Decentralized Finance (DeFi) is evolving into a multi-chain ecosystem where applications and assets interact across numerous blockchain networks. This expansion is driven by the popularity of appchains—custom-built blockchains dedicated to specific applications—and the rise of chain abstraction, which keeps users unaware of the complexities of underlying networks. This modular approach enhances scalability and encourages cross-chain integration to leverage unique ecosystem benefits.

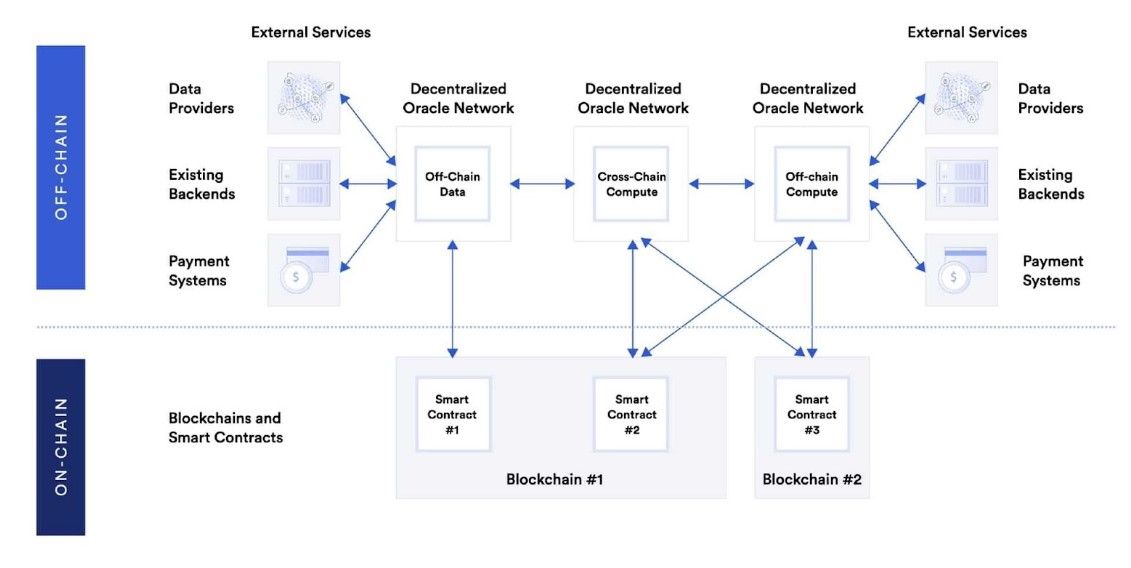

In this context, oracles play an increasingly critical role. Primarily, oracles provide blockchain networks with access to credible off-chain information, such as market prices, weather conditions, or on-chain information from other networks, enabling smart contracts to execute based on off-chain data. Additionally, as DeFi grows more interconnected, some oracles extend their functionality to facilitate cross-chain liquidity, acting as bridges for data and asset flows. While this cross-chain feature is a valuable subset, it complements rather than replaces the oracle’s foundational purpose.

This article discusses the essential role of oracles in supporting an integrated Web3, examining their core functions, significance, and future potential in a space that increasingly spans diverse, independent networks.

What Are Oracles in DeFi?

A blockchain oracle is a service that offers the following broad features:

On-Chain Services for Off-Chain Data

Oracles are essential blockchain services that connect decentralized networks with off-chain data sources, acting as intermediaries that securely relay information from the external world to on-chain smart contracts. Without oracles, blockchain applications would operate in isolation, unable to reference critical external data such as market prices, weather events, or real-time metrics necessary for automated contract execution. This linkage enables blockchains to expand beyond self-contained operations and accommodate use cases like DeFi, where data from off-chain sources drives on-chain financial decisions.

A Reliable Source of External Data for Blockchain

Oracles are trusted external data providers to a blockchain's ecosystem, often using advanced algorithms and cryptographic proofs to validate the information they transmit. As decentralized finance (DeFi) expands across multiple blockchains, credible data from outside blockchain networks is indispensable to ensure interoperability and maintain trust. The growth of appchains and chain abstraction—where users interact with applications without knowing the underlying blockchain—intensifies the demand for accurate data streams that Oracles supply, promoting ecosystem security and functionality.

Facilitating Cross-Chain Interactions

Although primarily designed to relay off-chain data, modern oracles have extended their utility to facilitate cross-chain liquidity by bridging different blockchain networks. This functionality allows oracles to transfer data, messages, or even tokens across networks, contributing to seamless interoperability. While this cross-chain capability is a subset of an oracle's broader purpose, it provides critical support to modular ecosystems by enabling data and assets to flow across independent chains, aligning with DeFi’s cross-chain ambitions.

