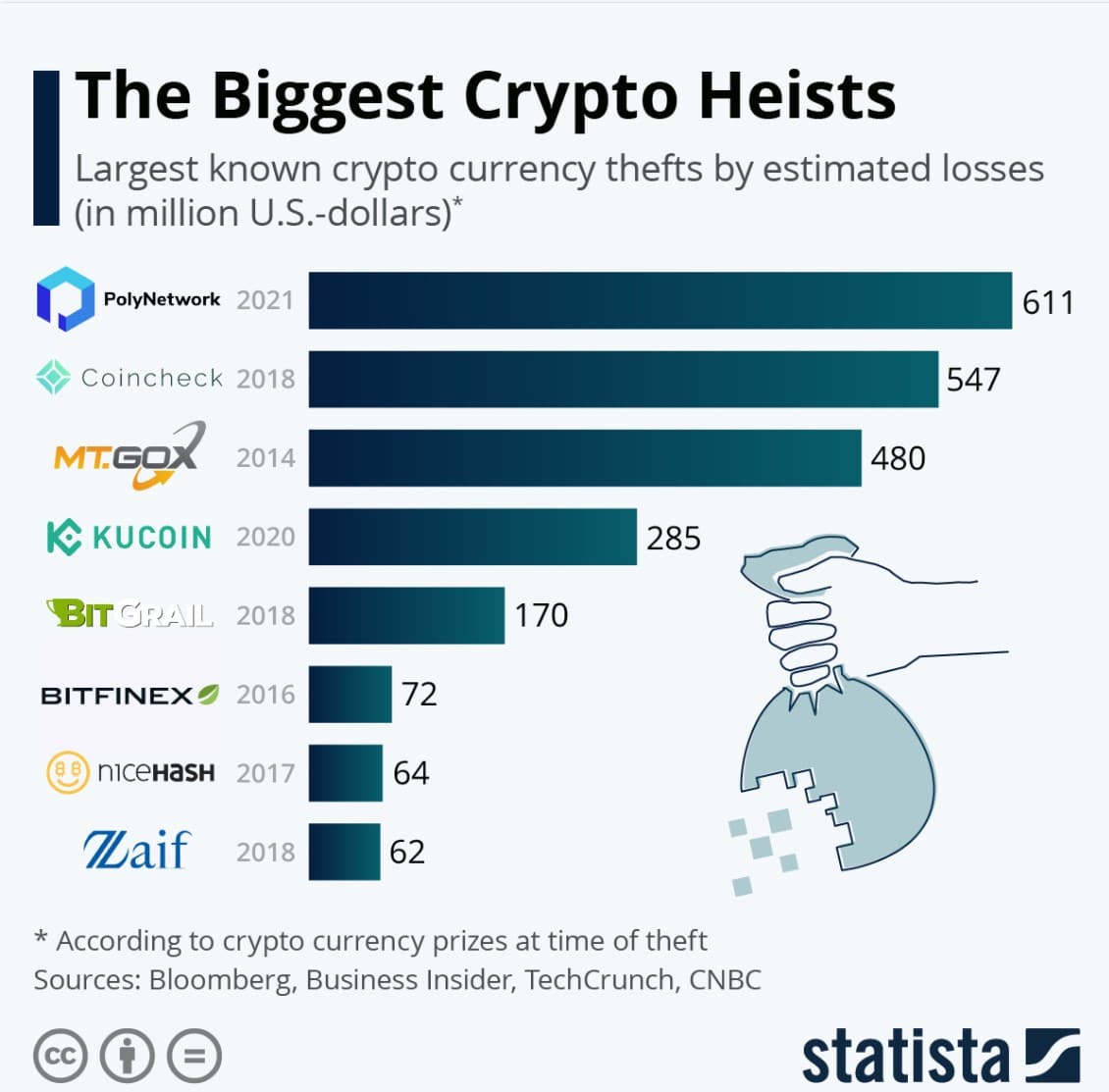

Another significant risk with custodial exchanges comes in the form of targeted hacks. Crypto has a long and dark history of suffering hacks. Many major exchanges have been victims of attacks resulting in millions of customer funds being stolen from the platform.

Cryptocurrency exchanges are popular targets for hackers as every crypto hacker on the planet is aware of these exchanges and how lucrative a successful attack can be. This is in contrast to individual users who self-custody their crypto. Unless a crypto holder spouts it all over social media, it is unlikely that a hacker will know that John Doe holds crypto, nor will they know where or how John Doe stores it, or if the amount is even large enough for it to be worth pursuing.

Some of the Largest Exchange Hacks Image via statista.com

Some of the Largest Exchange Hacks Image via statista.com The Downsides of Non-Custodial Exchanges

Of course, there are pros and cons to both custodial and non-custodial exchanges. The biggest downside of using non-custodial exchanges is that they are not as user-friendly as their centralized custodial counterparts. Anyone who uses a banking app can likely navigate a crypto exchange with ease.

