Ethereum’s scaling vision has long revolved around Layer-2 (L2) solutions, which offer faster transactions, lower fees, and increased network capacity. Yet, as the L2 ecosystem grows, a glaring issue remains—security.

With billions of dollars now flowing through rollups, bridges, and DeFi protocols, smart contract exploits and malicious attacks have become one of the biggest threats to mass adoption. Traditional security measures rely on audits, bug bounties, and reactive monitoring, but these solutions often fall short—by the time a vulnerability is detected, it’s already too late.

Zircuit is an L2 that takes a radically different approach. Unlike other zkEVM rollups, Zircuit integrates AI at the sequencer level, proactively monitoring transactions and quarantining malicious activity before it happens. This Sequencer Level Security (SLS) framework allows Zircuit to operate as a self-defending blockchain, designed to prevent exploits, not just react to them.

But security is only one piece of the puzzle. Zircuit also boasts a hybrid zkEVM architecture, modular proving pipelines, and parallelized circuits, making it one of the most advanced rollups in development.

In this article, we’ll explore how Zircuit is setting a new standard for L2 security and performance, covering everything from its team and funding to its technology, tokenomics, adoption, and roadmap.

Inception and Team

Zircuit was founded to address a fundamental issue in Ethereum’s Layer-2 ecosystem—security at the sequencer level. While most rollups focus on scaling and cost reduction, Zircuit integrates AI-driven security directly into its sequencer, making it the first rollup designed to proactively prevent malicious transactions before they reach the blockchain.

The project was co-founded by Dr. Martin Derka and Jan Gorzny, experts in blockchain security, cryptography, and zero-knowledge proofs. Dr. Derka holds a PhD in algorithms and complexity theory, while Gorzny has extensive experience in protocol research and decentralised infrastructure.

Mainnet and Funding

Zircuit’s public mainnet launched in August 2024, following a phased rollout. The network was initially opened to partners in July, allowing early testing and deployment before full public access. To ensure a controlled launch, bridge restrictions were put in place, limiting the amount of assets users could deposit. These restrictions were gradually lifted, and by October 2024, Zircuit allowed unrestricted deposits and withdrawals.

Funding and Strategic Investment

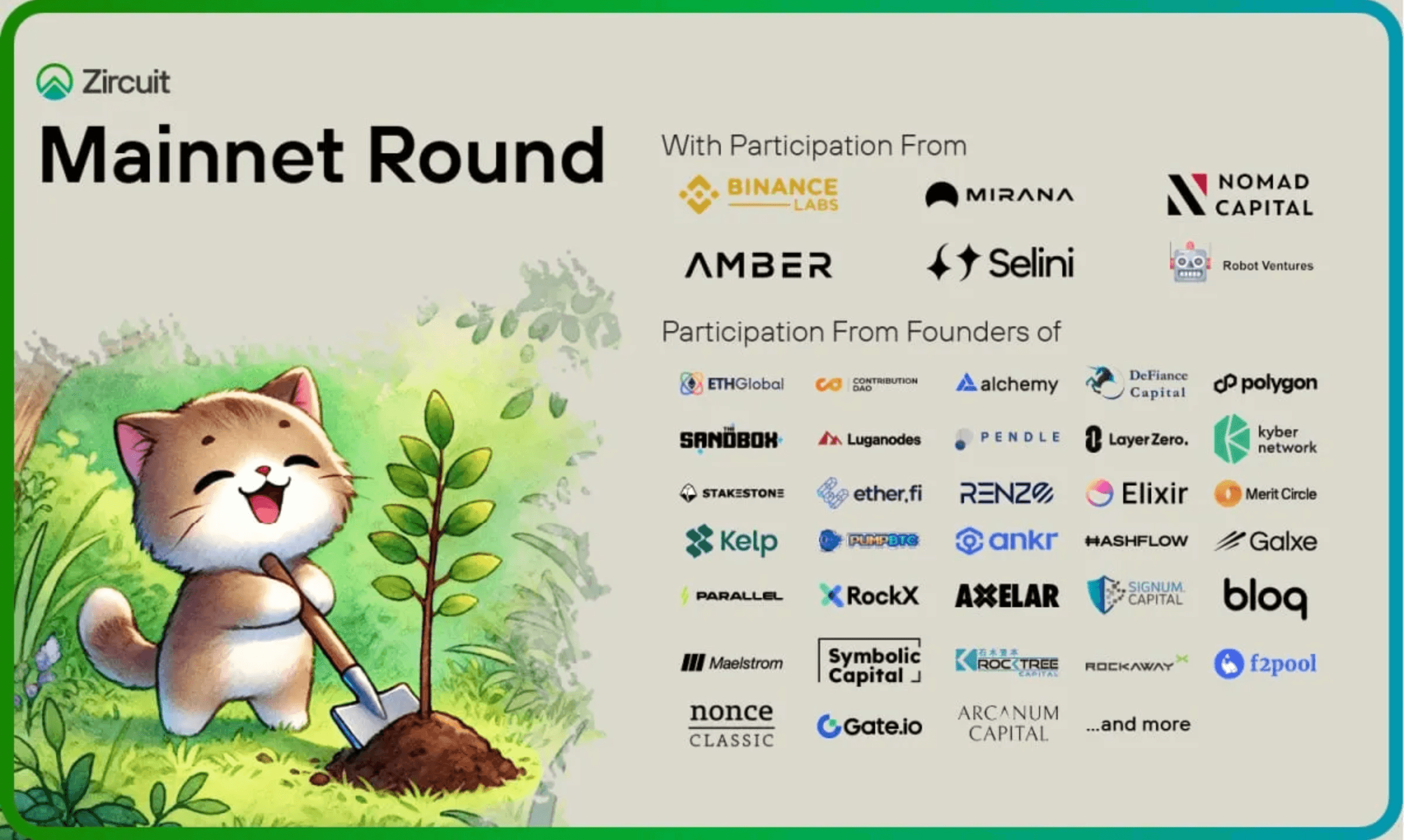

In June 2024, Binance Labs announced an investment in Zircuit, recognizing its approach to Sequencer Level Security (SLS) as a potential improvement in L2 security. Shortly after, Zircuit completed its mainnet funding round, attracting investment from firms such as:

- Binance Labs

- Mirana Ventures

- Amber Group

- Selini

- Robot Ventures

- Nomad Capital

- Angel investors from projects like Renzo, EtherFi, Pendle, Parallel, LayerZero, and Axelar

Zircuit Mainnet Round. Image via Decrypt

Zircuit Mainnet Round. Image via DecryptZircuit’s Technology

Ethereum’s rollup ecosystem has largely been defined by two competing approaches:

- Optimistic rollups, which rely on fraud proofs and a seven-day challenge period.

