The crypto ecosystem has long outgrown the confines of a single blockchain. With hundreds of chains, thousands of decentralized applications (DApps), and tens of thousands of tokens, Web3 is now a sprawling, multi-network environment. That’s not news anymore.

In the early days, each chain functioned as an isolated ecosystem. Value, data, and identity were largely siloed — moving assets or logic across networks was clunky, risky, and often impossible without centralized intermediaries. But that reality has changed.

Today, interacting with multiple chains is becoming more intuitive and streamlined. This shift is driven by several technical breakthroughs: bridges, interoperability protocols, solver networks, modular designs, and increasingly sophisticated developer tooling. Together, they’re laying the foundation for something bigger — the move toward chain and account abstraction.

This article explores one key part of that transition: multichain technology. We’ll define what multichain means, how it differs from cross-chain architecture, what it’s made of, and why it plays a central role in the broader effort to make Web3 feel like a unified, interconnected experience.

Defining Multichain Technology

Multichain isn't a specific protocol or plug-and-play feature. It’s a broader concept that adapts depending on whether we’re talking about networks, blockchains, or applications. At its core, multichain refers to using more than one blockchain to achieve a goal, serve a user base, or optimize technical performance.

Here's how the term plays out across different layers of the ecosystem:

- At the network level, a multichain environment simply means the coexistence of many independent blockchains — Ethereum, Solana, Avalanche, Cosmos, and so on — each with its own architecture, consensus rules, and user base.

- At the blockchain level, a multichain blockchain uses multiple chains to fulfill its core operations. For example, separating execution, consensus, and data availability across different chains to improve scalability and modularity.

- At the application level, a multichain DApp is deployed across multiple networks. Depending on the audience or infrastructure advantages, it might offer the same product experience on Ethereum, Arbitrum, and Base — or even tailor its features per chain.

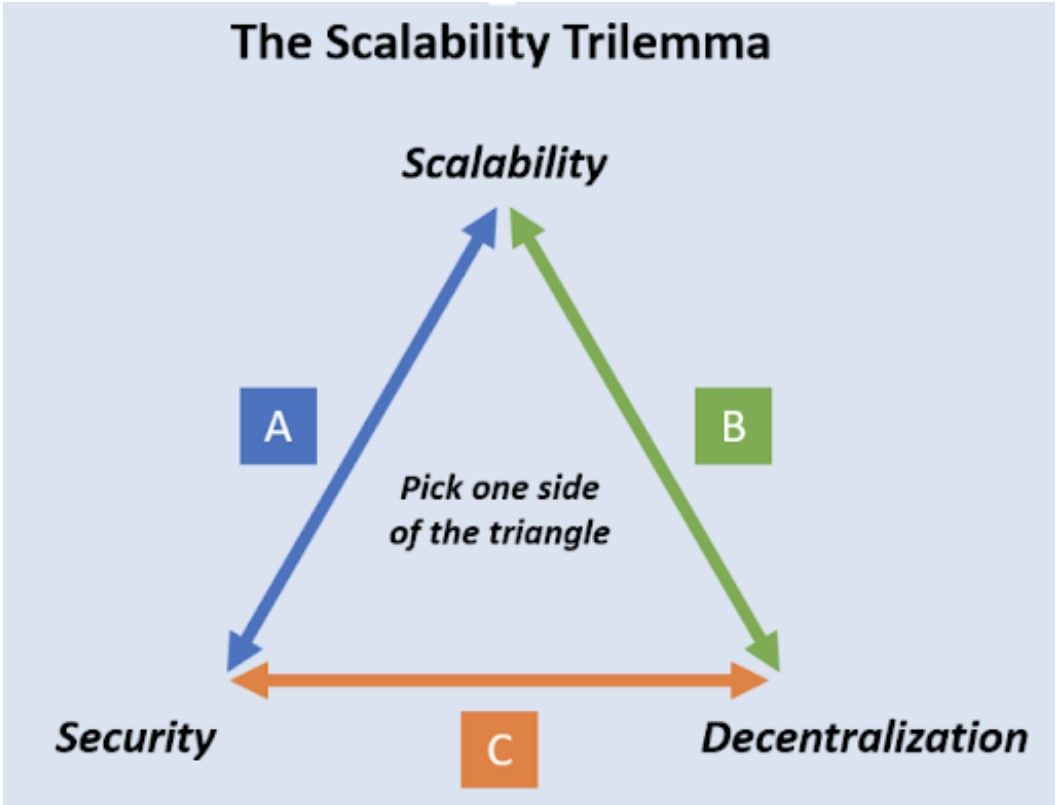

The rise of multichain thinking can be traced back to Ethereum’s scalability trilemma. As demand for Ethereum surged, two major bottlenecks became clear:

- Throughput limitations: Ethereum’s block space couldn't accommodate the growing user base. This led to rising gas costs and slower transaction times.