The learning curve associated with self-custodial ownership can be a steep one and is often stated as one of the major barriers to entry for users looking to get into crypto. It is really easy to create an account on an exchange like Binance, buy or swap your crypto, and keep it there, as opposed to having to understand how self-custody wallets work, how to use them with non-custodial exchanges, needing to understand how crypto transactions work, use block explorers etc.

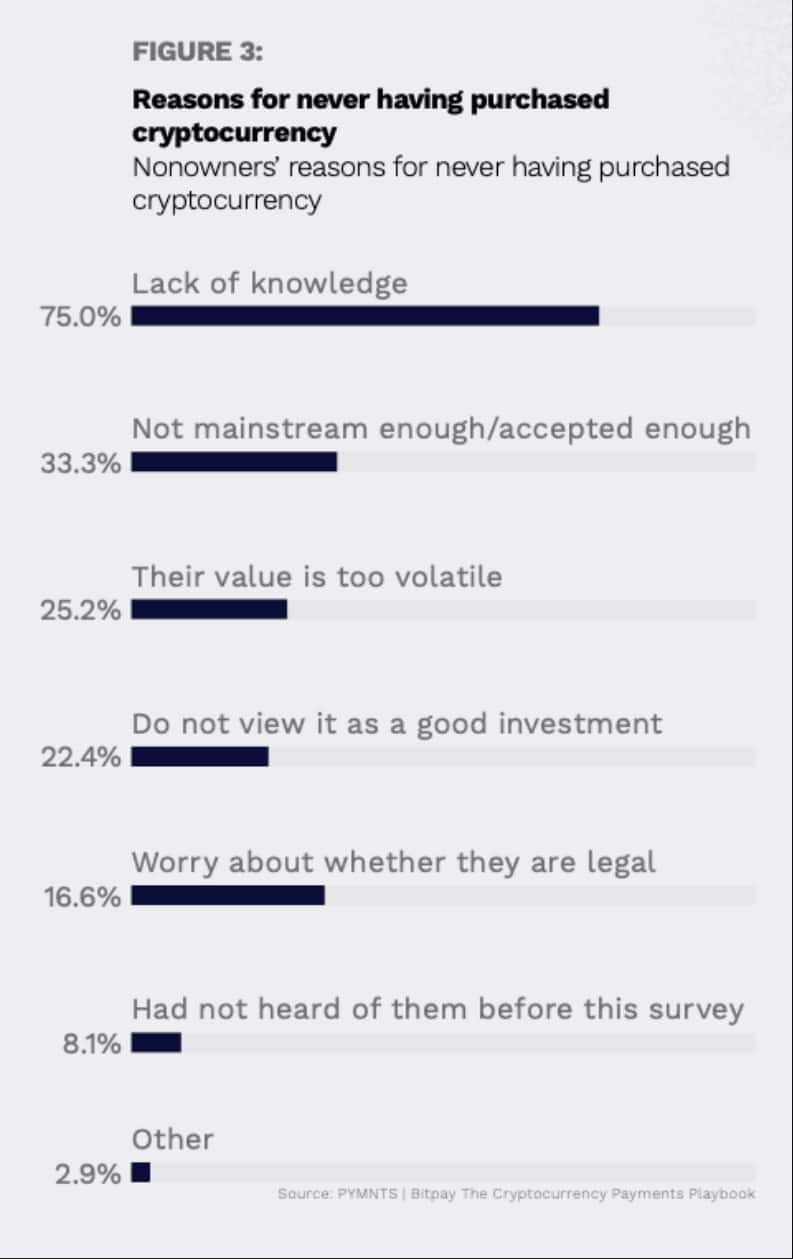

Survey Showing Lack of Knowledge/Confusion is the Largest Barrier to Crypto Adoption Image via techspot.com

Survey Showing Lack of Knowledge/Confusion is the Largest Barrier to Crypto Adoption Image via techspot.com The other downside to venturing outside of major centralized exchanges is a lack of liquidity and exchange pair support. Major exchanges have deep pockets and can handle massive amounts of trading volume, allowing users to sell and swap assets from different networks nearly instantaneously without the user needing to understand any of the nuances around the complexities of swapping assets cross-chain.

However, when using non-custodial exchanges or DEXs, especially during peak times, there may not be enough liquidity for large swaps, leaving many holders unable to sell their assets, and users possibly becoming frustrated, not understanding why they cannot swap their Cardano for Polkadot when using an Ethereum based exchange service.

The final downside to non-custodial exchanges is the lack of additional features. When using an exchange like Binance, users can save, earn, participate in promotions and competitions, trade different instruments and assets, access launchpads, explore an NFT marketplace, etc. Unfortunately, non-custodial exchanges are often more of a one-trick pony, providing users with the ability to buy and swap crypto, and that’s about it.

Now that we have covered some of the pros and cons let’s dive into the top five non-custodial exchanges.

