Blast boasts itself as the first native yield Layer 2 network on Ethereum. It has rapidly ascended the ranks of blockchain ecosystems, driven by its incentive-heavy structure. This unique approach rewards users for injecting liquidity into the network and actively engaging with the decentralized applications (DApps) within the ecosystem. It is a burgeoning platform that has seen massive growth in user base and total value locked (TVL), making it one of the fastest-growing chains in the crypto space.

This article will highlight the top Blast DApps, showcasing the standout projects driving the network's success and providing diverse opportunities within its expanding ecosystem.

What is the Blast Network?

The Blast network is a Layer 2 solution built on Ethereum, designed to enhance scalability and reduce transaction costs while providing native yield on assets like Ethereum (ETH) and stablecoins. Unlike other Layer 2 solutions, Blast automatically accrues yield for users without requiring them to engage in additional staking activities. This yield mechanism has drawn in a large user base and fostered significant activity across the network, solidifying Blast's position as a leading player in the decentralized finance (DeFi) ecosystem.

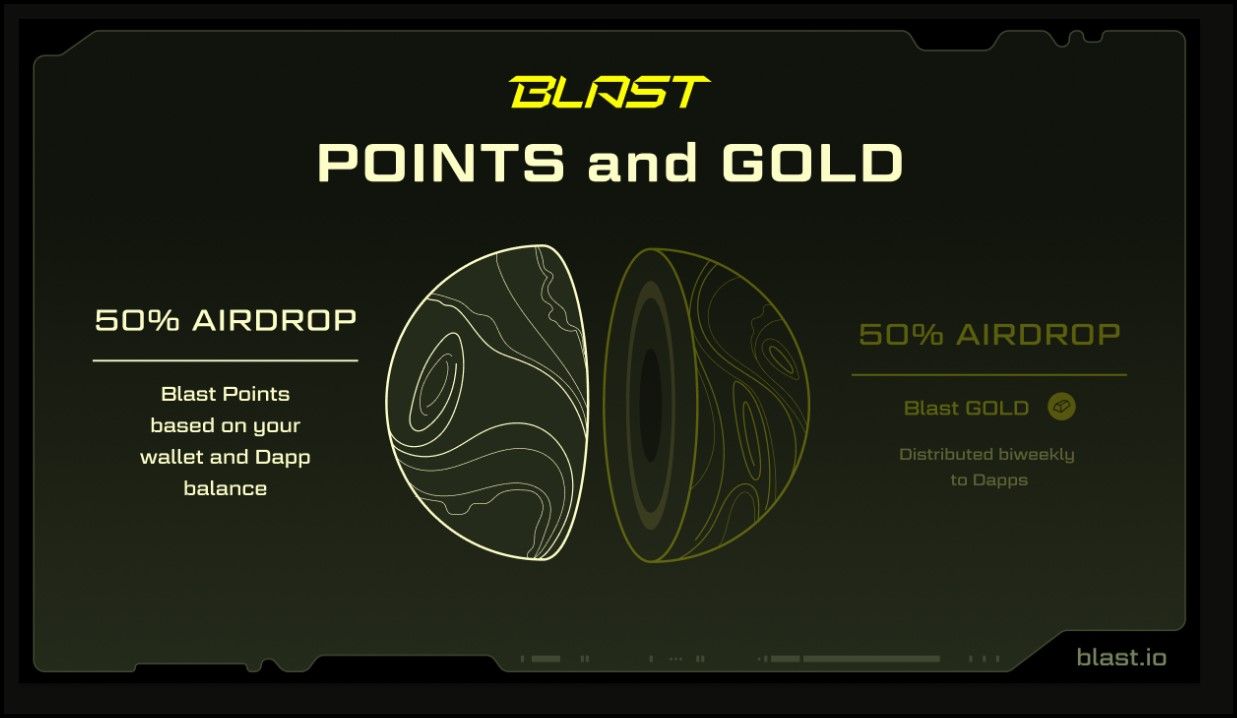

Ecosystem Incentive Schemes: Blast Points and Blast Gold

The Blast network's incentive schemes—Blast Points and Blast Gold—are pivotal to its rapid expansion. Blast Points are awarded to users based on their liquidity contributions, while Blast Gold is the reward for interacting with the network's DApps.

Blast Incentive System | Image via Blast Docs

Blast Incentive System | Image via Blast DocsAs of Q2 2024, Blast had attracted over 1.5 million users, participating to win millions of Blast Gold tokens. These incentives have proven highly effective in attracting new users and driving engagement, with the network now boasting over 1.5 million users and handling approximately 800,000 transactions daily. Interacting with DApps on Blast could be highly rewardingfor short-term earning opportunities.

Our full Blast Network review goes much deeper.

Blast Ecosystem

The Blast Ecosystem | Image via Messari

The Blast Ecosystem | Image via MessariThe Blast ecosystem has experienced exponential growth, with over 200 live DApps contributing to a total value locked (TVL) of $3 billion by the end of Q2 2024. This positions Blast as the sixth-largest on-chain economy globally. The network ranks among the top five chains by fees paid, underscoring its significant impact on DeFi. The network's native stablecoin, USDB, has also become the fifth most traded stablecoin globally, demonstrating the ecosystem's broad adoption and utility.

Top Blast DApps

Here are some of the best Blast DApps, which exemplify Blast's innovative potential and highlight the diverse opportunities available to users within this rapidly growing network.

Let's dive into the standout projects that are driving Blast's success.

