It's clear that one of the hottest narratives in this cycle is the rise of the so-called ‘Solana killers’—Layer 1 blockchains aiming to surpass Solana in key areas like transactions per second and transaction finality.

One of the prominent players in this scalability race is Aptos. With partnerships involving major tech giants like Microsoft and Google, Aptos is emerging as a serious contender for Solana's position as the go-to blockchain for institutional needs.

Given Solana's history of outages and network congestion issues, institutions are actively seeking alternative blockchains that offer reliability comparable to traditional financial systems. Aptos, with its cutting-edge technology developed by Facebook’s former Diem team, aims to provide just that.

In this article, we’ll cover some of the top Aptos projects, but before diving in, let’s take a moment to explore the background that makes this blockchain so promising.

Aptos Overview

Aptos is a highly scalable Layer 1 blockchain designed to deliver impressive scalability—up to 160,000 transactions per second (TPS)—with near-instant transaction finality and robust security. This combination enables Aptos to support a wide range of applications, from payments to gaming, making it an ideal blockchain for a vast variety of use cases.

Aptos achieves this scalability through its AptosBFT consensus mechanism and the utilization of Move, a purpose-built programming language for blockchains. Move, which is based on Rust—the same language used by Solana— enables Solana developers to transition smoothly to Aptos and even to Sui, without needing to learn a completely new language. Furthermore, developing on Move is reportedly much simpler than on native Rust, which is also one of the main factors positioning Aptos as a "Solana killer."

However, Aptos’s impressive speed comes with certain trade-offs, particularly in decentralization. Currently, Aptos operates with only 149 validators, making it relatively centralized. This can be attributed to the blockchain trilemma, which dictates that a blockchain must compromise on one of three aspects—decentralization, scalability, or security—to excel in the other two.

The Term Was Coined by Ethereum's Vitalik Buterin. Image via CertiK

The Term Was Coined by Ethereum's Vitalik Buterin. Image via CertiK

In terms of tokenomics, APT serves as the native coin of the Aptos blockchain. APT has multiple functions, including paying transaction fees, enabling staking for validators and delegators, and facilitating governance within the network.

Aptos History

Aptos was founded by Avery Ching and Muhammad Sheikh, both of whom previously worked at Facebook and contributed to the now-defunct Diem project. The project was founded in 2021 and launched its mainnet in 2022.

Aptos's Founders. Image via Aptos Labs

Aptos's Founders. Image via Aptos Labs Development of Aptos is spearheaded by Aptos Labs, a software company based in San Francisco. The ongoing development efforts are coordinated by the Aptos Foundation, a non-profit organization located in the Cayman Islands.

This brief overview obviously only scratches the surface of Aptos’s impressive technology and history. If you're interested in a deeper dive, we have a comprehensive review of the project, which you can find here.

If you prefer to watch a video instead, we’ve got you covered.

Now, let’s take a look at some of the top DApps within Aptos’s ecosystem.

Top Aptos Projects

Before diving in, here’s a table summarizing all the most crucial information for each DApp covered in the article.

| DApp | Category | Description |

|---|---|---|

| Amnis Finance | DeFi, Liquid Staking | A liquid staking platform on Aptos that allows users to stake APT tokens while retaining liquidity, featuring yield tokenization and auto-compounding rewards. |

| Propbase | Real World Assets (RWA) | A real estate platform that tokenizes properties on Aptos, enabling fractional ownership and making property investment more accessible and transparent. |

| Cellana Finance | Decentralized Exchange | The leading DEX on Aptos utilizing the Ve(3,3) model for liquidity incentives and governance, offering a flexible, community-driven approach to liquidity management. |

| Chingari & Stan | SocialFi | Chingari is a decentralized social media app like TikTok, and Stan is an esports and influencer platform; both enhance user engagement on Aptos through social and financial incentives. |

| Thala Protocol | DeFi, Stablecoin, Liquid Staking | A DeFi platform offering trading and yield products, including the over-collateralized stablecoin Move Dollar (MOD), various liquidity pools, and liquid staking options. |

| Eragon | Web3 Gaming | The largest Web3 gaming platform on Aptos, functioning as a decentralized app store optimized for mobile gaming with keyless account access and tools for developers. |

| Wapal NFT Marketplace | NFT Marketplace | A no-code NFT marketplace and launchpad on Aptos, simplifying NFT creation and trading with some of the lowest minting fees, catering to both individual artists and large projects. |

With that out of the way, let’s dive into these projects in greater detail, in no specific order.

