Match to Your Goals

- Small swaps, use a DEX with proven routing.

- High limits, use a CEX with posted non-KYC caps.

- Perps, pick on-chain venues with risk controls.

No-KYC exchanges sit at the intersection of privacy, access, and risk. For many traders, the question isn’t “Can I avoid KYC?” but “What trade-offs am I accepting if I do?”

This guide compares centralized and decentralized options you can actually use today, with clear notes on limits, liquidity, and regional access. We explain our scoring, show fee and depth snapshots, and highlight where self-custody shines versus where centralized venues still matter.

Nothing here is legal or tax advice; rules change quickly. The goal is simple: help you pick a venue that fits your goals without sleep-walking into avoidable risk.

It offers high non-KYC withdrawal limits, clear maker and taker fees, and remains reachable for U.S. users.

It provides broad ERC-20 coverage, deep liquidity on majors, and reliable access from most regions.

It delivers low fees on BNB Chain and supports simple wallet based swaps without registration.

| Exchange | Limit | Fees | U.S. Access | Type |

|---|---|---|---|---|

| MEXC | 1,000 USDT per day | Spot 0.00%/0.00% promo, standard 0.10%/0.10%; Perps 0.00%/0.01% | Varies | CEX |

| CoinEx | 10,000 USD daily, about 50,000 USD monthly | Spot 0.20%/0.20% base, lower with CET; Perps varies | No | CEX |

| CoinCatch | 50,000 USDT per day, about 200,000 USDT per month | Spot 0.10%/0.10%; Perps 0.02% maker, 0.06% taker | Yes | CEX |

| PrimeXBT | No stated limit, documents may be requested case by case | Crypto 0.05% trade fee, no maker or taker tiers; CFDs vary | No | CEX, CFD |

| Bybit | Small unverified withdrawals, higher limits with KYC Level 1+ | Spot 0.10%/0.10%; Perps 0.02% maker, 0.055% taker | No | CEX |

| Toobit | 5 BTC per day without KYC, 50 BTC per day with advanced KYC | Spot 0.04% to 0.06% maker and taker; Perps 0.04% maker, 0.06% taker base | No | CEX |

| Uniswap | No account limits | Pool fee 0.05% or 0.30% or 1.00% plus gas | Yes | DEX |

| Fluid DEX | No account limits | Very low swap overhead plus gas, no maker or taker tiers | Yes | DEX |

| Hyperliquid | No account limits | Perps about 0.015% maker, 0.045% taker, team announced fee cuts | No | DEX, Perps |

| PancakeSwap | No account limits | Pool fee 0.01% to 1.00% plus gas | Yes | DEX |

Data verified: Feb. 2, 2026

If you want privacy, use self-custody and trade on DEXs. For convenience, use a CEX and accept limits. U.S. access varies, so always check the platform’s terms.

“No-KYC” isn’t a loophole; it’s a design choice. Laws still apply, and risks shift from platforms to you. Read this before picking any venue.

AML/KYC obligations differ sharply.

Your residency and venue rules determine what’s truly allowed, not your IP.

Same phrase, different models.

Expect limits or triggers somewhere, by size, product, or payment rail.

Self-custody changes risk type, not its existence.

Manage both vectors: platform solvency and contract integrity, then size positions accordingly.

This section explains how this guide was built, what we verified directly, and where its limits are, so you can judge how closely it reflects real-world access and risk.

We compared a mix of centralized exchanges (CEXs) and decentralized exchanges (DEXs) that are commonly described as “no-KYC,” then filtered them down based on real usability, not marketing claims.

For CEXs, we verified the existence and practical meaning of “no-KYC” by checking:

For DEXs, we focused on factors that determine real execution quality and safety:

Where the guide includes “snapshot” data (limits, fees, PoR notes), it reflects the stated verification window in the article and may change quickly due to policy updates, regulatory pressure, or product changes.

We did not run forensic solvency checks, independently audit reserves, or attempt to validate Merkle proofs ourselves. Proof-of-Reserves can improve transparency, but it is not a full balance-sheet audit and does not eliminate counterparty risk.

We also did not test:

This section includes a fast, side-by-side look at comparable metrics for the exchanges listed in this article.

This matrix focuses on whether you can withdraw without KYC, how much you can move, whether U.S. users can connect at all, and key transparency signals (Proof-of-Reserves) and tooling (apps, API).

| Exchange | No-KYC Daily / Monthly | U.S. Access | Perps | PoR stance | App (iOS/Android) | API |

|---|---|---|---|---|---|---|

| MEXC | 1,000 USDT daily withdrawal | Varies (regional restrictions apply) | Yes | Publishes PoR page/snapshots | Yes/Yes | Yes |

| CoinCatch | 50,000 USDT/day, ~200,000 USDT/month (non-KYC) | Yes | Yes | Monthly Merkle PoR, >90% excess reserves on core assets | Yes/Yes | Yes |

| PrimeXBT | Email-only account; no routine KYC for trading/withdrawals (exchange may request docs case-by-case) | No (restricted in U.S., Canada, Japan) | Yes (CFD perps) | No formal public PoR; cold-storage + manual withdrawals | Yes/Yes | No public API |

| Bybit | Unverified tier with limited features, small withdrawals; higher limits at KYC Level 1+ | No (U.S., U.K., Canada, Singapore, HK, France restricted on global site) | Yes | Merkle-tree PoR with periodic third-party reports (e.g., Hacken) | Yes/Yes | Yes |

| Toobit | Trading/withdrawals require KYC; Basic up to 5 BTC/day, Advanced up to 50 BTC/day | No (U.S. services discontinued per support notice) | Yes | PoR program (1:1 coverage) referenced | Yes/Yes | Yes |

Takeaway: MEXC and CoinCatch offer the most usable non-KYC paths for withdrawals; Bybit and Toobit tighten access without KYC; PrimeXBT stays email-only but is unregulated and geo-restricted.

