In August 2024, the team behind Fantom unveiled a bold rebrand: Sonic—a new Layer-1 blockchain designed from the ground up to fix the limitations that couldn’t be patched in Fantom Opera. With a cleaner architecture, blazing-fast DAG-based consensus, and full EVM compatibility, Sonic marked more than just a name change—it was a shift in philosophy. Rather than competing as yet another generalized smart contract chain, Sonic positioned itself as a performance-first, developer-friendly environment where speed, throughput, and cost-efficiency are native, not bolted on.

Since launch, the Sonic ecosystem has grown steadily, attracting both innovative native DApps and prominent cross-chain protocols. Whether you’re here for lending markets, liquid staking, or bridging capital across chains, there’s already a solid stack of applications to explore—and the network's high throughput opens the door to use cases that demand speed, like perps trading and real-time yield strategies.

Here’s a breakdown of the top DApps on Sonic you should know about today.

What is Sonic?

Sonic is a high-performance, EVM-compatible Layer-1 blockchain that emerged from the Fantom ecosystem. Announced in August 2024, Sonic marks a clean break from Fantom Opera, built from the ground up to deliver faster finality, better infrastructure, and a more developer-friendly experience. It’s powered by a new native token, $S, and represents a fundamental rearchitecture rather than a simple network upgrade.

We have an in-depth review of Sonic on the Coin Bureau.

Blockchain Design

At the core of Sonic’s design is a combination of a Directed Acyclic Graph (DAG) data structure and a Proof-of-Stake (PoS) consensus model. This structure enables parallel block processing and sub-second finality. Transactions are validated concurrently, leading to throughput in the thousands per second. Sonic’s consensus layer incorporates Asynchronous Byzantine Fault Tolerance (ABFT), where validators independently verify and finalize transactions through root events organized into a canonical chain. This design ensures high reliability and fast settlement.

EVM Compatability

Sonic is fully compatible with the Ethereum Virtual Machine (EVM), supporting Solidity and Vyper smart contracts out of the box. This means developers can port their Ethereum dApps without code changes, tapping into Sonic’s faster execution and cheaper fees. Under the hood, Sonic features a specialized database with automatic pruning, which helps reduce validator costs and maintain high uptime.

$S Tokenomics

The $S token powers the network’s staking and governance. Validators require a minimum of 500,000 $S to participate, with delegated staking also supported. At launch, the token had a fixed supply of 3.175 billion, with 2.88 billion in circulation. Sonic’s inflation is capped at 1.5% annually for six years, with deflationary mechanisms such as burn penalties for unclaimed airdrops, unused funding, and a portion of DApp fees.

Strengths and Risks

Regarding strengths, Sonic offers impressive speed, efficient finality, robust token design, and tailored incentives for developers, including up to 90% fee rebates via the Fee Monetization program. But it’s not without challenges. The validator set remains small, user activity is still building, and Sonic must compete with a saturated field of L2s and alternative chains—all while trying to reignite momentum from the Fantom era.

Top Sonic DApps

The Sonic ecosystem is built for speed, and the applications being built on it reflect that. With its DAG-based architecture and sub-second finality, Sonic supports thousands of transactions per second at a fraction of the cost of typical EVM chains. This makes it an ideal playground for high-frequency use cases like perpetuals trading, real-time gaming, and automated DeFi strategies that rely on fast, cheap execution.

Sonic Announces Its Launch | Image via X

Sonic Announces Its Launch | Image via XIn this section, we’ve curated a list of standout DApps across the Sonic ecosystem, touching on various verticals—lending, trading, liquid staking, yield strategies, and more. These projects aren’t just technically compatible with Sonic’s infrastructure—they also make good use of it, leveraging the network’s speed and low fees to offer smoother UX and more capital-efficient operations.

Each DApp also integrates with Sonic’s Activity Points system, which rewards users for putting their assets to work.

How Sonic Activity Points Work

Sonic incentivizes on-chain activity through its Activity Points system. Users who deposit whitelisted assets into liquidity pools or smart contracts on participating DApps earn points for their engagement. This system is more rewarding because active participation (e.g., providing liquidity) yields 2x the points compared to simply holding assets in a wallet.