A Note Before Getting Started

None of the non-custodial exchanges listed in this article requires KYC or documentation upload to use the exchange/swap feature. Most non-custodial exchanges reserve the right to halt a transaction and ask for identification if they deem the transaction “suspicious,” which may happen on rare occasions. Some additional features will require account creation, and an account will be needed if you want to track your exchange history on the platform, but this is optional.

To purchase crypto, these exchanges use third-party companies such as Moonpay, Simplex, Mecuryo and others who facilitate the purchase crypto process, and they do require KYC.

Best All-Around: ChangeNow

I mention ChangeNow as the best all-rounder because they offer far more features and services than most non-custodial exchanges and can meet the needs of most crypto customers. ChangeNow is a lot more than just a simple exchange built for fast and limitless transactions. ChangeNow made history in the crypto industry by being the first decentralized exchange to support over 150 cryptocurrencies, with current support for nearly 400 assets.

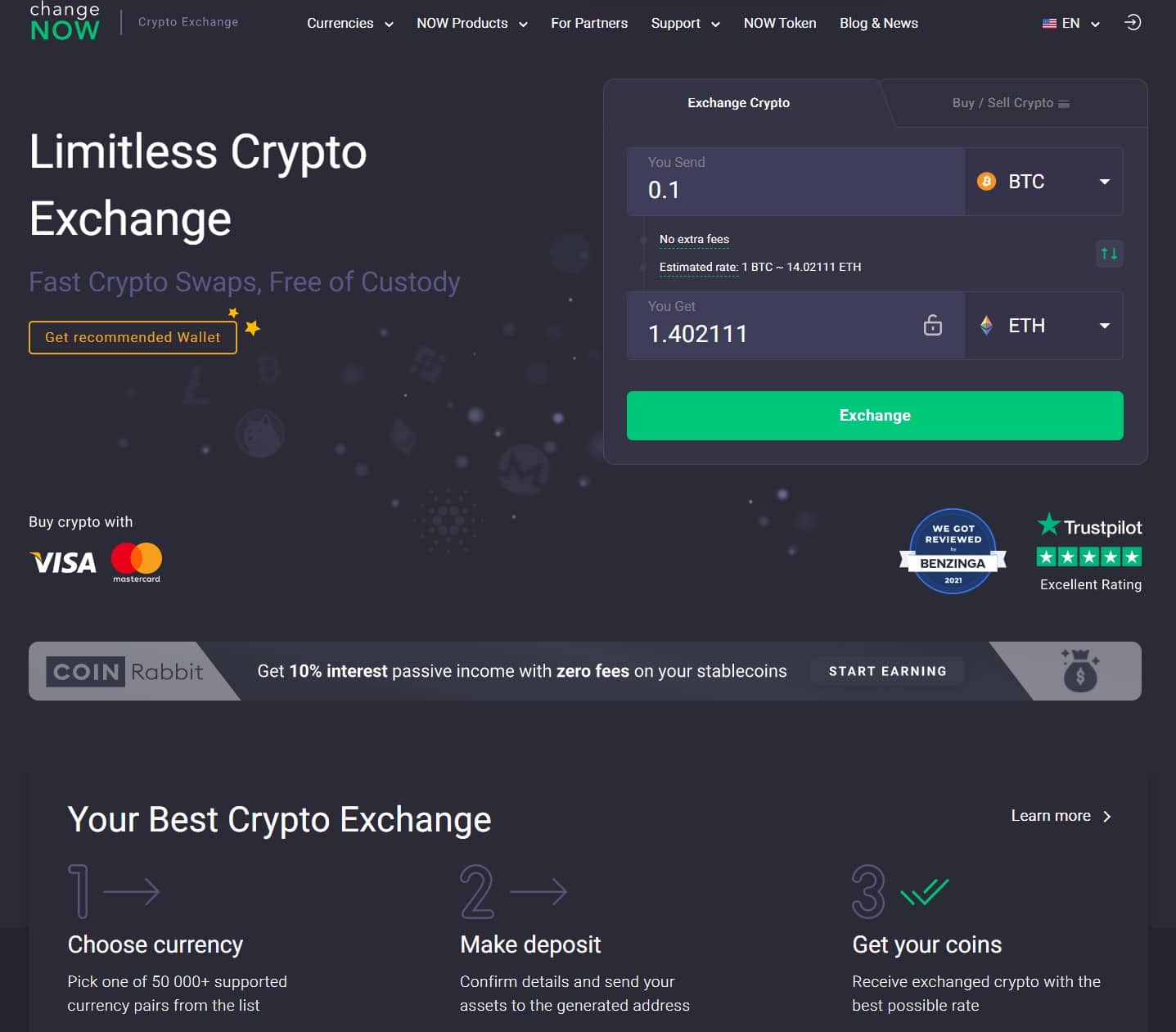

A Look at the ChangeNow Interface

A Look at the ChangeNow Interface There is no maximum number of swaps that users can conduct on the platform, and transactions take less than 15 minutes to be filled. Another huge benefit that ChangeNow has over many of its competitors is that they support Visa and MasterCard, enabling users with the ability to purchase crypto, not just exchange digital assets. ChangeNow also has its token (NOW) that users can use to cover fees on the platform.

