The Bitcoin ecosystem is evolving beyond its original design as a peer-to-peer payment network. With the rise of Bitcoin Layer 2s, sidechains, and BTCFi protocols, a new wave of infrastructure is forming around Bitcoin, bringing programmability, scalability, and yield-generating use cases to what was once considered a static asset.

As covered in our Bitcoin Layer 2 analysis, this evolution includes payment layers like Lightning, rollups like Stacks, and programmable environments like Rootstock. Simultaneously, new tools for Bitcoin staking, wrapped BTC, and tokenized derivatives have created new ways to use BTC across chains.

Rootstock stands out as one of the earliest and most fully featured implementations in this growing Bitcoin-based DeFi landscape. It offers Ethereum-compatible smart contracts secured by Bitcoin miners through merged mining, a pegged BTC token (rBTC), and a suite of DeFi applications.

Rootstock Overview

Rootstock is a Bitcoin sidechain designed to bring smart contract functionality to the Bitcoin network. By enabling Ethereum-compatible smart contracts, Rootstock transforms Bitcoin from a store-of-value chain into a programmable platform without compromising on decentralization or security.

The protocol derives its security directly from Bitcoin through a mechanism called merged mining, where Bitcoin miners simultaneously mine Rootstock blocks using the same hash power. Rootstock uses merged mining to avoid bootstrapping a validator network and a consensus token; it benefits from Bitcoin’s hash power while operating on its own infrastructure with a 30-second block time and throughput exceeding 300 transactions per second (TPS).

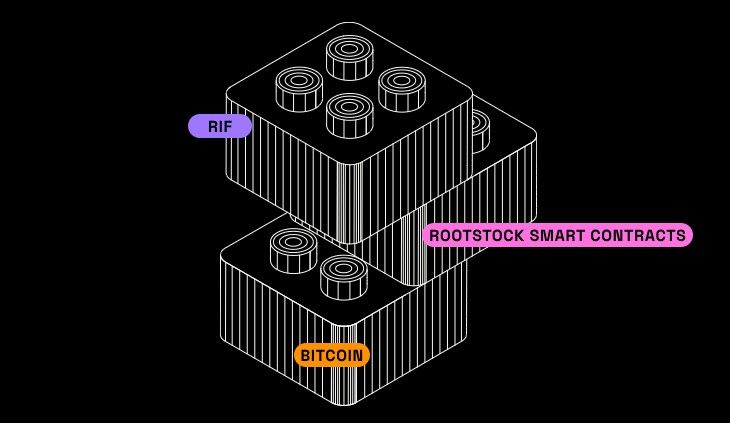

Rootstock Technology Stack | Image via Rootstock Docs

Rootstock Technology Stack | Image via Rootstock DocsRootstock operates with two key tokens:

- RBTC (Rootstock Bitcoin): A 1:1 pegged version of BTC used to pay gas fees and interact with smart contracts on Rootstock. Each RBTC is backed by an equivalent BTC locked in a multi-signature bridge.

- RIF (RSK Infrastructure Framework): The utility, staking, and governance token of the Rootstock ecosystem. It powers services such as naming, payments, storage, and oracles.

Launched on mainnet in 2018, Rootstock supports Turing-complete smart contracts via its Ethereum-compatible virtual machine. Over the years, it has attracted several well-known DeFi applications originally built on Ethereum, including Uniswap, SushiSwap, and Beefy Finance, among others.

Today, Rootstock’s ecosystem continues to grow, with an expanding suite of applications spanning DEXs, lending platforms, staking solutions, stablecoins, yield optimizers, and more.

How Does Rootstock Work?

Rootstock blends characteristics of both layer 2 solutions and sidechains, but it doesn’t fit neatly into either category. Layer 2s typically derive their full security from the parent chain’s consensus mechanism, while sidechains operate independently with their own consensus and maintain a token bridge to the main chain.

Rootstock sits somewhere in between. It does not inherit Bitcoin’s consensus guarantees like a rollup would, nor does it run its own independent validator set like many sidechains. Instead, it leverages Bitcoin’s mining infrastructure through merged mining, allowing existing miners to validate Rootstock blocks. For token bridging, it uses a unique system that doesn’t require a separate consensus layer. The following sections explain how this architecture works in detail.

Rooststock is a Smart Contract Capable Bitcoin Sidechain | Image via Rootstock

Rooststock is a Smart Contract Capable Bitcoin Sidechain | Image via RootstockMerged Mining

Rootstock uses merged mining to inherit security from Bitcoin without operating its own consensus layer. This allows miners to validate both Bitcoin and Rootstock blocks simultaneously using the same proof-of-work (double SHA-256), with no additional computational cost.

