- Founded

- 2018 ( About Bybit )

- Founder

- Ben Zhou ( About Bybit )

- Headquarters & footprint

- Commonly positions operations around Dubai/UAE and global reach; entity structure can be jurisdiction-dependent ( About Bybit ).

- Active users

- Publishes large user-base claims on corporate pages; treat as company-reported rather than independently verified ( 80M users announcement ).

- Core audience

- Pro & derivatives traders; fee framing foregrounds perpetuals/futures and active workflows ( Fees That You Need to Know ).

- Market role

- Frequently ranks highly across industry dashboards; rankings vary by methodology/timeframe. CoinGecko’s market-share research lists Bybit among top venues ( CoinGecko CEX market share report ).

Choosing a crypto exchange in 2026 is not about hunting for one “best” platform. It’s about picking the one that actually fits how you trade.

Bybit and Kraken get compared a lot because they optimize for different priorities. Bybit is built for active traders who care about fast execution, deep derivatives tools, and competitive maker-taker fees. Kraken, on the other hand, leans into trust and durability, with a long operating track record, strong account security, and a clearer compliance paper trail.

In this guide, we’ll break down where each exchange shines, where the trade-offs show up in real-world costs and access, and which type of trader each platform makes the most sense for.

Quick Verdict

Kraken is the security-first default, while Bybit is the active-trader value play (eligibility and risk discipline required).

Kraken: Stronger disclosures + client-verifiable Proof of Reserves, plus a more US-friendly posture for many users.

Bybit: Lower published fees and derivatives-first tooling for frequent traders, but more jurisdiction and platform-risk to manage.

Who Should Choose Which?

Choose Bybit if you want:

- Lower published baseline spot maker–taker fees for frequent order-book trading

- Derivatives-first workflows, deeper perps/options focus, and active-trader tooling

- High leverage products (where eligible) and fast execution-oriented UI

- Copy trading/bots and other “pro feature density” in one venue

- A platform you treat as active trading infrastructure (not long-term custody)

Choose Kraken if you need:

- A more conservative default with deeper disclosures and a longer operating history

- US-friendly onboarding and clearer fiat rail documentation (fees, minimums, timelines)

- Client-verifiable Proof of Reserves workflow with stated limitations

- Security-first account posture and risk-reduction controls for long-term holders

- Operational predictability for compliance-minded or institutional workflows

Comparison Table

| Criterion | Bybit | Kraken | Winner |

|---|---|---|---|

| Overall Rating | 5.1 / 10 | 7.2 / 10 | Kraken |

| Total Users (company-reported) | “80M users” claim | “15M+ clients globally” claim | Depends (self-reported) |

| Best For | High-leverage & active traders | Security-first & US-based users | Depends (your priorities) |

| Fees & Value | 8.2 / 10 | 6.6 / 10 | Bybit |

| Security & Trust | 5.4 / 10 | 8.4 / 10 | Kraken |

| Trading Tools | 8.7 / 10 | 7.1 / 10 | Bybit |

| Ease of Use | 6.5 / 10 | 6.9 / 10 | Kraken (slightly) |

| Customer Support | 5.8 / 10 | 6.8 / 10 | Kraken |

"Data verified Feb. 4, 2026."

Why Compare Bybit and Kraken in 2026?

Bybit and Kraken get cross-shopped because they’re built to solve different problems for different traders.

Bybit is usually the pick for active traders who want deep derivatives, leverage, fast execution, and competitive maker-taker pricing. Kraken, on the other hand, tends to suit users who care more about track record, a clearly documented compliance approach, and security controls designed to lower the risk of account takeovers. history, clearly documented compliance posture, and security controls designed to reduce account-takeover risk.

Take a look at our detailed reviews of Bybit and Kraken.

Bybit And Kraken are Built to Solve Different Problems For Different Traders

Bybit And Kraken are Built to Solve Different Problems For Different TradersRegulation, Proof of Reserves & Leverage Scrutiny

In 2026, exchange selection is less about “best overall” and more about what’s legally available to you and what you can verify.

Regulation is getting more standardized in major markets, especially across Europe as the Markets in Crypto-Assets regime gets operationalized. European Securities and Markets Authority published a supervisory briefing aimed at harmonizing authorization expectations for crypto-asset service providers under MiCA, which is part of why exchanges are tightening product gating and disclosures.

Proof of reserves (PoR) has become “baseline expectation,” but PoR is still not the same as a full financial audit. Kraken frames PoR as a client-verifiable cryptographic process with stated shortcomings and a clear verification flow.