DEX rows summarize where trades settle, what you pay (pool fee + estimated gas), whether privacy coins are practical, regional blocks, and wallet support.

| DEX | Chain(s) | Fees (est. gas) | Privacy coins? | Regional blocks? | Wallets |

|---|---|---|---|---|---|

| Uniswap | Ethereum, Arbitrum, Base, Polygon, BNB Chain | Pool fee tier (0.05%/0.30%/1.00%) + gas | No native privacy coins (ERC-20 only) | Interface is globally reachable; protocol is permissionless | MetaMask, Rabby, Ledger via WalletConnect |

| Fluid DEX | EVM (built alongside Instadapp Fluid lending) | Ultra-low swap overhead via callback design, plus gas (chain-dependent) | Generally no (focus on ERC-20s/stables) | Permissionless | MetaMask, WalletConnect-compatible |

| Hyperliquid | Hyperliquid L1 (trading), HyperEVM (contracts) | Maker/taker schedule on-chain; L1 gas negligible for users | No (perps/spot listings vary, privacy coins uncommon) | Terms restrict U.S. users | Native browser wallet + connectors |

| PancakeSwap | BNB Chain (plus Ethereum/other deployments) | 0.25% typical pool fee + low BNB gas | Limited | Permissionless | MetaMask, Trust Wallet, Ledger (WC) |

Takeaway: Uniswap and PancakeSwap remain the broad “everyday swap” choices, Fluid optimizes cost via design, and Hyperliquid/dYdX target on-chain perps rather than privacy coins.

The following table compares the fees and liquidity details of the CEXs in this article.

| Exchange | Maker/Taker (spot) | Perps fee (maker/taker) | Typical ETH-USDT withdraw fee | Depth on BTC/ETH (qualitative) |

|---|---|---|---|---|

| MEXC | 0% / 0% (promotional, standard 0.10%/0.10%) | 0.00% / 0.01% | Network fee only, dynamic by chain | High on majors; strong long-tail alts |

| CoinCatch | 0.10% flat | 0.02% (limit) / 0.06% (market) | Network fee only (varies) | Mid-tier books, improving |

| PrimeXBT | N/A (CFD pricing; crypto trading fee ~0.05%) | Per-product (CFD) | Withdrawals manual, network fees apply | Engine-driven liquidity (CFD), not spot order books |

| Bybit | 0.10% / 0.10% (VIP reduces) | 0.02% / 0.055% (VIP reduces) | Fixed per-asset, adjusted for miner fees | Very high depth on BTC/ETH |

| Toobit | 0.04%–0.06% (tiered) | 0.04%–0.06% (base) | Dynamic withdrawal fee (network-linked) | Growing depth, below top-tier CEXes |

Takeaway: Bybit remains the deepest on BTC/ETH among the CEXes listed, MEXC’s fee promos are the lowest, and CoinCatch publishes simple, predictable pricing.

| Platform | Custody risk | Smart-contract risk | Geo risk | Support recourse | Transparency |

|---|---|---|---|---|---|

| MEXC | PoR page, mixed regulatory history | ||||

| CoinCatch | North America reachable | monthly Merkle PoR, >90% excess | |||

| PrimeXBT | unregulated CFD venue | no DeFi code risk | broad exclusions | no formal PoR | |

| Bybit | post-2025 incident, PoR active | many restricted countries | mature help center and API tooling | Merkle PoR and third-party reports | |

| Toobit | U.S. discontinued | PoR 1:1 stated, young venue | |||

| Uniswap | self-custody | smart-contract and MEV | N/A community and governance | open-source, audits over time | |

| Fluid DEX | novel architecture | N/A | public docs, audits ongoing | ||

| Hyperliquid | self-custody | chain or protocol risk | U.S. blocked per terms | N/A | docs, public stats, not a CEX PoR |

| PancakeSwap | N/A |

Takeaway: Self-custody DEXs remove centralized custody risk, but introduce smart-contract and MEV exposure. Among CEXs here, Bybit improves transparency with PoR, CoinCatch publishes regular Merkle snapshots, while PrimeXBT’s lack of formal oversight places more onus on the user.

Here are our top picks for the best no-KYC CEXs and DEXs:

Why it’s here: MEXC earns a spot for its deep altcoin coverage, zero-fee trading, and flexible access tiers that allow trading and withdrawals without mandatory KYC.

No-KYC Withdrawal Limit: Up to 1,000 USDT daily withdrawals in most regions.

