Altcoin trading has exploded in popularity over the past few years, and it’s not hard to see why. While Bitcoin remains the king of crypto, altcoins like Ethereum, Solana, and Cardano have captured the imagination of investors and traders alike. These alternative cryptocurrencies offer unique use cases, from decentralized finance (DeFi) to smart contracts, making them an exciting addition to any portfolio.

But with great opportunity comes great responsibility. Choosing the right altcoin exchange is crucial to your success in this fast-paced market. The right platform not only provides access to a wide range of altcoins but also ensures your funds are secure, fees are reasonable, and trading options are robust. After all, no one wants to deal with high fees, poor liquidity, or—worse—a hacked exchange.

So, how do you pick an altcoin exchange? We’ve ranked the top platforms based on key criteria like security measures, trading fees, liquidity, supported altcoins, and user experience. Whether you’re a beginner looking for a simple way to buy your first altcoin or a regular looking to learn more, this guide has you covered.

What Are Altcoin Exchanges?

So, you’ve heard about Bitcoin, but what about altcoins? Altcoins are any cryptocurrency that isn’t Bitcoin. Think of them as the "other guys" in the crypto world—Ethereum, Solana, Cardano, and thousands more. But where do you trade these altcoins?

An altcoin exchange is a platform where you can buy, sell, and trade these cryptocurrencies.

When it comes to altcoin exchanges, there are two main types:

- Centralized Exchanges (CEX): These are the most common and user-friendly. Think of platforms like Binance or Coinbase. They act as intermediaries, holding your funds and facilitating trades. They’re great for beginners because they’re easy to use, offer customer support, and often have advanced trading features. However, they do require you to trust the platform with your money, which can be a risk.

- Decentralized Exchanges (DEX): Platforms like Uniswap or PancakeSwap operate without a central authority. Instead, trades happen directly between users through smart contracts. DEXs are more private and secure since you control your funds, but they can be trickier to navigate, especially if you’re new to crypto.

You can check out a comparison on both CEXs and DEXs here.

Key Factors to Consider When Choosing an Altcoin Exchange

Here are the key factors you should consider before committing to an exchange:

Security Measures

Let’s start with the big one: security. After all, you’re dealing with real money here. A good exchange should prioritize keeping your funds safe. Here’s what to look for:

- Two-Factor Authentication (2FA): This is a must. 2FA adds an extra layer of security by requiring a second form of verification (like a code from your phone) when you log in or make transactions. If an exchange doesn’t offer 2FA, run. Fast.

- Cold Storage: This is where exchanges store the majority of user funds offline, away from hackers. Think of it as a digital Fort Knox. Exchanges that use cold storage are generally safer bets.

- Regulatory Compliance: Check if the exchange is regulated in your country or region. Compliance with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering) laws is a good sign that the exchange is legit and takes security seriously.

Trading Fees & Deposit Costs

Fees can eat into your profits faster than you’d think, so it’s crucial to understand how an exchange charges. Here’s the lowdown:

- Maker/Taker Fees: These are the fees you pay when you place an order (maker) or take an order (taker) from the order book. Some exchanges offer lower fees if you trade more or hold their native token.

- Withdrawal Charges: Watch out for these! Some exchanges charge a flat fee or a percentage when you withdraw your funds. These can vary depending on the cryptocurrency you’re withdrawing.

- Hidden Costs: Always read the fine print. Some exchanges might have deposit fees, inactivity fees, or even fees for using certain features. Don’t let these catch you off guard.

Liquidity & Trading Volume

Liquidity is like the lifeblood of an exchange. It refers to how easily you can buy or sell an asset without affecting its price. Here’s why it matters:

- Fast Trades: High liquidity means your orders get filled quickly, even for large amounts. No one likes waiting around for a trade to go through.

- Better Prices: In liquid markets, the difference between the buying and selling price (the spread) is smaller, so you get a fairer deal.

- Stability: Exchanges with high trading volume are less prone to price manipulation, which is a big plus if you’re trading seriously.

With So Many Options Out There, it’s Easy to Feel Overwhelmed. Image via Shutterstock

With So Many Options Out There, it’s Easy to Feel Overwhelmed. Image via ShutterstockSupported Altcoins & Trading Pairs

Not all exchanges are created equal when it comes to the variety of altcoins they offer. Here’s what to consider:

- Diversity: If you’re into niche or newer altcoins, make sure the exchange supports them. Some platforms only offer the big names like Ethereum or Litecoin.