Leverage scrutiny is rising because leverage products amplify consumer-risk outcomes and tend to draw regulator attention. That usually shows up as stricter eligibility checks, changing product availability, and tighter disclosures.

Market Positioning Contrast

Bybit = derivatives-first, offshore, cost efficiency: Product surface area and fee framing emphasize perpetuals/futures and active trading. But availability is explicitly shaped by excluded jurisdictions.

Kraken = regulated, transparent, fiat-friendly: Kraken leans regulated, transparent, and fiat-first. Its jurisdiction-by-jurisdiction disclosures and funding-rail docs make it easier to understand what’s available where, and what to expect when depositing or withdrawing fiat.

Our Review Methodology & Disclosure

This section explains exactly how this comparison was built, what sources were used, and where readers should do their own verification. Exchange fees, features, and regional access can change quickly, sometimes without notice, so treat everything here as point-in-time guidance.

How We Evaluated Both Exchanges

Approach: Desk-based review using official exchange documentation and published tables.

What we used:

- Fee schedules and explainers

- Kraken’s published cash funding tables (deposit/withdrawal rails, fees, processing guidance)

- Official app store listings (iOS and Android) for Bybit and Kraken Pro to confirm availability and platform context

What This Review Covers

- Spot vs derivatives fee structure (maker/taker tiers and product differences)

- Known cost variables that can change the “real price” (Instant Buy vs Pro, spread, funding, borrowing/rollover fees)

- Proof of Reserves approach and transparency notes (what each portal claims, what it does and doesn’t prove)

- Regulatory and jurisdictional disclosures (where each exchange says it operates, and who it says it’s registered with)

What You Should Verify Before Using Either Exchange

Because outcomes can vary based on region, account type, payment method, and market conditions, readers should confirm the following inside their own account before depositing meaningful funds:

- Your live fee tier and the exact product fee table applied to you

- Withdrawal rules, limits, and expected processing windows for your funding rails

- KYC requirements and how long verification typically takes in your region

- Liquidity and slippage for your specific pairs and order sizes (test with small, controlled orders)

- Support responsiveness during busy periods (important around volatility events)

Limitations & Bias Disclosure

- Jurisdiction differences: Availability and feature access can vary by country, so eligibility should be confirmed first using each exchange’s restricted/regulated region pages.

- Market variability: Slippage, spreads, and funding costs are dynamic and can dominate fees depending on conditions.

- Affiliate transparency: This article may include affiliate links. If you use them, we may earn a commission at no extra cost to you. We do not accept payment in exchange for rankings or coverage, and our opinions remain our own.

Side-by-Side Comparison

If you just want the “what matters most” view, this section compresses fees, transparency, and compliance posture into one scan-friendly table.

Bybit vs Kraken Comparison Table

| Feature | Bybit | Kraken | Overall winner |

|---|---|---|---|

| Active user count | Company-reported “80M users” claim. (Celebrate Bybit’s 80M users announcement) | “More than 15 million clients globally” claim in Kraken press materials. (Kraken press release page) | Depends (self-reported) |

| Spot trading fees (typical entry tier) | 0.10% maker, 0.10% taker (non-VIP) | Maker/taker starts higher on Kraken Fee Schedule for low-volume tiers. | Bybit |

| Perpetual / futures fees (headline) | 0.01% maker, 0.06% taker (non-VIP) | Derivatives fee schedule starts at 0.0200% maker / 0.0500% taker on Kraken Fee Schedule. | Depends (product + tier + holding time) |

| Proof of reserves approach | PoR portal with reserve snapshots and account-level verification tools. (Bybit Proof of Reserves) | PoR portal with client self-verification flow and stated shortcomings. (Kraken Proof of Reserves) | Kraken |

| Mobile app ratings (iOS + Android)* | iOS: 4.7/5 (46K ratings); Android: 4.4/5 (1.39M reviews) | iOS: 4.7/5 (24K ratings); Android: 4.2/5 (46.2K reviews) | Depends |

| Welcome bonuses | Promos vary by region and change frequently (verify during onboarding). | Referral promos vary by region and change frequently (verify during onboarding). | Depends |

| Regulatory bodies (named) | Examples of named approvals/contexts include the UAE Securities and Commodities Authority (SCA) license claim in Bybit’s announcement. (Bybit SCA license announcement) | Named registrations/disclosures include FinCEN MSB and UK FCA registration in Kraken Legal Disclosures, plus FINTRAC/AUSTRAC coverage on Where is Kraken licensed or regulated?; NYDFS is the New York licensing framework context. (NYDFS Virtual Currency Business Licensing) | Kraken |

*App store ratings and review counts change over time; treat them as point-in-time signals, not guarantees.

