Cryptocurrency exchanges face many security threats, including hacking and cyber attacks. In January 2026, over $74 million was lost due to hacks and fraud, according to Immunefi. Both decentralized finance (DeFi) and CeFi platforms witnessed attacks.

In the cryptoverse, finding a secure platform to trade your digital assets is vital. Regulatory challenges add complexity, making it essential to choose well-regulated exchanges.

In this article, we'll highlight the most trusted crypto exchanges. From understanding key security features to choosing the best-regulated exchanges, you'll gain the knowledge to protect your crypto and trade with confidence.

Before we begin, you'd do well to check out our article highlighting the best crypto exchanges.

Secure Crypto Exchanges: Quick Verdict (30-Second Summary)

Based on CER.live’s security ratings, Kraken KuCoin, MEXC, Bitso, CoinW, Toobit and Coinbase are the cleanest picks for regulation + battle-tested ops. If you want the safest “default” path, prioritize exchanges with independent security attestations (e.g., ISO/SOC), user-verifiable Proof of Reserves, and strong account controls (2FA, anti-phishing, withdrawal protections).

The 3 reasons these exchanges win

- Security hygiene you can verify: Proof of Reserves (Merkle-tree / 1:1 snapshots) and published security programs reduce blind trust.

- Account-level armor: 2FA/MFA, anti-phishing protections, device/withdrawal controls help stop “stolen password” losses.

- Operational maturity: Audits/certifications, bug bounties, and hardened custody practices reduce single-point failures.

The 2 tradeoffs

- “AAA” isn’t a magic spell: Ratings can change; always re-check methodology + recent incidents before funding an account.

- Regulation varies wildly: Offshore entities can be fine for trading, but can be weaker for dispute resolution and consumer protections.

Key Takeaways

- Security is a stack: Exchange controls + your own account hygiene determine most real-world outcomes.

- Use CER.live as a filter, not a decision: Ratings help shortlist, but you still need to verify the why.

- Proof of Reserves matters most when it’s user-verifiable: Look for Merkle-tree liabilities + on-chain holdings, not just a screenshot dashboard.

- Certifications and audits are meaningful signals: ISO/IEC 27001 and SOC reports indicate security processes, not perfection.

- Regulation is your “recourse layer”: It can improve accountability, disclosures, and dispute handling.

- Insurance isn’t universal: Policies vary and often exclude user-side compromises (phishing, SIM swaps, malware).

- Withdrawals are the real test: Reputation for smooth withdrawals and transparent incident response is a better signal than marketing.

- Don’t store long-term holdings on an exchange: Use exchanges for trading, then self-custody for storage.

- Personal safeguards move the needle: Unique passwords, a manager, hardware-key 2FA, and withdrawal whitelists reduce most account-takeover risk.

Comparison Table

| Exchange | CER Rating | Key Security Features |

|---|---|---|

| KuCoin | AAA | Merkle-tree Proof of Reserves (user-verifiable liabilities vs on-chain holdings). Account protections like 2FA/MFA and anti-phishing safeguards for login/withdrawals (platform-level security controls). |

| Bitso | AAA | Regulated in Gibraltar under a GFSC DLT license. Third-party audits and risk assessments (per Bitso’s published security disclosures). |

| Coinbase Exchange | AAA | Stores 98%+ of customer assets in cold storage (offline). 2FA and additional account security options (platform security practices). |

| MEXC | AAA | Proof of Reserves with stated 1:1 reserve framework and public reserve-rate snapshots. Standard account protections such as 2FA and anti-phishing controls (per platform security design). |

| Kraken | AAA | ISO/IEC 27001 and SOC 2 Type 1 certifications; 2FA options; bug bounty; Proof of Reserves program. |

| CoinW | AAA | M-of-N multi-signature design + HSM-based key security described in CoinW’s own security materials. |

| Toobit | AAA | CER indicates approved penetration testing + ongoing bug bounty (certification components), plus Proof of Reserves positioning. External audit presence via Hacken’s published Toobit audits page. |

Data current as of Feb. 3, 2026.

The Top-Rated Crypto Exchanges with Rock-Solid Security

Ensuring the safety of your digital assets begins with choosing a reliable and secure cryptocurrency exchange. For this section of the article, we turned to CER.live, which assesses crypto exchange security.

