We’ve previously explored Regenerative Finance (ReFi) on Coin Bureau through a comprehensive breakdown of what it is and why it matters. In this follow-up, we shift the focus from theory to practice—highlighting some of the ReFi projects that are not just talking about change but actively building it. These protocols leverage blockchain to make a tangible impact on climate action, financial inclusion, and sustainable infrastructure across the globe.

What is Regenerative Finance?

Regenerative Finance (ReFi) is a financial movement focused on building systems that restore, replenish, and sustain social and environmental resources—rather than simply minimizing harm. While traditional finance (TradFi) aims to generate profits and Decentralized Finance (DeFi) decentralizes financial services, ReFi goes a step further by prioritizing regeneration—natural ecosystems, local communities, or economic equity.

At its core, ReFi integrates economic, environmental, and social goals into financial practices. This includes funding initiatives that improve biodiversity, support carbon removal, and promote climate justice while enabling inclusive economic participation.

The Role of Blockchain in ReFi

Blockchain serves as the infrastructure that makes ReFi practical and scalable. It enables:

- Transparency: ReFi projects use blockchain to track ecological and social outcomes in an auditable way, reducing greenwashing.

- Tokenization of real-world assets (RWAs): Carbon credits, biodiversity credits, and even fractions of land or green infrastructure can be tokenized to lower barriers to investment.

- Smart Contracts: These automate processes like verifying impact, disbursing funds when milestones are met, or redistributing value to local communities.

- Decentralized Governance: ReFi projects often use DAOs (Decentralized Autonomous Organizations) to ensure that funding decisions are made with community involvement.

Together, blockchain tools make it possible to design financial systems that are open, programmable, and rooted in verifiable impact.

How ReFi Differs from DeFi and TradFi

- TradFi operates through centralized institutions like banks and prioritizes capital accumulation, often with little concern for social or environmental outcomes.

- DeFi replaces centralized intermediaries with code-based financial services, improving access and transparency—but it doesn’t necessarily account for long-term societal or ecological impact.

- ReFi builds on DeFi’s technical foundation but shifts the focus to regeneration. It introduces long-term thinking, impact-first funding models, and inclusive governance to make finance a force for ecological restoration and social equity.

In short:

- TradFi = Profits

- DeFi = Access

- ReFi = Regeneration

Key Principles of ReFi

ReFi is guided by a set of principles that shape how it operates across different sectors:

- Sustainability: Funding climate-positive projects like renewable energy, sustainable agriculture, and carbon sequestration.

- Holistic Systems Thinking: Acknowledging the interconnectedness of social, economic, and environmental systems.

- Financial Inclusion and Equity: Creating opportunities for underserved communities to participate and benefit from financial activity.

- Long-Term Orientation: Prioritizing durable impact over short-term profits.

- Transparency and Accountability: Leveraging blockchain to make impact data public and auditable.

- Community Governance: Using decentralized models like DAOs to include stakeholders in decision-making.

ReFi isn’t just a finance category—it’s a values-driven rethink of how capital should move in the 21st century.

Why ReFi Matters in Crypto and Blockchain

Regenerative Finance (ReFi) brings a compelling purpose to the crypto space—one that goes beyond speculation, yield farming, or financial disruption. It grounds blockchain in real-world impact, making it a tool not just for decentralization, but for systemic regeneration.

At a time when the world is grappling with climate change, social inequality, and ecological collapse, ReFi channels the capabilities of blockchain to address these issues head-on. It transforms crypto from a parallel financial system into a platform for regenerative action.

ReFi Brings A Compelling Purpose To The Crypto Space. Image via Shutterstock

ReFi Brings A Compelling Purpose To The Crypto Space. Image via ShutterstockReFi Gives Crypto Real-World Relevance

ReFi projects demonstrate how crypto infrastructure—blockchains, smart contracts, and tokenization—can be used for more than just digital assets. They enable:

- Funding for climate and social impact projects that would otherwise struggle to raise capital.