Data verified Feb. 4, 2026.

Exchange Background & Market Positioning

Before fees and features, it helps to understand what each platform is optimizing for.

- Founded

- 2011 ( Kraken About )

- Founder

- Jesse Powell ( Kraken About )

- US roots

- Positions roots in the United States and operates with extensive US and international disclosures ( Kraken About ).

- Longevity advantage

- 13+ years across multiple market cycles in 2026 is a meaningful trust signal for risk-sensitive users.

- Institutional & compliance focus

- Publishes jurisdiction disclosures and named registrations ( Kraken Legal Disclosures ).

- Industry trust signals

- Emphasizes “don’t trust, verify” via a client-checkable Proof of Reserves workflow.

Fees & Real Cost Analysis

This section is about what you actually pay in the real world, where the interface you use (simple buy vs Pro), your maker/taker mix, and holding time can matter as much as the headline fee.

Bybit fee structure

Spot, perpetuals/futures, and options fees

According to Bybit’s Trading Fee Structure page, the base (VIP 0) rate for spot (crypto-crypto) starts at 0.1000% maker / 0.1000% taker. On perpetuals and futures, the same schedule lists 0.0200% maker / 0.0550% taker, while options start at 0.0200% maker / 0.0300% taker. Bybit also flags that fee rates can differ depending on where you’re based, so the most dependable number is what you see inside your account on the My Fee Rate view.

One detail worth spelling out for readers: Bybit’s Trading Fee Structure is the baseline schedule, but Bybit also maintains product-specific fee tables in some cases (for example, specialized trading zones), which is why you may occasionally see different “default” rates mentioned elsewhere.

VIP tiers

Bybit’s VIP program reduces fees as users qualify through asset balance or 30-day volume, using whichever route places them at a higher tier. Bybit also notes that VIP status refreshes daily at 7:00 AM UTC, and the fee rate applied is based on your VIP level at the moment the order is placed.

In Bybit’s published table, VIP 0 starts at 0.1000% / 0.1000% on spot (maker/taker) and 0.0200% / 0.0550% on perps/futures (maker/taker). Moving up to VIP 1 brings spot down to 0.0675% maker / 0.0800% taker, and perps/futures down to 0.0180% maker / 0.0400% taker, while options at VIP 1 list 0.0150% maker / 0.0200% taker. At the top end, Supreme VIP lists spot at 0.0300% maker / 0.0450% taker, perps/futures at 0.0000% maker / 0.0300% taker, and options at 0.0050% maker / 0.0150% taker.

Funding rates explained

For perpetuals, trading fees are only part of the cost picture. The other moving piece is funding, which can be paid (or received) repeatedly as long as a position stays open. Bybit walks through the math in its Funding fee calculation article, where it defines Funding Fee = Position Value × Funding Rate. For linear contracts, Bybit explains that Position Value = Quantity × Mark Price.

Liquidation and other “hidden” costs

Bybit states in its Bybit Fees That You Need to Know explainer that it does not charge liquidation fees for perpetuals and futures trading. Where liquidation-related fees do appear is on other product lines, Bybit lists a 2% liquidation fee for Spot Margin Trading / Crypto Loans and 0.2% for Options (where applicable).

Kraken and Kraken Pro fees

Kraken vs Kraken Pro distinction

Kraken makes a clear separation between simple purchase flows and order-book trading. On the standard Kraken experience, the Kraken pricing page describes a fixed 1% fee for instant buy/sell/convert, and Kraken’s Instant Buy FAQ also notes that a spread can be included in the quoted price depending on the transaction.

On Kraken Pro, fees shift to a volume-based maker–taker schedule. Kraken publishes the full ladder on its fee schedule, where the headline tier begins at $0+ (30-day volume): 0.25% maker / 0.40% taker, then steps down with volume, reaching 0.00% maker / 0.10% taker at $10,000,000+, with takers listed at 0.08% at $100,000,000+ and 0.05% at $500,000,000+.

Kraken also points out on the same fee schedule page that Instant Buy volume doesn’t count toward the 30-day volume tiers used for Kraken Pro pricing. For certain lower-liquidity pairs, Kraken also references maker incentives that can result in maker rebates under specific conditions.

Margin vs futures fees

Kraken’s margin trading materials describe margin costs as an opening fee plus a rollover fee that applies while a position remains open. Kraken explains that the opening fee typically ranges from 0.01% to 0.05% (pair-dependent), with a rollover fee of the same amount every four hours as long as the position stays open.