According to CER, these crypto exchanges offer the highest levels of security.

A Look At The Safest Crypto Exchanges in 2026

A Look At The Safest Crypto Exchanges in 2026KuCoin

Founded in 2017 and now based in Seychelles, KuCoin layers multiple account-level protections (MFA/2FA options, device and endpoint security, and anti-phishing safeguards for actions like login and withdrawals). It also publishes a Merkle-tree-based Proof of Reserves so users can verify liabilities vs. on-chain holdings in a tamper-resistant way.

Also Read:

Bitso

Founded in Mexico in 2014, Bitso is regulated in Gibraltar via a DLT license from the Gibraltar Financial Services Commission. On the transparency side, Bitso offers a “proof of solvency” approach (reserves + liabilities), designed so customers and third parties can verify financial health rather than relying on “trust us” dashboards. Bitso also states it provides insurance-backed protection and operates with third-party audits and risk assessments for custody.

Coinbase Exchange

Coinbase is globally recognized for its user-friendly interface and top-notch security. The platform uses 2FA, biometric logins, and cold storage for 98% of user funds. Coinbase also provides insurance against certain types of losses and conducts regular security audits, adhering to regulatory standards to ensure trustworthiness.

Also Read:

MEXC

Founded in 2018, MEXC publishes Proof of Reserves and states it maintains at least 1:1 backing (with a public reserve-rate framework and periodic snapshots). On the ops side, MEXC describes a cold–hot wallet separation model combined with multi-signature controls, plus account protections like 2FA and anti-phishing measures aimed at reducing credential and withdrawal risk.

Read our full MEXC review.

Kraken

Kraken is known for its rigorous security practices. The exchange employs advanced encryption, regular security audits, 2FA, and has a dedicated security team focused on risk management. Kraken also insures digital assets held in cold storage, making it a reliable choice for secure trading.

Also Read:

CoinW

CoinW is listed as established in 2017 and registered in the United Arab Emirates. It positions security as a core focus and has published Proof-of-Reserves style wallet-address disclosures/updates (including submitting reserve addresses to major data platforms for verification visibility).

Read our full CoinW review.

Toobit

Toobit markets a security stack built around “Bee-Safe” controls, including multi-signature cold storage and a zero-trust-style architecture approach. For transparency, Toobit states it maintains 1:1+ Proof of Reserves and undergoes audits/reviews with firms such as Hacken, plus other named security partners. Hacken has also published a case study around Toobit’s ISO/IEC 27001:2022 certification work.

Read our full Toobit review.

Checking CER.live for Security Ratings

While the above exchanges are highly rated, it is essential for users to verify these ratings and understand the methodology behind them. Visit CER.live to access the latest security ratings and detailed reports for various cryptocurrency exchanges. By regularly checking CER.live, you can stay informed about the security of different exchanges and make informed decisions based on the most current information.

These exchanges have been evaluated based on a comprehensive methodology that includes over 20 security indicators such as server security, user security, penetration testing, bug bounty programs, and funds insurance. By choosing one of these top-rated exchanges, you can ensure a higher level of security for your digital assets.

