Staking idle cryptocurrencies is fast emerging as a dependable avenue for enthusiasts to engage with blockchain networks while reaping rewards. The spectrum of options, ranging from running a personal validator node to staking directly on exchanges or opting for the more accessible route of staking pools, highlights the versatility offered by crypto staking.

Among the various options, staking pools have risen to prominence, presenting an affordable way for individuals seeking entry into the realm of crypto staking. These pools aggregate resources from multiple participants, enabling them to "pool" their staking power.

While the fundamental concept of staking is relatively straightforward — lock up crypto assets and earn rewards — navigating the Solana staking pool ecosystem can be challenging. This article will help you navigate the complexities of staking, with a specific focus on identifying the best Solana staking pools.

What is Solana Staking?

Like Ethereum, Solana employs a Proof-of-Stake (PoS) consensus mechanism where participants (known as validators) process transactions and add new blocks to the blockchain. This process ensures the legitimacy of transactions.

Solana staking is the process through which SOL token holders assign some or all of their tokens to specific validators. This act of assigning tokens to a validator is called "delegating." Importantly, delegating tokens to a validator does not grant the validator ownership or control over the tokens; the token holder (aka you) retains full control. In return for delegating your tokens to a validator, you earn rewards, and everyone's happy!

By allocating resources to the network, stakers actively contribute to its stability and functionality.

If you'd like to know more, our crypto staking guide dives deep into the intricacies and covers how staking contributes to blockchain networks.

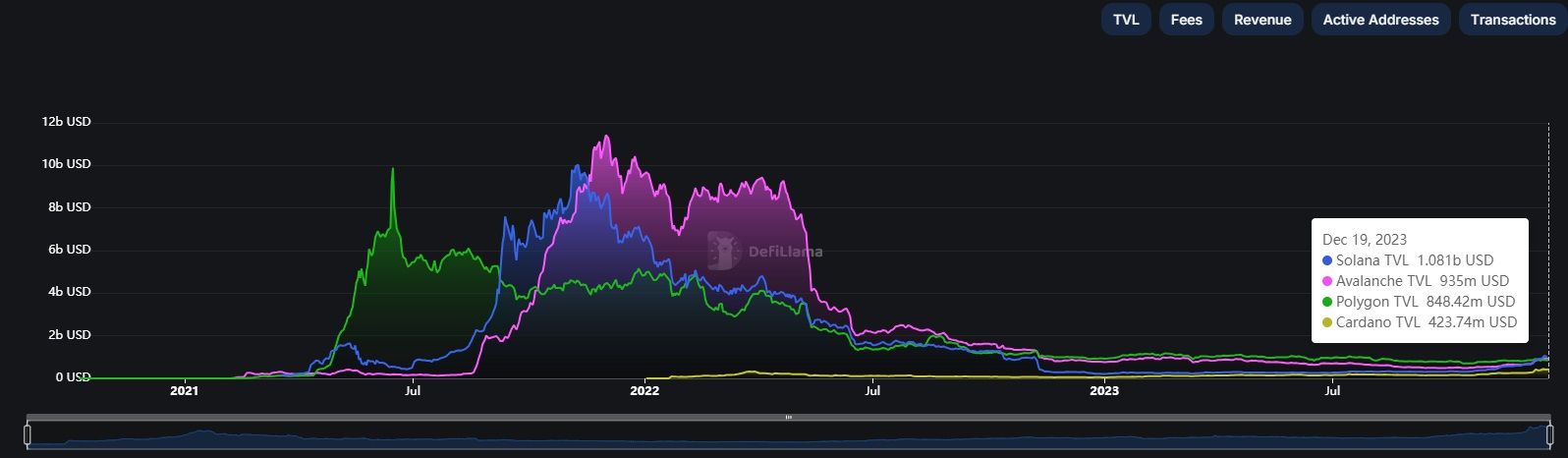

Solana has been referred to as an “Ethereum killer,” a monicker given to many third-generation blockchains that aim to improve upon Ethereum's shortcomings. Among these blockchains, Solana is among the leaders when measured by total value locked.

Solana's TVL is Far Ahead of Many Other Third-Gen Blockchains. Image via DefiLlama

Solana's TVL is Far Ahead of Many Other Third-Gen Blockchains. Image via DefiLlamaHowever, Solana Labs's founder Anatoly Yakovenko has warned against the “ETH killer” narrative.

