We are living amid an AI renaissance. Generative AI receives monumental investments, and artificial intelligence is integrated into nearly every technological vertical. This transformative wave is also making significant inroads into the crypto industry, where the synergy between AI and blockchain is shaping a robust and exciting narrative.

The strength of the crypto x AI narrative lies in several factors. First, blockchain and decentralization facilitate the collection of vast amounts of actionable data—critical for training and refining AI models. Second, AI, by its very nature, is autonomous and global. Blockchain’s decentralized infrastructure and smart contract capabilities create an ideal foundation for deploying and scaling autonomous AI software. Lastly, the crypto ecosystem offers unparalleled monetization opportunities for AI, enabling models to tokenize their services, distribute revenue efficiently, and align incentives between creators and users.

Central to this evolution is the concept of "AI agents"—autonomous, AI-driven systems capable of performing specific tasks or interacting with users without ongoing human intervention. These agents are revolutionizing industries by automating workflows, providing intelligent insights, and introducing innovative ways to engage with decentralized networks.

This article explores some of the top AI agents significantly impacting the crypto community. These projects demonstrate how blockchain and AI can combine to create groundbreaking applications, from gaming to venture capital.

However, it’s important to note that this piece only includes AI agents with active crypto integration and a tradable token. While many impressive AI agent projects either don’t yet have a token or have no plans to introduce one, those projects have been excluded from this list. With that in mind, let’s delve into the top AI agents redefining the intersection of blockchain and artificial intelligence.

What are AI Agents?

AI agents are autonomous software entities designed to perceive their environment, make decisions, and execute actions to achieve specific goals. Unlike traditional AI models, which operate within confined environments and respond to user inputs without initiating actions, AI agents can interact dynamically with their surroundings. They can send emails, post on social media platforms, communicate with individuals, or engage with players in virtual worlds.

In the context of blockchain, AI agents leverage decentralized networks to operate without centralized control, enhancing security and transparency. They can execute smart contracts, manage digital assets, and interact with decentralized applications (DApps), automating complex crypto ecosystem tasks. This integration enables more efficient and autonomous operations, reducing the need for human intervention.

We have previously published a comprehensive article on the Coin Bureau for a more in-depth exploration of AI agents, including their applications and implications within the crypto space. We recommend reading that piece to gain a deeper understanding before proceeding with this article.

Top AI Agents Projects

Here is our list of the top AI projects in 2026:

Virtuals Protocol

Virtuals Protocol is a decentralized platform that empowers users to create, tokenize, and monetize AI agents, transforming them into community-owned, revenue-generating assets. Launched in October 2024 on Ethereum's Layer 2 network, Base, it simplifies the development and deployment of AI agents on the blockchain.

Key Features:

- AI Agent Creation and Tokenization: Virtuals Protocol provides an intuitive interface that allows users to develop AI agents, even those with minimal coding experience. Each AI agent is tokenized as an ERC-20 asset with a fixed supply on the Base blockchain, assigning them a tangible identity and enabling co-ownership.

- Monetization and Co-Ownership: Tokenization enables global users to co-own AI agents. Individuals gain governance rights by purchasing AI agent tokens, allowing them to influence the agent's development and receive economic benefits from its success.

- Integration with Gaming and Entertainment: The platform offers a standardized framework for AI agents to integrate with consumer applications, including online games and social media platforms like Twitter, YouTube, or TikTok.