How It Works

- Bitcoin mining pools embed Rootstock block references in each mining job.

- When a miner finds a solution, it's checked against both networks' difficulty levels:

- Meets Bitcoin & Rootstock difficulty: Submitted to both networks. Bitcoin ignores the Rootstock reference; Rootstock accepts the block.

- Meets Rootstock difficulty only: Submitted to Rootstock alone.

- Below both thresholds (pool difficulty): Used for internal accounting only.

Miners must run a Rootstock node (or delegate this task) to obtain block IDs, which are embedded in Bitcoin blocks for Rootstock to reference.

Benefits

- Cost-Effective: Uses existing Bitcoin mining hashpower without extra hardware or energy.

- Miner Incentives: Miners earn Rootstock transaction fees and protocol-level rewards via Remasc, a smart contract managing reward distribution.

- Bitcoin-Level Security: Rootstock shares Bitcoin’s hashpower, making it highly secure. Its defense-in-depth model with PowPeg eliminates single points of failure.

- Bitcoin-Aligned: Rootstock extends Bitcoin’s utility without competing with BTC, preserving ideological alignment and avoiding miner censorship incentives.

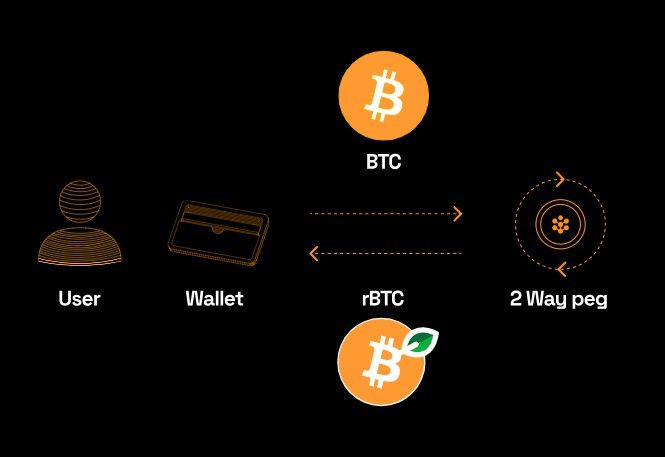

Powpeg Protocol

PowPeg is Rootstock’s mechanism for securely moving BTC between the Bitcoin network and Rootstock’s smart contract environment. It enables a 2-way peg where users lock BTC on Bitcoin and receive an equivalent amount of rBTC on Rootstock, and vice versa.

Unlike traditional sidechain bridges run by centralized parties, PowPeg uses a decentralized group of entities called functionaries, along with tamper-proof hardware modules, to manage this process. These actors cannot access user funds individually, and the protocol includes multiple layers of safeguards to prevent fraud or censorship.

All peg-ins and peg-outs are governed by Rootstock’s on-chain smart contracts, which independently verify Bitcoin transactions and release funds accordingly. Combined with Rootstock’s use of merged mining, the PowPeg design offers a strong blend of decentralization, censorship resistance, and auditability, without compromising on security.