- Flexibility tradeoffs: While Ethereum was built to be a general-purpose, decentralized compute layer, it wasn’t optimized for any single use case. As new categories of applications emerged — like high-frequency DeFi trading, gaming, and social — the need for custom-fit environments became obvious.

The Scalability Trilemma | Image via Mina Protocol

The Scalability Trilemma | Image via Mina ProtocolThe simplest workaround? Don’t force one chain to do everything. Build more of them.

This decision to go multichain — by launching new networks, spinning out appchains, or deploying to multiple chains — helped scale infrastructure without compromising on decentralization or performance. But the moment these parallel systems began to operate, another problem appeared: how do you coordinate activity between chains?

The Difference Between Multichain and Cross-Chain

The cryptosphere going multichain solved many immediate problems. With more networks to handle user activity, there was more block space. More transactions were executed per second, overall throughput increased, and gas costs fell since transactions weren’t all competing for the same block space.

This diversification also accelerated innovation — networks like Solana (Proof of History), Cosmos (IBC), Polkadot (shared security), and many others started to specialize in areas like speed, composability, and modular design.

But while multichain architecture helped sidestep Ethereum’s scalability limits, it came with its own set of challenges — mostly centered around fragmentation:

- Liquidity Fragmentation: Each chain needs capital. Proof-of-Stake networks rely on liquidity to secure the chain through validator staking. DEXs need deep liquidity pools to function efficiently. As the number of networks grew, so did the demand for liquidity, but capital inflows didn’t scale at the same pace. This led to thinner security guarantees, more volatile slippage on DEXs, and capital inefficiency across the board.

- User Fragmentation: Communities became siloed. Instead of one large user base interacting in a shared environment, Web3 saw smaller, chain-specific pockets of users that rarely crossed over. Each blockchain became its own walled garden.

- Mindshare Fragmentation: The developer brainpower that once focused on Ethereum was now distributed across dozens of chains. This diluted the collective innovation cycle, as teams spent more time adapting codebases to multiple environments than pushing the boundaries of what was possible.

- DApp Cloning: Projects scrambled to replicate their apps across multiple chains to stay relevant, pouring resources into deployment overhead rather than feature development. Fork fatigue became real.

- User Experience Complexity: More chains meant more wallets, private keys, RPC endpoints, and mental overhead. For non-technical users, navigating a multichain world quickly became overwhelming. In the early days, moving assets from one chain to another often meant withdrawing to a CEX and re-depositing on a different network—a clunky process that sacrificed privacy, speed, and user sovereignty.

This growing fragmentation across liquidity, users, and developer effort created the need for a new infrastructure layer: cross-chain technology.

Just like “multichain,” the term “cross-chain” is contextual. Broadly speaking, it refers to systems that enable communication and movement of assets or data across different blockchain networks. The goal is to eliminate the silos.

Cross-chain innovation led to the rise of bridges, messaging protocols, and generalized composability frameworks. These systems typically rely on specialized actors — such as light clients, relayers, and RPC nodes — to facilitate secure, verifiable communication between chains. These actors pass messages, confirm states, and relay value, allowing apps and users to operate across networks without needing to exit and re-enter each ecosystem manually.

In this way, cross-chain is a response to the inefficiencies of multichain. It fills the gaps — unifying liquidity, reducing the need for constant app replication, and enabling users to build a more cohesive presence across chains. Where multichain expands the surface area of Web3, cross-chain stitches it back together.

Core Components of Multichain

The multichain world comprises various components that collectively enable the proliferation of blockchains and DApps across different networks. While these components serve different functions, they all contribute to expanding the blockchain ecosystem beyond a single chain — each adding scale, specialization, and diversity to the Web3 stack.