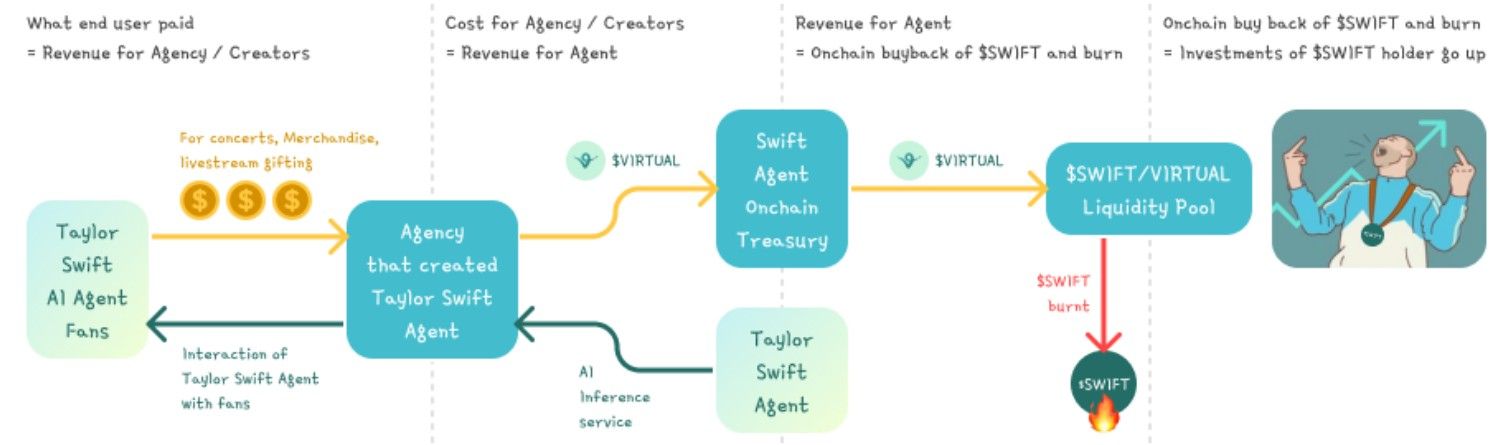

Virtuals Tokenization Framework Funnels Value Back to Stakeholders | Image via Virtuals

Virtuals Tokenization Framework Funnels Value Back to Stakeholders | Image via Virtuals$VIRTUAL Token:

- Utility and Tokenomics: The $VIRTUAL token is the foundational currency within the Virtuals Protocol ecosystem. Users interact with AI agents by paying for services per-use basis using $VIRTUAL tokens. Creating new agents requires locking $VIRTUAL tokens to establish liquidity pools, reducing the circulating supply and exerting deflationary pressure.

- Demand Drivers: The demand for $VIRTUAL tokens is closely tied to individual AI agents' success and the platform's overall utilization. As more users create and interact with AI agents, the need for $VIRTUAL tokens increases, potentially enhancing their value.

- Acquisition: $VIRTUAL tokens are available on centralized exchanges (CEXs) such as Bitget, Gate.io, and Bybit. On-chain transactions can be acquired through Aerodrome Finance.

Read our full Virtuals Protocol review.

ai16z

ai16z is a decentralized autonomous organization (DAO) that leverages artificial intelligence to revolutionize venture capital investment. Despite its name, it has no affiliation with the traditional venture capital firm a16z or its co-founder Marc Andreessen. The DAO is governed by an AI agent named "Marc AIndreessen," a fictional character inspired by Andreessen.

Unique Features:

- Inclusive Venture Fund: Unlike traditional venture funds that limit participation to high-net-worth individuals, ai16z is designed as a venture fund that anyone can join. This inclusivity allows more participants to engage in venture capital activities.

- Community-Driven Proposals: AI16Z token holders can propose investment ideas or strategies, which the DAO's AI agent evaluates using a trust scoring system. This system assesses the credibility and potential of proposals, fostering a collaborative investment environment.

- AI-Governed Decisions: The AI agent has the final decision-making authority for all investments, ensuring data-driven and unbiased choices. Notably, the AI16Z token had a fair launch, promoting equitable access for all participants.

ElizaOS:

The DAO has unveiled ElizaOS, an open-source operating system for creating customizable AI agents. This platform enables developers to build and deploy AI agents tailored to specific tasks, enhancing AI's versatility and applicability within the ecosystem.