MEXC Serve Millions of Users Across Over 170 Countries | Image via MEXC

MEXC Serve Millions of Users Across Over 170 Countries | Image via MEXCCore strengths:

Main drawback: Regulatory warnings in the EU and Canada, plus the revoked Estonian license, mean MEXC operates with uncertain regional status. Fiat withdrawals remain unsupported, and interface complexity may overwhelm new users.

Best for: Traders seeking wide altcoin exposure, low-fee perpetuals, or a no-KYC entry point for testing strategies via demo mode.

Quick facts:

MEXC offers acceptable market depth and minimal trading costs for non-KYC users, although its mixed regulatory track record warrants added caution when trading substantial sums.

Read out full MEXC review.

Why it's here: A long-standing global CEX with a strong no-KYC policy, a wide array of altcoins, and a user-friendly interface, though its US access has been severely restricted following regulatory action.

No-KYC Withdrawal Limit: 10,000 USD equivalent daily. This is a standardized limit for "Basic Verification" (non-KYC) accounts. Higher limits are unlocked via KYC ("Verified" and "Certified" tiers), but the platform remains fully functional for most users without it.

CoinEx Lets You Withdraw $10,000 daily with a $50,000 Monthly Cap Without KYC | Image via Cryptoslate

CoinEx Lets You Withdraw $10,000 daily with a $50,000 Monthly Cap Without KYC | Image via CryptoslateCore Strengths:

Main Drawback(s):

Best For:

Quick Facts:

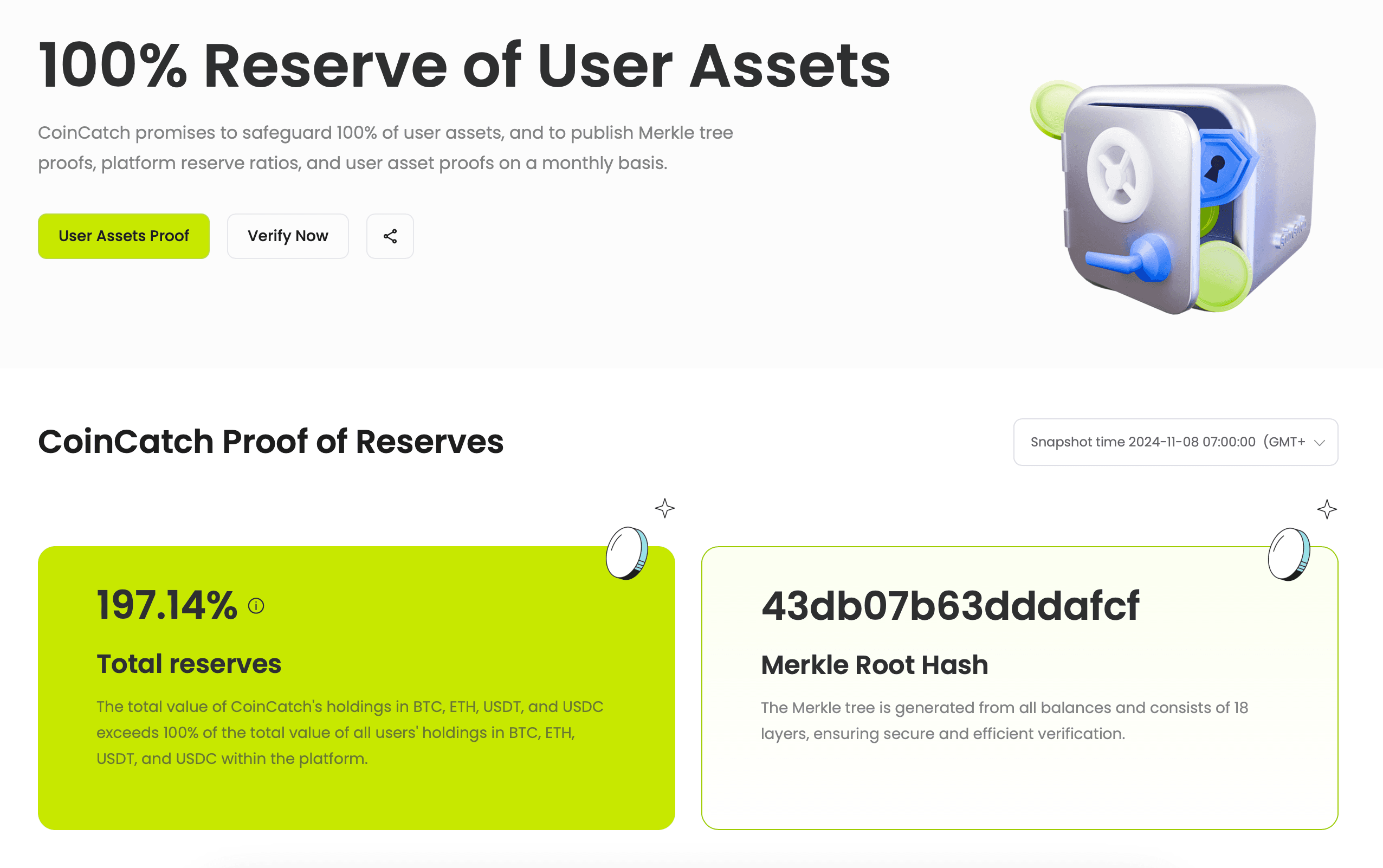

Why it’s here: CoinCatch earns a place for offering one of the highest no-KYC withdrawal limits among regulated exchanges, paired with transparent reserves and FINTRAC/FinCEN registration.

