Staying ahead of market trends is key to making informed trading decisions. This is where crypto charting apps come in. These platforms provide real-time price data, technical analysis tools, and portfolio tracking, helping traders and investors navigate the often volatile crypto market with confidence.

Choosing the right charting app is essential for market analysis. Whether you’re a beginner tracking Bitcoin’s price or a seasoned trader executing complex strategies, the right tool can make all the difference. Advanced charting features, customizable alerts, and cross-platform accessibility can help traders spot trends, set price alerts, and execute trades with precision.

This article explores the top crypto charting apps, highlighting their features, pros and cons, and pricing options. Whether you need an all-in-one trading platform, a free market data aggregator, or an advanced technical analysis tool, we’ve got you covered.

What Are Crypto Chart Apps?

If you’ve ever tried trading crypto without a charting app, you probably felt like a pilot flying blind. Crypto chart apps are essential tools that give traders a visual representation of price movements, helping them analyze market trends and make informed decisions.

At their core, these apps provide real-time price tracking, allowing users to see how different cryptocurrencies are performing at any given moment. But they’re more than just fancy price tickers. They come packed with technical indicators, overlays, and analytical tools that help traders predict market movements. Whether you're looking at simple line charts or deep-diving into complex candlestick patterns, these apps provide the necessary insights to strategize trades effectively.

Why Are They So Important?

Crypto markets are wildly volatile—prices can swing dramatically within minutes. A good charting app helps traders stay ahead by offering:

- Pattern Recognition – Identifying bullish or bearish trends early.

- Volume Tracking – Understanding market sentiment and liquidity.

- Custom Alerts – Notifying users of critical price levels or trend changes.

- Historical Data Analysis – Learning from past price movements to predict future trends.

For day traders, swing traders, and even long-term investors, a crypto charting app isn't just useful—it’s a necessity. Without it, you're essentially guessing in a market where data-driven decisions make all the difference.

Key Features to Look for in a Crypto Chart App

Some are packed with features that make trading a breeze, while others barely go beyond showing price movements. Whether you’re a beginner just dipping your toes into the crypto market or a seasoned trader looking for an edge, choosing the right charting app boils down to a few key features. Let’s break them down.

1. Real-Time Price Tracking and Data Updates

Crypto moves fast—like, blink-and-you-miss-it fast. A solid charting app should provide real-time price updates so you’re never caught off guard by a sudden price surge (or crash). Stale data is a trader’s worst enemy, especially in a market that operates 24/7. The best apps pull live data from multiple exchanges, ensuring accuracy and keeping you ahead of the game.

2. Advanced Charting Tools: Candlesticks, Indicators, and Overlays

Charts aren’t just for looking pretty—they’re the foundation of technical analysis. A powerful app should offer:

- Candlestick charts – The gold standard for traders, offering insights into market sentiment, momentum, and price direction.

- Indicators – Tools like Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands help predict potential price movements.

- Overlays – Allow traders to superimpose multiple technical indicators on a single chart for deeper analysis.

The more tools you have at your disposal, the better your chances of making profitable trades.

A Solid Charting App Ahould Provide Real-Time Price Updates. Image via Shutterstock

A Solid Charting App Ahould Provide Real-Time Price Updates. Image via Shutterstock3. Customizable Alerts for Price Movements and Trading Signals

Imagine waking up to find Bitcoin just hit the price you were waiting for—but you missed the trade. That’s where custom alerts come in. The best charting apps let you set:

- Price alerts – Get notified when an asset hits a certain level.

- Volume alerts – Keep track of sudden spikes or drops in trading activity.

- Indicator-based alerts – Get real-time updates when an asset crosses key technical levels.

Custom alerts take the guesswork out of trading and keep you informed even when you're away from the screen.

4. Integration with Exchanges and Portfolio Management Tools

A great charting app isn’t just about looking at charts—it should also make it easy to trade and track your portfolio. Look for:

- Exchange integration – The ability to trade directly from the charting app without constantly switching platforms.

- Portfolio tracking – Keeping tabs on your holdings, gains, and losses in real time.

- API connectivity – Seamless linking to multiple exchanges for unified data tracking.

In a market where timing is everything, an app that combines charting, alerts, and trading in one place gives you a serious advantage.

