If you’ve ever traded anything in your life, from stocks to sneakers, you understand how markets work: one person wants to sell, another wants to buy, and a middleman helps make the deal happen. In traditional markets, that middleman is often an exchange, and behind the scenes, market makers step in to keep things moving smoothly. They make sure there’s always someone on the other side of your trade, so you’re not left waiting.

But crypto doesn’t always work like that.

When you buy a token on a platform like Uniswap, there’s no broker lining up buyers and sellers. There’s no trader sitting across the screen. Instead, you’re trading against a pool of assets managed entirely by code. It’s instant, permissionless, and always online. The system powering this is called an Automated Market Maker, or AMM.

AMMs are one of the most important innovations in crypto, quietly running the exchanges that power much of DeFi. But how do they actually work? What makes prices move? Who provides the liquidity? And what risks are involved?

This article breaks down the mechanics, benefits, challenges, and future of AMMs, helping you understand the engine behind many of your crypto trades.

Key Takeaways

- Automated Market Makers (AMMs) are decentralized smart contract systems that enable users to trade crypto assets directly from liquidity pools—no order books, brokers, or counterparties needed.

- AMMs like Uniswap and Curve use pricing formulas (e.g.,

x * y = k) to determine token values, allowing trades to execute instantly based on supply ratios within the pool. - Liquidity is provided by users, who earn fees in return, and arbitrage traders play a key role in keeping AMM prices in sync with broader markets.

- Major protocols like Uniswap, Curve, Raydium, and PancakeSwap each specialize in different chains and features, from stablecoin swaps to concentrated liquidity and launchpads.

- AMMs carry risks including impermanent loss, MEV attacks, and smart contract vulnerabilities—making it essential to assess tradeoffs before providing liquidity or executing large trades.

Understanding Automated Market Makers

TL;DR: An Automated Market Maker (AMM) is a decentralized exchange system that lets users trade cryptocurrencies directly from a pool of assets instead of matching with another user. These pools are managed by smart contracts, which automatically calculate prices and handle the exchange.

In traditional finance, exchanges rely on order books. An order book lists all active buy and sell offers, reflecting traders’ collective perception of an asset’s value at any given moment. Every trade occurs between two counterparties—one buyer, one seller—and the price constantly adjusts based on supply and demand. It’s a dynamic, peer-to-peer system with humans (or bots) driving every price tick.

AMMs operate differently. Instead of waiting for a match, users interact with a pool that holds two tokens—say ETH and USDC—and trades are made directly with that pool. There’s no second party involved. Prices aren’t set by bids and offers but are determined by formulas embedded in smart contracts. The most common formula is the constant product rule, which balances the ratio between assets as users trade. While a Decentralized Exchange is an on-chain platform, an Automated Market Maker (AMM) is the program that runs it.

AMMs are Smart Contracts With Market Making Logic Programmed in them | Image via Swyftx

AMMs are Smart Contracts With Market Making Logic Programmed in them | Image via SwyftxIt’s also worth noting that all assets, even in traditional markets like stocks, trade in pairs—usually against the U.S. dollar. But that pair is often hidden from view. In crypto, where any token can potentially be paired with any other, these pairings are front and center. That’s why you’ll often see pools like ETH/DAI or OP/USDC prominently displayed in AMM interfaces.

The Evolution of Trading in DeFi

In the early days of crypto, most trading happened on centralized exchanges (CEXs). These platforms operated much like traditional stock markets—matching buyers and sellers through a familiar order book interface. Once users were registered, trades were typically fast and inexpensive. But CEXs were also burdened with red tape, frequent regulatory hurdles, and a dependence on central entities to function smoothly. Despite being in crypto, they never truly reflected its decentralized ethos.

Decentralized exchanges (DEXs) emerged to solve this. Instead of relying on a company to provide liquidity and custody, users themselves supplied funds to liquidity pools. These pools were managed by smart contracts that executed trades using predefined algorithms. In return, liquidity providers earned a share of the trading fees. Operating on public blockchains, DEXs offered a permissionless and borderless alternative, free from central control and often out of reach of regulatory bottlenecks.