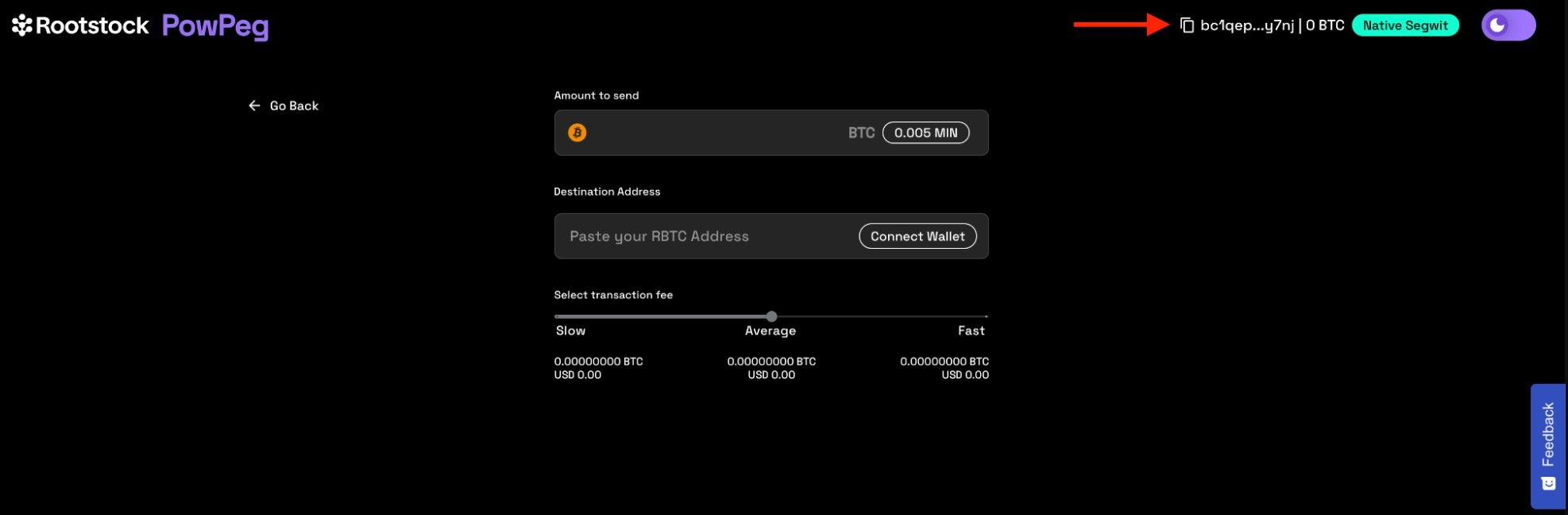

Powpeg is Available as a User Application to Bridge BTC To and From Rootstock | Image via Rootstock

Powpeg is Available as a User Application to Bridge BTC To and From Rootstock | Image via RootstockRootstock Virtual Machine (RVM)

The Rootstock Virtual Machine (RVM) is Rootstock’s smart contract execution environment, designed to mirror the Ethereum Virtual Machine (EVM). It enables developers to deploy Ethereum-style smart contracts and DApps on Rootstock without needing to rewrite them from scratch.

While the documentation doesn’t explicitly confirm full EVM compatibility, it does state that the RVM is compatible at the opcode level. In practice, this means the underlying instructions that smart contracts use, called opcodes, are understood the same way on both Ethereum and Rootstock. As a result, most Ethereum contracts can run on Rootstock with minimal or no modification.

This EVM-aligned design ensures that tools and applications built for Ethereum, such as MetaMask, Solidity, and Hardhat, can also be used on Rootstock, allowing developers to tap into Bitcoin’s security while retaining the familiar Ethereum development experience.

rBTC

rBTC (Rootstock Bitcoin) is the native asset of the Rootstock blockchain, pegged 1:1 with BTC. It serves two purposes: acting as a representation of Bitcoin within the Rootstock ecosystem and functioning as the gas token to pay for smart contract execution and transactions on the network.

To mint RBTC, users deposit BTC into a special multi-signature address on the Bitcoin network. This process is secured by PowPeg, Rootstock’s two-way peg system. Once the deposit is confirmed, the Rootstock Bridge releases an equivalent amount of RBTC to the user on the Rootstock chain. When users want to redeem their BTC, they send RBTC back through the bridge, and BTC is released on Bitcoin after sufficient confirmations.

This system makes RBTC a Bitcoin-native gas token, enabling BTC holders to interact with DeFi applications and smart contracts on Rootstock without introducing a new or speculative asset.

RIF Token

The RIF token is a utility and governance asset at the heart of the Rootstock ecosystem. It powers key protocols like RIF Name Service (RNS) and is closely tied to the RootstockCollective, the network’s decentralized governance initiative.

RIF’s governance role is activated through stRIF, a 1:1 staked version of RIF used for voting. Users can lock their RIF to mint stRIF, participate in governance, and reclaim their RIF at any time by burning stRIF. This system governs the RootstockCollective Treasury, which funds ecosystem development through targeted grant programs.

The decision to base governance power on RIF rather than a separate governance token aligns incentives between developers, token holders, and the broader Rootstock ecosystem. Future plans include redirecting RootstockLabs’ protocol fee share to the DAO and expanding governance to other RIF-based services.

RIF’s utility and its role in protocol governance make it integral to Rootstock’s long-term sustainability.

Rootstock Ecosystem

Rootstock is one of the most prominent platforms in the growing Bitcoin DeFi (BTCFi) movement, enabling smart contract-based financial services built on Bitcoin’s value layer. Its ecosystem has seen consistent growth in both bridged Bitcoin volume and DeFi activity over time.