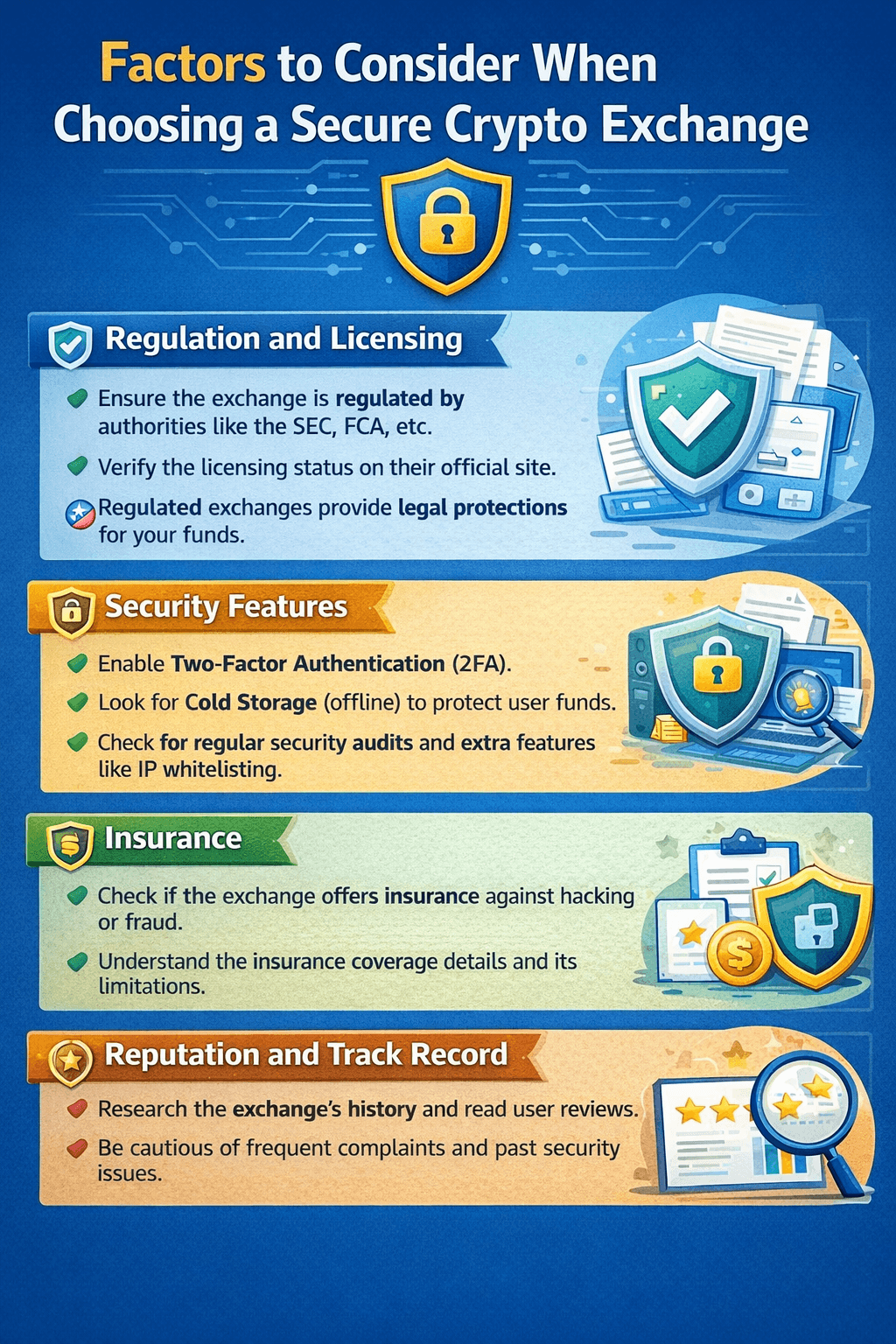

Factors to Consider When Choosing a Secure Crypto Exchange

When it comes to picking a crypto exchange, ensuring the security of your digital assets is essential.

Ensuring The Safety of Crypto is Essential

Ensuring The Safety of Crypto is EssentialRegulation and Licensing

One of the first things to check when selecting a crypto exchange is whether it’s regulated. Think of regulation as your superhero shield, protecting your investments from potential threats.

- Benefits of Using a Regulated Exchange: Regulated exchanges follow specific legal and financial standards, which means better protection for your money. It's like having the Avengers guarding your assets, ensuring they are safe and secure. Regulated exchanges are less likely to engage in fraudulent activities and are more likely to help you if something goes wrong.

- Key Regulatory Bodies for Crypto Exchanges: Look for exchanges regulated by reputable organizations like the SEC (Securities and Exchange Commission) in the U.S., the FCA (Financial Conduct Authority) in the U.K., or other similar entities worldwide. These organizations set the rules for financial practices, ensuring that exchanges operate fairly and transparently.

- How to Verify an Exchange's Regulatory Status: You can usually find regulatory information on the exchange’s website, often in the “About” or “Legal” section. Additionally, third-party reviews and official listings from regulatory bodies can help confirm an exchange’s status. This step is akin to doing your homework before buying a new gadget; it helps ensure you're getting something reliable.

Security Features

When evaluating crypto exchanges, prioritize those with robust security features.

- Two-Factor Authentication (2FA): This adds an extra lock to your vault. It requires not just your password but also a second form of verification, like a code sent to your phone. This makes unauthorized access much harder.

