Crypto.com is a centralized exchange, which means you’re trusting a company to custody assets, process withdrawals, and enforce security rules on your behalf. That trust can work well or break fast depending on how the platform is built, regulated, and operated under stress.

This article is for everyday crypto users, from first-time buyers to active traders, who want to understand how safe Crypto.com actually is before putting money on it. It focuses on real protections, known trade-offs, past incidents, and practical controls you can use today, not marketing claims, price speculation, or worst-case fear scenarios.

Is Crypto.com Safe? Quick Answer (1-Minute Verdict)

Our verdict in one sentence

Safety Score Snapshot

Top tier for custody practices, insurance coverage, and compliance breadth; weakest area is support responsiveness during peak demand.

Why We Say “Yes”

- $870M+ in insurance coverage: Approximately $750M covering cold-storage assets plus an additional $120M for institutional custody arrangements.

- 1:1 reserves claim: Crypto.com states all customer assets are fully backed and provides user-verifiable Proof-of-Reserves via its PoR portal and published dashboards.

- Security certifications: Holds ISO 27001, ISO 27701, SOC 2 Type II, and PCI DSS v4.0 certifications across core infrastructure.

- Regulatory footprint: Registered or licensed with major regulators including the FCA, MAS, FinCEN, and MFSA, with an established path under MiCA in the EU.

- No major public breaches since 2022: No large-scale, publicly disclosed security incidents impacting user funds have been reported since the 2022 event.

Known Concerns

- 2022 security incident: Roughly $35M was affected across several hundred accounts, with impacted users fully reimbursed by the platform.

- Proof-of-Reserves limitations: Merkle-tree verification is anchored to the original 2022 snapshot and does not yet represent a continuous, real-time audit.

- Support and KYC friction: User sentiment analysis consistently flags slow support responses and occasional KYC delays during traffic spikes.

How We Assessed Crypto.com's Safety

We evaluated Crypto.com’s safety by focusing on verifiable protections and real-world behavior, not marketing claims. The goal was to answer a practical question: is Crypto.com safe enough for everyday use, and where do the risks still sit?

Our evaluation uses eight weighted pillars, so no single strength, like insurance size or certifications, can inflate the final score on its own:

- Custody & storage: How assets are held, cold storage controls, and 1:1 reserve claims

- Proof of Reserves: User-verifiable backing and transparency limits

- Insurance: Coverage size, scope, and exclusions

- Regulation & licensing: Oversight by major regulators and regional restrictions

- Account security: 2FA, passkeys, whitelists, and user-controlled safeguards

- Incident history: Past breaches and how the platform responded

- Operational experience: KYC, withdrawals, and app reliability

- Customer support: How quickly issues are resolved when something breaks

Each pillar is weighted to reflect risk impact, not hype. The final safety score represents risk-adjusted protection for typical users, with clear trade-offs where Crypto.com still falls short.

Safety at a Glance

Crypto.com's safety profile stands out for its insurance depth and regulatory reach, but transparency gaps around exact cold/hot storage splits and ongoing PoR audits keep it from a perfect score. This checklist distills the key facts into a scannable format, drawing from official disclosures and third-party attestations.

Read our full Crypto.com review and our guide on how to withdraw funds from Crypto.com.

Crypto.com Safety Checklist

| What it is | Crypto.com | Why it matters | Evidence |

|---|---|---|---|

| Insurance | Up to $750M total crypto custody insurance + $120M institutional/cold storage crime & specie (arranged via Aon/Lloyds). | Protects against custodian theft, physical loss, or certain crimes—not user errors like phishing. | Official announcements; underwritten policies for cold storage ($100M) and crime ($20M). |

| Proof of reserves visibility | 1:1 reserve claim via PoR portal with Merkle-tree user verification + on-chain wallet dashboards (Nansen/DeFiLlama cross-checks). | Lets users confirm their balance is backed, reducing insolvency fears. | Mazars-attested 2022 snapshot; ongoing portal access. |

| Cold storage posture | Institutional-grade cold storage with HSMs, multi-sig, and segregated wallets; exact hot/cold % not publicly disclosed. | Minimizes online hack risk for the bulk of assets. | Custody Trust Company disclosures; $100M cold-specific insurance. |

| Certifications | ISO 27001/27701/22301, SOC 2 Type II, PCI DSS v4.0. | Independent proof of security, privacy, continuity, and payment controls. | Third-party audits listed on site. |

| 2FA, passkeys, whitelist + 24h lock | Mandatory TOTP 2FA, passkeys, anti-phishing codes, address whitelists with 24h pending review, trusted devices/session view. | Blocks unauthorized access and gives users control over outflows. | In-app toggles; post-2022 mandates. |

| Incident history | One major hack (Jan 2022: $34M from 483 accounts, fully reimbursed); no major breaches since. | Shows response capability but highlights past vulnerability. | Official post-mortems and reimbursements. |

| Regulatory footprint | Licenses in US (FinCEN MSB, state MTLs, NH Trust), UK (FCA), EU (MiCA Class 2 via Malta), SG (MAS MPI), AU, CA, etc. | Oversight reduces rogue-operator risk; enables fiat ramps. | Official licenses page. |

| Support handling | In-app chat (mic/GIF support), email/tickets; SLAs not public but user sentiment flags KYC/withdrawal delays. | Critical for resolving locks or incidents quickly. | Mixed Trustpilot/App reviews; some praise chat speed. |

What’s Covered vs Not Covered

Insurance misunderstandings lead many users to overestimate protection; here's the clear split based on Crypto.com's policies.

| Covered | Not covered |

|---|---|

| Custodian theft from cold/hot wallets. | Phishing, social engineering, or malware on user devices. |

| Physical loss/damage to cold storage (specie). | User-authorized transfers (even if tricked). |

| Certain institutional crime/third-party theft. | Market losses, volatility, or wrong-address sends. |

This plugs a common gap: insurance responds to platform failures, not personal errors, so user hygiene remains essential.

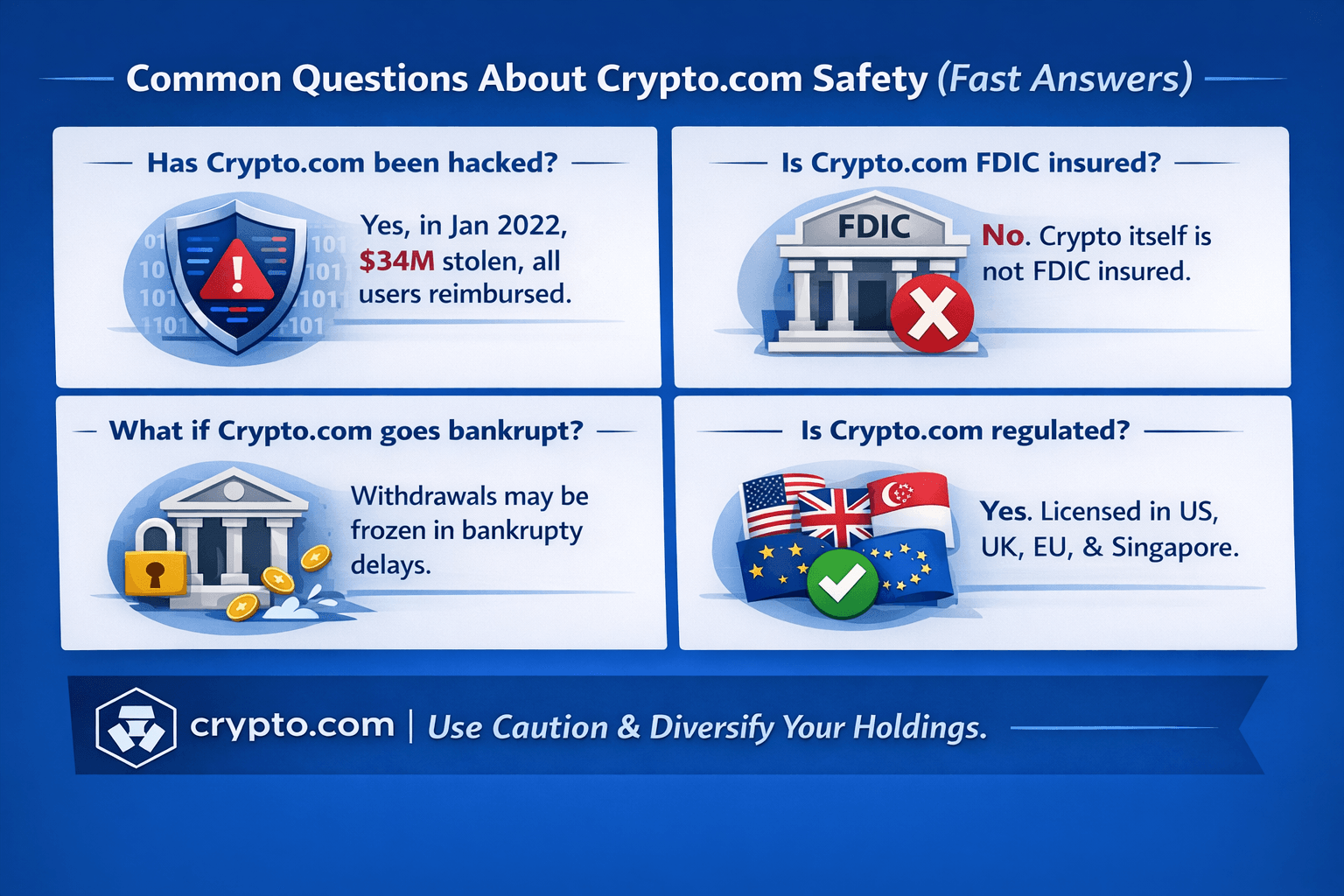

Common Questions About Crypto.com Safety

Clear Answers To The Most Asked Safety Concerns

Clear Answers To The Most Asked Safety ConcernsUsers often search these exact questions whilst choosing an exchange or when there is a pause on the withdrawals, or maybe just broader exchange anxiety, direct answers with context cut through the noise.