- Zero-knowledge rollups (zk-rollups), which use cryptographic validity proofs for instant finality.

While zk-rollups are widely considered the more advanced scaling solution, they come with technical and computational challenges that make widespread adoption more complex.

Zircuit takes a different approach. Rather than choosing between security and scalability, it aims to optimize both by combining a zkEVM rollup with AI-driven security at the sequencer level. This makes it one of the first Layer-2s to focus on preventing exploits at the network level while still maintaining the benefits of zero-knowledge proofs.

In this section, we’ll break down Zircuit’s key innovations, including:

- Hybrid zkEVM architecture

- Sequencer Level Security (SLS)

- Modular prover design

- Parallelized circuits and proof aggregation

- L1 data management and transaction efficiency

Hybrid zkEVM: Combining Proven Infrastructure with Zero-Knowledge Proofs

Zircuit is built on a hybrid zkEVM architecture, integrating elements of Optimism’s OP Stack while replacing fraud proofs with zero-knowledge (zk) proofs. This allows Zircuit to maintain EVM compatibility while eliminating the need for a seven-day challenge period, which is typically required for optimistic rollups.

OP Stack Benefits. Image via YouTube

OP Stack Benefits. Image via YouTubeInstead of waiting for fraud disputes, Zircuit transactions are immediately proven cryptographically, providing:

- Instant finality: Withdrawals do not require a waiting period.

- Lower verification costs: zk-proofs reduce the amount of data posted to Ethereum.

- Full EVM compatibility: Developers can deploy contracts without modifying existing code.

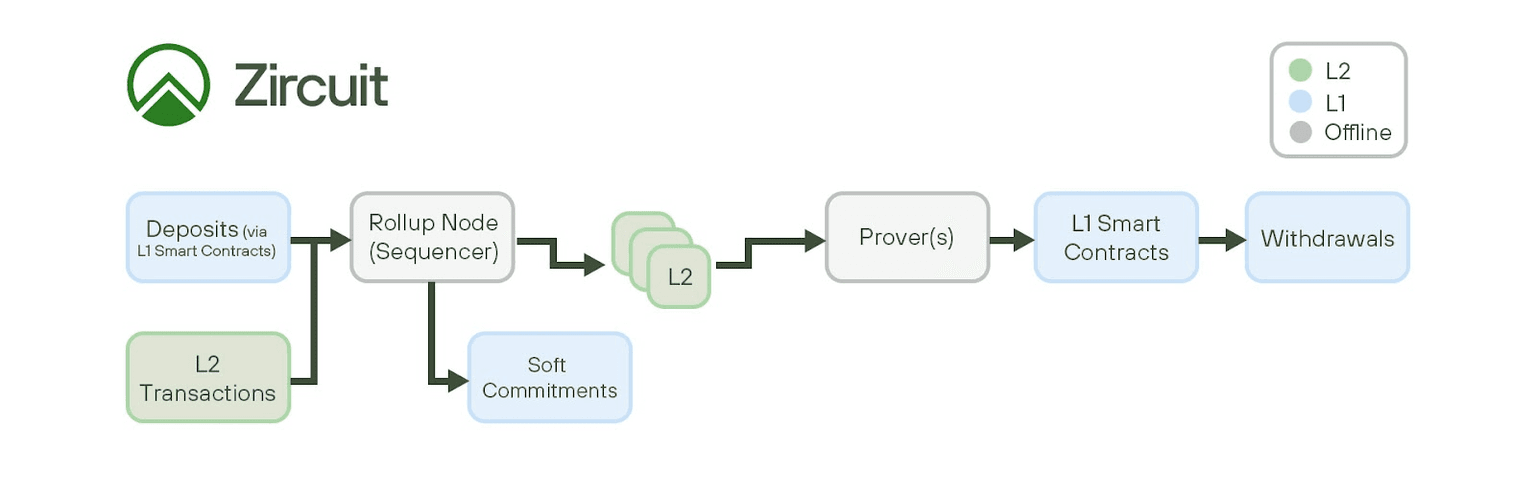

While the OP Stack was originally designed for optimistic rollups, Zircuit has modified it to support zkEVM circuits. This means transactions are still processed in a sequencer-batcher-execution model, but instead of relying on fraud proofs, all transactions are verified using cryptographic validity proofs. Transactions are processed in the following steps:

- A user submits a transaction.

- The sequencer orders transactions and applies SLS security checks.

- Transactions are batched and executed in L2 blocks.

- A zk-proof is generated to verify the batch.

- The validity proof is submitted to Ethereum, finalizing the transactions.

Transaction Flow of Zircuit. Image via Zircuit Docs

Transaction Flow of Zircuit. Image via Zircuit DocsAt the heart of this architecture is Zircuit's modular proving pipeline, which splits zk-proof generation into multiple specialized tasks for efficiency.