For derivatives, Kraken publishes a separate maker–taker schedule in its support documentation. The derivatives fee schedule lists fees starting at 0.0200% maker / 0.0500% taker, stepping down at higher volume tiers, and showing negative maker fees (rebates) at certain levels, meaning eligible makers can receive a rebate instead of paying a fee.

Fiat deposit and withdrawal costs

Kraken publishes detailed tables for cash rails, minimums, fees, and processing times in its support center. For USD funding, Kraken’s cash deposit options page lists ACH (Plaid) with a $1 minimum, no deposit fee, and “near-instant” processing, alongside a 7-day withdrawal hold for those deposits. The same cash deposit options table lists debit card deposits with a $10 minimum and a fee of $0.25 + 3.75%. For withdrawals, Kraken maintains a separate set of rails and fees on its cash withdrawal options page.

Staking as a cost offset

Kraken states in its staking overview that there are no transaction fees to stake or unstake; instead, Kraken earns by taking a commission from the rewards. That same staking overview lists a 30% commission for Flexible staking and Auto Earn, and it also publishes bonded staking commission tiers based on AUM: 25% for $0–$1M, 20% for $1M–$5M, 10% for $5M–$50M, 5% for $50M–$100M, and 0% for $100M+. Kraken also notes that staking availability can vary by region and by asset.

Real Trading Cost Scenarios

Below are modeled examples using published spot taker fees to isolate trading fees (not spreads, slippage, funding, or borrowing). Rates are from Bybit “Fees That You Need to Know” and “Kraken Fee Schedule.”

Assumptions:

“Round trip” = buy then sell (two fee events).

Annual notional = trade size × trades per period × number of periods.

Taker execution assumed for simplicity.

| Trader profile (assumption) | Annual notional traded | Bybit spot taker (0.10%) | Kraken Pro spot taker (0.40% at low tier) |

|---|---|---|---|

| Casual: 1 round trip/week on $1,000 (2 trades/week) | $104,000 | $104 | $416 |

| Active: 1 round trip/day on $5,000 (2 trades/day) | $2,600,000 | $2,600 | $10,400 |

| Very active: 5 round trips/day on $5,000 (10 trades/day) | $13,000,000 | $13,000 | $52,000 |

Funding rate impact

Funding can dominate fees for perpetuals if you hold positions through multiple funding timestamps. Bybit describes how funding is calculated and exchanged on schedule in Introduction to Funding Rate.

Quick example (math only, not a prediction):

A $100,000 perp position with a 0.01% funding rate would pay:

$100,000 × 0.0001 = $10

Since funding changes by market and contract, don’t “set and forget” perps. Check the live funding rate and recent funding history before holding a position overnight or longer.

Slippage considerations

Slippage is the gap between expected execution price and actual fills, and it becomes more visible when order size is large relative to the order book.

Kraken’s documentation explicitly distinguishes order-book trading from simplified purchase flows; your cost basis can differ substantially between “simple” buys and Pro order placement.

The practical implication:

- Order-book trading can reduce “embedded” spread costs but still faces slippage if the book is thin.

- Simplified flows are easier but can raise effective cost versus Pro execution for frequent traders.

Fee Verdict by Trader Type

Casual

If you reliably use Pro/order-book trading, Bybit’s published spot taker fee is structurally lower than Kraken Pro’s lowest-volume taker tier (based on published schedules). If you tend to use simplified purchase flows, Kraken’s simplicity may reduce mistakes but can increase cost per trade.

High-volume

Both platforms discount fees with volume/tier progression, but the decision shifts from “headline taker rate” to execution quality, liquidity, and product mix, especially where funding or borrowing dominates.

Institutional

Fees rarely stand alone. Kraken’s jurisdictional disclosures and published banking rails can reduce operational uncertainty for regulated entities, while Bybit’s product depth may appeal to active derivatives desks, but eligibility and legal structure require careful review.