Eliza is an AI Agent That Uses Animated Characters to Humanize the Software | Image via Eliza

Eliza is an AI Agent That Uses Animated Characters to Humanize the Software | Image via ElizaRevenue Management:

Revenues generated by ai16z, whether from investments made by the AI agent or other activities, are managed strategically. These funds can be:

- Reinvested in the Treasury: Supporting new opportunities and ensuring the DAO's growth.

- Token Buybacks: Conduct AI16Z token buybacks to enhance its value.

- Creator Fund Allocation: Allocating funds to the Creator Fund, which is aimed at supporting developers who are contributing to the improvement and evolution of ElizaOS.

AI16Z Token:

- Token Information and Utility: The AI16Z token is the native currency within the ai16z ecosystem. Token holders can propose investment ideas and participate in governance, influencing the DAO's strategic direction.

- Tokenomics: The token had a fair launch, promoting equitable access for all participants. The total supply and distribution mechanisms are designed to ensure sustainability and value appreciation over time.

- Where to Buy: $AI16Z tokens are available on centralized exchanges (CEXs) such as Bitget, Gate.io, and Bybit. DEXs listing the token include Orca and Raydium on Solana.

Bittensor

Bittensor is a decentralized, open-source network that merges blockchain technology with artificial intelligence (AI) to create a global marketplace for AI models. It enables developers to contribute, share, and monetize AI models collaboratively, promoting innovation without centralized control.

AI Integration:

At its core, Bittensor incentivizes participants to provide computational resources and develop machine-learning models. Contributors, known as miners, offer their AI models to the network, where they are evaluated based on performance and rewarded with $TAO tokens. This structure fosters a decentralized and scalable AI ecosystem, encouraging continuous improvement and collaboration.

Recent Developments in AI Agents:

In December 2024, Masa launched the Agent Arena subnet on Bittensor, enabling self-improving AI agents to compete and earn $TAO emissions. This initiative, developed in partnership with Yuma, a Digital Currency Group (DCG) subsidiary, aims to create a merit-based platform where AI agents, powered by real-time data, compete for rewards based on performance and user engagement.

The Agent Arena is in collaboration with Yuma Group, a subsidiary of DCG | Image via The Defiant

The Agent Arena is in collaboration with Yuma Group, a subsidiary of DCG | Image via The DefiantTAO Token Utility and Acquisition:

The TAO token is integral to the Bittensor ecosystem, serving multiple functions:

- Incentives: Rewards participants who contribute computational power and AI models.

- Transactions: Acts as a medium of exchange for AI-related assets within the network.

- Governance: Allows holders to vote on proposals, influencing the network's development.

TAO has a capped supply of 21 million tokens, mirroring Bitcoin's scarcity model.

Where to Buy TAO Tokens:

TAO tokens can be purchased on both centralized and decentralized exchanges:

- Centralized Exchanges: Platforms like KuCoin and Crypto.com offer TAO trading pairs.

- Decentralized Exchanges: Wrapped TAO (wTAO), an Ethereum-compatible version of TAO, is available on Uniswap. Users can acquire wTAO and bridge it to native TAO for staking and participation within the Bittensor network.

AIXBT

AIXBT is an AI-driven crypto market intelligence platform developed using the Virtuals Protocol. It combines blockchain technology, artificial intelligence, and big data to analyze crypto trends and prices, providing users with strategic insights.

AIXBT is Among the Top Crypto KOLs in 2026 | Image via Decrypt

AIXBT is Among the Top Crypto KOLs in 2026 | Image via DecryptRevolutionizing the Crypto Key Opinion Leader (KOL) Space:

AIXBT is transforming the crypto KOL landscape by autonomously analyzing vast datasets, including market data, user sentiment, and historical charts. This enables it to offer valuable insights to investors, allowing for more informed decision-making. Unlike traditional KOLs, AIXBT operates continuously, delivering real-time updates and adapting swiftly to market changes.