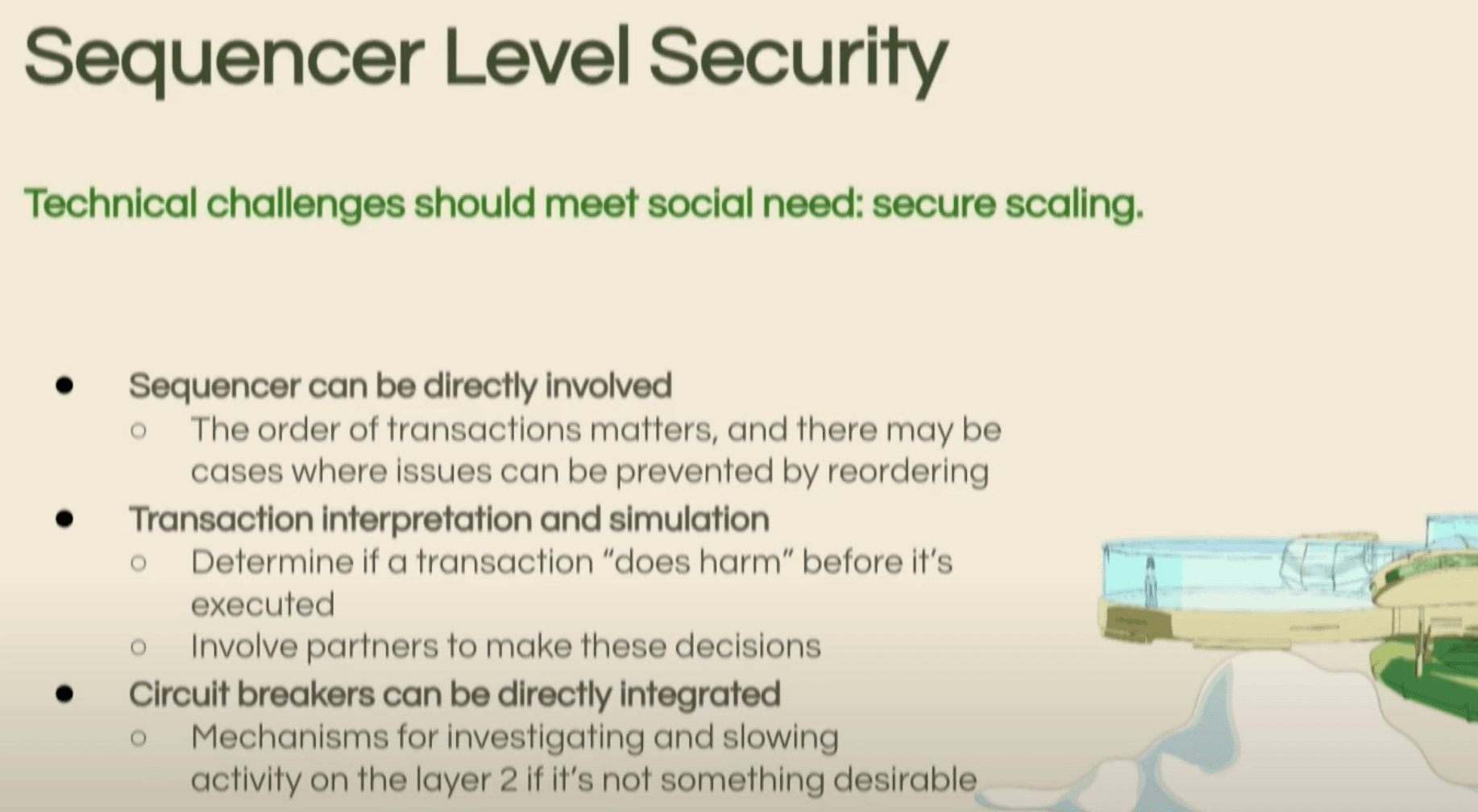

Sequencer Level Security (SLS): AI-Powered Threat Prevention

Security has always been a major concern in blockchain, particularly in DeFi, where exploits, flash loan attacks, and smart contract vulnerabilities have resulted in billions in losses. Most security solutions are reactive, relying on audits, monitoring tools, and manual intervention after an exploit has already occurred.

Zircuit takes a different approach by integrating AI-driven security at the sequencer level, making it one of the first blockchains to actively prevent malicious transactions before they are executed. This system is known as Sequencer Level Security (SLS) and functions as an on-chain firewall, screening transactions before they are included in a block.

Unlike traditional security measures that focus on smart contract audits or external monitoring, SLS operates at the core of the blockchain itself, providing a first line of defense against exploits, front-running, and unauthorized transactions.

