TrueUSD is another really popular stablecoin that has recently hit the market. Since being launched last year, this stablecoin is already a favorite among many traders.

TrueUSD was issued by the Trust Token team and is a fully fiat-backed cryptocurrency. This is a particularly hot topic at the moment especially when it comes to the numerous controversies that surround the largest stablecoin, Tether USDT.

Yet, is TrueUSD really the best alternative to the status quo?

In this TrueUSD review, I will attempt to answer that by giving you what you need to know. I will also look at the safety and security as well as the pros and cons.

What is TrueUSD?

The TrueUSD (TUSD) is one of a growing number of stablecoins that peg their value to the U.S. dollar.

It was created and issued by TrustToken and the peg and reserves are also maintained by TrustToken. The key unique feature of TUSD is that it is the first stablecoin which was released with the primary focus being transparency.

What is the TrueUSD? Image via Trust Token Site

What is the TrueUSD? Image via Trust Token SiteThose interested in the TUSD can register and purchase it at the rate of 1:1 against the U.S. dollar on the TrustToken platform.

The TUSD was quickly adopted thanks to its transparency and it is listed on many of the major cryptocurrency exchanges. It is currently the thirty-seventh largest cryptocurrency by market cap, which does put it behind several other stablecoins, however, it is also a major component of the evolving blockchain ecosystem.

The growth and prominence of the TUSD have helped to improve the perception and reputation of stablecoins among the general population, as well as among investors and regulators. This is due to it being fully transparent and the first regulated stablecoin fully backed by the U.S. dollar.

Fiat-Backed Stablecoins of Trust Token

Fiat-Backed Stablecoins of Trust TokenIn addition to the TUSD, TrustToken has announced the launch of several other tokenized fiat currencies recently. These include a tokenized version of the Australian dollar (TAUD), the British Pound (TGBP), the Canadian dollar (TCAD), and the Hong Kong dollar (THKD). In addition, the tokenized version of the Singapore dollar (TSGD) is expected in the coming year.

Many individuals, companies, and institutions have found that TUSD and other TrustToken stablecoins are ideal for their needs. In addition to the obvious use case as a stablecoin, other use cases for TUSD include margin funding at exchanges, cryptocurrency loans, and as deposits for interest-bearing accounts.

TUSD Stablecoin

TUSD is the ticker symbol and short-form name of the True U.S. dollar. It is the first tokenized asset created on the TrustToken platform and is the first fully regulated, transparent stablecoin released.

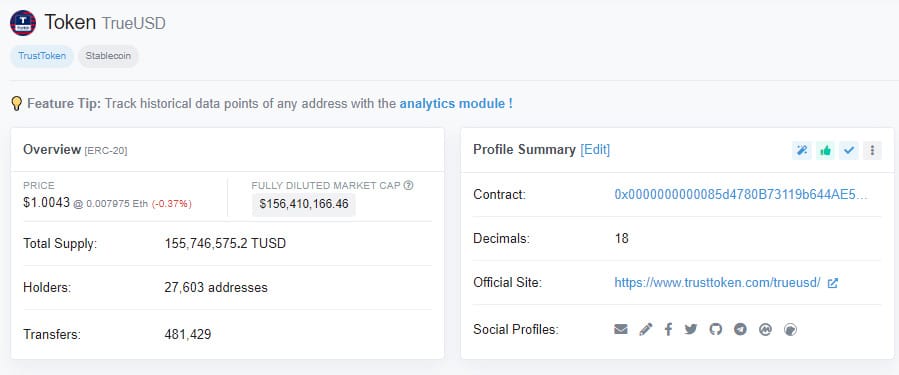

The TUSD represents tokenized U.S. dollars at a rate of 1:1. The TUSD is an ERC-20 token that was created on the Ethereum blockchain, which is where it derives its security from.

Those using the TUSD benefit from the ability to immediately enter and exit cryptocurrency markets without needing to worry about time constraints created by settlement processes in the traditional banking ecosystem.

TrueUSD Stablecoin ERC20 Contract. Image via Etherscan

TrueUSD Stablecoin ERC20 Contract. Image via EtherscanBecause TUSD is an ERC-20 token it takes advantage of the ever-expanding and evolving Ethereum blockchain ecosystem. This gives the benefit of open-source smart contracts, which power the USD transactions 24/7/365.

TUSD tokens are created and destroyed as users purchase and redeem them. Each USD taken in as TUSD is created is put in escrow, meaning the full issued and circulating supply of TUSD is completely collateralized and backed by U.S. dollars.

Furthermore, these U.S. dollars are held in FDIC-insured bank accounts in the U.S. and are audited monthly by the firm of Cohen & Company.

How Does TUSD Work?