Has Crypto.com been hacked?

Yes. In January 2022, attackers bypassed two-factor authentication (2FA) on 483 accounts and withdrew approximately $34 million before automated monitoring systems halted the activity. Crypto.com paused withdrawals across the platform, reimbursed all affected users, and later said the issue stemmed from API key exposure rather than a core wallet breach.

For context, incidents of this kind were not uncommon at the time. Binance lost about $40 million in 2019, which was covered by its SAFU fund, and KuCoin suffered a $280 million hot-wallet breach in 2020 that was also reimbursed. In contrast, failures like FTX were driven by insolvency and misuse of funds, not external hacks.

Is Crypto.com FDIC insured?

No. Cryptocurrency itself is not FDIC-insured anywhere. FDIC protection applies only to deposits held at insured banks, up to $250,000 per depositor, against bank failure.

Crypto.com may hold fiat balances at partner banks that offer FDIC pass-through coverage, but this applies only to cash, not to crypto assets. For digital assets, the platform relies on private crime and custody insurance, totaling more than $750 million, with an additional institutional cold-storage layer of around $120 million, covering losses under custodial control.

What happens if Crypto.com goes bankrupt?

In a bankruptcy scenario, users could face custodial risks such as withdrawal freezes while courts determine creditor claims. Access to funds could be delayed for months, as seen in past cases like Mt. Gox and Voyager.

Proof of Reserves helps by showing 1:1 asset backing at specific snapshot moments, which supports confidence in reserve integrity. However, it does not audit full corporate liabilities, off-balance-sheet obligations, or the solvency of non-crypto business lines. Risk mitigation comes down to diversification, strict withdrawal controls, and keeping only active trading balances on the exchange.

Is Crypto.com regulated in the US, UK, EU, and Singapore?

- United States: Crypto.com operates as a FinCEN-registered Money Services Business, holds Money Transmitter Licenses in most states, and runs a non-depository trust company in New Hampshire for custody. It does not hold a New York BitLicense, so services are unavailable to New York residents. Regulation varies by product, with some offerings such as derivatives falling under CFTC oversight through DCM or DCO frameworks.

- United Kingdom: The company is registered with the FCA as a Cryptoasset Business and holds an Electronic Money Institution license. UK users face tighter product restrictions, including no margin trading and limited access to higher-risk derivatives, in line with FCA rules.

- European Union: Through its Malta entity, Crypto.com secured a MiCA Class 2 Crypto-Asset Service Provider license in early 2025. This allows passporting of custody, exchange, and wallet services across the EEA. From 2026 onward, MiCA standardizes rules across member states, reducing fragmentation. The group also holds E-Money and MiFID investment firm licenses for fiat and broader financial services.

- Singapore: Crypto.com is licensed by MAS as a Major Payment Institution for Digital Payment Token services. Product scope and leverage are constrained to meet local regulatory standards, making it a compliant hub for Asia-Pacific users.

Is the Crypto.com app safe?

The mobile app includes multiple built-in protections, including biometric login, passkeys for passwordless authentication, trusted-device controls, real-time session monitoring, and mandatory 24-hour locks on new withdrawal addresses. These safeguards make everyday use more secure than basic web logins.

There have been no reported app-specific breaches. App store ratings sit around 4.5 on iOS and 3.4 on Android as of late 2025. Users generally praise usability, though some reviews mention occasional KYC or verification issues.

Is Crypto.com safer than Coinbase?

Both platforms sit in the top safety tier, but their strengths differ. Coinbase leads on regulatory depth and custody reputation, supported by its public listing and New York BitLicense. Crypto.com stands out for headline insurance coverage, totaling roughly $870 million, and stricter default withdrawal whitelisting.

Neither is universally safer. Coinbase tends to appeal to users prioritizing maximum regulatory clarity in the US, while Crypto.com is often favored by global users who value insurance coverage and built-in account controls.

Crypto.com Security by the Numbers

Crypto.com Key Safety Metrics And Proofs For 2026. Image via Crypto.com

Crypto.com Key Safety Metrics And Proofs For 2026. Image via Crypto.comCrypto.com presents itself as a security-first exchange, built around layered custody, insurance coverage, and user-verifiable reserves. Those strengths are real, but they sit alongside limits in transparency, such as undisclosed hot-to-cold wallet ratios and a Proof of Reserves system still anchored to a 2022 snapshot. Both sides matter when judging actual resilience.

This deep dive breaks down how the system works in practical terms, using plain language and sticking closely to what the company has formally disclosed or attested to.

Custody and storage architecture

At the base level, Crypto.com says it runs on a strict 1:1 reserve model. Every asset credited to a user account is matched by the same asset held under the platform’s control. That design avoids the kind of fractional reserve practices that played a role in failures like FTX.

The company does not publicly share how funds are split between hot wallets, which stay online for trading and withdrawals, and cold storage, which is kept offline. What it does emphasize is that the bulk of long-term holdings sit in institutional-grade cold storage.

That cold storage is protected using Hardware Security Modules, or HSMs. These are hardened physical devices that generate and store private keys internally and sign transactions without exposing keys to the internet. A useful mental model is a vault that can approve transactions but never hands over the key itself.

Withdrawals from cold storage require multiple approvals from separate teams in different locations, so no single employee or office can move funds on its own. Access is tightly segmented: engineers cannot touch funds, and custody operators cannot modify code. For higher-value clients, Crypto.com’s U.S.-chartered Custody Trust Company offers segregated accounts that meet institutional custody standards

Proof of Reserves (PoR) status, method, limitations

Crypto.com launched its Proof of Reserves system in December 2022, with an initial attestation from Mazars Group covering major assets such as BTC, ETH, USDC, and CRO. The system uses a Merkle tree, which is a cryptographic structure that allows each user to confirm their balance was included in the total snapshot without exposing anyone else’s data.

In practical terms, your balance acts like a leaf on a tree. That leaf mathematically connects to a single root hash published by the platform. If the math checks out, your funds were part of the reported reserves at that moment in time.

Mazars later exited the crypto Proof of Reserves space altogether, which left Crypto.com running the system internally. The company still provides public tools that let users generate proofs and cross-check on-chain wallets using third-party analytics platforms.

How verification works today:

- Log in to Crypto.com’s Proof of Reserves page and generate your personal Merkle proof.

- Check that the proof against the published root hash using the provided tools.

- Compare the platform’s disclosed wallet balances on blockchain explorers or services like Nansen or DeFiLlama.

A key limitation to understand

Proof of Reserves is strong at answering one question: do customer crypto assets exist and appear fully backed at a specific snapshot in time?

It does not answer broader questions about the company’s overall financial health. PoR does not audit corporate liabilities, fiat balances held off-chain, debts at subsidiaries, or risks tied to non-custodial business lines. It is best treated as a meaningful reserve check, not a full solvency or balance-sheet audit.

That distinction matters, and it’s where informed users should stay clear-eyed rather than overly reassured.

Insurance (what it covers, who underwrites, what it excludes)

Crypto.com’s insurance setup is built in layers, totaling roughly $870 million. The base layer is about $750 million in coverage for retail custody, designed to protect against theft or loss from wallets controlled by the platform. On top of that sits roughly $120 million tied to institutional custody, split between cold-storage coverage for physical damage or loss and crime insurance.

The institutional portion includes around $100 million in cold-storage “specie” coverage underwritten through Lloyd’s of London and an additional $20 million in crime coverage arranged by Aon. These policies are backed by major reinsurers and are specifically structured for digital-asset custody risks such as platform-side breaches.

Crypto.com also runs an Account Protection Program that can reimburse up to $250,000 per eligible user in cases of unauthorized access. That protection comes with conditions. Incidents must be reported promptly, typically within 60 days, and claims require evidence that the user was not at fault, such as avoiding password reuse or unsafe practices. Certain high-risk assets and sanctioned jurisdictions are excluded.

Does this mean my funds are invincible?

Insurance does not make funds “invincible.” Coverage applies only when failures happen on the platform’s side. Losses caused by phishing, fake apps, sending funds to the wrong address, approving malicious smart contracts, or market volatility remain the user’s responsibility.

Security certifications and compliance standards

Crypto.com’s security posture isn’t based on self-attestations alone. It is backed by a stack of external certifications that require ongoing audits and repeatable controls.

- ISO 27001: Sets the framework for how information security is managed, including regular risk assessments, staff training, and incident response planning.

- ISO 27701: Extends those controls to privacy, covering how personal data, such as KYC documents and transaction history, are handled and deleted under GDPR or CCPA.

- ISO 22301: Focuses on business continuity, showing the platform can recover trading and custody operations quickly after outages or disruptions.

- SOC 2 Type II: A long-form audit conducted over six to twelve months, testing security, availability, processing integrity, confidentiality, and privacy.

- PCI DSS v4.0: Applies to Crypto.com’s card products, enforcing encrypted card data storage and regular penetration testing.

Together, these certifications reduce blind spots by forcing documented, testable defenses rather than informal security promises.

Account security controls (what users can actually toggle)

Every Crypto.com user has access to a set of in-app controls that work together as a defense-in-depth system. No single toggle is enough on its own, but combined, they significantly reduce common attack paths.