ChangeNow is also an aggregator and has partnered with over ten other trading platforms to ensure that users get the best rates on the market. Users can use the exchange feature without providing their personal details, and the platform offers high security for users transacting on the platform.

As far as fees are concerned, there are no hidden fees on the platform. The exchange does not inflate or conceal any charges, and the fee structure is transparent and clear at the time of exchange to avoid nasty surprises after the transaction has taken place. Here is a breakdown of the fees:

- 1% ChangeNOW service fee

- 5% or $10 for purchasing crypto via Simplex

- Network fees

ChangeNow is also one of the few non-custodial exchanges that provide 24/7 customer support, so users are never left hanging.

A Look at ChangeNOW Benefits

A Look at ChangeNOW Benefits ChangeNow also has a public and transparent team, which is uncommon for these platforms. The members and platform are well-respected veterans in the crypto industry; the platform has an excellent rating on Trustpilot and is used by millions of people around the world. Plus, ChangeNow has received positive reviews from Investing.com and Benzinga.

I mentioned that ChangeNow is more than just an exchange; here is a look at the additional products and features available on the platform:

- Crypto Loans

- NOW crypto wallet

- NOWPayments

- Mobile Support

- NOWTracker

- Lightning NOW

- Premium Lounge

- NOWNodes

- Telegram Bot

Users can exchange assets with a value as low as $2 and swap as much crypto as needed. If users download and use the ChangeNOW non-custodial wallet, they can make swaps directly within the wallet, avoiding the traditional method of performing swaps which involve users needing to deposit crypto to the platform and entering a receiving address where the platform sends the funds.

Most User-Friendly: SimpleSwap

If you are looking for nothing fancy, no extra features, just a great and straightforward exchange service, you can’t go wrong with SimpleSwap.

