The crypto exchange landscape is more competitive than ever. As new platforms emerge and established ones expand their offerings, where to trade, store, or stake your digital assets can have a measurable impact on your portfolio and your overall experience in Web3.

Among the many contenders, Coinbase and Crypto.com continue to rank as two of the most prominent and widely used exchanges in 2026. Both have grown far beyond basic trading interfaces: Coinbase now offers everything from self-custody to advanced analytics, while Crypto.com has evolved into a sprawling crypto-fintech ecosystem complete with its own blockchain, card program and DeFi integrations.

In this article, we compare Coinbase and Crypto.com across the most critical metrics: trading fees, staking programs, wallet offerings, mobile performance, security, regulatory standing, and overall user experience. If you're on the hunt for an exchange to start your crypto journey, this piece is for you.

Key Takeaways

- Coinbase is ideal for beginners and U.S.-based users who value regulatory compliance and a simple, intuitive interface.

- Crypto.com offers lower fees, broader staking options, and a feature-rich ecosystem—best suited for active or international users.

- Coinbase charges higher trading and staking fees but provides strong U.S. oversight and transparency.

- Crypto.com supports more fiat currencies and blockchains, with deeper DeFi integration and rewards for $CRO holders.

- Both platforms provide robust security, mobile apps, and self-custody wallet options tailored to different user needs.

How They Compare

The main difference between Coinbase and Crypto.com is that Coinbase focuses on simplicity and regulatory compliance, while Crypto.com offers lower fees, more staking options, and a broader crypto ecosystem.

| Feature | Coinbase | Crypto.com |

|---|---|---|

| Main Focus | Simplicity & U.S. regulatory compliance | Low fees, staking, and broad crypto ecosystem |

| Trading Fees | Higher fees unless using Advanced Trade | Lower base fees; discounts for $CRO holders |

| User Experience | Beginner-friendly, minimal interface | Feature-rich but more complex |

| Staking & Earn Programs | Up to 35% commission on staking rewards | Lower fees, no $CRO staking fees, higher APYs |

| Wallets | Coinbase Wallet – easy and beginner-friendly | Crypto.com DeFi Wallet – supports more networks & DeFi |

| Security & Compliance | Strong U.S. regulatory alignment | Global licenses; publishes Proof of Reserves |

| Regional Access | Strong U.S. presence | Broader global fiat support |

| Best For | Beginners, streamlined UX, U.S.-based exchange | Cost-sensitive traders, staking/DeFi users, global access |

- Trading Fees: Crypto.com has lower base fees and deeper discounts for $CRO token holders. Coinbase’s fees are higher unless you use its Advanced Trade interface.

- User Experience: Coinbase is more beginner-friendly, with a clean, minimal interface. Crypto.com provides a feature-rich platform but may feel complex for new users.

- Staking & Earn Programs: Coinbase charges up to 35% in commissions on rewards. Crypto.com charges considerably less, doesn’t charge any staking fees for $CRO, and often offers higher APYs.

- Wallets: The Coinbase Wallet is easy to use and ideal for new users. Crypto.com DeFi Wallet supports more networks and integrates with DeFi protocols.

- Security & Compliance: Both offer robust security. Coinbase is stronger on U.S. regulatory alignment; Crypto.com holds more international licenses and publishes Proof of Reserves.

- Regional Access: Coinbase dominates in the U.S., whereas Crypto.com has wider fiat support across Asia, Europe, and other global markets.

Choose Coinbase if you’re just starting out, prefer a streamlined experience, or want a U.S.-based, publicly listed exchange.

Choose Crypto.com if you’re a cost-sensitive trader, interested in staking and DeFi, or want a feature-rich platform with global reach.

Overview of Coinbase

Coinbase was founded in June 2012 by Brian Armstrong, a former Airbnb engineer, and Fred Ehrsam, a former Goldman Sachs trader. The company began operations in October 2012, facilitating the buying and selling of Bitcoin through bank transfers. In April 2021, Coinbase became the first major cryptocurrency company to go public with a listing on the Nasdaq exchange, marking a significant milestone for the legitimacy of the blockchain industry.

Initially headquartered in San Francisco, Coinbase transitioned to a remote-first work culture in 2020. Over the years, Coinbase has achieved several milestones, including launching its own blockchain-based DeFi network called Base and making strategic acquisitions to bolster its growth and resilience.

Learn more about the exchange in the Coinbase Review.

Mission and Market Positioning

Coinbase's mission is to increase economic freedom in the world by providing a user-friendly and regulatory-compliant platform for individuals and institutions to participate in the cryptocurrency market. It positions itself as a well-respected and leading exchange, particularly in the U.S. market, aiming to be an easy entry point for newcomers to the crypto space while also offering advanced trading options for more experienced users through Coinbase Advanced. The platform offers a full suite of solutions for blockchain investing, including a trading terminal, an Earn program, a debit card, an NFT marketplace, and self-custody options.

Regulatory Compliance and Reputation

Regulatory compliance is a cornerstone of Coinbase's operations. The platform states that it complies with all applicable laws and regulations in each jurisdiction where it operates.

- It is licensed as a money transmitter in most jurisdictions and registered as a Money Services Business with FinCEN in the U.S.

- It complies with the Bank Secrecy Act and the USA Patriot Act.

