Bitcoin may have been the first true cryptocurrency, but a blockchain launched six years later has emerged as the trailblazer in the cryptocurrency market.

Ethereum has held a leading presence in the crypto space since its inception in 2015 (Bitcoin was launched in 2009). While Bitcoin is considered the currency of the future to some and a store of value to others, Ethereum is often considered the next evolution of the internet (Web3). The decentralized blockchain allows users to utilize and store non-fungible tokens (NFTs), conduct trading through DApps and DeFi, earn money through staking Ethereum's ETH token, play games, and interact with smart contracts, among other uses. In other words, Ethereum supports an entire ecosystem.

Ethereum's best-selling point is perhaps its ability to build and support decentralized applications (DApps) without a centralized authority overseeing everything. Speaking of authority, Ethereum is not controlled by any particular entity. It exists wherever there are connected computers, called nodes, running software following the Ethereum protocol and adding to the Ethereum blockchain.

As we delve into this analysis of Ethereum dominance, we will examine its strengths, weaknesses, and value proposition. We will also shine a spotlight on the challengers who seek to dethrone Ethereum from its high perch.

Disclaimer: I own BTC and ETH

What is Ethereum?

Vitalik Buterin co-founded the Ethereum project to improve upon Bitcoin's vision. The first generation of blockchains, such as Bitcoin, wasn't all that exciting, offering only decentralized ledgers for secure cryptocurrency transfers. However, these blockchains lacked an environment for complex deal settlement and the development of DApps.

The Ethereum network went a step further and filled this void by providing more enhanced solutions for writing and executing smart contracts, application development, and the creation of different token types. The result was widespread adoption.

Since The Early Days, Virtually Everyone Has Now Joined Ethereum. Image via Ethereum.org

Since The Early Days, Virtually Everyone Has Now Joined Ethereum. Image via Ethereum.orgThe early days of the project attracted interest from investors and developers. Now, it appears everyone is piling into the project. Here are a few facts to consider:

- In the first half of 2023, the number of ETH owners increased by 21% to 105 million from 87 million.

- With a market capitalization of $196.84 billion, ETH is the second-largest cryptocurrency after Bitcoin.

- Over 10,000 projects have been built on Ethereum.

- There are more than 96 million wallets with an ETH balance.

- The blockchain network has been used to create over 53 million smart contracts.

Interested in a deep dive into Ethereum? We cover everything in our in-depth Ethereum review.

Turning acorns into oaks

As noted, there wasn't much going on in the first generation of crypto with rapid advancement as the main focus. Ethereum's whitepaper in 2014 saw developers quickly push the envelope, harnessing the blockchain network for the second generation of crypto.

- Decentralized applications: These are apps built using the Ethereum ecosystem. Think decentralized finance apps like lending, borrowing, and private payments, but also gaming and technology in P2P transactions without the use of any personal data.

- Smart contracts: Smart contracts are programs stored on a blockchain that run when predetermined conditions are met.

- Ethereum Virtual Machine: EVM manages the state of the blockchain and enables smart contract functionality. It participates in block creation and transaction execution.

- Decentralized Autonomous Organizations: DAOs are a democratic body with no central authority. Members own ETH, and they can vote on initiatives and changes to the Ethereum blockchain network.

Understanding Ethereum Dominance

There are several factors that have made Ethereum the reigning monarch of blockchain technology.

Smart contracts

A major problem in conventional contracts is the need for trusted individuals to follow through. Smart contracts, on the other hand, are guaranteed to execute.

The term "smart contract" was first coined by Nick Szabo in 1994. He envisioned a digital marketplace where automatic, cryptographically secure processes enable transactions and business functions to happen without trusted intermediaries. Ethereum put this vision into practice.

A smart contract follows an "if this then that" logic. For example, if you go to a vending machine, and press the corresponding code of your favourite drink, "then" the machine will process your request and give it to you. Similarly, if an action is taken on the blockchain then the predetermined result is triggered.