- Transparent tracking of ecological benefits like carbon removal or biodiversity protection.

- Direct participation from global communities in decision-making through DAOs.

- This ties blockchain technology to outcomes that matter to the planet—not just markets.

A Counter-Narrative to Extractive Finance

Crypto often faces criticism for being energy-intensive and speculative. ReFi flips that narrative. It shows how on-chain systems can be regenerative by design, shifting value flows toward public goods, ecosystems, and underserved populations.

Whereas many DeFi applications are focused on optimizing yield, ReFi is value-driven—emphasizing long-term impact, sustainability, and community participation. It opens the door for new economic models where financial incentives align with ecological health and social equity.

Laying the Groundwork for Web3 Public Goods

ReFi plays a key role in shaping Web3 as a platform for public goods funding. Through mechanisms like quadratic funding, impact certificates, and tokenized regenerative assets, ReFi introduces novel models for scaling impact.

It enables builders, communities, and ecosystems to coordinate around shared goals—like climate resilience, inclusive finance, and regenerative development—without relying on centralized institutions.

ReFi Is Where Crypto Meets Purpose

ReFi injects a long-term, values-driven mission into the blockchain world in a space often dominated by hype cycles and short-term thinking. It’s a reminder that crypto’s tools—open networks, permissionless systems, decentralized coordination—can be used not just to disrupt the status quo but to heal and rebuild what’s broken.

That’s why ReFi matters. It’s the connective tissue between blockchain innovation and the regenerative future the world needs.

Top ReFi Projects

Toucan

Toucan is tackling inefficiencies in traditional carbon markets—specifically the lack of transparency, liquidity, and trust. Its mission is accelerating global climate action by bringing the fragmented carbon credit ecosystem onto blockchain rails, enabling scalable, efficient, and verifiable carbon trading.