Layer-1 Networks

A Layer-1 network is a standalone blockchain that establishes its own validator set to process transactions, execute smart contracts, and build blocks. These networks operate independently and typically have their own native token, consensus mechanism, and security model.

In the context of multichain, the number of Layer-1s has exploded. Ethereum, Solana, Avalanche, Polkadot, Sui, Aptos, and Near are just a few of the many L1s that coexist today. Each one brings different trade-offs around speed, decentralization, finality, and development tooling — giving developers a range of ecosystems to build in, and giving users more options to participate in.

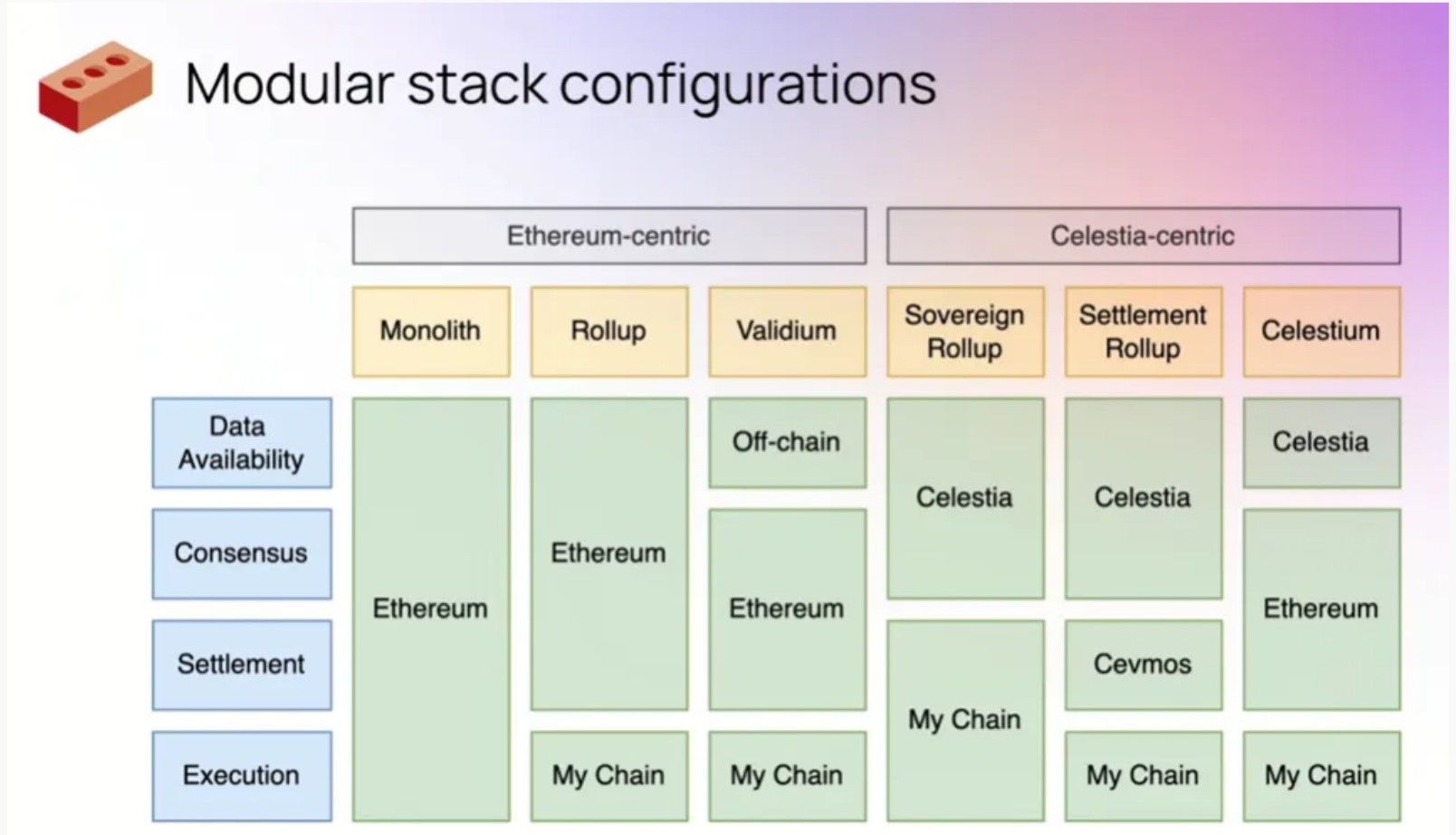

Modular Networks

Modular blockchains separate core functions of a blockchain — execution, consensus, and data availability — into distinct layers or modules. Modular networks split responsibilities to scale more efficiently instead of trying to do everything on a single chain (as monolithic chains do).

