OKX is well respected as one of the best cryptocurrency exchanges in the world. It began serving the cryptosphere way back in 2016 as a crypto trading platform and has since expanded to offer several advanced trading services, derivatives, and tools like copy trading, trading bots, and several passive income strategies under its Earn section. The exchange underwent an overhaul in 2022. It dropped the ‘Ex’ from its name and evolved from an exchange to explore new DeFi, NFT, GameFi, and Metaverse frontiers.

Similar to other major cryptocurrency exchanges, the OKX exchange is also fueled by a native token. The OKB token serves several roles in the OKX ecosystem. It follows the classic exchange token playbook by offering fee payment incentives, staking rewards and privileges, and some on-chain use cases, such as the OKB Chain (OKBC) settlement currency, like voting rights and DeFi-related applications.

If you are unfamiliar with OKX, check out our OKX Review before reading this analysis; it will help you paint the necessary backdrop for this article. Let’s dive into the OKB token analysis!

Note: Users located in the US and UK are not supported.

What is OKX?

Headquartered in Seychelles, OKX (formerly OKEX) is a global cryptocurrency exchange available in over 100 countries, managing billions in daily trading volume from institutional and retail investors.

After completing a mandated KYC verification, OKX allows users to buy crypto with fiat, P2P network, or transfer from an external wallet. While beginning its journey as a spot trading exchange, OKX offers several products today:

- Cryptocurrency trading

- Cryptocurrency swaps

- Spot market trading

- Derivatives

- Perpetual swaps

- Margin

- Futures

- Options

- Trading bots

- Copy trading

- Demo trading

- OTC services

- OKX Wallet

- Wealth products

- Simple earn

- On-chain earn products

- DeFi staking

- ETH staking

- Options-based structured products

- Dual investment

- Shark fin

- Snowball

- Loans

- Launchpad

- Blockchains

- OKB Chain

- OKT Chain

OKX is a Cryptocurrency Exchange Available in Over 100 Countries. Image via OKX

OKX is a Cryptocurrency Exchange Available in Over 100 Countries. Image via OKXAn essential feature that makes the OKX exchange quite handy, at least for average users, is the support for fiat withdrawals. The support of fiat on and off-exchange ensures retail investors’ easy onboarding on the exchange and improves the trading experience.

OKX Security

OKX deploys a series of hot and cold wallets for its exchange’s operations and security. Servers with a hot wallet, which holds 5% of the exchange funds, manage daily deposits and withdrawals. The rest are stored offline in cold wallets that require at least two authorized personnel to access. OKX has not suffered from any hacks or exploits to date. We have a dedicated analysis of OKX security for a deeper dive into its impressive security framework.

The OKB Token

The OKX Token (OKB) is the native utility token of the OKX ecosystem, which offers users a wide range of benefits and helps power various on-chain activities on the platform. We can categorize OKB applications into the following broad categories:

- Trading fee discounts

- Passive income through OKX Earn

- Access to token sales

- Settlements on OKC (OKX Chain)

OKB Token Overview

The OKB token is an ERC-20 token on the Ethereum mainnet. It has a maximum supply of 300 million units, which were minted in 2019 and allocated as follows:

- 60% - Ecosystem development and marketing

- 20% - Team

- 10% - Shareholders

- 10% - OK Blockchain Foundation

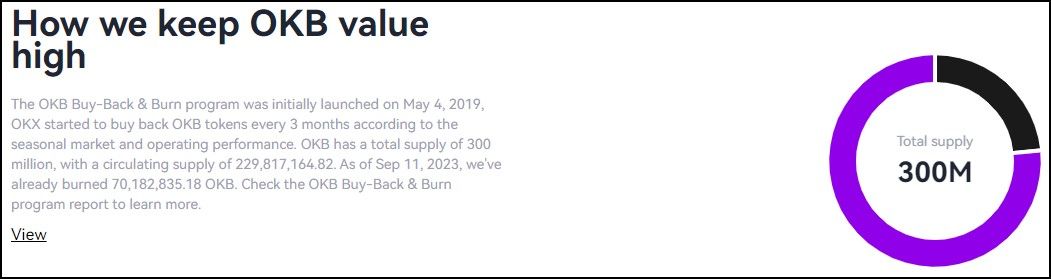

To boost the value of OKB tokens, OKX introduced a buyback and burn program for the OKB token on May 4, 2019, where 30% of the Spot market trading fees collected by the exchange is used to buy OKB from the open market and burn it on-chain with a burner address. The program conducts the burn program every three months. OKX concluded the 21st burn event on Sept. 11, 2023, burning over 70 million OKB tokens.