- Trading Pairs: Check if the exchange allows you to trade your altcoins against multiple currencies (like BTC, ETH, or USD). More options mean more flexibility.

User Experience & Platform Features

Let’s face it—no one wants to deal with a clunky, confusing platform. Here’s what makes for a good user experience:

- Ease of Use: A clean, intuitive interface is a must, especially if you’re a beginner. You shouldn’t need a PhD to figure out how to place a trade.

- Mobile Apps: If you’re always on the go, a mobile app is a game-changer. Look for exchanges with well-designed apps that let you trade from anywhere.

- Advanced Tools: For the pros, features like charting tools, stop-loss orders, and margin trading can make a big difference. Make sure the exchange offers the tools you need.

Customer Support & Reliability

Even the best exchanges can have hiccups, so good customer support is essential. Here’s what to look for:

- 24/7 Support: Crypto never sleeps, and neither should customer support. Look for exchanges that offer round-the-clock assistance.

- Multilingual Support: If English isn’t your first language, make sure the exchange offers support in your preferred language.

- User Feedback: Check reviews and forums to see what other users are saying. If an exchange has a reputation for being unreliable or unresponsive, steer clear.

Our Top Picks For 2026

Before we dive into any details, let's take a quick glance at what each exchange we have picked has to offer.

| Exchange | Pros | Cons | Fees | Best for |

|---|---|---|---|---|

| Binance |

|

| 0.1% maker/taker (lower with BNB) | Advanced traders & altcoin enthusiasts |

| Coinbase |

|

| 0.40% maker / 0.60% taker | Beginners & security-conscious users |

| Kraken |

|

| 0.25% maker / 0.40% taker | Security-focused traders & margin traders |

| KuCoin |

|

| 0.10% maker/taker (lower with KCS) | Altcoin hunters & niche traders |

| Bybit |

|

| 0.1% maker/taker fees | Derivatives traders & low-fee seekers |

| OKX |

|

| 0.08% maker / 0.10% taker fees | Spot & margin traders, DeFi users |

| Crypto.com |

|

| 0.25% maker / 0.50% taker fees (lower with CRO staking) | Beginners & users seeking extra perks |

Binance

Binance is the Go-To Exchange for Millions of Crypto Traders Worldwide. Image via Binance

Binance is the Go-To Exchange for Millions of Crypto Traders Worldwide. Image via BinanceBinance is the go-to exchange for millions of crypto traders worldwide, offering a massive selection of over 350 altcoins, low fees, and advanced trading tools. Whether you’re a beginner or a pro, Binance has something for everyone.

👉 Sign Up For Binance – Exclusive 20% Trading Fee Discount For Life + $600 Bonus

Pros

- Huge Altcoin Selection: From Ethereum to niche tokens, Binance supports it all.

- Low Fees: Just 0.1% trading fees, with discounts if you pay using Binance Coin (BNB).

- Advanced Tools: Spot trading, futures, margin trading, and customizable charts for experienced traders.

- High Liquidity: Fast trades with minimal slippage, thanks to its massive trading volume.

- Strong Security: Features like 2FA, cold storage, and the SAFU fund keep your assets safe.

Cons

- Regulatory Issues: Binance faces restrictions in some countries, including the U.S. (where Binance.US is a limited alternative).

- Complex Interface: The full platform can overwhelm beginners, though the Lite mode helps.

Fees

Fees stand at 0.1% for both makers and takers (lower with BNB).

Best For

Advanced traders, altcoin enthusiasts, and high-volume traders.

We have a review on Binance right here!