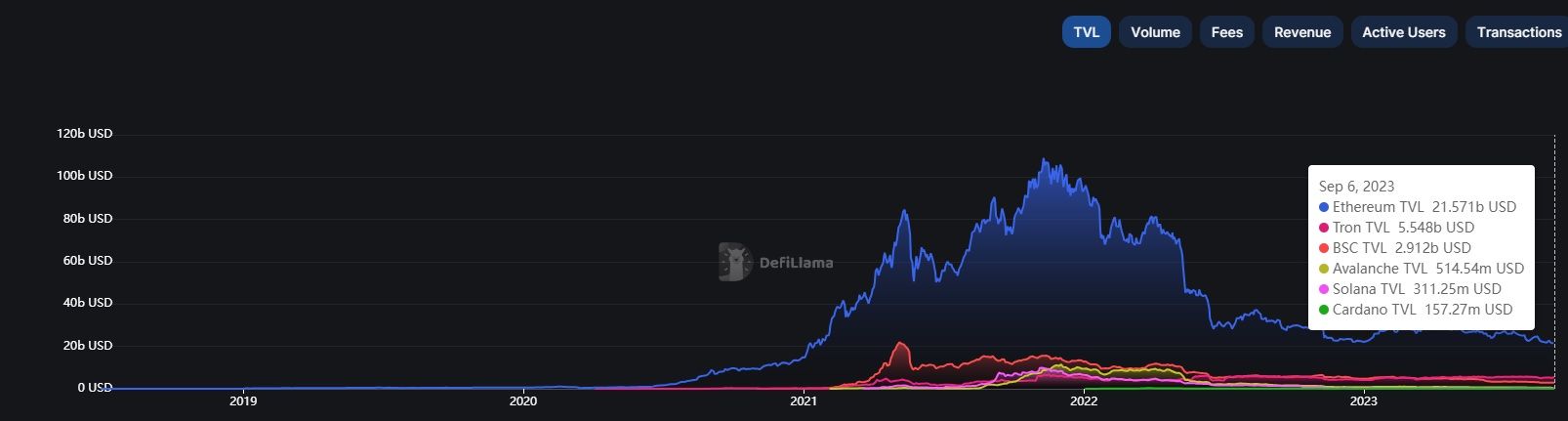

Ethereum's Competitors Are Playing Catch Up. Image via DefiLlama

Ethereum's Competitors Are Playing Catch Up. Image via DefiLlamaEthereum's total value locked (TVL), defined as the value of cryptocurrency locked in DApps, stood at $21.57 billion as of Sept. 6, far ahead of other blockchains with smart contract functionality.

Smart contracts offer automatic execution, the outcome is predictable, and the terms are visible. Oh, and the data is publicly available, allowing anyone to track asset transfers and other related information.

First-mover advantage

Buterin first broached the idea of a smart contract in the Ethereum whitepaper. He envisioned Ethereum as:

A blockchain with a built-in Turing-complete programming language, allowing anyone to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats and state transition functions. (Source)

Blockchain technology at the time was still in its early stages, and Bitcoin served as a digital currency (remember that guy who paid 10,000 BTC for two pizzas?) with limited programmability. Buterin sought to improve upon the blockchain technology underlying Bitcoin for uses beyond currency.

As the first blockchain to successfully implement smart contracts, Ethereum became a dominant leader in the space. This first-mover advantage led to rapid growth and market recognition.

Robust ecosystem

Ethereum's success is tied to the growth and diversity of its ecosystem, which has led to the development of a range of DApps, decentralized finance (DeFi) projects, and non-fungible token (NFT) marketplaces.

DApps

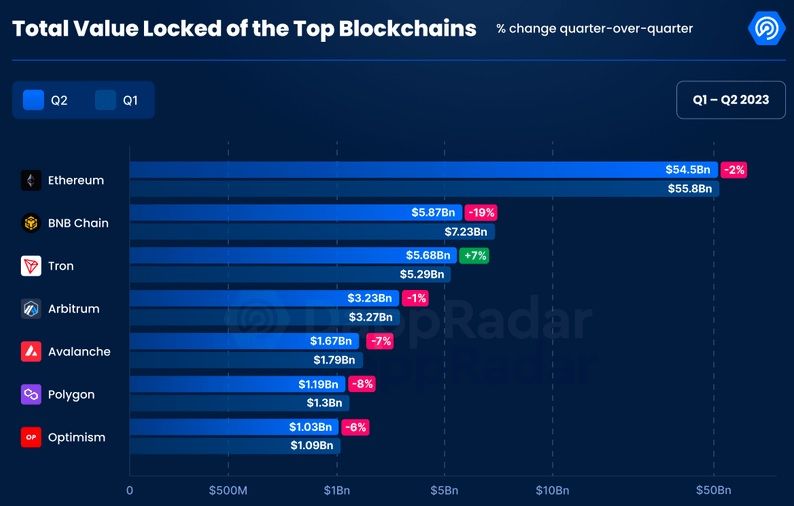

Ethereum's total value locked stood at $54.5 billion as of June 30, far outpacing all other blockchains offering this functionality.

Ethereum's Total Value Locked Registered a Slight Dip in Q2 But It Remained Far Ahead of Competitors. Image via DappRadar

Ethereum's Total Value Locked Registered a Slight Dip in Q2 But It Remained Far Ahead of Competitors. Image via DappRadarEthereum's DApps landscape is diverse, running the gamut from decentralized exchanges, gaming platforms, and social networks to supply chain management systems, and then some.

The Top DApps on Ethereum Are Mostly DeFi Apps. Image via DefiLlama

The Top DApps on Ethereum Are Mostly DeFi Apps. Image via DefiLlamaDeFi

Decentralized finance is the alternative to the current financial system. These apps let you borrow, save, invest, and trade just like apps in the traditional finance ecosystem. While the legacy system makes you jump through hoops to get your money, and in some cases even denying a service, DeFi applications are accessible to everyone.

Here's how the two stack up.

| DeFi | TradeFi |

|---|---|

| You hold your money | Your money is held by multiple parties |

| Transfer of funds happens in minutes | Payments can take days |

| All activity is pseudonymous | Personal information is required |

| DeFi is open to anyone | You must apply to use financial services |

| The markets are always open | Markets are only open during a certain timeframe |

NFTs

Ethereum's dominance extends to the NFT market as well thanks to its smart contract functionality.

The NFT market generated over $24.7 billion in sales in 2022, and Ethereum claimed the largest portion of the sales. Ethereum's market share in the NFT space has surpassed 78%.

The Ethereum blockchain houses many of the most sought-after NFT marketplaces, such as OpenSea, Magin Eden, Castle, and Floor. These marketplaces have attracted artists, creators, and collectors, which helps to further solidify Ethereum's dominant position in the NFT space.

Network effect

The network effect is a phenomenon where the value and utility of a platform increase as more users join. This is most evident on social media platforms that encourage users to add others to their network.

For example, most of my family and friends use X (Twitter), so it would make sense for me to join the platform instead of a rival. E-commerce platforms, such as Amazon, are also good examples. Most retailers sell their products on "The Everything Store." As a result, consumers will turn to Amazon when they want to buy something.

There is an argument for the network effects of cryptocurrencies. Ethereum has a vibrant developer community, and this large presence further attracts others to the ecosystem.