No-KYC Withdrawal Limit: Up to 50,000 USDT per day (≈ 200,000 USDT monthly) without verification. Non-KYC users cannot access P2P trading; KYC raises the limit to 3 million USDT daily with no cap.

CoinCatch Holds Over 190% Reserves For BTC, ETH, USDT & USDT | Image via CoinCatch

CoinCatch Holds Over 190% Reserves For BTC, ETH, USDT & USDT | Image via CoinCatchCore strengths:

Main drawback(s): No support for fiat deposits or card purchases, forcing users to source crypto elsewhere before trading. Fee structure lacks tiered discounts for high-volume accounts, and its copy-trading pool remains small.

Best for: Privacy-minded traders seeking regulated no-KYC access, high daily limits, and a balance between security and convenience.

Quick facts:

CoinCatch offers a rare blend of strong compliance, transparent reserves, and generous non-KYC limits, positioning it as one of the most privacy-friendly yet regulated centralized exchanges in 2025.

Why it’s here: PrimeXBT is one of the longest-running no-KYC trading platforms offering multi-asset leveraged products spanning crypto, forex, commodities, and indices with consistently low fees and strong execution.

No-KYC Policy: Account creation requires only an email and password; no ID verification is needed. PrimeXBT reserves the right to request documentation under specific compliance reviews, but trading and withdrawals are unrestricted by default.

PrimeXBT is One of the Longest Running No-KYC Exchanges | Image via PrimeXBT

PrimeXBT is One of the Longest Running No-KYC Exchanges | Image via PrimeXBTCore strengths:

Main drawback: Unregulated (based in Seychelles and St. Vincent & the Grenadines), with no fiat on/off-ramp and limited crypto listing compared to major CEXs. U.S., Canada, and Japan residents are restricted. API support remains absent.

Best for: Experienced traders seeking an anonymous, high-leverage platform for cross-market CFD trading and copy-trading income.

Quick facts:

PrimeXBT remains a privacy-friendly CFD exchange with broad market coverage and tight fees, suited to advanced users comfortable with leverage and self-managed risk on an unregulated platform.

Why it’s here: Bybit remains one of the most liquid and feature-rich derivatives exchanges, combining professional-grade tooling with strong transparency after its 2025 recovery and audit cycle.

No-KYC Policy: Non-KYC users can register with an email and trade spot or derivatives under limited access. Higher-risk products (P2P, Launchpad, fiat on-ramps) and increased withdrawal limits require verification. Full access typically begins at Standard KYC Level 1, while unverified accounts retain small-value withdrawals.

Bybit Suits Active, Derivatives-Focused Traders Who Value Advanced Tools | Image via Bybit

Bybit Suits Active, Derivatives-Focused Traders Who Value Advanced Tools | Image via BybitCore strengths:

Main drawback(s): The February 2025 $1.46B ETH wallet exploit, though resolved without client loss, underscored counter-party risk. U.S., U.K., Canada, Singapore, Hong Kong and France remain restricted; unverified accounts face limited functionality and potential freezes during compliance reviews.

Best for: High-frequency or derivatives traders seeking deep liquidity, automation tools, and transparent PoR audits, not beginners needing fiat access.

Quick facts:

Bybit balances institutional-grade liquidity and automation with renewed security oversight post-hack. Its no-KYC entry tier offers convenience, but region-specific rules and mandatory KYC for advanced features mean it suits active traders outside restricted markets rather than complete anonymity seekers.

Read our full Bybit review.

