Crypto credit cards sound like a simple idea: swipe a card, earn rewards. But in practice, there are two very different products hiding under the same label. Some are true credit cards that work like any other bank card, while others are crypto debit or prepaid cards that spend your own balance and just get marketed as “credit.”

This guide is for US readers who can qualify for credit, international readers navigating regional restrictions, and both crypto holders and newcomers who want rewards without the usual confusion. Just like we said, not all cards below are true credit cards; so, we label each clearly.

30-Second Pick: Which Crypto Card Should You Get?

Step 1: Are You in the US?

Yes, I’m in the US

- Gemini Credit Card: true credit card, category-based crypto rewards, no staking/collateral required.

- Coinbase One Card: true credit card tied to a Coinbase One membership, BTC rewards credited after eligible purchases post.

If you want “normal credit card behavior” with crypto rewards, start here.

No, I’m outside the US

- Crypto.com Visa Card: prepaid/debit-style card with tier-based rewards that can depend on CRO staking or subscription level.

- Nexo Card: collateral-backed spending (selected Europe), where Credit Mode depends on your collateral value and LTV.

US-only credit cards (Gemini, Coinbase One) generally won’t apply if you can’t legally onboard to those programs.

Step 2: Do You Have Good Credit (Typically 680+)?

If yes (680+)

- US: Gemini Credit Card and Coinbase One Card become realistic options (traditional underwriting applies).

- Why it matters: credit cards can be simpler day-to-day if you pay in full, since you’re not managing tiers or collateral.

| Opens up | True credit cards (US): Gemini, Coinbase One |

|---|---|

| Main watch-out | Interest can erase rewards if you carry a balance |

If no (or you want to avoid credit pulls)

- Crypto.com Visa (prepaid): typically focuses on identity checks and account eligibility, not credit score.

- Nexo (collateral-backed): spending power is determined by your collateral and LTV, not unsecured underwriting.

| Most practical | Crypto.com (prepaid) or Nexo (collateral-backed) |

|---|---|

| Main watch-out | Tiers, staking, collateral health, and fee conditions |

Step 3: What’s Your Priority?

Max rewards

- Coinbase One Card: up to 4% BTC back, strongest if you already hold assets on Coinbase.

- Crypto.com Visa: can advertise up to 5% back in CRO at higher tiers, but tiers usually require staking or subscription conditions.

- Gemini: up to 4% in select categories, but watch category caps that can step down your effective rate.

Simplicity

- Gemini Credit Card: category rewards, no staking/collateral, rewards credited to your Gemini balance.

- Coinbase One Card: simple if you already pay for Coinbase One, but reward tiers can depend on balances held.

Low fees

- Gemini: advertises no foreign transaction fees, so travel costs are easier to predict.

- Coinbase One: advertises no foreign transaction fees, reducing the most common “quiet cost” abroad.

- Crypto.com / Nexo: treatment can be more jurisdiction-dependent, so assume “it depends” until you confirm your region’s terms.

Travel perks

- Acceptance network: Visa/Mastercard can be more universally accepted internationally than Amex in some markets.

- Crypto.com: higher tiers may include travel perks like lounge access (where offered), but benefits depend on tier rules.

- Gemini: predictable no-FTF structure is travel-friendly even without flashy perks.

Flexibility of reward assets

- Gemini: category-based rewards paid into Gemini (you typically choose the reward asset in-app).

- Coinbase One: rewards paid in BTC into Coinbase, strongest if you want rewards to stay in one ecosystem.

- Crypto.com: rewards paid in CRO, so your “real return” depends on CRO price volatility.

Flexibility (how purchases are funded)

- Nexo: dual-mode spending can be useful, but Credit Mode is collateral-linked, so you’re effectively managing a credit line backed by your assets.

- Reality check: the best card is the one whose conditions you can maintain without babysitting tiers, staking, or LTV.

Our Methodology for Ranking

We ranked these cards by focusing on the things that change your real world experience after signup: what you earn, what you pay, how easy the card is to use day to day, and how well the issuer handles security and support.

Scoring Criteria

- Rewards: Advertised earn rates, category bonuses, reward caps, and how often rewards post.

- Fees: Annual fees, foreign transaction fees, FX spreads where disclosed, and any costs tied to staking or collateral.

- Supported assets: Which cryptocurrencies you can earn and hold, plus any limits on redemption or withdrawals.

- Security: Account protections like two factor authentication, card freeze controls, and clear fraud or dispute processes.

- User experience: App quality, clarity of reward tracking, and how simple it is to move between fiat and crypto.

- Integrations: Whether rewards and balances connect smoothly with major wallets and exchanges.

Our goal is to rank these cards based on how they perform in real use, not just how they look on a pricing page. Where hands on testing was possible, we verified rewards and usability directly, and where it was not, we relied on issuer disclosures and clearly separated those sections from tested results.

Is it time for crypto cards to shine? Find out in our video below.

Best Crypto Cards: Quick Comparison Table

This table is meant to help you filter fast. It focuses on the practical differences that affect eligibility, real world costs, and when rewards actually show up.

Comparison Table

| Card | Card type | Credit check | Reward timing | FX fees | Staking or collateral requirement | Availability |

|---|---|---|---|---|---|---|

| Gemini Credit Card | Credit | Yes | Rewards credited automatically | No foreign transaction fees | None | US |

| Coinbase One Card | Credit | Yes | Rewards credited after eligible purchases post | No foreign transaction fees | Coinbase One membership | US |

| Crypto.com Visa Card | Prepaid card | No | Rewards reflected after eligible transactions | Zero foreign exchange fees on some regional programs | Higher tiers require CRO staking or a subscription | Multi region |

| Nexo Card | Crypto collateralized spending | No | Cashback in Credit Mode | Subject to a 0.2% or 2% fee, depending on the Local Currency | Requires collateral to unlock credit line spending | Selected Europe |

Quick Takeaways From the Table

If you want a straightforward crypto rewards credit card, the cleanest options are Gemini and Coinbase One.

- The biggest functional difference is what powers the purchase: credit, membership based credit rewards, prepaid spending, or collateral backed credit.

- Travel costs can change your real return, so cards advertising no foreign transaction fees are easier to predict than programs where FX treatment depends on region and routing.

- Crypto.com can look strong on headline rewards, but the highest rates usually come with staking or subscription tiers.

- Nexo is less about approval and more about managing collateral and fees, so the real tradeoff is whether you are comfortable using a credit line backed by your assets.

Best Crypto Cards Reviewed

These breakdowns focus on what each card actually is, who it fits, and what you need to watch for so the headline rewards match your real world results.

Crypto.com Card (Debit Prepaid, Not Credit)

A prepaid spending card tied to your Crypto.com account, so it fits people who want crypto rewards without a traditional credit application. The main tradeoff: the best earn rates are usually linked to tiers, which often involve a CRO lockup or paid plan.