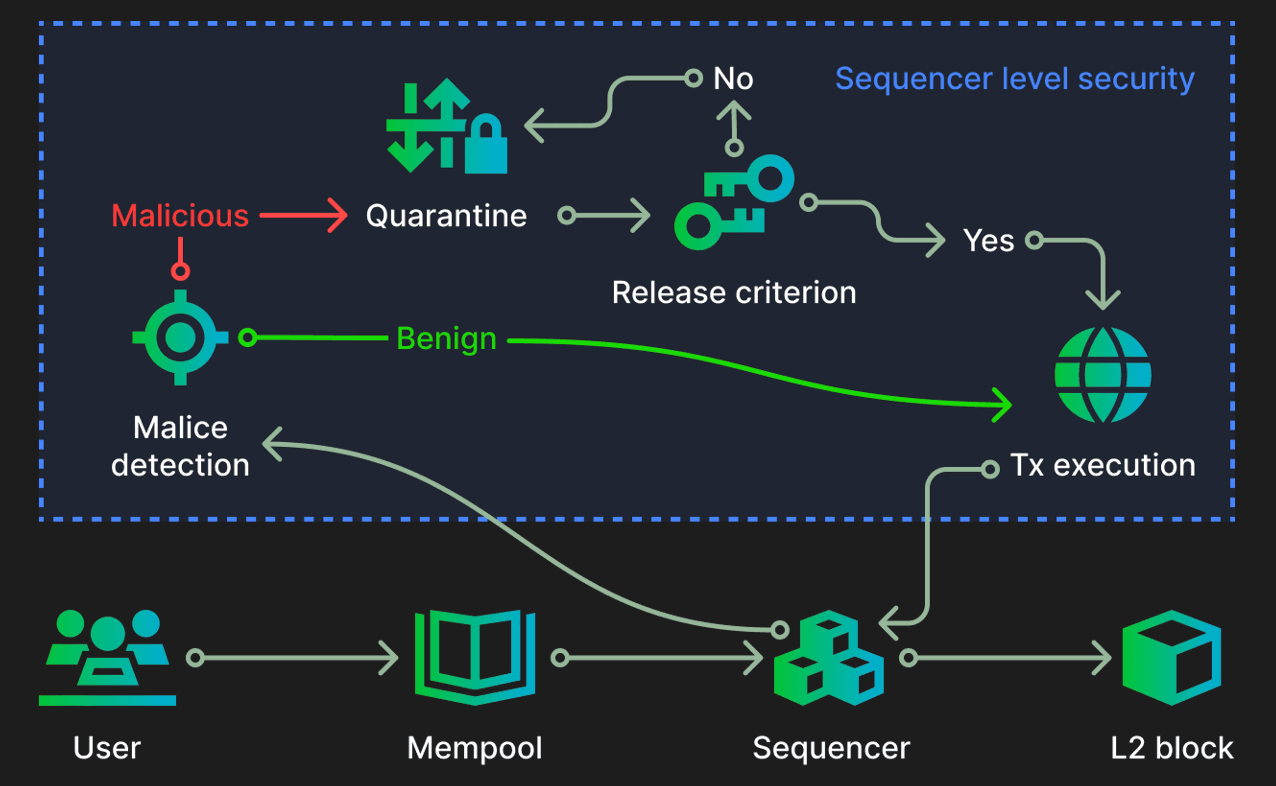

Sequencer Level Security. Image via Youtube

Sequencer Level Security. Image via YoutubeHow SLS Works: A Step-by-Step Breakdown

SLS functions by monitoring and analyzing transactions in real time before they are finalized on Layer-2. The process consists of four main stages:

1. Transaction Screening

- When a transaction is submitted, it first enters the Zircuit sequencer mempool, similar to how transactions are processed in Ethereum.

- The sequencer selects transactions based on gas fees, order of arrival, and network conditions, just like any other L2.

- However, instead of immediately including transactions in a block, Zircuit runs additional security checks using AI-powered analysis.

2. AI-Based Malice Detection

- Before execution, each transaction is simulated against the latest blockchain state to determine its expected outcome.

- Machine learning models, trained on historical exploits, known attack patterns, and behavioral anomalies, assess whether a transaction exhibits malicious intent.

- These models analyze transaction interactions with smart contracts, identifying red flags.

If a transaction exhibits characteristics of a known exploit, it is flagged as potentially malicious and diverted to quarantine instead of being executed immediately.

3. Transaction Dependency Analysis

- Some transactions are interdependent—meaning one transaction’s execution can change the outcome of another.

- SLS performs state dependency analysis to determine if transactions in the same batch interact with each other in ways that could enable complex multi-transaction exploits.

- Independent transactions are processed in parallel, while dependent transactions are queued for additional scrutiny.

4. Quarantine & Release Criteria

- Transactions flagged as high-risk are placed in a quarantine state, preventing them from being included in a block.

- If a transaction is wrongly flagged, it can be released from quarantine based on specific criteria, including:

- Manual override (by network security teams in exceptional cases)

- Failure due to changing blockchain state (if the conditions required for the exploit no longer exist)

- Expiration time (transactions can be automatically released after a certain period if no further malicious behavior is detected)

- Manual override (by network security teams in exceptional cases)

Overview of the SLS protocol. Image via Zircuit Docs

Overview of the SLS protocol. Image via Zircuit DocsOnce released, a transaction is re-evaluated for inclusion in the next block. If the risk conditions remain, it is permanently rejected.

Why SLS Matters: The Security Impact

Zircuit’s SLS fundamentally changes how blockchain security works by preventing attacks instead of reacting to them. This approach has several key benefits:

- Prevents smart contract exploits before they occur – Unlike traditional security models that rely on incident response, SLS stops attacks at the transaction level.

- Eliminates the need for chain rollbacks or emergency measures – Many past DeFi hacks have led to controversial hard forks, fund freezes, or governance disputes over whether stolen funds should be recovered. SLS eliminates these dilemmas by blocking attacks before execution.

- Protects users and protocols without requiring contract modifications – Developers don’t need to rewrite or modify their smart contracts to benefit from SLS. It functions transparently at the blockchain level, providing security for all dApps on Zircuit.

- Reduces front-running and malicious MEV – Many exploits involve manipulating transaction order through front-running. Since SLS operates at the sequencer level, it can identify and block transactions that exploit MEV strategies.

- Ensures DeFi users are protected without sacrificing decentralisation – Unlike centralised security solutions that rely on custodial risk monitoring, SLS operates natively within the Zircuit blockchain while still allowing for open participation.

SLS has already been tested against historical blockchain exploits, and according to Zircuit, it correctly identified 99.5% of known attacks with a false positive rate of just 0.01%.

Modular Prover Design: Efficient zk-Proof Generation

Generating zero-knowledge proofs is computationally expensive, making prover efficiency a critical factor in rollup performance. To address this, Zircuit uses a modular prover system, which allows different zk-proof schemes, commitment mechanisms, and recursion methods to be swapped as technology advances.

At present, Zircuit’s prover is based on Halo2, a widely used proving system in zkEVMs. However, the team is also researching zkVM-based solutions (such as RISC0 and SP1), which could replace Halo2 in the future.

Key Features of Zircuit’s Prover:

- Parallelized circuit execution: Proofs are generated simultaneously across multiple circuits to improve efficiency.

- Chunking mechanism: Ensures that provers are always processing useful data rather than padding empty slots.

