The world of cryptocurrency can feel like stepping into a high-tech maze—markets move fast, charts look intimidating, and every platform claims to be the “best” for beginners. But before you begin trading, the first thing you need is a crypto exchange—the platform where you’ll buy, sell, and trade digital assets.

Not all exchanges are built the same, though. Some are packed with advanced trading tools and complex features, while others focus on simplicity, security, and beginner-friendly options. If you’re new to crypto, choosing the wrong exchange could mean high fees, security risks, or a frustrating user experience. The best beginner-friendly platforms make things easy with intuitive interfaces, strong security, and affordable trading fees.

Whether you want to buy your first Bitcoin, stake crypto for passive income, or trade with confidence, this guide will help you find the right exchange for your needs—without the headache.

What Makes a Crypto Exchange Beginner-Friendly?

Choosing the right crypto exchange as a beginner can feel like stepping into a whole new world—one filled with charts, numbers, and industry jargon.

The best crypto exchanges for beginners focus on security, ease of use, low fees, and strong support systems to make the trading experience smooth and stress-free. Let’s break down the most important factors that define a beginner-friendly exchange.

1. Security Features: Keeping Your Funds Safe

Security is the most important factor when choosing an exchange. The best platforms implement robust security protocols to safeguard user funds. Key security features include:

- Two-Factor Authentication (2FA): Adds an extra layer of security when logging in.

- Cold Storage: Leading exchanges store the majority of user funds in offline wallets to prevent hacking.

- Regulatory Compliance: Some platforms are specifically known for their strong adherence to legal and financial regulations.

While no exchange is 100% hack-proof, choosing one with a strong track record of security and regulatory compliance can greatly reduce risks.

2. User-Friendliness: A Simple & Intuitive Experience

A complicated interface can be discouraging for new users. Beginner-friendly exchanges prioritize:

- Simple Buy/Sell Options – No need to mess with advanced order types.

- Mobile App Availability – Many platforms shine in this area to suit your needs.

- Educational Prompts & Guides – Step-by-step help as you navigate the platform.

If an exchange feels like you need a PhD to place a trade, it’s probably not beginner-friendly.

3. Low Fees: Keeping More of Your Crypto

Trading fees can add up quickly, especially for small transactions. A beginner-friendly exchange should have:

- Zero-fee options: Some platforms even offer fee-free trading on certain assets.

- Tiered fee structures: Many exchanges reduce fees as trading volume increases.

- Hidden costs: Be mindful of withdrawal and deposit fees—not just trading fees.

For beginners, an exchange with transparent pricing and low-cost trading options is ideal.

4. Availability of Fiat Deposits & Withdrawals

A seamless transition between traditional money and cryptocurrency is essential for beginners. Features to look for include:

- Bank Transfers & Debit Cards: Widely available on major exchanges.

- Instant Fiat Purchases: Some platforms allow direct crypto purchases with a credit card.

- Easy Withdrawals: A good exchange should allow users to cash out profits smoothly.

Without seamless fiat on-ramps and off-ramps, beginners can struggle to move money in and out of the crypto ecosystem.

5. Customer Support: Help When You Need It

New traders are likely to encounter technical or account-related issues. Quality customer support is essential, and should include:

- Live Chat & Email Support: Immediate help when things go wrong.

- Phone Support: Rare but valuable for urgent issues.

- Help Centers & FAQs: A good self-service knowledge base can be a lifesaver.

If an exchange lacks accessible customer support, it’s not beginner-friendly.

6. Educational Resources: Learning While Trading

A good exchange should not just facilitate trading—it should also help users understand how crypto works. Beginner-friendly exchanges often offer:

- Guides & Tutorials: Explaining key crypto concepts.

- Video Lessons: Interactive content to help users understand trading strategies.

- Demo Trading Features: Platforms like Bybit allow users to practice trading with virtual money.

A beginner-friendly exchange should make users feel empowered, not overwhelmed.