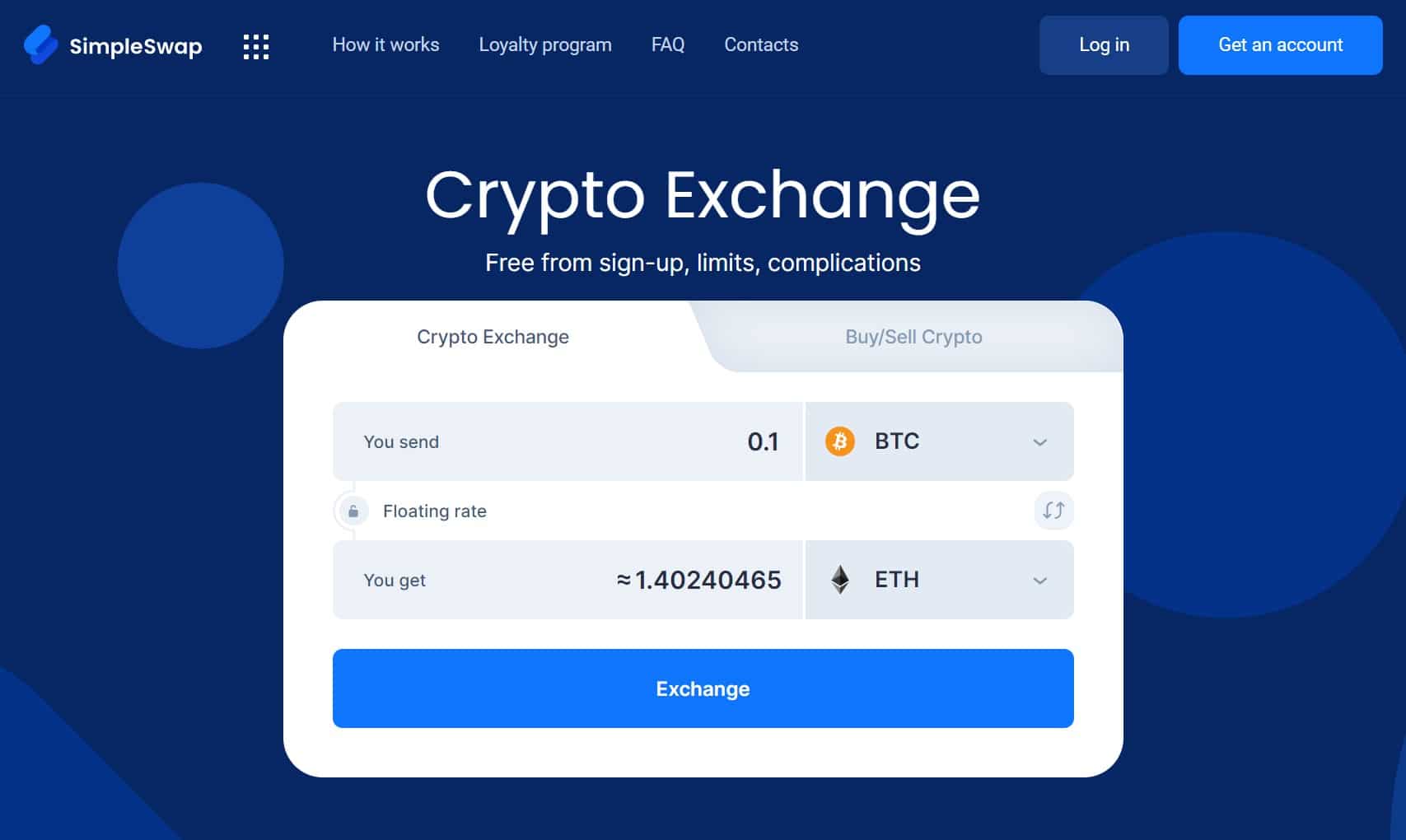

A Look at the SimpleSwap Interface

A Look at the SimpleSwap Interface SimpleSwap is a beginner-friendly instant swap service for crypto and fiat-to-crypto exchanges. Users can use the platform without signing up for an account, and it offers support for over 300 assets. The platform is available on desktop and mobile for both IOS and Android, and users can choose if they want to exchange at a floating or fixed rate. The mobile app is quite robust and does support the following benefits for users who wish to use them:

- Notifications with the status of your exchanges

- Address Book with quick access to the last used & saved addresses

- Price Alerts for the chosen cryptocurrencies

- Exchange History with all your operations

- Support Live Chat 24/7

- Customizable interface

Like ChangeNow, SimpleSwap has fantastic 24/7 customer support and has been enjoyed by the crypto community for years and has plenty of positive reviews on Trustpilot. SimpleSwap provides top industry rates by comparing a wide range of reliable platforms so users can enjoy the lowest fees. Here is a breakdown of the fees on the platform:

- The platform states they determine the rate based on market analysis.

- 4.95% for purchasing crypto (3.95% to partner Mercuryo, 1% to SimpleSwap)

- Network fee

As with other non-custodial exchanges, exchanges are made on the platform by users entering a destination wallet address, then sending crypto to SimpleSwap, then the desired funds are sent to the destination address.

A Look at SimpleSwap mobile

A Look at SimpleSwap mobileSimpleSwap has an attractive affiliate program where affiliates can earn BTC for new user signups and a revenue share on swaps. SimpleSwap also has its token (SWAP) that users can utilize as an internal currency for the SimpleSwap Loyalty Program, where users can get additional benefits such as BTC cashback, branded merch, participate in contests and more.