The goal is to encourage actual usage, not just idle TVL. All the DApps listed in this article are eligible for the Activity Points program, meaning users who interact with them may also be eligible for rewards in future airdrops or incentive campaigns.

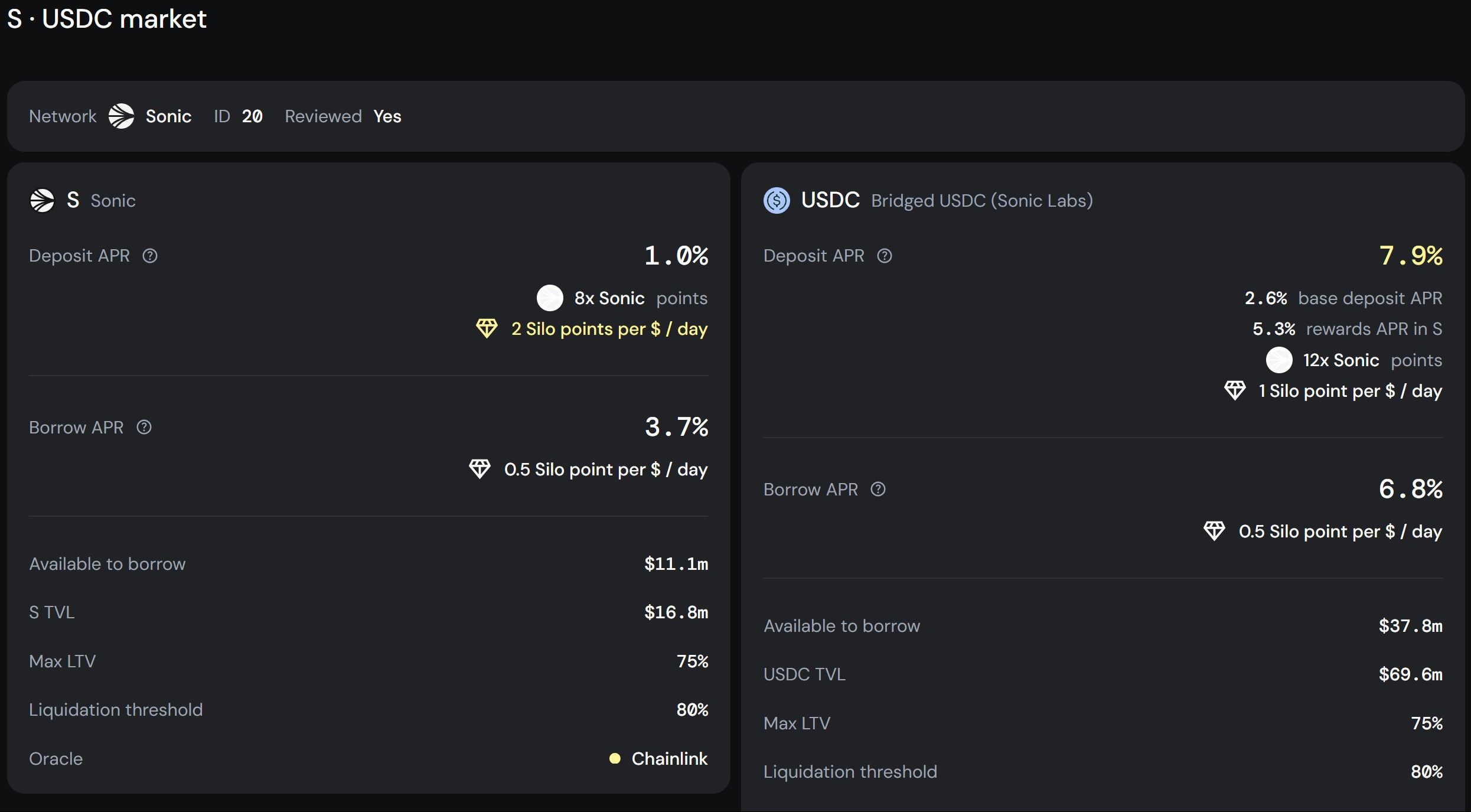

Silo Finance

Silo Finance is a decentralized, non-custodial lending protocol designed to facilitate secure and efficient money markets for a wide array of crypto assets. Unlike traditional shared-pool lending platforms, Silo employs an isolated pool approach, creating dedicated lending markets—referred to as "silos"—for each token asset. This design confines risk within individual markets, enhancing overall security and stability.