- Scalability: The prover system can integrate new optimizations, such as Poseidon-based zkTries for better ZK compatibility.

L1 Data Efficiency: Managing Costs with Template Proofs

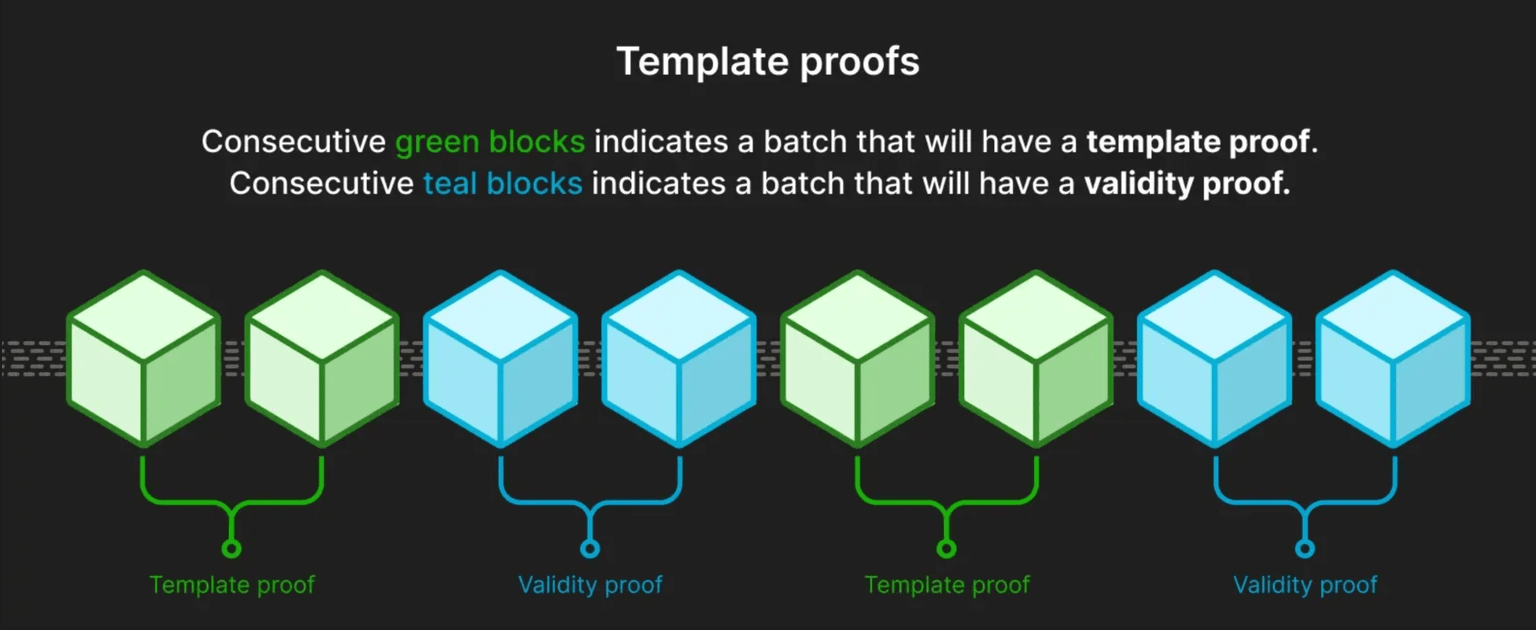

One of the biggest challenges for rollups is the cost of posting data to Ethereum. Zircuit uses a hybrid approach to manage L1 fees by combining validity proofs with template proofs, ensuring that state updates are posted without excessive computational overhead.

How it works:

- Full validity proofs are submitted periodically for transaction batches.

- Template proofs are used as placeholders to keep Ethereum updated while provers process full zk-proofs in the background.

- In future updates, every block will have a full zk-proof, eliminating the need for template proofs entirely.

Validity Proofs and Template Proofs. Image via Zircuit Docs

Validity Proofs and Template Proofs. Image via Zircuit DocsZircuit is also considering alternative data availability solutions, such as posting compressed transaction data to other blockchains or using Ethereum’s evolving blob storage system.

Tokenomics

Zircuit’s native token, ZRC, plays a central role in the network’s staking, governance, and incentive structures. Designed to align incentives between developers, users, and ecosystem participants, ZRC supports the network’s long-term sustainability and security.

ZRC Utility

ZRC is used for the following key functions:

- Staking & Rewards: Users can stake ZRC to participate in network incentives and earn rewards, particularly through Zircuit’s staking program.

- Ecosystem Incentives: ZRC is used to fund ecosystem growth, including grants, liquidity incentives, and rewards for early adopters.

- Governance (Future Feature): ZRC holders will eventually be able to participate in governance decisions, similar to other L2 tokens.