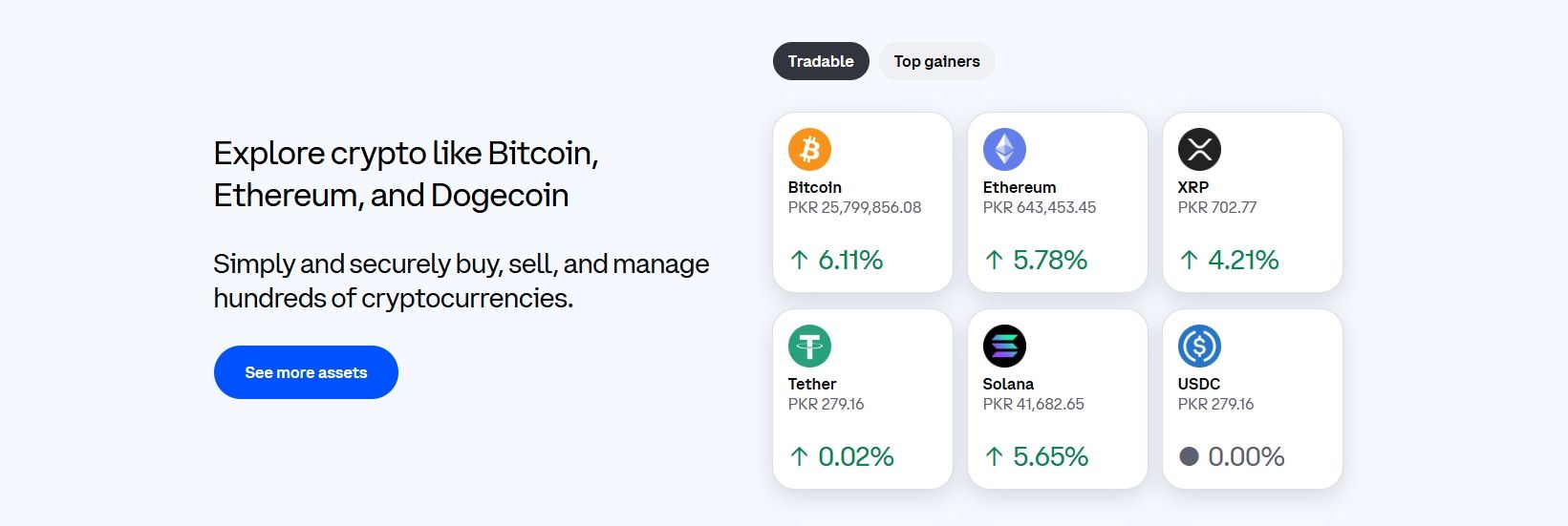

Coinbase

Coinbase is One of the Most Beginner-Friendly Crypto Exchanges. Image via Coinbase

Coinbase is One of the Most Beginner-Friendly Crypto Exchanges. Image via CoinbaseCoinbase is one of the most beginner-friendly crypto exchanges, known for its simplicity, regulatory compliance, and strong security. It’s a great starting point for newcomers to altcoin trading. Coinbase supports hundreds of cryptocurrencies.

Pros

- User-Friendly: The clean, intuitive interface makes it easy for beginners to buy and sell altcoins.

- Regulatory Compliance: Fully licensed and regulated in the U.S., making it a trusted choice for security-conscious users.

- Insured Custody: Funds stored on Coinbase are insured, adding an extra layer of protection.

- Educational Resources: Coinbase Earn offers free crypto rewards for learning about altcoins.

Cons

- Higher Fees: Coinbase’s fees are significantly higher compared to other exchanges.

- Limited Altcoin Selection: While it supports major altcoins like Ethereum and Solana, it lacks support for many smaller or newer projects.

Fees

Trading Fees are 0.40% for makers and 0.60% for takers (higher than most competitors).

Best For

Beginners and users who prioritize ease of use, security, and regulatory compliance.

Check out our detailed Coinbase review here!

Kraken

Kraken is Simply a Powerhouse for Altcoin Trading. Image via Kraken

Kraken is Simply a Powerhouse for Altcoin Trading. Image via KrakenKraken has been a trusted name in the crypto world since 2011, earning a reputation for its rock-solid security, low fees, and extensive altcoin offerings. Regardless of your experience, Kraken has you covered. With over 370 cryptocurrencies supported, including popular altcoins like Solana, Cardano, and Polkadot, Kraken is a powerhouse for altcoin trading. It’s also one of the few exchanges that’s fully regulated and transparent, making it a go-to platform for users who value trust and reliability.

Pros

- Strong Security: Kraken uses advanced security measures like 2FA, cold storage, and regular audits to protect user funds.

- Low Fees: Competitive spot trading fees, especially for high-volume traders.

- Wide Altcoin Selection: Supports over 370 cryptocurrencies, including many niche altcoins.

- Advanced Features: Offers margin trading, futures, and staking for users looking to maximize their returns.

- Regulatory Compliance: Fully regulated and transparent, making it a trusted platform globally.

Cons

- Complex Interface: The full platform can be overwhelming for beginners, though Kraken Pro offers a more streamlined experience.