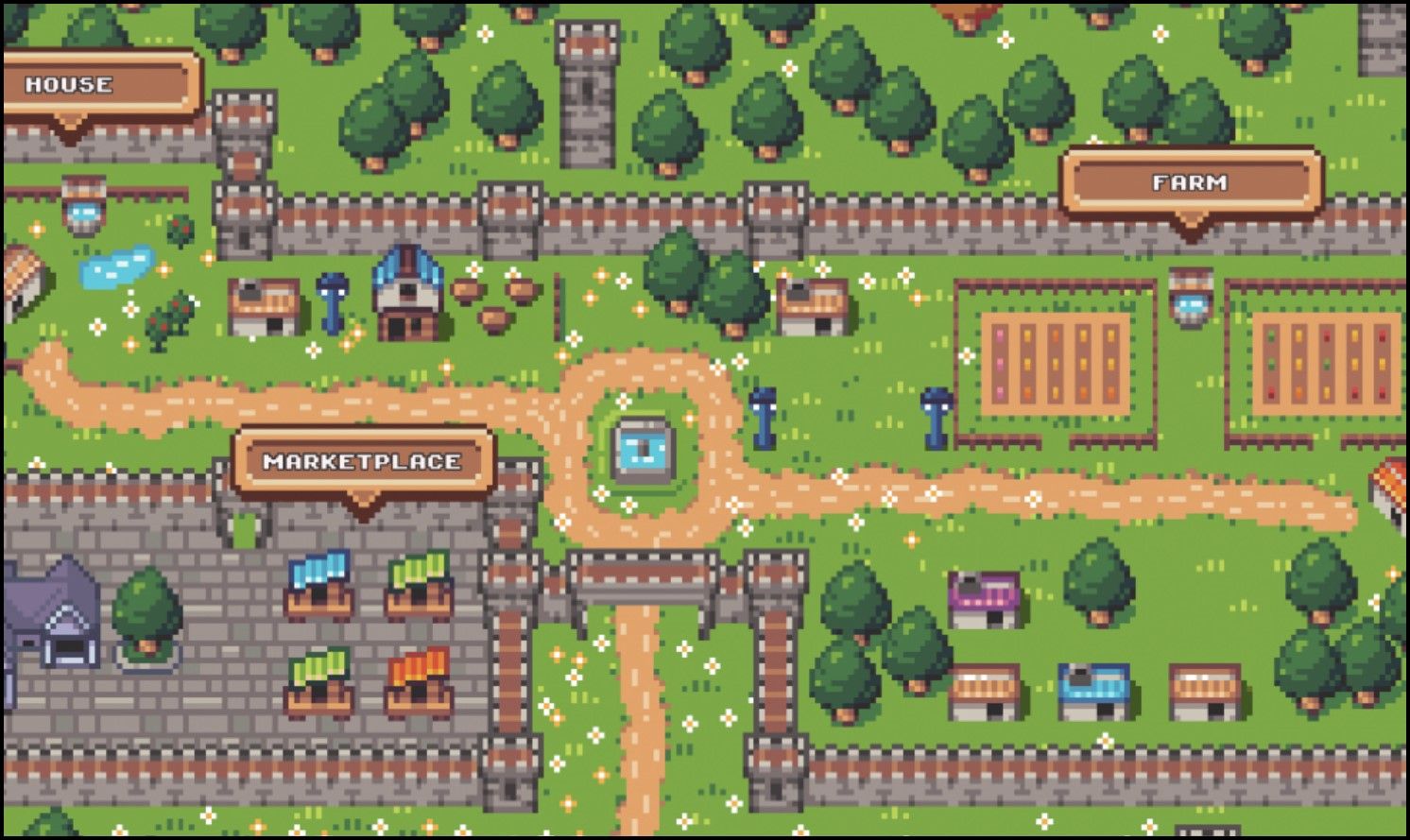

Crypto Valleys

Crypto Valleys is a blockchain farming and adventuring game built on the Blast Layer 2 network. Players engage in agriculture, collecting NFTs and expanding their virtual valleys. The core gameplay involves acquiring "Seed Packs" and nurturing them into crops sold in the marketplace or used to sustain adventurer NFTs. The game's strategic elements revolve around managing resources to level up and unlock new features.

Crypto Valleys Gameplay | Image via PlayToEarn

Crypto Valleys Gameplay | Image via PlayToEarnUtility of Crypto Valleys

The game provides a unique blend of resource management and strategy, where players must carefully plan their actions to maximize their valley's growth. NFTs play a significant role in the ecosystem, representing characters and items that enhance gameplay. Players can trade these NFTs in the marketplace, contributing to the in-game economy.

Token Utility

The native token of Crypto Valleys, $YIELD, serves as the in-game currency. Players earn $YIELD through farming activities and use it to purchase Seed Packs, items, and upgrades. The token's utility extends to trading within the game's marketplace, where players can buy and sell NFTs. $YIELD has seen significant market activity, with a market cap reaching $85 million, demonstrating its value within the ecosystem.

Milestones Achieved

Crypto Valleys has rapidly gained traction, with a notable milestone being the sale of 1,500 free-mint NFT characters, which generated over $2 million within 30 minutes. Continuous updates, such as the introduction of "Daily Chests," keep the gameplay dynamic and engaging, ensuring sustained interest from the community.