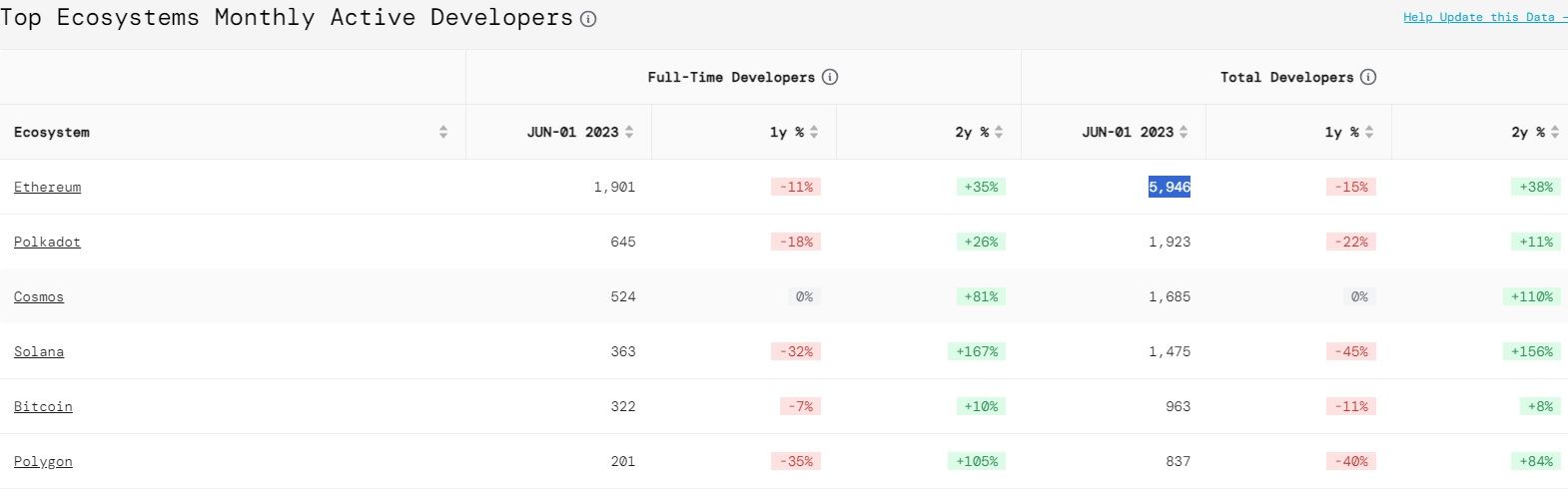

Ethereum Has More Developers Than Its Competitors. Image via Developerreport

Ethereum Has More Developers Than Its Competitors. Image via DeveloperreportAs of June 30, the Ethereum ecosystem had close to 6,000 total developers, far more than second-place Polkadot's 2,000 developers. By comparison, Bitcoin had around 1,000 developers.

Of course, all of Ethereum's bells and whistles translate into higher adoption.

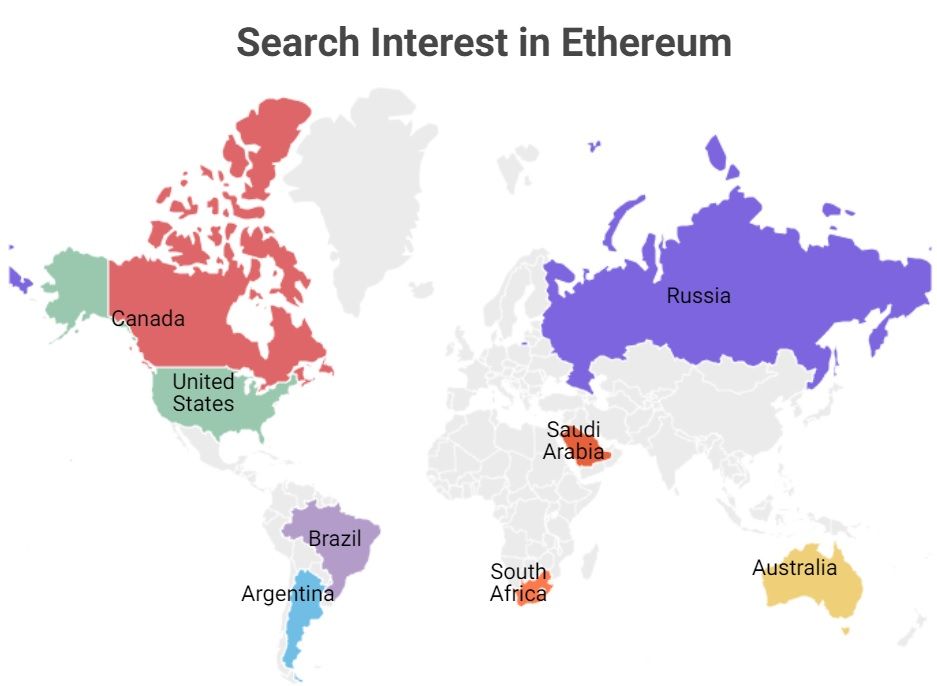

According to a survey, awareness about Ethereum stood at 19.49% globally in 2020. Not only that, but the blockchain's adoption rate after five years of its launch exceeded that of Bitcoin. In 2021, Ethereum’s search dominance was second only to Bitcoin.

Search Interest In Ethereum Spans Continents. Image via Bankless Times

Search Interest In Ethereum Spans Continents. Image via Bankless TimesUpgradeability

Continuous development and upgradeability are arguably Ethereum's most distinguishing features. Here are some of the upgrades the network has undertaken:

- Hard fork: In 2016, Ethereum made a radical change following an attack where an insecure contract was drained of over 3.6 million ETH in a hack. Those who didn't vote to fork went on to form Ethereum Classic.