The Top Crypto Exchanges For Beginners

Before we dive into the details of the exchanges we have picked for you, let's take a quick glance at what each has to offer.

| Exchange | Key Features | Spot Trading Fees | Futures Trading Fees | High-Volume Trader Discounts | Best for |

|---|---|---|---|---|---|

| Bybit | - Spot & derivatives trading - Copy trading & trading bots - Strong security measures | Maker: 0.10% Taker: 0.10% | Maker: 0.02%, Taker: 0.055% | Yes | Beginners interested in copy trading & low-fee trading |

| Toobit | - Spot & futures trading - Low trading fees - Simple interface | Maker: 0.07%, Taker: 0.1% | Maker: 0.02%, Taker: 0.06% | Yes | New traders looking for a simple interface |

| CoinCatch | - Focus on derivatives trading - Staking & passive income - Competitive fees | Maker: 0.1%, Taker: 0.1% | Maker: 0.02% Taker: 0.06% | No | Traders looking for a low-fee derivatives platform |

| Binance | - Wide range of cryptocurrencies - Low fees & BNB discounts - Binance Earn (staking & lending) | Maker: 0.1%, Taker: 0.1% | Maker: 0.02%, Taker: 0.05% | Yes | Traders looking for diverse trading options & passive income |

| OKX | - Spot, futures, margin, & options trading - DeFi & Web3 integration - Staking & NFTs | Maker: 0.14% Taker: 0.23% | Maker: 0.018% Taker: 0.05% | Yes | Users interested in DeFi & Web3 trading |

| KuCoin | - 700+ cryptocurrencies - Automated trading bots | Maker: 0.1% Taker: 0.1% | Maker: 0.02% Taker: 0.06% | Yes | Altcoin enthusiasts & privacy-conscious traders |

| Coinbase | - Simple & intuitive interface - Fully regulated & insured - Staking & educational tools | Maker: 0.4%, Taker: 0.6% | Not Available | Yes | Absolute beginners who prioritize security & ease of use |

Bybit

Bybit Boasts Copy Trading, Automated Bots, and Mobile-Friendly Features. Image via Bybit

Bybit Boasts Copy Trading, Automated Bots, and Mobile-Friendly Features. Image via BybitBybit is a fast-growing cryptocurrency exchange that originally gained popularity for its derivatives trading and leverage options. Over time, it has expanded into spot trading, staking, and other beginner-friendly features.

While it is known for its advanced trading tools, Bybit has also introduced copy trading, automated bots, and mobile-friendly features, making it more accessible to newcomers. Security remains a priority, with cold storage for user funds and two-factor authentication (2FA).

👉 Sign Up For Bybit - Up $60K In Rewards

Key Features

- Derivatives & Spot Trading: Offers leveraged trading for experienced users but also supports standard crypto buying and selling.

- Copy Trading: Allows beginners to automatically replicate trades from experienced investors.

- Trading Bots: Includes Grid Trading and DCA Bots for automated strategies.

- Fiat On-Ramps: Supports fiat deposits via third-party payment providers.

- Security Measures: Implements cold wallet storage, two-factor authentication (2FA), and withdrawal address whitelisting.

- Bybit Earn: Provides opportunities for staking and passive income.

Pros:

- Competitive trading fees compared to many other exchanges.

- Copy trading feature simplifies trading for beginners.

- Strong security framework with cold storage and additional protection layers.

- User-friendly mobile app for on-the-go trading.

Cons:

- Derivatives trading may be overwhelming for absolute beginners.

- Limited fiat deposit options compared to some competitors.

- Does not support direct fiat withdrawals to bank accounts.

Best For:

- Beginners interested in automated trading via copy trading or bots.

- Users who prefer strong security features.

- Traders looking for competitive fees and a smooth mobile experience.

Check out our detailed Bybit review here!

Toobit

Toobit Provides a Simple Sign-Up Process, Fiat Deposit Options, and a Mobile-Friendly Experience. Image via Toobit

Toobit Provides a Simple Sign-Up Process, Fiat Deposit Options, and a Mobile-Friendly Experience. Image via ToobitToobit is a relatively new cryptocurrency exchange that has been gaining traction due to its user-friendly interface, competitive trading fees, and security measures. The platform offers a mix of spot trading, derivatives trading, and staking, making it a flexible choice for both beginners and experienced traders.