Role of Oracles in the Blockchain Ecosystem

In a blockchain network, trade executions, token staking, or yield farming activities are shared across all participating nodes through the network’s peer-to-peer (P2P) system. This intrinsic network communication keeps all nodes up-to-date on internal activities, ensuring data consistency and transparency across the blockchain.

Challenges with Cross-Network Awareness

However, no built-in mechanism exists for one blockchain to inform another about its activities directly. Each network operates independently, with distinct validators, separate P2P networks, and unique consensus mechanisms that govern information flow within its boundaries. This isolation creates a barrier to inter-chain communication since each node is designed to operate in a trustless environment, rejecting any off-chain data that cannot be verified internally.

To ensure that blockchain nodes remain trustless, they cannot simply accept data from another network without secure validation, which is where the role of oracles becomes essential.

Oracles as a Bridge for Cross-Network Data

Oracles act as trusted intermediaries that bridge the information gap between separate blockchain networks. By providing secure, verifiable data, oracles enable networks to gain reliable insights into each other’s activities. This bridging role is crucial for DeFi protocols and other applications requiring accurate, cross-chain data, thereby supporting a more connected blockchain ecosystem.

Importance of Oracles for Smart Contracts

Decentralized exchanges (DEXs), yield farming protocols, cross-chain bridges, and other DeFi applications rely heavily on smart contracts to carry out operations autonomously. Smart contracts, however, require precise, deterministic data in a compatible format to execute effectively. Since these contracts are designed to operate within the constraints of a specific blockchain, they cannot directly access or interpret real-world data or data originating from another network.

Oracles resolve this limitation by transforming external data into a format that smart contracts can process. Whether it’s price feeds, sports scores, or cross-chain metrics, oracles retrieve, validate, and deliver this data in a way that allows smart contracts to execute transactions and complex operations seamlessly. In doing so, oracles empower DeFi protocols by expanding the range of data accessible to smart contracts, ensuring that blockchain-based applications can interact meaningfully with the real world and other blockchain networks.

How Do Oracles Work In Crypto?

Chainlink - The Largest Oracle's Workflow. Image via Chainlink

Chainlink - The Largest Oracle's Workflow. Image via ChainlinkAt their core, oracles bridge the deterministic world of blockchains and the dynamic external environment. To function effectively, an oracle needs to achieve the following:

- Data Acquisition from External Sources

- Retrieve accurate and relevant data from off-chain sources such as APIs, databases, sensors, or other data feeds.

- Blockchains cannot access external data natively due to their closed-loop nature; oracles fill this gap.

- Data Validation and Verification

- Ensure the authenticity and integrity of the acquired data before it is used by smart contracts.

- Prevents malicious or erroneous data from triggering unintended smart contract executions.

- Secure Data Transmission to the Blockchain

- Transmit data to the blockchain tamper-proof, often involving cryptographic techniques.

- It maintains data integrity during the transmission process, ensuring that the data received by the smart contract is exactly what was sent by the Oracle.

- Consensus Among Multiple Data Sources (for Decentralized Oracles)

- Aggregate and reconcile data from multiple sources to reach a consensus on the correct data value.

- Enhances reliability and reduces the risk of single points of failure or data manipulation.

- Interoperability and Scalability

- Operate across different blockchain networks and handle multiple data requests efficiently.

- Supports various applications and adapts to growing demands without compromising performance.

- Incentive Alignment and Economic Security

- Implement staking and rewards to align the oracle operators' incentives with the network's integrity.

- Encourages honest behavior among Oracle nodes and penalizes malicious actions.

Functionality: Delivering Tamper-Proof Inputs and Outputs

Chainlink's functionality revolves around a network of Oracle nodes that work collectively to fetch, validate, and deliver data to smart contracts. Here's how it works:

- Smart Contract Requests Data: A smart contract in need of external data emits a request specifying the data requirements and parameters.

- Chainlink Nodes Detect the Request: Oracle nodes monitoring the blockchain for such requests become aware of the need for data.

- Node Selection and Job Assignment:

- Nodes are selected based on reputation and stake to fulfill the data request.

- Job specifications outline how to fetch and process the data.

- Data Retrieval from External Sources:

- Selected nodes fetch the required data from specified off-chain sources (e.g., APIs, databases).

- Nodes may use External Adapters to interact with data sources that require specific protocols or authentication.

- Data Validation and Cryptographic Signing:

- Nodes validate the authenticity and accuracy of the data.

- Data is cryptographically signed to ensure it hasn't been tampered with during transmission.

- Data Reporting and Aggregation:

- Nodes submit the signed data back to the Chainlink network.

- An Aggregation Contract collects data from multiple nodes and computes a single reliable data point, often using methods like median calculation.