Rewards Structure

CRO rewards

Cashback is paid in CRO

Up to 5% back

Higher tiers can advertise stronger earn rates

+2% p.a. up to

Extra on fixed-term Earn allocations (paid in CRO)

Reality check matters

Your sustainable tier rate is the one that counts

The realistic rate is the one you can maintain after accounting for tier requirements and how often benefits are updated under programs like Level Up.

Fees & Costs

- Headline perk: “zero foreign exchange fees” for international spending (terms and limits vary)

- Fees and limits are best treated as jurisdiction-specific, not universal

- Intermediary channel fees (if any) are not charged by the exchange itself

Setup + Timeline

Expect identity checks during onboarding. After verification, pick a tier, meet any tier conditions, then order the physical card inside the app.

Pros & Cons

Pros

Easier approval path than credit cards, broad regional reach, and a simple rewards flow if you already use Crypto.com.

Cons

Not a true credit card, best rewards often depend on tier commitments, and program changes can affect long-term value.

Best for: people who want crypto rewards without a credit pull, and who are comfortable with tier-based benefits.

Coinbase One Card (True Credit Card)

A true credit card that earns bitcoin rewards and ties into a Coinbase One membership. Best for people who already use Coinbase and want rewards that stay in the same ecosystem.

Rewards Structure

BTC rewards

Cashback is paid in bitcoin

Up to 4% back

Scales with assets you hold on Coinbase

Post-only crediting

Rewards calculate after eligible purchases post

Ecosystem fit

Rewards land in your Coinbase wallet

Rewards are only calculated after an eligible purchase posts, which is how bitcoin rewards end up credited to your Coinbase wallet.

Fees & APR

- This card tends to make sense if you pay in full (interest can wipe out rewards quickly)

- Variable purchase APR depends on rate conditions and your agreement terms

- American Express network card issued by a bank partner (per the card agreement)

- Advertises no foreign transaction fees, which can matter for travel

Application + Approval Timeline

Typical credit card flow: an eligibility check can start without impacting your score, then a hard inquiry if you accept an offer through the application process.

Pros & Cons

Pros

True credit card structure, BTC rewards, and a strong fit for Coinbase users who already hold assets there.

Cons

Requires a paid membership, top reward tiers depend on balances held, and carrying a balance can negate reward value.

Best for: Coinbase power users who want BTC rewards to stay in one place and can avoid paying interest.

Gemini Credit Card (True Credit Card)

A true credit card with category-based crypto rewards that track everyday spending. Best for people who want crypto rewards without staking or collateral, and who are fine receiving rewards into a Gemini account.

Rewards Structure

4% back

Gas, EV charging, and transit

3% back

Dining

2% back

Groceries

1% back

Everything else

Rewards are credited to your Gemini balance, so this card is a clean fit if you already want a Gemini account.

Fees

- No annual fee and no foreign transaction fees, with the usual credit card caveat that interest costs matter if you carry balances

- Other fee types depend on the current schedule (issuer terms can change)

Application + Approval Timeline

Standard credit application. Approval odds depend on your credit profile and issuer underwriting, not collateral.

Pros & Cons

Pros

Strong everyday categories, no staking or collateral requirement, and rewards land into your Gemini account quickly.

Cons

Category caps can reduce the effective rate for heavy spenders, carrying a balance can erase reward value, and a Gemini account is required.

Best for: people who want crypto rewards that feel “set and forget” and don’t want to lock up funds to earn.

Nexo Card (Crypto Backed Credit Line / Hybrid)

A hybrid card because you can switch between credit-style spending and debit-style spending. Best for people who already hold assets on Nexo and understand collateral mechanics, since Credit Mode spending power is tied to collateral and LTV rather than unsecured underwriting.

Rewards Structure

Dual mode cashback

Cashback ties to how you use it and account status

Up to 2% back

Cashback in Credit Mode (conditions apply)

Credit Mode linked

Rate depends on collateral health and borrowing terms

Hybrid control

Switch modes based on how you want to fund spending

Nexo positions the card as dual-mode, with cashback tied to usage and account status. In practice, the headline rate only matters if your collateral and borrowing conditions stay healthy.

Borrowing Costs + Collateral Considerations

- In Credit Mode, each purchase draws from your credit line

- Collateral health is the core risk because the value of your deposit can move

- Think: borrowing against a secured deposit, where the deposit’s market value is not fixed

Availability Notes

Debit Mode and ordering requirements depend on jurisdiction and account eligibility.

Pros & Cons

Pros

No traditional credit underwriting, flexible modes, and useful for users already managing assets on Nexo.

Cons

Collateral management is the main risk, borrowing costs can offset rewards, and availability is region-limited.

Best for: users who understand LTV mechanics and want flexible spend options without traditional credit underwriting.