- Secure Storage of User Funds (Cold Storage vs. Hot Wallets): Cold storage keeps most of the funds offline. Hot wallets, on the other hand, are connected to the internet and are more accessible but less secure. A good exchange will use a combination of both, balancing accessibility with security, much like Batman balancing his duties as Bruce Wayne and the Dark Knight.

- Additional Security Features: Look for features like IP whitelisting, which only allows access from approved IP addresses, adding another layer of security. Regular security audits are also essential, ensuring that the exchange's security measures are always up-to-date. Additionally, some exchanges offer security notifications that alert you of any suspicious activities or unauthorized access attempts on your account, further enhancing your protection.

Insurance

Insurance is an often-overlooked aspect of crypto exchanges but can be a lifesaver if something goes wrong.

Some exchanges offer insurance to cover specific types of losses, like hacking or fraud. This is similar to how your car insurance protects against theft or damage. Having insurance can provide peace of mind, knowing that your assets are covered in case of an unforeseen event.

Generally, insurance covers losses due to security breaches, such as hacks. However, the coverage details can vary, so it's crucial to understand what is included.

Limitations of Crypto Exchange Insurance

Not all losses are covered, and there might be caps on the amount insured. For instance, an insurance policy might only cover up to a certain amount per incident. Always read the fine print to understand the extent of the coverage. It's also helpful to check if the exchange has a dedicated insurance fund, like Binance's Secure Asset Fund for Users (SAFU), which is specifically designed to protect users in case of major security breaches.

Reputation and Track Record

Before committing to an exchange, research its reputation and track record.

- Importance of a Positive User Experience and Reviews: A platform with good reviews and positive user experiences is more likely to be reliable and trustworthy. User feedback can provide insights into the exchange’s reliability and customer service.

- How to Research an Exchange's History and Reputation: Look for reviews on forums, social media, and review sites. Check if the exchange has had any significant security breaches or other issues in the past. This step is like investigating a company's background before investing, ensuring you know its history. Pay attention to how the exchange handled past issues; a quick, transparent, and effective response can be a good indicator of a trustworthy platform.

- Red Flags to Watch Out For: Be cautious of exchanges with frequent complaints about security, slow customer service, or withdrawal issues. These red flags are warning signs. Also, be wary of exchanges that offer unusually high returns or have opaque business practices as these can be indicators of potential scams or Ponzi schemes.

Conclusion

By considering these factors, you can make a more informed decision when choosing a safe crypto exchange, ensuring that your digital assets are well-protected and that you can trade with confidence. Additionally, it's beneficial to look at the exchange's offered features and services, such as support for various cryptocurrencies, ease of use, and fee structures.

Doing so will ensure that the platform not only meets your security needs but also provides a seamless trading experience. Lastly, stay updated with the latest industry news and trends, as the crypto landscape is constantly evolving, and being informed will help you make better decisions.

Top Considerations for Different Types of Users

When choosing a crypto exchange, it's essential to consider your trading experience and needs. Different types of users —beginners, experienced traders, and high-volume investors — each have unique requirements. This section will help you understand what to look for based on your user profile, ensuring you find an exchange that best suits your trading style and security needs.

Beginners

For those new to cryptocurrency trading, the priority should be on user-friendliness and education. Beginners need an exchange that offers a simple interface and comprehensive support resources.

- User-Friendly Interface: A straightforward and intuitive interface helps beginners navigate the complexities of trading without feeling overwhelmed. Exchanges like Coinbase and Gemini are known for their easy-to-use platforms that simplify buying, selling, and managing crypto assets.

- Educational Resources: Look for exchanges that provide extensive educational materials, such as tutorials, articles, and webinars. Binance Academy, for instance, offers a wealth of information to help new users understand the basics of cryptocurrency and trading strategies.

- Customer Support: Reliable customer support is crucial for beginners who may need assistance. Choose exchanges with robust support channels, including live chat, email, and phone support.

- Security Features: While ease of use is important, security should not be compromised. Ensure the exchange implements essential security measures like Two-Factor Authentication (2FA) and cold storage.

Experienced Traders

Experienced traders require advanced tools and features to execute their trading strategies effectively. For these users, the right exchange offers a blend of sophisticated functionalities and flexibility.