With an emphasis on accessibility, Toobit provides a simple sign-up process, fiat deposit options, and a mobile-friendly experience. It also integrates risk management tools and multi-layered security features to ensure user protection.

👉 Sign Up For Toobit - Up To 100,000 USDT Welcome Bonus + Up To 50% Fee Discount For Life

Key Features

- Spot & Derivatives Trading: Supports traditional crypto buying/selling and leveraged trading.

- Fiat On-Ramps: Allows users to deposit fiat via multiple payment methods.

- Low Trading Fees: Offers competitive fees for both spot and futures trading.

- Security Measures: Implements cold storage, two-factor authentication (2FA), and anti-phishing protections.

- Toobit Earn: Provides staking and passive income opportunities.

- User-Friendly Interface: Designed to be simple and accessible, even for beginners.

Pros:

- Intuitive platform, making it beginner-friendly.

- Competitive trading fees compared to industry averages.

- Strong security framework with cold wallet storage and 2FA authentication.

- Multiple fiat deposit methods for easy access to crypto.

- Mobile-friendly design for trading on the go.

Cons:

- Still a newer exchange, meaning it lacks the long-standing reputation of larger platforms.

- Fewer advanced trading tools compared to major exchanges.

- Limited support for fiat withdrawals, requiring users to convert crypto externally.

Best For:

- Beginners looking for an easy-to-use crypto exchange with fiat support.

- Traders seeking low fees for both spot and derivatives trading.

- Users who prioritize security features like cold storage and anti-phishing protection.

Read our full Toobit review here!

CoinCatch

CoinCatch is Designed for Traders Looking for High-Speed Transactions and Competitive Fees. Image via CoinCatch

CoinCatch is Designed for Traders Looking for High-Speed Transactions and Competitive Fees. Image via CoinCatchCoinCatch is a derivatives-focused crypto exchange designed for traders looking for high-speed transactions, competitive fees, and a secure trading environment. While it primarily caters to derivatives and futures trading, it also offers spot trading, staking, and other financial services.

The exchange prioritizes security and efficiency, utilizing multi-tier security protocols and a user-friendly interface to make trading more accessible. Though it is still growing in recognition, it has positioned itself as a fast and secure trading platform for users at different experience levels.

Key Features

- Derivatives & Spot Trading: Supports futures and leveraged trading, along with traditional crypto trading.

- Competitive Fees: Offers low trading fees, making it attractive for active traders.

- Security Measures: Implements cold storage, two-factor authentication (2FA), and advanced risk controls.

- Staking & Passive Income: Users can earn rewards through staking programs.

- Mobile-Friendly Interface: A well-optimized trading experience for both desktop and mobile users.

Pros:

- Low trading fees compared to many major competitors.

- High-speed trade execution with minimal latency.

- Advanced security features, including cold storage for user funds.

- Beginner-friendly interface with both spot and derivatives trading options.

Cons:

- Primarily focused on derivatives, which may not be ideal for absolute beginners.

- Still a newer exchange, meaning it lacks the long-standing reputation of older platforms.

- Limited fiat withdrawal options, requiring external conversion for cashing out.

Best For:

- Traders looking for low-fee derivatives trading.

- Users who want a mix of advanced trading tools and user-friendly navigation.

- Those who prioritize security features like cold storage and risk controls.

Check out our detailed CoinCatch review here!

Binance

Binance is the Largest Cryptocurrency Exchange by Trading Volume. Image via Binance

Binance is the Largest Cryptocurrency Exchange by Trading Volume. Image via BinanceBinance is the largest cryptocurrency exchange by trading volume, offering a vast selection of cryptocurrencies, trading options, and financial services. Known for its low trading fees, extensive market offerings, and strong security features, Binance caters to both beginners and advanced traders.