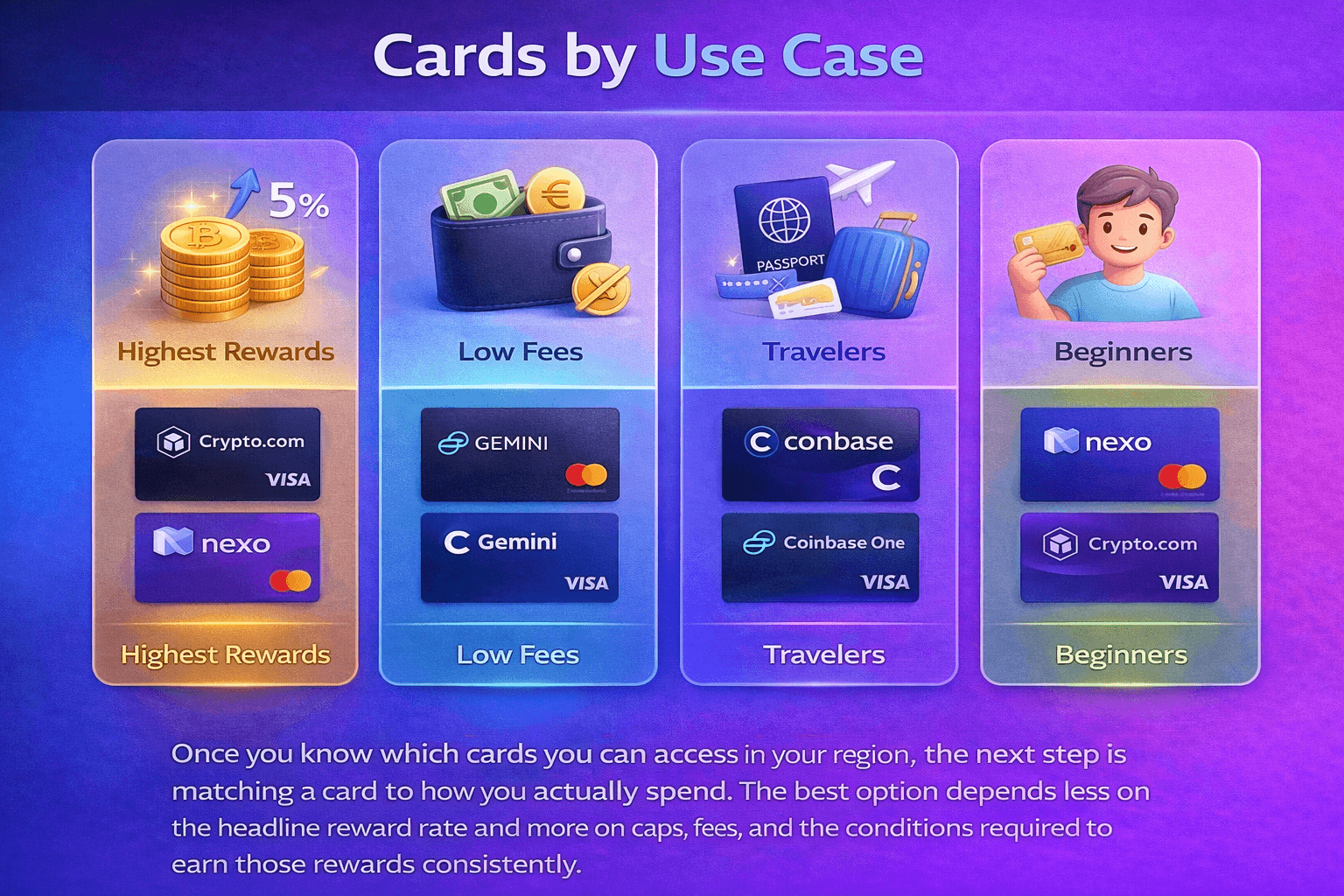

Comparing Cards by Use Case

Once you know which cards you can access in your region, the next step is matching a card to how you actually spend. The best option depends less on the headline reward rate and more on caps, fees, and the conditions required to earn those rewards consistently.

Weigh the Features, Pros and Cons Against Your Requirements to Find the Best Fit

Weigh the Features, Pros and Cons Against Your Requirements to Find the Best FitBest for Highest Rewards

If your goal is maximizing rewards, focus on the highest realistic rate you can maintain after caps, tiers, or collateral requirements.

- Crypto.com: Can reach up to 5% back in CRO on higher tiers, but those tiers typically require meaningful CRO commitments and the value of rewards can fluctuate with the token price. Read our Crypto.com review.

- Coinbase One Card: Offers up to 4% bitcoin back, with the reward tier tied to how many assets you hold on Coinbase, which makes it strongest for users already keeping larger balances there. Read our Coinbase review.

- Gemini: Delivers 4% back in select categories, but that top rate is capped by monthly spend limits, so heavy spenders should factor in the step down rate once the cap is reached.

- Nexo: Advertises up to 2% cashback in Credit Mode, but the effective outcome depends on collateral health and borrowing conditions, including interest that can start from 2.9%. Read our full Nexo review.

Best for Low Fees

Low fees matter most when you spend abroad or regularly convert between crypto and fiat. A strong rewards rate is less useful if FX and conversion costs eat it up.

- Gemini: Keeps costs predictable with no foreign transaction fees.

- Coinbase One Card: Promotes no foreign transaction fees, which reduces the most common travel friction.

- Crypto.com: Positions its prepaid card program around no foreign transaction fees in supported structures, but other card related charges can vary by tier and jurisdiction.

- Nexo: Applies FX costs that vary based on transaction type and timing, with conversions subject to weekday and weekend FX fees.

Best for Travelers

For travel, the practical checklist is acceptance network, FX treatment, and whether you actually get any travel perks that matter.

- Gemini: Runs on Mastercard World Elite, which is widely accepted and can come with network level benefits depending on issuer terms.

- Coinbase One Card: Operates on the American Express network, which is widely accepted in the US but can be less consistent internationally than Visa or Mastercard depending on the country and merchant category.

- Crypto.com: Uses a Visa card, which tends to be broadly accepted worldwide, and higher tiers can include benefits such as Priority Pass airport lounge access for eligible users.

- Nexo: Launched in partnership with Mastercard, so acceptance is generally aligned with Mastercard coverage in supported regions.

Best for Beginners

Beginners usually benefit most from a card that is easy to qualify for and easy to understand after the first swipe.

- If you want a true credit card with clear category rewards and a simple fee structure, the Gemini Credit Card is one of the easier models to grasp, provided you are comfortable using a Gemini account for rewards.

- If you already pay for Coinbase One and keep assets on Coinbase, the Coinbase One membership based structure can be straightforward, but the tiered reward rates make it less “set and forget” than a flat rewards card.

- If you want to avoid credit underwriting entirely, Crypto.com and Nexo can be easier to access, but their tiers, collateral, and program conditions add more moving parts, which is where most beginner “gotchas” tend to appear.

Other Notable Crypto Cards

These cards show up frequently in searches, but they sit outside our main ranking either because they target a narrower audience or because the product structure is meaningfully different from a consumer crypto rewards credit card.

Fold Card

The Fold Card is a prepaid debit card built around earning bitcoin rewards on everyday spending. It fits people who want to stack small amounts of BTC through regular purchases without applying for a credit line.

The main tradeoffs are that rewards are not a simple flat rate across all spending, and the best earning tends to be tied to membership features and boosted categories. For example, Fold rewards include perks like bitcoin back through bill pay and a baseline earn rate on eligible purchases, which means the real value depends on how you already pay your bills and where you spend most of your money.

RedotPay Card

The RedotPay Card is a stablecoin-powered spending card designed to let users pay like cash while holding crypto in the background. It works as a prepaid debit-style card and is aimed at people who want practical, day-to-day crypto spending rather than speculation or rewards chasing.

The main tradeoff is that RedotPay is about utility, not yield. There’s no flashy cashback structure or token rewards baked into everyday spending. Instead, the value comes from frictionless payments, broad merchant acceptance, and features like virtual cards, Apple Pay support, and global ATM access. For users already holding stablecoins and looking for a clean bridge between crypto balances and real-world payments, RedotPay prioritizes simplicity and reach over incentives.