- Layer-2 Chains: These execution environments rely on a Layer-1 for settlement and security. Examples include Arbitrum, Optimism, Base, and Scroll — all executing transactions off-chain or in rollups and settling them on Ethereum.

- Data Availability Layers: Celestia and EigenLayer are examples of chains explicitly built to provide scalable data availability for other networks. New chains can plug into these modules instead of rebuilding this functionality from scratch.

- Cosmos SDK: Cosmos introduced the idea of an internet of blockchains using its SDK and the Tendermint consensus engine. Developers can spin up new sovereign chains (like Osmosis, Secret Network, and Injective) that can optionally interoperate via Cosmos’s IBC protocol. Cosmos chains often serve as application-specific blockchains tailored to a single use case.

Modular Blockchain Layer Configurations | Image via Medium

Modular Blockchain Layer Configurations | Image via MediumModularity makes it easier to launch and scale new chains without rebuilding all components from scratch, a driving force behind the growth of multichain networks.

Execution Environments

One of the strongest enablers of multichain expansion has been the rise of standard execution environments — most notably, the Ethereum Virtual Machine (EVM). By adopting EVM compatibility, new chains can instantly support the vast array of Ethereum-native smart contracts, tooling, and developer knowledge.

This standardization has rapidly launched multiple EVM-based chains and rollups, such as Polygon, Fantom, Avalanche C-Chain, BNB Chain, and numerous Ethereum Layer-2s. A single codebase can often be ported to all these chains with minimal changes, allowing developers to easily deploy multichain applications.

The multichain boom owes a lot to the EVM’s role in reducing the complexity and friction of launching new execution environments.