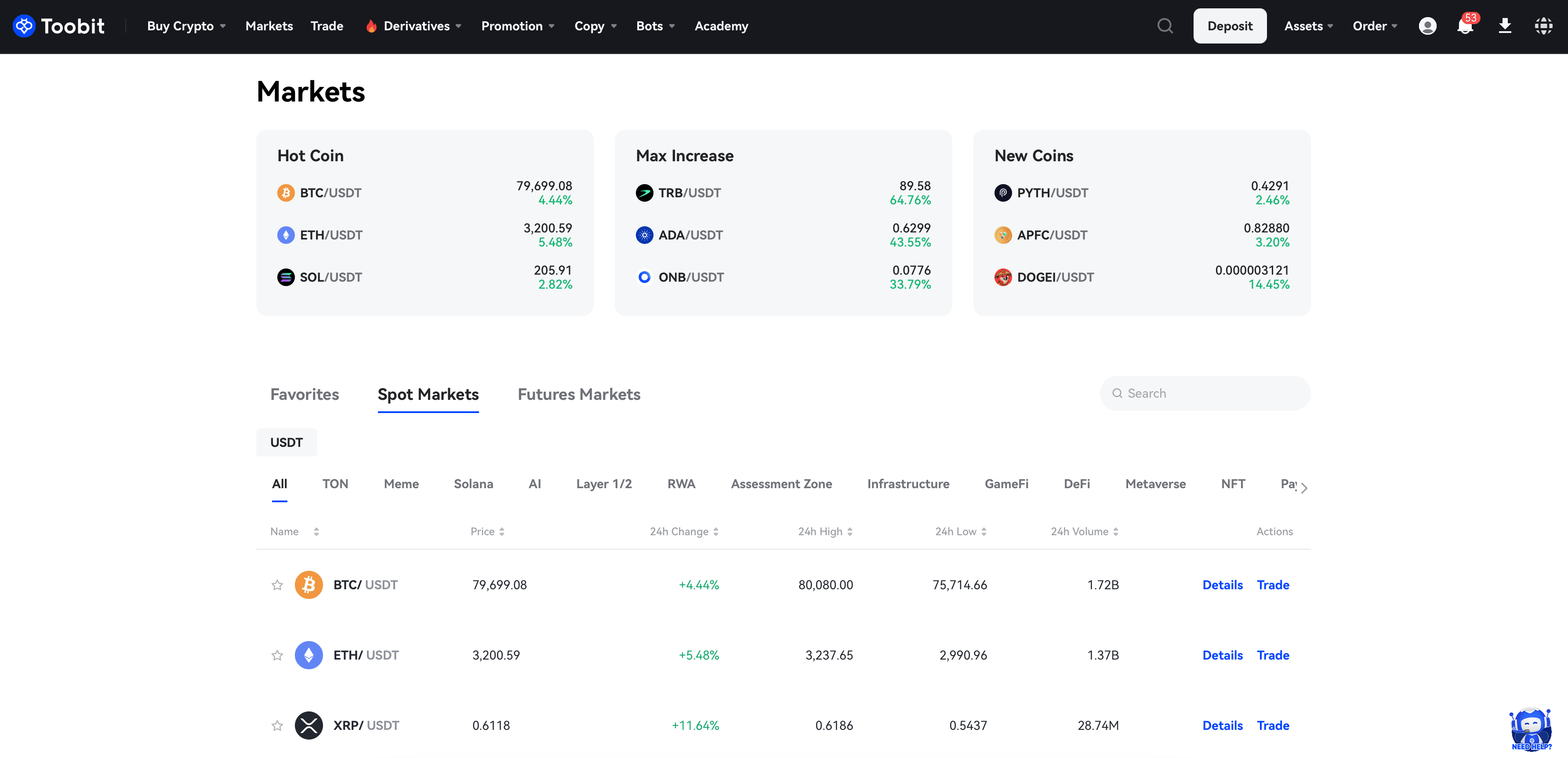

Why it’s here: Toobit combines strong FinCEN registration, broad asset support, and advanced tools such as bots and copy trading, making it one of the most feature-complete young exchanges still accessible without full KYC.

No-KYC Withdrawal Limit: No-KYC accounts allow withdrawals of up to 5 BTC per day, but you can't buy crypto with fiat. Advanced KYC raises that to 50 BTC per day.

A Look at Toobit's Interface | Image via Toobit

A Look at Toobit's Interface | Image via ToobitCore strengths:

Main drawback(s): No bank-transfer funding or U.S. access. Trust factor remains lower than veteran exchanges due to its 2022 launch and limited transparency history.

Best for: Intermediate traders wanting a high-leverage, low-fee environment with built-in automation and copy trading, but comfortable depositing crypto directly.

Quick facts:

Toobit delivers surprisingly comprehensive trading tools and competitive fees for a young exchange. Its FinCEN registration and visible reserves boost credibility, though users should recognize its short track record and region blocks before treating it as a long-term venue.

