Crypto fundraising has come a long way since the Wild West days of ICOs—a time when almost anyone with a flashy website and a promising roadmap could raise millions, often with little more than vaporware to show for it. While some projects delivered, many vanished into thin air, leaving investors with nothing but worthless tokens and a harsh lesson in due diligence.

Fast forward to today, and things look very different. Enter Binance Launchpad and Binance Launchpool—two platforms that offer a secure, transparent, and fairer way for projects to raise capital and distribute tokens. Backed by the world’s largest exchange, these platforms ensure that only high-quality projects make the cut, giving investors a trustworthy and accessible way to participate in early-stage token sales and earn new assets.

But how do these platforms work? What’s the difference between Launchpad and Launchpool? And, more importantly, how can you get involved? If you’ve ever wanted early access to promising crypto projects or a way to farm free tokens with minimal risk, then you’re in the right place.

In this guide, we’ll break down everything you need to know about Binance Launchpad and Launchpool and how you can make the most of them.

In addition, we also have articles that dive into other aspects of the Binance Exchange:

- Binance 2025 Review: Pros & Cons and In-Depth Exchange Overview

- Binance Coin (BNB): Native Token of the Largest Crypto Exchange

- Binance Earn Review 2025: Exploring the Benefits and Risks

- Binance NFT Review: The NFT Marketplace From Binance

- Binance App Review: Crypto Trading on the Go!

- Binance Exchange Security 2025: Is Binance Still Safe?

What is Binance?

Binance is the world’s largest cryptocurrency exchange, boasting unmatched trading volumes and an ecosystem that spans nearly every corner of the crypto space. Founded in 2017 by Changpeng Zhao (CZ) and Yi He, Binance began with a singular focus on crypto trading. However, throughout the years, it has evolved into a comprehensive platform offering tools and features tailored to both beginners and seasoned investors.

Binance Has Well Over 200 Million Users. Image via Binance

Binance Has Well Over 200 Million Users. Image via BinanceWith over 450 cryptocurrencies and 1,000 trading pairs available, Binance offers one of the most extensive selections of digital assets in the industry. Its low trading fees, fiat gateway supporting 65 currencies, and seamless multi-platform experience — accessible via web, mobile, desktop, and API — further solidify its position as the go-to exchange for millions of users worldwide.

In addition, the platform offers advanced features like Binance Futures, with up to 125x leverage, and Binance Staking, which allows users to grow their holdings. For those looking to delve deeper, Binance’s NFT Marketplace and Launchpad provide opportunities to explore digital collectibles and participate in early-stage token investments.

The numbers speak for themselves. With over 200 million users and daily trading volumes frequently surpassing $20 billion, Binance remains the largest cryptocurrency exchange by volume — and shows no signs of slowing down.

If you’re keen to learn more, check out our comprehensive Binance review, covering everything from its core features to its journey to dominance in the crypto space.

And don’t forget, Coin Bureau has secured an exclusive offer for anyone considering Binance as their go-to exchange.

👉 Sign Up For Binance – Exclusive 20% Trading Fee Discount For Life + $600 Bonus

Understanding Binance Launchpad

In the early days, blockchain startups often relied on Initial Coin Offerings (ICOs)—a model that, while game-changing at the time, was plagued by scams, technical failures, and a lack of investor protection. Many projects raised millions with little more than a whitepaper, leaving investors exposed to significant risk.

Then came Initial Exchange Offerings (IEOs), a more structured alternative where token sales were conducted directly through a centralized exchange. Binance Launchpad led this movement, offering a safer, more transparent, and efficient way for projects to raise capital while giving investors early access to vetted opportunities.

But what exactly is Binance Launchpad, and how does it work? Let’s break it down.

What Is Binance Launchpad?

Binance Launchpad is a token sale platform that provides early-stage blockchain projects with access to Binance’s massive user base, liquidity, and security infrastructure. Unlike the chaotic and unregulated ICO era, where investors often had to manually send funds to a smart contract, Binance Launchpad streamlines the process, ensuring a structured and transparent fundraising event.