As of August 2025, Rootstock’s metrics reflect its rising importance in the BTCFi landscape(data per DeFiLlama):

- TVL stands at $272.3 million, with $332.1 million in bridged assets.

- Of this, $54.5 million is native liquidity, while $277.6 million is canonical BTC bridged from the main chain.

- Rootstock holds 2,432 BTC on-chain as of July 30, 2025, representing cumulative BTC inflows.

- Weekly DEX trading volume is approximately $1.24 million.

- In 2024, total BTCFi TVL across all protocols jumped from $304.66 million to $7.117 billion, with Rootstock playing a key role in that expansion.

rBTC: Utility and Adoption

rBTC (Rootstock Bitcoin) is the gas and settlement asset of the Rootstock network, pegged 1:1 with BTC. It is minted when users bridge Bitcoin into Rootstock via the PowPeg, and burned during peg-outs, ensuring supply always matches locked BTC without independent issuance. By design, rBTC brings Bitcoin's value into an EVM-compatible environment without requiring changes to the Bitcoin protocol.

rBTC is the Gas Token of the Ecosystem | Image via Rootstock

rBTC is the Gas Token of the Ecosystem | Image via RootstockUtility

- Gas Token: Used to pay transaction fees on Rootstock (average ~$0.005), with fast confirmation times (~30 seconds).

- DeFi Collateral: Forms the base of Rootstock's DeFi stack, used in lending, yield farming, and to mint assets like DOC (Dollar on Chain).

- Cross-Chain Compatibility: Wrapped versions like WRBTC allow ERC-20 integration, and cross-chain swaps enhance liquidity.

- Yield Generation: rBTC can be staked in platforms like Solv and Money on Chain, with upcoming support for Vaulted rBTC: a product offering diversified yields across BTC and stablecoin positions.

rBTC Recent Adoption:

- Market Integration: Powers over 150 partner DApps and services.

- Protocol Usage: Q1 2025 Rootstock protocol revenue grew 5.5% quarter-over-quarter, driven by rBTC activity (per Messari data).

- DeFi Momentum: rBTC adoption parallels the rise of BTCFi, with rBTC central to liquidity, staking rewards (e.g., $390k+ campaigns), and integrations like Oku, SuperApp, and bridge aggregators.

As BTCFi expands, rBTC continues to cement its role as the default Bitcoin-native asset for smart contract applications.