- Delivery to the Smart Contract:

- The aggregated, validated data is then provided to the requesting smart contract.

- The smart contract can now execute its logic based on this secure and reliable input.

Significance of Chainlink’s Technical Design

The technical design of Chainlink has several important implications:

- Enhanced Security and Reliability: By combining decentralization with robust security measures, Chainlink ensures that smart contracts receive accurate and trustworthy data, which is crucial for applications like DeFi, where financial assets are at stake.

- Scalability and Flexibility: The network can handle numerous data requests simultaneously and can be customized to meet the specific needs of different smart contracts, making it adaptable to a wide range of use cases.

- Economic Incentive Alignment: Staking and reputation systems align node operators' interests with the network's overall health, fostering a cooperative ecosystem.

- Interoperability: Chainlink's blockchain-agnostic approach serves as a universal bridge between off-chain data and multiple blockchain networks, promoting a more connected and functional decentralized ecosystem.

- Trust Minimization: By eliminating reliance on a single data provider or oracle node, Chainlink reduces the need for trust in individual entities, adhering to the decentralized ethos of blockchain technology.

Understanding how oracles like Chainlink work reveals the intricate balance between technical design, functionality, and security necessary to bridge blockchain networks with the external world. Oracles must effectively acquire, validate, and transmit data while ensuring integrity and trustlessness.

Chainlink achieves this through a decentralized network of nodes, robust security measures like data aggregation and staking, and a design emphasizing interoperability and scalability. This comprehensive approach enables smart contracts to interact with real-world data securely and significantly expands the potential applications of blockchain technology.

Types of Oracles in DeFi

Blockchain oracles bridge blockchains and external data sources, enabling smart contracts to interact with real-world information. They come in various forms, each tailored to specific data acquisition and dissemination needs.

Software Oracles

Software oracles retrieve data from online sources such as APIs, databases, and web services, delivering it to the blockchain. They provide information like asset prices, weather updates, or event outcomes. For instance, Chainlink utilizes software oracles to supply decentralized finance (DeFi) platforms with real-time price feeds, ensuring smart contracts have access to accurate market data.

Hardware Oracles

Hardware oracles collect data from physical devices, including sensors and Internet of Things (IoT) devices, and transmit it to the blockchain. They are essential for real-world event verification applications, such as supply chain tracking or environmental monitoring. For example, a temperature sensor in a pharmaceutical shipment can act as a hardware oracle, recording temperature data on the blockchain to ensure compliance with storage conditions.

Inbound vs. Outbound Oracles

- Inbound Oracles: These oracles import external data into the blockchain, enabling smart contracts to respond to real-world events. For example, an inbound oracle might provide a smart contract with current exchange rates to facilitate currency conversions.

- Outbound Oracles: Outbound oracles allow smart contracts to send data from the blockchain to external systems. This capability is crucial for triggering actions in the real world based on blockchain events. For instance, a smart contract could use an outbound oracle to notify a bank to release funds once certain blockchain conditions are met.

Human Oracles

Human oracles involve individuals who verify and input information into the blockchain. They are particularly useful when data requires subjective judgment or isn't readily available through automated means. For example, in prediction markets, human oracles might confirm the outcome of an event, such as an election result, to settle bets placed on the platform.

Centralized vs. Decentralized Oracles

- Centralized Oracles: Managed by a single entity, centralized oracles provide data from a sole source. While they can be efficient, they introduce a single point of failure and potential trust issues, as the entire system relies on one data provider.

- Decentralized Oracles: These oracles aggregate data from multiple sources, enhancing reliability and trustworthiness. They reduce the risk of data manipulation by eliminating single points of failure. Chainlink is a prominent example, employing a decentralized network of nodes to deliver tamper-proof data to smart contracts.

Understanding these various types of oracles is crucial for developing robust and reliable blockchain applications, as they determine how effectively a blockchain can interact with external data and systems.

How Oracles Work With Smart Contracts

Oracles serve as vital intermediaries, enabling smart contracts to interact with external data sources and extending the functionality of blockchain applications beyond their native environments.

The Interaction Process

Smart contracts, by design, operate within the confines of their respective blockchains and lack the inherent capability to access off-chain data. Oracles bridge this gap through a structured process:

- Data Request: A smart contract initiates a request for specific external data necessary for its execution.

- Oracle Retrieval: The oracle fetches the requested data from reliable off-chain sources, such as APIs, databases, or IoT devices.

- Data Verification: The oracle may employ consensus mechanisms or aggregate data from multiple sources to ensure accuracy and trustworthiness.

- Data Delivery: The verified data is transmitted back to the smart contract, which then utilizes it to execute predefined operations.