In March 2025, Silo Finance launched its V2 protocol on the Sonic blockchain, introducing features such as customizable lending markets and a revenue-sharing model for market deployers. This deployment led to rapid growth, with the platform attracting over $400 million in Total Value Locked (TVL) and facilitating more than $200 million in active loans within a month. As of April 2025, Silo Finance TVL sits at $200 million and ranks among the top three protocols by TVL on the Sonic network, alongside Aave and Beets (via DeFiLlama).

The protocol's native token, SILO, serves multiple purposes within the ecosystem, including governance participation and incentivizing liquidity provision. Users can stake SILO to earn rewards and influence protocol decisions. Active participation through Silo can yield multiply the points earned compared to passive asset holding, potentially leading to additional rewards.

Snapshot of USDC Market on Silo | Image via Silo Finance

Snapshot of USDC Market on Silo | Image via Silo FinanceA distinctive feature of Silo V2 is the introduction of "hooks," programmable extensions that enable developers to deploy idle liquidity into other DeFi protocols and create fixed-term lending or permissioned markets for regulated assets. This flexibility positions Silo as a versatile and innovative player in the DeFi lending space.

In summary, Silo Finance offers an efficient, and customizable platform for decentralized lending within the Sonic Ecosystem.

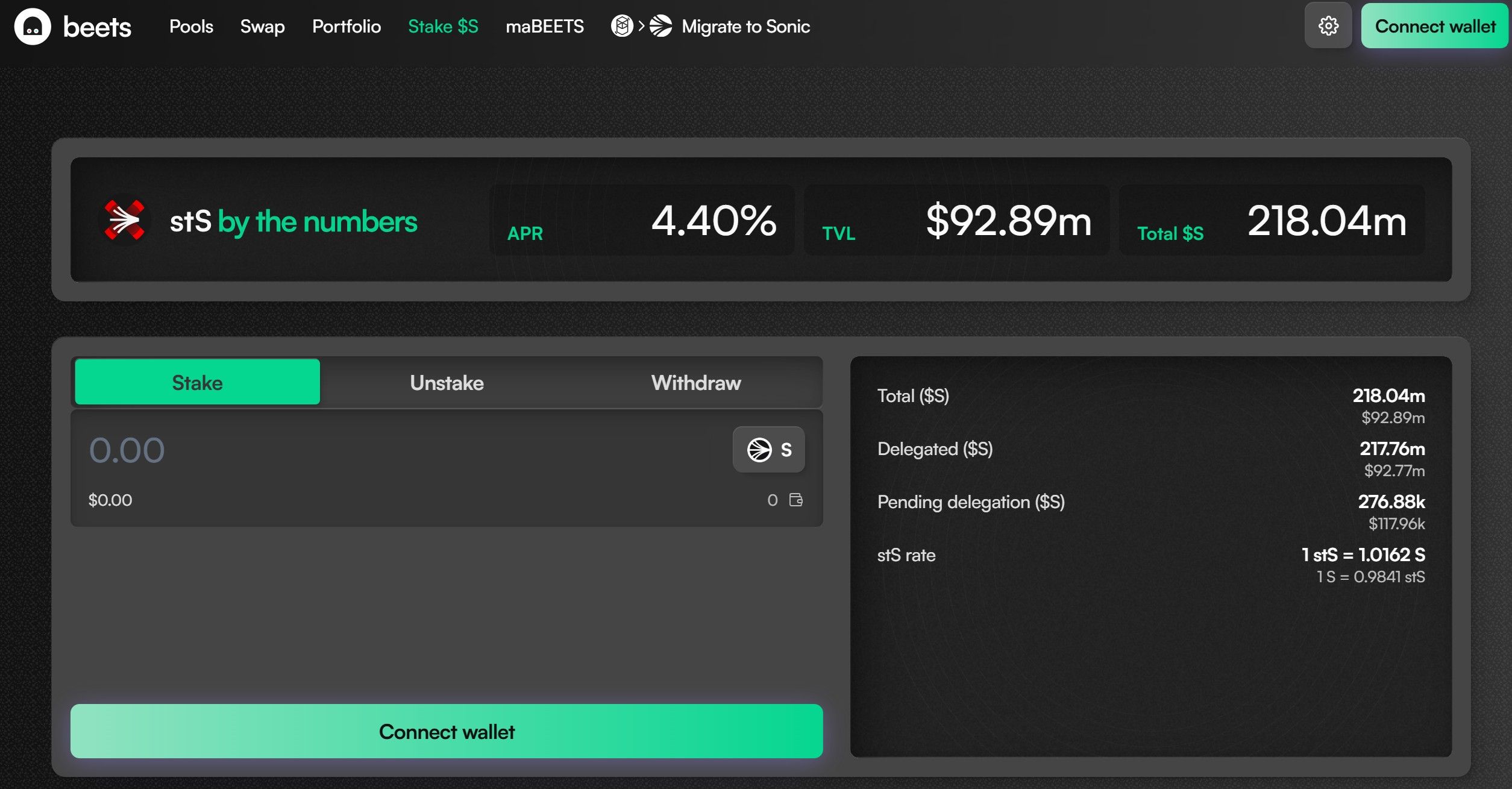

Beets

Beets is a liquid staking platform and automated market maker (AMM) in the Sonic ecosystem. It enables users to stake their $S tokens for Beets Staked Sonic (stS) tokens, which appreciate in value as staking rewards are automatically compounded. If you’re unfamiliar with LSTs, read the Liquid Staking Guide on the Coin Bureau.