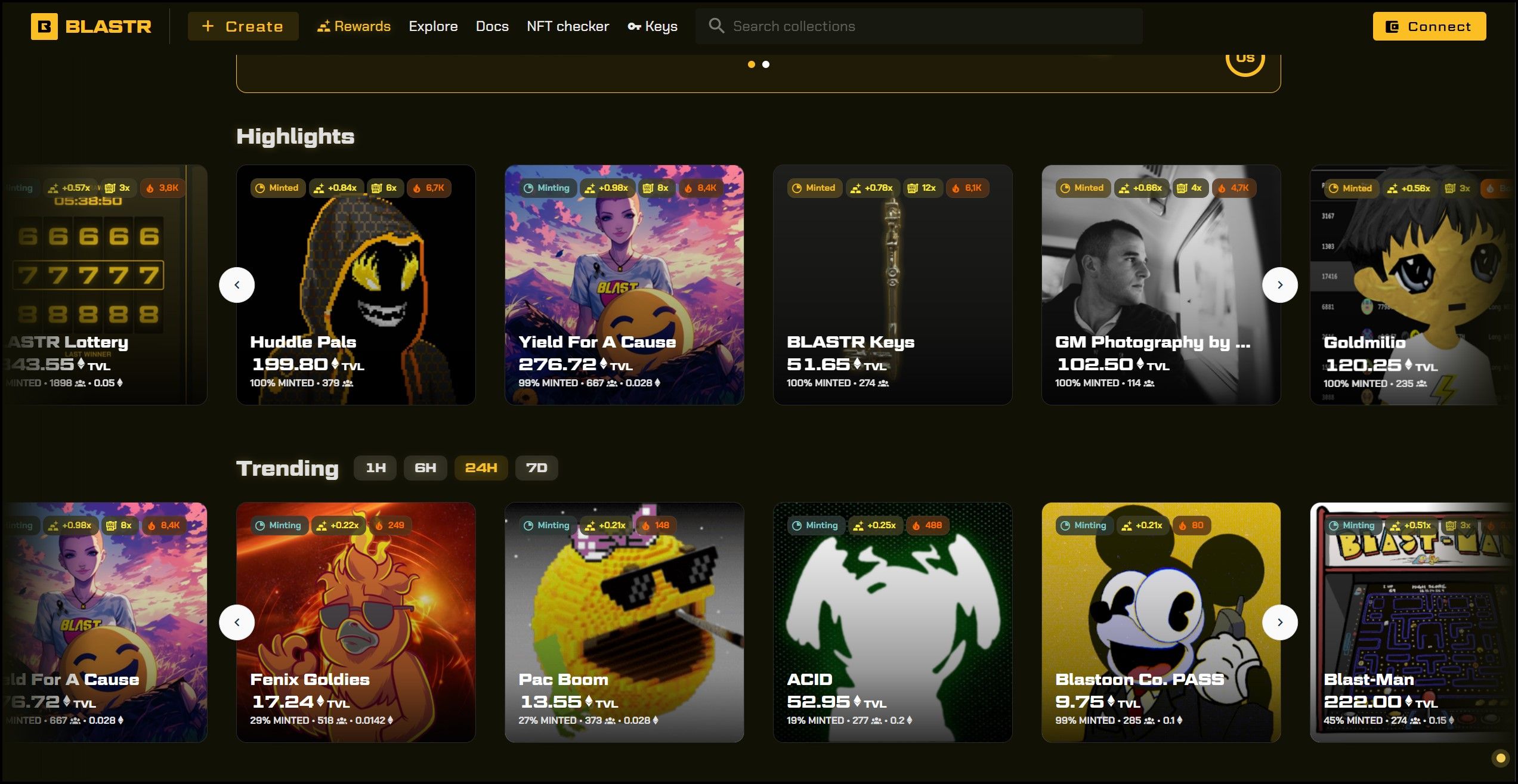

Blastr

Blastr is a novel NFT launchpad on the Blast network. It innovates the NFT space by introducing "Refundable NFTs," where locked funds back an NFT, preventing its value from crashing and ensuring users can claim a refund after a lock-in period. Refundable NFTs add significant confidence to NFT investments, creating a reliable environment for creators and collectors.

Blastr NFT Launchpad

Blastr NFT LaunchpadUtility of Blastr

Blastr's primary utility lies in offering a stable and reliable platform for trading and launching NFT collections. The platform combines ERC-721 standard NFTs with a refund mechanism. As a native yield protocol, Blast enables passive income streams by accruing yield from the ETH locked in NFT contracts. While users yield from NFTs, they also earn Blast Points and Blast Gold for simply engaging in the Blast ecosystem.

Does Blastr Have a Token?

While Blastr itself doesn't have a dedicated token, it integrates with Blast's native rewards system, offering users the ability to earn Blast Points and Blast Gold through their activities on the platform. These rewards can enhance user engagement and provide additional income streams for NFT creators.

Milestones Achieved

The Blast Q2 performance report highlights key milestones of the Blastr Launchpad. As of June 2024:

- Blastr hosted 160k+ distinct NFT collectors.

- The Launchpad had minted 5M+ refundable NFTs.

- The platform had locked over $30M in TVL.

