TrustToken is a relatively new platform that was created with the vision of making tokenized assets available. These are cryptocurrencies that are also known as “stablecoins” because their price tends to remain more stable since they are pegged to real-world assets.

The project's first stablecoin, and the flagship token of the platform is the TrueUSD (TUSD), which is a stablecoin that is pegged to the U.S. dollar and claims to maintain as 1:1 ratio with the USD. The TrustToken team is betting that the TrueUSD will be the first of many asset-based tokens on the platform. According to the TrueToken website:

TrueUSD is a USD-backed ERC20 stablecoin that is fully collateralized, legally protected, and transparently verified by third-party attestations

The team says that the TrueUSD token will use multiple escrow accounts to reduce counterparty risk as well as giving holders legal protections against theft.

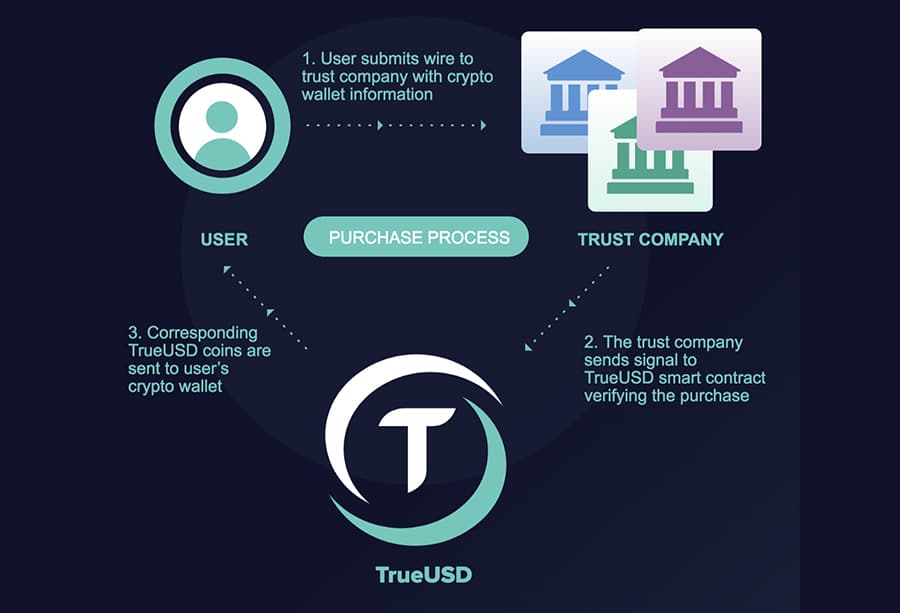

How TrustToken Works

The third-party escrow accounts are the key to the proper function of TrustTokens tokenized assets. Currently anyone can purchase TrueUSD once they’ve gone through the know-your-customer and anti-money laundering requirements.

This is accomplished by wiring U.S. dollars to an escrow account after which a matching amount of TrueUSD are minted. When other tokens are available the purchaser can choose which token they are purchasing.

How TrustToken Works. Source: Trustoken

How TrustToken Works. Source: TrustokenWhile the TrueUSD is paired with the U.S. dollar, the TrustToken team hopes to have pairings with other currencies in the future. Currently the minimum purchase is $10,000, although it is expected that this minimum purchase amount will decrease in the future.

Centralised Escrow & Decentralized Crypto?

Given that escrow accounts are by their very nature centralised, they go against the credence of decentralised cryptocurrencies. This is something that the TrustToken team does acknowledge. They also go on to point out that their system is addressing real-world issues and challenges.

In 2018 it isn’t possible to open accounts and transfer funds using smart contracts and smart contract signatures. Until this becomes possible the TrustToken team is building their platform to utilize the best-known and most used system in the world for bank account management – escrow accounts.

This type of account is already widely used, understood and trusted. It provides a hybrid approach for now, and in the future the team plans on moving away from escrow accounts. In their own words:

We recognize that escrow accounts aren’t the endgame for decentralized money and tokenized asset management, but the trust and escrow industry already work well for the management and distribution of assets.

Is TUSD Comparable to Other Stablecoins?

Tether vs. T USD

Tether vs. T USDThe TrustToken team feels that the TUSD is complimentary to other existing stablecoin projects such as Tether (USDT), BaseCoin and MakerDAO. TrustToken is somewhat different from BaseCoin and MakerDAO since they use algorithms to maintain stability, while TUSD maintains stability by remaining asset backed. This gives TrustToken a substantially different target audience.

The team admits that algorithm based solutions are exciting possibilities, but notes that they haven’t been tested or proven in the real-world. The TrustToken team feels that some investors will find added security in a token that is backed by fiat currency sitting in an audited bank account. In the future there should be use cases for both asset based and protocol based stablecoins.

In essence, the TrustToken platform is being developed primarily for the institutional investing audience.

Regarding the similarity to Tether, the TrustToken team simply said that they wanted to develop a stablecoin that they could “use and trust” themselves. This statement is likely in reference to the ongoing trust issues many have with Tether, given the controversial past of the token’s creator and questions regarding just how much fiat currency actually is being held to back-up Tether.