What Problems Did AMMs Solve?

- Liquidity: CEXs are funded and operated by companies with limited capital. AMMs unlocked a new model where everyday users could contribute liquidity in return for a share of fees. This crowdsourced approach facilitated the launch and sustained trading markets for a wide range of tokens.

- Price Discovery: Traditional markets rely on constant human and algorithmic input to shape price through thousands of simultaneous bids and asks. But blockchains can’t handle that kind of load. AMMs solved this by using deterministic pricing formulas—like Uniswap’s x*y=k—which let anyone plug in an order size and instantly calculate the post-trade price. No waiting, no traffic.

- Liveness: Traditional markets close overnight. Crypto doesn’t. AMMs function 24/7, powered by smart contracts that never sleep. This is essential for a global market that doesn’t operate in a single timezone.

- Standard Pairing: Unlike traditional exchanges that default to USD as the base, crypto allows any token-to-token swap. AMMs helped standardize the structure and display of token pairs, making it easier for users to navigate the market.

- Responsiveness: Even today, Ethereum can’t cost-effectively support a live order book. Storing and updating thousands of bids and asks in real time is data-intensive and expensive. AMMs, by contrast, store state data and rely on formulaic pricing, making them vastly cheaper and more efficient to run on-chain.

How Do Automated Market Makers Work?

The Role of Liquidity Pools

We’ve already established that AMMs operate through smart contracts, managing a pool of tokens—these are called liquidity pools. They’re the foundation of how decentralized exchanges function.

Every AMM pool consists of a pair of tokens, since all trades require swapping one asset for another. The most common pairs are against the network’s native token (like ETH, SOL, or ATOM) or against stablecoins (like USDC, USDT, or USDD), which provide a stable reference price. These pairs are essential to maintaining fluid, reliable markets in a system without central intermediaries.

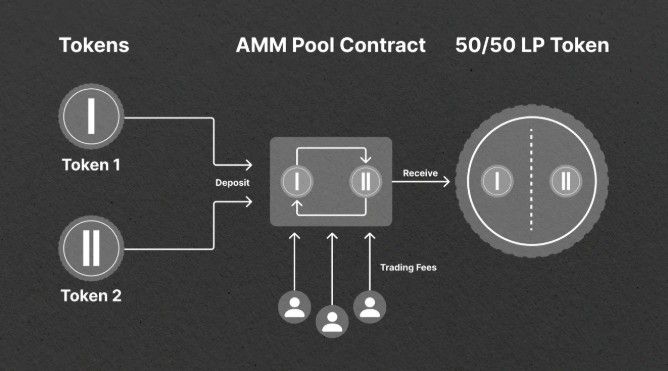

The process is simple: users deposit equal value amounts of both tokens into the pool—say ETH and BTC—to provide liquidity. In return, they receive LP (liquidity provider) tokens that represent their share of the pool. When trades occur, a small fee is taken and distributed proportionally to LPs as a reward. This incentive system encourages users to “fund” the market.

Liquidity Pools Operate in Trading Pairs | Image via Liquidity Provider

Liquidity Pools Operate in Trading Pairs | Image via Liquidity ProviderWhen a trader wants to swap tokens—for example, trading BTC for ETH—they don’t need to wait for a seller. They interact directly with the pool, adding BTC and withdrawing ETH. This swap changes the balance between the two assets in the pool, which in turn shifts the price.

How AMMs Calculate Prices

In traditional markets, price discovery is driven by the interplay of supply and demand across an open order book. Traders post their buy and sell offers, and the current market price is simply the level at which these offers intersect. More bids and asks create a deeper, more accurate market.

AMMs approach this differently. Instead of matching traders, the smart contract sets prices based on the relative ratio of assets in the pool. The logic is simple: as the supply of one token decreases, its price rises. Therefore, if a large number of users are buying ETH in an ETH/BTC pool, the ETH in the pool decreases, and the price increases. The reverse happens when users sell ETH.