- Passkeys: Device-bound, phishing-resistant logins using Face ID, Touch ID, or hardware keys, eliminating passwords that can be stolen.

- TOTP-based 2FA: App-generated codes from tools like Google Authenticator, required by default since 2022 to avoid SMS-based attacks.

- Anti-phishing code: A custom phrase shown in official emails and login pages, helping spot fake messages and clone sites.

- Withdrawal whitelist with a 24-hour lock: Approved addresses can withdraw immediately, while new addresses are delayed, giving time to catch mistakes or compromises.

- Trusted devices and session visibility: Users can view and revoke active sessions and block unfamiliar IP locations.

- Crypto.com Verify: A biometric challenge required for withdrawals above certain thresholds.

Turning these on takes only a few minutes and cuts off the vast majority of everyday attack vectors seen on exchanges. Explore more such practical habits for stronger crypto safety practices.

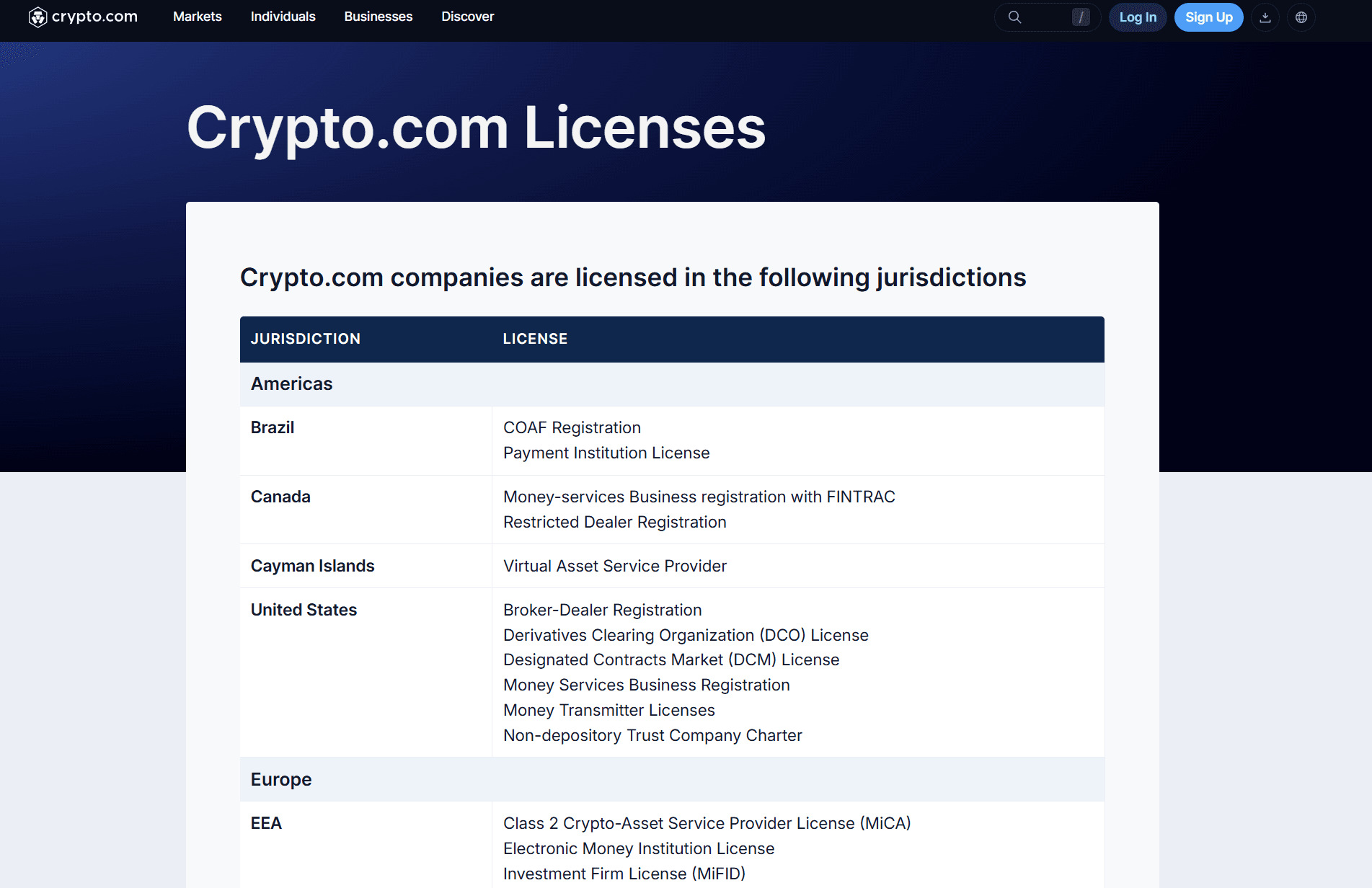

Regulation and Licensing (Jurisdiction-by-Jurisdiction)

Licenses Held Across Key Global Jurisdictions By Crypto.com. Image via Crypto.com

Licenses Held Across Key Global Jurisdictions By Crypto.com. Image via Crypto.comCrypto.com operates under a broad but carefully segmented regulatory framework. It holds licenses or registrations across most major G20 markets, giving it legitimacy for core services like AML checks, fiat on-ramps, and regulated custody. What changes by country is the product menu. Some regions allow the full stack, others impose limits on leverage, derivatives, or staking.

This section maps where Crypto.com can legally operate and what users should realistically expect in each jurisdiction.

Quick regulatory takeaway

- Crypto.com is regulated across the US, UK, EU, Singapore, Australia, Canada, and the UAE, covering the vast majority of global users.

- Product access depends on location. For example, leverage is restricted in the UK and Singapore, while most U.S. states support spot trading and fiat rails, excluding New York.

- The EU’s MiCA framework standardizes access, but users should always check the live license page to confirm what applies to their country.

United States

In the U.S., Crypto.com operates through a New Hampshire–chartered non-depository trust company for qualified custody and is registered with FinCEN as a Money Services Business. It also holds Money Transmitter Licenses in 48 states, enabling USD deposits and spot trading across most of the country.

Certain derivatives fall under CFTC oversight. The major exception is New York. Without a BitLicense, Crypto.com does not offer core services to New York residents, who typically need to use alternatives like Coinbase or Gemini. Outside New York, most users have access to compliant fiat on-ramps and standard trading features.

United Kingdom

In the UK, Crypto.com is registered with the Financial Conduct Authority as a cryptoasset firm, which covers custody and exchange services. It also holds Electronic Money Institution status, allowing GBP deposits and withdrawals.

UK rules are stricter on product promotion and risk. Margin trading, staking derivatives, and some higher-risk products are restricted under FCA guidance. AML supervision remains robust, but the experience is intentionally conservative by design.

European Union

Crypto.com’s European operations are anchored in Malta. In early 2025, the platform secured a MiCA Class 2a/2b Crypto-Asset Service Provider license from the Maltese regulator. This allows custody, exchange, and wallet services to be passported across all 27 EEA member states.

From 2026 onward, MiCA mandates full compliance across the bloc, replacing the patchwork of country-specific rules with a single regulatory standard. Additional VASP and Electronic Money licenses support fiat and payment services.

Singapore

In Singapore, Crypto.com operates under a MAS Major Payment Institution (MPI) license for Digital Payment Token (DPT) services. The trade-off is tighter product limits by design, including strict leverage caps (around 2.5x max) and daily volume limits. For most users, that translates to a more conservative, regulator-friendly setup for APAC access.

Malta, Australia, Canada, UAE

Beyond the core regions, Crypto.com maintains local registrations to support regional access and compliance.

- In Malta, the platform operates as a MiCA hub, enabling EU-wide services.

- In Australia, it is registered with AUSTRAC as a Digital Currency Exchange.

- In Canada, it operates as a FINTRAC-registered MSB, with additional provincial registrations in places like Ontario and Quebec.

- In the UAE, it holds approvals under Dubai’s VARA framework and the ADGM financial regulator, supporting both fiat and crypto services across the MENA region.

See why strong KYC/AML matters for exchange credibility.