- Limited Fiat Options: Fewer fiat currency options compared to competitors like Coinbase.

Fees

Maker and taker fees on Kraken Pro are 0.25% and 0.40% respectively.

Best For

Traders who prioritize security, low fees, and a wide range of altcoins.

We have Kraken covered in detail for you here.

KuCoin

KuCoin has Quickly Become a Favorite for Traders Looking to Explore Niche and Emerging Cryptocurrencies. Image via KuCoin

KuCoin has Quickly Become a Favorite for Traders Looking to Explore Niche and Emerging Cryptocurrencies. Image via KuCoinKuCoin is known for its extensive altcoin selection and user-friendly features. Launched in 2017, KuCoin has become a favorite for traders looking to explore niche and emerging cryptocurrencies. With over 750 supported assets, including many small-cap names, KuCoin is a paradise for altcoin enthusiasts. The platform also offers unique features like staking, lending, and futures trading, making it a versatile choice for both beginners and advanced users.

👉 Sign Up For Kucoin – Trading Fee Discount of Up To 60% + FREE Trading Bot!

Pros

- Massive Altcoin Selection: Supports over 750 cryptocurrencies, including many hard-to-find altcoins.

- Low Fees: Competitive spot trading fees, with discounts for using KuCoin’s native token (KCS).

- Innovative Features: Offers staking, lending, and futures trading for users looking to maximize their returns.

- User-Friendly: The interface is intuitive, and the platform provides helpful guides for beginners.

- Global Reach: Available in most countries, with support for multiple languages.

Cons

- Regulatory Concerns: KuCoin has faced scrutiny in some regions, which may limit access for certain users.

- Security Incidents: While KuCoin has improved its security, it suffered a hack in 2020, which may concern some users.

Fees

Spot trading fees are 0.10% for both makers and takers (lower if you hold KCS or trade high volumes).

Best For

Traders looking for a wide variety of altcoins, innovative features, and low fees.

We have a detailed review of KuCoin right here.

Bybit

Bybit is a Solid Choice for Altcoin Spot Trading, Offering a Growing Selection of Cryptocurrencies. Image via Bybit

Bybit is a Solid Choice for Altcoin Spot Trading, Offering a Growing Selection of Cryptocurrencies. Image via BybitBybit is a solid choice for altcoin spot trading, offering over 1,700 cryptocurrencies listed and a sleek, user-friendly interface. Launched in 2018, Bybit has gained a reputation for its low fees, high liquidity, and advanced trading tools. While it’s particularly popular among futures and margin traders, its spot trading features are equally impressive, making it a versatile platform for all types of traders.

👉 Sign Up For Bybit - Up $60K In Rewards

Pros

- Low Fees: Competitive spot trading fees, with no fees for makers and a small taker fee.

- High Liquidity: Ensures fast and efficient trades with minimal slippage.

- Advanced Tools: Offers advanced charting, customizable interfaces, and API support for professional traders.

- User-Friendly: The platform is intuitive, with a clean design that appeals to both beginners and experts.

Cons

- Limited Availability: Not accessible in certain regions, including the U.S.

- Complex for Beginners: The platform's advanced features and leverage trading may have a learning curve.

- Security Incidents: Bybit was hacked for $1.5 billion in 2025.

Fees

Spot Trading Fees are 0.1% for both makers and takers.

Best For

Traders interested in low fees, high liquidity, and advanced trading tools, especially those who also dabble in derivatives.

Read our full Bybit review to learn more.

OKX

OKX is Known for its Low Fees, High Liquidity, and Innovative Features. Image via OKX

OKX is Known for its Low Fees, High Liquidity, and Innovative Features. Image via OKXOKX is a global crypto exchange that has earned its stripes as one of the most versatile platforms for altcoin trading. With over 300 supported cryptocurrencies and a wide range of trading options—including spot, futures, margin, and even DeFi integrations—OKX is a powerhouse for both beginners and advanced traders. The platform is known for its low fees, high liquidity, and innovative features like staking and savings products. Whether you’re trading Ethereum, Solana, or lesser-known altcoins, OKX has you covered.

👉 Sign Up For OKX – Exclusive 40% Spot Trading Fee Discount + Get Up To $20K In Bonuses

Pros

- Wide Altcoin Selection: Supports over 300 cryptocurrencies, including many niche and emerging projects.

- Low Fees: Competitive spot trading fees, especially for high-volume traders.