- It also applied for a license under the EU's MiCA regulations.

This commitment to regulation contributes significantly to its reputation as a trusted and secure exchange. While it has been the target of attacks, Coinbase has responded promptly and has not disclosed any successful breaches leading to widespread loss of customer funds. It implements robust security measures like two-factor authentication and cold storage for the majority of user funds.

Target User Base

Coinbase's target user base is broad, encompassing beginners looking for an easy and intuitive platform to buy their first digital assets, as well as more experienced traders who can utilize the advanced trading interface and features. It also caters to institutional investors through services like Coinbase Prime and Coinbase Custody.

The platform offers educational resources like Coinbase Earn to help new users understand the crypto market. While its selection of altcoins is geared more towards mainstream coins than exchanges like KuCoin or Binance, it still offers a diverse range of cryptocurrencies.

Overview of Crypto.com

Crypto.com was established in 2016 in Hong Kong by Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo, initially operating under the name "Monaco." In 2018, the company rebranded to Crypto.com after acquiring the domain name from cryptography researcher Matt Blaze.

Since its inception, Crypto.com has expanded its services to include a comprehensive suite of financial products, such as a cryptocurrency exchange, a DeFi wallet, an NFT marketplace, and the Cronos blockchain ecosystem. As of mid-2024, the platform reported over 100 million users worldwide, reflecting its significant growth in the cryptocurrency industry.

Crypto.com CEO Kris Marszalek | Image via Coindesk

Crypto.com CEO Kris Marszalek | Image via CoindeskMission and Market Positioning

Crypto.com's mission is to accelerate the world's transition to cryptocurrency. The platform positions itself as a comprehensive solution for both retail and institutional investors, offering a wide range of services, including trading, staking, and payment solutions. With strategic partnerships and sponsorships in sports and entertainment, such as the UFC, Formula 1, and the FIFA World Cup, Crypto.com has significantly increased its brand visibility and market presence.

Regulatory Compliance and Reputation

Crypto.com has taken proactive steps to ensure regulatory compliance across various jurisdictions. The company holds multiple licenses and certifications, including ISO/IEC 27001:2022 and PCI DSS v4.0 Level 1 compliance, demonstrating its commitment to security and regulatory standards. In March 2024, the Dutch Central Bank imposed a €2.85 million fine on Crypto.com for compliance shortcomings, which the company is actively appealing. Additionally, in October 2024, Crypto.com filed a lawsuit against the U.S. Securities and Exchange Commission (SEC) after receiving a Wells Notice, challenging the SEC's authority over certain digital assets.

Target User Base

Crypto.com caters to a diverse user base, ranging from beginners to experienced traders and institutional investors. The platform's user-friendly interface and comprehensive educational resources make it accessible to newcomers, while its advanced trading features and wide range of supported cryptocurrencies appeal to seasoned investors.

With a global presence and a focus on expanding services in key markets like the United States, Crypto.com aims to serve a broad spectrum of users in the cryptocurrency space.

How Coinbase and Crypto.com Differ in Features & Offerings

Coinbase and Crypto.com are major exchanges and are stacked with features and offerings. The premise for both is similar: provide every feature a trader may need for centralized trading and sprinkle some DeFi elements on top of ot. Here is an overview of their features.

Trading Platforms and Tools

Coinbase and Crypto.com users appreciate their clean and user-friendly interfaces, which are accessible for novice traders. Both platforms offer a straightforward and streamlined design, with every necessary basic feature available and advanced ones easy to access.