This interaction enables smart contracts to respond to real-world events and conditions, significantly broadening their applicability.

Example Scenario: Cross-Chain Price Information for a Lending Protocol

Consider a decentralized finance (DeFi) lending protocol on Blockchain A that accepts collateral in the form of tokens from Blockchain B. To accurately assess the value of the collateral, the protocol requires real-time price information of the token from Blockchain B. Here's how an oracle facilitates this process:

- Price Data Request: The lending protocol's smart contract on Blockchain A requests the current price of the token from Blockchain B.

- Oracle Retrieval: An oracle capable of cross-chain communication fetches the latest price data from Blockchain B's network or associated off-chain sources.

- Data Verification: The oracle verifies the accuracy of the price data, possibly by aggregating information from multiple exchanges or data providers.

- Data Delivery: The oracle transmits the verified price data to the smart contract on Blockchain A.

- Contract Execution: The smart contract utilizes the price information to determine the collateral's value and proceeds with the lending process accordingly.

This seamless integration ensures that the lending protocol operates with accurate and up-to-date information, maintaining the integrity and efficiency of its operations.

Automation and Efficiency

By integrating oracles, DeFi protocols achieve higher levels of automation and efficiency:

- Transparency: Oracles provide verifiable data sources, enhancing the transparency of smart contract operations.

- Automation: The continuous flow of real-time data allows smart contracts to execute automatically without manual intervention, reducing the potential for human error.

- Reliability: Decentralized oracles aggregate data from multiple sources, mitigating the risk of single points of failure and ensuring consistent and reliable information.

Incorporating oracles into DeFi protocols not only broadens their functional scope but also enhances their operational robustness, paving the way for more complex and interconnected financial applications.

Key Use Cases of Oracles in DeFi

Oracles are critical in decentralized finance (DeFi) as they enable smart contracts to interact with real-world data. They provide secure, real-time access to external information, making various innovative financial services possible within the blockchain ecosystem.