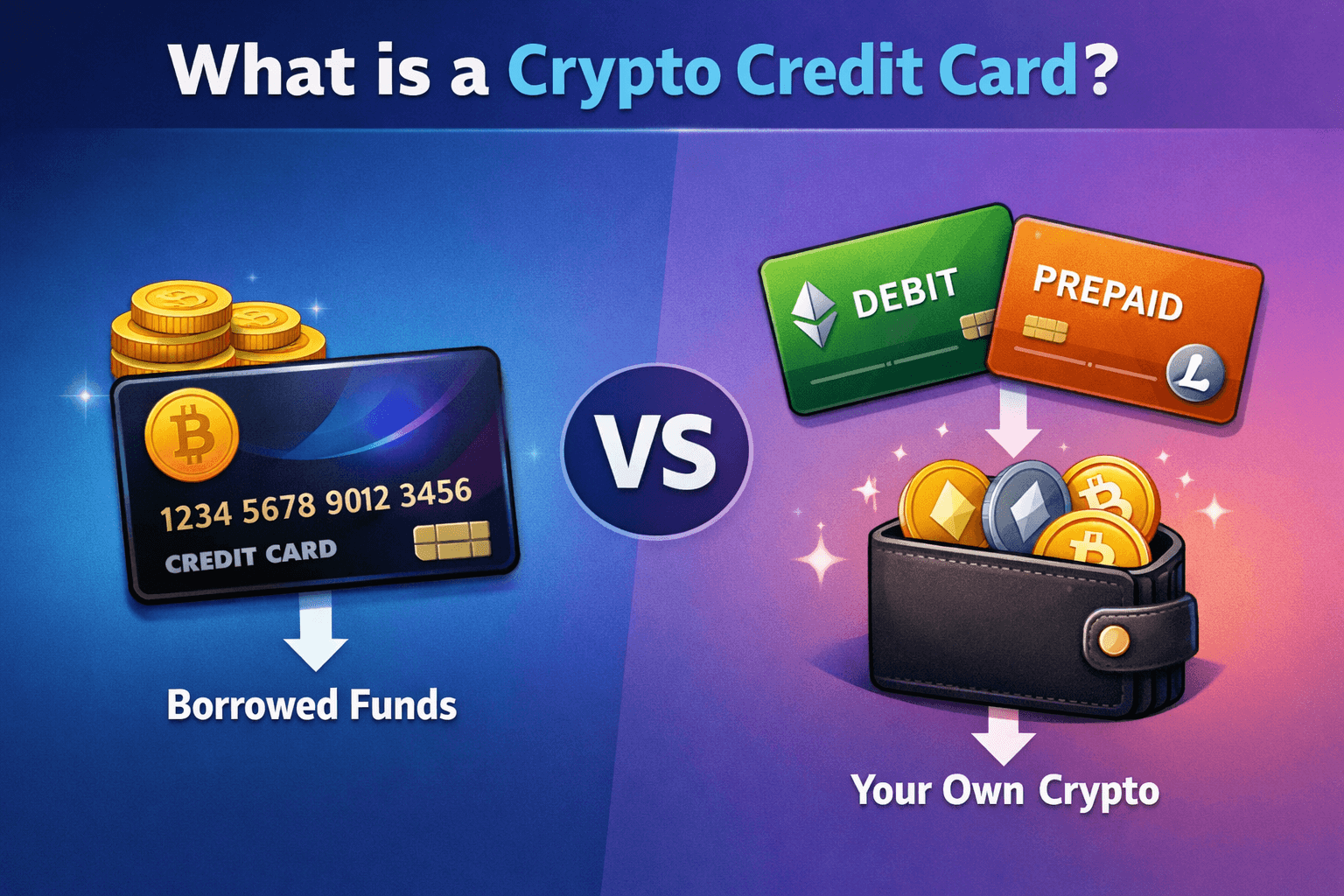

What Is a Crypto Credit Card? (And What It Isn’t)

A crypto credit card works like a normal credit card, but rewards are paid out in cryptocurrency. The problem is that many products marketed this way are not credit cards at all. A lot of them are crypto debit cards or prepaid cards that spend money you already hold, often by converting crypto into fiat at the point of purchase.

Not every Crypto Card that Earns Digital Asset Rewards is a True Credit Card

Not every Crypto Card that Earns Digital Asset Rewards is a True Credit CardCrypto Credit Cards vs Debit & Prepaid Cards

- Line of credit vs spending your own balance: Credit cards let you borrow first and repay later. Debit and prepaid cards spend your balance, more like paying from your own wallet.

- Credit checks vs no credit checks: Credit cards usually involve a credit score assessment. Debit and prepaid cards typically focus on identity checks instead.

- Repayment mechanics: Credit cards have statements and interest if you carry a balance. Debit and prepaid cards have no repayment cycle.

- Tax timing differences: Selling crypto to fund a purchase can trigger tax reporting in many regions, including the US where the IRS treats virtual currency as property.

Why the Distinction Matters in 2026

Approval odds, consumer billing dispute rights, and when rewards and taxable events occur can all change depending on whether you are using credit or simply spending your own crypto.

Not every crypto card that earns digital asset rewards is a true credit card. Some involve borrowing and repayment, others simply spend your existing balance, and a few sit somewhere in between. Knowing which model you are dealing with makes it much easier to set realistic expectations around approval, fees, protections, and taxes.