Amnis Finance

Amnis Finance, a liquid staking platform on the Aptos blockchain, has become a cornerstone of the Aptos DeFi ecosystem. At the time of writing, Amnis boasts a total value locked (TVL) of over $250 million and supports a large user base with over 300,000 stakers. Through liquid staking, yield tokenization, and auto-compounding rewards, Amnis empowers users to maximize returns on staked APT.

A Look at the Amnis Finance Homepage. Image via Amnis Finance

A Look at the Amnis Finance Homepage. Image via Amnis FinanceLiquid Staking

Amnis Finance’s liquid staking feature allows users to stake their APT while retaining liquidity. When users stake APT, they receive amAPT or stAPT tokens in return. These tokens can be freely used within the Aptos ecosystem for activities such as trading, lending, or yield farming, enabling users to earn staking rewards without locking their funds.

Yield Tokenization

Through yield tokenization, Amnis Finance splits yield-bearing assets (stAPT) into two distinct components: the Principal Token (PT) and the Yield Token (YT). The Principal Token represents the original staked value, while the Yield Token captures the accrued rewards. This separation allows investors to adopt unique strategies, such as holding or trading either the principal or the yield independently, thereby enhancing flexibility and potential returns.

amAPT and stAPT Utility

- amAPT is a liquid staking derivative pegged 1:1 to APT, offering a stable asset that retains its value while providing liquidity. Users can trade amAPT tokens, utilize them in DeFi applications, or redeem them back for APT at any time.

- stAPT functions as an auto-compounding asset, with rewards accruing in the stAPT vault over time. Similar to Aave’s aUSDC, this model eliminates the need for manual reward re-staking. stAPT holders receive an increasing claim on the vault’s assets, making it a flexible and passive way to accumulate staking rewards.

Security and Accessibility

Amnis Finance operates with a strong focus on user security, having been audited by MoveBit and Verichains. The platform offers swift, fee-free withdrawals and sets itself apart by charging no protocol fees, making it a cost-effective choice compared to some other staking options in the ecosystem.

Propbase

An emerging narrative that has gained significant traction in crypto this cycle is Real World Assets (RWAs), as evidenced by the increasing interest from major players like BlackRock, who project RWAs growing into a multi-trillion-dollar industry. RWAs enable the tokenization of various asset types, such as U.S. government bonds and real estate—the latter being the focus of Propbase.

Propbase is a real estate platform on the Aptos blockchain that brings fractional ownership of high-quality properties to investors worldwide. By tokenizing real estate, Propbase makes property investment more transparent and accessible, reducing traditional barriers to entry.

Fractional Real Estate Ownership

Propbase offers a marketplace where buyers and sellers connect directly, without the platform purchasing properties outright. Instead, Propbase identifies real estate investments with attractive returns and favorable pricing. Each property undergoes a six-step process to ensure compliance with legal and regulatory frameworks before being made available for investment.

Propbase’s Listing Process. Image via Propbase

Propbase’s Listing Process. Image via PropbaseProperties are launched in time-limited auctions on the Propbase platform. Once the funding target is reached and the property acquisition is complete, investors receive tokenized shares representing the property's underlying asset value. These tokens can be:

- Traded on Propbase's peer-to-peer marketplace.

- Held to earn passive rental income from the property's earnings.

- Buyers incur zero fees when acquiring tokens, while sellers are charged a 1% fee upon selling their tokens.

Lowering the Barrier to Entry

Traditional real estate investing is capital-intensive, often requiring substantial funds to enter the market. Propbase addresses this challenge by dividing properties into tokens, each valued at $100 at the time of purchase. This fractional ownership model allows investors to:

- Diversify their portfolios across multiple properties and property types.

- Invest in real estate with a significantly lower amount of capital.

- Benefit from property potential appreciation and rental income.

All property management and tenant sourcing are handled by professional property management companies, freeing investors from these responsibilities.

A Look at a Property Listing on Propbase. Image via Propbase

A Look at a Property Listing on Propbase. Image via Propbase

Future Expansion and Focus

Propbase initially focused on residential units but plans to expand its offerings to include condos and commercial real estate, with most properties located in Southeast Asia.