Our Top Picks for 2026

To make your life easier, we've curated a list of top-notch apps that stand out in 2026. Here's a quick overview:

| Platform Name | Available on | Free Version | Starting Price |

|---|---|---|---|

| TradingView | Web, iOS, Android | Yes | $14.95/month |

| CoinGecko | Web, iOS, Android | Yes | $103.2/month |

| Delta | Web, iOS, Android | Yes | $13.99/month |

| CoinMarketCap | Web, iOS, Android | Yes | $29/month |

| CryptoView | Web, iOS, Android | Yes | $19/month |

| Coinigy | Web, iOS, Android | Yes | $18.66/month |

TradingView

TradingView has Earned its Reputation as a Premier Charting Platform. Image via TradingView

TradingView has Earned its Reputation as a Premier Charting Platform. Image via TradingViewTradingView has earned its reputation as a premier charting platform, catering to both novices and seasoned traders. Its user-friendly interface combined with powerful analytical tools makes it a favorite in the crypto community.

Features:

- Comprehensive Charting Tools: Access over 400 built-in indicators and strategies, along with 110+ smart drawing tools, facilitating in-depth market analysis.

- Community-Driven Insights: Engage with a vast community where traders share ideas, scripts, and strategies, fostering collaborative learning.

- Multi-Device Accessibility: Seamlessly switch between devices with apps available for web, iOS, and Android, ensuring you're always connected to the markets.

Pros:

- User-Friendly Interface: Designed to be intuitive, making it accessible for traders at all levels.

- Extensive Customization: Tailor your charts with a plethora of indicators and drawing tools to suit your trading style.

- Active Community: Benefit from shared insights, custom scripts, and real-time ideas from traders worldwide.

Cons:

- Subscription Costs: While a free version is available, advanced features require a subscription, which might be a consideration for budget-conscious users.

- Learning Curve: The abundance of tools and features can be overwhelming for beginners, necessitating time to fully harness its potential.

Pricing:

TradingView offers multiple subscription tiers, with Non-Professional and Professional Plans.

The Non-Professional plan stands at:

- Essential: $14.95/month or $12.95/month if annual.

- Plus: $29.95/month or $24.95/month if annual.

- Premium: $59.95/month or $49.95/month if annual

The Professional plan stands at:

- Expert: $119.95/month or $99.95/month if annual.

- Ultimate: $239.95/month or $199.95/month if annual.

Each plan caters to different needs, with the Essential plan providing ample features for most traders.

Do check out our detailed guide on how to use TradingView.

CoinGecko

CoinGecko's Commitment To Transparency And Accuracy Makes it a Well-Trusted Resource. Image via CoinGecko

CoinGecko's Commitment To Transparency And Accuracy Makes it a Well-Trusted Resource. Image via CoinGeckoEstablished in 2014, CoinGecko has become a cornerstone in the cryptocurrency ecosystem, offering comprehensive data and insights that cater to both newcomers and seasoned traders. Its commitment to transparency and accuracy has solidified its position as a trusted resource in the crypto community.

Features:

- Extensive Cryptocurrency Data: CoinGecko tracks over 15,000 cryptocurrencies across more than 1,000 exchanges, providing real-time information on prices, trading volume, and market capitalization.

- Portfolio Tracking: Users can monitor their crypto holdings and assess performance through CoinGecko's intuitive portfolio tracker, available on both web and mobile platforms.

- Educational Resources: Beyond data aggregation, CoinGecko offers a wealth of educational content, including guides and articles, to help users navigate the complexities of the crypto world.

Pros:

- User-Friendly Interface: Designed with accessibility in mind, CoinGecko's platform is easy to navigate, making it suitable for users at all experience levels.

- Comprehensive Market Coverage: With data spanning a vast array of cryptocurrencies and exchanges, users gain a holistic view of the market.

- Free Access: Many of CoinGecko's features are available at no cost, providing valuable tools without financial commitment.

Cons:

- Advanced Features Require Subscription: While the free version is robust, accessing premium features necessitates a subscription.

- Data Overload for Beginners: The sheer volume of information can be overwhelming for newcomers, potentially leading to analysis paralysis.

Pricing:

CoinGecko offers the following plans for its API:

- Analyst: $103.2 per month if billed annually.

- Lite: $399.2 monthly if you pay for the full year.

- Pro: $799.2 per month if you choose yearly billing.