Image via OKX

Image via OKXOKB Token Benefits and Features

OKX Offers Multiple Features and Benefits to OKB Token Holders | Image via OKX

OKX Offers Multiple Features and Benefits to OKB Token Holders | Image via OKXOKX offers multiple features and benefits to OKB token holders. They are summarized as follows:

Fee Deduction: Exchange users can pay trading fees with the OKB token to benefit from up to 40% discount on trading fees. The exchange categorizes users by the amount of OKB in their account, offering better deals for holding more OKB tokens.

Trading: OKX lists OKB trading pairs with Bitcoin (BTC), Ethereum (ETH), Tether (USDT), USDC, Litecoin (LTC), and Ripple (XRP).

OKX Jumpstart: OKX Jumpstart is a token sales platform on the OKX cryptocurrency exchange that offers users easy access to new, high-quality crypto projects. Users can invest in new cryptocurrencies using OKB by participating in Jumpstart events. To join Jumpstart events, users must have an OKX account, complete Lv. 2 KYC verification, and hold a certain amount of OKB for staking.

OKX Jumpstart provides two types of events: Mining and On Sale. In the Mining model, users can stake OKB to gain token rewards issued by relevant projects. Each event has its staking period and total staking limit, following a "more staking, more tokens" basis. The On Sale model allows users to purchase tokens of new projects at a fixed price. Some of the previous successful projects on OKX Jumpstart include TAKI, ELT, and BRWL.

Listing votings: OKX organizes token listing programs where users can vote for their favourite tokens to be listed on the exchange with their OKB holdings.

External services: OKX has partnered with businesses to allow access to their services using the OKB token. Here is a summary of such benefits:

- Security services - Blockchain security firms like Slow Mist, Beosin, CertiK, and Safeguard have partnered with OKX. They provide services like security and smart contract audits, security consultancy, risk monitoring, and alerts. DApps may access their services using OKB.

- Financial services - Businesses like Bitpie, Blocto, and Cobo offer blockchain financial services like cryptocurrency storage and trade. They provide external storage and handling of OKB tokens outside the OKX ecosystem.

- Utility services - Many DApps, e-commerce platforms, and online stores have partnered with OKX to allow the use of OKB as a payment medium on their marketplaces.

OKB linked external services | Image via OKX

OKB linked external services | Image via OKXSimple Earn: It is a crypto fixed deposit service where user's deposits are lent out to earn interest. Subscribers can earn up to 5% APR on flexible OKB deposits.