- The Merge: Like Bitcoin, Ethereum started off as a proof-of-work system, an energy-intensive consensus mechanism. In 2022, the network switched to proof-of-stake.

- Capella: This consensus layer upgrade in 2023 brought the ability for stakers who did not provide withdrawal credentials with their initial deposit to do so, thereby enabling withdrawals.

- Shanghai: The most recent upgrade in 2023 brought staking withdrawals to the execution layer. In tandem with the Capella upgrade, this enabled blocks to accept withdrawal operations, which allows stakers to withdraw their ETH from the Beacon Chain to the execution layer.

Market recognition

Following the most recent upgrade, the number of active, or open, ether futures contracts trading on the Chicago Mercantile Exchange rose 39% to 6,248. In dollar value, open interest currently stands at $4.86 billion.

The Open Interest of Active or Open Ether Futures Stands at $4.86 billion. Image via Coinglass

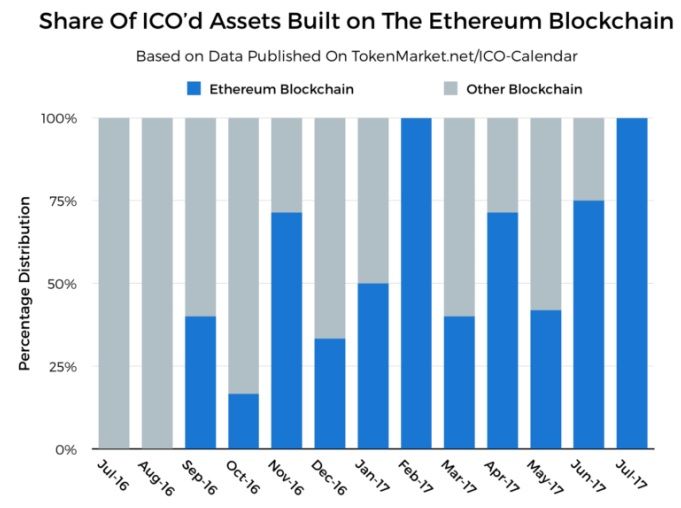

The Open Interest of Active or Open Ether Futures Stands at $4.86 billion. Image via CoinglassEthereum is also the go-to blockchain for initial coin offerings (ICOs). Remember the ICO frenzy of 2017 and 2018? With its smart contract capabilities, Ethereum played a central role in enabling this crowd-funded boom of raising capital ... all-digital and without personal information, of course.

Ethereum Was Behind The ICO Boom of 2017-2018. Image via TechCrunch

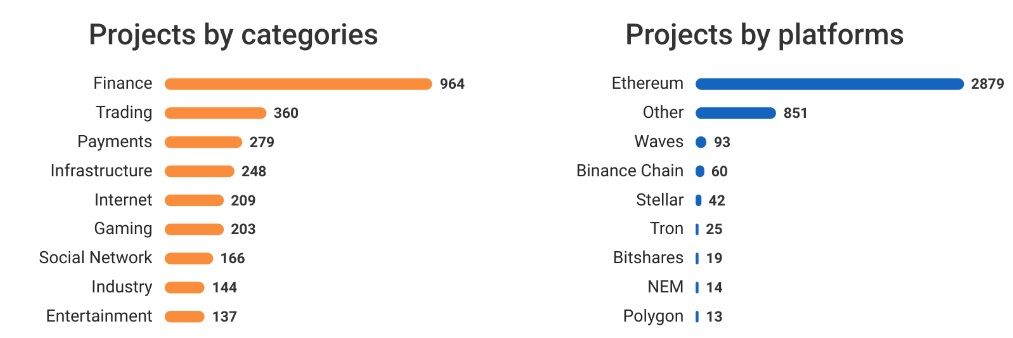

Ethereum Was Behind The ICO Boom of 2017-2018. Image via TechCrunchA total of 2,284 initial coin offerings in 2018 raised about $11.4 billion, 13% more than in 2017, with Ethereum claiming 84.29% of the projects. More recent data from 2023 suggests Ethereum captured 72% of all ICOs.

Recent ICO Data Suggest Ethereum Has Maintained Its Dominant Position. Image via ICO Bench

Recent ICO Data Suggest Ethereum Has Maintained Its Dominant Position. Image via ICO BenchJust like the wider crypto market, ICOs have been on the Securities and Exchange Commission's radar as well.

Why is Ethereum the Largest Smart Contract Blockchain?

By now, you're aware that Ethereum is a hotbed of cryptocurrency innovations, from DApps to NFTs. It's all possible thanks to smart contracts.

In addition to being the first blockchain to put smart contracts in effect, there's another reason behind Ethereum's smart contract dominance: decentralization. A quick glance at the project's website shows how decentralization is at the center of Ethereum's various endeavors. In the project's whitepaper, the word "decentralized" has been used over 50 times.

However, it is good to note that Ethereum's “decentralization” is a contentious topic, with many outspoken critics becoming disappointed in how centralized the project has become. You can find out more about why some don't agree with Ethereum's claims about being truly decentralized and all the different levels of decentralization in Guy's video on The Most Decentralized Cryptocurrencies.