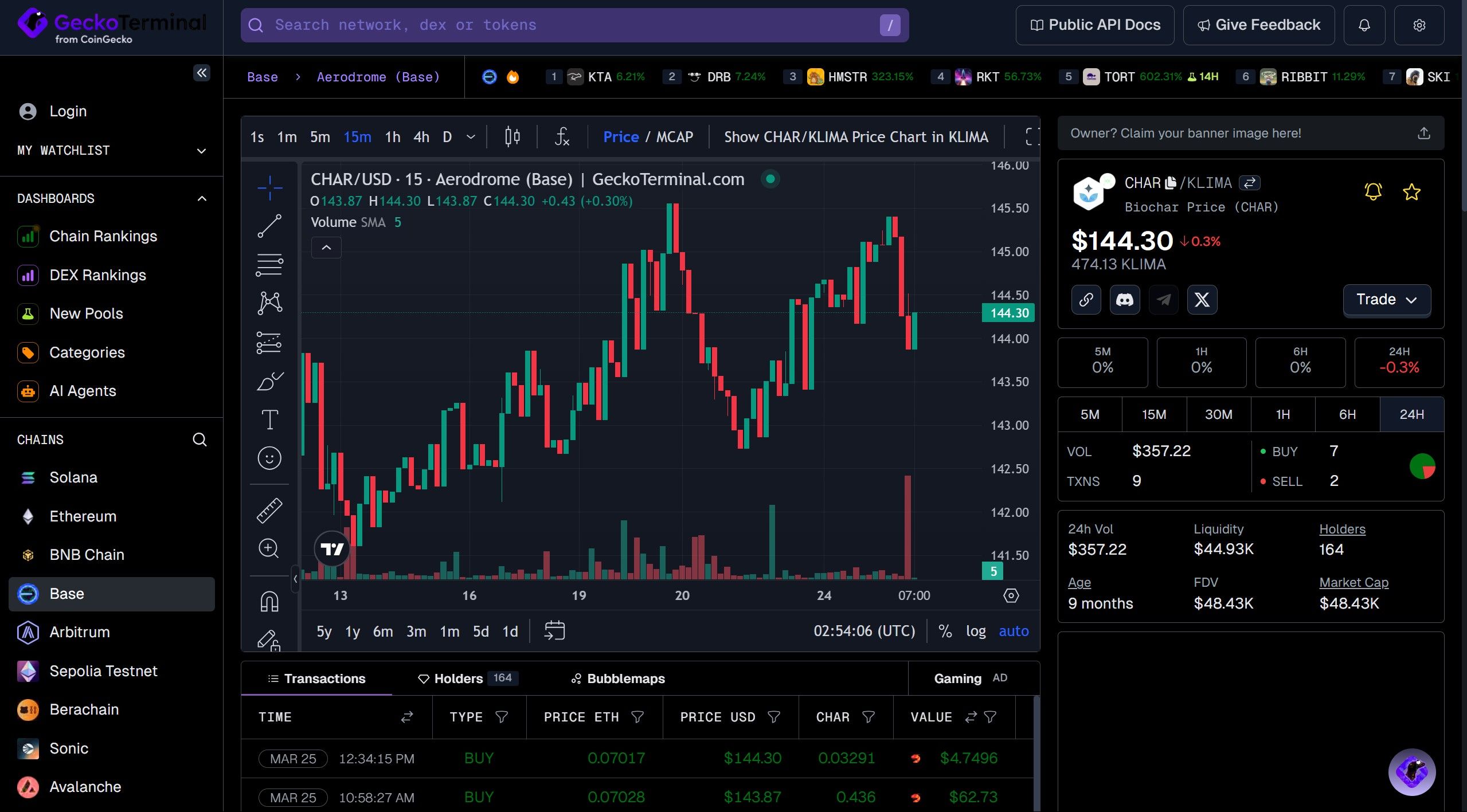

The CHAR Token Market is Active on Aerodrome on Base Network | Image via Gecko Terminal

The CHAR Token Market is Active on Aerodrome on Base Network | Image via Gecko TerminalWhat the Project Does:

Toucan builds blockchain infrastructure to tokenize carbon credits and create liquid, transparent carbon markets. It bridges legacy carbon credits (from registries like Verra or Puro.earth) to the blockchain as TCO2 tokens representing one tonne of verified carbon offset. These TCO2 tokens can then be deposited into carbon pools—such as BCT (Base Carbon Tonne), NCT (Nature Carbon Tonne), and CHAR—to generate fungible tokens that improve market liquidity and accessibility.

Carbon credits from multiple sources can be standardized and traded efficiently through the Toucan Meta-Registry. Market participants can easily buy, sell, retire, or even embed these tokens into other digital experiences—such as NFTs, DeFi protocols, or metaverse environments. By building on Polygon, Toucan also ensures its infrastructure remains energy-efficient.

Token Utility

Toucan’s ecosystem supports two main types of tokens:

- TCO2 Tokens

- Represent individual carbon credits with traceable project data.

- It can be transferred, traded, or retired directly on-chain.

- Serve as the base asset for building liquid carbon pools.

- Carbon Pool Tokens (e.g., BCT, NCT, CHAR)

- Created by bundling similar TCO2 tokens.

- It offers enhanced liquidity and price discovery on decentralized exchanges.

- It can be used in DeFi for yield farming, lending, or as treasury assets.

- It allows instant carbon offsetting and integration into Web3 ecosystems.

These tokens streamline trading and retirement and unlock new demand for carbon credits across DeFi, gaming, and digital collectibles—ultimately making climate finance more efficient and participatory.