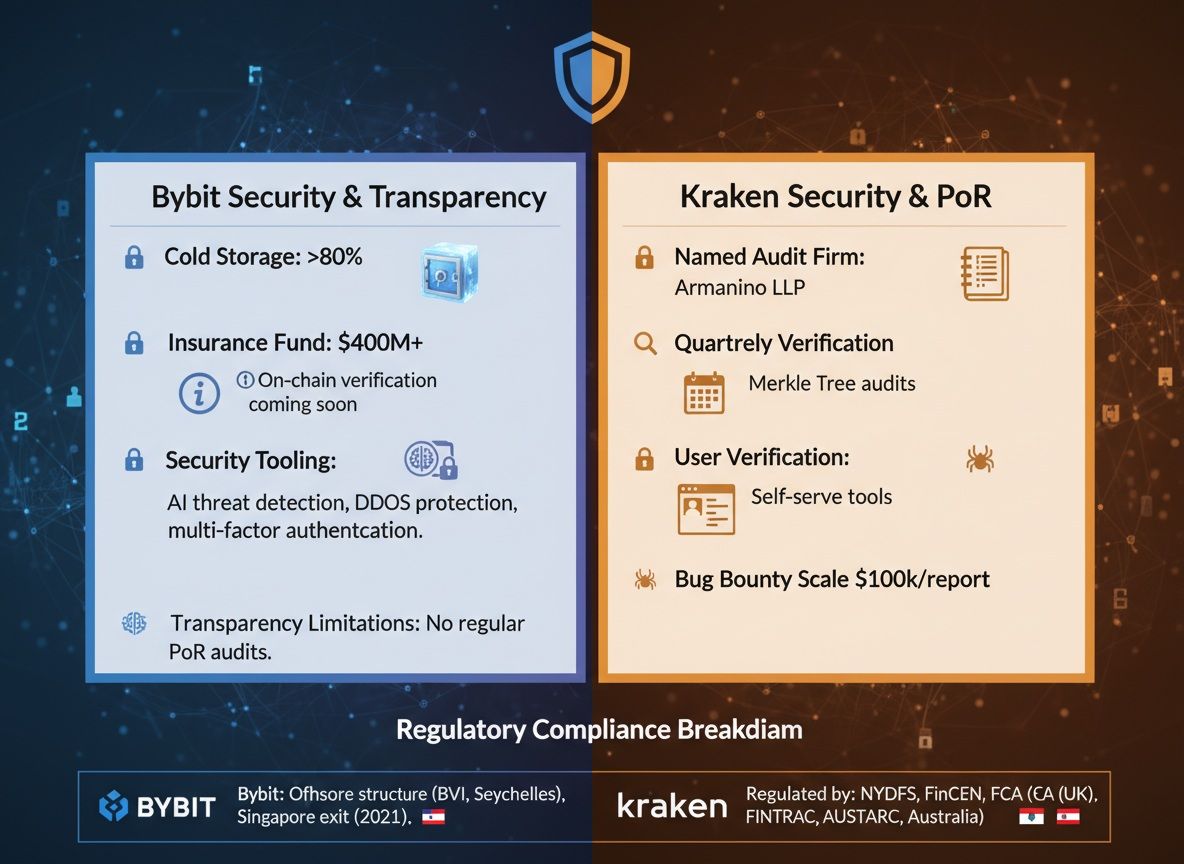

Security, Proof of Reserves & Regulation

This section separates three things that often get mixed up: account security controls, proof-of-reserves transparency, and regulatory/compliance footprint.

Both Exchanges Utilize Industry-standard Cold Storage And Two-factor Authentication

Both Exchanges Utilize Industry-standard Cold Storage And Two-factor AuthenticationBybit Security Architecture

Cold storage %

Bybit states it stores the “vast majority” of user funds offline in cold wallets, but it does not provide a precise percentage in that disclosure.

Insurance fund (with verification notes)

Bybit describes its derivatives insurance fund as a backstop for losses when liquidations execute worse than bankruptcy price, and it states the balance is viewable and updated daily at 12AM UTC.

Security tooling

Bybit documents anti-phishing code setup and withdrawal address controls in its help center.

Transparency limitations

Bybit maintains a PoR portal and publishes reserve snapshots, but PoR is still point-in-time and scope-limited. Bybit Proof of Reserves.

Kraken Security & Proof of Reserves

Named audit firm

Kraken has named The Network Firm in its PoR communications.

Quarterly verification process

Kraken has publicly committed to a quarterly PoR cadence.

How users verify reserves themselves

Kraken’s PoR portal provides a client verification flow and also lists shortcomings and future improvement notes.

Bug bounty scale

Kraken’s bug bounty page lists published payout tiers.. Kraken also documents account-hardening controls like Global Settings Lock and Master Key.

Regulatory Compliance Breakdown

Kraken: NYDFS, FinCEN, FCA, FINTRAC, AUSTRAC

Kraken’s disclosures cite the following registrations: Payward Interactive, Inc. as a FinCEN Money Services Business, and Payward Limited as a UK FCA-registered cryptoasset business.