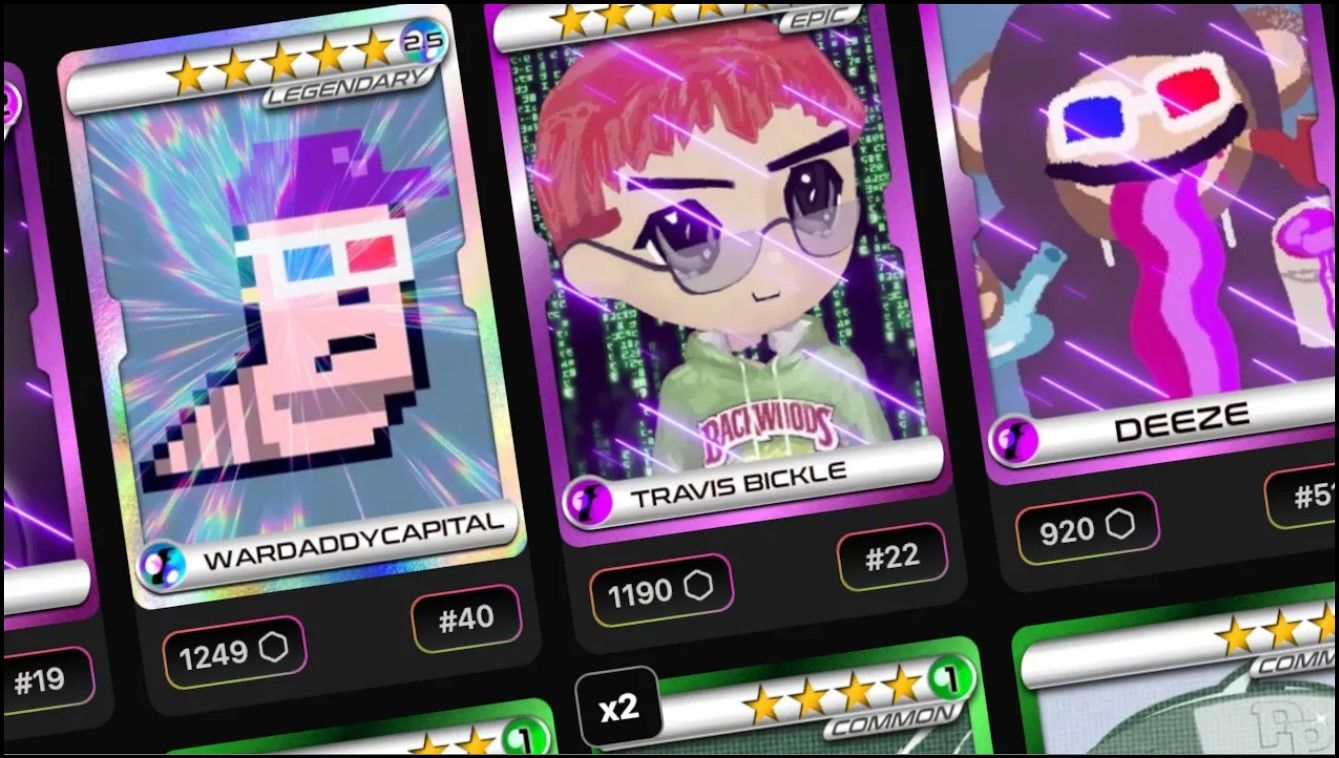

Fantasy Top

Fantasy is a SocialFi trading card game built on the Blast Layer 2 network that turns Crypto Twitter into a competitive fantasy sports experience. Instead of athletes, players collect and trade NFT cards representing over 120 crypto influencers, each with varying rarity levels. The game allows players to assemble lineups of these influencers, with scoring based on their real-world social media engagement. Players can compete in tournaments and earn crypto rewardsby strategically selecting and upgrading their cards.

Fantasy Top Cards | Image via Decrypt

Fantasy Top Cards | Image via DecryptUtility of Fantasy: Fantasy bridges the gap between social media and blockchain gaming by transforming influencers' social media performance into tradable assets. The game leverages the power of social media, offering players a way to monetize their understanding of influencer activity. The unique blend of gaming and social engagement has attracted many crypto enthusiasts, making Fantasy a leading DApp on the Blast network.

Does Fantasy Have a Token?

Fantasy itself does not have a native token, but it integrates with the Blast network's reward systems. Players earn Blast Gold and Fantasy Top Points (FAN) through gameplay. Additionally, influencers whose cards are traded receive a portion of the sales, incentivizing their participation and promotion of the game.

Milestones Achieved: Since its mainnet launch on May 1, 2024, Fantasy has seen remarkable success, distributing over $1.25 million in ETH to influencers and more than $2 million in Blast Gold rewards. The game has generated significant trading volume, accounting for over 50% of Ethereum's total NFT trading volume during its peak. Despite some challenges, such as concerns over botting and manipulation, Fantasy continues to grow and evolve, with plans for new features and competitions on the horizon.

Baseline Markets

Baseline Markets is an innovative DeFi platform on the Blast Layer 2 network that offers a novel approach to liquidity management and tokenomics. The platform uses a protocol-owned liquidity model to provide "infinite, unruggable liquidity" for tokens.

The protocol claims to ensure that the price of tokens deployed on Baseline is protected and maintained through dynamic market-making strategies. Baseline also allows users to borrow against their tokens without the risk of liquidation, distinguishing it from traditional DeFi platforms.

Baseline Protocol | Image via Baseline DApp

Baseline Protocol | Image via Baseline DAppUtility of Baseline Markets: Baseline Markets focuses on creating a stable and secure environment for new token launches. The platform ensures persistent on-chain liquidity and price stability by automatically seeding liquidity into Uniswap V3 pools and protecting token prices through Baseline Value (BLV). Additionally, Baseline's native credit facility allows users to borrow liquidity without selling their tokens, providing a non-liquidatable leverage mechanism that enhances token holders' utility and value proposition.

The first token launched on Baseline is YES, an ERC420 token that appreciates its value over time due to the platform's unique liquidity management and market-making strategies.

Milestones Achieved: Since its launch, Baseline Markets has gained attention for its innovative approach to DeFi, particularly its "unruggable" liquidity model and non-liquidatable loans. Baseline's market-making operations' deterministic and trustless nature ensures a fair and predictable market, a significant milestone in its development.