I don’t see a future where solana thrives and somehow eth dies. - X

Anatoly shares a similar belief held by many in the crypto industry that the future will be multi-chain without a one-winner-take-all scenario coming to fruition.

Solana Staking Pools Explained

A Solana staking pool is where multiple token holders combine their resources and stake their SOL tokens together. Staking pools are designed to simplify the staking process for individual participants by aggregating their tokens, delegating them to a chosen validator, and distributing rewards to each participant based on their contribution to the pool.

Here's how a Solana staking pool typically works:

- Formation: Several SOL token holders come together to form a staking pool. Each participant contributes a certain amount of SOL to the pool.

- Selection of a Validator: The staking pool participants decide on a validator to delegate their aggregated stake. The validator is responsible for processing transactions and validating blocks on the Solana network.

- Delegating Stake to the Validator: The SOL tokens contributed by each participant are delegated to the chosen validator. This increases the total stake of the validator, enhancing their chances of being selected to validate transactions and earn rewards.

- Reward Distribution: As the validator processes transactions and earns staking rewards, those rewards are distributed among the staking pool participants based on their individual contributions to the pool.

Solana staking pools offer individuals a convenient way to contribute to staking without the need for extensive technical expertise or a large deployment of capital.

How to Stake Solana

There are three ways you can go about staking Solana:

- DIY (Do it Yourself)

- Staking on Exchanges

- Solana Staking Pools

We'll touch on the first one here and go into detail on the other two later.

Opting for the DIY strategy involves setting up your own validator node, essentially creating a server to participate in Solana's proof-of-stake consensus. This comes with a few challenges.

- Hardware Costs: Running a node demands robust hardware, including a fast CPU with multiple cores, a substantial amount of RAM, and considerable storage space.

- Technical Complexity: Setting up and maintaining an independent node involves technical tasks such as software updates and troubleshooting, making it challenging for those less technologically inclined.

- 24/7 Uptime: Validators must ensure high uptime, requiring investment in backup systems and reliable internet connectivity for continuous availability.

Given these challenges, the DIY approach may be overwhelming for some, prompting many to explore alternative options like staking on exchanges or joining a staking pool using a self-custodial wallet.

Staking Solana On A Centralized Exchange

Staking on exchanges provides a more accessible option for individuals who may not want to handle the technical complexities of running their own node or avoid the responsibility that comes with self-custody. Some cryptocurrency exchanges offer staking services, enabling users to stake their Solana directly on the platform.

Here are a few exchanges that let you stake SOL.

- Binance: The largest exchange's Binance Earn program allows you to earn money via crypto. It features saving and lending products, as well as SOL staking. The annual percentage yield (APY) for staking Solana is currently around 7.3%.

For more information, head over to our full Binance Earn review where we explore the benefits and risks.

Important: As part of a recent settlement with the US government, Binance will completely exit the country. Binance is also not available in the UK.

- Kraken: Staking Solana on Kraken will fetch you an APR of between 2% to 4%. With Kraken, you can earn staking rewards on your cash and crypto twice a week. In addition, you can instantly unstake at any time with no penalties.

- Coinbase: Another credible exchange offering Solana staking is Coinbase, which offers up to 5.01% APY if you hold on to the asset for one year. Our full Coinbase review provides in-depth information on the exchange's Earn products as well as fees.

- Uphold: With Uphold, staking SOL can fetch you an APY of 5.5%, and rewards are rolled out on a weekly basis. The exchange charges a commission of between 3% and 34% depending on the asset being staked.

Before staking Solana on an exchange, it's essential to consider the following factors:

- Custodial Risk: Staking on exchanges means entrusting the platform with your staked SOL. In the event of security breaches or financial issues faced by the exchange, there's a risk of potential loss of funds.

- Loss of Control: Stakers on exchanges have limited control over the staking process compared to running an independent validator node. Decisions on upgrades or changes to the staking protocol are determined by the exchange's infrastructure.

- Fees: Prospective stakers should carefully review any fees associated with staking on an exchange and the withdrawal process to understand the costs.

- Staking Centralization- As exchanges provide the most convenient platform for staking, a high percentage of staked assets are concentrated in the pools utilized by exchanges. This centralizes staking and leads to a less robust, censorship-resistant and decentralized network.

Despite these considerations, staking on an exchange offers several advantages:

- Lower Entry Barrier: Staking Solana on exchanges provides a more accessible avenue for a wider audience. Individuals who don't meet the minimum requirement for running an independent validator node can still participate in staking.