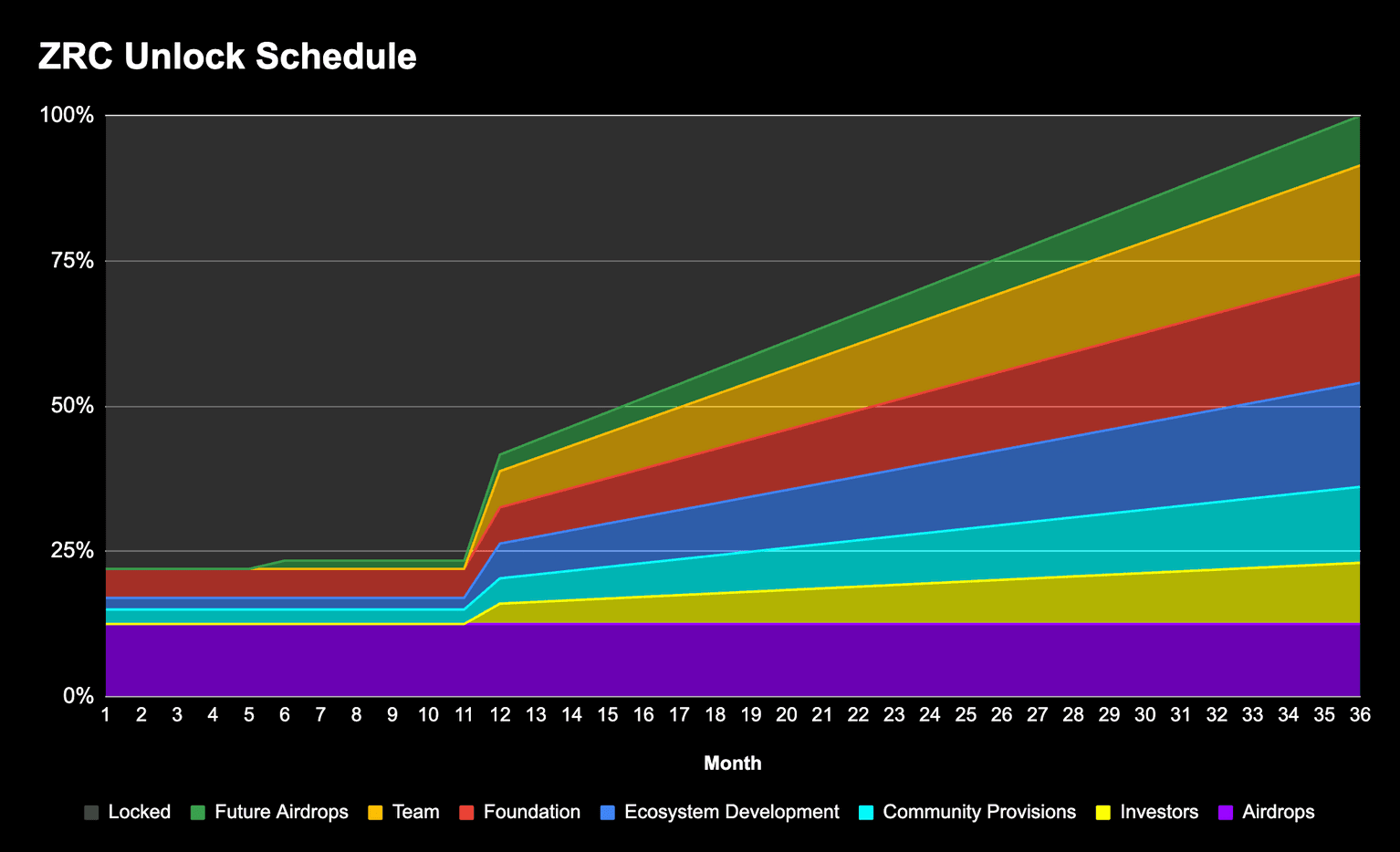

ZRC Token Distribution & Vesting

ZRC token distribution is as follows:

| Allocation | Percentage | Vesting Schedule |

|---|---|---|

| Airdrop & Community Rewards | 21.00% | 6-12 month cliff, then 24-month linear vesting |

| Season 1 & 2 Airdrops | 10.00% | Fully unlocked at TGE |

| Campaigns (Fairdrop, Binance Web3, etc.) | 2.45% | Fully unlocked at TGE |

| Future Airdrops & Rewards | 8.55% | 6-12 month cliff, then 24-month linear vesting |

| Community Provisions | 13.08% | 1-year cliff, then 24-month linear vesting |

| Ecosystem Development | 17.93% | 1-year cliff, then 24-month linear vesting |

| Foundation | 18.70% | 1-year cliff, then 24-month linear vesting |

| Team | 18.74% | 1-year cliff, then 24-month linear vesting |

| Investors | 10.55% | 1-year cliff, then 24-month linear vesting |

Unlocked at TGE

A total of 21.95% of the ZRC supply was unlocked at the Token Generation Event (TGE), including:

- Season 1 Airdrop (7%)

- Season 2 Airdrop (3%)

- Fairdrop & Binance Web3 Campaigns (2.45%)

- Community Provisions (2.50%)

- Ecosystem Development (2%)

- Foundation (5%)

Zircuit Unlock Schedule. Image via Zircuit Docs

Zircuit Unlock Schedule. Image via Zircuit DocsInflation Model & Emission Schedule

ZRC does not follow an aggressive inflation model, as the network relies on staking incentives and protocol revenue rather than continuous token issuance. However, future governance proposals may introduce supply adjustments to balance staking rewards, transaction fees, and ecosystem incentives.

Adoption and Ecosystem Growth

With Zircuit’s mainnet launch in August 2024, it is one of the newer entrants in the Layer-2 ecosystem. While adoption metrics are still developing, early indicators suggest strong interest from both users and developers.

During its testnet phase, Zircuit attracted significant participation, with over 110,000 users staking assets in its ecosystem, coupled with $3.5 billion in staked assets.