This formulaic pricing means more liquidity in a pool results in smaller price shifts per trade—creating a smoother, more predictable market.

How Prices Are Determined in AMMs

The pricing model used in most AMMs was pioneered by Uniswap, which introduced a simple yet powerful formula that’s become the foundation for how decentralized exchanges operate. Rather than taking and matching orders like traditional exchanges, AMMs rely on a formula hardcoded into the pool’s smart contract to calculate the token price after every trade.

This model is not just novel—it’s practical. Executing trades via formula rather than an order book makes AMMs cheaper and more efficient to run on a blockchain, where data storage and computation come at a premium.

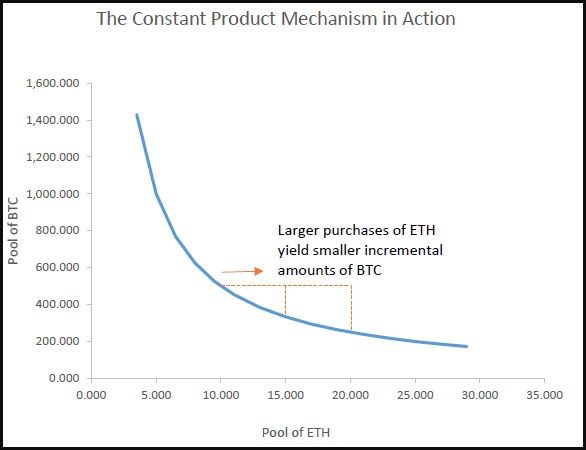

The core formula used in AMMs like Uniswap v2 is:

x * y = k

Here:

- x is the amount of one token in the pool (say ETH),

- y is the amount of the paired token (say BTC),

- and k is a constant that must remain unchanged after each trade.

Let’s say a pool contains 10 ETH and 1 BTC, making k = 10. If a trader adds 1 ETH to the pool, k must still equal 10, so the amount of BTC must decrease accordingly, resulting in less BTC received per ETH the more ETH is added. This is how the price dynamically adjusts to preserve the balance.

This leads to slippage, a natural outcome of how AMMs work. Slippage is the difference between the expected price and the actual execution price. It happens because your trade alters the pool’s balance. The larger the trade relative to the pool size, the more it distorts the ratio and changes the price.

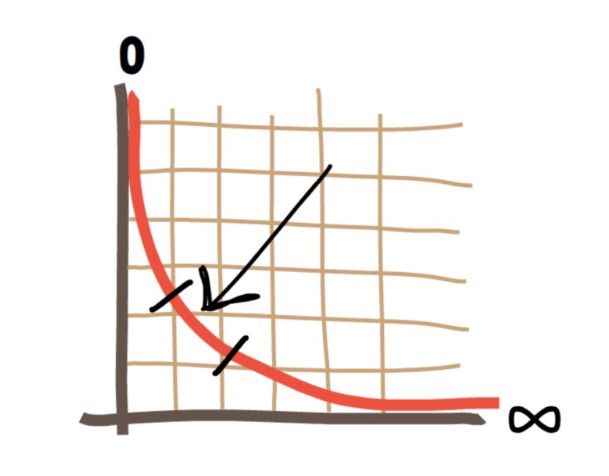

The Curve Defines How Price Moves With Liquidity | Image via Collective Shift

The Curve Defines How Price Moves With Liquidity | Image via Collective ShiftSlippage exists in traditional markets, too, like stocks or commodities, but it’s rarely noticeable for retail traders because those markets have enormous liquidity. In crypto, where liquidity can be shallow, slippage becomes more visible. That’s why large trades often take place via OTC (over-the-counter) desks rather than open market AMMs.

Slippage is not a bug—it’s an expected behavior. It can’t be avoided, only reduced. The more liquidity a pool has, the smaller the price impact of any single trade.