- Convenience: Choosing to stake on an exchange can be more convenient, especially for those already using the platform for their cryptocurrency needs. It allows users to stake and manage assets within the familiar interface of the exchange, avoiding the complexities of setting up an independent system.

- Free of Technical Expertise: For users lacking technical expertise, staking on exchanges is a user-friendly option. The exchange takes care of the technical aspects of staking, eliminating the need for users to possess in-depth knowledge about setting up and maintaining a validator node.

- Top-notch Security Measures: Reputable exchanges implement robust security measures to safeguard users' staked assets. This includes secure storage solutions, encryption, and other safeguards to prevent unauthorized access and mitigate potential security threats.

If you're looking for the best crypto exchanges, check out our top picks. DeFi enthusiasts should check out our article on the best decentralized exchanges.

Best Solana Staking Pools

Here are some of the top Solana staking pools.

| Platform | APY | Fees |

|---|---|---|

| Jito | 6.96% | Rewards fee of 4% SOL withdrawal fee of 0.10% |

| BlazeStake | 6.23% | Instant withdrawal fee: 0.3% Delayed withdrawal fee: 0.1% Epoch fee: 5% |

| JPool | 6.96 | 5% of rewards per epoch |

| Socean | 7.25% | Withdrawal fee of 0.06% Ongoing management fee of 2% on returns |

| StaFi | 5.72% | 10% commission on rewards |

Jito

Jito Networks is the largest liquid staking platform on Solana, with a specific focus on mitigating the adverse impacts of Maximum Extractable Value (MEV). It aims to foster an equitable redistribution of MEV profits among stakers.

Jito is The Largest Liquid Staking Platform on Solana. Image via Jito Networks

Jito is The Largest Liquid Staking Platform on Solana. Image via Jito NetworksJito takes staked assets and delegates them to MEV-enabled validators, who employ various strategies such as transaction re-ordering and arbitrage to generate profits. These profits are then redirected to boost the APY for JitoSOL holders. This innovative approach enables stakers to enjoy the combined benefits of staking yields and MEV rewards.

Jito offers an APY of 6.96%. The platform charges a rewards fee of 4% and a SOL withdrawal fee of 0.10%, according to Solana Compass. It boasts a TVL of over 6.3 million SOL, 82 validators, and more than 82,000 stakers.

BlazeStake

BlazeStake is a fully non-custodial Solana stake pool protocol endorsed by the Solana Foundation. Users have the flexibility to withdraw SOL from the stake pool instantly or opt for a delayed unstaking process with lower fees, allowing conversion of BlazeStake Staked SOL (bSOL) token into a traditional staking account.

BlazeStake is a Non-Custodial Protocol Endorsed By The Solana Foundation. Image via BlazeStake

BlazeStake is a Non-Custodial Protocol Endorsed By The Solana Foundation. Image via BlazeStakeBlazeStake spreads stakes across hundreds of validators. It boasts the largest validator set among Solana stake pools, with over 200 validators. Unlike other pools using third-party contracts, BlazeStake employs official stake-pool smart contracts from Solana Labs. The platform has been audited seven times by three companies, and the reports are publicly available.

Here are the pool fees:

- Deposit fee: 0%

- Instant withdrawal fee: 0.3%

- Delayed withdrawal fee: 0.1%

- Epoch fee: 5%

According to Solana Compass, BlazeStake offers an APY of 6.23%.