Kettle Finance

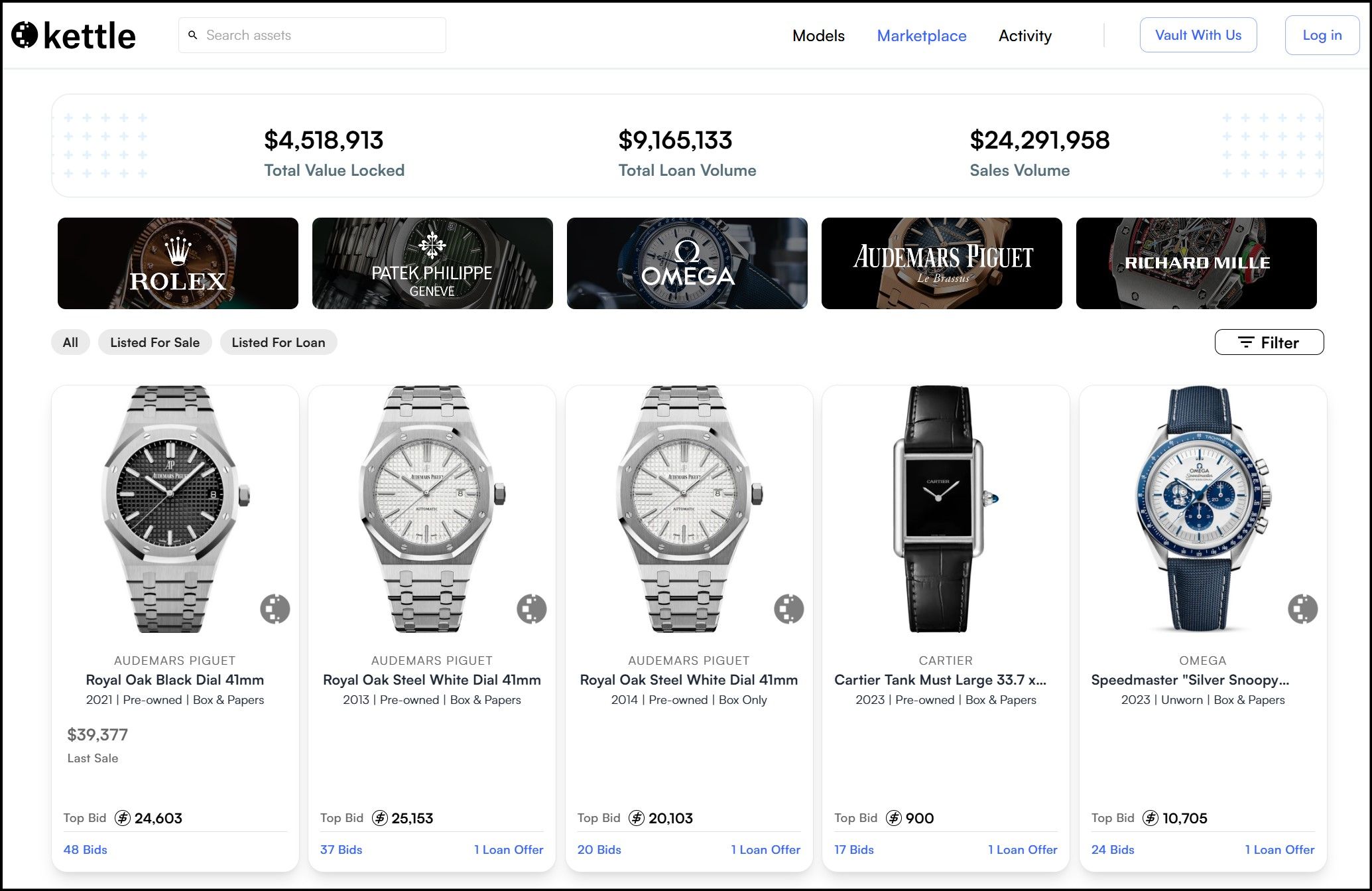

Kettle Finance is a marketplace on Blast that specializes in trading and financializing luxury watches. The platform tokenizes high-end watches, allowing users to digitally buy, sell, and trade these assets. Each watch listed on Kettle is fully insured, authenticated, and stored securely in the Kettle Vault in New York. The physical assets are stored safely, while their digital tokens trade freely on the blockchain.

Kettle Finance Marketplace

Kettle Finance MarketplaceUtility of Kettle Finance: It innovates the luxury watch market by providing a transparent and efficient platform for trading high-value items. On-chain transactions ensure security and verifiability. Additionally, the platform offers peer-to-peer loans, allowing users to unlock liquidity by borrowing against their watch tokens. This feature opens up new financial opportunities in a traditionally illiquid market, making it easier for luxury watch owners to access capital.

Milestones Achieved: Since its launch on the Blast network, Kettle Finance has quickly gained traction, with over $20 million in transaction volume and $6 million in loan volume. The platform has successfully tokenized over 340 luxury watches, demonstrating the demand and potential for blockchain-based luxury asset trading.