- Enterprise: Pricing for this tier is assessed on a case by case basis.

To see what's included in each plan, you can head to the CoinGecko pricing page. Also, we have a detailed review right here!

Delta

Delta Provides Real-Time Data And Insights For Both Novice And Seasoned Investors. Image via Delta

Delta Provides Real-Time Data And Insights For Both Novice And Seasoned Investors. Image via DeltaDelta is a versatile investment tracking app that offers a comprehensive overview of various asset classes, including cryptocurrencies, stocks, ETFs, indices, commodities, forex, and NFTs. Designed for both novice and seasoned investors, Delta provides real-time data and insights to help users make informed investment decisions.

Features:

- Multi-Asset Tracking: Monitor a wide range of assets, from traditional stocks to digital currencies and NFTs, all within a single platform.

- Auto-Syncing: Connect your portfolios seamlessly with various wallets, exchanges, and brokers to automatically synchronize transactions and balances.

- Advanced Analytics: Gain deeper insights into your investments with features like portfolio analytics, asset detail screens, and performance metrics.

- Customizable Alerts: Set personalized notifications for price movements, news updates, and significant changes in your portfolio's value.

- Cross-Device Syncing: Access your portfolio across multiple devices, ensuring you stay updated whether you're on your phone or desktop.

Pros:

- User-Friendly Interface: Delta's intuitive design makes it accessible for investors at all levels, providing a seamless user experience.

- Comprehensive Asset Coverage: The app supports a vast array of assets, allowing users to manage diverse portfolios efficiently.

- Real-Time Data: Stay informed with live price updates and market charts, enabling timely investment decisions.

- Free Version Available: Delta offers a robust free version with essential features suitable for many users.

Cons:

- Limited Connections on Free Plan: The free version restricts users to two connections with wallets or exchanges, which may be insufficient for active traders.

- Premium Features Require Subscription: Advanced functionalities, such as unlimited connections and deeper analytics, are accessible only through a paid subscription.

Pricing:

Delta operates on a freemium model. Free Version includes basic features with a limit of two connections and two-device syncing. Then there is also Delta PRO.

- Delta PRO: Priced at $13.99 per month, or $99.99 annually, and is even available for $299 as a lifetime purchase.

PRO offers benefits like unlimited connections, advanced metrics, live price updates, and multi-device syncing across up to five devices. The lifetime purchase option isn't bad at all if you are a serious investor.

CoinMarketCap

CoinMarketCap Offers a Comprehensive Suite of Tools and Features to Both Novice and Experienced Investors. Image via CoinMarketCap

CoinMarketCap Offers a Comprehensive Suite of Tools and Features to Both Novice and Experienced Investors. Image via CoinMarketCapLaunched in 2013, CoinMarketCap has established itself as a leading authority in cryptocurrency data aggregation, offering a comprehensive suite of tools and features to assist both novice and experienced investors in navigating the complexity of crypto happenings.

Features:

- Extensive Cryptocurrency Data: CoinMarketCap provides real-time tracking of thousands of cryptocurrencies, offering insights into prices, market capitalization, trading volumes, and historical data.

- Portfolio Tracker: Users can monitor their crypto holdings across multiple exchanges and wallets through a unified dashboard, enabling efficient tracking of profits, losses, and overall portfolio valuation.

- Watchlist Functionality: The platform allows for the creation of multiple watchlists, enabling users to monitor selected cryptocurrencies and receive updates on market movements.

- Educational Resources: Through CoinMarketCap Academy, users have access to a wealth of articles, guides, and tutorials.

- API Access: Developers and analysts can utilize CoinMarketCap's API to access live prices, market caps, and historical data, facilitating the integration of comprehensive crypto data into various applications and services.

Pros:

- Comprehensive Data Coverage: With a vast array of tracked assets, CoinMarketCap offers users a holistic view of the cryptocurrency market.

- User-Friendly Interface: The platform is designed to be intuitive, making it accessible for users with varying levels of expertise.

- Free Access to Core Features: Many of CoinMarketCap's essential tools and data are available at no cost, providing valuable resources without financial commitment.

Cons:

- Advanced Features Require Subscription: While the platform offers a robust free version, access to premium features, particularly within the API services, necessitates a paid subscription.