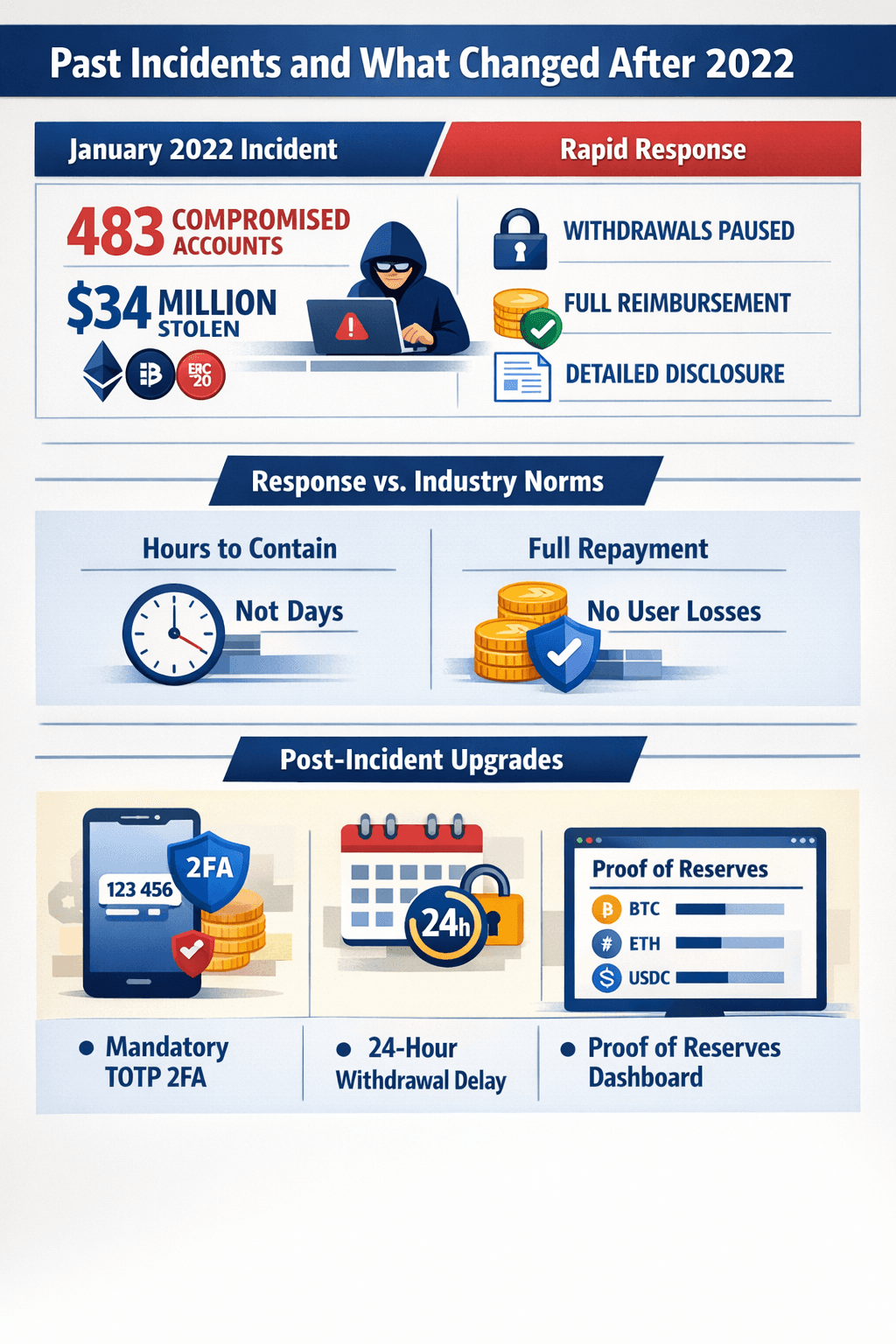

Past Incidents and What Changed After 2022

2022 Breach Lessons And The Fixes Implemented

2022 Breach Lessons And The Fixes ImplementedCrypto.com’s security history includes one major, widely reported incident. What sets it apart is how that incident was handled: fast detection, full user reimbursement, and public disclosure of what went wrong and how it was fixed. The response triggered permanent security upgrades that have held up through 2026, while also serving as a reminder that no centralized platform is completely risk-free.

January 2022 incident

On Jan. 17, 2022, attackers exploited a vulnerability in the platform’s 2FA flow, likely through compromised API keys or session tokens. This allowed unauthorized access to 483 accounts and led to roughly $34 million in withdrawals, mostly in ETH and ERC-20 tokens.

Crypto.com’s monitoring systems flagged the abnormal activity within hours, triggering a global withdrawal pause that lasted about 14 hours while the incident was investigated. The company published a detailed security report the following day and reimbursed every affected user in full using operational funds, not insurance.

Subsequent investigations pointed to unauthenticated API endpoints as the entry point. Importantly, there was no compromise of core cold storage, master keys, or custody infrastructure.

Response quality versus industry norms

Measured against similar events in the crypto industry, Crypto.com’s handling was notably faster and more transparent.

Detection and containment took hours rather than days, contrasting sharply with KuCoin’s 2020 hot-wallet breach, which unfolded over a longer window. User reimbursements were completed within weeks and did not rely on dipping into customer balances, exceeding the partial recovery model used after Binance’s 2019 incident.

Read our safety review to see whether KuCoin is secure in 2026.

The company also released a public post-mortem outlining root causes and fixes, avoiding the opacity that later defined failures like FTX. Platform downtime was limited to a short withdrawal pause, rather than the weeks-long freezes seen elsewhere.

Post-incident hardening

The 2022 breach led to permanent changes that now form the baseline for all Crypto.com accounts. App-based TOTP 2FA became mandatory, replacing vulnerable SMS-based authentication. Real-time behavioral monitoring was expanded to flag suspicious login and withdrawal patterns instantly. Withdrawal address whitelisting was strengthened with a mandatory 24-hour delay for any new destination.

Crypto.com also launched public Proof of Reserves dashboards, giving users ongoing visibility into on-chain asset backing rather than relying solely on private attestations.

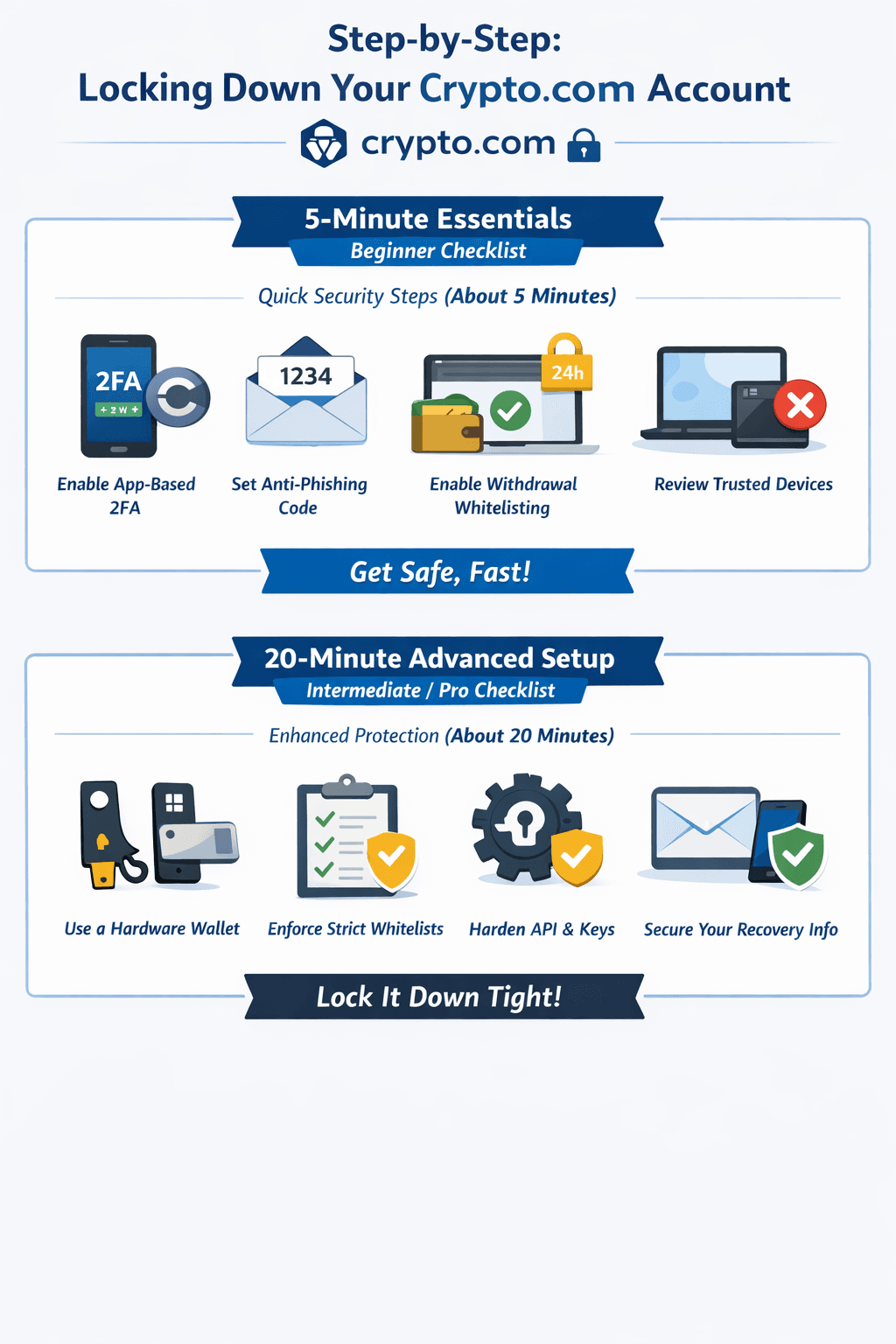

Step-by-Step: Locking Down Your Crypto.com Account

Quick Setup Steps That Block Common Attacks

Quick Setup Steps That Block Common AttacksCrypto.com can be reasonably safe out of the box, but proper setup is what turns it into something far more resilient. A few simple switches and habits eliminate most avoidable risks. The checklists below focus on actions you can actually complete, with realistic time estimates and clear reasons to follow through.

5-minute essentials

These are the must-do steps right after signing up.

- Turn on app-based 2FA (1 minute)

Go to Security settings and connect an authenticator app.

This matters because it shuts down SIM-swap attacks that can bypass SMS codes. - Set an anti-phishing code (30 seconds)

Generate a unique code that appears on real Crypto.com emails and login screens.

This matters because fake apps and clone sites are easier to spot instantly. - Enable withdrawal whitelisting with a 24-hour lock (2 minutes)

Add your cold wallet addresses first.

This matters because funds can’t be sent anywhere new without a delay you can catch and cancel. - Review trusted devices and active sessions (1 minute)

Log out of anything you don’t recognize.

This matters because it cuts off hijacked access immediately. - Add biometrics or a passkey (30 seconds)

Link Face ID or Touch ID in your profile.

