Dinosaurs ruled the Earth for 165 million years before an asteroid wiped them out. That’s an unfathomably long reign compared to most things in nature. In the world of crypto, most projects don’t last more than a few years before fading into irrelevance. Yet, a few veteran cryptocurrencies have defied the odds, surviving multiple market cycles and still holding significant value today.

These assets are often called “Dino Coins”—a term the crypto community uses to describe older cryptocurrencies that remain actively traded despite the ever-changing landscape of blockchain innovation. Unlike their prehistoric namesakes, Dino Coins have survived the equivalent of multiple financial asteroids, including market crashes, regulatory crackdowns, and shifting investor sentiment.

The recent crypto crash of early 2025, which erased nearly $960 billion in market value, provided a stark reminder of how unforgiving the industry can be. Newer tokens, mainly AI-related coins, collapsed by as much as 80%, while some Dino Coins weathered the storm far better—and in some cases, even rallied.

This raises an important question: Why have these old cryptos performed better than newer, more hyped projects? And more importantly, could they continue to outperform in the future?

In this article, we’ll break down:

- What Dino Coins are and how to define them

- Why they have outperformed newer tokens

- Which Dino Coins are the strongest today

- If they can continue leading the market

- Which newer projects could eventually become Dino Coins

What are Dino Coins?

Unlike Layer 1 blockchains, DeFi tokens, or meme coins, Dino Coins aren't an official asset class. Instead, the term is a community-driven label for cryptocurrencies that have survived multiple market cycles and remain actively traded today.

However, the definition is subjective. If you ask different traders, you’ll likely get different answers.

- Some define Dino Coins as any cryptocurrency launched before 2015—before Ethereum and smart contracts revolutionized the industry.

- Others believe any crypto that has existed for “a long time” qualifies as a Dino Coin—even if its fundamentals or use cases have faded.

A Discussion on Dino coins Demonstrating Divided Opinions | Image via Reddit

A Discussion on Dino coins Demonstrating Divided Opinions | Image via RedditHowever, neither of these definitions fully captures what separates long-standing projects from truly resilient ones. To correctly identify Dino Coins, we need to create objective criteria.

Defining Dino Coins Objectively

To qualify as a Dino Coin, a cryptocurrency must meet three strict criteria:

1. The Coin Must Have Traded Through At least Two Full Market Cycles

This ensures it has survived both bull and bear markets, demonstrating resilience in different economic conditions.

- Any coin that has been around since at least 2017 would have experienced the massive 2017-18 bull run and crash, followed by the 2021-22 cycle.

- Coins that have only existed in one cycle may have benefited from hype but haven’t yet proven they can endure downturns.

2. The Coin Must Have a Market Cap of at Least $100 Million

A low market cap often indicates that a project is losing relevance or being gradually abandoned.

- A $100M+ valuation ensures that Dino Coins still have substantial investor interest.

- While some old coins technically still exist, they don't make the cut if their market cap has dwindled into irrelevance.

3. The Coin Must Have an Average Daily Trading Volume of at Least $50 Million

A Dino Coin needs to be actively traded—not just sitting in old wallets collecting dust.

- A minimum $50M trading volume ensures these assets remain liquid, meaning investors can enter and exit positions without massive price swings.

- Low-volume coins are easy targets for manipulation and tend to fade from relevance over time.

Why These Criteria Matter

The Dino Coin classification isn’t just about age—it’s about proven resilience, value retention, and continued market relevance. The three key filters—market cycle endurance, market cap, and trading volume—ensure that only strong, time-tested assets qualify.

Let’s break down why each of these criteria is crucial.

1. Surviving Two Full Market Cycles: A Test of Time and Relevance

Crypto history has shown that hype fades fast, but actual value persists. Surviving two complete market cycles isn’t just about longevity—it’s about proving that an asset has staying power beyond speculative manias.

- It filters out hype-driven tokens. Many coins ride a bull market wave only to disappear in the next downturn. A coin that has lived through multiple cycles has demonstrated it can withstand speculation and retain a core user base.

- It separates assets with intrinsic value. A project that remains relevant beyond its launch hype is more likely to have real utility, strong adoption, or a dedicated community.

- It signals the potential for long-term ownership. Dino Coins aren’t just assets traders flip—they’re projects investors are willing to hold passively for years, a key feature differentiating them from short-lived trends.