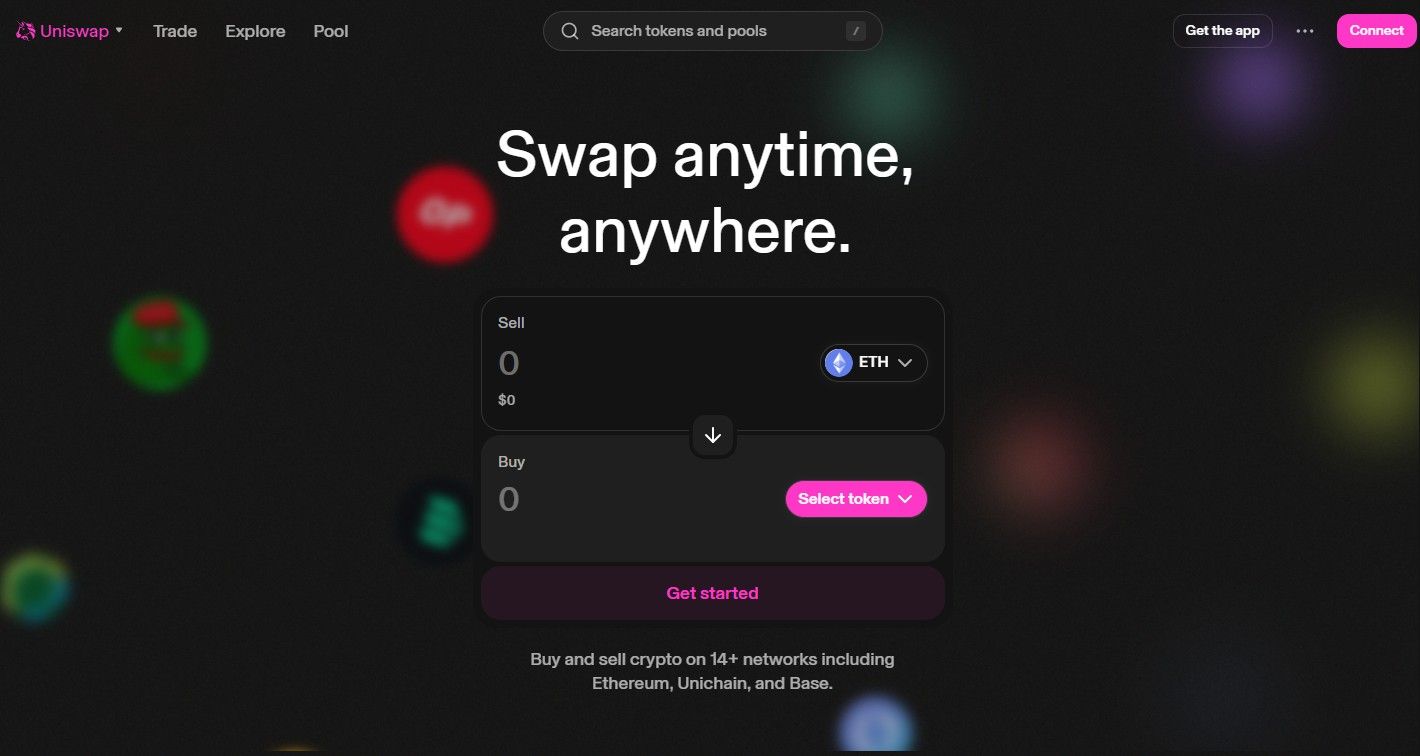

Why it’s here: Uniswap is universally regarded as the gold standard among decentralized exchanges. It is fully on-chain, non-custodial, deeply integrated in the Ethereum ecosystem, and with robust market depth across many EVM chains.

No-KYC Policy: Because Uniswap is purely on-chain, there is no account, registration, or KYC requirement, and swaps occur directly via your wallet.

Uniswap Uses an Intent-Based Swap Interface | Image via Uniswap

Uniswap Uses an Intent-Based Swap Interface | Image via UniswapCore strengths:

Main drawback: Outside Ethereum or EVM-compatible chains, Uniswap’s reach diminishes. Non-ERC-20 assets (e.g. UTXO chains, certain privacy coins) are unsupported. Gas fees on the Ethereum mainnet can become prohibitive for small trades.

Best for: Everyday on-chain traders who prioritize decentralization, composability, and permissionless access, especially those trading ERC-20 tokens or using DeFi strategies built around liquidity pools.

Quick facts:

Uniswap remains the de facto benchmark for non-custodial trading, proving that permissionless, on-chain liquidity can scale. Its modular v4 architecture and deep DeFi integration further cement its role, though Ethereum gas costs and non-ERC asset limitations remain the primary trade-offs.

Read our full Uniswap review.