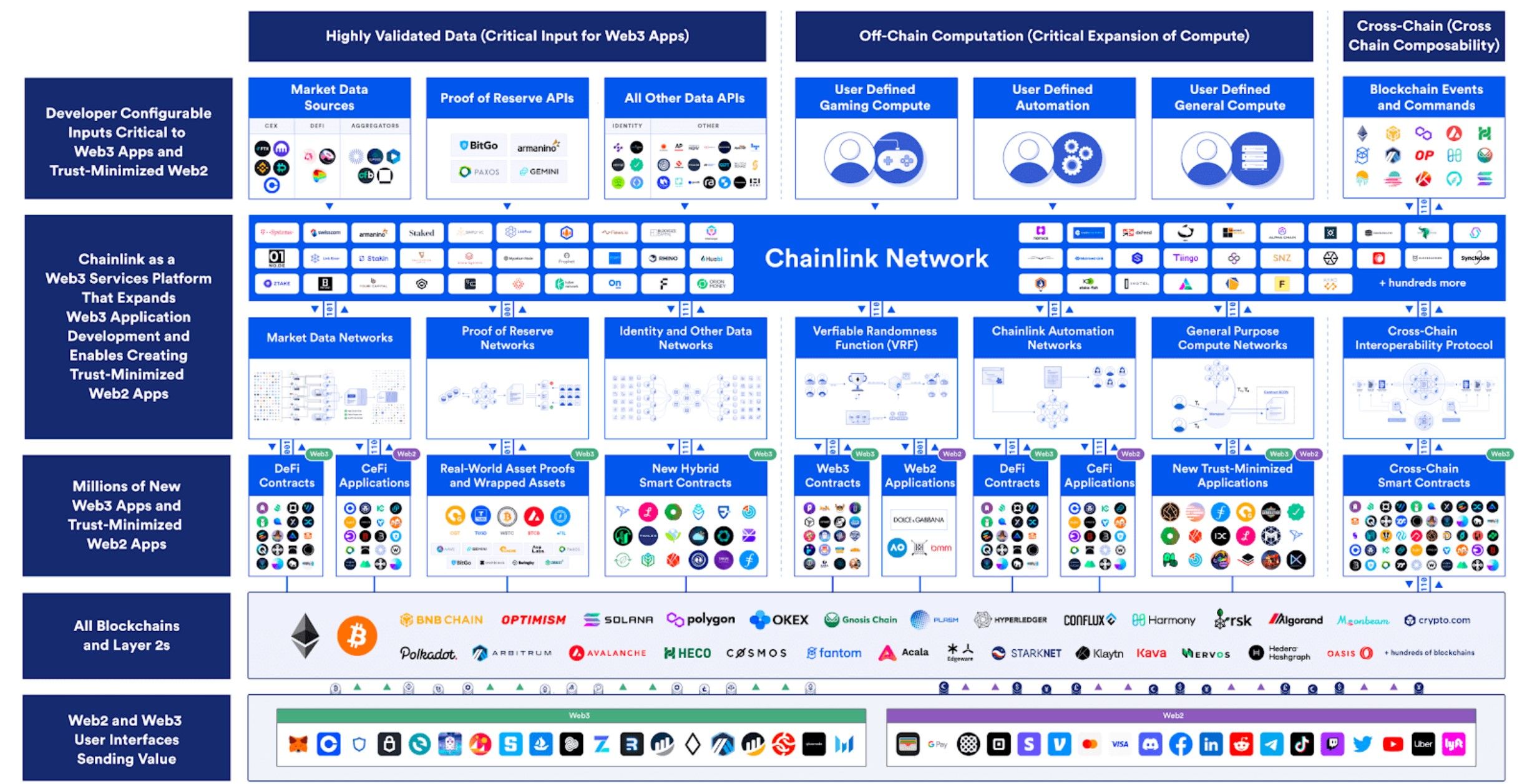

Chainlink Oracle Use Cases | Image via Chainlink

Chainlink Oracle Use Cases | Image via Chainlink- Decentralized Lending and Borrowing Platforms: Platforms like Aave, Compound, and MakerDAO allow users to lend and borrow cryptocurrencies by collateralizing assets. Oracles offer real-time price data for accurate collateral valuation, trigger automated liquidations when collateral values fall, and enable effective risk management. Without oracles, these platforms cannot value assets or manage loans effectively, leading to potential defaults and financial instability.

- Decentralized Exchanges (DEXs) with Automated Market Makers (AMMs): DEXs like Uniswap and Balancer facilitate trading without order books by adjusting token prices based on supply and demand. Oracles provide external price references to align token prices with the broader market, minimize arbitrage opportunities that could deplete liquidity pools, and reduce price slippage for traders. Without oracles, AMMs would have inaccurate pricing, leading to exploitation and diminished trader confidence.

- Derivatives and Synthetic Assets: Platforms such as Synthetix and dYdX enable trading of derivatives that track real-world assets like stocks and commodities. Oracles supply real-time prices to ensure these derivatives accurately reflect market values and facilitate fair settlement upon contract expiration. Without oracles, synthetic assets cannot maintain their value peg, rendering derivatives unreliable.

- Stablecoins: Stablecoins like DAI aim to maintain a stable value relative to assets like the USD, adjusting supply based on market conditions. Oracles provide exchange rates and monitor collateral values to maintain the stablecoin's peg and ensure sufficient backing. Without oracles, stablecoins cannot maintain price stability, leading to volatility and loss of trust.

- Prediction Markets: Platforms like Augur and Gnosis allow users to bet on future events. Oracles provide verified results to determine bet outcomes and ensure accurate distribution of winnings. Without oracles, bets cannot be resolved, undermining the platform's functionality.

- Insurance Protocols: DeFi insurance platforms like Nexus Mutual offer coverage against smart contract failures and hacks. Oracles provide incident data to validate and trigger insurance claims and supply information on threats for accurate premium pricing. Without oracles, claims processing cannot be automated, leading to delays and reduced trust in the system.

- Yield Farming and Liquidity Mining: Protocols incentivize users to provide liquidity or stake assets for rewards based on real-time metrics. Oracles deliver data on interest rates and token prices for accurate reward calculations and enable automated strategies to optimize returns. Without oracles, platforms cannot offer accurate rewards or adjust strategies effectively.

- Cross-Chain Interoperability: Projects enable interaction between different blockchain networks, allowing assets and data to move across chains. Oracles facilitate data relay and transaction verification between blockchains. Without oracles, cross-chain applications cannot function, limiting interoperability and the potential of DeFi.

- Asset Management and Robo-Advisors: DeFi platforms offer automated portfolio management, rebalancing assets based on predefined strategies. Oracles supply price data and market trends for informed decision-making and enable algorithmic trading. Without oracles, asset management services lack necessary information, hindering their ability to function.

- Flash Loans: Flash loans allow users to borrow funds without collateral, provided the loan is repaid within the same transaction block. Oracles confirm asset prices during transactions and provide accurate price feeds for safe exploitation of arbitrage opportunities. Without oracles, flash loans become risky due to potential price discrepancies, undermining their viability.

- Decentralized Identity Verification: Some DeFi applications require compliance with regulations, necessitating identity verification. Oracles relay verified identity information from trusted sources to smart contracts, enabling platforms to comply without centralization. Without oracles, services requiring regulatory compliance cannot be offered, limiting platform adoption.