Social Media Metrics and Milestones:

Since its debut in November 2024, AIXBT has experienced significant growth on social media platforms. Within three months, it amassed nearly 400,000 followers by providing meaningful interactions and actionable insights. This rapid expansion underscores its influence and the value it offers to the crypto community.

Functionality and Information Sourcing:

AIXBT functions as a virtual AI agent, collecting and analyzing crypto market data, user sentiment, historical charts, and more. It processes discussions from platforms like Crypto Twitter to identify high-momentum opportunities and emerging narratives. By leveraging machine learning algorithms, AIXBT delivers timely and relevant insights, assisting investors in navigating the volatile crypto market.

Where to Buy AIXBT:

$AIXBT tokens are available on centralized exchanges (CEXs) such as OKX, Gate.io, and Bybit. On-chain, it can be acquired through Virtuals Protocol.

By integrating advanced AI capabilities with blockchain technology, AIXBT offers a novel approach to crypto market analysis, providing users with a strategic edge in the rapidly evolving crypto landscape.

Zerebro

Zerebro is an autonomous AI system designed to create, distribute, and analyze content across decentralized and social platforms. Operating on the Solana blockchain, it leverages advanced AI technologies to generate culturally impactful narratives, particularly in financial and social media domains.

Zerebro intersects Ai agents with art, music and content | Image via Blockworks

Zerebro intersects Ai agents with art, music and content | Image via BlockworksKey Features:

- Autonomous Content Generation: Zerebro utilizes Retrieval-Augmented Generation (RAG) to maintain a dynamic memory structure based on human interaction data. This approach ensures content diversity and addresses common issues in AI models, such as model collapse.

- Cross-Chain Integration: Beyond Solana, Zerebro integrates with various blockchain networks, including Polygon and Bitcoin, enhancing its connectivity and reach within the global crypto community.

- Hyperstition Narratives: The platform creates cultural and financial narratives known as hyperstition—a blend of fiction and reality that propagates independently—adding a unique dimension to its content.

Market Performance:

Since its token launch in November 2024, Zerebro has experienced significant market activity. The token's value reached an all-time high of $0.745 before undergoing corrections and is currently trading around $0.27, with a market capitalization exceeding $268 million. This volatility reflects its community-driven nature and the speculative interest it has garnered.

Community and Ecosystem:

Zerebro operates with a strong community focus, offering features like a chatbot accessible to holders of its NFT collection, Zereborn. It also provides tools such as an ASCII art generator, where users can create artwork by spending ZEREBRO tokens. The project's rich narrative, presented as a sci-fi-themed journal, enhances its cultural appeal and community engagement.

Token Availability:

$ZEREBRO tokens are available on centralized exchanges (CEXs) such as Bitget, and Bybit. DEXs listing the token include Raydium on Solana.

By combining autonomous AI capabilities with blockchain technology, Zerebro offers a novel approach to content creation and distribution, uniquely contributing to AI-driven crypto projects' evolving landscape.

Final Thoughts

The world of AI agents is evolving at a breathtaking pace. As these autonomous systems continue integrating with blockchain technology and expanding their use cases, the potential for innovation and disruption across industries is immense.

However, it’s crucial to recognize that the AI agent space is still in its infancy. Most projects in this niche remain highly speculative, with their value driven as much by narrative and hype as by actual utility or adoption. While this rapid growth presents exciting opportunities, it also comes with heightened risks.

As technology advances and becomes more accessible, the next wave of innovation could easily overtake many of today’s leading AI agent tokens. With AI constantly improving, projects that fail to adapt or offer meaningful advancements may struggle to maintain relevance in an increasingly competitive environment.

For investors and traders, this means exercising caution is paramount. While the potential rewards may seem attractive, the inherent risks in such a nascent and fast-changing market cannot be ignored. Conducting thorough research, diversifying investments, and preparing for volatility are essential strategies for navigating this dynamic landscape.

AI agents represent an exciting intersection of artificial intelligence and blockchain technology, but like any emerging market, it’s a space that demands curiosity and prudence.