What makes it unique is that Binance carefully selects and vets each project before allowing it to conduct a token sale. This means that only high-quality projects with strong fundamentals make it to the platform, reducing the risk of fraud and increasing the likelihood of long-term success.

Since its inception, Binance Launchpad has been instrumental in launching some very successful projects in crypto, including BitTorrent (BTT), Axie Infinity (AXS) and The Sandbox (SAND).

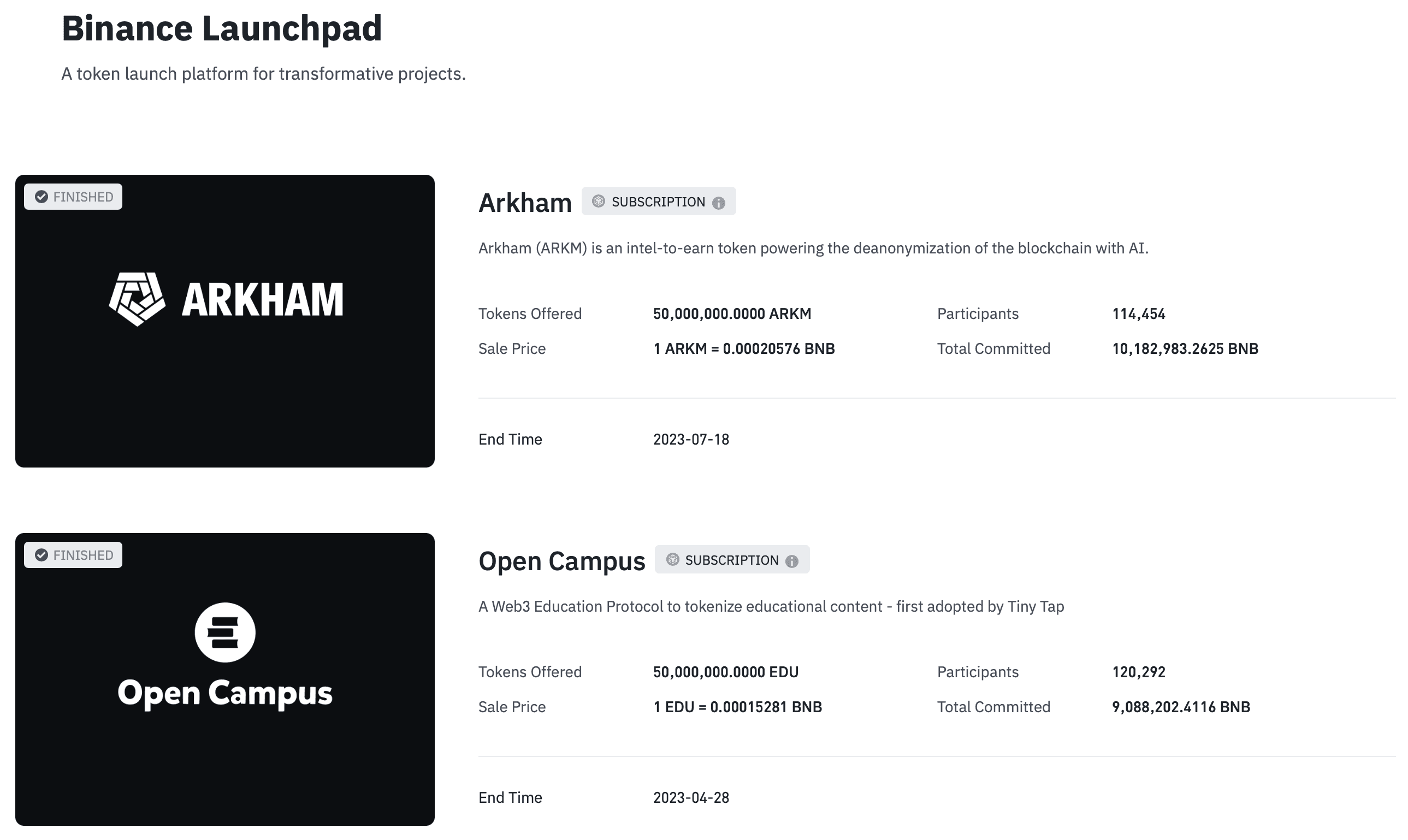

Past Binance Launchpad Projects. Image via Binance

Past Binance Launchpad Projects. Image via BinanceHow Binance Launchpad Works?