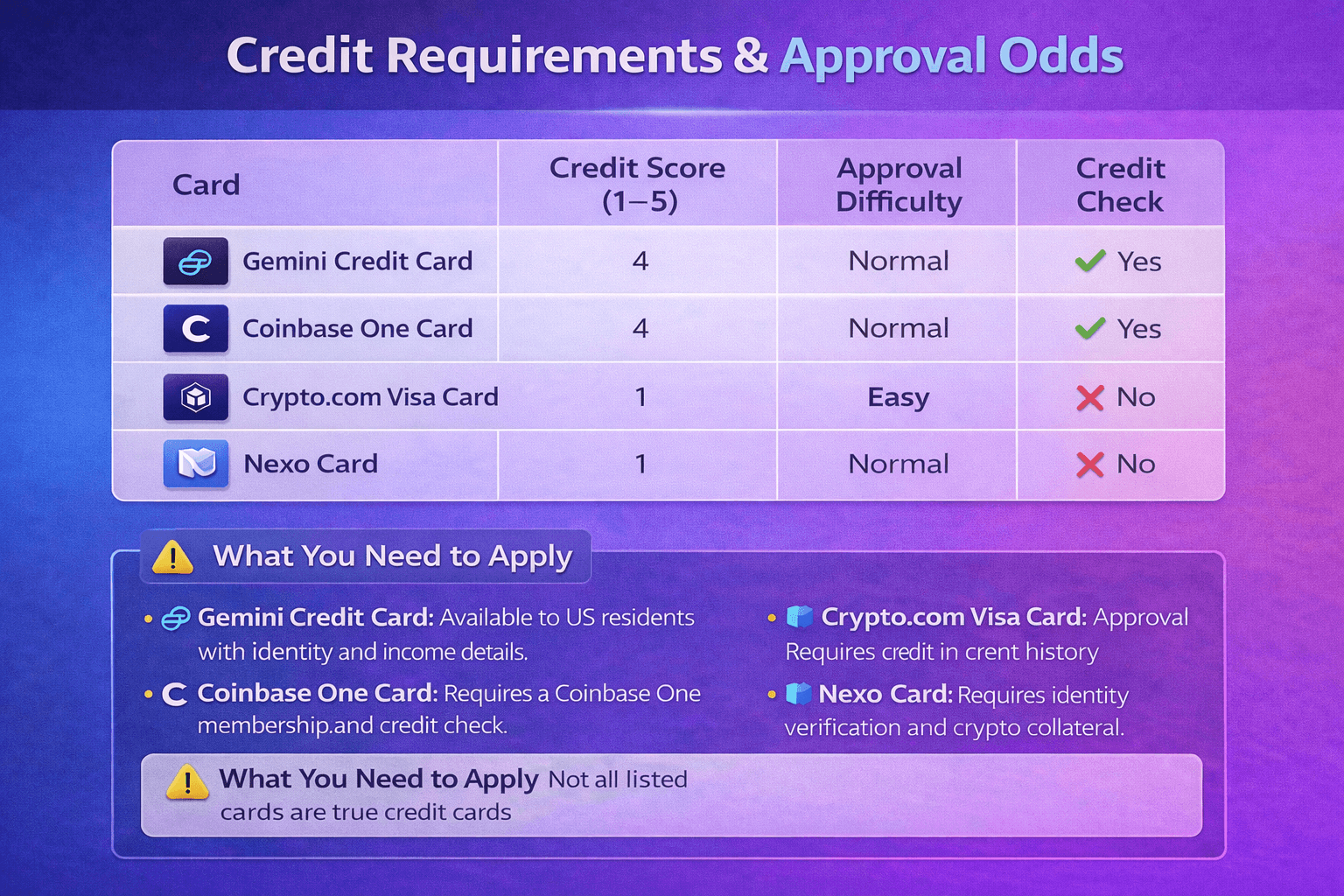

Credit Requirements & Approval Odds

Before comparing rewards, it is worth understanding whether you can realistically qualify. Some crypto cards are true credit products with traditional underwriting, while others avoid credit checks entirely by using prepaid balances or crypto collateral instead.

Before Comparing Rewards, It Is Worth Understanding Whether You Can Realistically Qualify

Before Comparing Rewards, It Is Worth Understanding Whether You Can Realistically QualifyCredit Score Requirements Table

These scores reflect editorial difficulty, not issuer disclosures. A higher score means approval depends more heavily on conventional credit history.

| Card | Credit score (1–5) | Approval difficulty | Credit check |

|---|---|---|---|

| Gemini Credit Card | 4 | Normal | Yes |

| Coinbase One Card | 4 | Normal | Yes |

| Crypto.com Visa Card | 1 | Easy | No |

| Nexo Card | 1 | Normal | No |

What You Need to Apply

- Gemini Credit Card: Available to US residents who qualify for a Gemini account, with standard identity details, a Social Security number, and income information required as part of the application process.

- Coinbase One Card: Requires a Coinbase One membership and application through the Coinbase app, with identity details, income information, and a credit check if you accept an offer.

- Crypto.com Visa Card: Approval is based on account eligibility and identity verification rather than credit history, since this card operates as a prepaid product.

- Nexo Card: Requires identity verification and residence in a supported jurisdiction, with spending power determined by the value of crypto collateral rather than credit history.

Important Clarification: Not All These Are True Credit Cards

- True credit cards: Gemini Credit Card, Coinbase One Card

- Debit or prepaid cards: Crypto.com Visa Card

- Crypto collateralized credit lines: Nexo Card

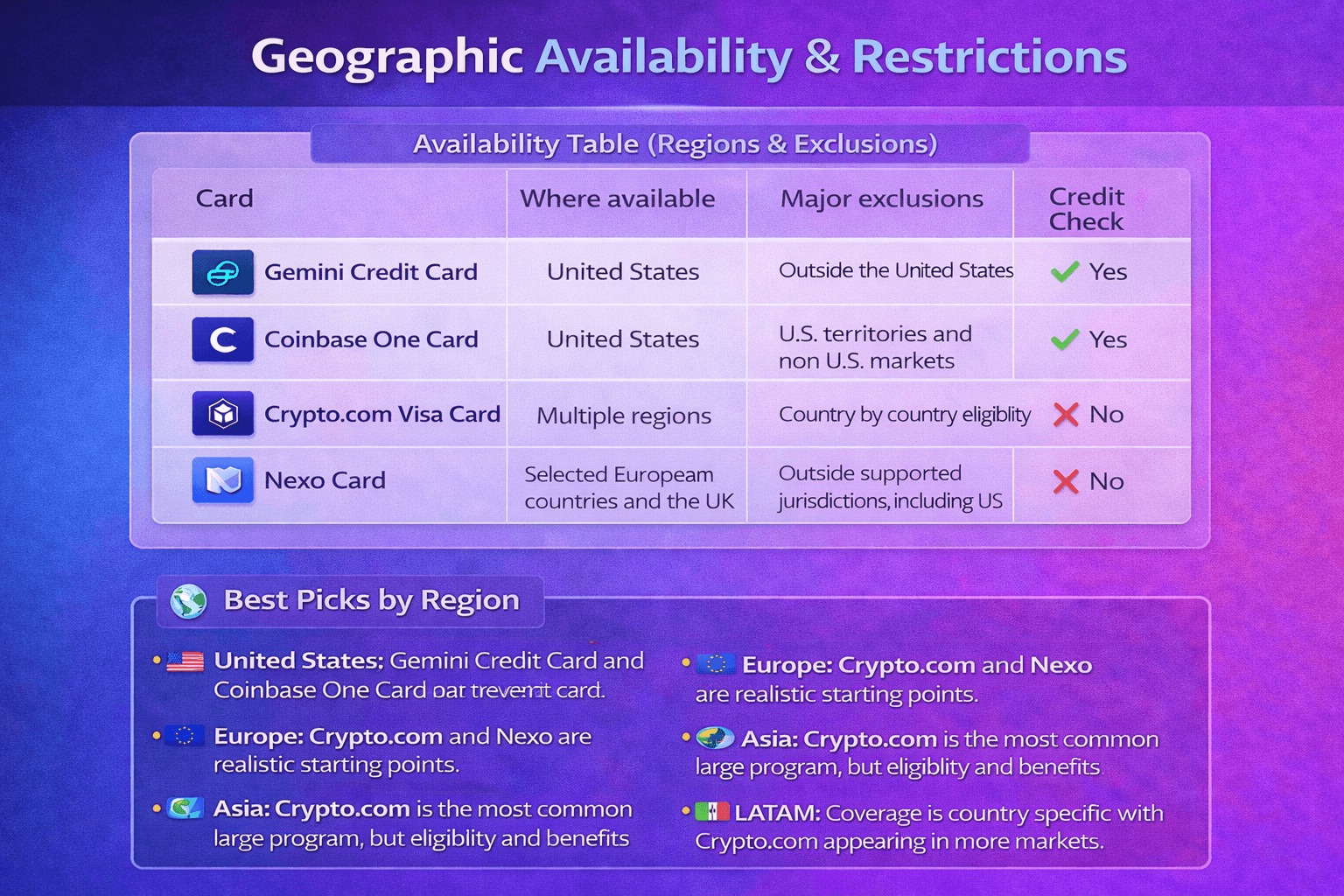

Geographic Availability & Restrictions

Even the strongest rewards card is a non starter if it is not offered where you live. Crypto cards are especially sensitive to local licensing, banking partners, and compliance rules, so availability should be the first filter before comparing perks.