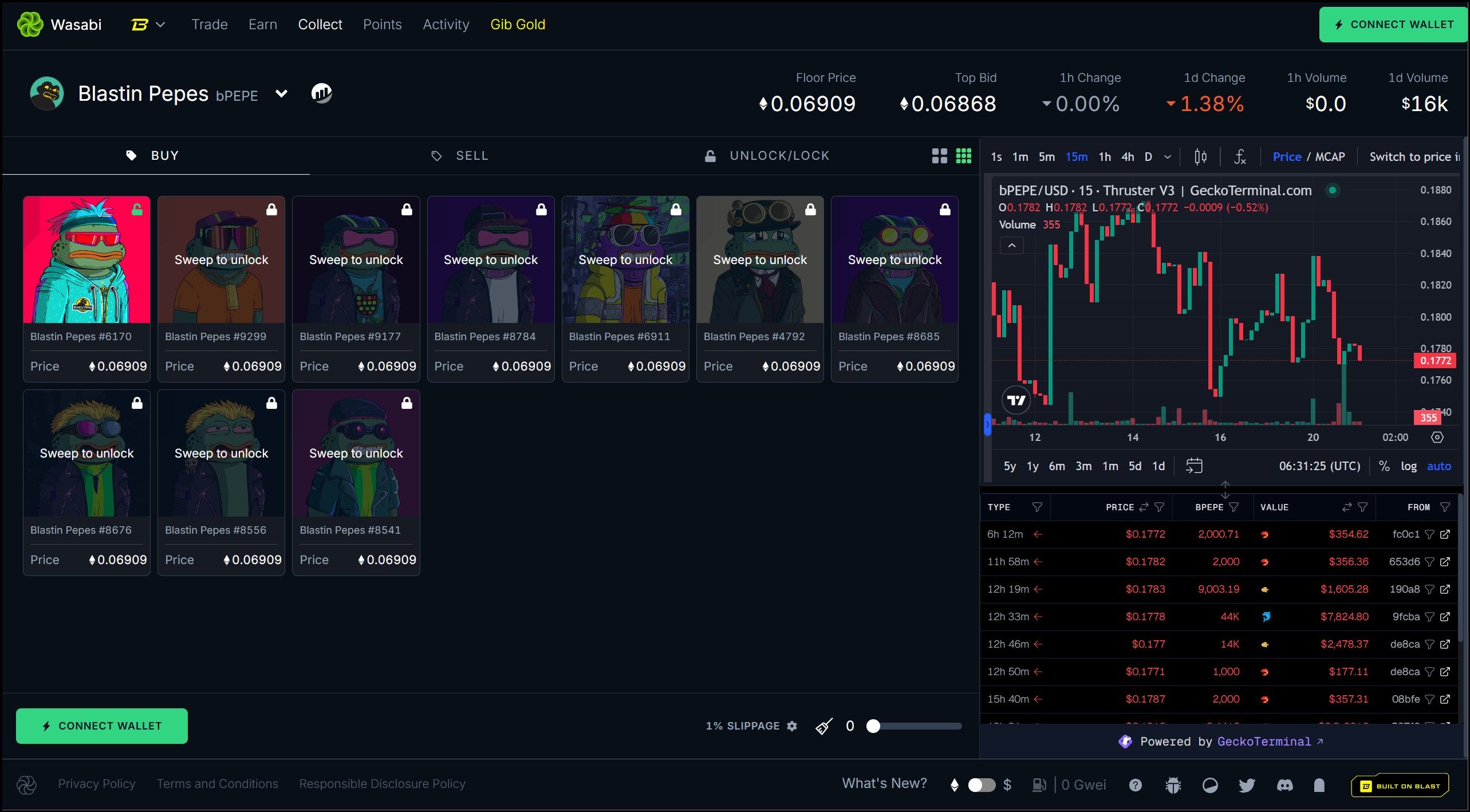

Wasabi Protocol

Wasabi is a decentralized NFT options protocol built on the Blast Layer 2 network, allowing users to issue and trade options as non-fungible tokens (NFTs). The protocol enables market participants to leverage their NFT holdings by creating options contracts, facilitating both hedging and speculative trading. Wasabi supports various NFT collections and long-tail assets, providing a unique platform for NFT financialization.

Wasabi Financializes NFTs | Image via Wasabi

Wasabi Financializes NFTs | Image via WasabiUtility of Wasabi: Wasabi offers a range of DeFi services focused on NFTs, including leverage trading, options trading, and NFT fractionalization. Users can long or short NFTs and earn yields by staking their assets in Wasabi vaults. Additionally, Wasabi's protocol allows liquidity providers to generate income by issuing covered options on their NFTs. It makes unlocking liquidity from traditionally illiquid NFT assets possible, providing users with more flexibility and financial opportunities within the NFT ecosystem.

Wasabi rewards users with Wasabi Points, which are used to calculate distributions of Blast Gold. Additionally, Wasabi has introduced Wasabi Passes, which enhance the points accumulation process for users, thus allowing them to maximize their rewards.

Milestones Achieved: Wasabi has quickly become a prominent player in the NFTfi space, with significant user engagement and growing adoption within the Blast ecosystem. The protocol has attracted attention for its innovative approach to NFT options trading and its ability to unlock liquidity from NFTs. By successfully integrating options trading and DeFi with NFTs, Wasabi is pushing the boundaries of what's possible in the intersection of finance and digital art.

Thruster Finance

Thruster is a yield-first decentralized exchange (DEX) built on the Blast network. It is a central hub for Blast-native projects and tokens, offering enhanced liquidity and trading opportunities. Thruster integrates deeply with the Blast ecosystem, utilizing its native yield mechanisms to provide liquidity providers (LPs) with higher returns than traditional DEXs. The platform supports various Automated Market Maker (AMM) models, including Uniswap v2, Concentrated Liquidity (CL), and Stableswap, making it versatile for different trading needs.

Image via Thruster Docs

Image via Thruster DocsUtility of Thruster: Thruster's primary utility lies in its ability to maximize yield for LPs by integrating Blast-native yield and liquidity management tools. The platform allows users to participate in liquidity provision with enhanced capital efficiency, thanks to its partnerships with key DeFi protocols and liquidity aggregators. Additionally, Thruster supports a variety of Blast-native tokens and projects, making it a go-to platform for those looking to trade and earn within the Blast ecosystem.

The platform rewards LPs and participants with Blast Gold and Thruster Points. These rewards are distributed based on liquidity provision and trading activity, incentivizing users to contribute to the platform's growth. Blast Gold, in particular, has been a significant part of the reward mechanism, with over 2 million tokens already distributed to users, further enhancing the platform's appeal.

Milestones Achieved: Thruster has rapidly become one of the largest and most active DApps on the Blast network since its launch. The platform has completed multiple rounds of Blast Gold distribution, amounting to over 2 million tokens. It has also won the Big Bang hackathon, showcasing its innovative approach to decentralized trading and liquidity provision.

Ring Protocol

Ring Protocol is a decentralized finance (DeFi) platform on the Blast network that focuses on enhancing liquidity and asset utilization across the DeFi ecosystem. The protocol aims to solve the issue of idle on-chain assets by providing a universal liquidity solution. It integrates with various DeFi applications to maximize the efficiency of asset usage, offering features like decentralized exchange (DEX) aggregation and liquidity provision.

Image via Ring Protocol

Image via Ring ProtocolUtility of Ring Protocol: Ring Protocol's primary utility is its role as a liquidity aggregator. The platform's DEX aggregator, RingX, launched in July 2024, is designed to provide users with optimal swap rates, minimal slippage, and low transaction costs. It aggregates liquidity from multiple DEXs within the Blast ecosystem, ensuring users receive the best rates for their trades. Additionally, Ring Protocol supports trading major cryptocurrency pairs and rewards users with Blast Gold for their participation.