Binance Launchpad operates using a subscription-based model, which ensures that token distribution is fair and accessible to Binance users. Participants need to commit Binance Coin (BNB) in order to gain access to a token sale.

Here’s a step-by-step breakdown of how a Launchpad token sale typically unfolds:

Step 1: BNB Holding Calculation Period

- Before the subscription opens, Binance tracks your BNB holdings over a specific period.

Step 2: Subscription Period

- Once the holding period ends, you can commit a portion of your BNB to the token sale.

- Binance locks your committed BNB for the duration of the event.

- No additional fees are required—your allocation is purely based on your committed BNB.

Step 3: Final Token Distribution

- After the sale ends, Binance calculates the final allocation of tokens based on demand.

- You receive the newly launched tokens directly in your Binance account.

- Any unused BNB is refunded, ensuring you don’t lose anything beyond the committed amount.

Benefits of Binance Launchpad

So why do both projects and investors prefer Binance Launchpad over other fundraising methods?

Early Access to Promising Crypto Projects

- Launchpad users get first access to tokens before they hit the public market, providing an opportunity to invest in early-stage projects that may see significant adoption.

Enhanced Security Compared to ICOs

- Unlike ICOs—where investors had to send funds directly to project teams with no guarantees of token delivery—Launchpad ensures all transactions are handled by Binance, significantly reducing the risk of fraud.

Liquidity & Trading Pairs from Day One

- Unlike traditional fundraising models where investors had to wait weeks or months for a token listing, Binance Launchpad projects are listed on Binance, ensuring they have access to deep liquidity and multiple trading pairs.

Global Exposure & Project Legitimacy

- For projects, being featured on Binance Launchpad provides instant credibility and visibility. With millions of active traders on Binance, a token sale automatically gets exposure to a global audience, boosting community engagement and adoption.

Understanding Binance Launchpool

While Binance Launchpad provides early investment opportunities in new crypto projects, Binance Launchpool offers an alternative way to acquire new tokens—without actually buying them. Instead of purchasing tokens upfront, users can stake their existing assets (such as BNB or stablecoins) and earn new project tokens as rewards.

This concept, often referred to as token farming, has become an increasingly popular way for crypto holders to gain exposure to new projects with minimal risk. By simply locking their assets in Launchpool, users can passively earn tokens while maintaining the flexibility to withdraw at any time.