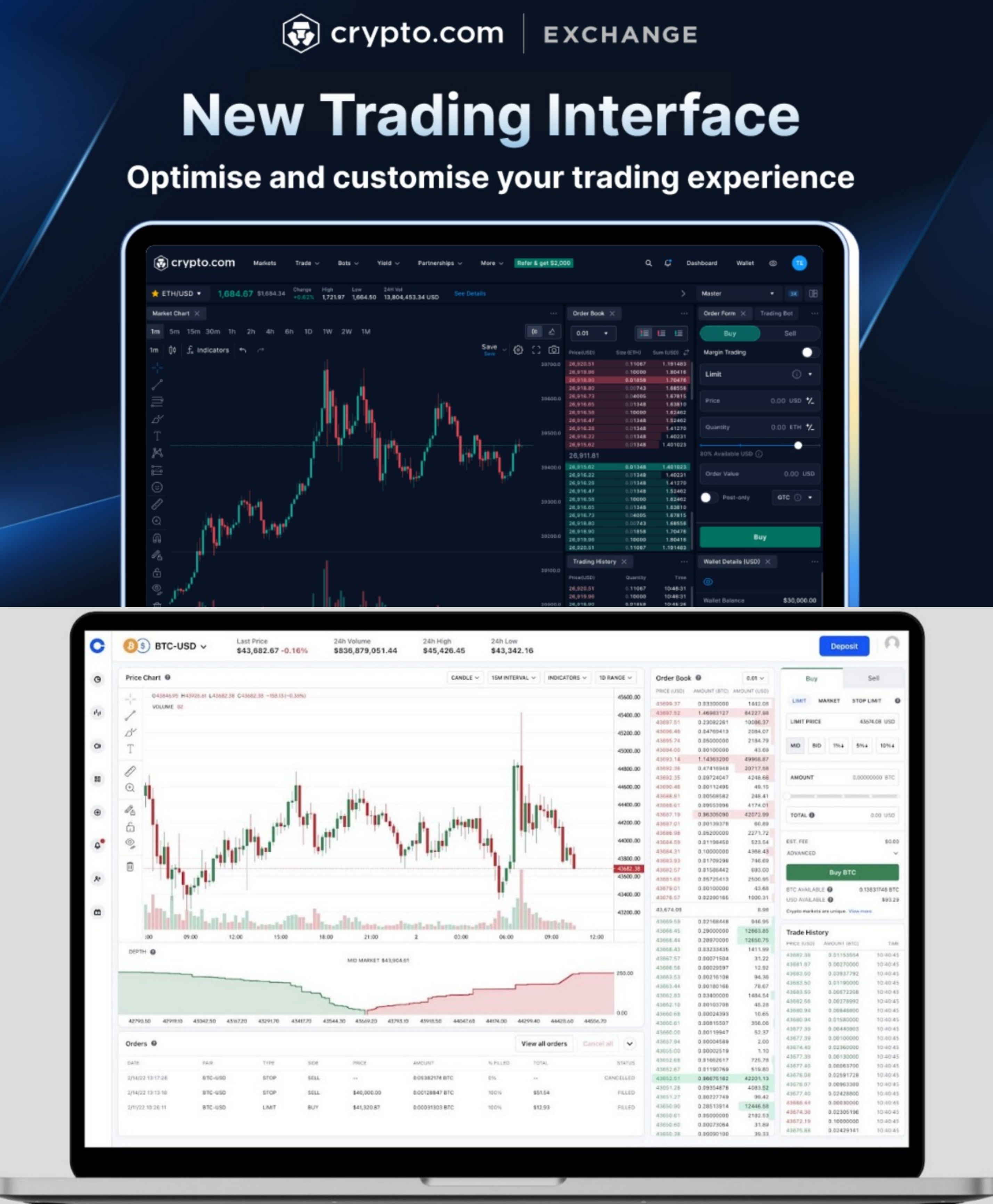

Crypto.com (Top) and Coinbase (Bottom) Trading Interfaces | Image via Crypto.com and Coinbase

Crypto.com (Top) and Coinbase (Bottom) Trading Interfaces | Image via Crypto.com and CoinbaseCore Trading Features Offered by Both Platforms

- Spot Trading: Buy and sell a wide range of cryptocurrencies.

- Market and Limit Orders: Execute trades at current market prices or set specific price points.

- Mobile Applications: Access trading platforms via iOS and Android apps.

- Real-Time Market Data: Monitor live price movements and market trends.

- Security Measures: Implement two-factor authentication (2FA) and other security protocols.

- API Access: Integrate trading functionalities with third-party applications.

Unique Features of Coinbase

- Coinbase Advanced: Offers enhanced tools like interactive charts powered by TradingView, advanced order types, and access to all of the other features offered by Coinbase.

- Automated Trading Bots: Supports automated trading strategies, including Dollar Cost Averaging (DCA) and Grid Trading.

- Coinbase Prime: Provides institutional investors with advanced trading capabilities, custody solutions, and dedicated support.

- Coinbase Wallet: A self-custody wallet allowing users to store their own crypto and explore decentralized apps.

Unique Features of Crypto.com

- VIP Tiering System: Provides lower fees for makers at the first VIP level, with additional discounts available by locking up CRO tokens.

- Crypto.com DeFi Wallet: A non-custodial wallet giving users full control over their private keys and enabling secure storage for various assets.

- Supercharger: Allows users to deposit CRO tokens and earn rewards in other cryptocurrencies.

Fiat Support & Deposit Options

- Coinbase:

- Supported Fiat Currencies: Over 60 fiat currencies, including USD, EUR, and GBP.

- Deposit Methods: Bank transfers (ACH, SEPA), debit cards, Apple Pay, and Google Pay.

- Crypto.com:

- Supported Fiat Currencies: Multiple currencies, including USD, EUR, GBP, AUD, CAD, BRL, TRY, SGD, and AED.

- Deposit Methods: Bank transfers (ACH, SEPA, SWIFT), credit/debit cards, Apple Pay, and Google Pay.

Cryptocurrency On-Chain Withdrawal Support

- Coinbase Withdrawal Capabilities: Supports on-chain withdrawals for all listed cryptocurrencies, including BTC, ETH, and various ERC-20 tokens.

- Crypto.com Withdrawal Capabilities: Supports on-chain withdrawals for a wide range of cryptocurrencies. However, certain EVM chain native tokens (except ETH) from smart contracts may not be automatically credited.

Supported Cryptocurrencies and Fiat Deposits

- Coinbase:

- Cryptocurrencies: Supports over 240 digital assets and 400 trading pairs.

- Fiat Deposits: Accepts deposits in over 60 fiat currencies.

- Crypto.com:

- Cryptocurrencies: Supports over 250 cryptocurrencies, including major tokens like BTC, ETH, CRO, and USDC.

- Fiat Deposits: Accepts deposits in multiple fiat currencies, including USD, EUR, GBP, AUD, CAD, BRL, TRY, SGD, and AED.

Which Platform Offers Better Wallet Security?