As of April 2025, DeFiLlama tracks ~$188 million TVL locked in Beets and $34 million daily trading volume on CoinGecko. The platform's native token, BEETS, is utilized for governance, allowing holders to vote on protocol decisions and proposals. Additionally, staking BEETS can unlock enhanced rewards and benefits within the ecosystem.

Beets $S Staking Interface and TVL Numbers | Image via Beets

Beets $S Staking Interface and TVL Numbers | Image via BeetsIn April 2025, Beets introduced "stS Seasons," a quarterly initiative aimed at accelerating the adoption of stS tokens. Each season spans three months and offers unique rewards and incentives for participants, further enhancing user engagement and platform growth.

In summary, Beets offers liquid staking and swaps within a single interface, and an innovative reward mechanism to provide users with flexible and rewarding financial opportunities.

SwapX

SwapX is a decentralized exchange (DEX) native to the Sonic blockchain, designed to provide efficient and user-friendly trading experiences. Its Algebra Integral V4 protocol concentrated liquidity pools similar to Uniswap V3, enhancing capital efficiency and reducing slippage for traders.

The platform utilizes a ve(3,3) tokenomics model through its native token, SWPX. Users can lock SWPX to receive veSWPX, an ERC-721 token representing voting power within the protocol. This mechanism incentivizes active participation and aligns the interests of token holders, liquidity providers, and the protocol itself.As of April 2025 CoinGecko data, SWPX has a circulating supply of approximately 15.89 million tokens, with a total supply of 63.17 million and a maximum supply capped at 123 million.

A Look at SwapX Trading Interface | Image via SwapX

A Look at SwapX Trading Interface | Image via SwapXIn collaboration with Orbs, SwapX has integrated the Liquidity Hub, an advanced Layer-3 (L3) technology that aggregates liquidity from both on-chain and off-chain sources. This integration enhances execution prices, provides protection against miner extractable value (MEV), and offers gasless transactions, thereby significantly improving the trading experience.