- Advanced Features: Offers futures, margin trading, staking, and DeFi integrations for users looking to maximize their returns.

- High Liquidity: Ensures fast and efficient trades with minimal slippage.

- Strong Security: Uses industry-standard measures like 2FA, cold storage, and withdrawal whitelist.

Cons

- Complex Interface: The platform can be overwhelming for beginners, though it offers a Lite mode for simpler trading.

- Regulatory Limitations: Not available in some jurisdictions.

Fees

Fees are at 0.08% for makers and 0.10% for takers (dropping further as per higher trading volume).

Best For

Traders looking for a wide variety of altcoins, low fees, and advanced trading features.

Check out a complete overview of OKX here.

Crypto.com

Crypto.com Supports Over 250 Cryptocurrencies, Including Major and Emerging Altcoins. Image via Crypto.com

Crypto.com Supports Over 250 Cryptocurrencies, Including Major and Emerging Altcoins. Image via Crypto.comCrypto.com has rapidly grown into one of the most popular crypto platforms, offering a wide range of services beyond just trading—staking, loans, and even a crypto Visa card. Its exchange, however, is a standout feature for altcoin traders, supporting over 400 cryptocurrencies with competitive fees and high liquidity. Known for its sleek mobile app and user-friendly interface, Crypto.com is a great choice for both beginners and experienced traders. Plus, its strong focus on security and regulatory compliance makes it a trusted platform globally.

Pros

- Wide Altcoin Selection: Supports over 400 cryptocurrencies, including major and emerging altcoins.

- Low Fees: Competitive spot trading fees, with discounts for using Crypto.com’s native token (CRO).

- User-Friendly: The mobile app and web platform are intuitive and easy to navigate.

- Additional Features: Offers staking, loans, and a crypto Visa card for added utility.

- Strong Security: Uses 2FA, cold storage, and insurance on custodial assets.

Cons

- Complex Fee Structure: The fee discounts tied to CRO staking can be confusing for new users.

- Limited Advanced Tools: While great for beginners, advanced traders may find the platform lacking in sophisticated trading features.

Fees

Spot trading fees are 0.25% for makers and 0.50% for takers (giving extra discounts with CRO lockup). VIP tiers offer even better rates but with much higher trading volumes.

Best For

Beginners and users looking for a versatile platform with additional features like staking and a crypto Visa card.

We have a detailed review on the exchange right here!

How to Start Trading Altcoins on an Exchange

Here’s a step-by-step guide to get you started:

Step 1: Create an Account & Verify Identity

The first step is to sign up on a reputable altcoin exchange like Binance, Coinbase, or Kraken. You’ll need to provide basic information like your email address and create a strong password. Most exchanges also require KYC (Know Your Customer) verification, which involves submitting a government-issued ID and sometimes a selfie.

This process ensures your account is secure and compliant with regulations. While it might feel like a hassle, it’s a necessary step to unlock full trading features and higher withdrawal limits.

Step 2: Deposit Funds (Crypto or Fiat)

Once your account is set up, you’ll need to deposit funds. Most exchanges allow deposits in both crypto and fiat (like USD, EUR, or GBP). If you’re depositing crypto, you’ll need to transfer it from your wallet to the exchange’s wallet address. For fiat deposits, you can use bank transfers, credit/debit cards, or even PayPal on some platforms. Keep an eye on deposit fees, as they can vary depending on the method you choose.

Most Exchanges also Require KYC Verification, like Submitting a Government-Issued ID and Sometimes a Selfie. Image via Shutterstock

Most Exchanges also Require KYC Verification, like Submitting a Government-Issued ID and Sometimes a Selfie. Image via ShutterstockStep 3: Choose a Trading Pair

Now comes the fun part—choosing a trading pair. A trading pair is simply the two cryptocurrencies you want to trade against each other, like BTC/ETH or USDT/SOL. Most exchanges offer a wide range of pairs, so take your time to explore and pick the one that suits your strategy. If you’re new to trading, starting with a stablecoin pair (like USDT) can help reduce volatility.

Step 4: Place a Trade (Market vs. Limit Orders)

There are two main types of orders you can place:

- Market Order: This executes instantly at the current market price. It’s great for beginners who want to get in and out of trades quickly.

- Limit Order: This lets you set a specific price at which you want to buy or sell. It’s ideal for more strategic traders who want to maximize their profits.