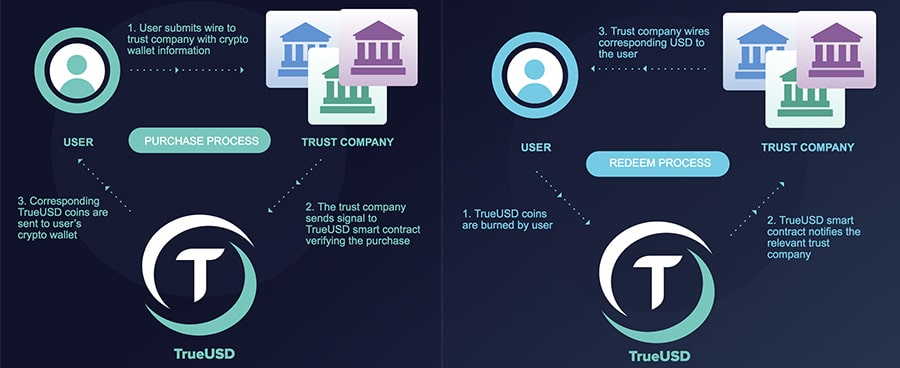

The TrueUSD works through the use of Ethereum smart contracts on the Ethereum blockchain. Through these smart contracts, it is able to issue and redeem a tokenized version of the U.S. dollar.

Whenever a user purchases TUSD through the TrustToken platform with U.S. dollars the smart contract that underlies the platform automatically creates and issues the corresponding equivalent amount of TUSD, which then becomes a part of the circulating supply of the token.

Conversely, whenever a user redeems TUSD through the TrustToken platform a smart contract automatically takes the tokens being redeemed and burns them, or removes them permanently from the circulating supply of TUSD. At the same time, the platform credits the user with an amount of U.S. dollars equal to the amount of TUSD redeemed.

The Purchase & Redeem Process with TrueUSD. Image via TrustToken Blog

The Purchase & Redeem Process with TrueUSD. Image via TrustToken BlogOne of the benefits of using the TUSD is that TrustToken charges no purchase or redemption fees for transactions. The company generates its revenues through the collection of interest on the U.S. dollars being held in the company accounts.

Because traders are well aware of their ability to buy and sell TUSD at a 1:1 ratio with TrustToken it creates a natural arbitrage opportunity in the market, and this keeps the token at its peg to the dollar.

Is TUSD Safe?

TUSD is widely considered to be one of the safest stablecoins currently available on the markets. This is partially due to the transparency of TrustToken and the fully-backed nature of the cryptocurrency. There are other reasons to consider TUSD to be a safe holding:

- Security – The smart contracts used by TrustToken have been independently audited three times, by three different security firms, and no issues were found or reported by any of them.

- Escrow – Not only are all the funds backing TUSD held in escrow but they are also held by third-party trust companies so that TrustToken has no direct access to the user funds being held in reserve.

- Asset Insurance – Holders of TUSD are legally protected from misappropriation of funds by the laws of the United States and the accounts where funds are held are FDIC-insured accounts.

- Audits – TrustToken is audited monthly by the accounting firm Cohen & Company and attestations are posted. This ensures that TUSD remains fully collateralized with escrowed funds that match its issued supply.

- Licensed and Regulated – TrustToken is fully licensed to operate in the U.S., and the TUSD is the first regulated stablecoin to be issued in the U.S.

Benefits of Using TUSD

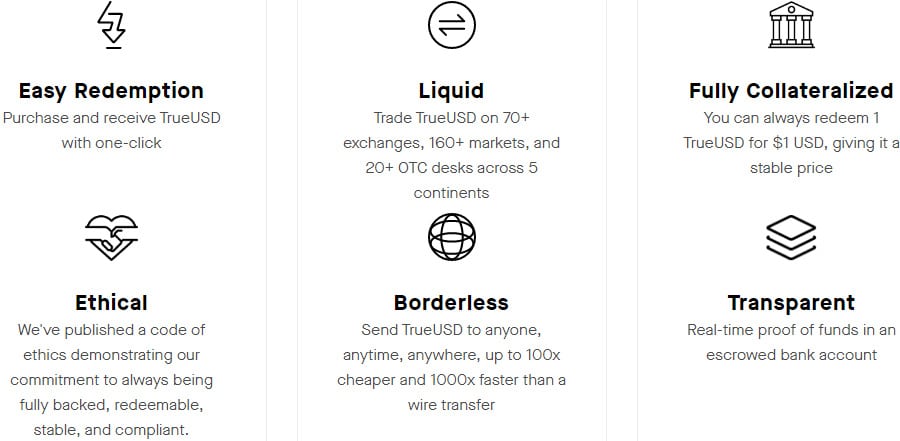

There are a number of reasons for individuals and institutions to use TUSD. One is that it allows traders and investors to enter the cryptocurrency markets without being instantly exposed to volatility. It also allows the same investors and traders to exit the markets and avoid rising volatility by seeking the stability of the TUSD.