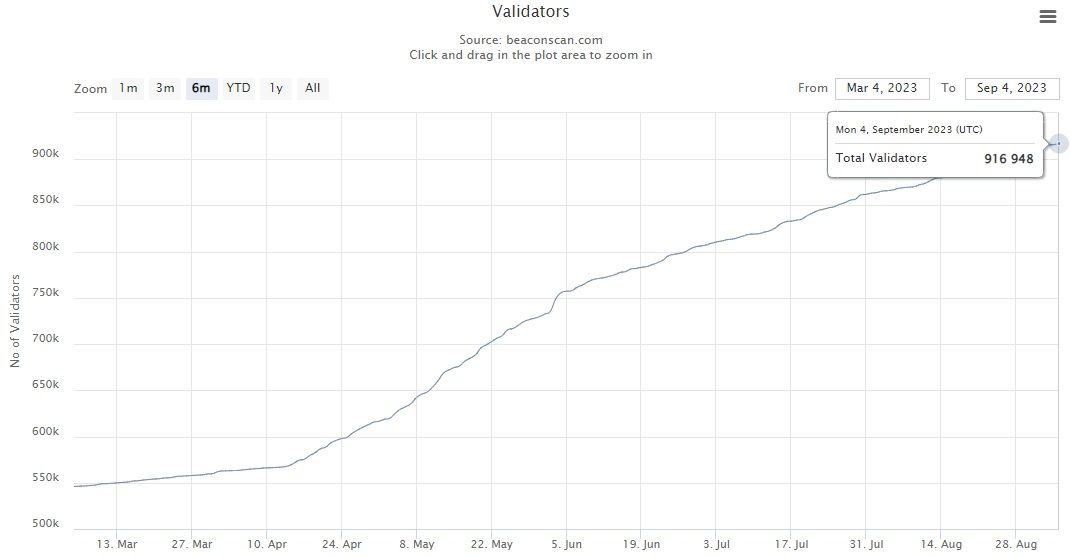

One metric we can look at is the validator count in the post-Merge era to see how decentralized Ethereum really is. As a reminder, The Merge resulted in the replacement of miners with validators and the ability for holders to stake their funds.

The Number of Validators on Ethereum Has Been Steadily Rising. Image via BeaconScan

The Number of Validators on Ethereum Has Been Steadily Rising. Image via BeaconScanThe number of validators on the Mainnet Beacon Chain has been steadily increasing and currently stands at over 900,000. A validator is a virtual entity that lives on Ethereum and participates in the consensus of the Ethereum protocol. The high validator count is an encouraging sign that the network is decentralized.

Ethereum's dominance has also led to the rise of so-called "Ethereum killers." However, these up-and-coming networks trade affordability and scalability for decentralization, as we'll discuss in detail later.

Advantages of Ethereum Over Other Blockchains

Scalability and Network Upgrades

The main goal of scalability is to increase transaction speed and transaction throughput without sacrificing decentralization or security. Ethereum says these factors are fundamental to its mass adoption.

As the number of people using Ethereum increased, the blockchain faced certain capacity limitations. As a result, the cost of using the network rose. To address this issue, the network envisioned Ethereum 2.0, the next evolution of the blockchain that will turn it into a better-performing, more accessible network.

Ethereum's shift from a proof-of-work consensus mechanism to a proof-of-stake mechanism is widely considered to be the first step in that direction. Since the launch of the Beacon Chain in December 2020, which allowed for the staking of ETH, the network has undergone nine upgrades, with the most recent one in April 2023.

Ethereum is also undertaking steps to future-proof itself, including threats from quantum computing even as the technology is probably decades away from being a genuine threat to modern cryptography. There are also efforts being made to simplify Ethereum and remove code that has hung around through various upgrades but is no longer needed.

Some of the upgrades in the Ethereum roadmap will be implemented in a few months, while others such as quantum resistance have a longer horizon (five to 10 years).

Ecosystem and Developer Support

Two heads are better than one!