Kraken also publishes jurisdictional licensing/availability notes, including New York availability constraints. New York’s primary licensing framework is the NYDFS virtual currency licensing regime.

Bybit: Offshore structure, Singapore exit context

Bybit publishes an explicit restricted jurisdictions list including the United States and Singapore.

For Singapore context, Monetary Authority of Singapore clarified that from 30 June 2025, DTSPs serving only customers outside Singapore still require licensing under the DTSP regime and licensing is set at a high bar.

Security Comparison Table

| Security / Transparency item | Bybit | Kraken | Verification notes |

| Cold storage disclosure | States “vast majority” stored offline; no precise % in the cited disclosure. | Not expressed as a single “cold %” claim in the sources used here. | Treat “cold %” as not precisely disclosed unless a clear % is published. |

| Account takeover protections | Anti-phishing code; withdrawal address controls. | Global Settings Lock + Master Key (account-hardening). | Kraken’s GSL/Master Key are explicitly positioned as “last-line” defenses. |

| Insurance / backstop mechanisms | Derivatives insurance fund with daily balance update notes. | Not framed as an exchange-wide insurance fund in the sources used here. | Insurance funds are market-structure tools, not blanket guarantees. |

| Proof of reserves | PoR portal with reserve snapshot framing. | PoR portal with client verification flow + shortcomings. | PoR ≠ full financial audit; both are point-in-time and scope-limited. |

| Named third party for PoR | PoR portal exists; third-party attestations vary by snapshot. | The Network Firm named in Kraken PoR communications. | Treat as attestation/examination context, not a “security audit.” |

| Regulatory transparency | Restricted jurisdiction list is central to access. | Detailed jurisdiction disclosures + named regulators in disclosures. | Availability is jurisdiction-dependent for both; Kraken publishes deeper compliance mapping. |

Available Markets & Trading Products

This is the “what can I trade here, and how do those products behave under stress?” section, because access and mechanics often matter more than UI.

Spot Trading

Coin counts

Counts change frequently. As a point-in-time snapshot, CoinGecko lists Bybit with a published “coins” and “pairs” figure on its exchange profile. CoinGecko also lists Kraken’s “coins” and “pairs” figure on its exchange profile.

Liquidity depth

Liquidity is pair-specific and time-dependent. If you trade size, you should test with controlled limit orders in your target pairs.

Fiat pairs

Kraken is more explicitly fiat-rail-forward, publishing cash deposit/withdrawal tables and processing-time guidance. Bybit offers fiat deposit/buy flows, but available rails vary by supported countries and payment methods.

Listing standards

Kraken describes legal/compliance standards for listings and EEA whitepaper expectations. Bybit documents token evaluation and delisting mechanics.

Derivatives & Leverage

Exact leverage by asset

Kraken states it offers up to 10x leverage on selected assets and up to 5x across a broader set of margin-enabled markets. It also publishes a detailed table of margin pairs and their maximum leverage.

Bybit leverage is contract- and risk-limit-dependent, but Bybit explicitly references up to 100x leverage on BTCUSDT in its derivatives risk/TP-SL explainer.

Liquidation mechanics

Liquidation depends on maintenance margin, mark price, and risk limits. Bybit’s maintenance margin explainer shows how liquidation is triggered once maintenance margin thresholds are breached.

Settlement types

Bybit describes USDT/USDC perpetuals as linear, cash-settled products and inverse contracts as settled in the underlying coin. Kraken documents how settlement works for derivatives contracts (including how final settlement amounts are calculated and delivered).

Best platform for pro traders

- If your strategy is derivatives-heavy and execution-focused, Bybit’s product emphasis and fee framing can be attractive.

- If you want clearer compliance mapping and a more documented operational footprint, Kraken’s disclosures tend to be more explicit.

Passive & Advanced Features

Staking

Kraken documents staking mechanics and its commission model. Bybit offers earn/passive products that vary by region and eligibility; verify availability during onboarding.

Copy trading

Bybit offers copy trading features and documentation.

Bots

Bybit offers trading bots (e.g., grid/DCA-style tools).

Launchpads

Bybit runs launch-style event pages that change over time and are often region-gated.

NFTs

NFT marketplace offerings across exchanges have shifted materially since the 2021–2022 cycle. Treat NFT support as unstable and verify current status before relying on it.

Trading Platforms & User Experience

This section is about the “daily driver” reality: charting, order entry, and the specific controls you’ll use when markets move fast.