In essence, if a coin has survived two brutal bear markets and still holds significant value, it’s not just luck—it’s a sign of true resilience.

2. A Minimum $100 Million Market Cap: Proving Value Retention

Market capitalization reflects the total value held in an asset, and a minimum threshold of $100M ensures that a coin has retained significant market interest.

- It demonstrates value retention. If a coin has been around for years but has failed to accumulate a meaningful market cap, it likely has weak fundamentals. A Dino Coin should be able to hold value over time.

- Larger market cap assets are more stable. Coins with high market caps require more capital inflow to move their price, making them more resistant to extreme volatility. Stability is key for assets intended for long-term passive holding.

- It filters out forgotten projects. Many old cryptos still technically exist but have faded into irrelevance. If a project has been around for years but still struggles with a low valuation, it’s a red flag for weak fundamentals.

Essentially, if a project has endured multiple cycles but still can’t hold a $100M valuation, it’s more of a relic than a true Dino Coin.

3. A Minimum $50 Million Daily Trading Volume: Ensuring Active Market Demand

Trading volume is one of the most overlooked yet critical factors in assessing a coin’s viability. A Dino Coin isn’t just an asset that just exists—it’s actively traded.

- It signifies continued interest from investors. High trading volume means that many market participants still find the asset worth trading. This confirms ongoing relevance, not just legacy status.

- It ensures liquidity for easy buying and selling. A Dino Coin should be something investors can enter and exit positions in at any time. Low trading volume means fewer buyers and sellers, making it harder to trade efficiently.

- It protects against volatility. If a coin is illiquid, even small trades can cause massive price swings due to slippage. A Dino Coin should be liquid enough to absorb large trades without extreme price fluctuations.