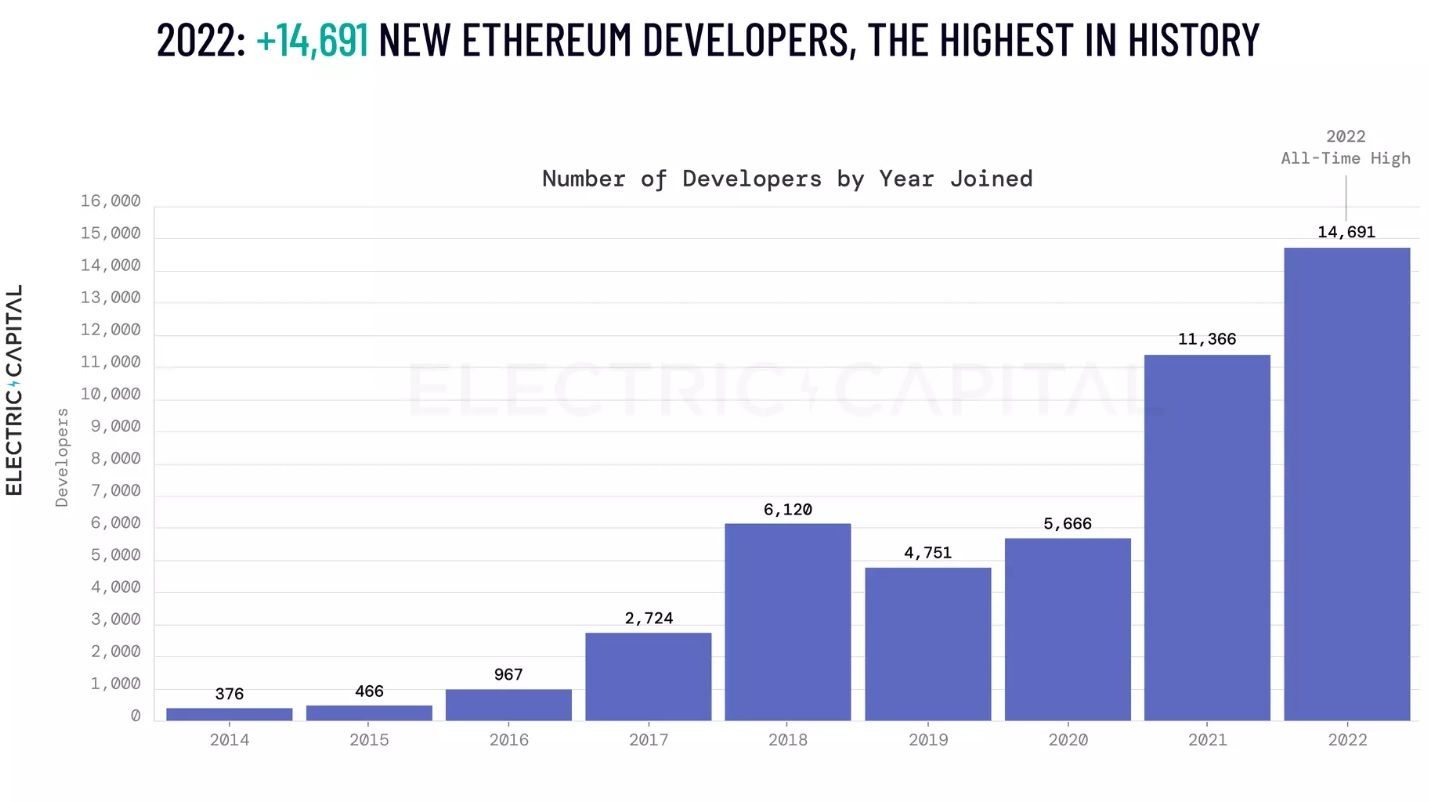

2022 Saw More Developers Join Ethereum Than Ever Before. Image via Developerreport

2022 Saw More Developers Join Ethereum Than Ever Before. Image via DeveloperreportThe crypto industry had 23,343 monthly developers as of December 2022. and Ethereum's monthly active developers grew 5x to 5,819 from 1,084. The Ethereum project also saw over 14,500 new developers join in 2022, the highest in history.

Ethereum has a well-established developer ecosystem, providing them with a range of tools and documentation on foundational concepts as well as the development stack. Thanks to Ethereum's vast developer community, the blockchain is at the forefront of innovation in the industry.

- Smart contracts: We've written about smart contracts extensively in this article, but they're perhaps Ethereum's most distinguishing feature. These contracts serve as the foundation for a host of apps on Ethereum.

- Stablecoins: Ethereum has been the go-to platform for creating stablecoins, outpacing others by a wide margin.

- Vast DeFi ecosystem: More than 165 DeFi projects have been built on Ethereum. By comparison, only 40 were created on BSC.

Security and Decentralization

One year after its launch, Ethereum faced probably its darkest episode to date.

In 2016, the Ethereum decentralized autonomous organization (DAO) was hacked to the tune of $60 million after exploiting vulnerabilities in the DAO wallet's smart contract. In response, Ethereum underwent a highly controversial hard fork that not only fixed the bug but also took the hacked funds and returned them to their owners. The culprit has never been identified.

The DAO hack stressed the importance of security for the crypto market generally and Ethereum specifically.

The company plans to roll out quality-of-life improvements so Ethereum stays resilient to all kinds of attacks far into the future. These include subtle changes to the way Ethereum clients deal with competing blocks, as well as increasing the speed at which the network considers blocks to be finalized. There are also improvements that make censoring transactions much more difficult by making block proposers blind to the actual contents of their blocks, and new ways to identify when a client is censoring.

Security upgrades on the roadmap are in the advanced stages of research, but they are not expected to be implemented for some time.

Challenges and Competitors

Ethereum's Scalability Issues

"The blockchain trilemma" was a term popularized by Buterin, who said that it's impossible to achieve scalability, decentralization, and security on the same blockchain without weakening one. Ethereum is a great example of this.

From DeFi and gaming to NFTs, Ethereum supports thousands of applications and transactions. Still, the protocol is plagued with scalability issues due to its emphasis on decentralization and security. Ethereum can currently process about 30 transactions per second, far below its target of 100,000.

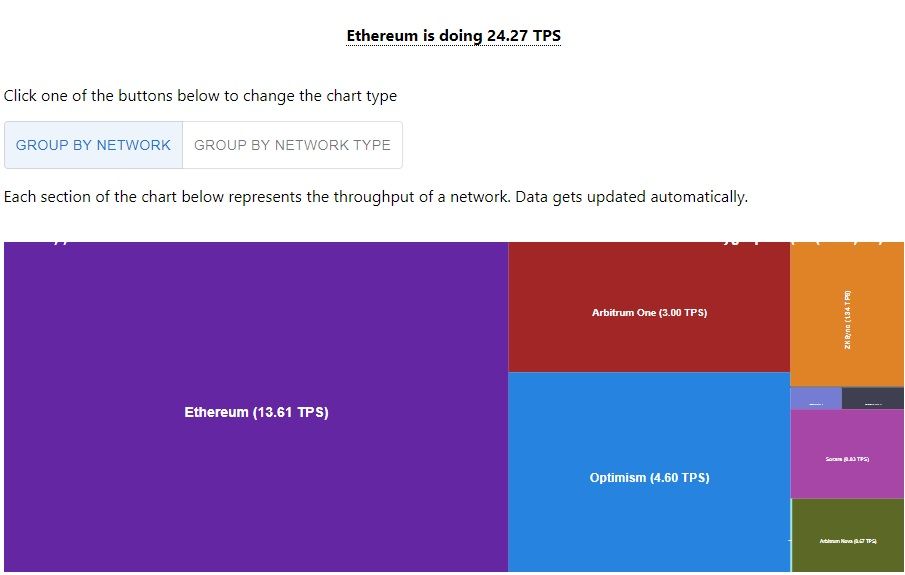

Ethereum Can Process Up To 30 Transactions Per Second. Image via ethtps.info

Ethereum Can Process Up To 30 Transactions Per Second. Image via ethtps.infoAs it currently stands, Ethereum is processing 24 transactions per second. The Merge was widely expected to solve Ethereum's scalability and high-cost issues, but it did not address either in a meaningful manner. In a way, it could be said that the scalability problem is by design.