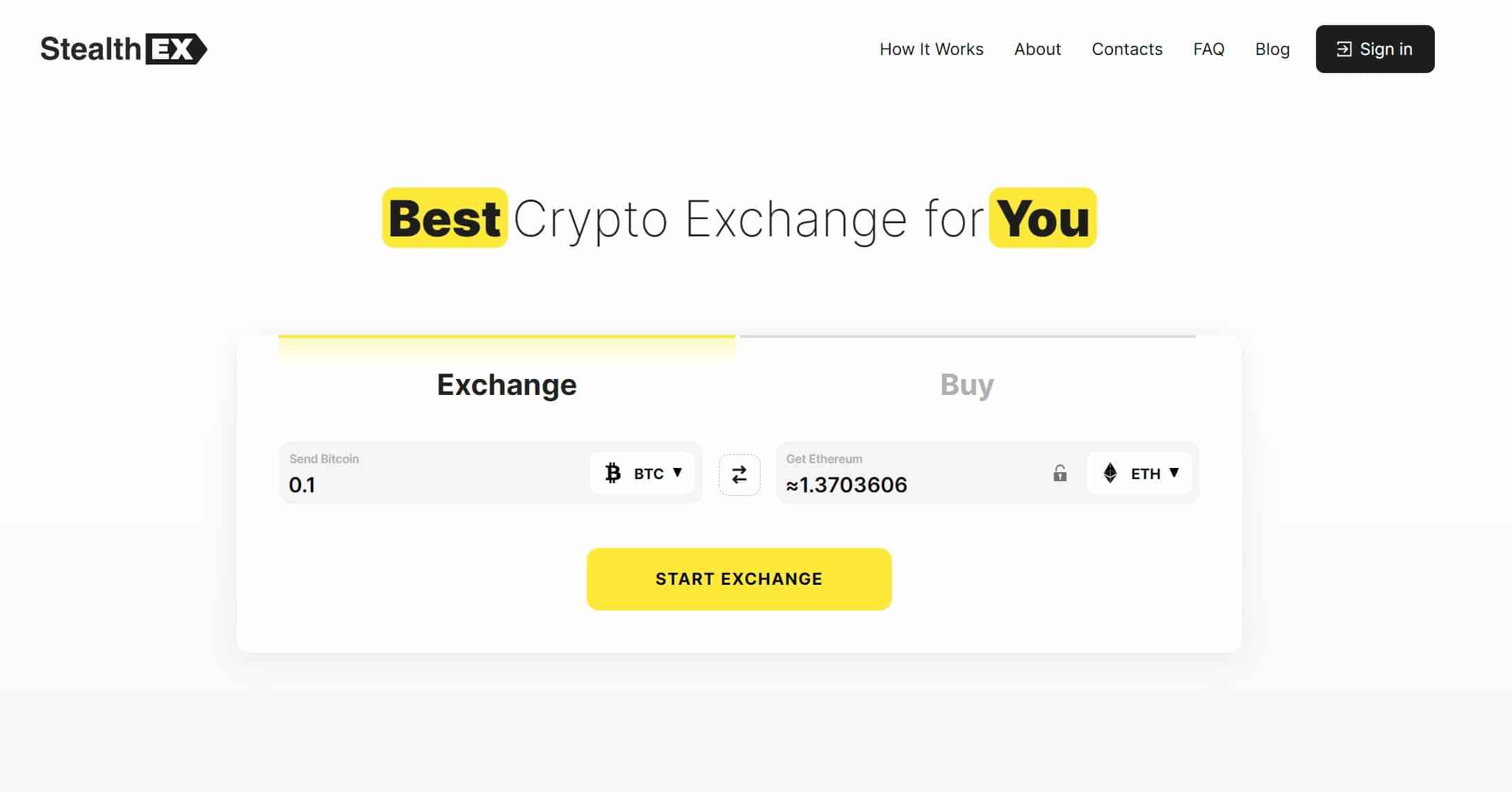

Best for Anonymity: StealthEX

StealthEX was founded in 2018 and has a long, successful track record serving the community with non-custodial exchange services. Right from the start, StealthEX has placed a strong emphasis on privacy and anonymity, so the use of the platforms does not require registration or KYC, nor do they keep any personal data. Funds are also not stored on the platform as exchanges are performed wallet-to-wallet, and there are no extra or hidden fees on top of what users are shown at the time of the swap.

StealthEX also supports buying crypto via MasterCard, Visa, Apple Pay and Samsung Pay through their partner Mercuryo. Here is a breakdown of the fees:

- Variable fees depending on the currencies chosen (will be shown before making the swap)

- Network fees

Note that users will need to verify their identity through Mercuryo to buy crypto.

A Look at the StealthEX interface

A Look at the StealthEX interface StealthEX has an impressive list of over 400 cryptocurrencies and has partnered with exchanges such as Binance to ensure that users are getting the cheapest swap prices. StealthEX has multiple positive reviews on Trustpilot. One thing that stands out is the comments on how simple this platform is to use. Similar to SimpleSwap, StealthEX does not offer all the additional features and functions of ChangeNOW, just a simple, easy to use non-custodial exchange with great asset support and strong dedication to privacy.

StealthEX does not have its own wallet, so users will need a non-custodial wallet first, then send coins to the exchange with a recipient address to receive the swapped tokens.

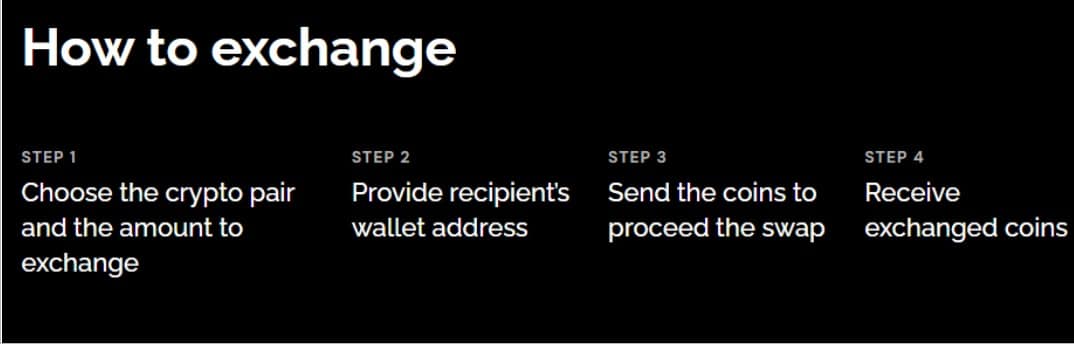

Exchanging on StealthEX

Exchanging on StealthEX StealthEX does not have upper limits for exchanges, and the minimum is so low that it states that as for minimum amounts, users only need to have enough to cover network fees, meaning this exchange is great for pretty much any amount of crypto whether you are swapping a few bucks worth or a few hundred thousand dollars’ worth. StealthEX also provides 24/7 support, so you know you’ll be in good hands.