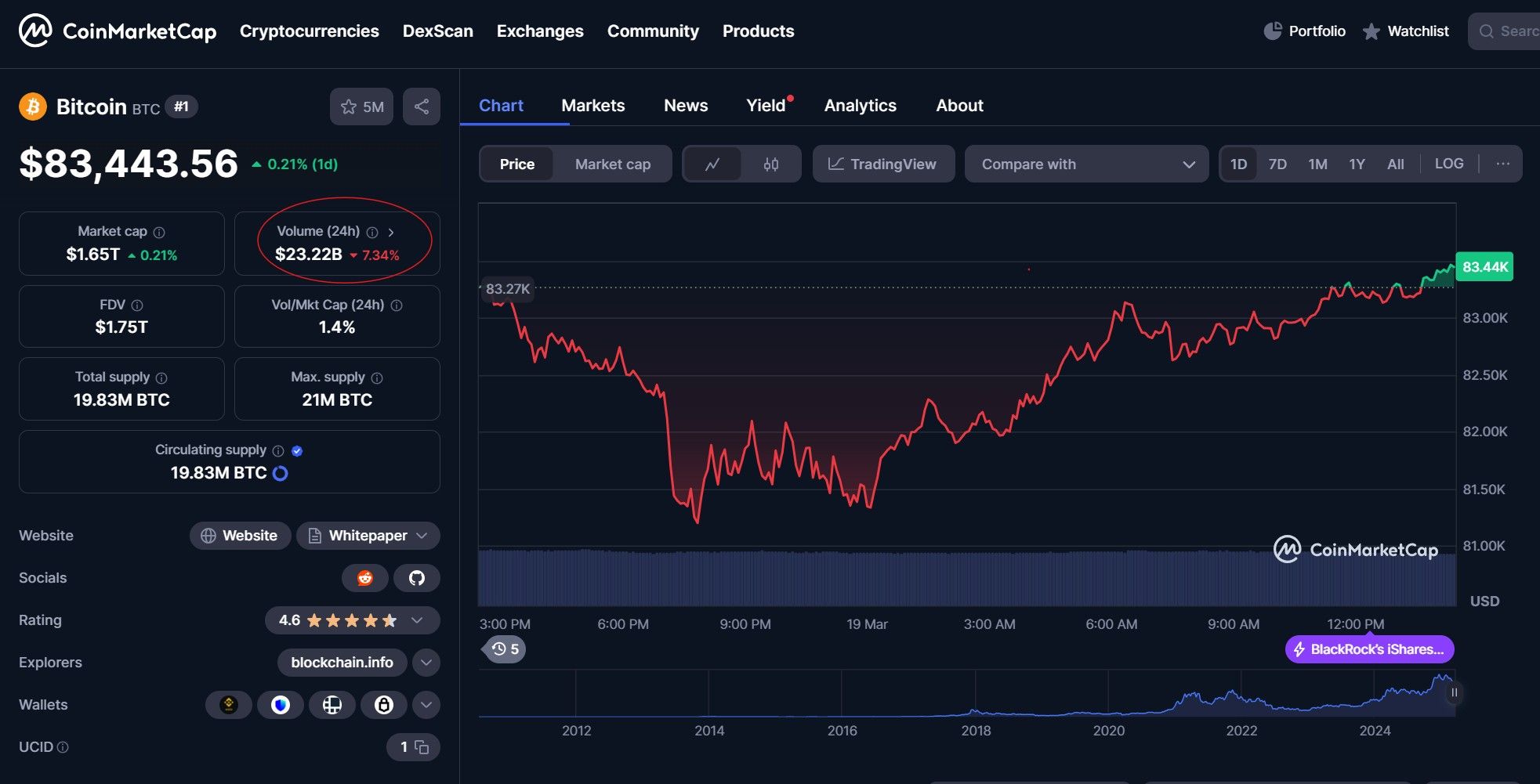

NEO Has a Daily Volume of Just $42 million, Which Makes It Very Volatile And Not a Dino Coin Candidate | Image via CoinMarketCap

NEO Has a Daily Volume of Just $42 million, Which Makes It Very Volatile And Not a Dino Coin Candidate | Image via CoinMarketCapIn short, trading volume ensures that Dino Coins remain tradeable, accessible, and relatively stable.

The Bottom Line

These three criteria aren’t just arbitrary filters—they’re designed to identify assets that have proven their resilience, held their value, and continue to attract investors. By enforcing these filters, we can separate genuine Dino Coins from outdated, forgotten projects, ensuring that only the strongest survivors of past cycles make the cut.

Importantly, this definition isn’t static.

A coin can enter or exit Dino Coin status as market conditions evolve. A highly traded token today might lose volume and fade away, while a newer crypto that survives multiple cycles could eventually earn Dino status.

Which Coins Qualify as Dino Coins Today?

Based on these criteria, around 25 cryptocurrencies currently qualify as Dino Coins (per March 2025 data). Here's a list of all these coins:

- Bitcoin (BTC),

- Litecoin (LTC)

- Ripple (XRP)

- Dogecoin (DOGE)

- Monero (XMR)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Cardano (ADA)

- Stellar (XLM)

- IOTA (IOTA)

- Zcash (ZEC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Tron (TRX)

- BNB (BNB)

- Maker (MKR)

- Polygon (POL)

- Cosmos (ATOM)

- Hedera Hashgraph (HBAR)

- Algorand (ALGO)

- Polkadot (DOT)

- Compound (COMP)

- Aave AAVE)

- Uniswap (UNI)

- Filecoin (FIL)

Some of these assets, like Bitcoin and Ethereum, have established themselves as industry cornerstones. Others, like Dogecoin and XRP, have maintained strong liquidity and community support despite their fluctuating fundamentals.

Why Have Dino Coins Outperformed the Market?

In a crypto market that moves at breakneck speed, it’s easy to assume that newer equals better—but recent market trends have challenged this assumption. Between January and March 2025, the crypto market lost $960 billion in value, marking a 25% decline from its December 2024 highs. While newer token categories—especially AI-related coins—collapsed by as much as 80%, many Dino Coins held their ground, with some even seeing price gains.

This raises a key question: Why have older crypto assets outperformed the market?

Let’s break down the factors driving their resilience.

1. Deep Liquidity and Market Stability

Liquidity is one of the most important yet underrated factors in crypto markets. A highly liquid asset is more resistant to manipulation, large sell-offs, and extreme volatility.

Dino Coins, being older and more established, benefit from:

- High trading volume across major exchanges. Unlike newer tokens that rely on niche DeFi pools or specific trading pairs, Dino Coins are listed on every major CEX and DEX.

- Institutional-grade market depth. Their deep liquidity ensures that even large buy or sell orders don’t drastically impact price movements, making them more attractive for serious investors.

- Protection against market manipulation. Newer coins, especially those with low liquidity, are vulnerable to whale games and flash crashes. With their broader investor base and higher trading volumes, Dino Coins are harder to manipulate.