- Advanced Trading Tools: Look for exchanges that provide advanced charting tools, real-time market data, and various order types.

- Liquidity: High liquidity is essential for experienced traders to execute large orders without significant price slippage.

- API Access: Experienced traders often use trading bots and algorithms to automate their strategies. Exchanges that offer robust API access enable traders to connect their bots and integrate third-party trading tools seamlessly.

- Fee Structure: Competitive fees are crucial for traders who make frequent transactions. Look for exchanges with tiered fee structures that offer lower fees for higher trading volumes.

- Security and Insurance: Experienced traders handle larger volumes of assets, making security a top priority. Ensure the exchange has strong security protocols and insurance policies.

High-Volume Investors

High-volume investors, or whales, require exchanges that offer exceptional support, high transaction limits, and additional security features to protect significant assets.

- VIP Programs and Dedicated Support: Many exchanges offer VIP programs for high-volume traders, providing benefits like lower fees, higher withdrawal limits, and dedicated account managers.

- High Transaction Limits: High-volume investors need exchanges that can handle large deposits and withdrawals without restrictions.

- Enhanced Security Measures: For investors dealing with substantial amounts of cryptocurrency, security cannot be overstated. Look for exchanges that offer multi-signature wallets, withdrawal whitelists, and insurance against theft or hacking.

- Customizable Trading Solutions: High-volume investors may require bespoke trading solutions and over-the-counter (OTC) services for large trades.

- Regulatory Compliance: Ensuring the exchange complies with regulatory standards is crucial for high-volume investors to protect their investments from legal risks.

Securing Your Crypto Holdings on an Exchange

Once you’ve chosen a secure crypto exchange, it’s crucial to take further steps to protect your digital assets. Here are some practical tips and best practices to help you secure your crypto holdings effectively:

- Creating Strong Passwords and Using a Password Manager: A strong password is your first line of defence against unauthorized access. Use a mix of uppercase and lowercase letters, numbers, and special characters to create a unique password. A password manager can help generate and store these complex passwords.

- Avoiding Suspicious Links and Phishing Attempts: Phishing attempts often come in the form of fake emails or messages designed to trick you into revealing your login details. Always be cautious of unsolicited communications and avoid clicking on unknown or suspicious links.

- Only Depositing Funds from Trusted Sources: Ensure that you only deposit funds from reputable sources to reduce the risk of fraud or scams. Depositing funds from unknown or untrustworthy sources can expose you to money laundering risks and other legal issues.

- Considering Withdrawing Funds to a Personal Wallet: For added security, consider withdrawing funds to a personal wallet, especially if you are not actively trading. Cryptocurrency wallets, such as hardware wallets, provide extra security by storing your funds offline, away from the prying eyes of hackers.

- Regularly Updating Software and Devices: Keeping your software and devices updated is important for security. Updates often include patches for security vulnerabilities that could be exploited by hackers.

- Educating Yourself and Staying Informed: The world of cryptocurrency is constantly evolving, and staying informed is key to protecting your assets. Follow reputable news sources, join online communities, and participate in forums to stay up-to-date on the latest security threats and best practices.

Understanding What Happens if a Crypto Exchange Gets Hacked

Despite taking all precautions, hacks can still occur. Knowing what happens if a crypto exchange gets hacked and what measures are in place to protect your funds is essential. Many top exchanges, like those listed on CER.live, have insurance policies and emergency plans to lessen the impact of such incidents. Understanding these can provide peace of mind.

When a hack occurs, exchanges typically freeze transactions and withdrawals to prevent further losses. They will then investigate the breach, often working with cybersecurity experts and law enforcement. Exchanges with insurance policies may compensate users for their losses, depending on the terms of the policy.

Closing Thoughts

Navigating the world of cryptocurrency requires choosing secure exchanges and taking proactive steps to protect your assets.

Regulatory compliance ensures transparency and protection; exchanges adhering to standards set by bodies like the SEC or FCA are generally safer. Understanding the difference between decentralized (DEX) and centralized exchanges (CEX) is crucial—DEXs offer more privacy, while CEXs provide stronger security and support.

Most crypto exchanges are not FDIC-insured, but reputable ones often have their own insurance policies. Staying informed about the latest security trends and using resources like CER.live for updated security ratings is essential.

As always, do your own research, and approach your crypto journey with careful planning.