Coinbase Wallet

The Coinbase Wallet is a non-custodial wallet allowing users to store and manage various cryptocurrencies and NFTs securely and on-chain. It gives users complete control over their private keys and offers easy access to decentralized applications (DApps) and decentralized finance (DeFi) platforms.

Key Details:

- User-Friendly Interface: Designed with beginners in mind, offering a simple and intuitive user experience.

- DApp and NFT Support: Provides seamless access to a variety of DApps and supports NFT storage and management.

- Security: Incorporates robust security features, including biometric authentication, encrypted backups, and non-custodial private key storage.

- Integration with Coinbase Ecosystem: Allows easy transfers between Coinbase Wallet and Coinbase Exchange accounts.

- Supported Networks: Ethereum and all EVM-compatible chains, such as Avalanche C-Chain and Polygon.

- Adoption: Widely adopted, especially among users already within the Coinbase ecosystem, due to its ease of use and integration capabilities.

Read the Coinbase Wallet Review to learn more about it.

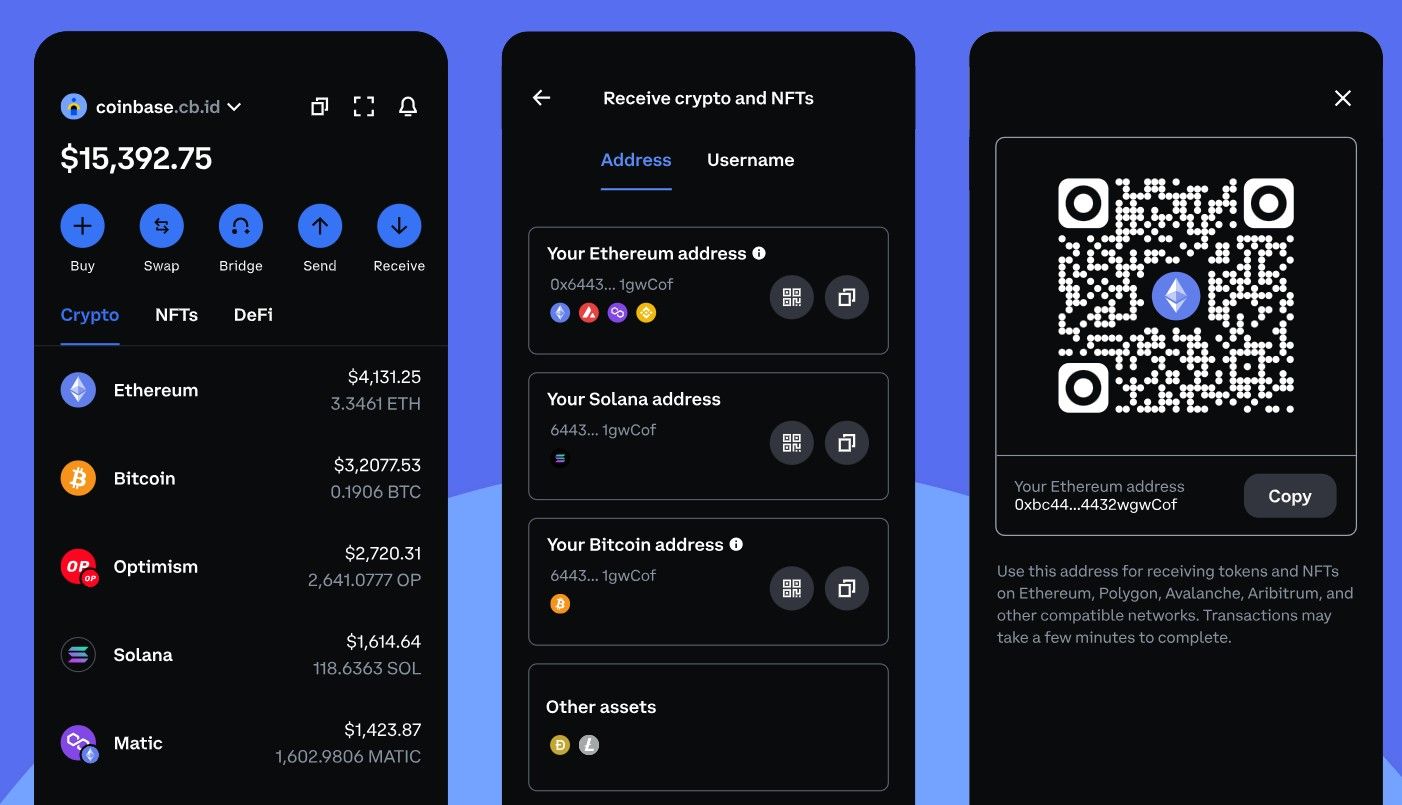

Coinbase Wallet Interface | Image via Coinbase

Coinbase Wallet Interface | Image via CoinbaseCrypto.com DeFi Wallet (Now Crypto.com Onchain)

Crypto.com DeFi Wallet, recently rebranded as Crypto.com Onchain, is a non-custodial wallet that supports 36 blockchains, including Bitcoin, Ethereum, and Solana. It offers both a mobile app and a Chrome browser extension for accessibility.

Key Details:

- Multi-Chain Support: Supports a wide range of blockchains, allowing users to manage diverse crypto assets.