- Data Overload for Beginners: The extensive amount of information available can be overwhelming for newcomers, potentially leading to analysis paralysis.

Pricing/Fee:

CoinMarketCap offers tiered plans to cater to different user needs:

- Basic Plan: Free access with limited endpoints and call frequency.

- Hobbyist Plan: Priced at $29 per month (billed annually) or $35 monthly, offering increased data access and call limits.

- Startup Plan: At $79 per month (billed annually) or $95 monthly, this plan provides more comprehensive data and higher call limits.

- Standard Plan: For $299 per month (billed annually) or $375 monthly, users receive extensive data coverage suitable for professional use.

- Professional Plan: For $699 per month (billed annually) or $875 monthly, with more upgrades, particularly suiting commercial use or for super high-end traders.

- Enterprise Plans: Tailored solutions with custom pricing are available for organizations requiring advanced custom features and support.

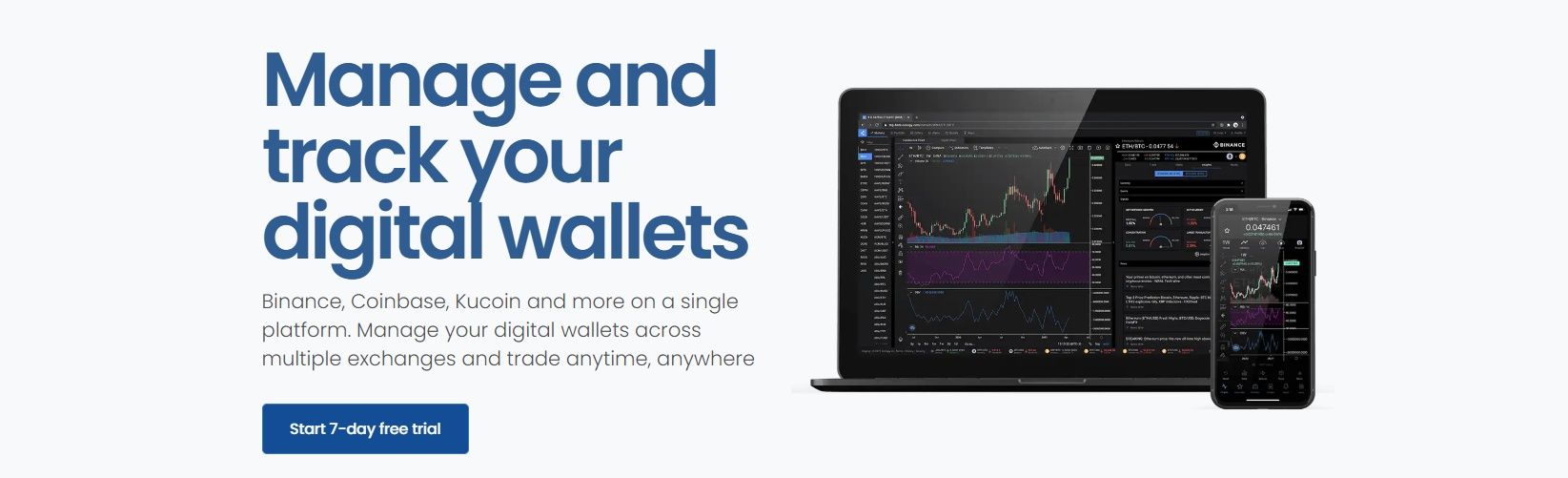

CryptoView

CryptoView Offers a Comprehensive Solution for Managing and Analyzing Cryptocurrency Assets. Image via CryptoView

CryptoView Offers a Comprehensive Solution for Managing and Analyzing Cryptocurrency Assets. Image via CryptoViewLaunched in 2019, CryptoView is an all-in-one cryptocurrency portfolio management and trading platform designed to streamline the trading experience for both novice and seasoned investors. By integrating multiple exchange accounts and wallets into a single, secure interface, CryptoView offers a comprehensive solution for managing and analyzing cryptocurrency assets.

Features:

- Multi-Exchange Trading: CryptoView allows users to connect and trade across various major cryptocurrency exchanges from a unified platform.

- Advanced Charting Tools: The platform incorporates TradingView charts, and users can monitor multiple trading pairs simultaneously through a fully customizable multi-charting interface.