Bitcoin's Liquidity At Any Day Is In Tens Of billions | Image via CoinMarketCap

Bitcoin's Liquidity At Any Day Is In Tens Of billions | Image via CoinMarketCapThis liquidity helps Dino Coins remain stable during downturns, preventing extreme drawdowns even when sentiment shifts.

2. Strong Holding Behavior and Community Support

A key reason Dino Coins didn’t experience the same crash as newer assets is the difference in investor psychology. Dino Coin holders tend to be long-term believers, not short-term traders.

Look at the data:

- Litecoin (LTC): Most LTC holders have held for over a year, indicating long-term commitment.

- Bitcoin (BTC): The average holding age of BTC in self-hosted wallets is 150 weeks—nearly three years (per Chainanalysis).

- Ethereum (ETH): The average holding age for ETH is 60 weeks, proving that investors aren’t just trading it; they’re holding it for the long haul (per Chainanalysis).

- Chainlink (LINK): Active circulating supply has dropped from 800 million tokens in 2023 to 480 million in 2025, meaning fewer LINK tokens are moving into the market—reducing selling pressure, according to Messari.

- Cardano (ADA): Of its 45 billion total supply, nearly 21.82 billion ADA is staked (based on explorer data), essentially removing it from active circulation.

Unlike newer tokens that attract short-term traders looking for quick gains, Dino Coins tend to be held by long-term investors who aren’t panic-selling at every dip. This strong holding behavior acts as a shock absorber, making these assets more resistant to rapid sell-offs.

3. Staking and Locked Supply Reduce Selling Pressure

Staking is another significant reason Dino Coins didn’t crash as hard as newer tokens. Many top Dino Coins feature staking or locked token models, reducing their available circulating supply and minimizing selling pressure.

- Cardano (ADA): Nearly half of ADA’s total supply is staked, meaning the tokens are not actively sold on exchanges.

- Polkadot (DOT): Over 50% of DOT is locked in staking, further reducing liquid supply.

- Ethereum (ETH): Over 30 million ETH have been staked since the Shapella upgrade, creating a natural demand floor.

For comparison, newer altcoins often lack these mechanisms, which can lead to higher selling pressure when market sentiment turns bearish.

4. Institutional Demand and Traditional Finance Integration

One of the most significant differences between Dino Coins and newer crypto projects is their integration with traditional finance (TradFi). Bitcoin and Ethereum have wholly entered traditional finance.

- The Bitcoin Spot ETF market alone has surpassed $750 billion in cumulative trading volume—bringing billions in new institutional inflows.

- Ethereum ETFs have also gained traction, providing investors with a regulated way to invest in ETH’s growth.

Institutions aren’t speculating on meme coins or newly launched tokens—they’re buying BTC, ETH, and other well-established assets. This institutional demand creates a steady, reliable buying force that doesn’t exist for most newer altcoins.

5. Trump’s “Crypto Reserve” Speculation

One of the most unexpected narratives fueling Dino Coin interest is the speculation surrounding Donald Trump’s rumored “Crypto Reserve” list. Reports have suggested that Trump’s pro-crypto administration may be considering an official list of cryptocurrencies that the U.S. government could accumulate as reserves.

- BTC and ETH are obvious contenders, given their institutional adoption.

- XRP has also been rumored as a potential inclusion, given its recent legal clarity after winning its SEC lawsuit.

- Some even speculate that ADA, DOGE, or LTC could cut—especially if Trump prioritizes assets that retail investors already hold.

While this is purely speculative, even the rumor of U.S. government involvement has increased demand for Dino Coins, which newer, VC-backed projects can’t access.

6. Survivor’s Bias – Only the Strongest Remain

Finally, one of the simplest yet most powerful reasons Dino Coins have outperformed is survivor’s bias. The only old coins we see today are the ones that didn’t die. Since Bitcoin’s launch in 2009, thousands of altcoins have been created—most of them are now worthless.

- Dino Coins, by definition, have already survived:

- Multiple bear markets

- Regulatory scrutiny

- Investor sentiment shifts

- New technological innovations

If they were going to die, they would have died already. This doesn’t guarantee continued success, but it does mean these assets have already overcome hurdles that newer projects have yet to face.