This matters because passwordless login is far harder to phish or keylog.

Explore top self-custody wallets for secure crypto storage.

20-minute advanced setup

These steps add isolation and redundancy for higher balances.

- Pair passkeys with a hardware wallet (5 minutes)

Bind a YubiKey or Ledger for offline signing where possible.

This matters because you stay protected even if your phone is lost or compromised. - Enforce strict whitelist rules (3 minutes)

No exceptions. Test the setup with a small transfer first.

This matters because every anomaly triggers a pause instead of instant loss. - Harden API keys (4 minutes)

Limit keys to specific IPs and use read-only scopes unless trading requires more.

This matters because leaked keys can’t be abused in automated setups. - Create sub-accounts (3 minutes)

Separate trading, long-term holdings, and NFTs.

This matters because a breach in one area can’t drain everything. - Clean up email and recovery paths (2 minutes)

Use a dedicated email alias and secure your backup phone number.

This matters because phishing and account recovery are common attack paths. - Lock down your devices (3 minutes)

Install the app only on clean, updated phones and enable app pinning where available.

This matters because it blocks malware and clipboard hijackers at the device level.

Ongoing maintenance calendar

Security drifts over time if you don’t check it. These quick routines keep your setup tight with minimal effort.

- Monthly (5 minutes): Review active sessions and trusted devices, test your 2FA code, and confirm withdrawal whitelists are still correct.

- Quarterly (10 minutes): Generate a fresh Proof of Reserves check, rebalance or clean up sub-accounts, and rotate passkeys or hardware credentials if you use them.

- After any DApp or wallet integration (2 minutes): Revoke token and contract approvals using the app or a tool like Revoke.cash.

- If you suspect a compromise (immediate): Lock the account, document what happened, and contact in-app support right away.

- One high-impact rule to remember: Withdrawal whitelisting with a 24-hour lock stops the majority of post-login thefts on its own.

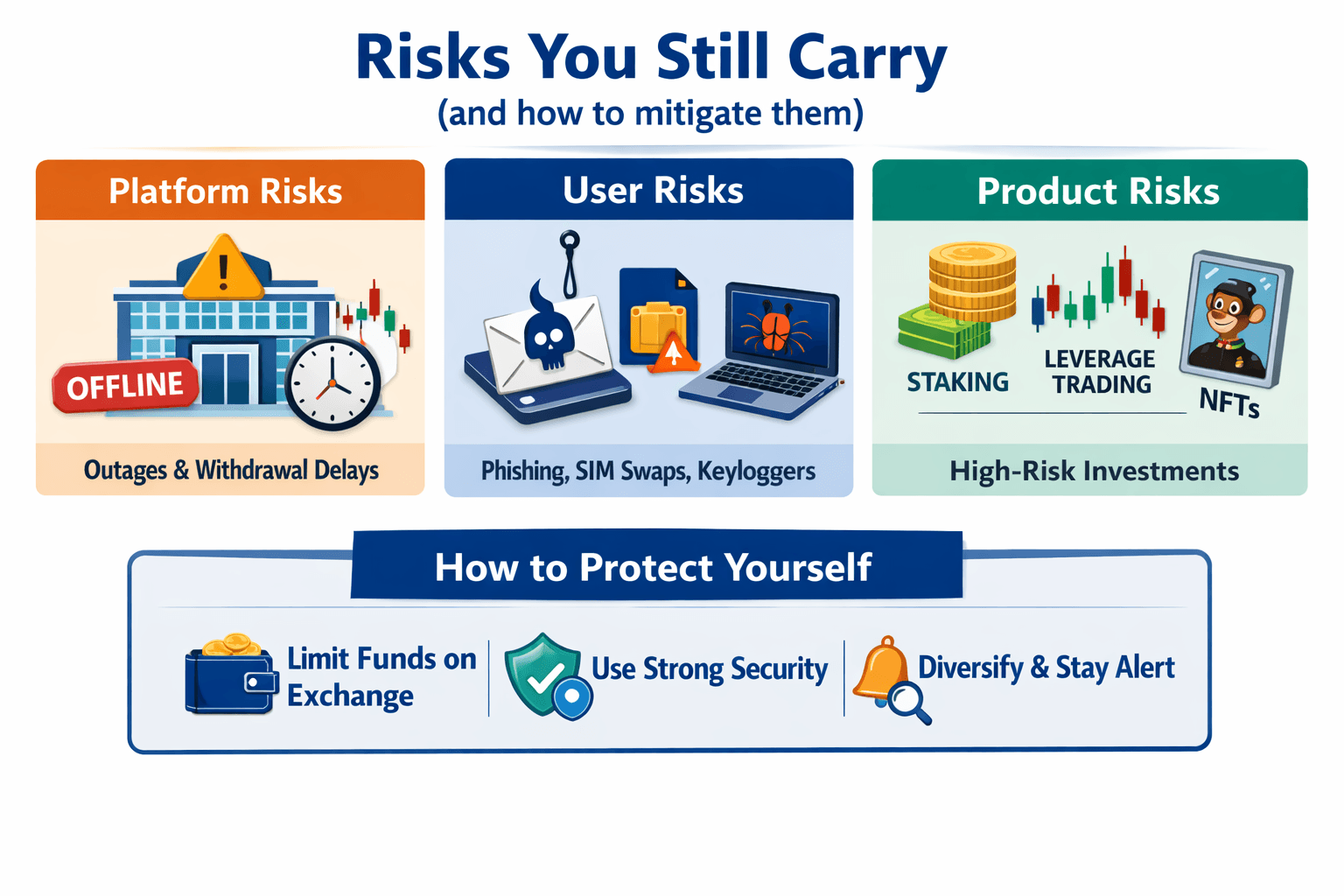

Risks You Still Carry (And How to Mitigate Them)

User Risks And Practical Mitigation Tactics

User Risks And Practical Mitigation TacticsCrypto.com’s custody, insurance, and internal controls do a good job of handling platform-side threats. What they can’t eliminate are risks tied to operations, user behavior, and certain high-risk products. Those gaps can still turn into real pain points, from temporary lockups to full losses.

The goal here isn’t fear. It’s clarity. Once you understand where the risk actually lives, you can turn most of it into routine, manageable behavior.

Platform risks

Even well-run exchanges can hit operational stress. During sharp market moves, you may see brief outages, withdrawal backlogs, or precautionary pauses like the 14-hour global freeze after the 2022 incident.

What this means in practice

Your funds are usually safe, but temporarily unreachable. In fast markets, that can hurt. You might miss a sell, fail to meet a margin call elsewhere, or get stuck holding risk during a drawdown. These moments tend to show up during extreme events, even on platforms with strong uptime.

How to reduce the impact

- Keep exposure small: Hold only one to two weeks of active trading funds on the exchange. Move the rest to cold storage as soon as trades settle.

- Spread liquidity: Use two or three platforms instead of one so a single pause doesn’t lock everything.

- Stay alert: Subscribe to status alerts and test small withdrawals regularly to catch issues early.

- Plan for volatility: When daily swings exceed 10 percent, pre-position fiat or stablecoins off-platform so you’re not forced to react mid-crisis.

User-side risks

Most retail losses don’t come from exchange failures. They come from people being tricked. Phishing emails, fake support chats, SIM swaps, keyloggers on shared devices, and social engineering still account for the majority of real-world losses.

What this means in practice

Attackers don’t need to break the platform. They wait for you to approve the wrong thing or reveal access indirectly. Once that happens, insurance doesn’t apply. Losses are often total and unrecoverable.

How to shut this down

- Go passwordless: Use passkeys or hardware-backed authentication so there’s nothing for phishers to steal.

- Treat whitelists as sacred: Never turn off the 24-hour lock or add addresses on impulse. Keep a small, verified list and review it monthly.

- Harden your devices: Stick to updated phones, enable app pinning and full-disk encryption, and avoid public WiFi for logins.

- Ignore off-platform help: Real support lives inside the app. Anything else is noise. Report fakes and use dedicated email aliases for recovery.

- Use hardware approval for size: For larger balances, approve transactions on a hardware device, not on-screen.

Product-specific risks

Certain features amplify exposure through lockups, leverage, or smart contract vectors, rated by likelihood/impact with product-tailored fixes.

- Earn / Staking — Medium risk

Funds are often locked for fixed periods (while staking), which limits access during market stress. Early exits can carry penalties, and validator or protocol issues can affect returns. Best used with capped allocations and flexible terms. - Derivatives / Futures — High risk

Leverage amplifies small price moves into rapid liquidations, and mistakes scale fast. API misuse or emotional trading can wipe out positions even when the platform itself is functioning normally. Suitable only for disciplined, experienced traders with strict limits. - Crypto.com Visa Card — Low to Medium risk

Everyday spending is convenient, but exposure exists through card fraud, SIM-linked chargebacks, or merchant category blocks. Losses are usually capped by daily limits and freezes, making the impact manageable with monitoring. - NFT Marketplace / Web3 tools — Medium to High risk

Smart contract approvals and post-mint permissions can drain linked wallets without an obvious warning. Price manipulation and illiquidity add secondary risk. Safe use depends on wallet segregation and aggressive approval revocation.