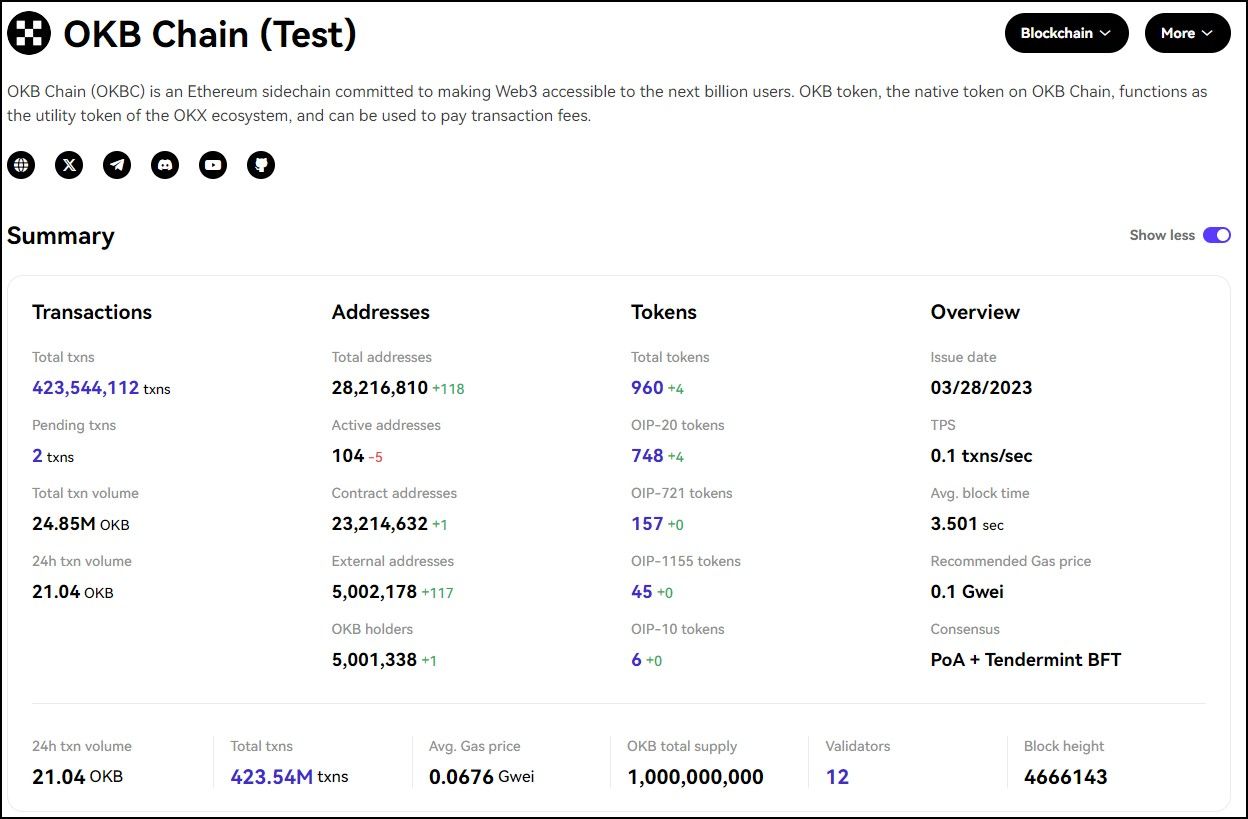

OKB Chain: The OKB Chain (OKBC) is a zkEVM layer-2 on the Ethereum network. It uses the Proof of Authority consensus protocol and deploys OKB as the settlement token for paying gas fees on the network. OKBC will feature a bridge transporting OKB tokens to and from the Ethereum mainnet.

The layer-2 network operates a live testnet with a mainnet release scheduled for Q1 of 2024. While the testnet activity does not affect OKB in real life, the network shows promising on-chain activity, which may translate to more demand for OKB following the mainnet launch.

OKBC testnet stats | Image via OKX

OKBC testnet stats | Image via OKXOKB Token Price History

At the time of this analysis, the OKB token is trading at around $42, nearly a 4x increase from its bottom in June 2022, ranking 27th by market capitalization on CoinGecko. The token is in about 84,000 watchlists on CoinMarketCap. OKX launched the token in May 2018.

The OKB Token is 4x Higher From its Bottom in June 2022 | Chart via CoinGecko

The OKB Token is 4x Higher From its Bottom in June 2022 | Chart via CoinGeckoTrading and Storing OKB

The OKX exchange is the best place to buy OKB tokens. It offers multiple crypto trading pairs with the most traded cryptocurrencies like BTC, ETH, and stablecoins and a direct gateway to buy it with fiat.

👉 Sign Up for OXK and Enjoy a 40% Trading Fee Discount for Life!

You may hold your OKB tokens in your exchange account to use platform benefits like fee discounts and Earn products. For the OKB holders who prefer self-custody, many wallet providers such as Ledger, Trust Wallet, MetaMask and the OKX Wallet support the OKB token.

The Future of OKB Token

The most significant utility upcoming for the OKB token is the mainnet launch of the OKX chain as a zkEVM-based layer-2 on Ethereum. Here are some features of OKBC which make it an exciting development to follow:

- EVM Compatible - OKBC will offer an EVM-compatible, high-throughput execution environment, which means Ethereum DApps and developers can begin to work on OKBC without additional overheads.

- Tendermint Core - OKBC is built using the Tendermint consensus algorithm, which also powers consensus in the Cosmos ecosystem. With Tendermint, OKBC gains significant scalability capabilities. The Tendermint consensus connects to the blockchain execution environment (where all the DApps live and the computation takes place) using the Application Blockchain Interface (ABCI). ABCI allows the execution environment to support multiple programming languages without compatibility issues with the underlying consensus engine.

- Gas and fees - All transactions on OKBC will settle with the OKB token. Therefore, if OKBC successfully attracts developer attention and hosts a thriving DApp environment, the demand for OKB to pay transactions will increase significantly.

Conclusion

In summary, OKB serves as a multi-faceted utility token within the OKC ecosystem, offering a range of benefits and use cases that extend from trading fee discounts to participation in token sales. Its tokenomics are designed to encourage long-term holding, and the introduction of the OKC Chain adds another layer of utility and potential for growth.

While the future of any cryptocurrency is inherently uncertain, OKB seems well-positioned for sustained relevance due to its integration with the OKX platform and its expanding utility. For those interested in buying, trading, or earning OKB, various avenues are available, making it accessible for both novice and experienced investors. As with any investment, conducting your own research and understanding the risks involved is crucial.