Even the Strongest Rewards Card is a Non Starter if it is not Offered where you Live

Even the Strongest Rewards Card is a Non Starter if it is not Offered where you LiveAvailability Table

| Card | Where available | Major exclusions |

|---|---|---|

| Gemini Credit Card | United States | Outside the United States |

| Coinbase One Card | United States | U.S. territories and non U.S. markets |

| Crypto.com Visa Card | Multiple regions | Country by country eligibility |

| Nexo Card | Selected European countries and the United Kingdom | Outside supported jurisdictions, including the US |

Best Picks by Region

- United States: Gemini Credit Card and Coinbase One Card are the most relevant true credit card options for earning crypto rewards.

- Europe: Crypto.com and Nexo are more realistic starting points, with the better fit depending on whether you prefer prepaid spending or collateral backed credit.

- Asia: Crypto.com is the most common large program, but eligibility and benefits vary significantly by jurisdiction.

- LATAM: Coverage is uneven, and availability tends to be country specific rather than region wide, with Crypto.com appearing in more markets than most alternatives.

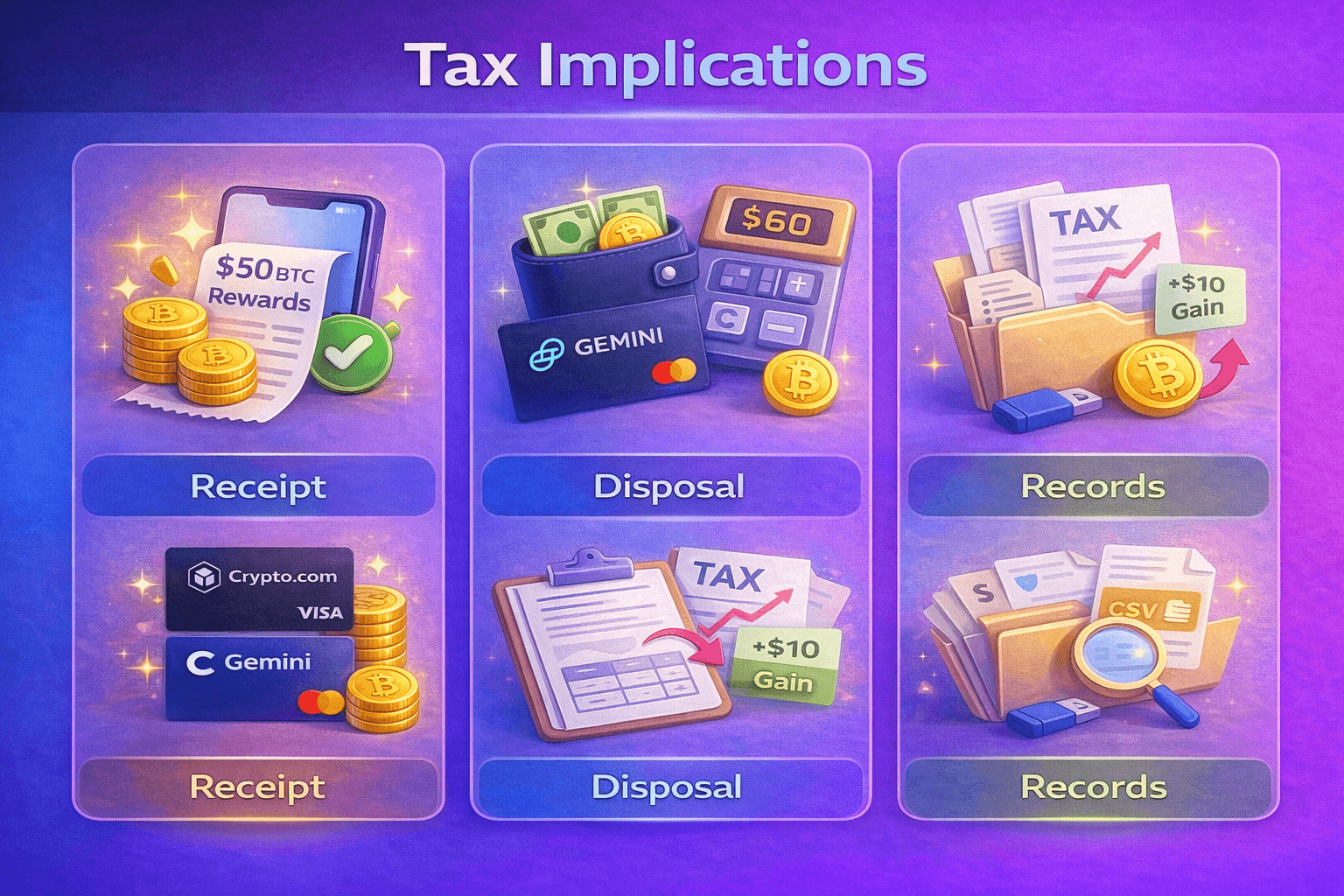

Tax Implications of Crypto Card Rewards

Crypto card rewards can create tax complexity for a simple reason. You are earning an asset that can change in value, and many tax systems treat crypto as property. The exact treatment depends on where you live, so this section is practical guidance, not tax advice.

Many Tax Systems Treat Crypto as Property

Many Tax Systems Treat Crypto as PropertyHow Rewards Are Typically Taxed

- At receipt: Many tax systems often treat card rewards as a rebate or discount, so there may be no tax the moment you receive rewards, but this can vary by country and by how the reward is structured.

- On disposal: Selling or spending rewarded crypto can create a taxable gain or loss. In the US, the IRS treats digital assets as property, so disposal is the moment many people trigger reporting.

- Regional differences: Some authorities treat certain crypto receipts as income in specific contexts, such as staking rewards in Australia, which is why it is worth thinking in two buckets: income at receipt and gains on disposal.

Simple Tax Example

- You earn $50 of BTC rewards when BTC is $50,000, so you receive 0.001 BTC.

- You later sell 0.001 BTC when BTC is $60,000, and receive $60.

- Your cost basis is $50 and proceeds are $60, so you may have a $10 capital gain to report.

- The same logic applies if you spend the BTC instead of selling it, because spending is also a taxable disposal under many rulesets.

What Records to Keep

- Dates and amounts of each reward payout.

- Fair market value in your local currency at the time you received each reward.

- Disposal details when you sell or spend, including proceeds, fees, and timestamps.

- Account and transaction IDs from the platform, wallet, or exchange you used.

Tax Tools & Reporting Support

- Many platforms offer CSV exports or activity logs, which you can download from account settings or statements when available.

- Some issuers and exchanges provide tax forms in certain regions, but forms do not always include card rewards, so tracking still matters.

- Third party trackers often used for crypto tax reporting include CoinTracker, Koinly, and TokenTax.

Even if rewards feel small, treating them like “real” crypto transactions saves headaches later. If you track what you received, what it was worth at the time, and what you did with it afterward, you can usually handle reporting cleanly even when rules differ by country.

Don't forget to check out our top crypto tax software picks.