Benefits of Using the TUSD Stablecoin

Benefits of Using the TUSD StablecoinAmong stablecoins, TUSD remains transparent, with monthly audits confirming the amount of U.S. dollars held in escrow in FDIC-insured U.S. bank accounts matches the amount of TUSD in circulation.

As the number of trading pairs and liquidity grows the TUSD will become increasingly useful. Finally, there is a limited third-party risk since TUSD can be easily redeemed, or stored in any ERC-20 compatible personal wallet.

The TrustToken Company

TrustToken was developed as a platform for asset tokenization. It plans on bringing the benefits of the blockchain to traditional assets, beginning with the U.S. dollar and other major global fiat currencies.

From there TrustToken plans on moving on to the tokenization of other assets such as gemstones, precious metals, real estate and much more. It is possible that even equities or collectibles such as art could be tokenized in the future.

One of the major benefits of such tokenization is that it brings the potential for fractional ownership of assets.

Overview of the TrustToken Company

Overview of the TrustToken CompanyTrustToken created their platform with the belief that tokenization of various asset classes will give investors the ability to access what were previously unavailable illiquid investment opportunities. And by using blockchain technology this can be done safely, securely, and easily on a global scale.

TrustToken has taken a compliance-first approach to its platform, which led to the first regulated stablecoin. It also gave us the transparency of the blockchain assets being developed and released by TrustToken.

The combination of a strong, experienced development and management team and strong backing from firms such as BlackTower Capital have led to early success for the platform and the blockchain assets being released.

The TrustToken Team

What stands out the most for me about the Trust Token company is how transparent they are. This is in stark contrast to the likes of Tether which has operated with an increasingly opaque organisational structure.

The CEO and a co-founder of TrustToken is Jai An, who worked as the first engineer at Kernel trying to mathematically model the human brain. Prior to that, he graduated from the University of Texas at Austin with a Bachelor’s degree in Information Systems.

He is joined by Rafael Cosman, who acts as Head of Engineering at TrustToken, in addition to being a second co-founder. Prior to helping found TrustToken Cosman also worked as an engineer at Kernel.

He also spent time working as an engineer at Google and was also a co-founder of the East Palo Alto non-profit tech hub StreetCode. He is a graduate of Stanford University with a Bachelor’s degree in Computer Science.

Co-Founders of Trust Token

Co-Founders of Trust TokenTory Reiss is a third co-founder, as well as acting as the Head of Partnerships and Business Development at TrustToken. After graduating from Northwestern University with a degree in Behavioral Economics and Entrepreneurship in Emerging Markets he went on to a position on sales at Microsoft and later moved into a role in business development.

Following that he was a founding sales leader for Lob where he grew sales from hundreds of thousands when he joined to tens of millions in ARR in two years while scaling to over 40 employees. The final co-founder at TrustToken is Stephen Kade, who has a long history of successful positions in neuroscience and economics.

Trading & Storing TUSD

To purchase TUSD directly you can go to the TrustToken website, register as a user, complete the KYC process, and purchase directly at a 1:1 ratio.

All purchases and redemptions of tokens are handled as bank transfers. While TrustToken does not charge any fees for purchasing or redeeming TUSD, the users' respective banks may have their own fees.