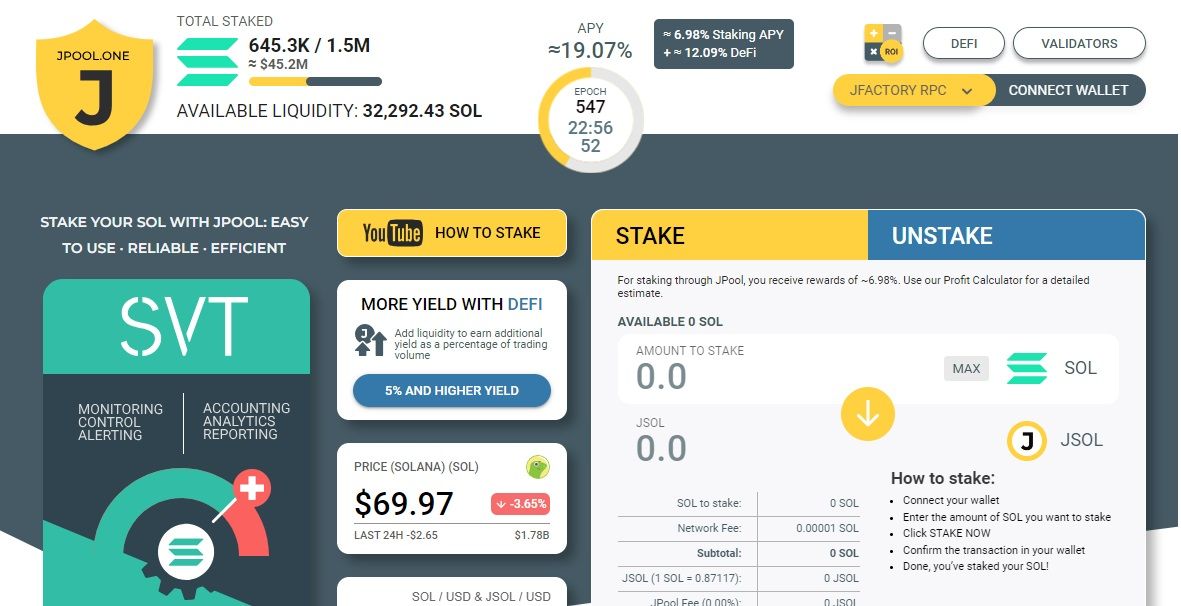

JPool

Backed by the Solana Foundation, JPool employs a scoring strategy that distributes SOL stake among participating validator nodes.

JPool is Backed By The Solana Foundation. Image via JPool

JPool is Backed By The Solana Foundation. Image via JPoolThe algorithm behind JPool is designed for continuous monitoring of all nodes, allowing it to proactively identify performance gaps among validators. This approach enables the redistribution of stake to maintain top returns in every epoch.

Users have full visibility into processes, strategic decisions made by the JPool engine, and the ranking/scoring of validators. The strategy is open for independent verification, and all fees, currently at 5% of rewards per epoch (equivalent to less than 0.3% p.a.), are transparently listed.

JPool uses the Solana Foundation's stake pool program for all operations with the funds; the pool itself has no access to your SOL. The staking APY currently stands at 6.96%.

Socean

Socean emphasizes a meritocratic and transparent delegation strategy outlined in its whitepapers. Unlike some stake pools, there are no undisclosed agreements or preferential treatment for specific validators, meaning any validator demonstrating good performance can be selected by the delegation algorithm.

Socean Offers an APY of 7.25%. Image via Socean

Socean Offers an APY of 7.25%. Image via SoceanSocean has worked with the Solana Foundation to help develop the foundation's stake pool program. The platform has also received multiple grants from the foundation to develop the stake pool ecosystem.

By utilizing the Solana Foundation's open-source reference implementation, Socean ensures that its code has undergone thorough audits and receives timely fixes and updates. The stake pool has strategic partnerships with leading DeFi protocols in Solana, such as Saber, Orca, Raydium and Solend.

Socean offers an APY of 7.25%. It charges no deposit fee, a withdrawal fee of 0.06%, and an ongoing management fee of 2% on staking returns, which comes to roughly 0.14% per annum.

StaFi

StaFi is a multi-chain liquid staking protocol that supports the Ethereum, Polygon, BSC, Cosmos, Polkdot and Solana ecosystems. The protocol aims to reconcile the traditional trade-off between mainnet security and token liquidity inherent in PoS consensus.

StaFi is a Multi-Chain Liquid Staking Protocol. Image via StaFi

StaFi is a Multi-Chain Liquid Staking Protocol. Image via StaFiStaFi adheres to stringent security measures, including regular security audits conducted by reputable auditors. The protocol has a well-defined security incident response plan in place. In addition, governance decisions are democratically made by the community and the core team.

For SOL, the APY on offer is 5.72%. The protocol applies a 10% commission on staking rewards.

How To Pick A Staking Pool

Choosing a suitable staking pool can be a daunting task for those new to the crypto world. However, the following step-by-step instructions should assist you in selecting the best Solana staking pool.

- Educate Yourself: Before you dive into staking pools, you must educate yourself about the fundamentals of staking. As we've discussed here, staking involves holding a specific amount of cryptocurrency (Solana, in this case) in a crypto wallet to support the network's operations. For this, stakers receive rewards in the same cryptocurrency they are staking.