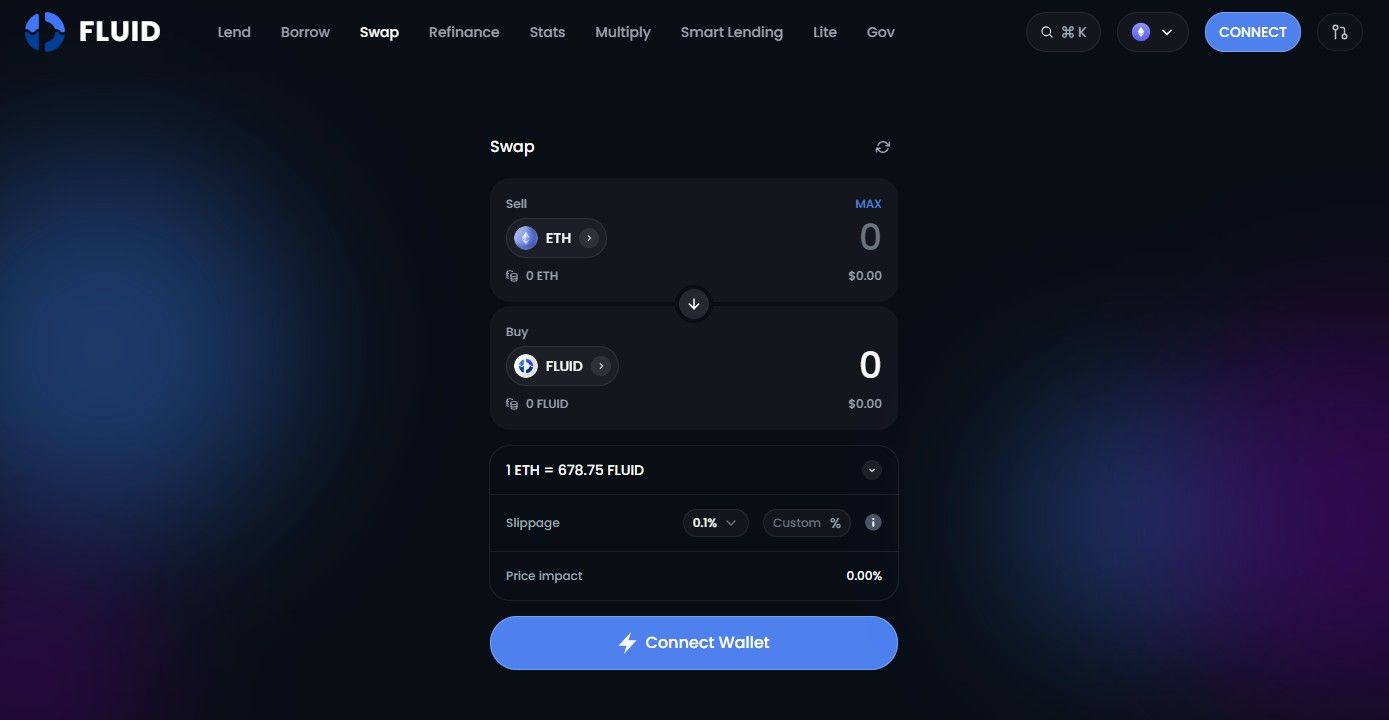

Why it’s here: Fluid offers a next-generation DEX architecture that combines ultra-low swap costs with integrated lending/collateral mechanics, making it a standout among permissionless protocols for efficient trading and capital reuse.

No-KYC Policy: As with all pure DEXs, Fluid is fully on-chain and permissionless. No account, no registration, no identity checks, users transact directly from wallets.

Fluid Adopts an Intent-Like User Interface for Swaps | Image via Fluid

Fluid Adopts an Intent-Like User Interface for Swaps | Image via FluidCore strengths:

Main drawbacks:

Best for: Stablecoin traders, high-frequency or arbitrage users, and EVM-native traders who want to squeeze out minimal cost on repeated trades.

Quick facts:

Fluid is pushing the boundaries of what a DEX can be, blending swaps with lending, minimizing gas, and creating capital reuse through Smart Debt/Collateral layers. While still growing its token support, it’s already ideal for stablecoin swaps, efficient gas users, and those who want lower friction, highly composable DeFi access.

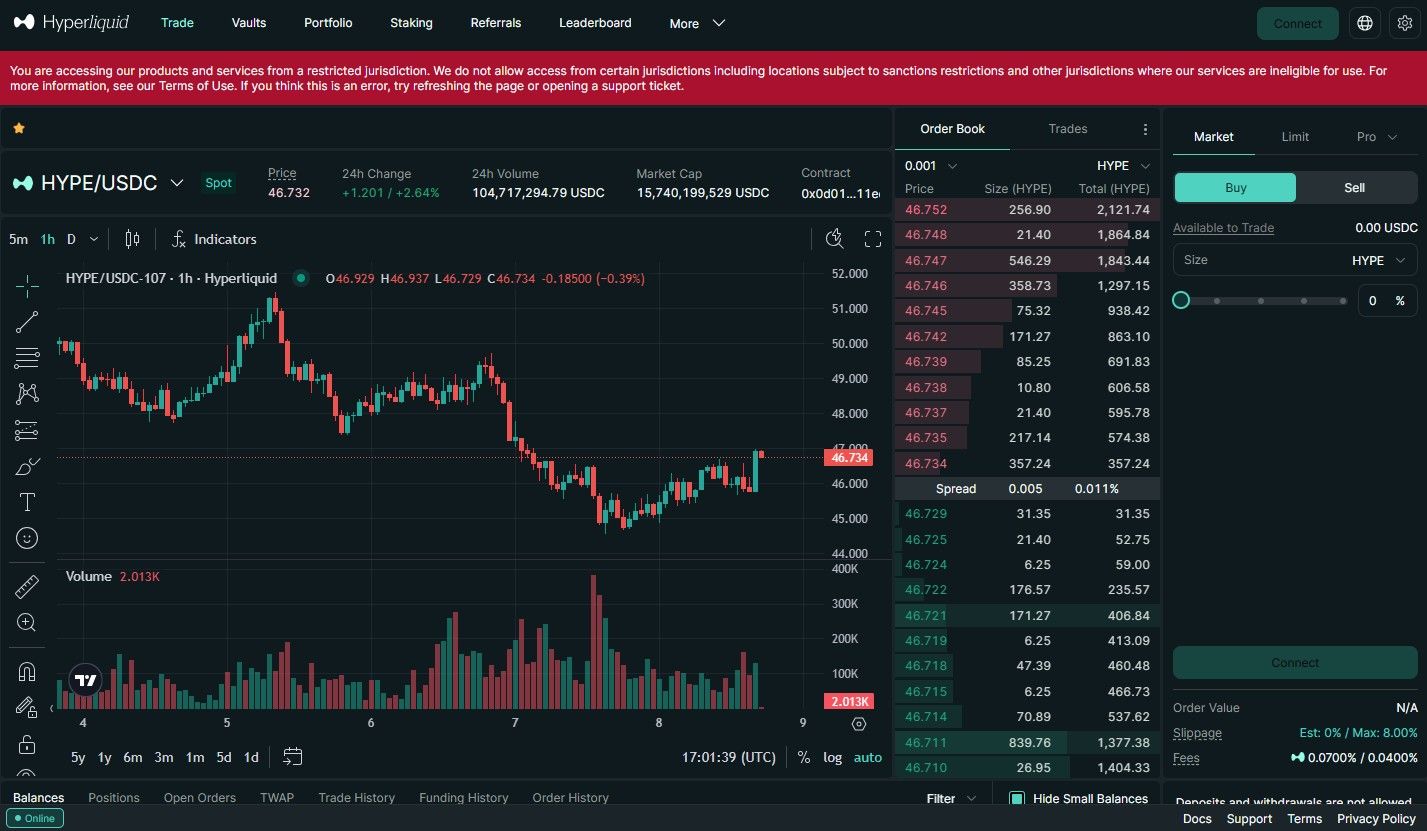

Why it’s here: Hyperliquid consistently ranks among the top derivatives venues by open interest and is the leading perp DEX by OI in 2025, with deep liquidity and sustained volume share.