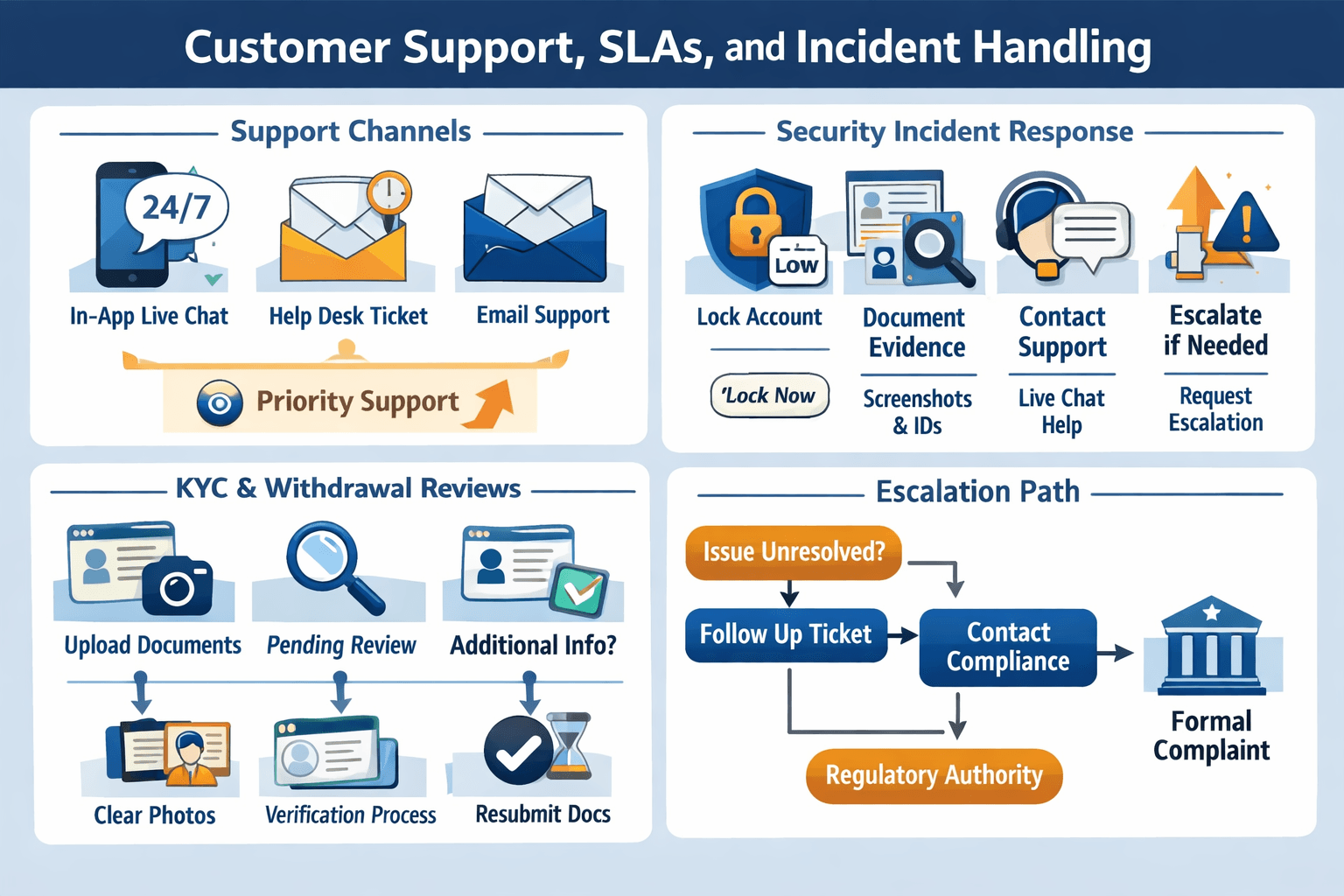

Customer Support, SLAs, and Incident Handling

How Support Handles Issues When Things Break

How Support Handles Issues When Things BreakSupport quality tends to matter most when something goes wrong. Crypto.com’s system is built around fast, in-app handling, but user feedback shows friction during high-volume moments like KYC reviews or withdrawal disputes. Knowing how the process actually works and where it breaks down helps you resolve issues faster and avoid getting stuck in loops.

Official channels and expected response windows

Crypto.com routes support through a tiered structure based on urgency.

The primary channel is in-app live chat, available 24/7. It supports text, voice notes, images, and screen sharing, which speeds up diagnosis. Initial responses often arrive within 30 minutes, though this varies during peak periods. For non-urgent issues, users can submit self-service tickets through the help portal. These typically escalate within one to two days. Email support is reserved for complex or VIP cases and can take several business days. There are no publicly guaranteed SLAs, but higher account tiers tied to CRO staking unlock priority handling and, in many cases, faster responses. If a case stalls, unresolved complaints can be escalated through formal compliance channels or regulators, depending on jurisdiction.

Best practice: Always start with in-app chat. Include screenshots, timestamps, and transaction IDs upfront. Clear evidence shortens resolution time dramatically.

What to do during an incident

When you suspect unauthorized activity or hit an unexpected lock, speed and documentation matter.

- Lock the account immediately: Use the one-tap “Lock Account Now” option in security settings. This halts withdrawals, trades, and transfers while keeping login access intact.

- Document everything: Capture screenshots of suspicious sessions, transaction hashes, timestamps, IP addresses, and any error messages. Note your last confirmed legitimate action.

- Contact in-app support right away: Open live chat and clearly state the issue. A direct, factual message helps agents triage faster. Upload all evidence in the same thread.

- Complete KYC refresh if requested: Use fresh photos, good lighting, and clear document edges to avoid rejections. Expect this step in most security-related cases.

- Escalate if progress stalls: If there’s no movement after a day, reference your chat ID in a follow-up ticket and request escalation. In regulated regions, formal complaints can be submitted through the relevant authority if needed.

This flow aligns with Crypto.com’s account protection requirements and strengthens eligibility for goodwill reimbursements when applicable.

Where support tends to fail

Patterns from reviews and community feedback show three recurring pressure points.

- KYC verification loops: Repeated document rejections or “pending review” states can hold funds for days. This usually happens during volume spikes or when uploads are unclear. High-resolution images with all document corners visible reduce delays. Chat follow-ups tend to move faster than email.

- Withdrawal reviews and delays: Large withdrawals or new destination addresses often trigger manual checks lasting one to three days. Pre-whitelisting addresses, splitting large transfers, and checking the status page before submitting help reduce friction.

- Chat drop-offs during peak hours: Support agents sometimes disconnect mid-conversation during busy US and EU evenings. Reaching out during off-peak hours improves continuity. Polite escalation requests after extended waits often help.

The upside is that persistence pays off. A majority of tickets that are properly documented and followed up on do reach resolution, with particularly strong outcomes reported for card disputes and higher-tier accounts.

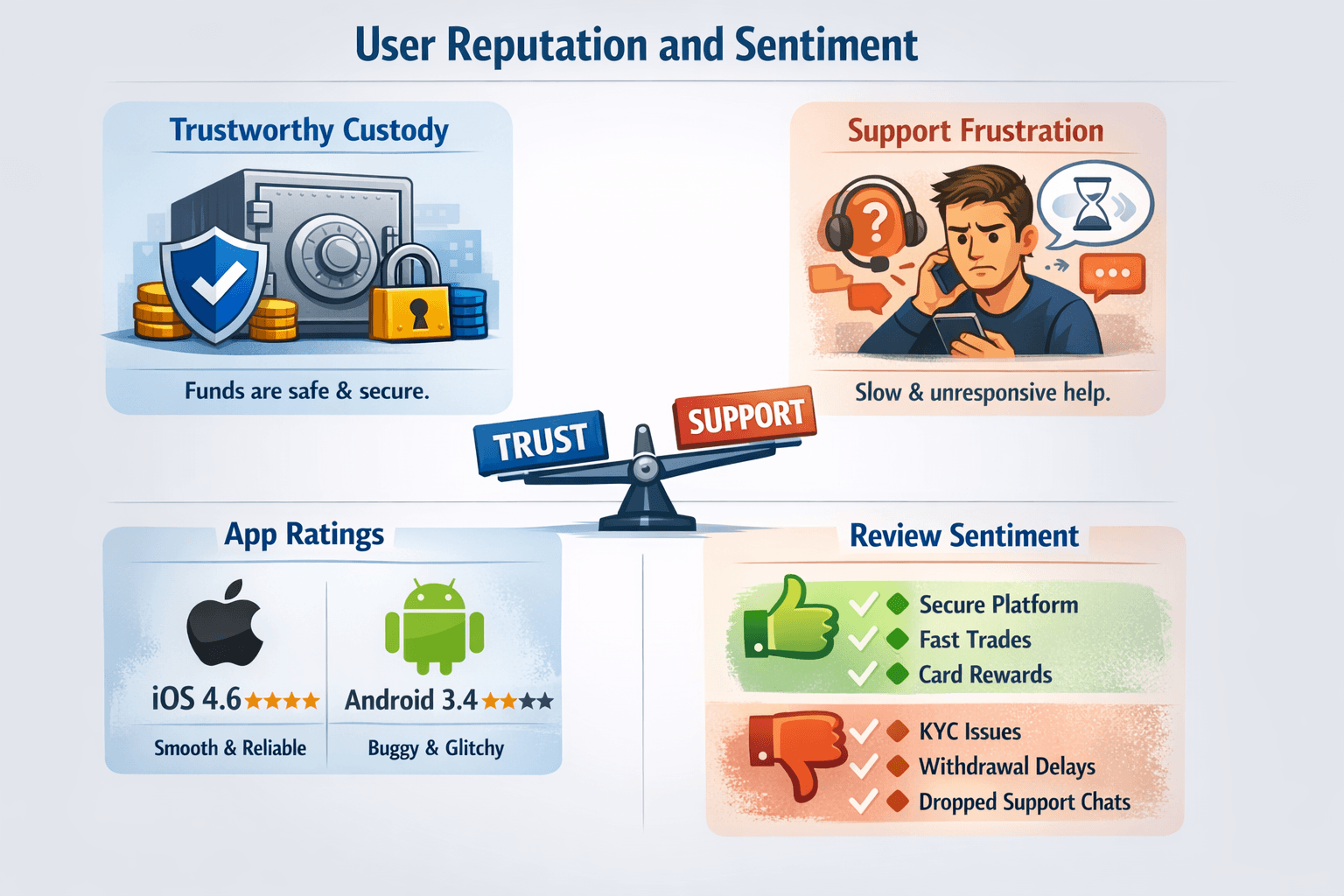

User Reputation and Sentiment

What Real Users Consistently Praise And Criticize of Crypto.com

What Real Users Consistently Praise And Criticize of Crypto.comUser feedback paints a fairly consistent picture. Crypto.com is widely seen as structurally solid on custody and trading, but weighed down by operational friction, especially around support. People tend to trust where funds are stored, yet feel frustrated when something goes wrong and human help is slow.