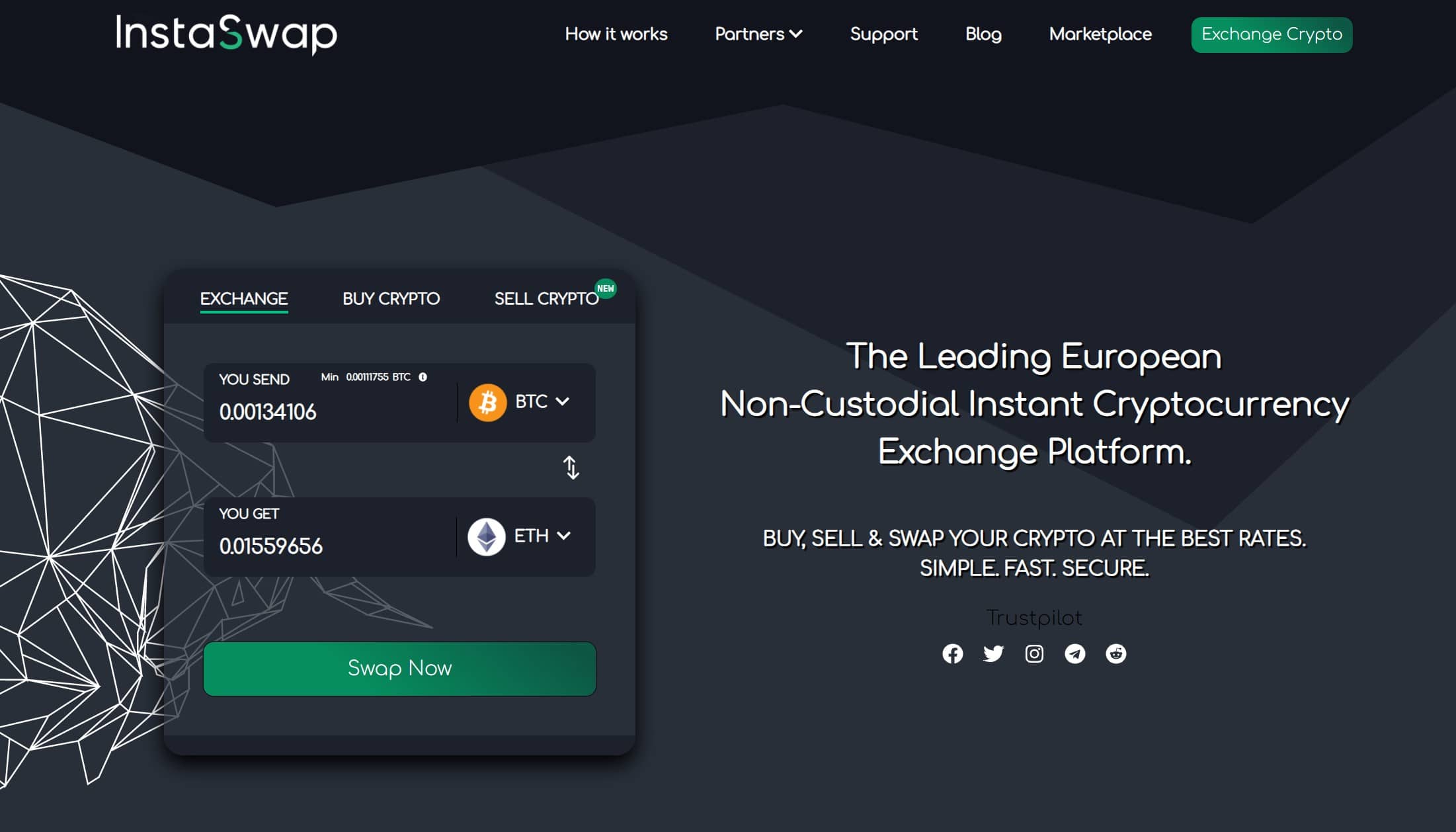

Best for Crypto to Fiat: InstaSwap

InstaSwap is a non-custodial crypto exchange based out of Europe. The platform has support for both digital and fiat currencies, supporting 130+ cryptocurrencies and claim to offer some of the best market exchange rates, carrying out transactions in around 10-30 minutes.

A Look at the InstaSwap interface

A Look at the InstaSwap interfaceUsers don't have to provide KYC or create an account to use the service. The website interface is beginner-friendly and easy to use. This exchange works similar to the others on the list. Users provide a "receive" crypto address and deposit their funds on the platform. Unlike ChangeNow, there is no option to swap assets directly in a native wallet, so users will need a wallet already set up. Both ChangeNow and InstaSwap support crypto to fiat transactions; however, InstaSwap is more user/beginner-friendly and doesn't have all the additional features that ChangeNow has, making it the better choice for users only looking for a simple fiat offramp.

A Look at How InstaSwap Works

A Look at How InstaSwap Works InstaSwap has partnered with some of the most reliable service providers such as Binance, Kraken, HitBTC, KuCoin and more to provide users with the lowest prices and plenty of liquidity. Note that InstaSwap does require an email address for verification, but they do not require KYC or ID document uploads. Here is a look at the fee breakdown on InstaSwap:

- 0% fee on exchanges! (Aside from Network Fees, of course)

- 5% fiat-to-crypto (split between Moonpay and InstaSwap)