The platform supports spot trading, futures, margin trading, staking, and an integrated NFT marketplace. While it provides a wealth of tools, some beginners may find its interface overwhelming due to the sheer number of features. However, Binance also offers a Lite mode on its mobile app for a simplified experience.

👉 Sign Up For Binance – Exclusive 20% Trading Fee Discount For Life + $600 Bonus!

Key Features

- Massive Cryptocurrency Selection: Supports hundreds of cryptocurrencies for trading.

- Low Trading Fees: One of the lowest fee structures in the industry, with additional discounts for BNB token holders.

- Security & Compliance: Implements cold storage, two-factor authentication (2FA), and anti-phishing protections.

- Multiple Trading Options: Offers spot trading, derivatives, P2P trading, and margin trading.

- Binance Earn: Provides staking, lending, and yield-generating opportunities.

- Beginner Mode: Binance Lite simplifies the interface for new users.

Pros:

- Low trading fees with additional discounts for using Binance Coin (BNB).

- Wide range of cryptocurrencies and trading pairs.

- Multiple passive income options, including staking and lending.

- Strong security framework with insurance fund protection (SAFU Fund).

- Beginner-friendly Lite mode for a simplified experience.

Cons:

- The full platform can feel overwhelming for absolute beginners.

- Regulatory challenges in some countries, limiting certain features.

- Limited customer support options compared to competitors.

Best For:

- Beginners who want access to a massive selection of cryptocurrencies.

- Traders looking for low fees and diverse trading options.

- Users interested in earning passive income through staking and lending.

We have a detailed Binance review right here!

OKX

OKX Offers Spot Trading, Futures, Margin Trading, and Staking. Image via OKX

OKX Offers Spot Trading, Futures, Margin Trading, and Staking. Image via OKXOKX is a globally recognized cryptocurrency exchange known for its wide range of trading options, low fees, and DeFi integration. It offers spot trading, futures, margin trading, and staking, making it a versatile platform for both beginners and experienced traders.

Beyond traditional trading, OKX provides access to Web3 services, an integrated crypto wallet, and DeFi features. Its user-friendly mobile app and customizable trading interface make it easier for beginners to navigate.

👉 Sign Up For OKX – Exclusive 40% Spot Trading Fee Discount + Get Up To $20K In Bonuses

Key Features

- Diverse Trading Options: Supports spot, futures, margin, and options trading.

- Low Trading Fees: Competitive fee structure with additional discounts for OKB token holders.

- Security & Compliance: Implements cold storage, 2FA, anti-phishing protection, and withdrawal whitelisting.

- DeFi & Web3 Integration: Provides access to NFTs, staking, and decentralized finance applications.

- Passive Income Opportunities: Offers staking, lending, and savings products.

- Customizable Trading Interface: Allows users to tailor their experience based on skill level.

Pros:

- Low trading fees with discounts for OKB token holders.

- Wide range of cryptocurrencies and trading features.

- Integration with DeFi, NFTs, and Web3 applications.

- Beginner-friendly mobile app with educational resources.

- Strong security measures, including cold storage and anti-phishing protections.

Cons:

- Some advanced features may be overwhelming for absolute beginners.

- Limited fiat withdrawal options in certain regions.

- Regulatory restrictions in some countries may limit access.

Best For:

- Beginners looking for a mix of traditional and DeFi trading options.

- Traders who want low fees and access to multiple earning opportunities.

- Users interested in NFTs, staking, and Web3 applications.

Read our full OKX review here!