KlimaDAO

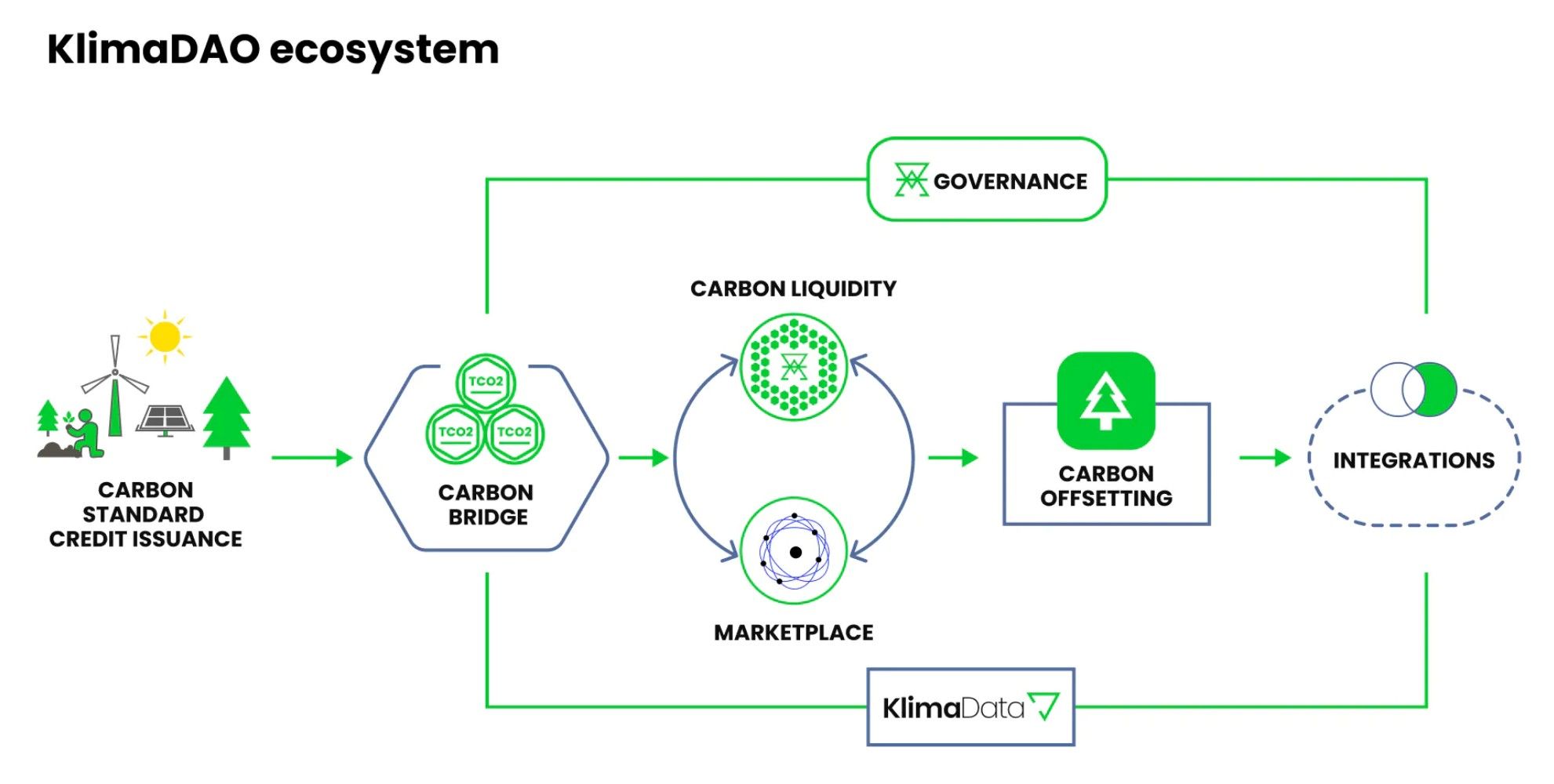

KlimaDAO focuses on fixing the inefficiencies in global carbon markets by using blockchain to bring access, liquidity, and transparency to environmental commodities. Its goal is to support large-scale climate action by making it easier to buy, sell, and retire carbon credits while also addressing price discovery and ensuring project developers receive fair value for their work.

What Does KlimaDAO Do?

Launched in 2021, KlimaDAO operates as an open-source, community-driven infrastructure protocol for the Digital Carbon Market (DCM). It developed tools like Carbonmark, a universal marketplace for carbon credits, and the Klima Protocol, which provides the technical foundation for carbon trading on-chain.