This summary pulls together patterns from 2025–2026 app store reviews, forums, and social channels to help users understand what the experience actually feels like day to day and how that affects perceived safety.

App store ratings (iOS vs Android)

The mobile app is generally well regarded for core functions, but the experience differs noticeably by operating system.

- On iOS, Crypto.com scores around 4.6 out of 5 from more than half a million ratings. Users regularly praise smooth performance, clean charting, reliable biometric login, and tight Visa card integration. Reviews often highlight fast trade execution and confidence in the app’s security controls.

- On Android, ratings drop to roughly 4.0 out of 5 across about 100,000 reviews. Complaints cluster around practical issues rather than security itself: crashes on older devices, KYC uploads failing or looping, and delayed push notifications. A common refrain is that buying and holding works well, but support interactions are exhausting when problems arise.

The combined average looks strong on paper, but it hides a real split. iOS users tend to have a premium-feeling experience, while Android users need more patience and tolerance for friction.

Forums and social (Reddit, X, Trustpilot)

Apple App Store & Google Play Ratings

iOS App Store: 4.6/5 (500K+ reviews, U.S./global stores)

Dominant positives: Seamless biometrics, intuitive charts, Visa card perks ("5% CRO cashback beats competitors").

Dominant negatives: KYC holds ("verified 3x, still pending 2 weeks"), deposit glitches.

Recurring bugs: Staking sync delays, push notifications failing during volatility.

Bottom line: iOS users love mobile-first features; minor operational friction noted.

Google Play (Android): 3.4/5 (1M+ reviews)

Dominant positives: Easy setup, card convenience ("real-world spending made simple").

Dominant negatives: Withdrawal failures ("multiple attempts, always rejected"), support ghosts.

Recurring bugs: Portfolio not updating, app crashes on older devices.

Bottom line: Functional for basics, but Android-specific UX/KYC issues drag scores.

Social & Forums (Reddit / X / Trustpilot)

Reddit (r/Crypto_com, r/CryptoCurrency 20K+ relevant threads)

Most common complaints: Endless KYC loops ("circle of re-uploads"), 72h+ withdrawal reviews.

Most common positives: Insurance reassurance ("$870M > Coinbase"), fast spot trades.

What gets resolved: 70% via public escalation ("post here, support responds in hours").

Bottom line: Community-driven fixes shine; amplify for traction.

X (Twitter) (high-volume searches, 2025–2026)

Most common complaints: Card freezes, promo exclusions ("staking APY nerfed").

Most common positives: App updates ("passkeys fixed phishing fears").

Company response: Official @cryptocom replies to viral threads (30–60 min).

Bottom line: Public visibility accelerates resolutions; scam warnings are prevalent.

Trustpilot (4.0/5, 287+ pages, 100K+ reviews)

Most common complaints: Support abandonment ("chat drops after 20 min"), hidden fees/limits.

Most common positives: Reward ecosystem ("CRO perks pay off long-term").

What gets resolved: Persistent tickets + screenshots (65% favorable closures).

Bottom line: Frustration peaks on ops; positives from patient users.

What this means for safety

From a security standpoint, sentiment does not point to custody or solvency problems. There were no widely reported cases in 2025 or 2026 involving unbacked funds, hidden losses, or platform-wide hacks.

What sentiment does signal is inconsistent support speed. Funds are usually protected through whitelists, locks, and insurance, but access can feel uncertain when verification or manual reviews take longer than expected. For users in a rush, that delay can feel like a safety issue even when assets themselves are secure.

The practical takeaway is simple. Strong upfront setup does most of the work. Users who enable all controls, segment balances, and avoid last-minute withdrawals bypass the majority of complaints seen in reviews. Support works best as a fallback, not something you rely on during stressful moments.

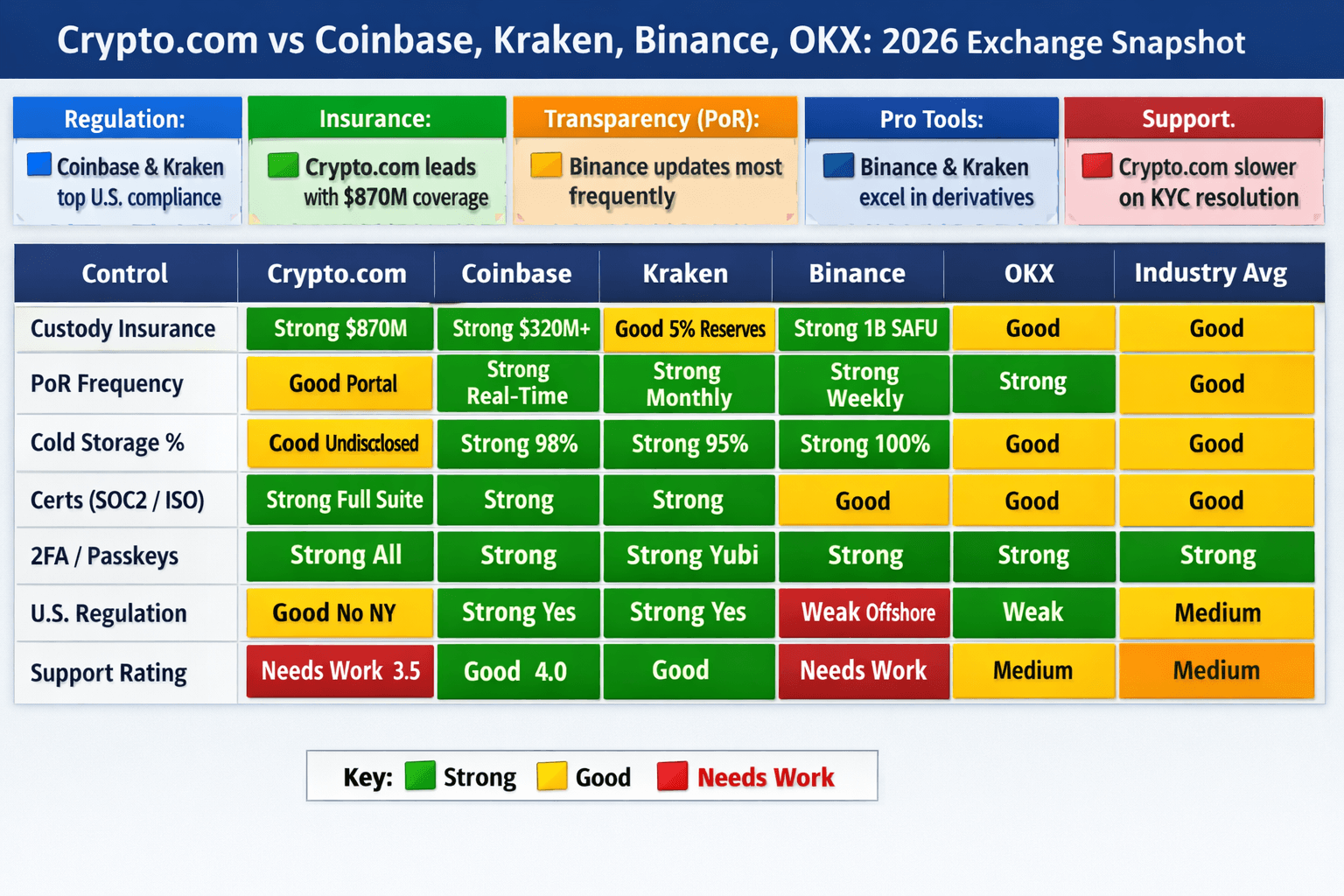

Crypto.com vs Coinbase, Kraken, Binance, OKX

Comparative Safety Ratings And Risk Indicators For Exchanges

Comparative Safety Ratings And Risk Indicators For ExchangesCrypto.com comfortably sits in the top tier alongside the biggest exchanges. Its edge shows up in insurance coverage and user-level safety controls, while it gives up some ground on U.S. regulatory depth and advanced professional tooling. This comparison uses 2026-era signals to highlight where each platform is strongest and which trade-offs matter by use case.

Quick comparison summary

Before getting into details, here’s the fast scan. These five points capture where each exchange clearly leads and where trade-offs begin.

- Regulation: Coinbase and Kraken lead on U.S. oversight; Crypto.com and Binance offer broad global access with lighter U.S. depth.

- Insurance: Crypto.com stands out with $870M in coverage; Binance and Kraken rely on SAFU-style funds; Coinbase focuses on custodial safeguards.