What makes AMMs powerful is their determinism. Since the pool's liquidity is public, traders can calculate their expected slippage in advance. Most DEXs display this information before confirming a swap. And the higher the pool’s liquidity, the more favorable those numbers tend to be.

An Example:

Let’s say an ETH/WBTC liquidity pool starts with:

10 ETH

1 WBTC

So, x * y = k → 10 * 1 = 10

Now, a trader wants to swap 1 ETH for WBTC. After the trade, the pool will have 11 ETH, and we need to solve for how much WBTC remains to keep k = 10:

11 * y = 10 → y = 10 / 11 ≈ 0.909

So the pool now holds 11 ETH and 0.909 WBTC. That means the trader receives:

1 - 0.909 = 0.091 WBTC

The effective price paid was 1 ETH = 0.091 WBTC, which is higher than the original price of 1 ETH = 0.1 WBTC due to slippage.

This example shows how adding ETH reduces its relative value in the pool and increases the price of WBTC. Every trade shifts the price slightly, based on how much it alters the token balance.

Arbitrage and Price Balancing

If you’re wondering, “If each pool’s liquidity determines the relative price of an asset pair, then can the same asset have different prices in different pools?”—you’re absolutely right. And yes, this happens quite often.

That discrepancy leads us to one of the core mechanics of DeFi markets: arbitrage. Arbitrage is a price-balancing force that helps align the price of the same asset across different pools, decentralized exchanges, and even centralized platforms.

Here’s how it plays out in practice.

Imagine an ETH/USDC pool on a DEX like Uniswap. A sudden wave of ETH purchases causes ETH to be withdrawn from the pool, while USDC flows in. Because of the constant product formula, ETH's relative scarcity in the pool pushes its price higher, perhaps to $3,120, while the price of ETH on Coinbase remains at $3,100.

An arbitrageur notices this gap. They buy ETH on Coinbase for $3,100 and immediately sell it on the Uniswap ETH/USDC pool for $3,120. This action replenishes ETH in the pool, increases its liquidity, and nudges the pool’s price back down tow ard the broader market level.

This process isn’t just a curiosity—it’s essential for DeFi to function properly. Arbitrage keeps AMM prices aligned with the rest of the market, ensuring users get fair and accurate pricing even though AMMs operate in isolation from traditional order books.

And this isn’t done manually.

In today’s DeFi landscape, arbitrage is a real business. Sophisticated traders and institutions run bots that constantly scan hundreds of pools and exchanges for price discrepancies. With enough capital and speed, they can execute near risk-free trades across these gaps, often earning solid returns on volume alone. In fact, arbitrage profits are so significant that they’ve become one of the dominant forces in high-frequency on-chain activity.

While users rarely notice these price imbalances in real time, it's this constant behind-the-scenes arbitrage that helps AMMs stay competitive and aligned with the rest of the crypto market.

Key Features and Benefits of AMMs

Automated Market Makers aren’t just a new way to trade—they’re a foundational layer of the DeFi ecosystem. Here are the key features and benefits that make AMMs so effective and widely adopted:

- Liveness: AMMs stay online as long as the blockchain they operate on is live. There’s no need for centralized infrastructure or intermediaries. Anyone with a crypto wallet can interact with the pool directly, preserving the self-custodial, always-on ethos of DeFi.

- No Counterparty Required: In traditional markets, you need someone on the other side of your trade. With AMMs, the pool is the counterparty. That means you don’t have to wait for an order to be matched—your trade is executed instantly at the price determined by the pool’s algorithm.

- Democratized Liquidity Provision: Anyone can become a market maker. By depositing tokens into a pool, users earn a share of the trading fees. This model created an entirely new DeFi economy built around LP tokens, yield farming, governance rights, and arbitrage. The opportunity to earn yield from idle assets brought in millions of users and billions in liquidity.

- Token Pair Flexibility: AMMs allow any two tokens to be paired and traded, even if they have no existing market history. This flexibility fuels innovation, enabling users to create custom markets for niche tokens or experimental assets without needing exchange approval.