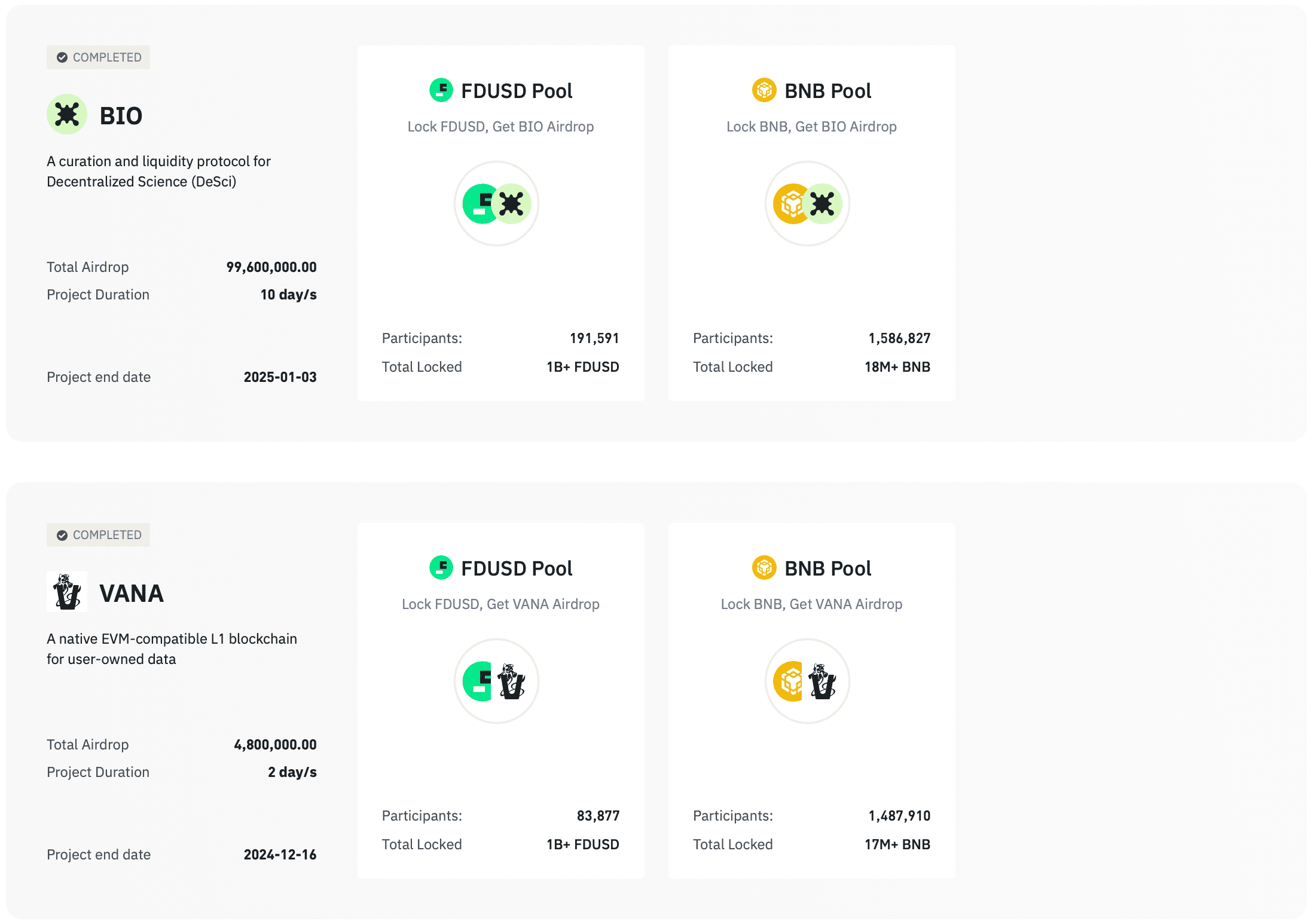

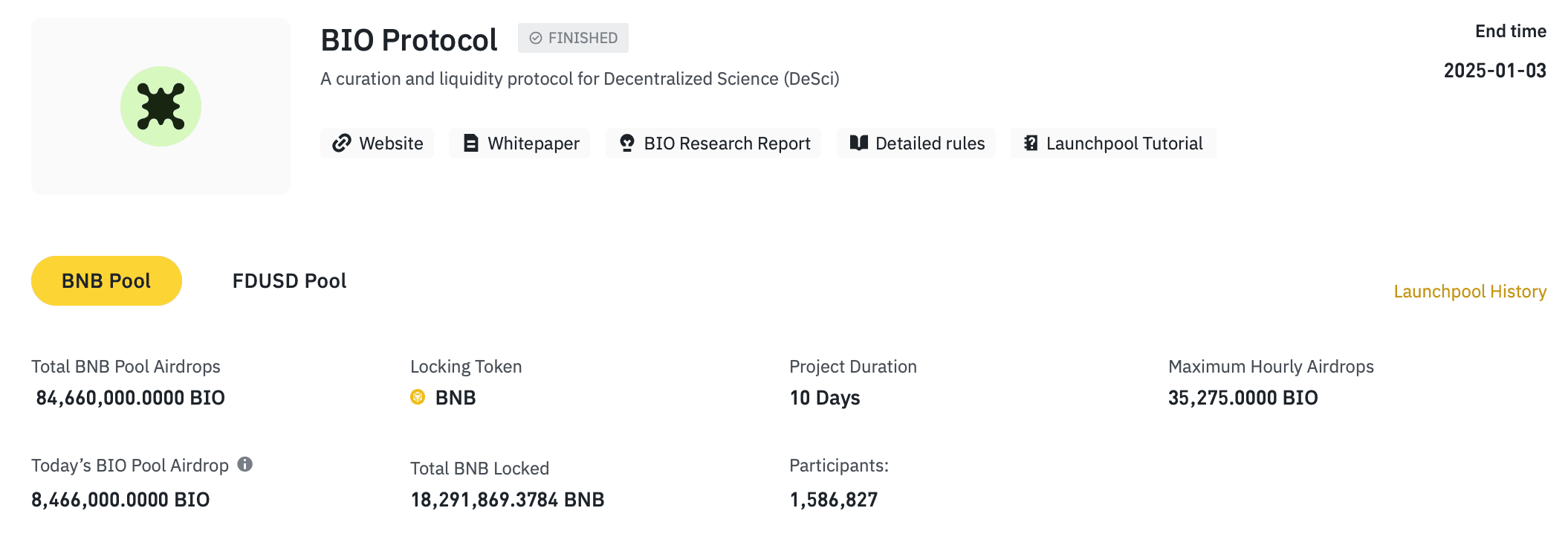

A Look At Binance Launchpool Projects. Image via Binance

A Look At Binance Launchpool Projects. Image via BinanceWhat Is Binance Launchpool?

Binance Launchpool is a staking-based token distribution platform that allows users to earn newly launched tokens by locking their existing assets. Unlike Binance Launchpad—where users have to commit BNB to purchase tokens—Launchpool enables participants to farm new assets passively.

The key difference between Launchpad and Launchpool is that no upfront purchase is required. Instead of buying tokens, users earn them by staking BNB, stablecoins, or other supported assets into liquidity pools. The more you stake, the more rewards you receive, making it a low-risk way to gain exposure to new projects.

How Binance Launchpool Works?

Participating in Binance Launchpool is straightforward, and unlike Launchpad, it offers greater flexibility when it comes to accessing funds. Here’s how it works:

Step 1: Staking Your Assets

- Users can choose a project currently listed on Binance Launchpool.

- Supported assets typically include BNB, stablecoins like FDUSD, or other tokens.

- Users can allocate funds to a specific staking pool, committing their assets to farm new tokens.

Step 2: Earning Rewards

- Once staked, users begin earning new tokens immediately, based on the amount they’ve locked.

- Rewards are distributed proportionally—the more you stake, the more tokens you receive.

- Farming periods usually last a few weeks, but users can claim their rewards daily.

Step 3: Claiming and Unstaking Assets

- Users can withdraw earned tokens at any time, rather than waiting until the farming event ends.