- Tokenized Real-World Assets: Platforms tokenize physical assets like real estate and stocks for blockchain trading. Oracles provide current market values and regulatory data to ensure tokens represent accurate ownership stakes. Without oracles, tokenized assets lose connection to their physical counterparts, making accurate valuation and legal compliance impossible.

- Gaming and Non-Fungible Tokens (NFTs): Blockchain games and NFT platforms create tokens that change based on external data. Oracles feed real-time data to update NFTs and ensure fair gameplay by providing verifiable in-game events. Without oracles, dynamic NFTs and interactive gaming cannot react to real-world events, limiting creativity and user engagement.

- Governance and Decentralized Autonomous Organizations (DAOs): DAOs manage decentralized projects through member votes and need external data for decision-making. Oracles relay off-chain voting results to on-chain governance systems and provide necessary information like market conditions for informed proposals. Without oracles, integrating off-chain activities and accessing external information is not feasible, hindering effective decentralized governance.

Conclusion

Oracles are essential for enabling a wide range of DeFi applications by connecting smart contracts to external data sources. Without them, many innovative financial services would be impossible, significantly limiting the capabilities and growth of the DeFi ecosystem. They ensure data integrity, facilitate complex financial instruments, and enable interoperability across platforms, solidifying their role as a cornerstone in decentralized finance.

The Blockchain Oracle Problem

Blockchains derive their security and reliability from foundational principles, such as decentralization, redundancy, and strict adherence to consensus algorithms. By validating every piece of data across all nodes and requiring network-wide agreement for protocol changes, blockchains provide strong guarantees of computational determinism. However, this design inherently limits blockchains to answering binary, internally verifiable questions using data already stored on their ledgers.

When a blockchain needs to answer subjective or external questions, such as determining the market price of Bitcoin or the weather in a specific location, its design principles face significant challenges. These challenges include:

- Data Quality: Ensuring the reliability of external data is difficult. A single unreliable source, like a random website, may compromise the integrity of on-chain operations. Additionally, maintaining high-quality external data sources often requires financial resources that not all nodes can afford, reducing decentralization.

- Scalability: Adding new data sources or updating existing ones demands network-wide coordination. This creates governance overhead, slows down core development, and introduces complexities that increase the attack surface for all applications on the blockchain.

- Security and Governance Risks: Introducing subjectivity at the blockchain’s base layer risks the entire ecosystem. A single failure in data aggregation or oracle management could disrupt unrelated applications running on the same chain.

To mitigate these risks, oracles operate as separate networks rather than being integrated into the blockchain’s base layer. This separation allows oracles to handle the complexities of retrieving and verifying external data without compromising the blockchain’s core security and determinism. By maintaining this division of responsibilities, blockchains can focus on their core strengths, while oracles provide the necessary flexibility for integrating off-chain data into the on-chain ecosystem.

Popular Oracle Providers and Networks

Blockchain oracles are essential for connecting smart contracts with external data, enabling decentralized applications to interact with real-world information. Here's an overview of four prominent oracle projects, highlighting their core features and distinguishing aspects:

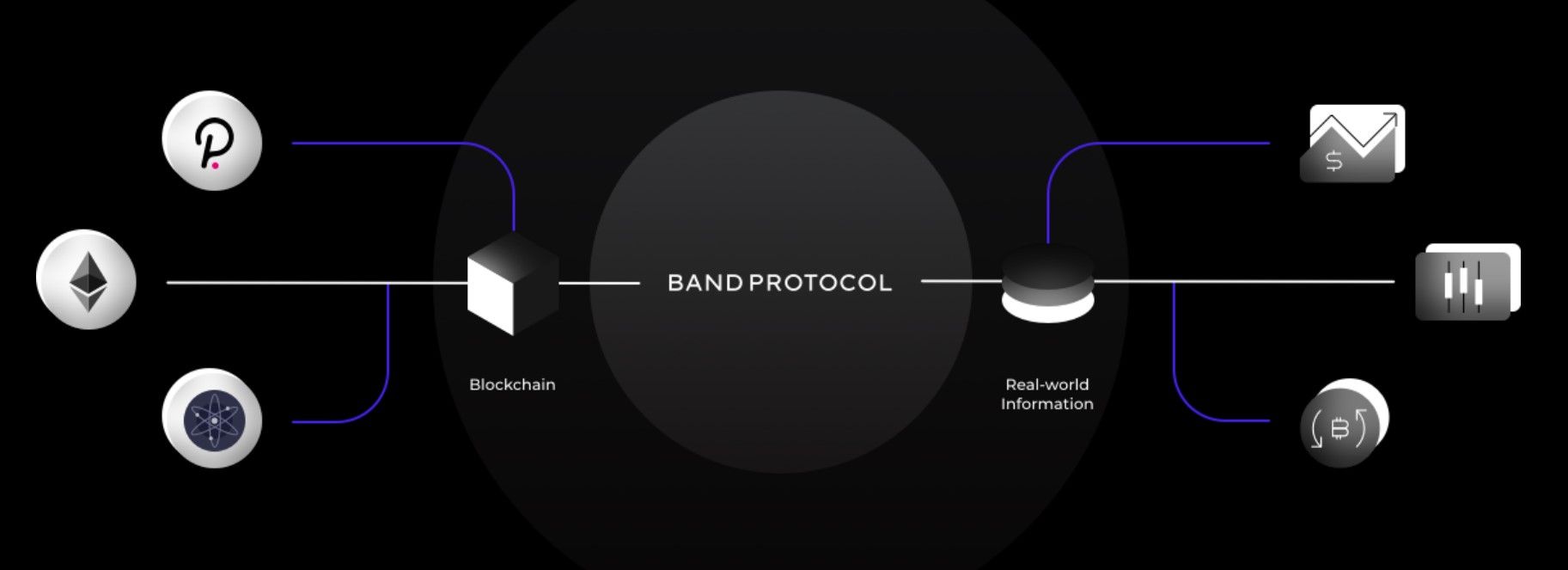

Band Protocol

Band Protocol is an Oracle specializing in price feeds | Image via Band Protocol

Band Protocol is an Oracle specializing in price feeds | Image via Band ProtocolBand Protocol is a cross-chain data oracle platform that aggregates and connects real-world data and APIs to smart contracts. Initially launched on Ethereum, Band transitioned to the Cosmos network to enhance scalability and reduce latency. Its integration with multiple blockchains allows developers to access diverse data sources efficiently. Band's use of delegated proof-of-stake (DPoS) consensus ensures data integrity and quick updates, making it a versatile choice for various decentralized applications.

Chainlink

Chainlink is the most well-known oracle | Image via Chainlink

Chainlink is the most well-known oracle | Image via ChainlinkChainlink is a decentralized oracle network that provides reliable, tamper-proof data for complex smart contracts on any blockchain. It connects smart contracts with real-world data, events, and payments, enabling them to execute based on information from external sources. Chainlink's extensive network of node operators and data providers ensures high-quality data feeds, making it a widely adopted solution in the DeFi ecosystem. Its flexibility and robust infrastructure have established Chainlink as a leader in the oracle space.

API3

API3 is a DApp API | Image via API3

API3 is a DApp API | Image via API3API3 aims to connect traditional APIs directly to blockchain applications through first-party oracles, eliminating intermediaries. By enabling API providers to run their own nodes, API3 ensures data transparency and reduces trust issues associated with third-party oracles. Its Airnode technology simplifies the process for API providers to offer their services to smart contracts, promoting a more decentralized and trustless data ecosystem.