- Token Bootstrapping: Many new crypto tokens launch by creating liquidity pools. This allows immediate trading and organic price discovery, without needing a CEX listing. It’s one of the easiest ways to kickstart a token’s market presence.

- Market-Driven Management: Liquidity pools are self-adjusting. The balance between supply, fees, and trading activity ensures that pools maintain themselves. Arbitrage keeps prices aligned. Incentives attract capital. There’s no need for manual rebalancing.

- Permissionless Access: Platforms like Uniswap, Curve, and Balancer allow anyone to launch a pool. You don’t need to apply, register, or get whitelisted. Just deploy a smart contract and go.

- Composability: Because AMMs are built on smart contracts, they can be stacked and integrated into larger systems. A single pool might feed a DEX, which plugs into an aggregator, which feeds into a yield optimizer. This “money Lego” effect is one of DeFi’s biggest strengths.

- Transparency: All trades, fees, and pool balances are publicly visible on-chain. Users can verify activity, track LP positions, and analyze markets in real time—something most centralized platforms don’t offer.

Together, these features make AMMs not just efficient but also deeply flexible and user-driven financial primitives.

Common Examples of AMM Protocols

There are hunters of AMM protocols in Defi, most of them copy the AMM design of a select few AMM protocols like Uniswap, which have created an industry benchmark. Here are a few common examples you'll likely stumble on in Defi(stats via DefiLlama):

Uniswap: The Gold Standard

Uniswap pioneered the AMM model and remains a dominant force in decentralized exchanges. As of June 2025, it boasts nearly $5 billion in Total Value Locked (TVL) across 38 chains, primarily within the Ethereum Virtual Machine (EVM) ecosystem. Uniswap's iterative designs, from V2 to V3, have set industry benchmarks, with V3 introducing significant improvements in liquidity efficiency.

Uniswap is the Most Popular AMM | Image via Uniswap

Uniswap is the Most Popular AMM | Image via UniswapCurve DEX: Liquidity Layer of Web3