No-KYC policy: Purely on-chain. Connect a wallet and trade. No account or ID checks.

Hyperliquid is the Leading DeFi Perps Exchange Today | Image via Hyperliquid

Hyperliquid is the Leading DeFi Perps Exchange Today | Image via HyperliquidCore strengths:

Main drawback: Steeper learning curve. New users can confuse the trading L1 (HyperCore) with the smart-contract layer (HyperEVM). U.S. users are restricted.

Best for: Perp traders who want CEX-level speed and depth while keeping custody in their own wallet.

Quick facts:

Hyperliquid delivers on-chain speed and depth that rivals centralized futures venues while preserving self-custody. If you are comfortable with a purpose-built L1 and want high-liquidity perp markets without KYC, it is a strong pick. U.S. restrictions and the protocol’s two-layer design are the main frictions to note.

Read our full Hyperliquid review.

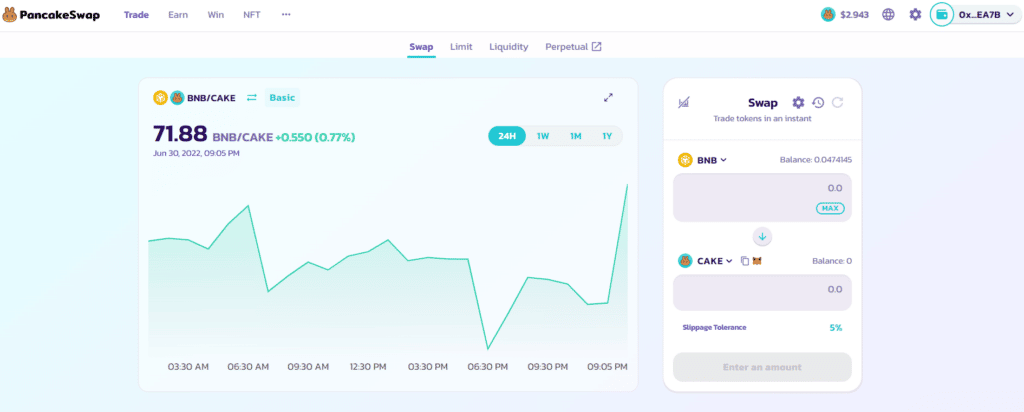

Why it’s here: The flagship DEX on BNB Chain with multi-chain reach, PancakeSwap pairs low fees with deep on-chain liquidity and a mature product stack.

No-KYC policy: Fully non-custodial and on-chain. Swaps execute from your wallet; no registration or identity checks.

Swap Interface on PancakeSwap | Image via PancakeSwap

Swap Interface on PancakeSwap | Image via PancakeSwapCore strengths:

Main drawback: Coverage for non-EVM or non-ERC/BEP assets is limited, and gas on Ethereum mainnet can be costly for small trades. Token discovery still requires diligence to avoid spam or illiquid pairs.

Best for: Everyday on-chain traders who want fast, low-fee ERC-20/BEP-20 swaps, especially on BNB Chain and composability with the broader DeFi stack.

Quick facts:

A long-running, audited AMM with concentrated liquidity, multi-chain presence, and strong depth, PancakeSwap is a default pick for low-cost swaps in EVM, particularly on BNB Chain, with the usual on-chain trade-offs of gas and token vetting.

Read our PancakeSwap review.

If you’re in the U.S., true “no-KYC” typically means self-custody and on-chain execution. Centralized options are limited and can change fast; DEXs remain the most durable path, with higher responsibility on the user.

On-chain = highest reliability for U.S. access; centralized “no-KYC” comes with sharper caps, fewer products, or policy risk.

Privacy coins are sparingly available on either CEX or DEX, and pairs have low liquidity even when they're available.

On-chain will always be the least traceable, while we recommend you file your taxes regardless of the exchange.

Pick based on what you need, not brand familiarity. The right fit depends on privacy level, limits, product scope, and your ability to self-custody.

Align platform design to personal requirements and the job at hand:

Map goal → venue type → one key constraint (fees, limits, or listings).

Quick pre-trade hygiene saves pain later.

If any box is blank, size down or skip.

Prove the path with small funds.

Only scale after this path is fast, predictable, and cheap.

No-KYC platforms give you speed and privacy, but they remove the safety net of regulated exchanges. You hold the keys and the responsibility. Before trading, lock down custody, verify code and liquidity, and set clear rules for your digital hygiene.

Also on The Coin Bureau

Get exclusive access to premium content, member-only tools, and the inside track on everything crypto.