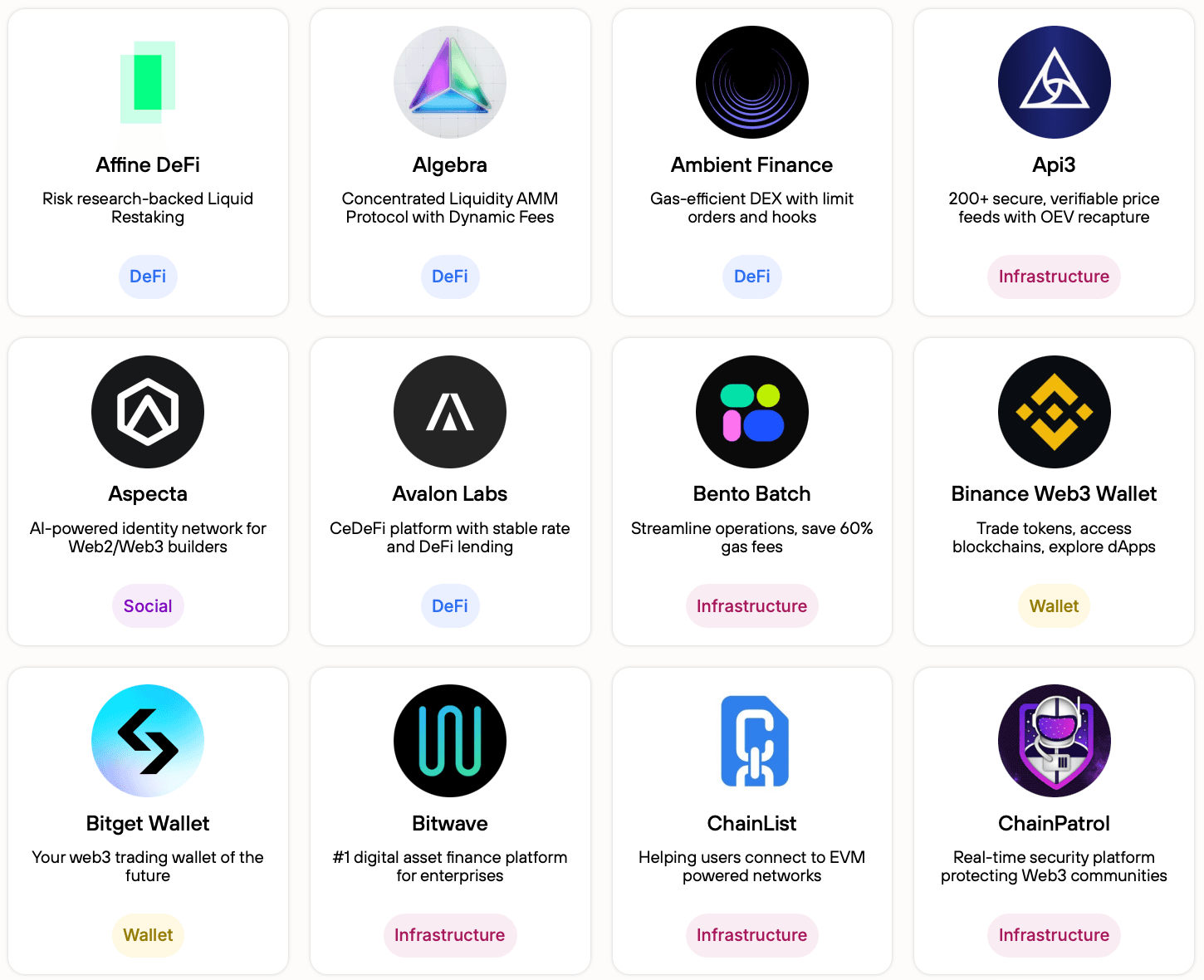

DApps and Projects on Zircuit

Dozens of DeFi and infrastructure projects have already committed to building on Zircuit. Given the network’s Sequencer Level Security (SLS) and zkEVM architecture, it is particularly appealing to projects focused on DeFi security and cross-chain functionality.

Some notable projects currently integrating with or launching on Zircuit include:

- Renzo – Liquid restaking protocol supporting Ethereum staking derivatives.

- Pendle – DeFi protocol that enables yield tokenization and trading.

- ZeroLend – Lending and borrowing protocol for Zircuit-native assets.

- Gud Tech – AI-driven DeFi trading and automation tools built for Zircuit.

Projects Integrated or Building on Zircuit. Image via Zircuit

Projects Integrated or Building on Zircuit. Image via ZircuitZircuit’s early adoption has been strongest in DeFi, particularly among liquid staking, restaking, and lending protocols.