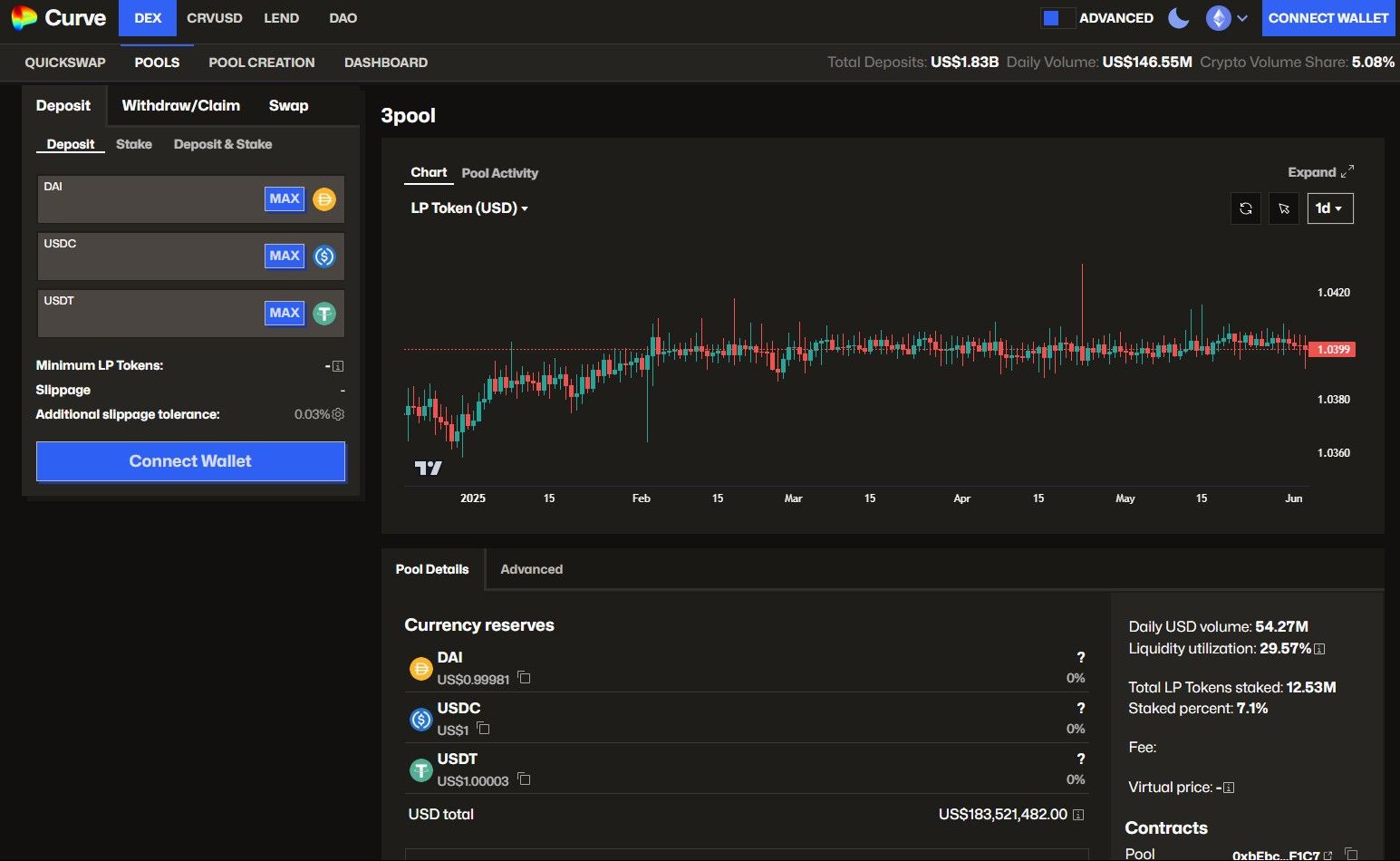

Curve specializes in stablecoin swaps, offering low-slippage exchanges between similar assets like USDC and USDT. With approximately $2 billion TVL in June 2025 and operations on 22 chains, Curve is integral to stablecoin liquidity in DeFi. Its vote-escrowed governance model has influenced numerous other protocols seeking effective decentralized governance mechanisms.