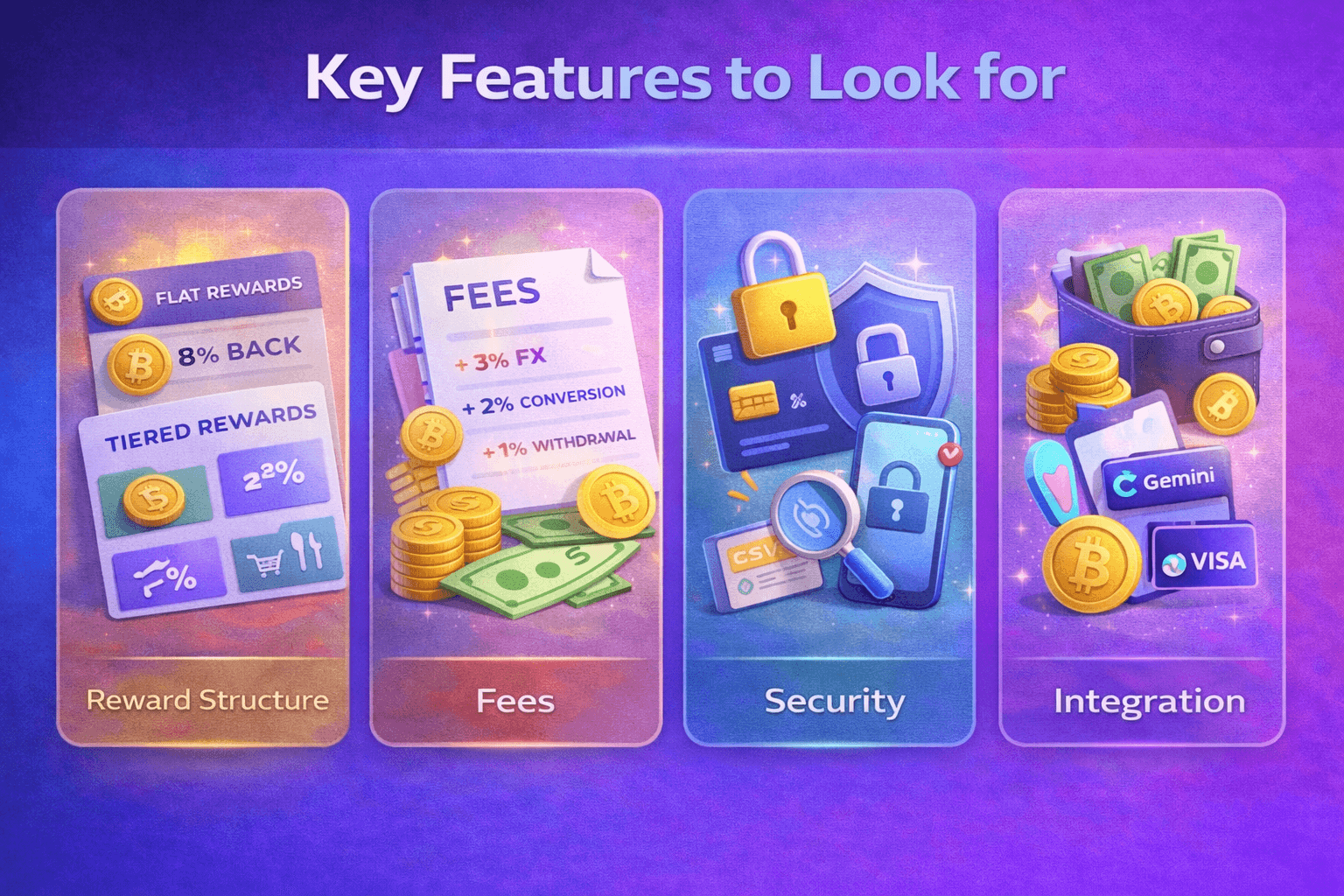

Key Features to Look For in a Crypto Credit Card

A crypto card is easiest to compare when you break it down into four practical questions: how you earn, what it costs, how safe it is, and how easily you can move rewards in and out of the crypto ecosystem.

Treat a Crypto Card like a System, not just a Reward Rate

Treat a Crypto Card like a System, not just a Reward RateReward Structure

- Flat rewards are the simplest to manage because you earn the same rate everywhere, like the “up to 4% bitcoin back” structure on the Coinbase One Card.

- Category rewards can be stronger if your spending matches the bonus buckets, such as the category tiers that we mentioned on the Gemini Credit Card.

- Tiered or staking linked rewards can look best on paper but tend to be the least predictable, because your rate may depend on requirements like the CRO lockup or other tier conditions.

Fees That Quietly Kill Rewards

- Foreign transaction fees matter most for travel and online purchases billed in another currency. Some cards advertise no foreign transaction fees, while others vary by region and card program.

- FX spreads can be more important than the fee line item on the rate sheet, because a “no FX fee” card can still bake costs into the conversion rate, which is one reason crypto card economics often depend on the platform’s latest fees and limits.

- Conversion and withdrawal friction shows up when rewards are locked to one asset, one network, or one platform, so it helps to understand how crypto exchange fees and withdrawal costs work before assuming the headline rewards are “free.”

Don't miss our picks for crypto exchanges with lowest fees.

Security & Fraud Controls

- Look for the basics you would expect from a mainstream issuer: card freeze controls, transaction alerts, and clear dispute handling. Credit cards can offer stronger dispute rights under rules like the Fair Credit Billing Act, while prepaid products vary more by issuer and region.

- If rewards are deposited into a crypto account, account security matters as much as card security, which is why enabling two factor authentication and using strong device security is not optional.

Wallet/Exchange Integration + Cash-Out Friction

- The smoothest setup is when rewards land directly where you already manage crypto, such as BTC rewards credited into a Coinbase wallet or rewards deposited into a Gemini account.

- Friction increases when you need extra steps to redeem or move rewards, especially across networks with different fees, so it helps to understand how crypto wallets and exchange withdrawals work before you commit to a card ecosystem.

The simplest way to avoid disappointment is to treat a crypto card like a system, not just a reward rate. If the rewards are easy to earn, the fees are predictable, security controls are solid, and moving rewards into or out of crypto is friction free, you are far more likely to stick with the card and actually benefit from it over time.

Pros and Cons of Using a Crypto Credit Card

Crypto credit cards can be useful, but they also introduce extra moving parts compared to normal cashback cards. The goal is to understand what you gain and what you take on, so the card fits your habits instead of creating avoidable friction.

Pros

- Crypto rewards: You can earn bitcoin or other crypto from everyday spending through cards like the Gemini Credit Card or the Coinbase One Card.

- Convenience: A single card can handle normal purchases while rewards flow into an account you already use, which can make portfolio building feel more automatic than making separate buys on an exchange.

- Potential upside: If rewards are paid in a volatile asset, the value can rise after you receive it, similar to earning airline points before a price increase, except the asset can also move down.

Cons

- Volatility: Rewards paid in crypto can lose value after payout, which makes the real return less predictable than fixed fiat cashback.