However, Ethereum is well aware of these shortcomings and is looking at multiple on- and off-chain solutions without sacrificing its ethos of decentralization and security.

- Sharding: Sharding is the process of splitting a database.

- Layer 2 scaling: A specific layer 2 instance may be open and shared by many applications, or may be deployed by one project and dedicated to supporting only their application. Layer 2 scaling should reduce transaction speed and gas prices.

- Rollups: Rollups perform transaction execution outside layer 1 and then the data is posted to layer 1 where consensus is reached. As transaction data is included in layer 1 blocks, this allows rollups to be secured by native Ethereum security.

- State channels: State channels utilize multisig contracts to enable participants to transact quickly and freely off-chain, and then settle finality with Mainnet. This minimizes network congestion, fees, and delays.

- Sidechains: A sidechain is an independent EVM-compatible blockchain that runs in parallel to Mainnet. These are compatible with Ethereum via two-way bridges and run under their own chosen rules of consensus and block parameters.

Rival Blockchains on the Horizon

A number of next-generation blockchains have sprouted up to threaten Ethreuem's dominance.

| Feature | Ethereum | BSC | Cardano | Solana | Tron | Avalanche |

|---|---|---|---|---|---|---|

| Market cap | $195.06 billion | $33.02 billion | $8.99 billion | $7.90 billion | $6.92 billion | $3.47 billion |

| Consensus mechanism | Proof-of-stake | Proof-of-stake | Proof-of-stake | Proof-of-stake | Proof-of-stake | Snowman consensus |

| Average transaction time | 3 minutes | 30-60 seconds | 20 seconds | 400 milliseconds | About a minute | A few seconds |

| Average fees | $3.64 | $0.1014 | $0.09 | $0.00025 | $0 | Less than $0.01 |

| Number of validators | 900,000+ | 50 | 3,000+ stake pools | 1,950+ | 402 super representatives | 1,300+ |

| TVL (Sept. 6) | $21.57 billion | $2.91 billion | $157.3 million | $311.3 million | $5.55 billion | $514.5 million |

Binance Smart Chain

Binance Smart Chain, or BSC as it's commonly known, was unveiled by crypto exchange Binance in 2020, at the peak of the “DeFi summer,” to support the creation of smart contract-based applications. The idea was to build a network compatible with the Ethereum Virtual Machine so developers could transfer their applications from Ethereum to BSC and enjoy cheaper gas fees and faster confirmation times.

To entice developers, Binance CEO Changpeng Zhao announced a $100 million fund to promote DeFi projects running on BSC. But despite some early successes, BSC often faces criticism from Ethereum believers that it is just a fork of Geth i.e. a copy of Ethereum.

Cardano

This blockchain was born out of a dispute.

Charles Hoskinson left the Ethereum project after a disagreement with Buterin. Hoskinson wanted to accept venture capital money and make Ethereum for-profit, while Buterin was in favor of keeping it a nonprofit organization. As a result, Hoskinson left and founded what is now known as Cardano.

Cardano's focus has been to build a system that's cheaper to use and more efficient than Ethereum. To address scalability, it is implementing various techniques (like data compression) and is working to introduce Hydra, which will enable multiple side chains functionality. Here's a snapshot:

- Cardano is being developed to support cross-chain transfers, multiple token types, and commonly used smart contract languages.

- To ensure sustainability, the treasury system is controlled by the community and is refilled constantly from potential sources such as newly-minted coins being held back as funding, a percentage of stake pool rewards, and transaction fees.

- Cardano is still a new company, and it'll be some time before it truly becomes a threat to Ethereum.

Solana

Just like Ethereum was created to improve upon Bitcoin's shortcomings, many of these Gen 3 blockchains were formed to address Ethereum's weaknesses, and Solana is no different.

Many of the core Solana builders, like co-founder Anatoly Yakavenko, have a background in building cell phone networks. That means they are singularly focused on building for scalability and efficiency. One factor that differentiates it is the ability to automate the transaction ordering process for blockchains. This is why it is able to achieve high TPS, which stood at over 4,900 at press time, compared to Ethereum's 30.

Solana supports NFT marketplaces, DeFi applications, DEXs, stablecoins, and payments, and Solana Pay was recently integrated with Shopify for immediate USD Coin transactions.

Tron

While Ethereum aims to be Amazon's equivalent of blockchain networks, Tron has found its niche in the digital creator space and entertainment sector.

Founded in 2017 by Justin Sun for content producers, Tron aims to break entertainment companies' hold on digital content distribution. Sun famously paid $4.5 million (which went to charity) for a dinner with investment guru and crypto naysayer Warren Buffett, who reportedly called Bitcoin a "store of fear" during the dinner.

Ethereum may be more decentralized and popular, but Tron has a few tricks up its sleeves as well. It boasts a higher transaction speed and doesn't charge any fees. Its TPS of up to 88 is also higher than Ethereum's.

Avalanche

Cornell researcher Emin Gün Sirer founded Ava Labs, which launched Avalanche in September 2020. Like others, it was created to reduce problems faced by Ethereum users.