Curve is Known for Stableswap Pools | Image via Curve

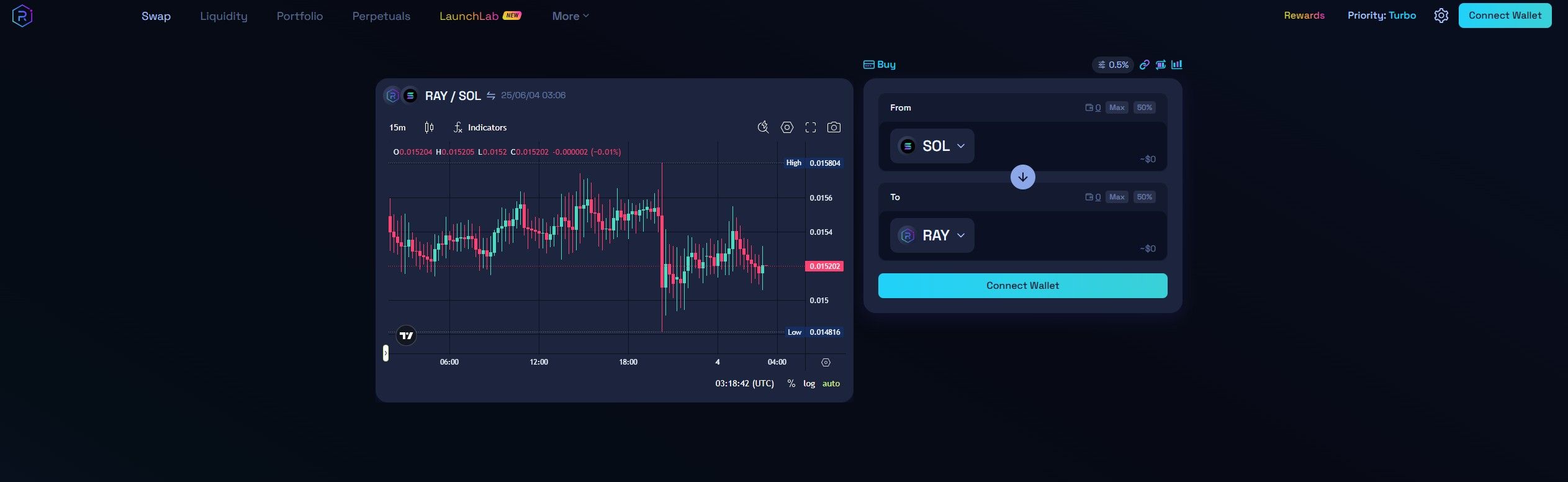

Curve is Known for Stableswap Pools | Image via CurveRaydium: Solana’s Premier AMM

Raydium stands as the leading AMM on the Solana blockchain, leveraging Solana's high throughput and low fees. As of June 2025, it holds around $1.9 billion in TVL. Raydium integrates with OpenBook, Solana's central limit order book, enabling access to broader liquidity and facilitating features like limit orders. Its AcceleRaytor launchpad supports new project token launches, enhancing its role in the Solana DeFi ecosystem.

Raydium is the Flagship DEX on Solana | Image via Raydium

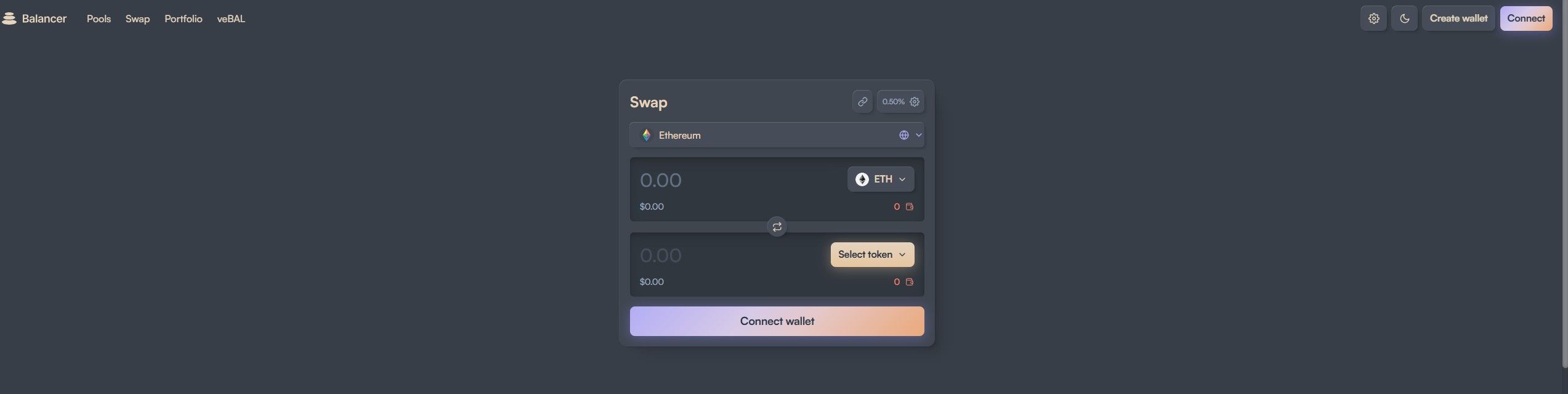

Raydium is the Flagship DEX on Solana | Image via RaydiumBalancer: Multi-Asset Liquidity Pools

Balancer introduces flexibility with pools supporting up to eight tokens in customizable ratios, diverging from the typical two-token model. This design allows for dynamic portfolio management and acts as a decentralized index fund. With about $800 million TVL in June 2025, Balancer's Smart Order Routing ensures efficient trade execution across its diverse pools.