The Bottom Line: Dino Coins Have Outperformed for a Reason

Dino Coins haven’t just survived—they’ve outperformed because they are:

- More liquid and harder to manipulate

- Held by long-term investors, reducing panic selling

- Integrated with staking mechanisms that reduce supply

- Supported by institutional demand and TradFi products

- Potentially benefiting from government-level speculation

- Proven survivors of previous cycles

Which Dino Coins Are the Best?

Not all Dino Coins are created equal. While many older cryptocurrencies have stood the test of time, only a handful continue to innovate, attract institutional demand, and maintain strong liquidity.

Here are the top Dino Coins that still dominate the market today.

1. Bitcoin (BTC) – The King of Crypto

Bitcoin has cemented itself as the gold standard of digital assets. Despite endless competition from newer projects, no cryptocurrency has come close to replacing BTC’s role as the industry’s foundation.

- Recent Performance: Bitcoin broke above $100,000, holding that level for a respectable period before retracing. This breakout further solidified its position as the most trusted store of value in crypto.

- Institutional Adoption: The Bitcoin Spot ETF market has surpassed $750 billion in cumulative trading volume, attracting more institutional capital to BTC than ever before.

- Corporate Accumulation: MicroStrategy, one of the biggest Bitcoin advocates, now holds 499,096 BTC (March 2025), valued at approximately $41.7 billion. They have publicly committed to buying more, reinforcing institutional confidence in BTC’s long-term value.

MicroStrategy BTC Holdings Chart | Image via BitBo

MicroStrategy BTC Holdings Chart | Image via BitBoAt this point, Bitcoin isn’t just a crypto asset—it’s a parallel financial system outside government control. Its scarcity, liquidity, and adoption make it the undisputed leader among Dino Coins.

2. Ethereum (ETH) – The Backbone of Web3

Ethereum has retained its dominance as the most widely used blockchain for smart contracts, DeFi, and NFTs. While competitors have tried to challenge ETH’s position, its first-mover advantage and ongoing upgrades keep it at the forefront of innovation.

- Scalability Upgrades: Ethereum’s recent Dencun upgrade introduced proto-danksharding, a significant step toward improving scalability and reducing transaction costs.

- Layer 2 Expansion: The Ethereum ecosystem now has over $48 billion locked in Layer 2 networks, a testament to its growing adoption and efficiency.

- Institutional Interest: Ethereum ETFs are gaining momentum, providing a regulated way for institutions to gain exposure to ETH.

Ethereum isn’t just surviving—it’s actively shaping the future of blockchain technology.

3. XRP – A Legal Win and Institutional Reawakening

After years of regulatory uncertainty, XRP finally secured a major victory in 2024, when a U.S. court ruled that it is not a security. This ruling gave XRP something most altcoins don’t have—legal clarity.

- Post-Lawsuit Rebound: Since its legal win, institutional interest in XRP has surged, with major financial institutions re-evaluating partnerships with Ripple.

- Potential Government Adoption: Speculation is rising that XRP could be included in sovereign digital asset reserves, especially if the U.S. government formalizes a crypto reserve strategy.

XRP’s regulatory clarity, institutional backing, and continued liquidity keep it firmly in the Dino Coin club.

4. Maker (MKR) – The OG of DeFi

Before DeFi became a buzzword, MakerDAO was already pioneering decentralized lending. It remains one of the most important protocols in the ecosystem, securing billions in assets.

- Key Innovation: Maker’s Spark Protocol now offers yield-bearing assets, bringing DeFi closer to traditional finance models.

- Long-Term Stability: Unlike newer lending platforms, Maker has survived multiple DeFi crashes and remains one of the most resilient protocols in crypto.

As DeFi grows, Maker’s role as a foundational pillar of decentralized lending is unlikely to fade.

5. Uniswap (UNI) – The Gold Standard for Decentralized Exchanges

Uniswap isn’t just another DEX—it’s the model that every decentralized exchange is built upon.

- Ongoing Innovation: The introduction of Unichain is making Uniswap faster, cheaper, and more efficient.

- Version 4 Upgrades: Uniswap V4 introduces customizability, gas efficiency, and an intent-based trading framework, keeping it ahead of competitors.

- Cross-Chain Expansion: Uniswap’s cross-chain intents system sets new standards for seamless blockchain interoperability.