Cellana Finance

Naturally, every ecosystem needs a solid DEX, and in Aptos’s case, that role belongs to Cellana Finance, one of the leading DEXs on the blockchain.

Cellana Finance Homepage. Image via Cellana Finance

Cellana Finance Homepage. Image via Cellana FinanceWhat sets Cellana apart from other DEXes in the ecosystem is its use of the Ve(3,3) model, which addresses the complex challenges of liquidity incentives and governance, creating new possibilities for both emerging and established protocols by offering a more flexible, community-driven way to manage liquidity.

Ve(3,3) Economic Model

The Ve(3,3) economic model is designed to tackle two major challenges often faced by decentralized exchanges:

- Providing attractive incentives to liquidity providers

- Creating sustainable revenue for governance token holders

Traditional DEXes like Pancakeswap and Uniswap often struggle with these issues. Trading fees alone are frequently insufficient to attract liquidity, leading to liquidity mining initiatives that rely on continuous token emissions, which can dilute the token value and complicate revenue allocation for protocol token holders.

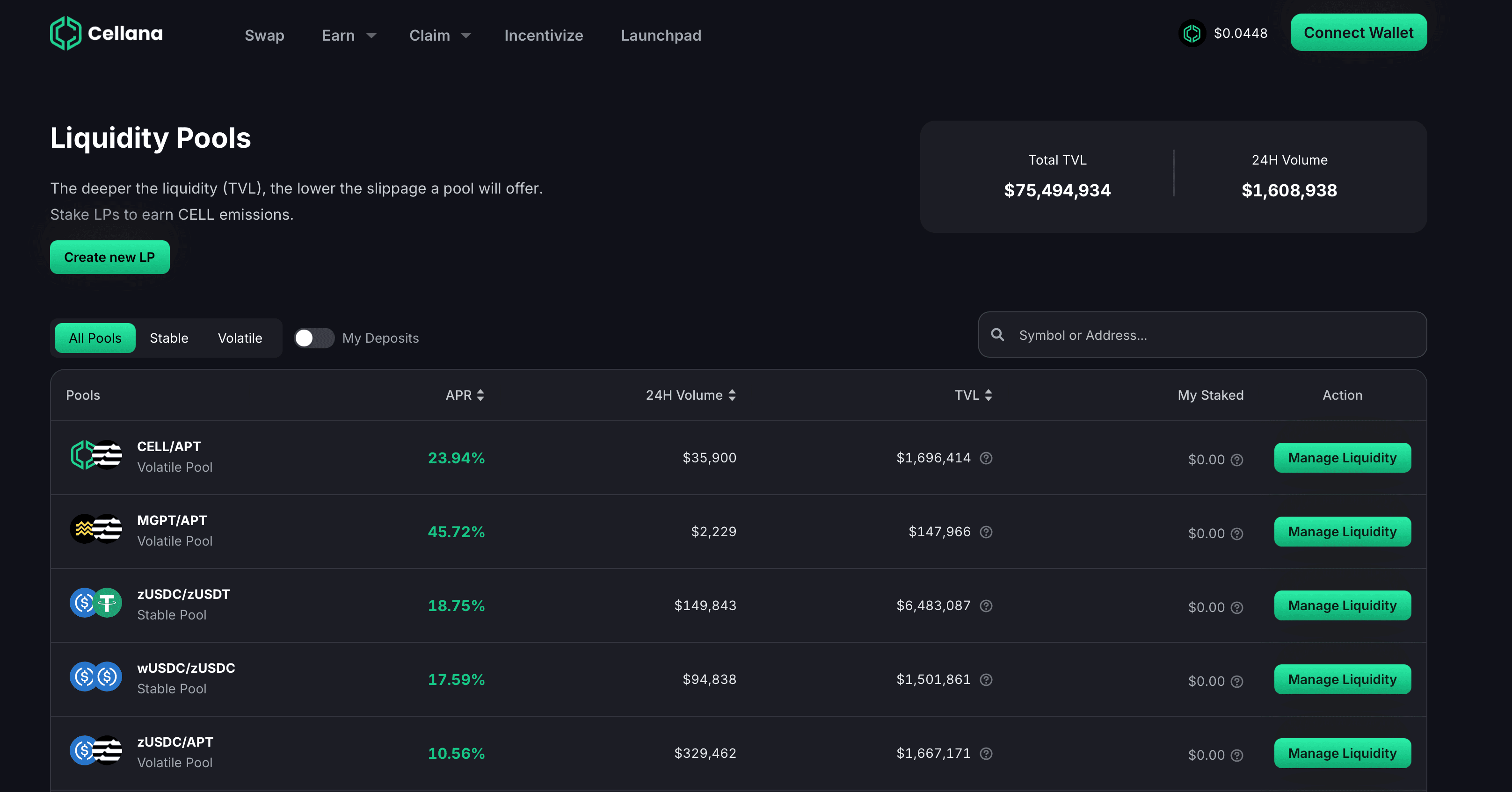

A Look at Cellana’s Liquidity Pools. Image via Cellana Finance

A Look at Cellana’s Liquidity Pools. Image via Cellana FinanceCellana’s Ve(3,3) model provides a self-sustaining approach to aligning incentives across the platform. Unlike most DEXes, where token emissions are controlled centrally, the Ve(3,3) model allows the community to manage and direct these emissions. This flexibility lets protocols add their own incentives to liquidity pools, drawing in voters whose voting power influences emission distribution to targeted pools. In turn, liquidity providers receive CELL emissions, supporting deep liquidity that boosts trading efficiency and reduces slippage for traders.

Cellana operates a dual token model:

- CELL is the utility token, distributed through weekly emissions to encourage users to add liquidity and stake LP tokens.

- veCELL serves as Cellana’s governance token, enabling holders to vote on liquidity pools and direct CELL emissions to their preferred pools while earning trading fees.

Benefits for All Participants

The Ve(3,3) framework aligns incentives for all participants in the Cellana ecosystem:

- Protocols: Bootstrap their liquidity pools with tailored incentives, attracting voters.

- Voters: Lock CELL tokens to obtain veCELL, allowing them to vote on pools and earn trading fees along with additional incentives from the pools they support.