- If needed, participants can unstake their original assets anytime, giving them full control over their funds.

- Once the farming period concludes, the newly acquired tokens are listed on Binance for trading.

Benefits of Binance Launchpool

Binance Launchpool offers several advantages that make it an appealing alternative to traditional token sales.

Earn New Tokens Without Direct Investment

- Unlike Launchpad, where users purchase tokens, Launchpool allows users to farm new assets by simply staking their existing holdings.

Flexibility to Unstake Funds Anytime

- Unlike many staking or farming platforms that lock assets for fixed periods, Launchpool offers full control over staked funds.

- Users can unstake their assets at any time, allowing them to reallocate funds elsewhere if needed.

Fair Token Distribution Model

- Tokens are distributed proportionally, ensuring that all participants receive a fair share based on their staked amount.

Access to Vetted Projects with Binance’s Backing

- Just like Binance Launchpad, Launchpool only features projects that have been thoroughly vetted by Binance’s investment and listing teams.

- This adds a layer of trust and legitimacy, reducing the risk of fraudulent or low-quality projects.

Global Exposure and Liquidity Post-Farming

- Once the farming period ends, the tokens are listed on Binance, providing liquidity and multiple trading pairs.

- This ensures that newly launched assets are available for trading without the delays often seen in smaller token launches.

Key Differences Between Binance Launchpad and Binance Launchpool

Now that we’ve covered both Binance Launchpad and Binance Launchpool, you might be wondering: Which one is better for me?