DEX trading isn’t going anywhere, and Uniswap remains the top decentralized exchange in the industry.

6. AAVE – The Leader in DeFi Lending

AAVE has dominated the DeFi lending space for years, consistently ranking as one of the most valuable and widely used DeFi platforms.

- Massive Liquidity: With $20.6 billion in Total Value Locked (TVL), AAVE is the largest lending protocol by a huge margin—nearly 6x larger than its closest competitor.

- Institutional DeFi Integration: AAVE continues to expand its institutional offerings, bridging the gap between TradFi and DeFi.

AAVE’s position as the dominant force in DeFi lending remains unchallenged.

Summary: Dino Coins That Refuse to Die

While many cryptocurrencies have come and gone, these Dino Coins have proven they can evolve, adapt, and remain dominant.

Will Dino Coins Continue to Outperform the Market?

Speculating on the future of Dino Coins requires careful analysis—because if predicting crypto was easy, we'd all be billionaires by now. Even here at Coin Bureau, we don’t have a crystal ball, so take these opinions with a grain of salt.

That said, strong indicators suggest Dino Coins could continue to outperform, but there are also a few reasons why their dominance might not last forever.

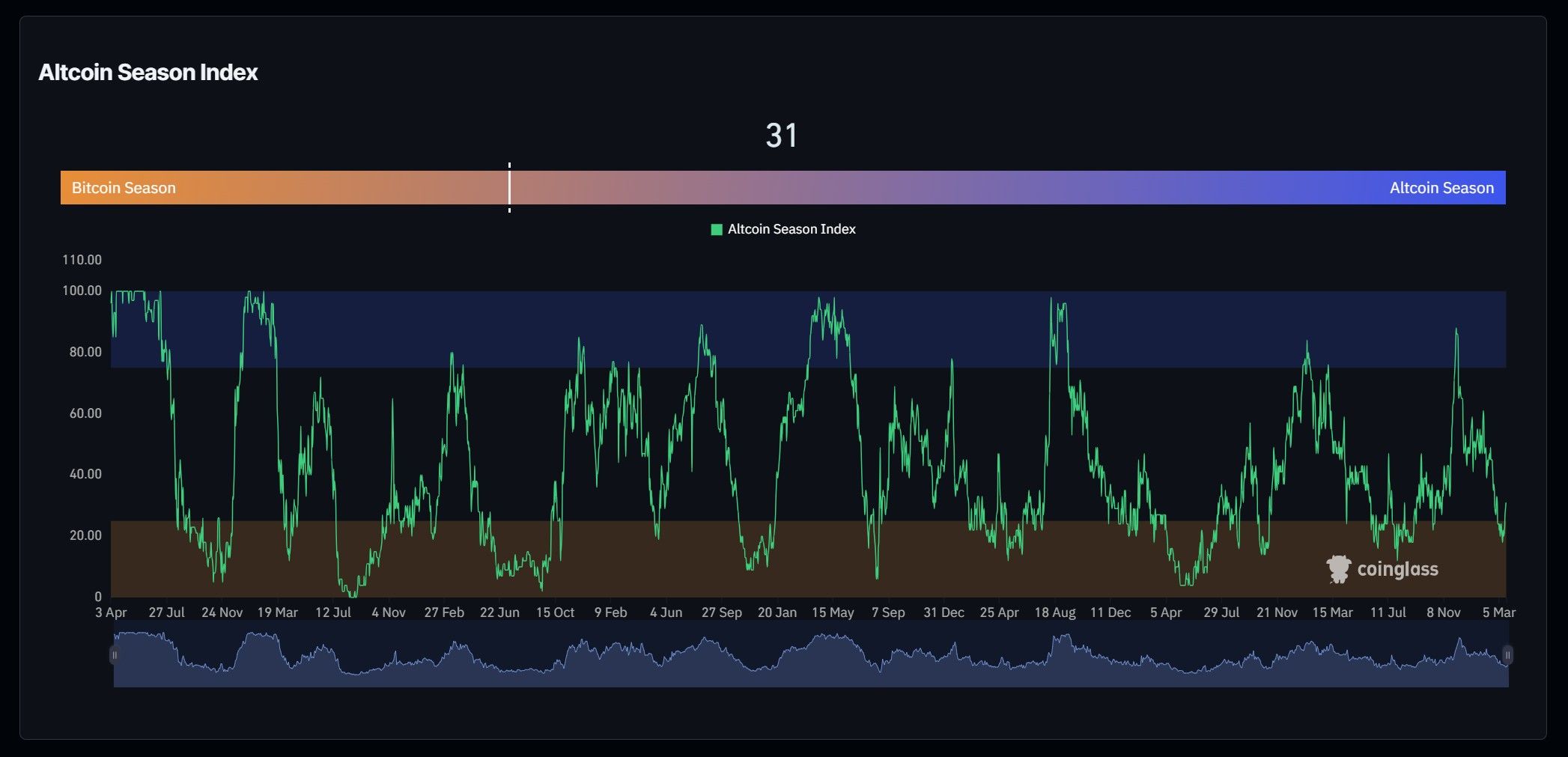

1. The Altcoin Season Index Says It’s Still Bitcoin’s Time

One of the most apparent signals of where money flows in the market is Coinglass’s Altcoin Season Index. This index measures whether the market favors altcoins or Bitcoin, using a scale of 1 to 100.

- The latest 90-day Altcoin Season Index sits at 31/100, meaning we are firmly in a Bitcoin-dominated market.

- Historically, altcoin season is only considered active when the index crosses 75/100.

Altcoin Season Index | Image via Coinglass

Altcoin Season Index | Image via CoinglassWhile Bitcoin and select Dino Coins have held their ground or rallied, newer altcoins have yet to experience a real market-wide surge. In fact, since 2022, Bitcoin dominance has been on a steady upward trend, further proving that capital is flowing into BTC rather than speculative altcoins.

2. Newer Altcoins Have Never Seen a True Alt Season

The lack of a strong altcoin season since 2021 has created an unusual market dynamic:

- Many new altcoins launched in the past 3-4 years have never experienced a full-fledged altcoin rally.

- This means they haven’t had the chance to build deep liquidity or solidify themselves in the market.

- In contrast, Dino Coins already survived and thrived through at least one alt season, giving them an edge in value retention.