Klima Ecosystem Can Offset Carbon Emissions | Image via Klima DAO

Klima Ecosystem Can Offset Carbon Emissions | Image via Klima DAOWith the rollout of KlimaDAO 2.0, the protocol is transitioning into a more modular structure led by the Klima Foundation, introducing Klima X—an Automated Market Maker (AMM) designed to serve as the main liquidity venue for carbon assets on-chain. The project acts as a neutral, blockchain-based infrastructure layer for climate finance, offering builders and buyers access to environmental assets with minimal friction.

Token Utility

The protocol’s native token, $KLIMA, is a carbon-backed digital asset where each token is backed by at least one tonne of carbon in the DAO’s treasury. It serves multiple roles:

- Governance: $KLIMA holders can vote on protocol upgrades and decisions.

- Staking: Tokens can be staked (sKLIMA) to earn rewards and participate in protocol pricing mechanisms.

- Carbon Offset: $KLIMA can be used to offset emissions digitally and burned to issue retirement certificates.

- Market Participation: In Klima 2.0, long-term stakers influence carbon pricing and can access yield opportunities tied to carbon market activity.

By bridging DeFi mechanics with real-world climate outcomes, KlimaDAO is shaping a transparent and accessible marketplace for regenerative finance at scale.

Worldcoin

Worldcoin is a cryptocurrency project co-founded in 2019 by Sam Altman, Alex Blania, and Max Novendstern, developed by Tools for Humanity. Its primary goal is to create a globally inclusive identity and financial network owned by humanity, addressing challenges in digital identity verification and financial inclusion.

Worldcoin enrolment | Source: Worldcoin blog

Worldcoin enrolment | Source: Worldcoin blogCause Addressed:

Worldcoin aims to provide a reliable method for online human authentication, known as World ID, to combat bots and fake virtual identities, especially in the age of advanced artificial intelligence. Additionally, it seeks to promote financial inclusion by offering a global currency accessible to everyone.

Project Overview:

The project revolves around three main components:

- World ID: A privacy-preserving digital identity that verifies an individual as a unique human. Users obtain a World ID by undergoing an in-person iris scan using the "Orb." This biometric data is then converted into a unique identifier, allowing users to prove their humanness online without revealing personal information.

- World App: A self-custodial wallet application that facilitates payments, transfers, and purchases using both cryptocurrency and traditional assets. It integrates with the World ID to provide a seamless user experience.

- WLD Cryptocurrency Token: The native digital token of the World Network, designed to be freely available to all verified and eligible individuals. It serves both utility purposes within the ecosystem and potential governance functions in the future.

Token Utility:

The WLD token has several utilities within the Worldcoin ecosystem:

- Governance: WLD holders may be able to participate in the decision-making processes regarding the protocol's future developments. The introduction of World ID allows for "one-person-one-vote" mechanisms, offering a unique approach to governance compared to traditional "one-token-one-vote" systems.

- Transactions: Users can utilize WLD tokens for various transactions within the World App, including payments, transfers, and purchases, promoting financial inclusion and accessibility.

- Incentives: Individuals who participate in the iris scan to obtain a World ID may receive WLD tokens as an incentive, depending on their country's regulations. Discussions around universal basic income inspire this distribution mechanism.

By integrating biometric verification with blockchain technology, Worldcoin establishes a secure and inclusive digital identity system, facilitating broader participation in the global economy.

Energy Web Token

Energy Web Chain addresses the urgent need to decarbonize the global electricity sector by modernizing outdated, centralized energy systems. Its mission is to build a transparent, democratized, digitized energy infrastructure supporting the global transition to clean energy. By enabling peer-to-peer energy trading, integrating distributed energy resources (like solar panels and EVs), and promoting verifiable clean energy, Energy Web aims to make the energy grid more efficient and climate-aligned.