- In-App Swaps and Staking: Enables users to perform token swaps and stake certain cryptocurrencies directly within the app.

- Integration with Crypto.com Exchange: Offers seamless connectivity with the Crypto.com Exchange for buying supported cryptocurrencies.

- Security: Features multi-layer encryption, biometric authentication, two-factor authentication (2FA), and optional hardware wallet support on desktop.

- Supported Networks: 36 blockchains, including Bitcoin, Ethereum, Solana, and Cronos.

- Adoption: Gaining popularity among users interested in DeFi and those already within the Crypto.com ecosystem.

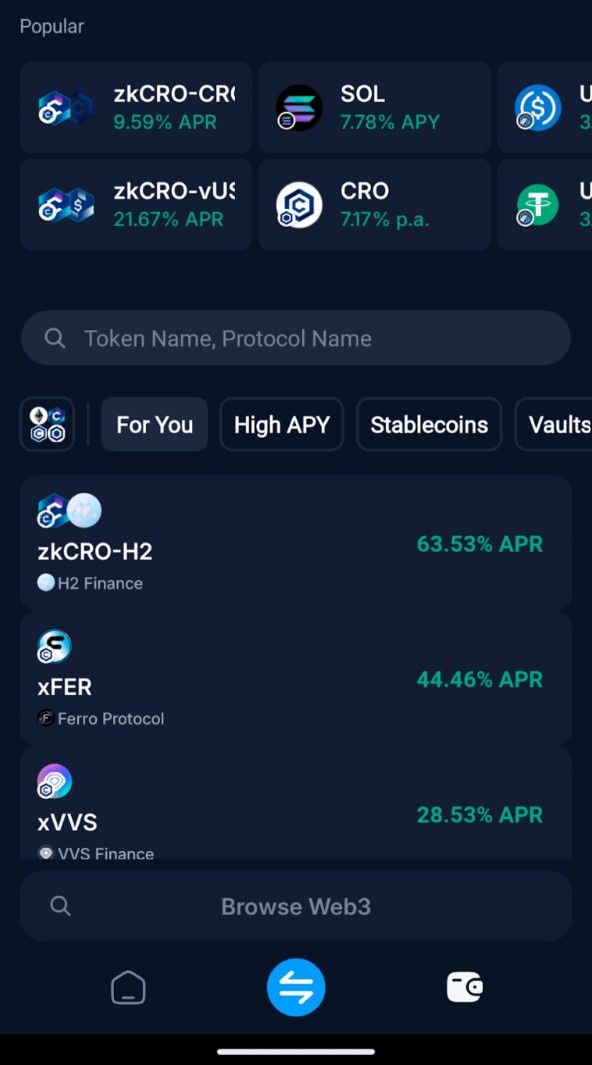

Crypto.com Wallet Interface | Image via Crypto.com

Crypto.com Wallet Interface | Image via Crypto.comStaking, Rewards, and Earn Programs: A Head-to-Head Review

Coinbase and Crypto.com both offer ways to earn rewards, but their approaches differ in flexibility, asset support, and reward structures.

| Feature | Coinbase Earn | Crypto.com Earn |

|---|---|---|

| Learning Rewards | Yes; earn crypto by completing educational tasks | No dedicated learning rewards program |

| Term Flexibility | No lock-up periods imposed by Coinbase; unstaking time varies by network | Offers flexible, 1-month, and 3-month fixed terms |

| DeFi Integration | Limited direct DeFi integration | Yes; integrates with protocols like Compound, Aave, and Yearn Finance |

| CRO Staking Benefits | Not applicable | Higher rewards available for users who stake CRO tokens |

| User Accessibility | Available in over 100 countries | Availability varies by jurisdiction; not available in some countries |

Coinbase allows users to earn cryptocurrency through two primary avenues: staking and educational rewards.

Staking Rewards

- Supported Assets: Users can stake various cryptocurrencies, including Ethereum (ETH), Solana (SOL), Cardano (ADA), Avalanche (AVAX), Polkadot (DOT), Cosmos (ATOM), Polygon (MATIC), and BNB.

- Flexibility: Users can start staking with as little as $1, and Coinbase imposes no lock-up periods. However, unstaking periods depend on the specific blockchain network.

- Security: Staked assets remain in the user's account, and Coinbase has a strong track record with no reported losses from staking activities.

Learning Rewards

- Educational Incentives: Coinbase rewards users who complete short educational courses and quizzes about various cryptocurrencies.

- Accessibility: This program is available to users in over 100 countries, allowing them to earn small amounts of crypto while learning about blockchain technology.