But this also raises an important question: What happens when the next alt season actually arrives?

If newer altcoins finally get their moment in the sun, their current low valuations could allow them to skyrocket in price with relatively little capital inflow. This could shift market momentum away from Dino Coins and toward newer assets—at least in the short term.

3. Some Dino Coins Could Keep Outperforming

Not all Dino Coins are equal—some are more deeply integrated into financial systems and widely held by institutions and governments.

- Bitcoin and Ethereum are now fully embedded into TradFi. With multiple actively traded Spot and Futures ETFs, these assets have mainstream adoption that newer tokens lack.

- Institutional and sovereign demand is rising. If rumors of Trump’s Crypto Reserve List hold any truth, BTC, ETH, and possibly XRP could see massive demand from sovereign wealth funds.

- Dino Coins with real utility, such as Uniswap (UNI) and AAVE, will likely continue to perform well due to their dominance in DeFi.

So, while some Dino Coins may fade, others will likely remain at the core of the crypto ecosystem for years to come.

The Verdict: Will Dino Coins Keep Winning?

Short-term? likely. The market is still in a Bitcoin-led cycle, and Dino Coins remains the safest bet for large investors. Long-term? It depends. Once a true altcoin season arrives, newer tokens may finally get their chance to shine. Dino Coins have a proven track record, deep liquidity, and strong adoption—but in crypto, nothing is permanent.

Which New Tokens Could Become Dino Coins in the Future?

At the start of this article, we established that the definition of Dino Coins isn’t static. Over time, new projects will survive multiple market cycles, grow in liquidity, and cement themselves as the industry's core pillars. Predicting which tokens will reach this status isn’t easy, but based on market traction, innovation, and staying power, we believe these six assets have strong potential to become future Dino Coins.

1. Solana (SOL) – The Fastest Layer 1 in the Game

Solana has emerged as one of the most battle-tested blockchain networks, proving that it can withstand both brutal bear markets and intense industry competition.

- Speed and Scalability: Solana’s Proof-of-History (PoH) consensus allows it to process over 65,000 transactions per second, making it one of the fastest blockchains.

- Ecosystem Growth: Despite network challenges in previous years, Solana’s DeFi, NFT, and gaming ecosystems are thriving.

- Institutional Interest: Major funds and developers continue building on Solana, reinforcing its longevity.