Instead of using the common proof-of-stake consensus, Avalanche is powered by consensus protocol for specific use cases on Avalanche. The platform is made to be totally ordered and linear, and it's known as the Snowman consensus protocol. This is one difference between Ethereum and Avalanche.

The other is TPS. While Ethereum can process up to 30 transactions per second, Avalanche processed over 120 last week. In addition, Avalanche has considerably low fees compared to Ethereum, which has notoriously high gas fees.

Looking Ahead: Ethereum's Future

I don't have a crystal ball that tells the future (would be a neat trick though), so we'll instead turn to Buterin's own words to see what the future holds for Ethereum, and what it needs to do to go to the next level.

In a June post on his website, Buterin outlines the three technical transitions the network must undergo as the company transitions from a young experimental technology into a mature tech stack.

- The L2 scaling transition: Everyone moving to rollups

- The wallet security transition: Everyone moving to smart contract wallets

- The privacy transition: Making sure privacy-preserving funds transfers are available, and ensuring all of the other gadgets that are being developed (social recovery, identity, reputation) protect privacy as well.

L2 Scaling

Vitalik believes that without users and applications moving to rollups, Ethereum fails because products looking for mass adoption may have to abandon the chain and adopt centralized workarounds to avoid excessive transaction fees.

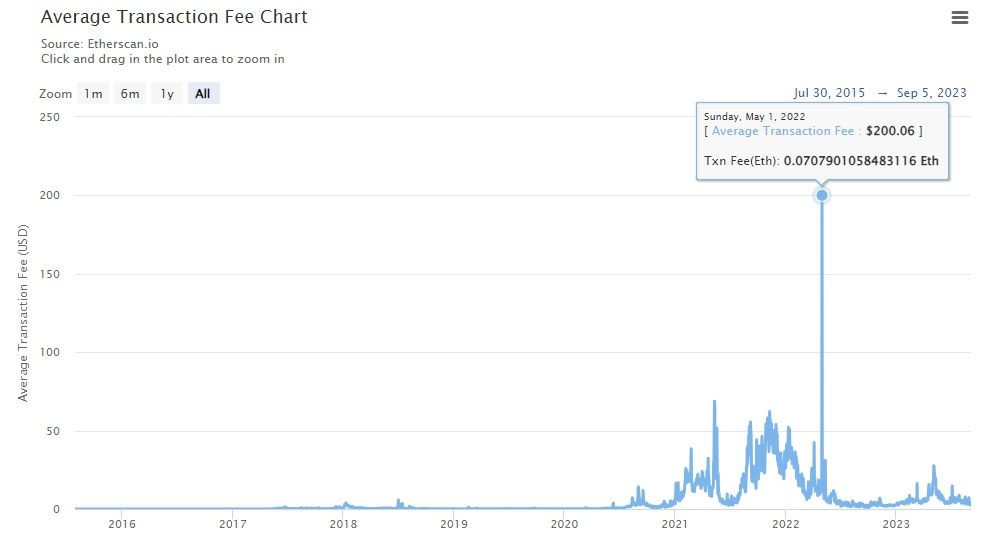

Ethereum's Average Transaction Fee is Still on the High Side. Image via etherscan.io

Ethereum's Average Transaction Fee is Still on the High Side. Image via etherscan.ioThe average transaction fee was as high as $200 in 2022, but that number has since fallen. By comparison, Layer 2s can process transactions at a much lower price.

Layer 2 Solutions Cost a Fraction of the Price. Image via L2Fees

Layer 2 Solutions Cost a Fraction of the Price. Image via L2FeesSending one ETH in Optimism costs less than $0.01, compared to $0.50 on Ethereum. A token swap in Optimism also costs a fraction of the price on Ethereum. According to L2Beat, rollups see 5.04 times the number of transactions the main Ethereum chain sees.

Smart-Contract Wallets

Without the move to smart contract wallets, Buterin fears users may not feel comfortable storing their funds and non-financial assets in Ethereum. This could affect adoption and encourage custodial solutions instead of self-storage.

Most Ethereum users currently utilize externally owned accounts (EOAs), which are cryptographic key pairs, with the public key serving as the account's address and the private key used to sign transactions. Ledger and MetaMask are some examples of this type of wallet.

Social recovery wallets fit Buterin's vision. These wallets use a system where trusted contacts or devices, known as guardians, can help users regain access to their wallets if they lose their private key or other account access credentials.

Privacy Transition

Privacy is crucial to Ethereum's success, and if the company fails to address this issue, users may opt for centralized solutions that offer some data privacy.

Transparency is the blockchain's top trait, but it is a double-edged sword. It offers an immutable ledger of transactions that everyone can verify, but it could also dissuade many users due to privacy concerns.

The solution? Stealth address protocols, which create unique addresses for each transaction instead of a user having a single static address.

Conclusion

Ethereum isn't just a cryptocurrency, it is a multifaceted blockchain ecosystem that offers far more than just a means of financial transactions. Thanks to its pioneering smart contracts, Ethereum has become the epicenter for blockchain applications and innovations.

Smart contracts revolutionized the industry, playing a pivotal role in the rise of DeFi, NFTs, and a multitude of DApps that have gained widespread adoption. Its first-mover and network advantages, market recognition, and robust developer community made Ethereum into the juggernaut it is today.

Still, Ethereum is facing a number of challenges, with the biggest one being its scalability bottleneck which results in high transaction fees and slower processing times. These challenges have spurred the rise of so-called "Ethereum killers" who want to improve upon its flaws, just as Ethereum did with Bitcoin. But these new-gen blockchains have a long way to go before they can be seen as a credible threat to Ethereum.

Ethereum is well aware of these shortcomings, however, and is taking steps to address them. How that turns out, we'll have to wait and watch!