Energy Web is Developing Enterprise Solutions in the Energy Sector | Image via IQ.wiki

Energy Web is Developing Enterprise Solutions in the Energy Sector | Image via IQ.wikiWhat the Project Does:

Energy Web Chain (EW Chain) is the first blockchain platform tailored specifically for the energy sector. It serves as the trust layer of the Energy Web Decentralized Operating System (EW-DOS)—an open-source tech stack for managing energy data, digital identities, and smart devices. The chain allows utilities, grid operators, and clean energy developers to deploy decentralized applications that automate and coordinate complex energy systems.

The EW Chain uses a Proof of Authority (PoA) consensus model, validated by reputable energy sector entities, to ensure regulatory compatibility while maintaining low energy consumption. The platform also anchors decentralized digital identities (DIDs) and supports timestamped datasets, making it possible to trace the origin and usage of clean energy in real time.

The long-term vision is for EW Chain to evolve into a Relay Chain (similar to Polkadot), hosting scalable energy-specific parachains. One of its initiatives, D3A, is a decentralized marketplace where energy-producing devices can interact autonomously, creating a more responsive and efficient grid.

Token Utility:

The Energy Web Token ($EWT) is the native utility token of the EW Chain. Its core functions include:

- Transaction Fees: EWT can be used to pay for transactions on the EW Chain, though the network also supports payments in other crypto or fiat currencies.

- Network Security: EWT plays a role in maintaining the integrity of the system by deterring malicious activity.

- Ecosystem Access: Holding EWT enables participation in services and applications built within the Energy Web ecosystem.

- Validator Incentives: Validators earn EWT as block rewards and transaction fees.

There’s also EWTB, an ERC-20 version of EWT that bridges to Ethereum, enabling DeFi integrations and liquidity on platforms like Uniswap. By aligning blockchain infrastructure with the needs of modern energy systems, Energy Web is building the digital backbone for a decentralized, low-carbon energy future.

Celo Layer-2

Celo is focused on building inclusive, regenerative financial systems for underserved populations—particularly in regions where traditional banking infrastructure is weak or non-existent. Its core mission is to use blockchain technology as a tool to promote financial inclusion, enable universal access to stable digital money, and support regenerative finance models that shift away from extractive, profit-maximizing systems.

Celo is a Layer-2 Building Real-World Use Cases | Image via Celo

Celo is a Layer-2 Building Real-World Use Cases | Image via CeloWhat the Project Does:

Originally launched as a mobile-first Layer 1, Celo allowed users to send and receive crypto using just a phone number—abstracting away technical barriers to crypto adoption. It provided easy access to stablecoins (like cUSD, cEUR, and cREAL), DeFi tools, and digital identity—all through lightweight mobile clients designed for low-bandwidth environments.

Celo is now undergoing a transition to an Ethereum Layer 2 using the OP Stack. This move brings stronger security through Ethereum’s consensus, deeper compatibility with the broader Ethereum ecosystem, and access to shared infrastructure like EigenLayer for off-chain data availability. Crucially, Celo will become the first L2 with a decentralized sequencer, maintaining its commitment to decentralization and its original validator base.

Beyond its technical evolution, Celo’s DeFi ecosystem supports a range of mission-aligned projects—from ImpactMarket, which distributes micro-UBI and microcredit, to Mento, which manages its overcollateralized stablecoin system. These applications reflect Celo’s commitment to real-world impact through digital tools.

Token Utility:

The native token $CELO serves multiple purposes within the ecosystem:

- Staking and Governance: CELO holders can participate in network governance and validator elections.

- Stablecoin Collateral: CELO backs the minting of Celo-native stablecoins via the Mento protocol.

- Gas Fees: Even as an L2, users can still pay gas fees in CELO, maintaining seamless continuity for existing users.

- Ecosystem Incentives: CELO is used for validator rewards and can be deployed to fund regenerative public goods.

By aligning mobile accessibility with regenerative finance principles—and now scaling through Ethereum—Celo represents one of the most pragmatic and mission-driven entries in the ReFi space.