- Portfolio Management: Users can track their crypto assets across different exchange accounts and wallets, monitoring various performance indicators to make informed investment decisions.

- Market Scanner: CryptoView's market scanner covers over thousands of trading pairs, equipped with smart filters and analytics to help users discover trading opportunities across supported exchanges.

- Security Measures: The platform emphasizes security by not storing customer funds or providing wallet services. All funds remain securely in users' exchange wallets, and CryptoView applies enterprise-grade security standards to protect API keys and personal data.

Pros:

- User-Friendly Interface: CryptoView's intuitive design caters to both beginners and experienced traders, facilitating efficient navigation and analysis.

- Comprehensive Toolset: The integration of advanced charting tools, portfolio management, and market scanning features provides a holistic trading experience.

- No Additional Trading Fees: Apart from the subscription fee, CryptoView does not impose extra transaction fees or commissions, allowing users to trade without incurring additional costs.

Cons:

- Subscription-Based Model: While CryptoView offers a 30-day free trial, continued access to premium features requires a subscription, which may be a consideration for budget-conscious users.

- Learning Curve for Advanced Features: The extensive range of tools and functionalities might require time for new users to fully explore and utilize effectively.

Pricing/Fee:

CryptoView operates on a subscription-based model with different plans. The Free Plan provides basic access with limited features. There is also the premium plan which offers full access to all features, including multi-exchange trading, advanced order types, order history synchronization, and the market scanner.

The Premium subscription is available at:

- Monthly Subscription: $19 per month.

- 3-month Subscriptions: $17 per month.

- 6-Month Subscription: $15 per month.

- Annual Subscription: $13 per month (billed annually), providing a 30% discount compared to the monthly plan.

Coinigy

Coinigy Is a Multi-Exchange Cryptocurrency Trading And Portfolio Management Platform. Image via Coinigy

Coinigy Is a Multi-Exchange Cryptocurrency Trading And Portfolio Management Platform. Image via CoinigyFounded in 2014, Coinigy is a multi-exchange cryptocurrency trading and portfolio management platform. By integrating over 45 exchanges into a single interface, it streamlines the trading experience for both beginners and advanced users.

Features:

- Multi-Exchange Integration – Trade and monitor assets across Binance, Coinbase Pro, Kraken, and more from one dashboard.

- Advanced Charting Tools – TradingView-powered charts with 75+ technical indicators and customizable layouts.

- Real-Time Data & Alerts – Live price feeds via CryptoFeed, plus SMS, email, and browser alerts for price movements.

- Portfolio Management – 24/7 automatic balance tracking across all connected exchange accounts.

- Mobile & API Access – iOS and Android apps, along with developer-friendly API services for automation.

Pros:

- Comprehensive Exchange Support – One of the best multi-exchange trading solutions.

- No Extra Trading Fees – No commission beyond exchange fees.

- Security-Focused – API-based trading means funds stay on exchanges.

Cons:

- Paid Subscription Required – No free plan beyond the trial period.

- Learning Curve – Some advanced features may take time to master.

Pricing:

- Pro Trader – $18.66/month, includes unlimited trading, portfolio tracking, and charting.

- API Developer Pro – $99.99/month, adds enterprise API access and priority support.

Desktop vs. Mobile: Which Platform Should You Choose?

When it comes to crypto charting apps, one of the biggest decisions traders face is whether to use desktop or mobile. Both platforms have their advantages, but the right choice depends on your trading style and needs.

Desktop: Power and Precision

For serious traders, desktop platforms offer superior charting capabilities and better performance. Large screens allow for in-depth technical analysis with multiple indicators, overlays, and trading pairs displayed at once. Plus, desktop apps often integrate with hardware wallets and offer faster execution speeds, making them ideal for professional traders.

Limitations: Desktop platforms lack mobility, meaning traders might miss opportunities when away from their setups.

Mobile: Convenience and Accessibility

Mobile apps provide on-the-go trading, real-time price alerts, and quick order execution. They’re great for casual traders or those who need to react to market movements anytime, anywhere. Most apps offer cross-device syncing, ensuring a seamless experience between desktop and mobile.

Limitations: Mobile apps often have fewer charting tools and limited screen space, making detailed analysis more challenging.

Best of Both Worlds: Cross-Platform Syncing

Users can sync their settings and charts across devices, combining desktop power with mobile convenience. This ensures you can analyze charts on your PC and execute trades from your phone without missing a beat.