- Taxes: Selling or spending rewarded crypto can trigger reporting, especially in places where digital assets are treated as property.

- Fees: Costs like foreign transaction fees, FX spreads, or platform conversion fees can quietly reduce your net reward rate, even when the headline percentage looks strong.

- Complexity: Tier rules, subscriptions, collateral requirements, and regional restrictions can make a crypto card harder to “set and forget” than a standard card.

- Approval limits: True credit cards still depend on credit underwriting, while collateral based models can introduce a different constraint, since spending power depends on the value of your pledged assets.

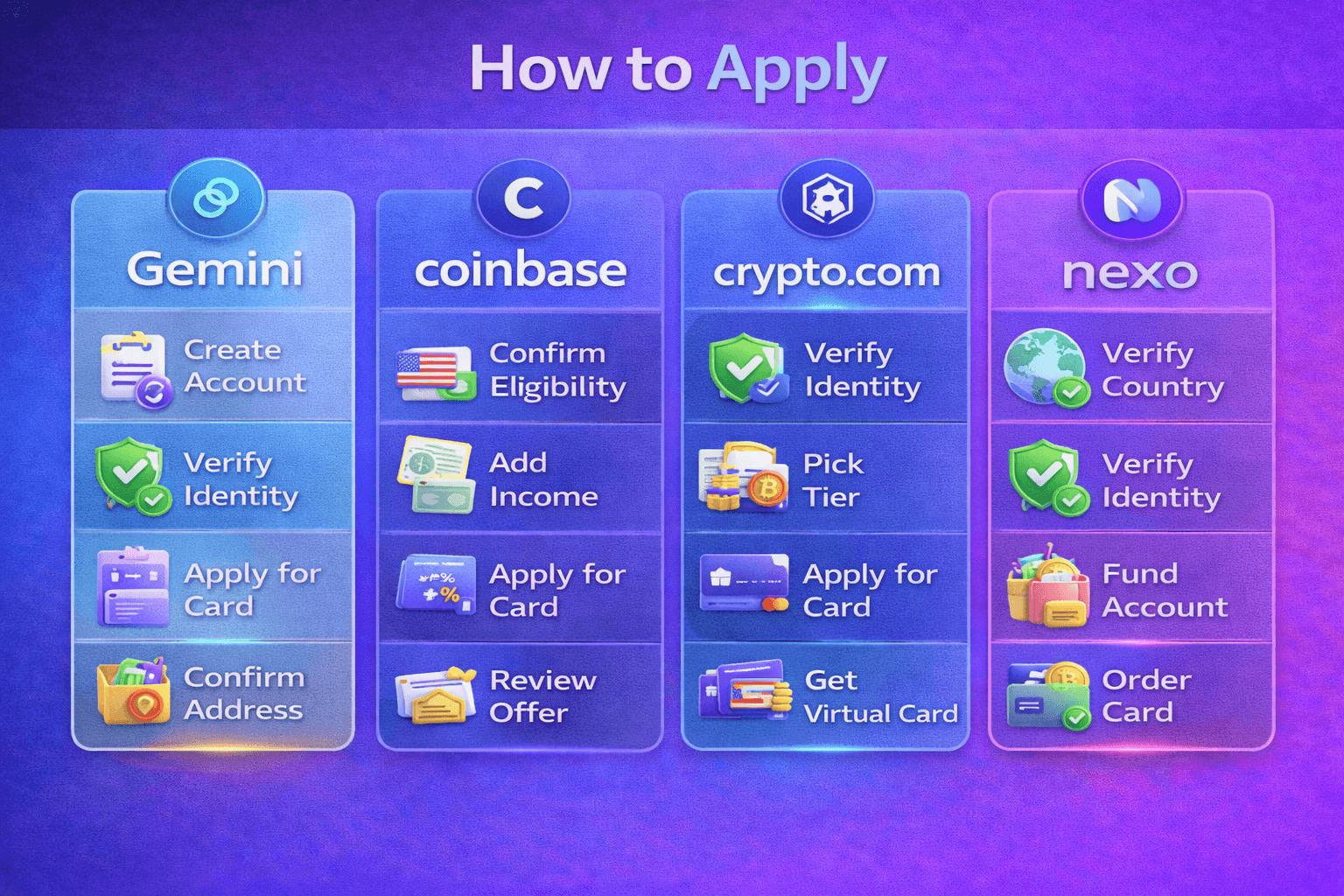

How to Apply

Most crypto cards follow the same basic flow: confirm eligibility, complete identity checks, apply, then add the card to your wallet while you wait for delivery. The difference is whether you are applying for a true credit line or ordering a prepaid or collateral backed card.

Most Crypto Cards Follow the Same Basic Flow

Most Crypto Cards Follow the Same Basic FlowGemini Application Steps

- Create a Gemini account and complete identity verification.

- Start the card application and submit your details through the online flow in the Gemini Credit Card application process.

- If approved, choose your card color and confirm your mailing address.

- Expect an application decision that is often close to instant, and a physical card that typically arrives within 5 to 7 business days after approval.

Coinbase One Application Steps

- Confirm you are eligible through the Coinbase One Card application, including US residency requirements and a paid Coinbase One membership.

- Apply in the Coinbase app, provide annual income, and submit identity details.

- If you see an approved offer, review the credit limit and APR, then accept the offer to continue.

- Confirm your shipping address and add the card to your mobile wallet if prompted so you can start using it sooner while the physical card is on the way.

Crypto.com Application Steps

- Create an account and complete KYC verification, which can take anywhere from a few hours to a couple of business days depending on region and document quality.

- Choose your card tier and confirm your shipping details inside the app.

- Request the card through the in app flow shown in the application process for a Crypto.com Prepaid Card, which also lists typical delivery ranges by issuance region.

- If a virtual card is available in your market, you can usually start online spending sooner, then transition to the physical card once it arrives.

Nexo Onboarding

- Confirm you are in a supported country before you start, since ordering depends on eligibility.

- Create your account and complete identity verification, then order the card through Nexo's guidance on how to order the Nexo Card.

- Fund your account with eligible collateral if you plan to use Credit Mode, since spending power depends on your available collateral and loan to value under Credit Mode.

- If you prefer to spend from balances instead of borrowing, switch to Debit Mode and keep enough eligible assets available for purchases.

Final Verdict: The Best Crypto Card for Each Type of User

If You Want a True Credit Card (US)

Pick the Gemini Credit Card for simple category rewards, or the Coinbase One Card if you already live inside Coinbase and want BTC back.

If You’re Outside the US

Start with the Crypto.com Visa Card for broad availability, or look at the Nexo Card if you are comfortable using collateral.

If You Want Max Rewards (And Accept Lockups)

Crypto.com can advertise big numbers, but the best rates usually come with tier requirements and a rewards token that can swing in value.

If You Want Simplicity + Predictability

A true credit card with no staking and clear categories, like the Gemini card, is usually the least surprising over time.