TrustToken's Tokenization of Assets

While TrueUSD is the first tokenized asset released on the platform, the team has plans to allow for the tokenization of any real-world asset. On the TrustToken website they give examples such as real estate, rental properties, timeshares, stocks and bonds and small businesses. There are obviously many others.

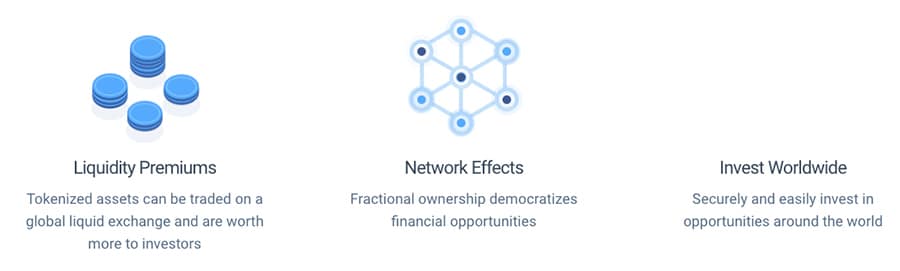

What Assets You Can Tokenize. Source: Trusttoken Website

What Assets You Can Tokenize. Source: Trusttoken WebsiteThe tokenization will also allow users to offer fractional ownership of objects that can then be traded on global exchanges.

What assets might be tokenized? Well, real estate is a prime example, but other assets that could benefit from tokenization include commodities such as gold and oil, copyrights and patents, collectibles such as art or coins, private equity in businesses, and even sports teams could be tokenized.

This means those that own illiquid assets such as art and intellectual property could offer fractional ownership of the assets and recover some of the value of those objects. Entrepreneurs and creators could offer fractional ownership of new business ventures and creations on a global stage in a crowdfunding type of model. Investors would gain access to new opportunities and asset classes from across the globe.

Benefits of Tokenization on TrustToken

Benefits of Tokenization on TrustTokenThe ability to tokenize any asset would make the $256 trillion worth of real world assets available to be controlled and transacted on a blockchain, which would completely transform both the crypto and investing landscapes.

While still a new field in the cryptocurrency industry, there are other projects which have also focused on tokenized assets or "securities tokens". Another well known example is that of the Polymath network. They would like to do something similar with their proprietary securities token platform.

The TrustToken Team

The team behind TrustToken brings a depth of knowledge and experience that is expected to help the project succeed and potentially exceed expectations. The team has three co-founders:

Co-founders of TrustToken

Co-founders of TrustToken

- Danny An – CEO of TrustToken and former data scientist at Kernel where he worked on human brain model development.

- Rafael Cosman – CTO of TrustToken and former machine learning expert at Google and Kernel as well as founder of StreetCode Academy.

- Stephen Kade – COO of TrustToken, and former commercialization project manager at Kernel as well as a technical advisor for Bankorus.

In addition to the trio of founders the TrustToken team consists of a full complement of developers and marketing professionals, as well as a solid group of project advisors.

What about the TUSD Market?

The TrueUSD was created as a peg to the U.S. dollar, which means it should always trade at $1, and in a perfect world it would. However we don’t live in a perfect world. As of mid-August 2018 one TUSD is being quoted at $1.01 on Coinmarketcap.com, and over the past few months has traded as low as $0.98 each. In general the USD price remains around $1, but the Bitcoin price has seen a wider variation by far.

Price Performance TUSD since launch

Price Performance TUSD since launchThis isn’t surprising given the peg to the USD. What was surprising were the two spikes in the value of TUSD in May 2018 that saw the coin trading briefly up to nearly $1.40. This spike was explained as the result of bot buying following the coin being listed on Binance, and was quickly corrected as human traders soon began selling their coins for a hefty profit.

Potential Challenges

TrustToken is attempting to tokenize real-world asset in a way that is realistic given the current state of money and banking. It offers institutional investors a way to enter the cryptocurrency ecosystem without exposing them to unnecessary and unfamiliar risks.

The one point that seems to be holding the project back at this point is its current similarity to Tether. That project has a very similar use case, but has also struggled with trust issues due to a lack of transparency and past indiscretions by the backers. TrustTokens developers have addressed this similarity briefly, and have emphasized the issue of trust.It’s possible that TrueToken and the TUSD can provide a more trustworthy alternative to replace Tether.

Ultimately that battle will be decided by the adoption rate of the TrueUSD. Tether obviously has a huge headstart at this point, but it is very early in the crypto revolution and Tether also faces some stiff headwinds. TrueUSD is also facing headwinds due to its similarity to Tether, but it can possibly overcome those with its laser focus on institutional investors. That may eventually lead to specialized tools that Tether won’t possess.

Conclusion

Tokenizing real-world assets is something that is seen as having great potential as it will unlock value and create a trustless environment free of the need for expensive third-party intermediaries. We’ve seen it working already in the tokenization of digital assets, such as crypto-collectibles, and DigixDAO has also successfully tokenized gold.

The next logical step in tokenization is other real world assets being tokenized via smart contracts. This could allow people to own parts of rental properties or copyrights or other income producing assets that allow the holders to collect a part of the income in relation to their token ownership, all managed securely and without costs by smart contracts.

This could even allow for artists, other creators or even sports figures to potentially sell parts of the entire future earnings, creating value now from the future earnings potential of the person.