How to Invest in ReFi Projects

Investing in Regenerative Finance (ReFi) isn’t just about chasing returns—it's about choosing to support systems that restore. While it’s fair for any investor to expect profit, regeneration must come first in ReFi. ReFi may not be the most efficient path if your primary goal is yield maximization. Not because it can’t produce returns, but because its structure and priorities are fundamentally impact-first.

There are two reasons to approach ReFi investing through the lens of regeneration:

- It’s an ethical imperative. ReFi exists to repair ecological and social systems damaged by extractive finance. Treating these systems as speculative playgrounds contradicts their purpose and can actively harm the work being done.

- It’s not built for pure yield. DeFi protocols are optimized for speed, leverage, and composability—perfect for short-term returns. ReFi protocols are built for long-term outcomes, prioritizing sustainability, transparency, and distributed value creation over quick profit.

That said, several ways exist to invest meaningfully in ReFi while earning potential returns.

Types of ReFi Investments:

Native Tokens ($KLIMA, $CELO, etc.): Investing in ReFi-native tokens can align capital with a mission. Buying and holding tokens like $KLIMA or $CELO signals belief in the underlying cause—scaling voluntary carbon markets or building mobile-first financial systems for underserved communities. Long-term value may grow as these ecosystems mature and adoption increases.

Carbon Credits (e.g., TCO2): If you're looking to offset your own carbon emissions—or contribute to broader decarbonization—buying tokenized carbon credits is a practical entry point. You can acquire verified credits through platforms like Toucan or Carbonmark and retire them on-chain. Sometimes, these credits can also be staked or pooled to earn yield, blending purpose with profit.

Staking, Yield Products, and Liquidity Pools: Several ReFi projects offer yield mechanisms tied to regenerative activity. You can:

- Stake tokens to support network security (e.g., CELO staking).

- Provide liquidity to carbon-backed pools (e.g., BCT or NCT) and earn trading fees.

- Participate in regenerative yield farming, where rewards are issued for backing socially or environmentally beneficial assets.

These strategies reward users who provide the capital infrastructure needed to keep regenerative markets active.

Participating in ReFi-Focused DAOs

Many ReFi ecosystems are governed by DAOs, which coordinate funding, development, and impact tracking. By participating in DAOs—whether through governance, contribution, or simply holding DAO tokens—you can help shape regenerative outcomes and earn from incentive programs or grant allocations. This is less of a passive investment and more of a participatory role in building long-term systems.

Key Risks to Evaluate Before Investing

Before committing capital to any ReFi project, consider:

Regenerative Mission: Does the project have a clear, verifiable impact goal?

- Transparency: Can you trace where funds go and what outcomes are achieved?

- Token Utility: Is the token used meaningfully or just speculative?

- Long-Term Viability: Does the project have a roadmap and team that is aligned with sustainability?

- Community and Governance: Is there an active, engaged user base that steers the project?

Approaching ReFi with the right expectations—impact first, profit as a consequence—will make you a more aligned investor and contribute to the kind of economy these protocols are trying to build.

Final Thoughts

Regenerative Finance (ReFi) is one of the most meaningful experiments in blockchain today—an attempt to rewire financial systems so they serve people and the planet, not just profit. In this article, we explored what ReFi is, why it matters in crypto and blockchain. We highlighted some of the most promising projects leading the way, including Toucan, KlimaDAO, Energy Web, and Celo. We also discussed how to think about investing in this space—emphasizing regeneration first, with profit as a possible outcome, not the primary goal.

That said, it’s essential to be realistic about the risks. Most ReFi tokens are still early-stage and low market cap, which means they can be highly volatile and susceptible to sudden price swings. Liquidity can be limited, and narratives shift quickly. If you choose to invest in ReFi tokens, do so with a long-term mindset only after thoroughly understanding the project’s fundamentals.

DISCLAIMER: This article is intended for informational purposes only and should not be construed as financial advice. Always do your own research and consult a professional financial advisor before making investment decisions.