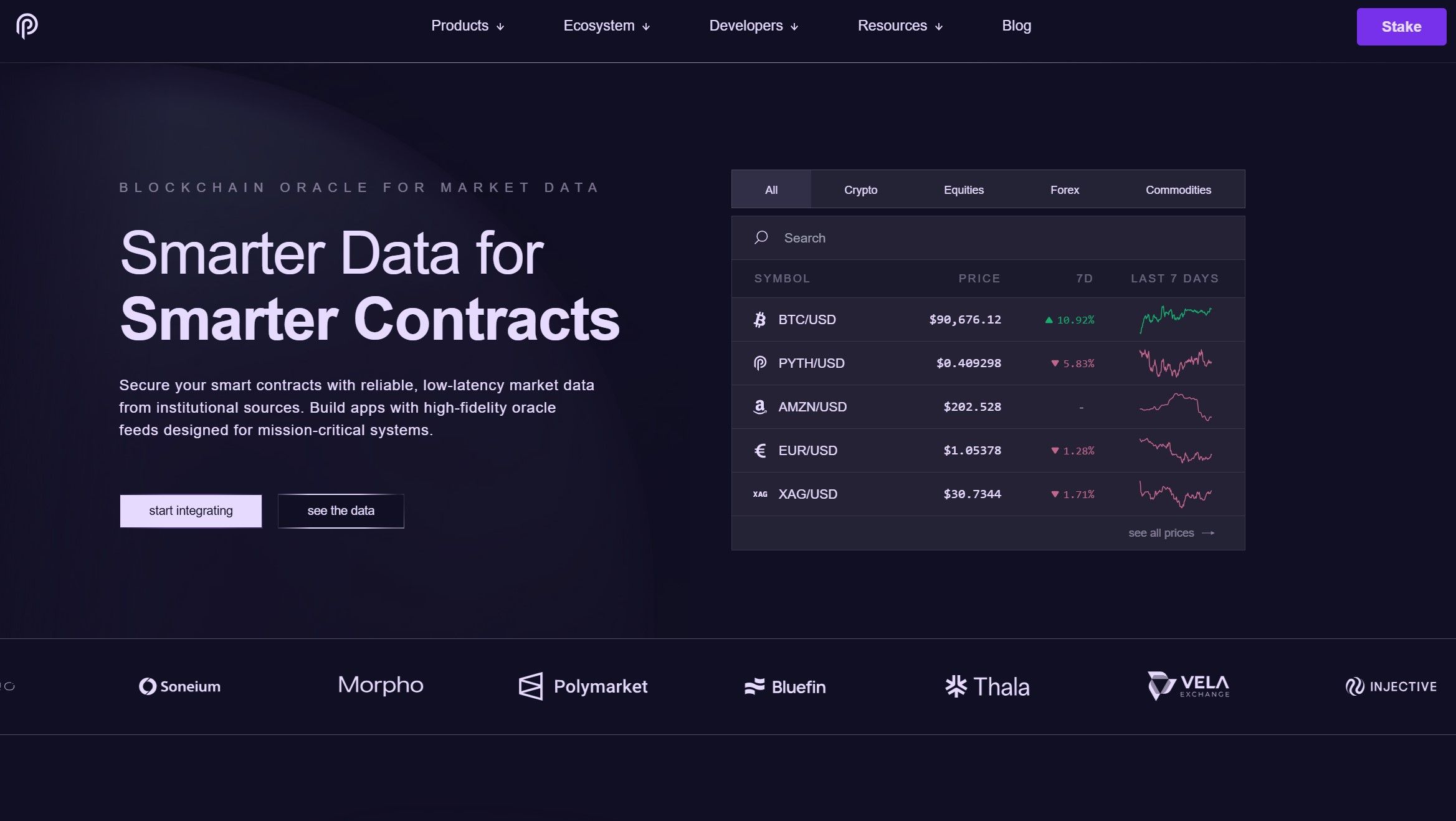

Pyth Network

Pyth network provides real-time market data | Image via Pyth Network

Pyth network provides real-time market data | Image via Pyth NetworkPyth Network delivers high-fidelity, high-frequency financial market data to decentralized applications. It sources data directly from trading firms and exchanges, ensuring accuracy and timeliness. Pyth's focus on financial data and its ability to provide real-time price feeds make it particularly valuable for DeFi applications requiring precise market information. Its integration with various blockchains enhances cross-chain data availability, supporting a more interconnected DeFi ecosystem.

Future of Oracles in DeFi and Blockchain

Oracles are set to play a crucial role in the future of decentralized finance by providing secure and reliable connections between blockchains and real-world data.

Hybrid Smart Contracts

Hybrid smart contracts, which combine on-chain code execution with off-chain data provided by oracles, are significantly expanding the scope of DeFi use cases. By integrating real-world data such as market prices, weather conditions, or sports results, hybrid contracts enable innovative applications like parametric insurance, dynamic NFTs, and advanced derivatives. This integration enhances DeFi's flexibility, paving the way for more sophisticated financial products and services.

Improved Decentralization and Security

Oracles are evolving toward more decentralized models, reducing reliance on single points of failure. Innovations like multi-source data aggregation and cryptographic proofs, such as Chainlink’s DECO and OCR (Off-Chain Reporting), bolster both decentralization and security. These advancements make oracles more robust against manipulation, ensuring the reliability of data critical for high-stakes DeFi applications.

Growth Potential

Oracles play a pivotal role in driving DeFi's growth and facilitating mainstream blockchain adoption. By bridging the gap between blockchains and external data sources, oracles enable new business models and attract institutional participants. Their ability to provide high-quality, real-time data will become increasingly important as DeFi matures and scales, making oracles integral to the broader Web3 economy.

Real-World Integrations

The future of oracles lies in deeper real-world integrations. By connecting blockchains to off-chain events in sectors like finance, supply chain, and healthcare, oracles enable the automation of complex workflows. For example, oracles can facilitate real-time auditing in supply chains, automate payouts in insurance based on IoT sensor data, or verify medical records securely for decentralized healthcare platforms. These integrations have the potential to bridge traditional industries with blockchain technology, accelerating its global adoption.

The Role of Oracles in DeFi: Closing Thoughts

Oracles are a cornerstone of blockchain technology, enabling smart contracts to interact with real-world data and other networks. From facilitating cross-chain liquidity to empowering hybrid smart contracts, oracles are instrumental in expanding the scope and usability of decentralized finance (DeFi). While challenges like the Oracle Problem persist, ongoing innovations in decentralization, security, and real-world integrations highlight their transformative potential.