- Liquidity Providers: Contribute liquidity to incentivized pools, staking their LP tokens to earn CELL emissions, thereby deepening liquidity pools.

- Traders: Benefit from these deeper pools with lower slippage, resulting in a more efficient and cost-effective trading experience.

Chingari

Chingari is a decentralized social media platform often described as the ‘TikTok of India’, enabling users to create and engage with short-form video content and livestreams. Chingari has emerged as the most popular DApp on the Aptos blockchain, consistently attracting millions of unique active wallets each month and boasting over 200 million downloads.

A Look at Chingari. Image via Gari

A Look at Chingari. Image via GariAt the core of Chingari’s ecosystem is the GARI token, which incentivizes users to participate on the platform. Both creators and viewers earn GARI tokens for sharing, watching, and interacting with content. Additionally, GARI powers the Ghingari NFT marketplace, providing creators with more monetization options and enhancing their ability to generate income within the platform.

Stan

Stan is an esports and influencer platform focused on transforming fan engagement in India’s gaming scene. With over 10 million downloads on the Google Play Store and hundreds of thousands of unique active wallets each month, Stan allows fans to purchase exclusive digital collectibles, access unique content, and connect with leading influencers in the gaming community.

Stan’s Homepage. Image via Stan

Stan’s Homepage. Image via StanThala Protocol

Thala Protocol is a DeFi platform on the Aptos blockchain, offering a comprehensive suite of trading and yield products. These include various pool types, liquid staking, and the Move Dollar (MOD) stablecoin.

A Glimpse of the Thala Protocol Homepage. Image via Thala Protocol

A Glimpse of the Thala Protocol Homepage. Image via Thala ProtocolMove Dollar (MOD)

MOD is Thala's flagship product—an over-collateralized decentralized stablecoin. Unlike traditional centralized stablecoins like USDT and USDC, MOD is backed by a diverse basket of on-chain assets, including liquid staking derivatives, liquidity pool tokens, and deposit receipt tokens. This diverse collateralization ensures that MOD remains decentralized, censorship-resistant, and capital-efficient.

MOD maintains its $1 peg through the following mechanisms:

- Over-Collateralization: Users mint MOD by depositing collateral valued higher than the MOD they receive, ensuring that the collateral always exceeds the stablecoin supply.