Notable Applications in the Rootstock Ecosystem

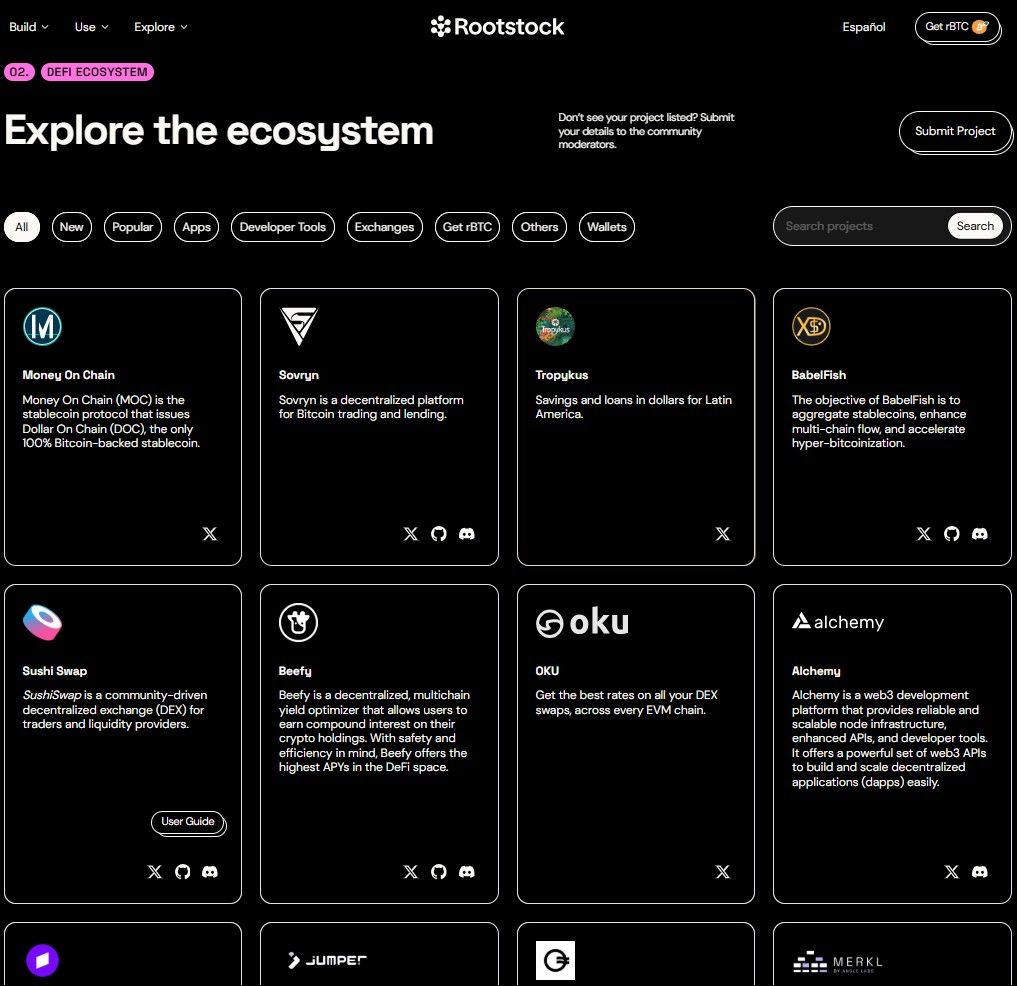

Rootstock's ecosystem includes >150 DApps across DeFi categories, with EVM compatibility enabling Ethereum tool reuse. Below are basics on specified apps, including TVL where available (as of mid-2025; figures fluctuate).

Rootstock Ecosystem is Diverse, but Doesn't Feature DApps Outside DeFi Yet | Image via Rootstock

Rootstock Ecosystem is Diverse, but Doesn't Feature DApps Outside DeFi Yet | Image via RootstockLending and Borrowing

- Sovryn: Non-custodial Bitcoin lending/borrowing/margin trading protocol. Users lend BTC for yields or borrow against collateral.

- LayerBank: Bitcoin-native lending for BTC-backed loans/yields, among the top-ranking protocols in Rootstock ecosystem.

- Tropykus: Decentralized lending for emerging economies, focusing on social impact. Deposits: ~$9M (BTC/stablecoins) at ~6% APY as of Jan 2025; integrates with Rootstock for cost reduction.

Staking

- Money on Chain (MoC): BTC-collateralized protocol for stablecoins (DOC) and leveraged BTC exposure (BPro). Stake MoC tokens for governance/oracles; fully decentralized since 2019.

- Rootstock Collective: DAO for staking RIF tokens to reward builders/backers via stRIF governance. TVL: $1.3M staked. Rewards distributed via governance; fastest-growing Bitcoin DAO in 2025.

- Pell: Omnichain Bitcoin restaking network. TVL: >$239M (per DeFiLlama on Aug 2025); focuses on shared liquidity/security.

- Solv Protocol: Liquid staking for rBTC/SolvBTC, TVL: $1.95B (per DeFiLlama on Aug 2025).

Stablecoins (Canonical, Non-Wrapped)

Prominent canonical stablecoins on Rootstock include:

- Dollar on Chain (DOC): 100% BTC-backed, decentralized stablecoin pegged to USD and overcollateralized. Issued via Money on Chain; bridged to Arbitrum via LayerZero/Stargate for cross-chain DeFi.

- USDT0: Omnichain USDT natively on Rootstock via LayerZero's OFT standard; unifies liquidity without bridges.

- Others like RUSDT (bridged USDT) exist but are wrapped.

Liquidity Protocols

- ICHI: Non-custodial liquidity management for Uniswap V3; enables single-token vaults/branded dollars.

- Steer Protocol: Enterprise-grade vaults/liquidity engines with AI tools; supports 40+ chains. Builds/manages smart pools on Rootstock; enhances DeFi automation.

- GAMMA: Active liquidity management/market-making; non-custodial concentrated liquidity. TVL: $12.5M (as of Aug 2025).

DEXs

- SushiSwap: Multi-chain DEX with swaps/liquidity; live on Rootstock since 2024. Powers aggregation across 40+ chains.

- Uniswap: V3 deployed on Rootstock; aggregates liquidity ($500k+ TVL post-launch). TVL: ~$36.29M in V3 pools (Aug 2025).

- Oku: Uniswap V3-based trading platform; integrates rBTC/DOC swaps, one of the top Rootstock DEX.

Yield Optimization

- Beefy Finance: Multi-chain yield optimizer; auto compounds tokens for max returns, supports vaults across multiple chains.