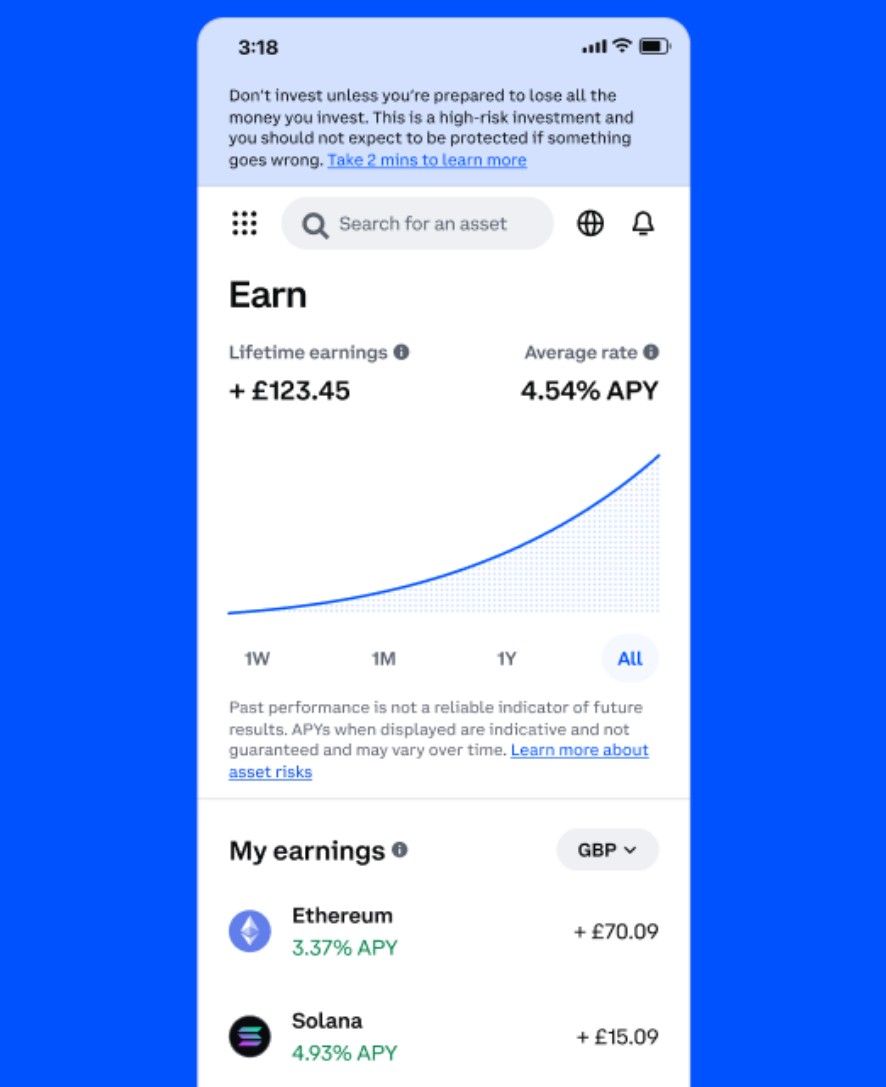

Coinbase Earn Offers DeFi Integration With the Comfort of Centralized Asset Management | Image via Coinbase

Coinbase Earn Offers DeFi Integration With the Comfort of Centralized Asset Management | Image via CoinbaseCrypto.com allows users to earn rewards by allocating their crypto assets into flexible or fixed-term deposit programs.

Earn Program

- Supported Assets: Over 40 cryptocurrencies are supported, including Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), and Crypto.com's native token, Cronos (CRO).

- Term Options: Users can choose between flexible terms, 1-month, or 3-month fixed terms. Longer terms and higher CRO stakes typically yield higher rewards.

- Earn Plus: A program offering higher deposit limits and no tiered rewards quota, allowing users to enjoy full rewards up to the maximum allocation limit.

DeFi Earn

- Integration with DeFi Protocols: Crypto.com's DeFi Earn allows users to earn rewards by supplying assets to decentralized finance protocols like Compound, Aave, and Yearn Finance.

- Supported Assets: Through these DeFi integrations, users can earn interest on assets such as DAI, USDC, USDT, and WBTC.

Crypto.com Earn Goes Beyond Simple Staking to Offer DeFi Lending | Image via Crypto.com

Crypto.com Earn Goes Beyond Simple Staking to Offer DeFi Lending | Image via Crypto.comIn summary, Coinbase Earn is well-suited for users interested in straightforward staking and educational opportunities to earn crypto, especially those new to the space. Crypto.com Earn offers more varied options with higher potential rewards, particularly for users willing to commit to fixed terms and stake CRO tokens and those interested in DeFi integrations.

Coinbase vs Crypto.com: Fees and Pricing Compared

Here is a table summarizing Coinbase and Crypto.com fee details:

| Category | Coinbase Exchange | Crypto.com Exchange | Coinbase Wallet | Crypto.com Wallet |

|---|---|---|---|---|

| Deposit Fees (Fiat) | - ACH: Free - Wire (USD): $10 - SEPA (EUR): €0.15 - SWIFT (GBP): Free | - ACH/SEPA: Free - Wire transfers: Varies (up to $45) - Credit/Debit: ~2.99% | N/A (Wallet-only transactions) | N/A (Wallet-only transactions) |

| Withdrawal Fees (Fiat) | - ACH: Free - Wire (USD): $25 - SEPA (EUR): Free - SWIFT (GBP): £1 | - ACH/SEPA: Free - Wire (USD): $25+ - ATM withdrawals: 2% over monthly limit | N/A | N/A |

| Trading Fees | - Standard: 0.60% (maker) / 1.20% (taker) - Advanced: Tiered (0.00%–0.6% maker; 0.08%–1.2% taker) | - Spot: 0.25% (maker) / 0.50% (taker) - Futures: 0.02% (maker) / 0.04% (taker) - Discounts with CRO staking | - 1% swap fee - 0.5%–4.5% for trades via linked Coinbase account | - Free for on-chain transactions - Network fees apply |