Choose Bybit For High-leverage Derivatives And A Massive Selection of Altcoins, Or Kraken For Security And A Fully Regulated Platform

Choose Bybit For High-leverage Derivatives And A Massive Selection of Altcoins, Or Kraken For Security And A Fully Regulated PlatformBybit Platform Walkthrough

UI strengths

Bybit’s derivatives-first workflow is reflected in how quickly you can move between markets, positions, and risk controls.

Charting depth

Bybit documents that its charting interface includes TradingView-powered charts and a set of chart features and indicators. (Bybit Trading Chart FAQ)

Order types

Bybit lists a range of supported order types (with product-specific availability) in its help documentation.

API quality

Bybit publishes API documentation and rate-limit guidance (important for automation)

Kraken & Kraken Pro Experience

Interface split

Kraken separates simplified flows from Kraken Pro’s order-book interface; the fee model and tooling differ depending on which you use.

Desktop vs mobile

Kraken supports Pro-style experiences across devices, but the depth of order entry and analytics typically remains best on desktop terminals.

Pro terminal capabilities

Kraken Pro documents advanced derivatives execution controls like Conditional Close (OTO-style) and bracket-style TP/SL for derivatives.

UX Verdict by Skill Level

Beginners

- Kraken’s simplified experience can reduce mistakes, but it can cost more if you rely on non-Pro flows.

- Bybit’s feature density can overwhelm beginners, especially around leverage and liquidation risk.

Intermediate

- Kraken Pro becomes more attractive once you’re comfortable with order books and want tighter execution control.

- Bybit remains attractive if you want one venue optimized for spot + derivatives workflows.

Advanced

- Bybit often fits high-frequency discretionary traders who live in derivatives markets. It tends to suit high-frequency discretionary traders who spend most of their time in derivatives.

- Kraken can be a better fit for systematic traders who want clear documentation, predictable API behavior, and a more transparent compliance setup.

Deposits, Withdrawals & Payment Methods

Funding rails and withdrawal rules are where many real-world exchange frustrations show up.

Fiat On-Ramps Compared

Kraken’s cash funding tables name processors/banks for certain rails. For example, the deposit table includes ACH via Plaid and wire options via named banks/providers (e.g., FedWire via Dart Bank; SWIFT via Customers Bank; SWIFT via Bank Frick; SEPA providers including Banking Circle, Openpayd, and others listed).

Kraken’s withdrawal table names rails and processors/banks as well (e.g., ACH; FedWire via Customers Bank/Dart Bank; SWIFT via Bank Frick; SEPA via Bank Frick/Banking Circle; SEPA/SEPA Instant via Openpayd).

Bybit supports fiat deposit flows with payment-method availability varying by country (card networks and wallets are region-dependent).

Kraken publishes fee tables by rail and currency; Bybit states fiat deposit fees and processing time are visible when selecting the payment method (How to Deposit Fiat Currencies on Bybit).

Kraken includes processing-time estimates in the cash funding tables and explicitly notes they’re estimates outside of Kraken’s control.

Crypto Transfers & Limits

Confirmation speed is chain-dependent and congestion-dependent, not exchange-dependent.

Some exchanges batch withdrawals depending on network conditions and risk controls; this can affect “time to receive.”

Crypto withdrawal fees and minimums change frequently by asset and network. Best practice: check the withdrawal screen in-app right before sending.

Accessibility Verdict

Best for US

Kraken’s US onboarding and restrictions are explicitly documented.

Best internationally

Bybit can be attractive for derivatives-focused users, but eligibility must be confirmed first because excluded jurisdictions include the United States and Singapore.

Customer Support & Education

Support is hard to measure without ticket testing, so the most responsible approach is to document what exists (channels and resources) and clearly label what was not tested.

Learning Resources

Guides

- Kraken maintains extensive support documentation and education content, including PoR explainers.

- Bybit publishes product and security setup guides in its help center and Learn portal (e.g., How to Set Up the Anti-Phishing Code).

Webinars

Kraken maintains a webinars/events listing.

Bybit runs educational/community programming that can include event-style sessions; availability and cadence change over time.

Pro education

Advanced traders should prioritize exchange docs for order types, margin mechanics, and API rate limits.

Support Verdict

Urgent traders

- If fast withdrawals matter to your strategy, run small deposit/withdrawal tests before committing meaningful capital, especially ahead of major volatility events.

Beginners

- Kraken’s account-hardening features (GSL/Master Key) can reduce the impact of compromised email/password events.

- Bybit’s security tooling helps, but leverage products can increase support dependency if used too early.

User Reviews & Community Feedback

This section uses Trustpilot and G2 because they provide structured review collection and show patterns across many users. No review platform is perfect; focus on recurring failure modes (withdrawal delays, verification friction, account holds), not single anecdotes.