The truth is, both platforms serve different purposes. Binance Launchpad is designed for users looking to invest in early-stage projects by purchasing tokens through an Initial Exchange Offering (IEO). On the other hand, Binance Launchpool is ideal for those who prefer a low-risk, passive approach by farming tokens through staking, without the need for direct investment.

Here’s a breakdown of the key differences:

| Feature | Binance Launchpad | Binance Launchpool |

|---|---|---|

| Token Acquisition | Purchased via IEO | Earned through staking |

| Participation Method | Commit BNB to the token sale | Stake BNB or other supported assets |

| Risk Level | Higher (price volatility) | Lower (no direct purchase required) |

| Flexibility | BNB is locked during sale | Funds can be unstaked anytime |

| Liquidity After Launch | Immediate listing on Binance | Farming rewards, then listing |

| Earning Potential | Depends on token price movement | Earn fixed rewards based on staked assets |

| Best For | Users willing to invest in early-stage projects | Users looking to earn new tokens passively |

How to Access Binance Launchpad & Launchpool?

Getting started with Binance Launchpad and Launchpool is simple, as both platforms are integrated within Binance’s ecosystem. Here’s how you can access them:

1. Log in to your Binance account

- Ensure you have a verified Binance account before participating in any token sale or staking event.

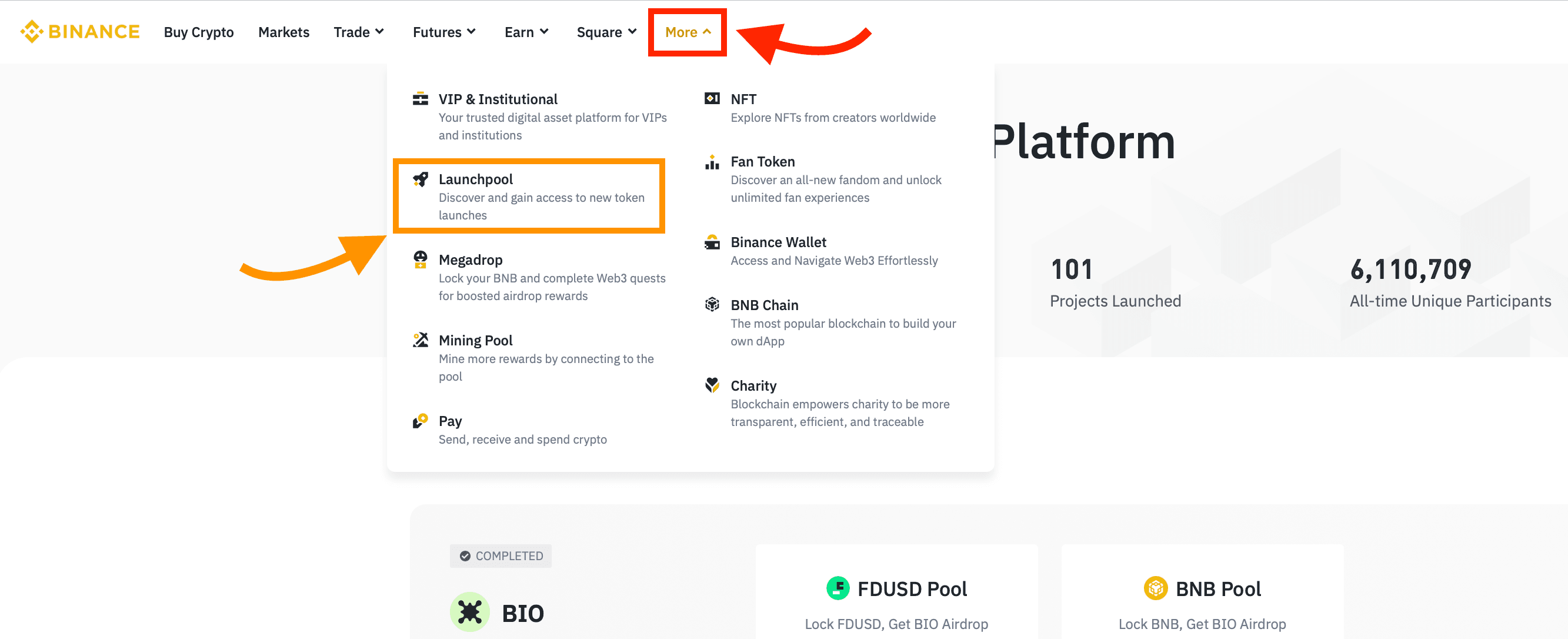

2. Navigate to “Launchpad & Launchpool”

- On the Binance homepage, hover over "More" in the top menu.