Rings Protocol

Rings Protocol is a yield-bearing stablecoin platform on the Sonic blockchain, designed to enhance capital efficiency and liquidity within the DeFi ecosystem. By leveraging Veda's BoringVaults and drawing inspiration from Solidly's ve(3,3) model, Rings enables users to mint and stake assets like scUSD and scETH, facilitating yield generation and active participation in governance.

Key Features and Assets:

- scUSD and scETH: Users can mint scUSD by depositing stablecoins such as USDC, USDT, DAI, and GHO, or scETH by depositing ETH or its derivatives like WETH, stETH, and weETH. These assets are minted fee-free and can be staked to earn additional yields.

- Staked Assets (stkscUSD and stkscETH): Staking scUSD or scETH through Rings allows users to receive staked versions (stkscUSD or stkscETH), which are deposited into Veda-operated vaults on Sonic. These vaults generate yield through automated farming strategies, with rewards distributed directly to stakers.

- veNFTs: Users obtain veNFTs by locking staked assets, granting them voting power within the protocol's gauge system. This mechanism enables veNFT holders to direct liquidity incentives across various DeFi applications on Sonic, aligning with the ve(3,3) governance model.

Integration with Sonic's Activity Points System:

Rings Protocol is integrated with Sonic's Activity Points system, rewarding users who deploy whitelisted assets as liquidity on participating applications. Active engagement through Rings can yield higher points, potentially leading to additional rewards in future airdrops or incentive programs.

Notable Collaborations:

Rings has partnered with Lombard Finance to introduce scBTC, a yield-bearing Bitcoin asset on Sonic. Users can deposit BTC derivatives like LBTC, eBTC, and wBTC to mint scBTC, further expanding the protocol's asset offerings and enhancing Bitcoin's utility within the Sonic DeFi landscape.

Rings Protocol Let’s Users Automate Staking and Farming Strategies | Image via Rings DApp

Rings Protocol Let’s Users Automate Staking and Farming Strategies | Image via Rings DAppIn summary, Rings Protocol offers a comprehensive suite of yield-bearing assets and governance mechanisms on the Sonic blockchain, providing users with opportunities for enhanced capital efficiency, liquidity provision, and active participation in the DeFi ecosystem.

Avalon Labs

Avalon Labs is a BTCfi solution on the Sonic network. It allows financialization of Bitcoin by enabling BTC-lending, yield generation, credit cards and even BTC-backed stablecoin.

Key Features and Services:

- USDa Stablecoin: Avalon Labs introduces USDa, a Bitcoin-backed stablecoin designed to provide stability, liquidity, and profitability. USDa offers an 8% fixed lending rate and up to 15% annualized yield, transforming Bitcoin from a passive store of value into an active financial instrument.

- CeDeFi Lending Platform: Avalon's CeDeFi lending platform offers Bitcoin holders instant liquidity with the stability of a fixed borrowing rate. This platform bridges centralized and decentralized finance, providing users with predictable costs and enhanced financial flexibility.

- Multi-Chain Support: To expand its DeFi and CeDeFi lending services, Avalon Labs supports multiple blockchain networks, including Ethereum and BNB Chain. This multi-chain approach enhances accessibility and broadens the platform's reach within the DeFi ecosystem.

Tokenomics:

The native token, AVL, serves multiple functions within the Avalon ecosystem:

- Governance: AVL token holders can participate in platform governance, influencing decisions and protocol upgrades.

- Incentives: The token rewards users who contribute to the ecosystem, such as developers and liquidity providers.

- Staking and Yield Farming: Users can stake AVL tokens to generate rewards and engage in various yield farming opportunities.

The AVL token has a capped supply of 1 billion tokens, and its distribution model is designed to balance rewards among investors, community members, and the development team.

Avalon Labs Bring BTCfi on Sonic | Image via Avalon Labs

Avalon Labs Bring BTCfi on Sonic | Image via Avalon LabsUnique Aspects:

Avalon Labs distinguishes itself by integrating Bitcoin into the DeFi ecosystem, allowing users to unlock the value of their BTC holdings without selling them. This approach enhances Bitcoin's utility and allows users to participate in DeFi activities while retaining their assets.