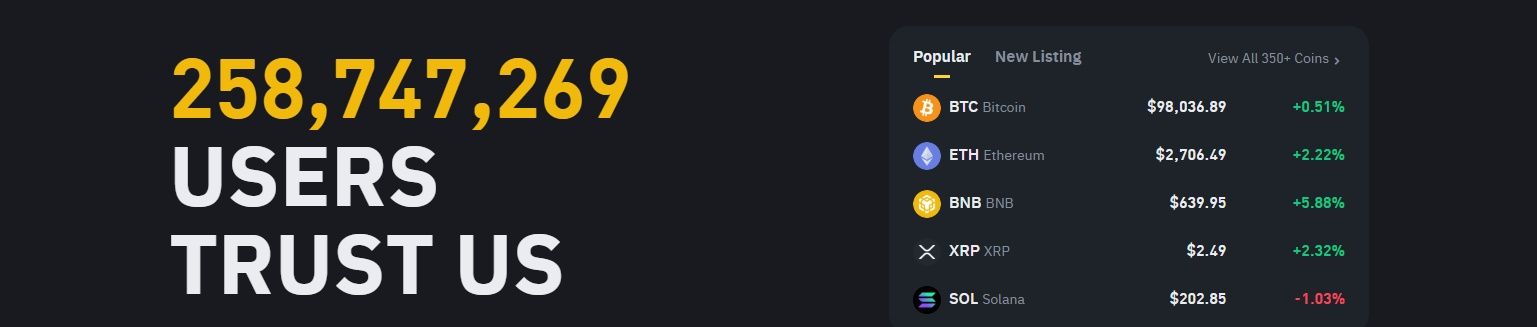

KuCoin

KuCoin is Known for its Wide Selection of Altcoins, and Competitive Fees. Image via KuCoin

KuCoin is Known for its Wide Selection of Altcoins, and Competitive Fees. Image via KuCoinKuCoin is a popular global cryptocurrency exchange known for its wide selection of altcoins, competitive fees, and advanced trading features. With over 700 cryptocurrencies listed, it is one of the largest crypto marketplaces available.

Despite offering professional-grade tools like margin trading, futures, and trading bots, KuCoin also provides beginner-friendly features such as quick buy options, passive income opportunities, and a mobile-friendly interface. While it does not require standard KYC for basic trading, full verification is needed for higher withdrawal limits.

👉 Sign Up For Kucoin – Trading Fee Discount of Up To 60% + FREE Trading Bot!

Key Features

- Extensive Altcoin Selection: Supports over 700 cryptocurrencies, making it a go-to platform for altcoin traders.

- Low Trading Fees: Competitive fee structure with discounts for KCS token holders.

- Security & Privacy: Offers two-factor authentication (2FA), and cold storage.

- Trading Bots & Automation: Includes built-in grid trading and DCA bots for automated strategies.

- KuCoin Earn: Enables users to earn interest on crypto through staking and lending programs.

- P2P Trading & Fiat Support: Allows users to buy crypto via bank transfers, credit cards, and peer-to-peer transactions.

Pros:

- Wide range of cryptocurrencies and early access to new altcoins.

- Low trading fees, with extra discounts for KCS token holders.

- Multiple ways to earn passive income, including staking and lending.

- Supports trading bots and automated strategies.

Cons:

- Not as regulated as some larger exchanges, leading to restrictions in certain countries.

- Customer support response times can be slow during high-demand periods.

- Fiat withdrawal options are limited compared to competitors.

Best For:

- Beginners looking for a wide selection of cryptocurrencies and passive income options.

Traders who want low fees and access to automated trading bots.

We have a detailed review of KuCoin right here!

Coinbase

Coinbase is Fully Licensed Exchange, it is Particularly Popular in Regions like the U.S., U.K. Image via Coinbase

Coinbase is Fully Licensed Exchange, it is Particularly Popular in Regions like the U.S., U.K. Image via CoinbaseCoinbase is one of the most beginner-friendly cryptocurrency exchanges, known for its simple interface, strong security measures, and regulatory compliance. As a fully licensed exchange, it is particularly popular in regions like the U.S., U.K., and Europe, where compliance with financial laws is crucial.

Coinbase offers a quick and easy way to buy, sell, and store crypto, making it an ideal choice for newcomers. While its fees are higher than some competitors, its ease of use, educational tools, and customer support make it a great entry point into crypto trading.

Key Features

- Beginner-Friendly Interface: Simple design that makes buying and selling crypto easy.

- Strong Security & Regulation: Fully compliant with U.S. laws, offering cold storage and insurance on digital assets.

- Educational Resources: Provides guides, tutorials, and Coinbase Earn, which rewards users for learning about crypto.