Bridges

- LiFi Aggregator: Multi-chain DEX aggregator for capital-efficient bridging; supports Rootstock via Jumper for seamless transfers.

- Jumper Exchange: Intent-based router integrated with LiFi; enables QR/one-tap bridging to Rootstock.

- Other Supported Bridges: Powpeg (native), LayerZero (for omnichain like USDT0/DOC to Arbitrum), Stargate (stablecoin bridging), Boltz/FastBTC (quick BTC swaps). 2025 roadmap adds trust-minimized options; >20 chains bridged (Ethereum, Base, etc).

Advantages and Challenges of Rootstock

Like every other ecosystem, Rootstock also has its advantages and challenges. The key is understanding them to determine if they are a dealbreaker or dealmaker for you.

Advantages of Rootstock

- Bitcoin-Native DeFi Growth: Rootstock enables smart contract functionality directly connected to Bitcoin, supporting over $272 million in DeFi TVL and holding 2,432 BTC on-chain (as of August 2025). This positions it as a major driver of BTCFi adoption.

- Unlocks Utility for Idle Bitcoin: Users can deploy their BTC in lending, yield farming, and other DeFi strategies by converting it to rBTC, creating yield opportunities for long-term holders without leaving the Bitcoin standard.

- Ethereum Compatibility: Rootstock supports Solidity and Ethereum’s development stack, allowing seamless porting of Ethereum DApps. This boosts composability, speeds up ecosystem development, and encourages cross-chain interoperability.

- Staking and Passive Earnings: rBTC can be staked across multiple Rootstock protocols, such as Solv or Money on Chain, offering users DeFi-native yields while retaining exposure to BTC.

- User-Friendly Interfaces: Rootstock works with familiar tools like MetaMask, making onboarding easy for Ethereum users looking to engage with Bitcoin-based DeFi.

Challenges of Rootstock

- Security Dependence on Merged Mining: Rootstock’s security model relies on Bitcoin’s hashpower. While it regularly captures 50–60% of Bitcoin’s mining power, this still depends on miner participation and can vary.

- Centralization Risk in Miner Participation: If only a few Bitcoin mining pools choose to merge-mine Rootstock, control over Rootstock could become concentrated, introducing potential governance or censorship issues.

- Handling High Block Frequency: Rootstock’s fast block times (30 seconds) increase the likelihood of uncles, competing blocks that need to be managed within the consensus. This adds operational complexity.

- Limited Novelty in DApp Ecosystem: Many Rootstock applications are forks of Ethereum protocols (e.g., Uniswap, SushiSwap, Beefy Finance), with little original innovation. While this ensures proven functionality, it may limit the network’s distinctiveness over time.

Rootstock Roadmap (2025)

Rootstock’s 2025 roadmap focuses on improving bridge infrastructure, decentralizing governance, and expanding BTCFi utility. The upgrades aim to enhance scalability, reduce costs, and introduce new tools for Bitcoin-native DeFi users.

Q3 2025

- Segwit PowPeg Activation (Reed Network upgrade): Reduces BTC peg-out costs by ~60% and expands the number of pegnatories, improving decentralization.

- Union Bridge Testnet Launch: Introduces a next-gen bridge using BitVMX with a 1-of-n honest assumption model for BTC movement, and it is trust-minimized and verifiable.

Q4 2025

- Vetiver Network Upgrade: Activates consensus changes required to run the Union Bridge on mainnet via Rootstock’s bridge aggregator.

- Public Attestation for PowHSMs: Adds firmware attestation to verify hardware integrity and enhance transparency.

- Governance Enhancements: Expands RootstockCollective DAO functionality, including treasury deployment, proposal flows, and stRIF participation incentives.

These upgrades mark a shift toward greater decentralization, security, and usability for Bitcoin-native smart contract ecosystems.

Final Thoughts

Rootstock combines Ethereum-style programmability with Bitcoin’s economic foundation. Its main strengths include EVM compatibility, a functioning DeFi ecosystem, and tight integration with Bitcoin via rBTC and merged mining.

For users already familiar with BTC-rails on Ethereum (e.g., wBTC, tBTC), Rootstock offers a Bitcoin-sidechain alternative worth exploring. However, users should remain cautious: Bitcoin on Ethereum is still more battle-tested, and Bitcoin on Bitcoin remains the most secure option. While Rootstock is one of the most advanced Bitcoin-based smart contract networks, it introduces risks inherent to sidechains, such as bridge security and miner participation.