Roadmap

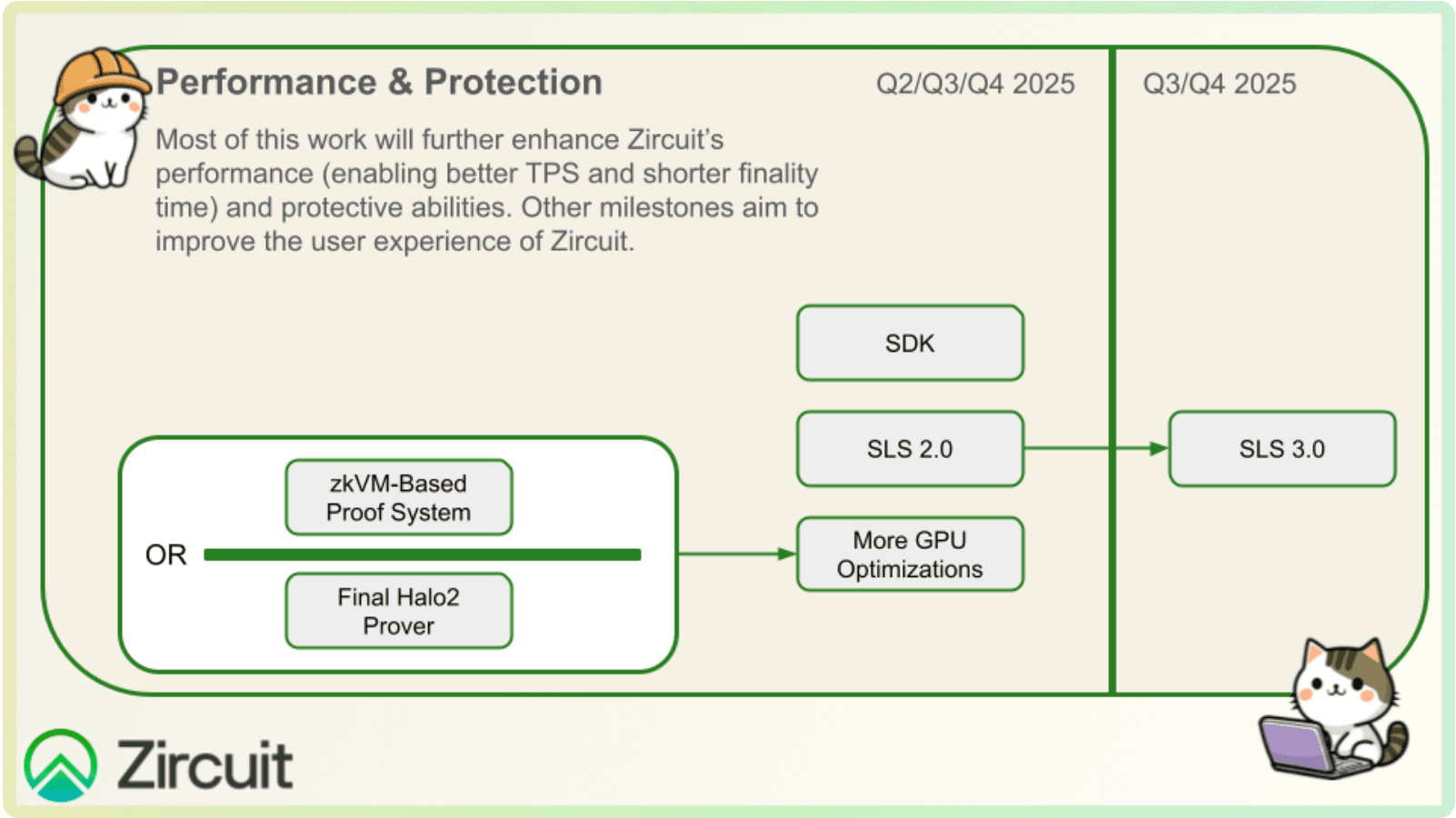

While Zirquit doesn’t have a singular complete roadmap, potential milestones can be found from multiple interviews and presentations with the founders in addition to blog posts by the team.

Technical Upgrades

One of Zircuit’s key priorities is upgrading its proving system to improve efficiency and reduce costs. The team is researching alternative proof systems, including zkVMs, which could offer better performance compared to its current Halo2-based setup.

Part of Zircuit’s Roadmap. Image via Zircuit Blog

Part of Zircuit’s Roadmap. Image via Zircuit BlogAnother major focus is refining its Sequencer Level Security (SLS). While the current version already scans and quarantines malicious transactions, future updates aim to expand detection capabilities. The next iteration, SLS 2.0, will introduce deeper transaction analysis, helping identify coordinated attack patterns that may not be obvious at the individual transaction level.

Ecosystem Expansion

Adoption is still in its early phases, but Zircuit is actively working on increasing liquidity and supporting more assets. Future updates will introduce broader ERC-20 token support, making it easier for projects to launch on the network. Additionally, Zircuit is strengthening its cross-chain capabilities through integrations with interoperability protocols like LayerZero and Axelar, which will allow seamless transfers between Zircuit and other blockchains.

Zircuit is also positioning itself as a hub for AI-driven DeFi applications. The team is working on tools that will enable automated trading, yield optimization, and risk management using AI, catering to the growing demand for on-chain financial automation.

You can also check out our in-depth article on DeFAI here.

Governance and Decentralisation

Currently, Zircuit operates with a centralised sequencer and proving system, but the team has plans to progressively decentralise aspects of the network. The introduction of on-chain governance will allow ZRC holders to vote on key decisions, including protocol upgrades, funding allocations, and security measures. While a fully decentralised sequencer is not yet in place, the team is researching ways to allow for greater community participation in network operations without compromising security.

Potential Challenges

While Zircuit presents a compelling approach to Layer-2 scaling with its AI-driven security and zkEVM architecture, several challenges could impact its adoption and long-term success. These range from technical hurdles in its proving system to competition within the Ethereum rollup space.

Competition in the zkEVM Space

Zircuit is entering an increasingly competitive field, with established zk-rollups such as zkSync, Scroll, and Starknet already gaining traction. Each of these networks is also improving their performance, security, and developer tooling. To stand out, Zircuit must continue attracting projects and liquidity, particularly in the DeFi and AI-driven automation sectors, where it aims to differentiate itself.

Adoption and Liquidity Growth

While Zircuit had secured over $3.5 billion in staked assets at one point, actual network adoption beyond staking protocols remains to be seen. Attracting high-value applications, users, and liquidity providers will be crucial for sustaining long-term growth. The success of incentive programs, partnerships, and integrations with major DeFi protocols will play a significant role in determining whether Zircuit can compete with other L2s in terms of Total Value Locked (TVL) and transaction activity.

Regulatory and Security Risks

As an AI-driven security layer, Zircuit introduces new attack surfaces that must be carefully managed. While SLS has been highly effective in early testing, its ability to adapt to evolving exploit techniques will be continuously tested by sophisticated attackers. Additionally, the broader regulatory landscape for blockchain security, AI-based transaction filtering, and staking incentives is still developing, which could present compliance challenges down the line.

Closing Thoughts

Zircuit enters the competitive Ethereum Layer-2 landscape with a unique focus on security and efficiency. By combining zkEVM scalability with AI-driven transaction screening, it aims to offer a secure and high-performance rollup that mitigates common DeFi risks while maintaining instant finality and EVM compatibility.

The network’s Sequencer Level Security (SLS) is its defining feature, allowing it to prevent exploits before they happen—a significant departure from traditional security models that rely on retroactive monitoring and manual intervention. Alongside its modular proving system and zk-friendly storage improvements, Zircuit is making technical strides that could set new standards for Layer-2 security.

However, Zircuit still faces key challenges, including the gradual decentralisation of its sequencer, and the need to drive real adoption beyond staking and DeFi integrations. Competing with well-established zk-rollups like zkSync, Scroll, and Starknet will require sustained growth, strong ecosystem incentives, and a compelling case for projects to build and remain on Zircuit long-term.

As the network continues its 2025 roadmap, the success of prover upgrades, liquidity expansion, and AI-driven automation tools will be critical in shaping its role within the Ethereum scaling ecosystem.