Multichain Applications

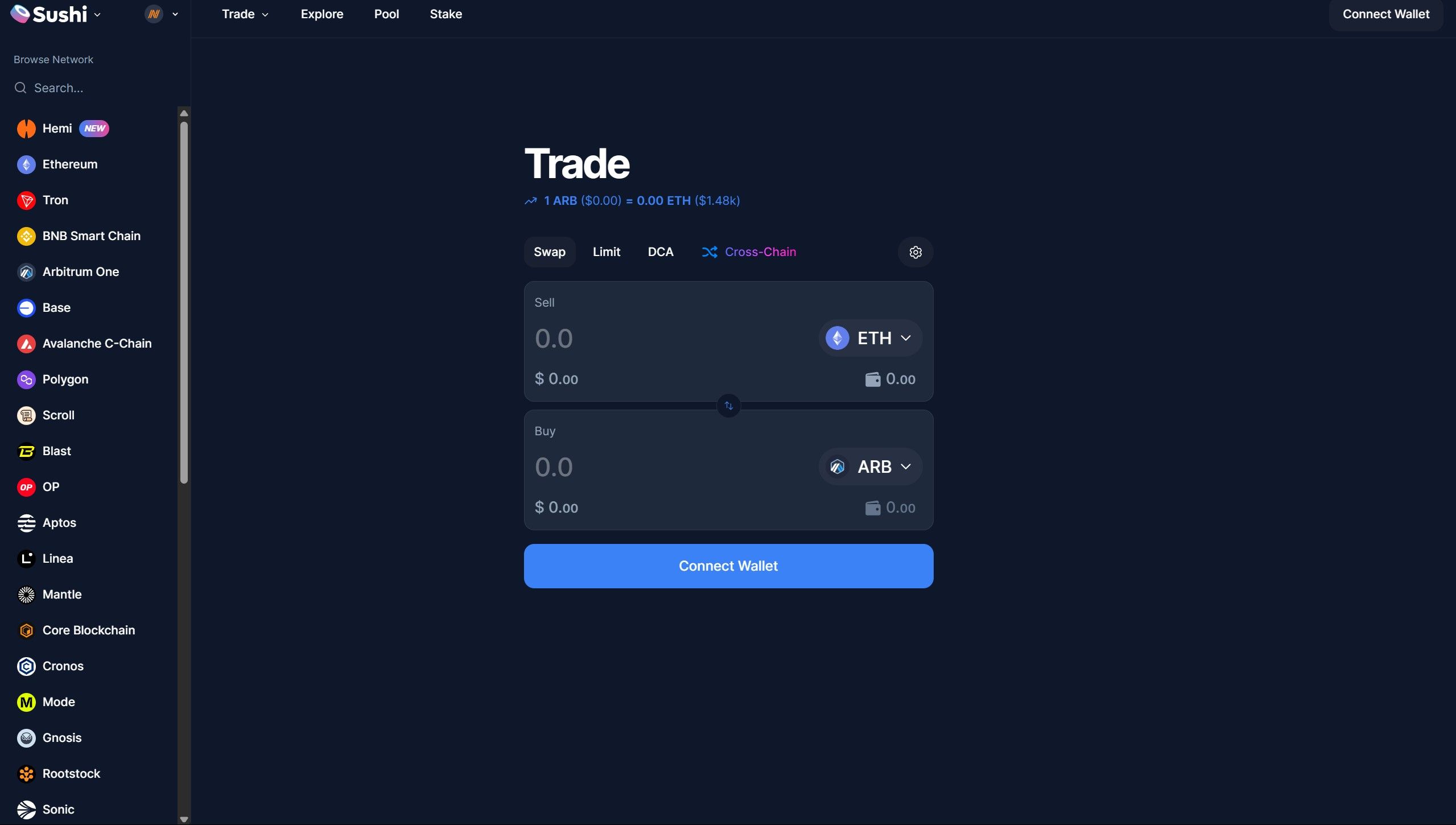

A multichain application is one that exists on more than one blockchain — not through interoperability, but by independently deploying the app on multiple networks. These deployments are often maintained in isolation, meaning the smart contracts on one chain don’t automatically sync state with those on another.

Examples include:

- Uniswap: Deployed on Ethereum, Arbitrum, Optimism, Polygon, and Base.

- Aave: Runs on Ethereum, Avalanche, Polygon, and Base, with isolated deployments per chain.

- SushiSwap: Actively maintains versions of its DEX across 15+ networks.

DApps Often Offer Forked Versions of Their Application, Look at SushiSwap | Image via SushiSwap

DApps Often Offer Forked Versions of Their Application, Look at SushiSwap | Image via SushiSwapProjects often fork and adjust codebases to support different execution environments or even virtual machines (like deploying on both EVM and WASM chains). This increases reach but also creates overhead, as each instance must be maintained separately.

Consensus Algorithms

Multichain development has also fostered experimentation with various consensus mechanisms — each offering different trade-offs around scalability, latency, energy usage, and decentralization.

Some of the consensus designs that have found traction in the multichain era include:

- Proof of Stake (PoS) – Used by Ethereum, Cosmos, Near, Avalanche

- Delegated Proof of Stake (DPoS) – Solana, Tron, EOS

- Proof of Authority (PoA) – Gnosis Chain

- Proof of History (PoH) – Solana combines PoH with PoS to improve time synchronization

- Proof of Work (PoW) – Though less common in new chains, it still powers Bitcoin, Litecoin, and Ethereum Classic

The diversity of consensus models directly results from the multichain expansion, where different networks optimize for various performance metrics or trust assumptions.

Use Cases and Applications of Multichain

The multichain paradigm didn’t just expand block space — it unlocked entirely new design space for decentralized applications. By enabling developers to choose from a range of networks, each with its own performance profile and technical assumptions, multichain environments made it possible to build DApps that weren’t viable in a one-chain world.

Multichain DApps and Specialized Use Cases

Different chains offer different strengths — low latency, high throughput, better UX, or cost-efficiency — and developers are increasingly choosing chains based on what their application needs most.

- GameFi on Sui and Immutable X: Games require rapid, real-time interactions with near-zero fees. Networks like Sui (with its object-based execution model) and Immutable X (purpose-built for gaming) make running live-service games possible without compromising responsiveness or cost. These workloads simply aren’t feasible on the Ethereum mainnet.

- Perpetual Markets on Hyperliquid and Arbitrum: Derivatives trading demands high-frequency execution with minimal latency. Hyperliquid, a custom Layer-1 for perpetual futures, and Arbitrum, a high-throughput Ethereum rollup, have become hubs for decentralized perpetuals markets due to their speed, capital efficiency, and trust-minimized environments.

- Metaverse and NFTs on Solana: With its fast finality and low fees, Solana has become home to a vibrant NFT and metaverse ecosystem. Projects like Aurory and Tensor leverage Solana’s throughput to power immersive in-game economies and marketplaces.

- Appchains on Cosmos: Application-specific chains like Osmosis (DEX), dYdX v4, and Neutron use the Cosmos SDK to deploy sovereign blockchains tailored to single use cases. This model improves performance and allows teams to control their own upgrade cycles and fee markets.

- SocialFi on Farcaster (Optimism): Social protocols like Farcaster are built on Optimism’s stack, leveraging fast, inexpensive L2 transactions to power high-volume, low-value interactions that wouldn’t be viable on L1s.

- DeFi on Base and Blast: Newer Ethereum Layer-2s like Base and Blast are attracting developer ecosystems focused on yield, stablecoin primitives, and retail DeFi, all supported by faster UX and cheaper on-chain execution.

Interoperability and Composability Networks

As multichain ecosystems expanded, the need for coordination between chains became apparent. A new category of infrastructure emerged to support interoperability and composability across chains.

- Bridges: Protocols like Stargate, Across, and deBridge enable users to transfer tokens between networks, creating the foundation for cross-chain liquidity.

- Smart Contract Messaging Protocols: LayerZero enables contracts on different chains to send messages to each other, allowing developers to create DApps that span multiple chains with shared logic.

- Bridge Aggregators: Protocols like LiFi bundle together multiple bridges into one SDK, allowing applications to offer optimal routing for asset transfers without managing bridge infrastructure themselves.

- Account Abstraction Protocols: Particle Network enables developers to simplify wallet management across chains, improving UX and enabling multichain onboarding flows.

- Chain Abstraction: Omni Network is building a unified execution layer where apps can interact with multiple chains as if they were one, pushing toward a world where “what chain you’re on” becomes irrelevant for users.

- Solver Networks: Protocols like Anoma or emerging MEV auction layers operate as chain-agnostic solvers, coordinating off-chain execution or order flow across different chains.

Shared Security and Modular Services

New chains need security, but bootstrapping it from scratch is expensive. As multichain networks proliferated, shared security systems emerged to fill the gap.

- Data Availability Layers: Celestia and EigenDA decouple data availability from execution, letting new rollups focus on performance without having to solve DA from scratch.

- Restaking: EigenLayer enables Ethereum validators to opt-in to secure new services or networks by restaking their ETH, exporting Ethereum’s trust model to emerging multichain modules.

- Decentralized Sequencers: These help decentralize rollup infrastructure, removing reliance on a single entity to order transactions and pushing the multichain ecosystem toward more censorship-resistant designs.

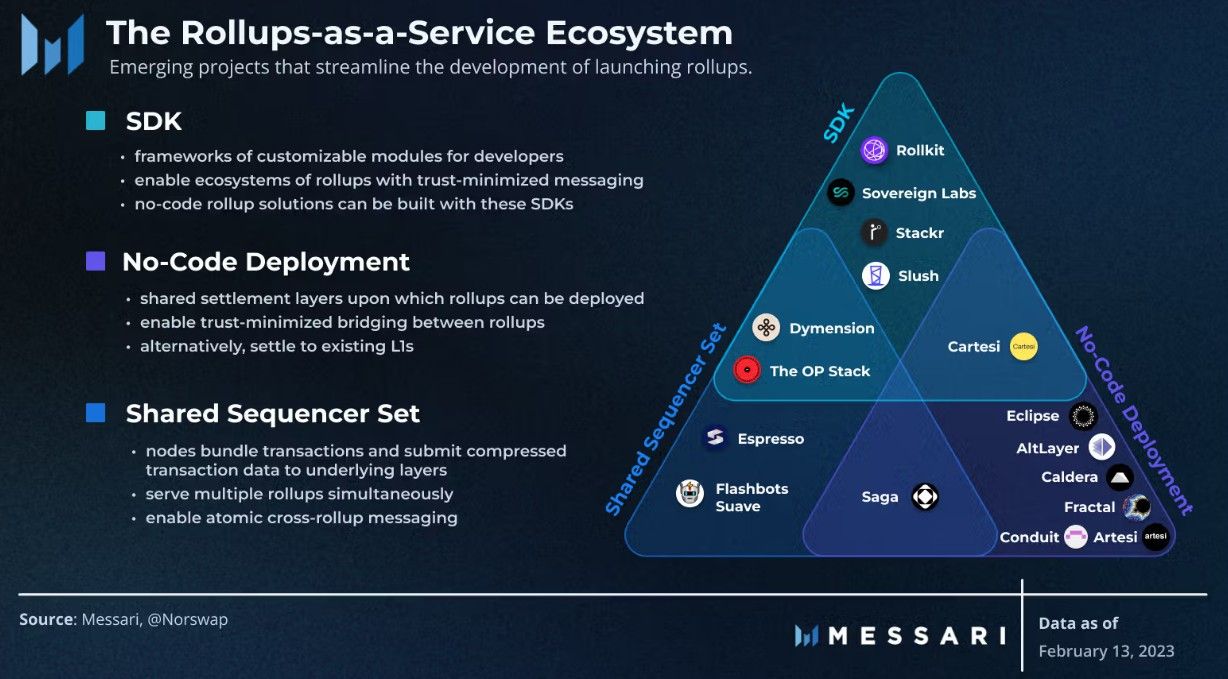

Rollup-as-a-Service (RaaS)

As the cost and complexity of launching chains dropped, a new category of infrastructure emerged: RaaS platforms. These services let teams launch their own rollups without reinventing the wheel.

RaaS Ecosystem Overview | Image via Messari

RaaS Ecosystem Overview | Image via MessariExamples: AltLayer, Caldera, Conduit, Zeeve, and Saga offer customizable rollup infrastructure, letting projects choose their settlement layer, DA provider, sequencer configuration, and even monetization strategy. This is accelerating the growth of multichain environments with chain-per-app designs.

Future Outlook and Considerations

The future of multichain isn’t years away — it’s already here. Web3 has effectively solved the multichain challenge. Dozens of Layer-1s and Layer-2s are live, production-ready, and host meaningful ecosystems. Cross-chain communication, once a major limitation, is also primarily solved. Bridges, messaging layers, and composability networks now connect nearly every major chain.

Today, the focus is no longer on making chains—it’s on making all chains feel like one. That’s where the opportunity lies.

Multichain adoption exploded between 2020 and 2022, driven by Ethereum’s explosive growth and its limitations. Block space was limited, fees were high, and new networks began to emerge rapidly. Since then, the space has matured: ecosystems stabilized, best practices emerged, and cross-chain coordination improved. Now, the attention has shifted toward creating seamless user experiences across chains.

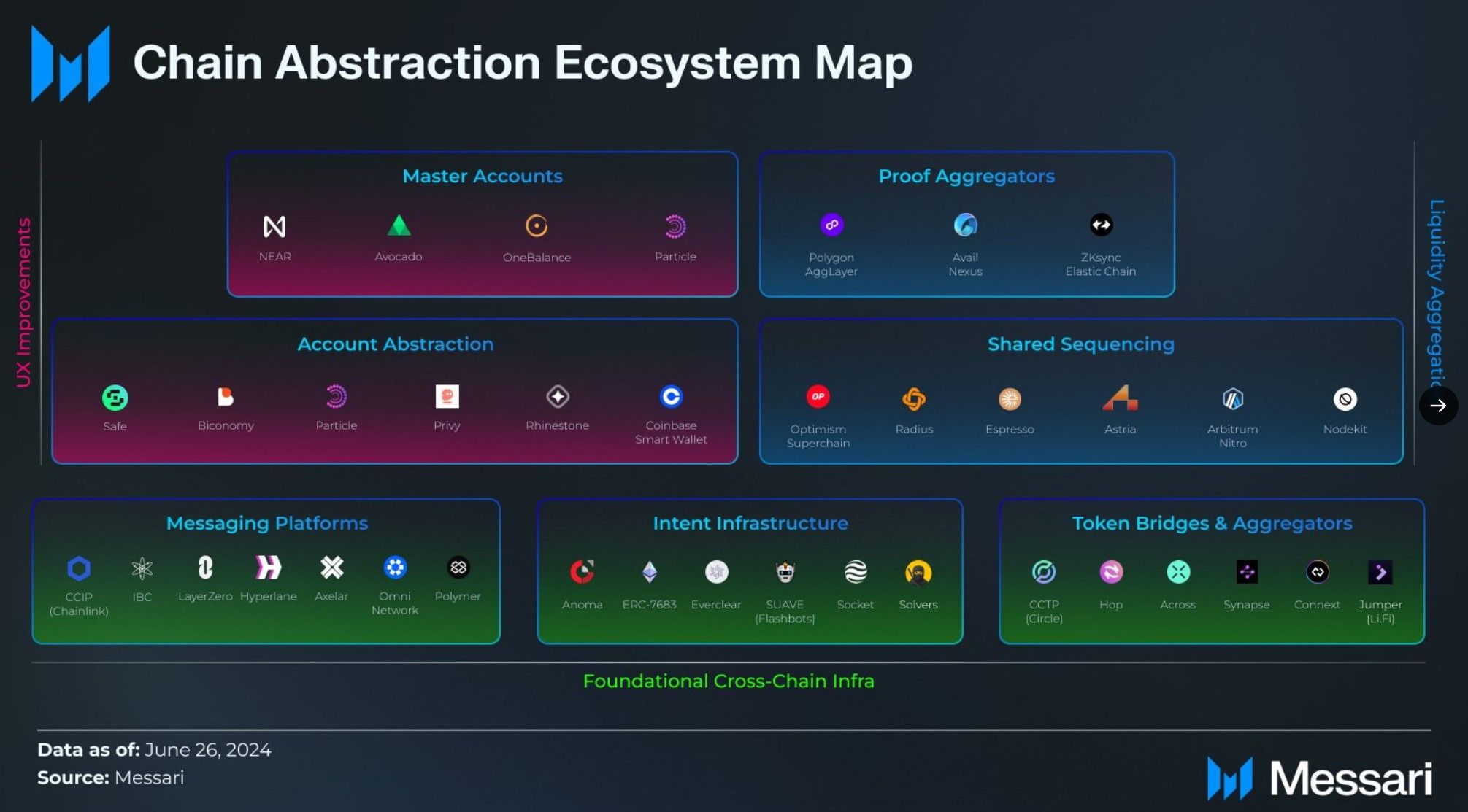

Chain Abstraction Ecosystem Map | Image via Messari

Chain Abstraction Ecosystem Map | Image via MessariPotential Challenges

Even though multichain infrastructure is functional, a few challenges remain, especially as we move toward higher abstraction.

- User Complexity: Managing wallets, tokens, and apps across multiple chains is still too complex for the average user. This is where chain abstraction and account abstraction play a vital role — streamlining multichain access without requiring users to think about which chain they’re on.

- Security Overhead: Each new chain needs to secure its validator set, data availability, and block production. In a multichain world, shared security and DA layers like EigenLayer, Celestia, and Cosmos are critical infrastructure.

- Interoperability Limits: While basic asset transfers are solved, deeper interoperability, like shared liquidity, unified execution layers, or native composability, still needs work. Emerging frameworks like Optimism’s Superchain, Polygon AggLayer, and ZKsync’s ZKChains are trying to standardize resources and logic across ecosystems to make inter-chain coordination seamless.

Opportunities for Growth

The next wave of innovation focuses on abstraction — building infrastructure that entirely removes chains from the user experience.

- Solver Networks: Protocols that can optimize transactions across chains, find the best liquidity routes, or coordinate intent execution are still early — but the design space is rich and largely unexplored.

- Chain and Account Abstraction: Projects like Omni Network, Particle Network, and several smart contract wallet frameworks are gaining traction. They’re building tools that abstract away the complexity of multi-network activity for both developers and end-users.

These systems will likely define how the next billion users interact with Web3 — not by learning how to switch chains, but by never needing to think about them in the first place.

Final Thoughts

- Multichain isn’t a problem to solve anymore — it’s the foundation we’ve already built.

- Cross-chain systems stitched fragmented networks into a connected mesh.

- Now, abstraction is perfecting the experience: simplifying interfaces, unifying liquidity, and hiding backend complexity.

- The endgame? Users shouldn’t need to know what chain they’re on. And soon, they won’t.