With a large developer base, strong network effects, and deep liquidity, Solana is one market cycle away from solidifying its status as a true Dino Coin.

2. Sui (SUI) – A Rapidly Developing Ecosystem

Sui is one of the most promising next-generation blockchains, focused on parallel execution and extreme scalability.

- Scalability Focus: Sui’s object-based architecture enables ultra-fast transaction speeds and low gas fees, making it ideal for gaming and high-frequency applications.

- Growing Adoption: Developers are rapidly building on Sui, and its ecosystem is expanding faster than many of its competitors.

Sui’s ability to attract projects and maintain strong liquidity will determine whether it becomes a long-term industry staple or fades like many past “Ethereum killers.”

3. Hyperliquid – The Layer 1 DEX Chain

Decentralized trading is a critical sector in crypto, and Hyperliquid is redefining how perpetual swaps work on-chain.

- On-Chain Derivatives Revolution: Hyperliquid offers high-speed perpetual futures trading, eliminating the need for traditional centralized exchanges.

- Layer 1 Innovation: Unlike traditional DeFi derivatives platforms, Hyperliquid is built as a dedicated Layer 1 chain, meaning it has deep liquidity natively integrated.

If decentralized trading continues to gain traction, Hyperliquid could become a dominant force in DeFi and one of the most valuable DEX platforms in crypto.

4. Ondo Finance – Bringing U.S. Treasuries On-Chain

Real-world asset (RWA) tokenization is one of the most prominent crypto narratives, and Ondo Finance is leading the charge.

- Bridging TradFi and Crypto: Ondo is bringing U.S. Treasuries and yield-bearing assets on-chain, making traditional finance products accessible to crypto investors.

- Institutional Adoption: With the growing demand for tokenized securities, Ondo is well-positioned to play a major role in the future of digital finance.

If RWAs become a core part of DeFi, Ondo could evolve into a foundational protocol within the industry.

5. Lido Finance (LDO) – The Leader in Liquid Staking

Lido is already the most dominant liquid staking platform, but its long-term potential suggests it could become a permanent part of the crypto infrastructure.

- Pioneering Liquid Staking: Lido allows users to stake ETH and receive liquid stETH in return, unlocking liquidity while securing the network.

- Massive Market Share: Lido holds over 30% of all staked ETH (per March 2025 data), making it the largest staking service provider by a wide margin.

With Ethereum staking continuing to grow, Lido’s market dominance makes it a strong candidate for long-term survival.

6. EigenLayer – The Future of Restaking

Ethereum’s restaking model can potentially change how network security is managed, and EigenLayer is at the forefront of this innovation.

- Restaking Revolution: EigenLayer allows staked ETH to be used to secure multiple networks, creating a new layer of security for Ethereum’s ecosystem.

- Explosive Adoption: EigenLayer has attracted billions in staked assets in just a short period, proving its strong market demand.

If restaking becomes a fundamental part of Ethereum’s infrastructure, EigenLayer could join the ranks of Dino Coins.

The Bottom Line: The Next Generation of Dino Coins?

Each of these assets meets at least some of the key Dino Coin criteria:

- They already have $100M+ market caps and significant trading volumes.

- They’ve operated through at least one market cycle and need one more to prove longevity.

- They are pioneering new technologies in their respective sectors.

While it’s impossible to guarantee their long-term survival, these projects have strong foundations, growing adoption, and the potential to become the next generation of Dino Coins.

Final Thoughts

Dino Coins have proven that age isn’t just a number in crypto—it’s a sign of resilience. While thousands of projects have faded into obscurity, these veteran assets have weathered multiple market cycles, retained value, and continued evolving. But will they keep outperforming newer assets, or will the next alt season finally shift momentum to fresh innovations? The market is constantly changing, and while Dino Coins have the advantage of history, newer projects are quickly gaining traction.

One thing is certain: crypto never stands still. Whether you're holding onto a classic Dino Coin or betting on the next big thing, understanding which assets have true staying power is key to navigating this ever-evolving space.

DISCLAIMER: The information provided in this article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency markets are highly volatile, and all investments carry risk. The views and opinions expressed in this article are those of the author and are based on research, data, and market analysis. While we strive for accuracy, opinions may differ, and readers should conduct their own due diligence before making any financial decisions. Always consult a qualified financial professional and DYOR before investing in cryptocurrencies or any other financial assets.