- 0.25% fiat-to-fiat

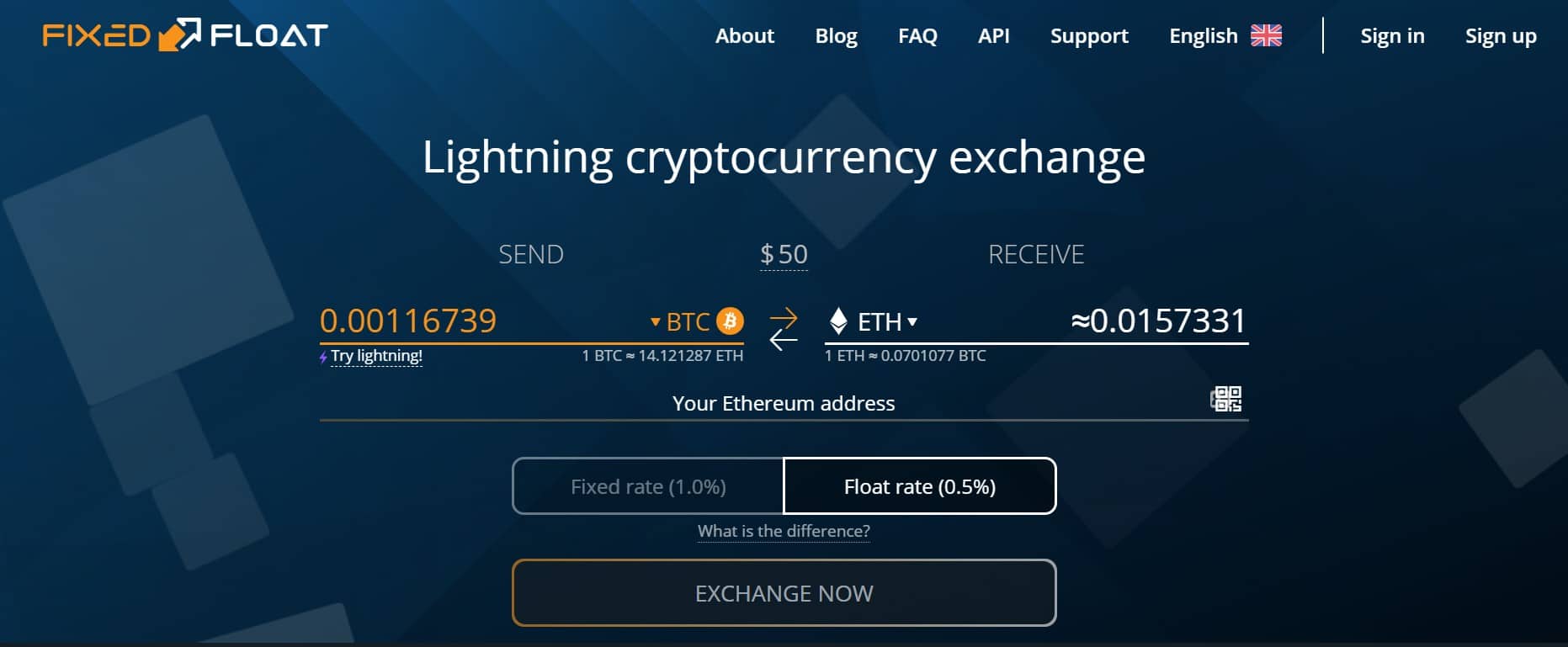

Best for Bitcoin Lightning Support: FixedFloat

FixedFloat is a lightning cryptocurrency exchange service that claims to provide the lowest exchange rates and highest transaction speeds, along with support for the Bitcoin Lightning network, which is awesome.

A Look at the FixedFloat Interface

A Look at the FixedFloat Interface FixedFloat places a strong emphasis on transparency and does not have hidden or additional fees. Here is a look at the price breakdown:

- 1% fee for fixed rate

- 0.5% fee for floating rate

- Network fee

There are no upper limits for exchanges, transactions are completed in under 30 minutes, and the platform has 24/7 customer support.

This exchange has no native wallet, so the exchange process works the same as some of the other mentions on the list, and there is no fiat support. FixedFloat is a relatively new exchange, and not much is known about the team which should be taken into consideration. However, they do have over 1000 positive reviews on Trustpilot with excellent ratings, so I wouldn’t hesitate to use the service.

Closing Considerations

Non-custodial exchanges are a fantastic alternative to the traditional centralized custodial exchanges that most of us are used to. The ability to swap our favourite assets without the need for KYC or needing to learn the complexities behind DeFi DEXs is also a nice perk. Many of these exchanges also search and compare prices from multiple leading exchanges. Using these platforms can help ensure users save money by getting the best possible exchange rates.

There is another factor to consider, and that is the increasing crackdowns faced by exchanges in recent months and the scramble to enforce KYC requirements for many of the largest exchanges. Although, we have seen exchange giants Binance and KuCoin bend to the will of regulators after years of resisting enforcing KYC requirements, the non-custodial exchanges on this list have been safe so far in not enforcing KYC for swaps, though KYC is needed for purchasing crypto. I feel it is only a matter of time before these platforms also come under fire and start enforcing KYC for all transactions, but I guess time will tell what the future holds for non-custodial exchanges.