In summary, Avalon Labs offers a comprehensive suite of decentralized financial services aimed at enhancing Bitcoin's utility and providing users with secure and scalable financial solutions.

Non-Native DApps on Sonic

So far, we've looked at projects built primarily for the Sonic ecosystem—protocols deeply integrated with the network’s infrastructure and incentives. But Sonic has also attracted established, battle-tested DeFi applications that are expanding from other chains. These non-native DApps bring liquidity, credibility, and advanced tooling to the network, opening up new opportunities for users and developers alike. Here are three major names making an impact on Sonic:

Aave V3

Aave is one of the most widely used decentralized lending protocols in crypto. It allows users to borrow against collateral and earn interest on deposits. Its robust risk management, deep liquidity, and multi-chain deployment make it a cornerstone of DeFi.

On Sonic, Aave V3 is live with lending markets for $S, $USDC, and $WETH. As of April 2025, according to DeFiLlama, Aave holds the largest share of TVL on Sonic—approximately $367 million. Its presence provides users a trusted, efficient option to tap into leverage or earn passive yield on core assets.

Pendle Finance

Pendle is a yield-trading protocol where users can split yield-bearing assets into Principal Tokens (PTs) and Yield Tokens (YTs). This lets users speculate on future yields, lock in fixed returns, or create advanced DeFi strategies.

On Sonic, Pendle supports a growing number of markets, including Beets' staked $S (stS), Rings Protocol’s wstscETH and wstscUSDC, and Silo Finance’s scUSD. It’s become a central hub for yield speculation on Sonic, with DeFiLlama reporting a TVL of around $98 million as of April 2025.

Stargate Finance

Stargate is a cross-chain bridge protocol that enables seamless asset transfers between chains without the need for wrapped tokens. It focuses on unified liquidity and native asset bridging, simplifying the user experience.

With Stargate V2 now supporting Sonic, users can easily bridge funds to and from other supported chains like Ethereum, Arbitrum, and BNB Chain. This makes it one of the most efficient options for onboarding assets into Sonic and expanding liquidity across networks.

Where to Buy $S

The native token of the Sonic blockchain, $S, is accessible through various centralized exchanges (CEXs) and decentralized exchanges (DEXs). Here's how you can acquire $S:

Centralized Exchanges (CEXs):

$S is listed on several prominent CEXs, providing a straightforward method for users to purchase the token using fiat or other cryptocurrencies. Notable exchanges include:

- Gate.io: Offers trading pairs such as S/USDT.

- Binance: Supports trading pairs like S/BTC and S/ETH.

- Bybit: Provides access to S/USDT trading.

Find the right platform to buy $S from by referring to Coin Bureau’s Top Exchanges List.

Decentralized Exchanges (DEXs):

For on-chain transactions, $S is available on decentralized exchanges within the Sonic network. These DEXs facilitate peer-to-peer trading without intermediaries. You'll need a compatible wallet and some $S to cover transaction fees and bridge compatible tokens from another network to engage in these transactions.

Important Considerations:

- Security: Ensure you use official links and platforms to avoid phishing scams.

- Fees: Be aware of transaction fees, which can vary between platforms.

- Liquidity: Check the liquidity and trading volume on the chosen platform to ensure efficient trade execution.

Always conduct thorough research and consider your security practices when purchasing and storing cryptocurrencies.

Closing Thoughts

The Sonic ecosystem stands out for more than its technical foundations—it already shows a wide variety of DApps across DeFi verticals, from isolated lending markets and liquid staking to yield speculation and native stablecoins. For a newly launched Layer-1, it’s rare to see this level of functional diversity so early on.

Most of Sonic’s momentum right now is clearly DeFi-driven, and that aligns with its infrastructure strengths: fast finality, low latency, and near-zero fees. But the same traits that power high-frequency DeFi could easily translate to NFT marketplaces, gaming, and consumer apps—categories that typically struggle on slower chains.

As Sonic grows, its next chapter will likely depend on how well it can convert its speed advantage into sticky user experiences. For now, these DApps represent some of the best ways to engage with the network's offerings.