- Liquidation Protocol: Vaults that fall below the minimum collateralization ratio are subject to liquidation, protecting the stablecoin's $1 peg.

Thala AMM

Thala’s Automated Market Maker (AMM) introduces a range of liquidity pool types designed to ensure smooth trading and support for new projects. Here’s a breakdown:

- Weighted Pools: Customizable token ratios allow projects to set liquidity according to specific needs.

- Stable Pools: Reduce slippage for similar or pegged assets, like stablecoins.

- Liquidity Bootstrapping Pools (LBPs): Ideal for new projects, LBPs facilitate a gradual and controlled token distribution, helping to establish fair market pricing and initial liquidity depth.

Liquid Staking

Similar to Amnis Finance, Thala offers liquid staking on Aptos through a two-token model involving thAPT and sthAPT:

- thAPT: Serves as a liquid representation of staked APT, pegged 1:1 to APT.

- sthAPT: Functions as a rebasing token, meaning its value increases over time as staking rewards accumulate.

Eragon

Eragon is the largest Web3 gaming platform on the Aptos blockchain, designed to simplify and enhance Web3 mobile gaming experiences. Backed by the Aptos Foundation, the platform boasts around 200,000 monthly active wallets as of this writing.

A Look At Eragon’s Game Store. Image via Eragon

A Look At Eragon’s Game Store. Image via EragonEragon essentially functions as a decentralized app store, primarily tailored for Web3 mobile gaming. It includes features like Keyless Account Access, which eliminates the need for complex seed phrases, catering especially to users less familiar with crypto. Eragon also provides a suite of tools to help developers transition Web2 games into Web3 environments.

Wapal NFT Marketplace

A project ecosystem overview wouldn’t be complete without mentioning an NFT marketplace, and on the Aptos blockchain, Wapal takes the lead as the go-to platform for NFT trading and launches.

A Look at Wapal’s NFT Marketplace. Image via Wapal

A Look at Wapal’s NFT Marketplace. Image via WapalWapal is a no-code NFT marketplace and launchpad on the Aptos blockchain, designed to simplify the creation and trading of NFTs for both new and seasoned users. It provides a unique blend of tools for creators and some of the lowest minting fees available, making it attractive to both individual artists and large projects alike.

Where to Buy APT?

APT can be purchased on most major centralized crypto exchanges, including:

Additionally, you can check out our top picks for the best crypto exchanges.

For those looking to buy APT on a decentralized exchange, the previously covered Cellana Finance is a solid option.

Where to Store APT?

If you're looking to start exploring the Aptos ecosystem or secure your APT through self-custody, you have several wallet options to choose from.

Software Wallets

Petra Wallet

Petra Wallet is the most popular wallet in the Aptos ecosystem, developed by Aptos Labs. Petra offers essential features such as storing, transferring, and managing your assets, creating and viewing NFTs, and interacting seamlessly with decentralized applications (DApps) within Aptos’s ecosystem. So, nothing particularly unique, but all the essential features you’d expect from a quality software wallet.

Martian Wallet

The Martian Wallet stands out with its support for multiple Move-based cryptocurrencies, currently limited to Aptos and Sui. This allows users holding both Aptos and Sui to store, swap, and interact within both ecosystems through the same wallet. Martian also includes all the standard features offered by Petra Wallet.

Hardware Wallets

For those prioritizing security, hardware wallets like Ledger and Tangem are some of the top options that support Aptos. These devices provide enhanced security over software wallets, making them ideal for long-term APT storage.

Considering purchasing a hardware wallet? Check out the Coin Bureau Deals page for discounts on some of the best ones in the space.

Top Aptos Projects: Closing Thoughts

Aptos's ecosystem growth has been undeniably impressive, particularly within the SocialFi niche, where much of its user base comes from. However, Aptos doesn’t seem to have yet aligned itself with one particular narrative, unlike its close competitor Sui, which has taken a clear focus on gaming with the launch of SuiPlay0X1.

This means that Aptos could very well still be in a discovery phase, exploring where its state-of-the-art technology can create the most impact. The variety of DApps already in its ecosystem showcases Aptos’s ability to support a wide range of use cases, making it an prominent player in the scalability race.