- Transparency (PoR): All publish Proof of Reserves; Binance updates most frequently, Crypto.com uses snapshot-based Merkle proofs.

- Pro tooling: Binance and Kraken dominate derivatives and API depth; Coinbase and Crypto.com are better balanced for retail users.

- Support: Mixed across all platforms; Coinbase trends more consistently, and Crypto.com is slower on KYC resolution based on user sentiment.

Control-by-control matrix (scannable)

| Control | Crypto.com | Coinbase | Kraken | Binance | OKX | Industry Avg |

|---|---|---|---|---|---|---|

| Custody Insurance | Strong ($870M) | Strong ($320M+) | Good (5% reserves) | Strong (1B SAFU) | Good | Good |

| PoR Frequency | Good (Portal) | Strong (Real-time) | Strong (Monthly) | Strong (Weekly) | Strong | Good |

| Cold Storage % | Good (Undisclosed) | Strong (98%) | Strong (95%) | Strong (100% claim) | Good | Good |

| Certs (SOC2/ISO) | Strong (Full suite) | Strong | Strong | Good | Good | Good |

| 2FA/Passkeys | Strong (All) | Strong | Strong (Yubi) | Strong | Strong | Strong |

| Whitelist/Lock | Strong (24h) | Good (Address book) | Good | Good (Optional) | Good | Good |

| U.S. Reg (BitLicense) | Good (No NY) | Strong (Yes) | Strong (Yes) | Weak (Offshore) | Weak | Medium |

| Support Rating | Needs Work (3.5) | Good (4.0) | Good | Needs Work | Medium | Medium |

Which exchange fits which use case

Tailored picks based on 2026 priorities:

- Beginners: Coinbase—simplest UX, strongest U.S. compliance, educational resources. (Fallback: Crypto.com for cards.)

- Active traders: Binance/OKX—deep derivatives, low fees, advanced order types. (Kraken for USD pairs.)

- Institutions: Kraken/Coinbase—qualified custody, OTC desks, audit trails.

- NFT heavy users: Crypto.com—integrated marketplace + CRO ecosystem.

- Card users: Crypto.com—top rewards (5%+ CRO), global acceptance.

Also consider for U.S. profiles: Gemini (NYDFS trust charter, ultra-custody focus) and Robinhood (brokerage integration, no-fee basics)

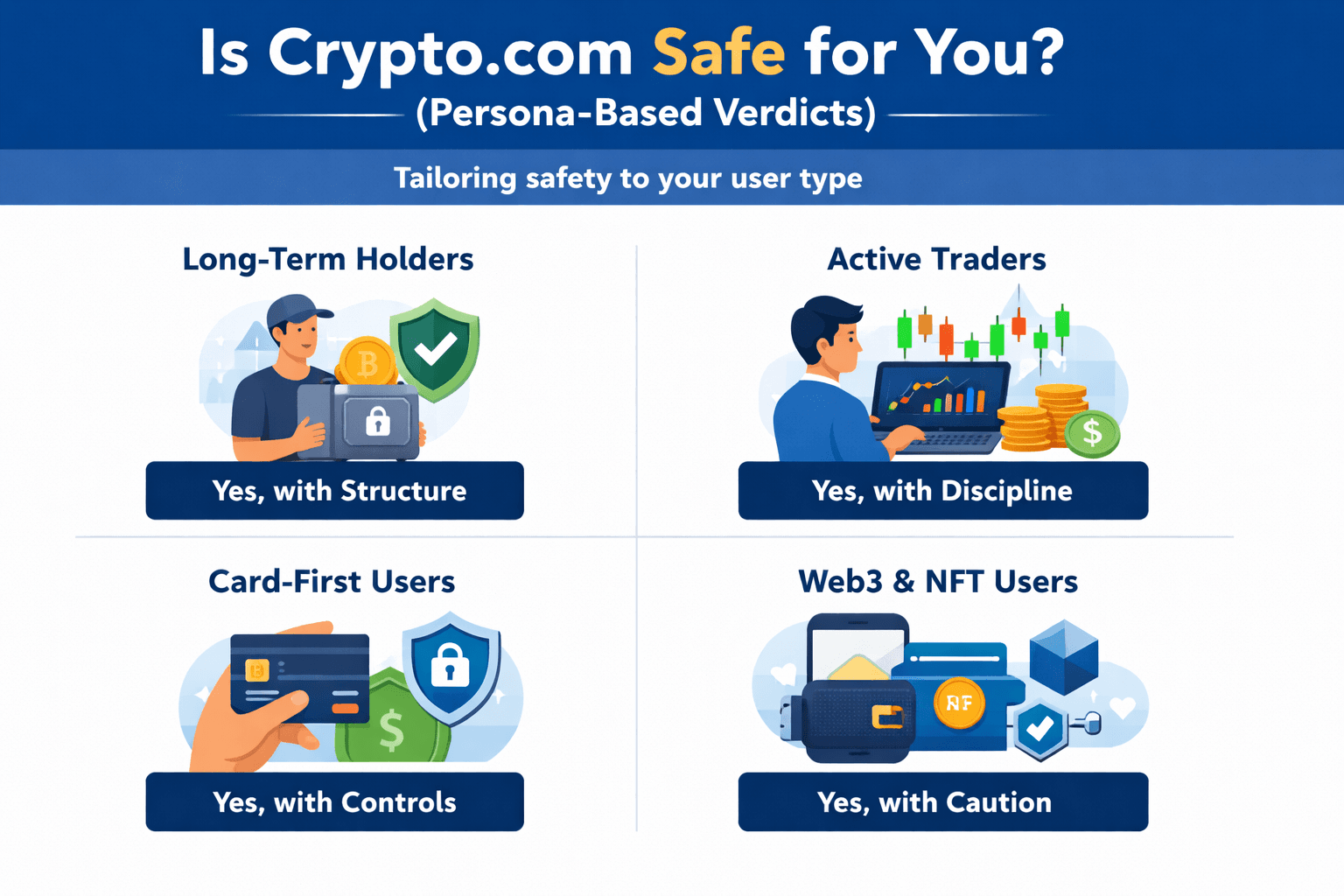

Is Crypto.com Safe for You?

Safety Guidance Tailored To Different User Profiles

Safety Guidance Tailored To Different User ProfilesSafety depends on how you use an exchange. Crypto.com works well for several user types, but only if you actively tailor it to your risk tolerance and habits. The verdicts below translate everything discussed so far into clear, profile-specific guidance.

Long-term holders

Yes, with structure. Crypto.com works best as a controlled trading hub, not a forever vault. The 1:1 Proof of Reserves and roughly $870 million in insurance provide solid protection for active balances, but long-term capital still belongs in self-custody.

How to use it safely

- Keep only 5 to 10 percent of your portfolio on the exchange, roughly one to two weeks of trading needs.

- Store the rest in cold storage and move funds only through whitelisted addresses.

- Keep withdrawal whitelisting and the 24-hour lock enabled at all times.

- Verify Proof of Reserves monthly and use a separate sub-account for small balances.

Why this works

You reduce exposure to platform and custodial risks while still benefiting from liquidity and execution when needed.

Learn what “HODL” really means in the crypto space.

Active traders

Yes, but only with discipline. Crypto.com is well-suited for frequent spot and derivatives trading thanks to APIs, sub-accounts, and liquidity. The main risk here is over-leverage combined with withdrawal friction during volatile periods.

How to use it safely

- Lock down APIs with IP allowlists and restrictive permissions. Rotate keys every quarter.

- Use separate sub-accounts for spot, perps, and higher-risk trades to isolate losses.

- Keep the 24-hour withdrawal lock on and review active sessions daily.

- Cap total open exposure to a small percentage of overall capital.

Why this works

Segmentation and strict limits prevent one bad trade or compromised key from escalating into a portfolio-level failure.

See our ranked list of the best crypto exchanges for trading in 2026.

Card-first users

Yes, with tight controls. Crypto.com is particularly strong for spending, with competitive rewards and smooth Visa integration. That said, the card should be treated like a hot wallet, not a savings account.

How to use it safely

- Set low daily spending limits and freeze the card when not in use.

- Route card spending through a low-balance sub-account, not your main holdings.

- Watch for merchant category restrictions, especially around crypto ATMs.

- Review transactions every two weeks and use in-app support quickly for disputes.

Why this works

Spending exposure stays capped, and any fraud or error is contained to a small balance.

Web3 and NFT users

Yes, but only with strict segregation. Crypto.com’s wallet connections and marketplace are usable, but smart contract approvals are the biggest risk in this category.

How to use it safely

- Use a dedicated burner wallet funded with a minimal amount for mints and dApp interactions.

- Never connect your main holdings wallet to new or unaudited contracts.

- Revoke approvals immediately after sessions using in-app tools or Revoke.cash.

- Test interactions with small-value transactions before committing meaningful funds.

Why this works

Isolation ensures that a malicious contract or approval drain cannot touch your core assets.

Conclusion

Crypto.com is not risk-free, but it is not reckless either. Its security model is built around layered custody, conservative controls, and a willingness to slow users down when something looks off. That trade-off can feel frustrating in the moment, yet it explains why the platform has avoided the systemic failures seen elsewhere.

For most users, safety on Crypto.com depends less on hidden mechanics and more on how deliberately the account is set up and used. With basic hygiene, tight limits, and realistic expectations around access and support, it functions reliably as a trading and spending platform. Treated as a long-term vault or a high-leverage playground, the risks rise quickly.

In short, Crypto.com works best when you meet it halfway: use the protections it offers, keep exposure intentional, and assume responsibility for the parts no exchange can secure for you.