- Fiat Support: Allows direct deposits via bank transfers, debit/credit cards, and PayPal.

- Staking & Passive Income: Users can earn rewards by staking supported cryptocurrencies.

- Coinbase Pro: A separate platform with lower fees and advanced trading options.

Pros:

- Extremely easy to use, even for complete beginners.

- High-security standards, including insured custodial wallets.

- Direct fiat deposits and withdrawals via multiple payment methods.

- Educational resources help users learn while trading.

- Staking rewards and passive income opportunities.

Cons:

- Higher trading fees compared to competitors.

- Limited advanced trading features on the standard platform.

- Customer support response times can be slow during peak demand.

Best For:

- Absolute beginners who want an easy way to buy and sell crypto.

- Users who prioritize security, regulation, and insured custody services.

- Those interested in earning passive income through staking and rewards.

Check out our detailed Coinbase review here!

How to Choose the Best Exchange as a Beginner

Selecting the right cryptocurrency exchange is crucial for beginners, as different platforms cater to different needs. Whether you're looking for a simple way to buy and hold crypto or planning to trade actively, it’s important to evaluate factors like fees, security, regulations, and learning resources before making a decision.

Here’s a step-by-step guide to help beginners choose the best exchange based on their individual goals.

Step 1: Define Your Needs

Before choosing an exchange, it’s essential to determine your investment strategy and what you expect from a trading platform.

- Long-Term Investing: If your goal is to buy and hold cryptocurrencies for months or years, you’ll want an exchange that offers secure storage, low withdrawal fees, and staking opportunities to earn passive income.

- Active Trading: If you plan to trade frequently, look for an exchange with low trading fees, high liquidity, advanced charting tools, and fast execution speeds.

- DeFi & Web3 Access: Some exchanges offer NFT marketplaces, staking, lending, and access to decentralized applications (DApps) for users who want to explore the broader crypto ecosystem.

Understanding your trading style and investment goals will help narrow down the best platform for your needs.

Step 2: Compare Fees & Deposit Options

Fees can significantly impact your overall profitability, especially for beginners making smaller trades. Here’s what to consider:

- Trading Fees: Look for low maker/taker fees, and check if the platform offers discounts for using native tokens (e.g., Binance’s BNB).

- Deposit & Withdrawal Fees: Some exchanges allow free bank transfers, while others charge for credit card purchases and PayPal deposits.

- Hidden Costs: Be aware of network fees, withdrawal limits, and inactivity fees, which can eat into your funds over time.

It’s always a good idea to compare deposit methods to ensure the platform supports bank transfers, credit/debit cards, PayPal, or direct crypto deposits based on your needs.

Selecting The Right Crypto Exchange is Crucial for Beginners. Image via Shutterstock

Selecting The Right Crypto Exchange is Crucial for Beginners. Image via ShutterstockStep 3: Check Security & Regulations

Security should be a top priority when choosing a crypto exchange. Here are key factors to consider:

- Regulatory Compliance: Ensure the exchange operates legally in your country and follows financial regulations and KYC/AML guidelines.

- Security Features: Look for exchanges that offer two-factor authentication (2FA), cold storage for user funds, and withdrawal address whitelisting.

- Insurance & Fund Protection: Some exchanges provide insurance coverage (e.g., Coinbase’s FDIC insurance for USD balances) and emergency funds like Binance’s SAFU Fund to protect users in case of hacks.

Avoid using unregulated or offshore exchanges that may not have proper consumer protection policies in place.

Step 4: Explore Learning Resources

For beginners, an exchange should not only facilitate trading but also provide educational tools to help users understand crypto markets. Look for platforms that offer:

- Guides & Tutorials: Step-by-step instructions on buying, selling, and securing crypto.

- Trading Simulators: Some exchanges provide demo trading accounts for beginners to practice without real money.

- Crypto Rewards & Learning Programs: Some platforms offer incentives like Coinbase Earn, where users receive free crypto for learning about different projects.