Does Ring Protocol Have a Token?

Ring Protocol has its native token, $RING. Users can convert Ring Points earned on the platform into tradeable RING tokens, governance, and other DeFi activities within the protocol. The introduction of RING has added a layer of utility and governance to the platform, enabling users to engage more deeply with its ecosystem.

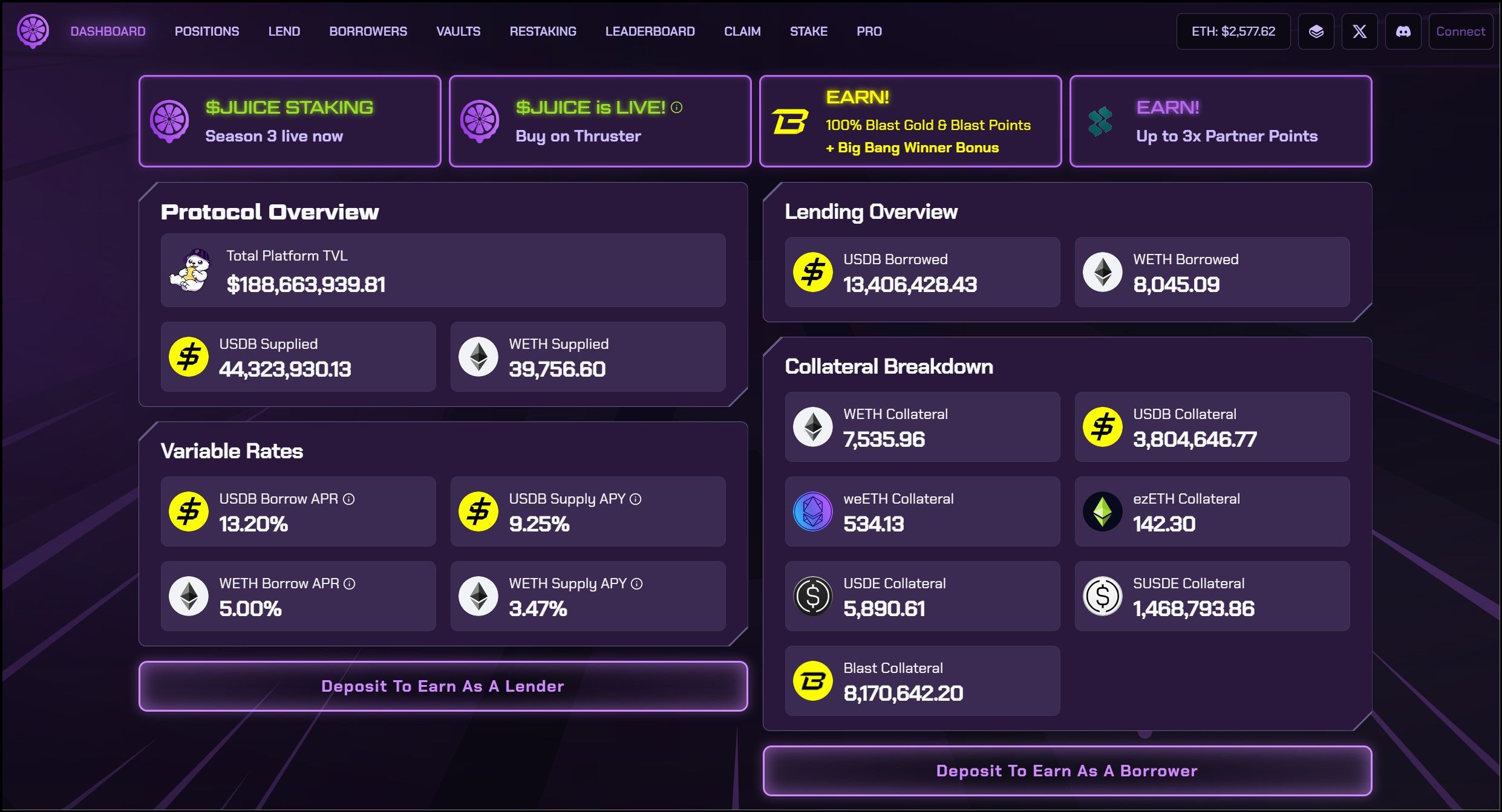

Juice Finance

Juice Finance is a leading leveraged yield farming protocol on the Blast Layer 2 network. It allows users to maximize their yield by borrowing up to 3x leverage against their collateral, typically in WETH or USDB. This borrowed capital can be deployed across various DeFi strategies within the Blast ecosystem, such as liquidity provision in partner DApps like Thruster and Wasabi. Juice Finance helps users earn more yield, rewards, and points, making it an integral part of the Blast DeFi landscape.

Juice Finance Application

Juice Finance ApplicationUtility of Juice Finance: Juice Finance is a hub for cross-margin lending and yield farming within the Blast ecosystem. By integrating with Blast's native rebasing tokens and offering gas refund mechanics, Juice enables users to optimize their farming strategies efficiently. The protocol's farming vaults are particularly noteworthy, as they allow users to maximize their returns by leveraging borrowed assets in highly vetted DeFi strategies, ensuring that all yields and rewards are delivered back to the users.

Does Juice Finance Have a Token?

Juice Finance has its native token, $Juice. This token is primarily used for governance within the protocol, allowing token holders to influence critical decisions, such as protocol upgrades and the allocation of rewards. In the future, the Juice DAO may implement features like buy-back and burns, increasing the token's utility and value within the ecosystem.

Milestones Achieved: Since its launch, Juice Finance has become one of the most popular DApps on the Blast network, with significant adoption among yield farmers. The protocol has successfully distributed millions in rewards, including Blast Gold, further cementing its role as a cornerstone of the Blast DeFi ecosystem.