Ultimately, the best choice depends on your trading habits—but having access to both platforms offers the most flexibility.

Free vs. Paid Crypto Charting Tools

When choosing a crypto charting app, one of the biggest decisions traders face is whether to stick with a free plan or invest in a premium version. While free plans provide basic features, paid subscriptions unlock powerful tools that can elevate your trading game.

Free Plans Provide Basic Features But Paid Subscriptions Unlock Powerful Tools. Image via Shutterstock

Free Plans Provide Basic Features But Paid Subscriptions Unlock Powerful Tools. Image via ShutterstockWhat Do Free Plans Offer?

Most free crypto charting tools provide real-time price tracking, basic charting, and limited technical indicators. Apps like CoinGecko, CoinMarketCap, and Delta offer free access to market data, price alerts, and portfolio tracking. TradingView’s free tier even includes interactive charts and a handful of indicators.

However, free versions often come with ads, limited historical data, fewer alerts, and restrictions on simultaneous chart layouts. For casual traders, this might be enough, but active traders will likely find these limitations restrictive.

When Should You Upgrade?

If you're serious about trading, premium plans can be a game-changer. Paid subscriptions—like TradingView ($14.95/month), CryptoView ($19/month), and Coinigy ($18.66/month)—offer:

- Advanced technical indicators (e.g., Bollinger Bands, RSI, MACD)

- Multiple chart layouts for side-by-side comparisons

- Faster data updates and priority access to new features

- Custom alerts via email, SMS, or push notifications

- API access for automated trading and custom analysis

If you find yourself frustrated by free-tier limitations—especially lack of advanced indicators, real-time data, or cross-platform syncing—upgrading is a smart move. Serious traders will quickly find that the extra cost pays for itself in better insights and more efficient decision-making.

How to Use Crypto Chart Apps Effectively

Crypto charting apps are powerful tools, but to get the most out of them, you need to know how to use them effectively. Whether you're analyzing price trends, setting alerts, or reading candlestick patterns, mastering these features can help you make better trading decisions.

Setting Up Your First Crypto Chart

Before diving into technical analysis, you need to configure your chart correctly:

- Choosing the Right Time Frame – Short-term traders (scalpers and day traders) often use 1-minute to 1-hour charts, while swing traders prefer 4-hour to daily charts. Long-term investors benefit most from weekly or monthly charts to capture macro trends.

- Selecting a Chart Type – Candlestick charts are the most widely used because they provide detailed insights into price action. Line charts are simpler but lack depth, while bar charts offer similar data to candlesticks but in a different visual format.

- Adding Technical Indicators – Popular indicators include Moving Averages (MA), Relative Strength Index (RSI), and Bollinger Bands. These tools help traders identify trends, overbought/oversold conditions, and potential breakouts.

Using Candlestick Patterns for Better Market Insights

Candlestick charts are packed with information. Understanding key patterns can improve your market timing:

- Bullish patterns: Hammer, Engulfing, Morning Star → Indicate potential price increases.

- Bearish patterns: Shooting Star, Dark Cloud Cover, Evening Star → Suggest possible downturns.

- Reversal signals: Doji, Head and Shoulders → Warn of trend changes.

Setting Price Alerts and Notifications

Most charting apps let you set custom alerts to monitor market movements:

- Price Alerts: Get notified when an asset hits a predefined price target.

- Volume Alerts: Identify sudden spikes in buying or selling pressure.

- Momentum Alerts: Track RSI or MACD crossovers for potential trend shifts.

By effectively using these features, traders can stay ahead of the market without constantly staring at their screens.

Final Thoughts

Choosing the right crypto charting app is essential for better market analysis, smarter trades, and overall portfolio management. In 2026, platforms like TradingView, CoinGecko, Delta, CoinMarketCap, CryptoView, and Coinigy stand out, offering a mix of free and premium features tailored to different trading styles.

For beginners, free plans provide basic charting, price tracking, and portfolio tools. Experienced traders, however, benefit from premium versions that unlock advanced indicators, multiple chart layouts, real-time alerts, and API access.

The best way to find the right platform? Test different apps and see what fits your needs. Whether you prefer mobile convenience or desktop precision, using the right charting tool can help you stay ahead of the market and trade with confidence.