Safety & Security Tips for Beginner Crypto Traders

Security is one of the most critical aspects of crypto trading, especially for beginners. With cyber threats, exchange hacks, and scams on the rise, it’s essential to take the right precautions to protect your funds and personal information. Here are three key security measures every beginner should follow.

1. Enable Two-Factor Authentication (2FA)

Two-factor authentication (2FA) adds an extra layer of security to your account by requiring a second verification step beyond your password. Most exchanges support 2FA via Google Authenticator, SMS codes, or email verification.

- Always use an authenticator app instead of SMS, as SIM-swapping attacks can compromise phone-based 2FA.

- Enable 2FA not just for login but also for withdrawals and account settings changes.

2. Avoid Phishing Scams

Phishing scams are one of the most common ways hackers steal crypto funds. Scammers create fake exchange websites, emails, or social media accounts that look legitimate to trick users into entering login credentials.

- Always verify URLs before entering login details—avoid clicking on links from emails or social media messages.

- Never share your exchange login credentials or private keys with anyone.

- Bookmark official exchange websites to prevent visiting fraudulent sites.

3. Store Your Crypto in a Secure Wallet

Keeping your assets on an exchange can be risky, as exchanges can be hacked or freeze withdrawals. Beginners should consider using a secure wallet for long-term storage.

- Hot Wallets: Convenient but connected to the internet, making them vulnerable.

- Cold Wallets: Offline storage (like hardware wallets) that provides maximum security.

Looking for a hardware wallet? Check out exclusive offers on Ledger, Trezor, NGRAVE and Ellipal

Using a cold wallet for long-term holdings while keeping only small amounts on an exchange for trading is the safest approach.

Common Mistakes to Avoid

Many beginners make costly mistakes when choosing and using a crypto exchange. To ensure a safe and smooth trading experience, avoid these common pitfalls.

1. Choosing an Exchange Without Proper Security Measures

Security should be the top priority when selecting an exchange. Some platforms lack cold storage, two-factor authentication (2FA), or regulatory compliance, making them high-risk for hacks and fraud.

- Always choose exchanges with strong security protocols, including cold wallet storage, anti-phishing protection, and insurance funds.

- Verify whether the exchange follows regulatory standards in your region.

2. Not Understanding Trading Fees

Many beginners overlook trading fees, which can eat into profits over time. Exchanges charge fees for trading, deposits, withdrawals, and even inactivity.

- Compare maker/taker fees and check for hidden costs like high withdrawal charges.

- Some exchanges offer discounts for using native tokens (e.g., Binance’s BNB).

3. Keeping Funds on an Exchange Instead of a Personal Wallet

Leaving assets on an exchange is risky—if the platform is hacked or suspends withdrawals, you could lose access to your funds.

- Use a cold wallet (hardware wallet) for long-term holdings and keep only small amounts on an exchange for trading.

4. Falling for Scams and Phishing Attempts

Scammers often use fake exchange websites, phishing emails, and social media impersonations to steal login credentials.

- Always verify URLs, emails, and customer support contacts before providing any personal information.

- Never share your private keys or recovery phrases with anyone.

Crypto trading can be exciting and profitable, but small mistakes can lead to big losses. By choosing a secure exchange, understanding fees, storing assets safely, and staying alert to scams, beginners can avoid unnecessary risks and focus on building their crypto portfolio with confidence. In the fast-moving world of crypto, staying informed and cautious is the best way to protect your investments.

Closing Thoughts

Stepping into the world of crypto doesn’t have to be overwhelming. With the right exchange, you can trade with confidence—without feeling like you’re deciphering an alien language.

Now that you know where to start, the next step is to take action. Choosing an exchange that aligns with your goals is key, but security should always come first. Setting up two-factor authentication, withdrawing long-term holdings to a secure wallet, and staying alert to scams will help safeguard your funds. Once you’re ready, making your first trade is an exciting milestone, but the real journey lies in continuous learning and smart decision-making.

Crypto rewards those who stay informed and approach trading with caution. Start small, stay secure, and explore the exciting world of digital assets with confidence. The best time to start is now. And you can learn even more from our review on the best crypto exchanges. Good luck!