| Crypto Withdrawal Fees | - BTC: $1–5

| - BTC: 0.0005 BTC - ETH: 0.01 ETH - Higher for frequent small withdrawals | - Standard network fees (e.g., ETH gas fees) - Free USDC transfers on L2 networks | - Network fees apply - No platform fees |

| Card Fees | - Coinbase Card: 0% transaction fee (spread included) - ATM withdrawal: $2.50 | - Crypto.com Visa Card: 1% fee for top-ups - 2% for ATM withdrawals over limit - 3% for non-USD purchases | N/A | N/A |

| Staking Fees | - 35% fee on rewards (26.3% for Coinbase One subscribers) | - Varies by asset (up to 16.64% APY) - No staking fees | N/A | - No staking fees - Rewards depend on CRO holdings |

Coinbase Fee Details

1. Trading Fees

- Coinbase has a bigher base fees (up to 1.2% for takers) but offers tiered discounts for high-volume traders via Advanced Trade.

2. Fiat Withdrawals

Comparative Insights

- Coinbase charges $25 for USD wire withdrawals.

3. Crypto Withdrawals

- Coinbase's BTC withdrawal fee is significantly lower than Crypto.com's.

4. Card Benefits

- Coinbase Card charges no transaction fees but includes a spread.

6. Transparency

- Coinbase’s fee structure is criticized for being less transparent, with hidden spreads and complex tiered rates.

Unique Features

- Coinbase Wallet: Free USDC transfers on Ethereum L2s and Ledger integration.

Crypto.com Fee Details

1. Trading Fees

- Crypto.com: Lower base fees (0.25% maker/0.50% taker) with further reductions through CRO staking or high-volume trading.

2. Fiat Withdrawals

- Crypto.com imposes a 2% ATM withdrawal fee over monthly limits.

3. Crypto Withdrawals

- Crypto.com’s BTC withdrawal fee is significantly higher than Coinbase.

4. Card Benefits

- Crypto.com Visa Card: Cashback rewards (up to 8%) but higher fees for international transactions.

5. Staking

- Crypto.com offers fee-free staking with higher APYs.

6. Transparency

- Crypto.com provides clearer fee schedules, especially for institutional users.

7. Unique Features

- Crypto.com Wallet: Supports cross-chain swaps and integrates with DeFi protocols.

Summary

- Coinbase suits beginners with its user-friendly interface but is costlier for small transactions and staking.

- Crypto.com offers competitive fees for active traders and CRO holders, with robust DeFi integrations.

- Both wallets prioritize low fees for specific actions (e.g., USDC transfers on Coinbase, on-chain swaps on Crypto.com).

User Experience and Interface: Which Feels Better to Use?

When choosing a crypto exchange, usability matters just as much as functionality. A clean, intuitive interface can make the difference between a smooth trading experience and a frustrating one—especially for beginners. In this section, we compare how Coinbase and Crypto.com stack up in terms of website usability and mobile app performance.

Website and Platform Usability

Coinbase: Coinbase's website is renowned for its clean, intuitive design, catering primarily to beginners. The platform offers straightforward navigation, making it easy for users to buy, sell, and manage cryptocurrencies. However, some users have noted that the simplicity may come at the expense of advanced features housed in the separate 'Advanced Trade' section.

Crypto.com: Crypto.com's platform is designed as a comprehensive ecosystem, integrating various services like trading, staking, and a Visa card. While this all-in-one approach offers convenience, it can lead to a steeper learning curve for new users. Some users have reported that abundant features can make navigation slightly overwhelming.

Pros and Cons:

- Coinbase:

- Pros: User-friendly interface; ideal for beginners.

- Cons: Advanced features are less accessible; may require navigating to different sections.

- Crypto.com:

- Pros: Comprehensive platform with diverse features.

- Cons: It can be overwhelming for new users; navigation may be less intuitive.

Mobile App Performance

Coinbase: The Coinbase mobile app maintains the platform's reputation for simplicity and ease of use. Users appreciate the straightforward interface, which facilitates quick transactions and portfolio monitoring. However, some users have reported occasional glitches, such as missing performance data and limited charting capabilities.

Crypto.com: Crypto.com's mobile app is praised for its sleek design and robust functionality. It offers many features, including trading, staking, and access to the DeFi wallet. While the app provides a comprehensive crypto experience, some users have noted occasional performance issues, such as slow loading times and minor bugs.

Pros and Cons:

- Coinbase:

- Pros: Simple and intuitive interface; suitable for quick trades.

- Cons: Limited advanced features; occasional glitches reported.

- Crypto.com:

- Pros: Feature-rich app; integrates various crypto services.

- Cons: Potential performance issues; may be complex for beginners.

In summary, Coinbase offers a streamlined experience that is ideal for newcomers, while Crypto.com provides a more feature-rich platform that may appeal to experienced users seeking a comprehensive crypto ecosystem.

Which Exchange Is More Trustworthy and Compliant?

Security and regulatory compliance are non-negotiables when choosing a crypto exchange. Both Coinbase and Crypto.com have taken distinct approaches to building trust, securing user funds, and meeting global compliance standards.