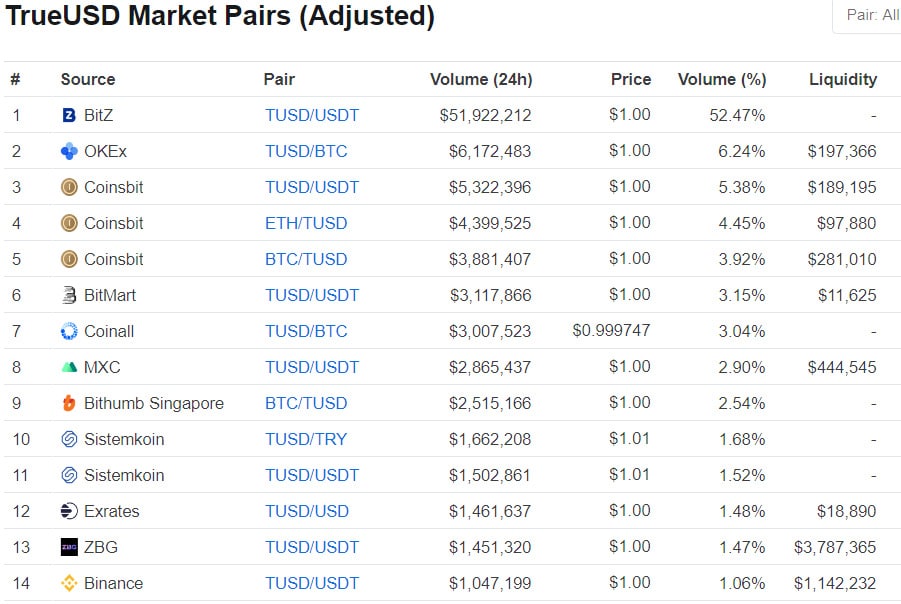

Moving onto exchange support, there is a pretty extensive list where you can trade TUSD. The largest exchange volume is at the BitZ exchange, however, with over 50% of the reported volume occurring there. Interestingly this is for the TUSD/USDT pair, where traders are exchanging the Tether stablecoin for the TrueUSD stablecoin.

Some of the Largest Markets for Trading TUSD. Image via CMC

Some of the Largest Markets for Trading TUSD. Image via CMCThe next largest exchange for TUSD is Coinsbit, where there is a solid amount of trading not only against USDT but also with the BTC and ETH pairs. Other exchanges with fairly good trading volumes of TUSD include OKEx, BitMart, Coinall, MXC, Binance, and Bithumb Singapore.

The main benefit of having such extensive exchange support is that any mispricings of TUSD are arbitraged out. This means that if there was ever a minor deviation from the $1 peg on any of these exchanges then the price could be restored by trading among the exchanges.

TrueUSD (TUSD) Wallets

Because TUSD is an ERC-20 token users may store the token in any wallet that is compatible with ERC-20 tokens. That gives users a large selection of wallets, from mobile wallets to web-based wallets, to desktop wallets, or for the strongest security, a hardware wallet like the Ledger or Trezor can be used.

For anyone holding more than a few hundred dollars of TUSD, we recommend using a hardware wallet for the best security. This is because all of your private keys are kept on the device and all transaction signing is done in on the device.

TUSD Pros and Cons

So now that you vaguely know what TrueUSD is, let's objectively take a look at some of the pros and cons of using this stablecoin.

TUSD Pros

- The TUSD is fully regulated and licensed in the U.S.

- Regular monthly audits are performed by accounting firm Cohen & Company, which ensures the TUSD always remains fully backed by U.S. dollars on a 1:1 basis.

- There is excellent liquidity for the TUSD, with the token trading on dozens of different exchanges, including the largest such as Binance and MXC.

- TUSD is an ERC-20 token which gives it the security of the Ethereum blockchain. Additionally, it gives users a full range of wallets to store the token, including hardware wallets that keep the token safe from hackers.

- The bank accounts which hold the U.S. dollars backing TUSD are all FDIC insured up to $250,000.

- In addition to the TrueUSD, TrustToken has also issued the TrueCAD, TrueAUD, TrueHKD, and TrueGBP and has plans to issue many more tokenized currencies and other assets.

TUSD Cons

- Users who purchase or redeem TUSD from TrustToken are required to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) documents. While some might not see this as a negative, there are many in the blockchain space who would consider this to be an invasion of their privacy.

- TUSD and the other digital assets issued by TrustToken are completely centralized, to the extent that TrustToken could freeze a users account or even confiscate their tokens in the event they feel a user has broken the terms and conditions of use or any of the laws and regulations that TrustToken is required to abide by.

- There is a lot of selection now. Gone were the days when Tether was the only alternative. Now you have the likes of the Circle USDC, the Gemini dollar and even a decentralised version in the DAI Stablecoin.

Conclusion

TrueUSD has been gaining popularity as a transparent and useful stablecoin and is certainly a contender for becoming the top stablecoin. Its focus on compliance and transparency has made it a solid competitor for Tether, which has a long history of questionable practices. In time TUSD might even become an alternative to USDT.

By putting TUSD on the Ethereum blockchain the TrustToken team is using the proven security, wallet infrastructure, and smart contracts that TUSD needs to grow and thrive. It really was a wise decision that has helped TUSD get off to a faster start than might have been possible otherwise.

TrustToken has already released stablecoins based on other major fiat currencies, with more being planned in future months and years. While that in itself is exciting, what’s even more exciting is the coming release of tokenized real estate, bonds, commodities, and other assets.

By tokenizing these assets TrustToken will make them more widely available through fractional ownership by those who might not otherwise be able to afford an investment in a particular asset.

TUSD is an exciting project with a lot of potential. While it currently has a market capitalization of just over $150 million, that could balloon into billions if TUSD is able to successfully replace USDT as the stablecoin of choice for traders.