Bybit Is Preferred For Advanced Features And High Leverage, While Kraken Is Favored For Its Superior Security And Regulatory Trust

Bybit Is Preferred For Advanced Features And High Leverage, While Kraken Is Favored For Its Superior Security And Regulatory TrustVerified Bybit User Reviews

Trustpilot examples below are point-in-time and can change quickly. Also, do not assume “Verified/Invited” labels unless they are explicitly shown on the review card. Bybit examples below are presented exactly as labeled on the page.

Jan 7, 2026: 5/5 (no “Invited” label shown on the card in the captured view): Positive sentiment tied to feature convenience (card-related mention).

Jan 4, 2026: 2/5 (no “Invited” label shown on the card in the captured view): Negative sentiment tied to verification/EDD friction.

Jan 29, 2026: 3/5 (shown as “4 days ago” on Feb 2, 2026 view; no “Invited” label shown): Complaint about service restrictions/access.

Jan 27, 2026: 1/5 (shown as “6 days ago” on Feb 2, 2026 view; no “Invited” label shown): Complaint tied to card/charge dispute narrative.

G2 note (scope transparency): during this update pass, we did not find a stable, clearly attributable standalone Bybit.com exchange product page on G2 comparable to Kraken’s product page. For that reason, Trustpilot is treated as the primary structured review source for Bybit in this draft.

Verified Kraken User Reviews

Jan 28, 2026: 5/5 — “Invited” label shown: Positive sentiment tied to ease of use.

Jan 19, 2026: 1/5 — “Invited” label shown: Complaint about withdrawal delays.

Jan 5, 2026: 4/5 — “Invited” label shown: Generally positive with minor UX/expectation notes.

Jun 13, 2022: 3.5/5 — “Current User” + “Validated Reviewer” badges shown (in page legend): Praises token access; notes past latency issues.

Jun 13, 2022: 5/5 — “Current User” + “Validated Reviewer” badges shown (in page legend): Praises ease of setup and buying; notes documentation burden.

Bybit vs Kraken – Who Should Use Which? (Decision Framework)

This practical decision layer considers what's most important given your trading style, custody habits, and jurisdictional constraints.

Quick Decision Table

| If you are… | Better fit | Why |

| Fee-sensitive spot trader (order-book) | Bybit | Lower published baseline spot maker–taker fees (Bybit “Fees That You Need to Know”). |

| High-frequency derivatives trader | Bybit | Derivatives-first UX + published derivatives fees and tooling emphasis. |

| Security-first, long-term holder | Kraken | Account-hardening features like GSL/Master Key + PoR verification workflow (Kraken Proof of Reserves). |

| Fiat-heavy user | Kraken | Transparent banking rails, fees, and processing-time tables (Cash deposit options / Kraken Cash withdrawal options). |

| API-driven / systematic trader | Kraken | Clear API rate-limit guidance and documentation (What are the API rate limits?). |

| Needs maximum clarity on PoR verification | Kraken | PoR portal includes verification flow + stated shortcomings (Kraken Proof of Reserves). |

If/Then Decision Logic

Quick rules of thumb based on typical user priorities.

Kraken is typically the simpler choice for US users because it supports US-facing onboarding and commonly used domestic fiat rails, reducing friction for deposits/withdrawals compared with offshore-focused venues.

Bybit is built around derivatives, so its product flow, risk controls, and fee disclosures tend to be optimized for margin and perpetuals trading rather than “spot-first” usage.

For “park it and protect it” behavior, Kraken emphasizes account-hardening options (for example, extra lock features and security controls) and publishes proof-of-reserves workflows that help users verify holdings.

For frequent entries/exits, Bybit’s trading-first interface and derivatives tooling are typically geared toward fast execution workflows and active trader features.

Final Verdict

If you want the most conservative “default,” Kraken is typically the better choice for users who prioritize security posture, transparency mechanics, and predictable fiat rails. Its Proof of Reserves portal is client-verifiable and includes explicit limitations, and its account-hardening tools (Global Settings Lock and Master Key) are unusually strong advantages in retail exchange security.

Bybit is typically the better value choice for traders who prioritize active trading, derivatives tooling, and low published maker–taker fees, provided they are eligible to use the platform in their jurisdiction and are comfortable managing platform risk actively.

Crypto trading involves risk of loss. Leverage can liquidate positions quickly. Even strong exchanges can experience outages, delays, or policy changes. Use small test transactions, enable strong account security, and consider self-custody for long-term holdings.