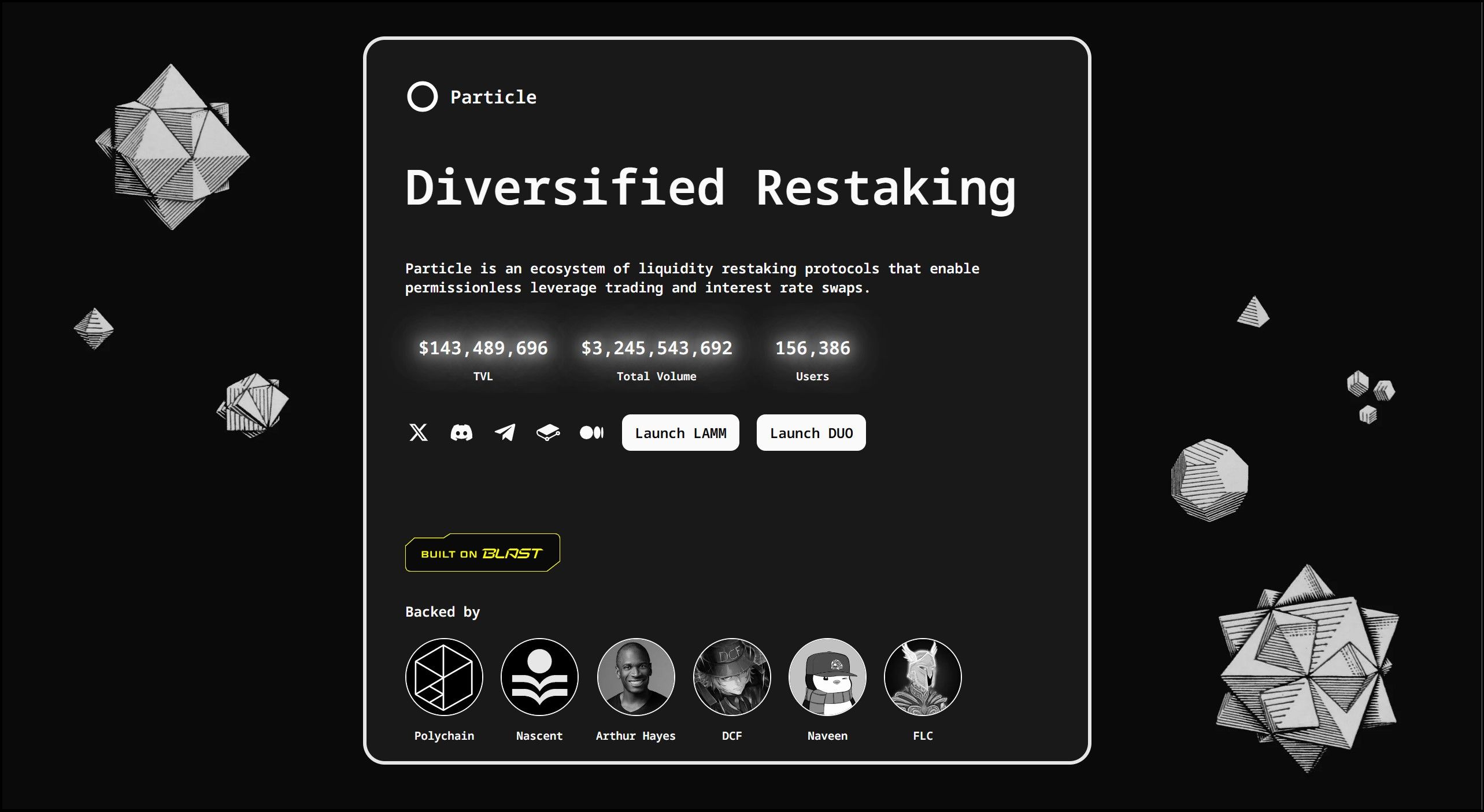

Particle

Particle is a DeFi protocol on the Blast network designed for permissionless leveraged trading. It integrates with Automated Market Makers (AMMs) like Uniswap v3 to provide traders with leverage directly from liquidity pools without relying on traditional borrowing mechanisms. This approach allows Particle to offer a unique form of Leveraged Automated Market Making (LAMM), which enables traders to access higher capital efficiency and enhanced trading opportunities within the DeFi ecosystem.

Image via Particle

Image via ParticleUtility of Particle: Particle's core utility lies in its ability to facilitate leveraged trading without needing external price oracles, reducing potential vulnerabilities associated with price manipulation. The protocol also introduces Liquidity Interest Rate Swaps (LIRS), allowing users to swap interest rates between different liquidity pools, which enhances flexibility and profitability for liquidity providers. Particle is an attractive option for traders seeking leverage and liquidity providers looking for optimized returns with minimal impermanent loss.

Does Particle Have a Token?

Particle has a native token, $PTC, which serves multiple purposes within the ecosystem. PTC is used for governance, enabling token holders to influence the protocol's development and decision-making processes. Additionally, PTC is used for platform transactions and incentivizes participants through rewards and yield farming opportunities.

Milestones Achieved: Since its launch, Particle has quickly gained traction, achieving a total value locked (TVL) of $300 million and surpassing $3.5 billion in trading volume within just four months.

Top Blast DApps: Closing Thoughts

The Blast network is driven by its unique native yield mechanism and aggressive incentive programs. The rapid growth of its ecosystem, with a wide array of innovative DApps, reflects the strong appeal of its reward-driven model. However, the speculative nature of Blast's ecosystem demands caution.

While the potential for short-term gains is significant, primarily through its incentive schemes, such environments are inherently risky. The reliance on continuous incentives to sustain growth could pose challenges in the long term, especially if the rewards begin to diminish or the user base shifts.

As with any speculative-driven ecosystem, participants must remain cautious and informed, weighing the potential rewards against the risks involved. For those who choose to engage with Blast, understanding the dynamics of its incentives and the volatile nature of its ecosystem will be vital to navigating it successfully.