Security Measures and Protocols

Coinbase

As one of the longest-operating regulated crypto exchanges in the U.S., Coinbase has built its reputation on trust and compliance. Since its founding in 2012, Coinbase has emphasized security-first infrastructure, becoming the first major crypto firm to go public in 2021. This move subjected it to rigorous financial and security scrutiny. Its incident response history is strong, with no major breaches resulting in user fund losses.

- Two-Factor Authentication (2FA): Mandatory for all users.

- Cold Storage: Roughly 98% of user assets stored offline in secure vaults.

- Encryption: Uses AES-256 encryption for sensitive user data.

- Insurance: Covers hot wallet holdings against hacking-related losses.

- Additional Safeguards: Includes device whitelisting, time-delayed withdrawals, and biometric access.

Crypto.com

Launched in 2016, Crypto.com scaled aggressively while maintaining a security-centric approach. The platform famously reimbursed all affected users following a 2022 hack that compromised $35 million, signaling its commitment to protecting customer funds. It has since ramped up investment in security infrastructure, insurance, and auditing—earning certifications like ISO/IEC 27001 and deploying zero-trust architecture across its systems.

- Multi-Factor Authentication (MFA): Combines passcodes, biometrics, and 2FA.

- Cold Storage: Over 90% of funds held in offline wallets.

- Anti-Phishing Measures: Includes address whitelisting and custom anti-phishing codes.

- Insurance: Holds a $100 million policy for cold storage assets.

- Bug Bounty Program: Active HackerOne partnership for continuous vulnerability testing.

Regulatory Environment and Compliance

Coinbase

Coinbase operates with a U.S.-first compliance model and is registered as a Money Services Business with FinCEN. It has faced regulatory scrutiny, including a $100 million settlement with NYDFS and a £3.5 million fine in the UK. Still, Coinbase is one of the few exchanges that publishes annual transparency reports and pushes for regulatory clarity through lobbying and legal action.

- Licensing: Active licenses across most U.S. states; MiCA-compliant in Europe.

- Transparency: Publishes regular audits and government request reports.

- Compliance Hurdles: Regulatory fines acknowledged and addressed through expanded compliance departments.

Crypto.com

Crypto.com has focused on securing regulatory approval across jurisdictions—holding licenses in the U.S., UK, EU, Canada, Singapore, and more. It was one of the first to release third-party verified Proof of Reserves in 2022 and continues to prioritize auditability and user trust in new product rollouts.

- Global Licensing: Extensive international regulatory footprint.

- Certifications: ISO 27001, ISO 27701, SOC 2 Type II.

- Audit Transparency: Regular Proof of Reserves disclosures.

Summary

Coinbase and Crypto.com both implement strong security and regulatory frameworks, though their approaches differ. Coinbase emphasizes compliance and transparency within U.S. jurisdictions but has faced penalties. Crypto.com has opted for wider global regulatory approval and has invested heavily in technical certifications and reserve disclosures. Both platforms offer industry-leading security, with varying levels of trust-building measures tailored to their geographic and user priorities.

Conclusion and Final Verdict

Coinbase and Crypto.com stand out as two of the most widely used cryptocurrency exchanges in 2026, each offering strong platforms but targeting slightly different user profiles.

Coinbase remains the go-to platform for beginners and U.S.-based users who prioritize regulatory clarity, simplicity, and ease of use. It offers a highly intuitive interface, straightforward fiat onboarding, and one of the most trusted reputations in the industry. However, it comes with higher trading and staking fees, and its fee structure can be opaque unless users upgrade to Advanced Trade.

Crypto.com, in contrast, is designed as a full-featured crypto ecosystem. It provides lower base trading fees, more flexible earn and staking programs, DeFi integration through its wallet, and attractive benefits for CRO holders. Its interface can be more complex, but it rewards users who engage deeper with its ecosystem. Regulatory compliance is strong, particularly across Europe and Asia, and it supports a wider range of fiat currencies for global users.

Key Differences Recap:

- Trading Fees: Lower on Crypto.com, especially for high-volume and CRO-staking users.Staking: Crypto.com offers higher APYs and no staking commissions; Coinbase charges up to 35%.

- User Interface: Coinbase is simpler and easier to navigate; Crypto.com is feature-rich but denser.

- Mobile App: Both are strong; Coinbase is more minimal, Crypto.com more comprehensive.

- Wallets: Coinbase Wallet is more beginner-friendly; Crypto.com DeFi Wallet suits advanced users seeking DeFi access.

- Security & Compliance: Both exchanges implement industry-standard security; Coinbase is highly U.S.-compliant, while Crypto.com offers wider global licensing and more reserve transparency.

Choosing the Right Platform:

Choose Coinbase if you’re a new crypto investor, prefer a clean user experience, live in the U.S., or value institutional-grade compliance and access to public equity markets.

Choose Crypto.com if you’re an active trader, want deeper access to DeFi and staking opportunities, hold CRO tokens, or live in regions outside the U.S. where Crypto.com offers stronger fiat support and lower costs.

Ultimately, the best choice depends on your experience level, trading volume, reward expectations, and geographic location. We recommend exploring both platforms further—especially their wallet apps and Earn sections—to determine which aligns better with your crypto goals. For more in-depth reviews and walkthroughs, check out our dedicated pages on each exchange.

Which you're here, check out our video on the best crypto exchanges below: