Since 2017 there have been reports that cryptocurrency exchanges are faking their volume, and most recently in March 2019 a report from Bitwise Asset Management gave the most detailed evidence of this, showing that 95% of Bitcoin volume is faked by exchanges.

At the time of the report Bitcoin trading volume was roughly $6 billion per day, however, the exchanges reporting the greatest volume are unrecognized by most cryptocurrency investors.

The report claims and shows that nearly all of this volume is faked or the result of non-economic wash trading. Even though the data from these exchanges is widely reported, even by mainstream media, it has been shown to be utterly wrong.

The data in question is that reported by CoinMarketCap.com, widely considered the go-to source for Bitcoin volume and pricing. Data from this site is used by every major media outlet in the world including The Wall Street Journal, The New York Times, Forbes, CNBC, and Barron’s.

And yet its data is egregiously wrong, including a significant amount of faked trading volume, which paints a false picture of the size and nature of the Bitcoin market.

What is Exchange Volume Faking?

Exchange volume faking, which is also called wash trading, is when a trader buys and sells at nearly the same instant, with the purpose of feeding the market with false information. Wash trades can be done by a trader and exchange working together, or by two traders colluding with each other in traditional markets.

The Bitcoin market wash trading is especially pervasive because it can be done by the same person using the same account. In equity markets in the U.S. wash trading is illegal, but because cryptocurrency markets are unregulated the same is not true for them.

Some Pretty Obvious Exchange Faking on OkEX. Image Source

Some Pretty Obvious Exchange Faking on OkEX. Image SourceWash trading was most recently in headlines in 2013 when the then-Commissioner of the Commodity Futures Trading Commission launched an investigation into potential violations of wash trading laws in the high-frequency trading industry. High-frequency trading is when trading software is used to perform thousands or tens of thousands of trades per second.

The then-Commissioner felt that carrying out wash trades using this type of technology would be extremely easy. He was right and guess what other industry has adopted high-frequency trading software in the past few years? Yes, the Bitcoin and cryptocurrency traders use such software.

Why is Volume Faking Used?

The largest crypto exchanges in the world get to decide which tokens will get liquidity, and which won’t. This is critically important to token projects, particularly those in the ICO or IEO phase because without liquidity there’s little chance the token price will rise.

This gives these projects an incentive to pay huge sums to get listed on an exchange, and naturally one of the criteria they use when deciding which exchanges they will pay to get listed on is trade volumes.

This type of volume faking is common in self-reported league tables, but for crypto exchanges the incentives to inflate volume is huge. The exchanges that show the most trading volume are able to command listing fees from ICOs that are reportedly in the millions of dollars.

It might seem as if this type of agreement shouldn’t be a big deal since it is between the ICO and the exchange, but what is the impact when exchanges are faking volume to boost listing fees? That’s the subtle danger in faked exchange volume.

Another potential reason for faking volume is from new exchanges who are trying to attract traders to their platform.

Why is Volume Faking Risky for Users?

It doesn’t matter if it’s wash trades or something else, faking exchange volume has serious consequences for traders. Those who trade large amounts have the most to lose and take the greatest risks.

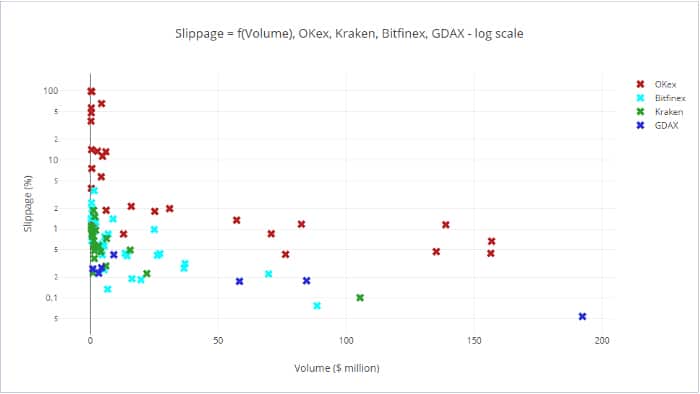

There was a study done in March 2018 by trader Sylvain Ribes in which he investigated the impact of volume faking when selling $50,000 worth of cryptocurrencies in various pairs on the then-largest volume exchange OKEx.

Slippage as a function of volume with Log Scale. Image via Sylvain Ribes

Slippage as a function of volume with Log Scale. Image via Sylvain RibesHis study showed that even pairs which supposedly had volumes of $5 million there was the potential for slippage (the difference between the quoted price and the actual trade price) of 10%.

That’s huge and it makes it extremely difficult to trade markets effectively. It also makes it impossible for large accounts to trade in and out of crypto efficiently.

Examples of Real Exchange Volume

Coinbase is one of the most well-known cryptocurrency exchanges, at least in the U.S. It is based in San Francisco and went through the necessary steps to obtain a BitLicense to operate in the state of New York. At the time of the Bitwise study, it was reporting $27 million a day in Bitcoin volume.

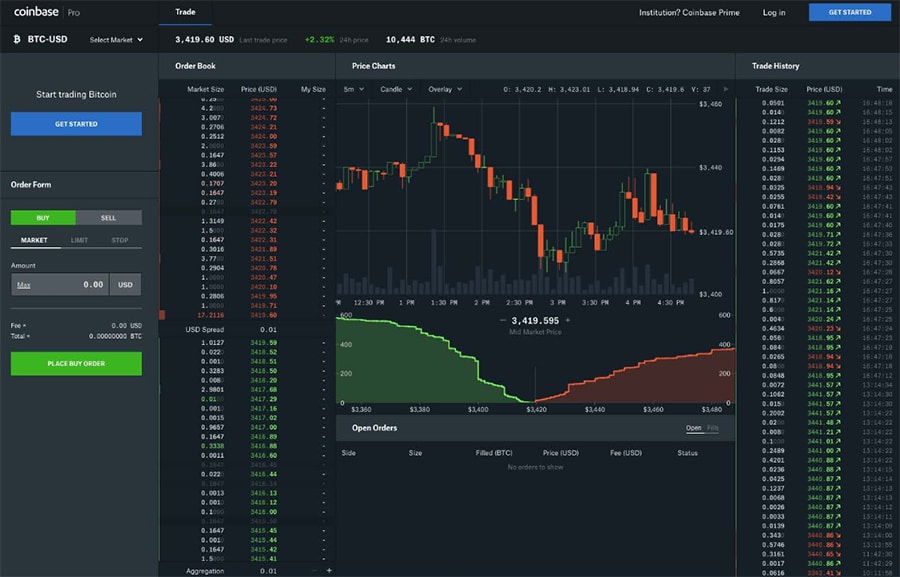

Here’s a screenshot of their Coinbase trading platform.

Screenshot of Coinbase Pro Platform. Image via Bitwise Report

Screenshot of Coinbase Pro Platform. Image via Bitwise ReportOn the right is the trade history, giving trade size, price and time. The trade price is shown either in green, for buy orders that increased the price, or in red, for sell orders that lowered price. You’ll notice that there is no pattern and that green prices far outnumber red prices. If you take a screenshot at a different time the opposite might be true.

The trade size column also shows no pattern. Trade sizes vary randomly. One notable non-random feature of trade size is the prevalence of trade sizes featuring round numbers, such as 0.10 BTC, 0.50 BTC, etc. This is expected because people have a tendency to trade in round numbers.

In the center of the image is the trade graph, with each candle representing a five-minute time period. You can easily see that the size of the candles changes over time. Some five minute periods see greater price changes than others. And under the price candles are grey volume candles which also vary randomly.

Finally, if you look to the left of the chart you’ll see the order book. That’s all the open orders waiting to be matched. Sell orders are on top in red and buy orders are on the bottom in green.

In between the two is the spread or the difference between the highest buying price and the lowest selling price. In this case, it is $0.01 on a trade price of $3,419.60. In percentage terms that’s a 0.0003% spread, by far the tightest spread you’ll find in any financial instrument in the world.

Example of an Exchange Faking Volume

At the time Bitwise did its study CoinBene was the largest exchange in the world, with reported daily volume of $480 million or 18 times the Coinbase Pro volume.

CoinBene Exchange Faking

CoinBene Exchange FakingThe trading interface for Coinbene shows pretty much the same information as that for Coinbase Pro. On the right is the trade history. Note that the red and green trade prices are evenly distributed and alternating. It is nearly impossible that trades would alternate in such an even manner.

If you look at the timestamp column you’ll see that orders are coming in pairs, with one buy order and an offsetting sell order. And the trade sizes are also nearly matching, which allows buy and sell orders to basically offset each other over time. Sounds suspiciously like a series of wash trades.

Trade sizes also follow a very different pattern. You’ll notice there are no round number trades, despite the human tendency to trade in round numbers. And the smallest trade is 0.43 BTC, or roughly $1,400. Coinbase Pro had trades as small as 0.0017 BTC or $5.

Looking at the order book you can see the highest buy order is $3239.59 and the lowest sell order is $3,274.33. This is a spread of $34.74, which is 3400 times the size of the Coinbase Pro spread! That’s very unusual since increased volume always leads to tighter spreads in any other financial market.

Another Example of Faking It...

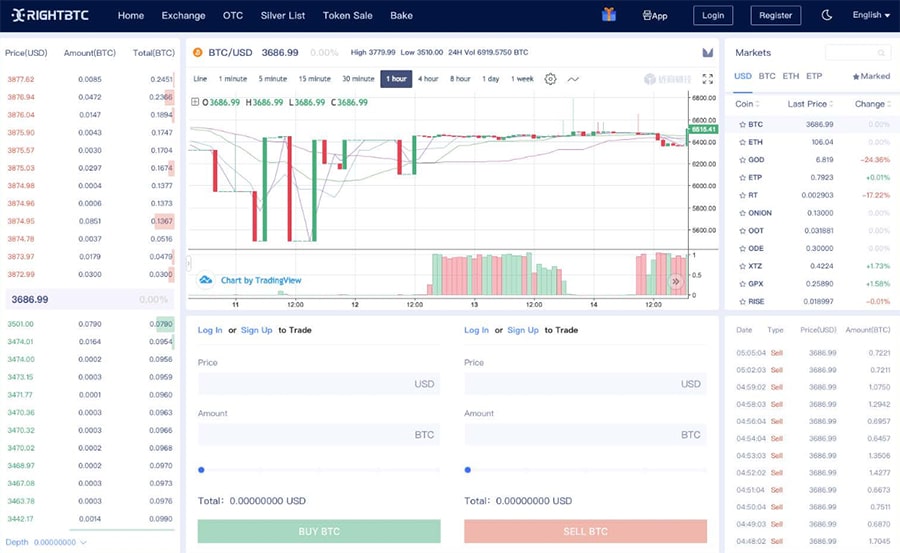

There are other ways to see the faked volume on crypto exchanges, and one is clearly demonstrated by RightBTC, which at the time of the Bitwise study claimed four times the volume of Coinbase Pro or more than $100 million per day.

RightBTC Fake Volume

RightBTC Fake VolumeWhat’s notable here is that despite the reportedly large volume of trading, the chart shows hours and even days at a time in which there are no trades at all. The red and green candles at the bottom of the chart represent volume, but there are large gaps when there is no trading volume. There’s no correlation with time of day or uptime or any other factor.

Looking to the left at the order book shows the spread at RightBTC to be $371.99. That’s absolutely insane. It’s more than 10% versus the spread of 0.00003% at Coinbase Pro, despite RightBTC’s claims of greater volume.

One More - Faking Till You Make It

The exchange ChaoEx claims to have more than double the volume of Coinbase Pro at $70 million per day.

ChaoEX Exchange Screenshot with Fake Volume

ChaoEX Exchange Screenshot with Fake VolumeAs you can see from the image of the ChaoEx trading platform above this volume is at times monotonic. That is, it doesn’t change at all from hour to hour. It is inconceivable that volume would remain the same hour after hour, ignoring real-world events, news, time of day, and price movements.

The chart above shows the trade volume remaining exactly the same every single hour for three consecutive days. That’s nearly impossible.

Solving the Problem of Fake Trading Volume

Following this report from Bitwise, there have been several proposed solutions to the problem of cryptocurrency exchanges faking trading volumes. CoinMarketCap would be the first part of the solution by improving how they present market data.

That isn’t likely to happen however as the company behind CoinMarketCap has said their policy is to over-provide on data and let users draw their own conclusions based on the data.

CoinMarketCap has said they will be updating their metrics to give users more insight into real trading volume, but so far that hasn’t been the case and no timeline has been provided for when the data metrics might change.

In the meantime, those who want to see exchange volume only from the exchanges that have not been found to be faking their volume the site OpenMarketCap has that data. The open-source EDGAR database Messari also has data specific to the exchanges not faking volume, which it calls the “Real 10 Volume.”

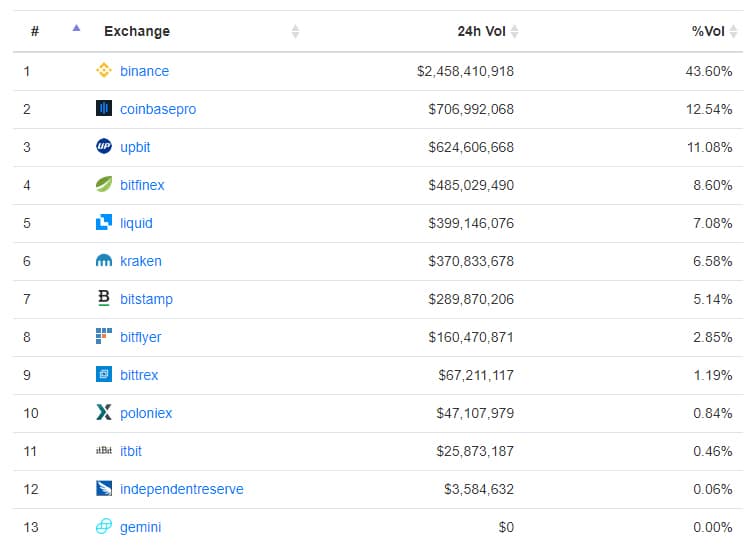

The Top 10 Ranking by "Trusted Exchanges" as Determined by BitWise Report

The Top 10 Ranking by "Trusted Exchanges" as Determined by BitWise ReportOf course, the real solution needs to be with the exchanges themselves, not the data providers. Greater transparency is needed in the entire industry to help eliminate these types of problems. Additionally, it is possible that sites such as CoinMarketCap could use their influence in the cryptocurrency ecosystem to help promote ethical behavior among the cryptocurrency exchanges.

One suggestion made is for CoinMarketCap to consider imposing fines or suspend the listing of exchanges found to be engaging in unethical behavior. Of course, the question then is who makes the determination on which exchanges need to be suspended, and how large fines might be.

Ultimately, and as much as proponents of decentralization hate the idea, exchanges will need to face regulation. That way there is impartial third-party monitoring of the behavior of these platforms to ensure they aren’t engaging in market manipulating tactics.

Conclusion

If the Bitwise report is accurate and 95% of the reported Bitcoin volume is being faked, then the cryptocurrency markets have a serious problem that will require a solution sooner rather than later. If claims of faking are true traders and investors are up against market manipulation that prevents market sentiment from determining what the true price of Bitcoin should be.

One can hope that the negative impact will diminish as the market matures and more traders move to reputable exchanges, and as more reputable exchanges join the ecosystem.

Up until now, it isn’t certain that all the fake wash trading occurring has had a significant impact on the price of Bitcoin, but then again there’s no way to prove whether it has or not. However, by focusing only on the ten exchanges deemed to be providing real market data it appears that the Bitcoin and cryptocurrency markets are actually more stable than previously thought.

Based on research thus far, nearly all of the actual market liquidity is coming from the 10 “honest” crypto exchanges, even though there are literally hundreds of exchanges offering trading services. It’s easy to see that the price of Bitcoin is quite similar and consistent among the ten exchanges deemed to be faithfully reporting trade volume. Perhaps significantly for the future of the industry is that nine of those ten exchanges are regulated.

As long as the broader market remains unregulated this type of volume faking will continue. There is no disincentive for exchanges, and every reason why they should engage in faking, from increased listing fees to growing their customer base to the contention that “everyone is doing it.”

Inflating trade volume makes an exchange look more important, and increases its visibility. In turn that draws more traders to the platform, while also attracting more ICOs and allowing for higher listing fees. It’s a cycle not likely to solved from inside the industry.