Once you’ve placed your order, the exchange will match it with a buyer or seller, and your trade will be executed.

Step 5: Withdraw Altcoins to a Secure Wallet

After your trade is complete, it’s a good idea to withdraw your altcoins to a secure wallet. Leaving funds on an exchange can expose you to risks like hacks or platform failures. Hardware wallets like Ledger or Trezor are the safest options for long-term storage, while software wallets are more convenient for frequent trading.

Final Tip

Start small, do your research, and never invest more than you can afford to lose. Altcoin trading can be exciting, but it’s important to approach it with caution and a solid plan.

And by the way, you might want to check out arbitrage trading and day Trading as they might interest you as well.

Risks & Challenges of Altcoin Trading

While altcoin trading can be exciting and profitable, it’s not without its risks. Understanding these challenges is crucial to navigating the crypto market safely and effectively. Here are the key risks to watch out for:

Altcoin Market is More Susceptible to Price Manipulation Compared to Traditional Markets. Image via Shutterstock

Altcoin Market is More Susceptible to Price Manipulation Compared to Traditional Markets. Image via ShutterstockMarket Volatility & Price Manipulation

Altcoins are notoriously volatile. Prices can swing dramatically in a matter of minutes, driven by market sentiment, news, or even social media hype. This volatility can lead to significant gains, but it can also result in steep losses. Additionally, the altcoin market is more susceptible to price manipulation compared to traditional markets. “Pump and dump” schemes, where groups artificially inflate the price of a coin before selling off, are common. Always do your research and avoid FOMO (fear of missing out) to protect yourself from these risks.

Security Risks & Exchange Hacks

Despite advancements in security, crypto exchanges remain prime targets for hackers. As we mentioned before, high-profile hacks, like the ones on Mt. Gox and KuCoin, have resulted in millions of dollars in losses. Even with measures like 2FA and cold storage, no exchange is completely immune. To minimize risk, use hardware wallets for long-term storage and only keep funds on exchanges for active trading. Always choose platforms with strong security track records and insurance policies for user funds.

Regulatory Uncertainty in Different Countries

The regulatory landscape for cryptocurrencies is still evolving, and it varies widely from country to country. Some nations embrace crypto, while others impose strict regulations or outright bans. This uncertainty can impact the availability of certain altcoins, the legality of trading, and even the stability of exchanges. For example, China’s crackdown on crypto in 2021 caused massive market disruptions. Stay informed about the regulations in your region and choose exchanges that comply with local laws.

Best Practices for Secure Altcoin Trading

Trading altcoins can be rewarding, but it’s essential to prioritize security and risk management. Here are some best practices to keep your funds safe and your trading experience smooth:

1. Use Hardware Wallets for Long-Term Storage

Hardware wallets like Ledger or Trezor are the gold standard for securing your crypto. These devices store your private keys offline, making them immune to online hacks. Only keep funds on exchanges for active trading—everything else should go into cold storage.

2. Avoid Trading on Unregulated or Low-Volume Exchanges

Unregulated exchanges may offer tempting features, but they often lack proper security measures and are more prone to hacks or scams. Similarly, low-volume exchanges can expose you to liquidity issues and price manipulation. Stick to reputable, high-volume platforms with strong security track records.

3. Keep Funds on Exchanges Only for Active Trading

Exchanges are prime targets for hackers, so it’s risky to leave large amounts of crypto sitting there. Transfer only the funds you need for trading and withdraw profits to a secure wallet immediately after.

4. Understand the Risks of Leverage and Margin Trading

Leverage can amplify your gains, but it also magnifies your losses. Margin trading is particularly risky in the volatile altcoin market, where prices can swing dramatically in seconds. If you’re new to trading, avoid leverage until you’re confident in your strategy.

Closing Thoughts

Choosing the right altcoin exchange is a critical step in your crypto journey. Platforms like Binance, Coinbase, Kraken, KuCoin, Bybit, OKX, and Crypto.com stand out for their unique strengths—whether it’s low fees, advanced tools, or a wide range of altcoins.

Your choice should depend on your trading needs. Beginners might prefer Coinbase for its simplicity, while advanced traders could lean toward Binance or Kraken for their robust features. Always prioritize security, low fees, and regulatory compliance.

Before making a decision, take the time to compare fees, security features, and supported altcoins. The right exchange can make all the difference in your trading success. Ready to dive in? Start exploring these platforms today!