- Assess Credibility and Reliability: A thorough research of the staking pool's reputation would serve you well. Look for user reviews online as well as check resources like Solana Compass to assess stake pool operators.

- Compare Fees: Staking pools impose fees to cover operational costs and generate revenue. If these fees are higher, they can eat into your rewards. However, the sweet spot lies in striking a balance between fees and rewards as lower fees do not always guarantee better returns.

- Examine Rewards and Payouts: Each staking pool has a different reward structure, prompting the need for a comprehensive comparison to pinpoint the most fitting option. Essential factors to assess include the pool's APY, minimum staking requirements, payout frequency, as well as any lock-up periods or withdrawal restrictions.

- Evaluate Security Measures: The cryptosphere is rife with frauds and hacks, which makes security a top priority. Look for what kind of security measures the pool has in place to safeguard user funds, and use sites such as DeFiLlama, Solana Compass, or a project's Github, website, or whitepaper to ensure you are navigating to the correct staking pool and not a malicious or phishing site.

Risks of Staking Solana

Staking on the Solana network offers the potential for earning rewards and contributing to network security, but it comes with its own set of considerations and challenges.

- Slashing Risk: Slashing involves the punitive measure of destroying a portion of the stake delegated to a validator in response to malicious actions undertaken by that validator. On Solana, slashing is not automatic. If an attacker causes the network to halt, they can be slashed upon network restart.

- Downtime Penalties: Validators are expected to maintain high uptime, and significant downtime can result in penalties, diminishing the overall staked amount and potential rewards.

- Market Volatility: The value of SOL may experience fluctuations due to market volatility. If the price decreases during the staking period, the value of staked assets in fiat currency terms decreases. Participants face market risk, earning 7% APY on a token that loses 80% of its value will leave investors at a net loss.

- Uncertain Returns: Staking rewards are influenced by network conditions, the total staked SOL, and validator performance. While staking returns can vary, actual rewards may deviate from initial expectations.

- Operational and Technical Challenges: Operating a node on Solana requires technical expertise. Challenges such as hardware failures, software issues, or connectivity problems can impact the overall performance of the validator.

How Much Can You Earn Staking Solana?

Several factors contribute to determining your earnings from staking SOL.

- Staking Rate: The staking rate, representing the percentage of total Solana being staked on the network, plays a role in rewards.

- Validator Performance: The performance of validators, including uptime and adherence to network rules, can affect rewards. Validators demonstrating consistent high performance are likely to receive increased rewards.

- Network Conditions: The overall health and activity of the Solana network can affect staking rewards. A network with heightened transaction volume and activity may generate increased fees, contributing to higher rewards for validators.

- Economic Variables: Economic factors, such as changes in the price of SOL, can influence the value of staking rewards. If the value of SOL increases, the staking rewards' value in fiat currency terms also experiences an uptick.

- Validator Commission Fees: Validators impose commission fees on the rewards distributed to stakers. Higher commission fees result in lower net returns for stakers, and it's essential to consider these fees when evaluating potential earnings.

- Staking Period: Staking SOL involves locking up funds for a specified period. The duration of the staking period directly impacts potential rewards. Opting for a longer staking period enhances potential returns, but it also means the staked SOL remains inaccessible during that time.

Current Solana staking returns range from 3% to 8%, depending on the staking pool.

Top Solana Wallets for Staking

Exodus, Trust Wallet, Solflare and Phantom Wallet are some of the wallets that allow you to stake Solana. If hardware wallets are your thing, Ledger (of the Nano X and S Plus fame) lets you delegate the Solana you want to stake to the Figment validator node.

If you're in the market for an SOL storage solution, check out our article on the best Solana wallets. Also, check out our picks for the best hardware wallets, desktop wallets and mobile wallets.

Best Solana Staking Pools: Closing Thoughts

The Solana ecosystem offers various options to stake SOL—running personal validator nodes, staking on exchanges and participating in staking pools.

Staking on exchanges provides a convenient option for those not wanting to handle the technical aspects of running a node or the responsibility of self-custody, while staking pools that can be accessed via self-custodial wallets offer a convenient and safe way to stake for those who want to take self-custody over their assets and reduce third-party risk while contributing to the Solana network.

However, before you take the plunge, it's important that you educate yourself about the fundamentals of staking, comparing fees, and evaluating security measures. Potential stakers should also be aware of the risks associated with staking Solana, such as slashing.

Ultimately, the choice depends on individual preferences, technical expertise, and risk appetite.