- Click on “Launchpool" to access the token launch platform.

Navigating To Launchpool. Image via Binance

Navigating To Launchpool. Image via Binance3. Explore available projects

- The page will display any ongoing or upcoming token sales for Launchpad and ongoing Launchpools. Note that there haven’t been any active token sales since 2023.

How to Use Binance Launchpad

1. Ensure You Have a Binance Account & Hold BNB

- Since Binance Launchpad uses a subscription model, you’ll need to hold BNB in your Binance wallet for a specific period before the token sale begins.

2. Check for Active or Upcoming Token Sales

- Look for any upcoming token sales and review project details, including tokenomics, sale structure, and participation rules.

3. Participate in the Token Sale

A Launchpad sale follows a structured process consisting of three key phases:

- BNB Holding Calculation Period

- Binance tracks your daily BNB balance over a specific time frame.

- Binance tracks your daily BNB balance over a specific time frame.

- Subscription Period

- Once the calculation period ends, you’ll need to commit your desired amount of BNB to the token sale.

- Binance temporarily locks your BNB for the duration of the event.

- Once the calculation period ends, you’ll need to commit your desired amount of BNB to the token sale.

- Final Token Distribution

- Binance allocates tokens based on the total committed BNB and overall demand.

- Any unused BNB is refunded, and the new tokens are automatically credited to your Binance spot wallet.

- Once the token sale is complete, the newly acquired tokens are listed on Binance for trading.

- Binance allocates tokens based on the total committed BNB and overall demand.

How to Use Binance Launchpool

1. Ensure You Have a Binance Account & Supported Assets

- To use Launchpool, you need a verified Binance account.

- Make sure you have BNB, FDUSD, or other supported tokens in your Binance wallet, as these are typically required for staking.

2. Find an Active Launchpool Project

- Navigate to “Launchpool” from the Binance homepage.

- Scroll down to the Launchpool section, where you’ll see active and upcoming farming opportunities.

- Click on a project to view details such as farming period, rewards, supported tokens, and APY.

Launpool Project Parameters. Image via Binance

Launpool Project Parameters. Image via Binance3. Choose a Staking Pool & Allocate Funds

- Each project has multiple staking pools (e.g., BNB pool, stablecoin pool, or other token pools).

- Select a pool and enter the amount of assets you want to stake.

- Your funds will be locked for farming, but you can unstake them anytime if needed.

4. Earn & Claim Rewards

- Once your assets are staked, you’ll start earning new tokens in real time.

- Rewards are distributed proportionally based on the amount staked.

- You can claim your rewards anytime, rather than waiting for the farming event to end.

5. Unstake & Withdraw Funds

- Unlike many staking programs, Binance Launchpool offers full flexibility—you can unstake your funds at any time.

- Once the farming period ends, your earned tokens and staked assets will be automatically credited to your Binance spot wallet.

Closing Thoughts

Binance Launchpad and Launchpool have redefined how crypto projects raise funds and distribute tokens, offering structured, secure, and efficient alternatives to traditional fundraising models.

For those looking to invest early in promising projects, Binance Launchpad provides a vetted and transparent way to participate in Initial Exchange Offerings (IEOs). Meanwhile, Binance Launchpool caters to users who prefer a low-risk, passive approach, allowing them to farm new tokens simply by staking their assets.

Both platforms benefit from Binance’s extensive security measures, global liquidity, and reputation, making them trusted choices for both investors and blockchain startups. However, while Binance applies a strict vetting process, it’s important to remember that no investment is without risk.

As always, DYOR (Do Your Own Research) before committing to any token sale or staking opportunity. Crypto markets can be volatile, and understanding a project’s fundamentals is crucial to making informed investment decisions.