A Look at Balancer's UI | Image via Balancer

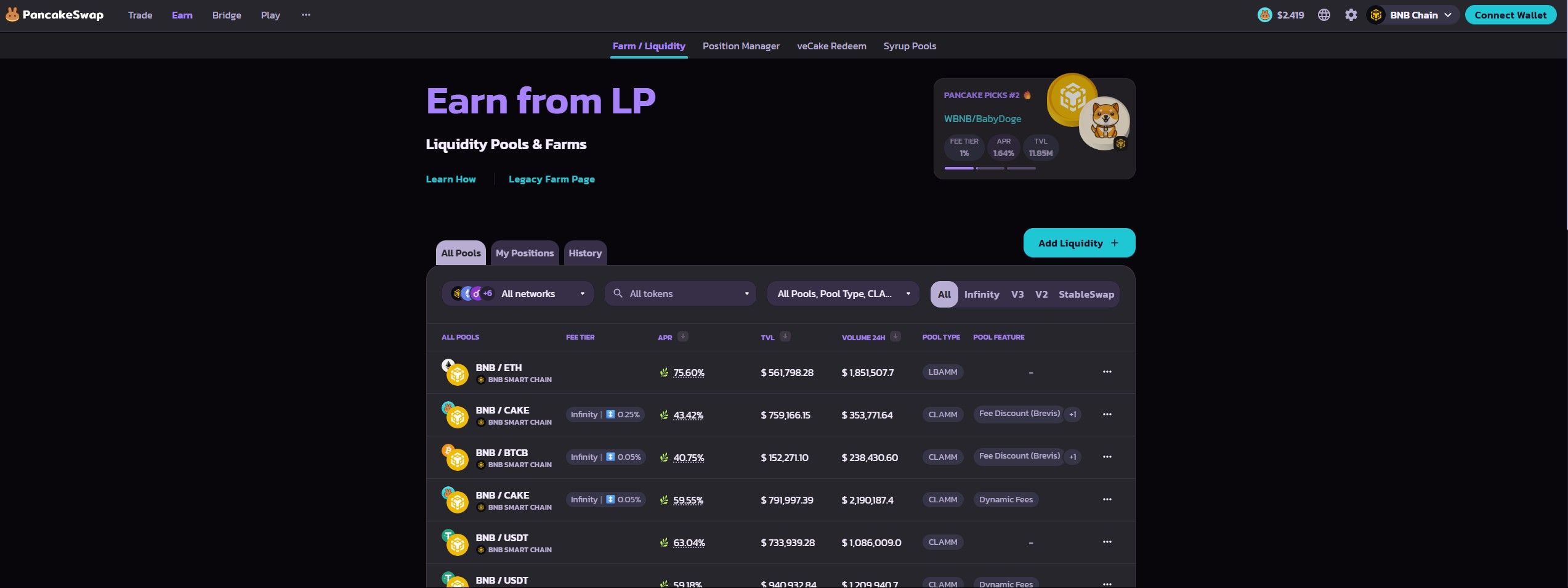

A Look at Balancer's UI | Image via BalancerPancakeSwap: BNB Chain’s Flagship AMM

Operating primarily on the BNB Smart Chain, PancakeSwap is the go-to AMM for BEP-20 token swaps. As of June 2025, it manages approximately $1.8 billion in TVL. PancakeSwap offers a suite of features, including yield farming, staking, and a lottery system. Its latest iteration, PancakeSwap Infinity, introduces modular design elements, enhancing flexibility and future-proofing the platform.

PancakeSwap is the Most Popular in the Binance Ecosystem | Image via PancakeSwap

PancakeSwap is the Most Popular in the Binance Ecosystem | Image via PancakeSwapThese protocols exemplify the diversity and innovation within the AMM space, each contributing to the evolving DeFi ecosystem through unique features and community-driven development. Check out the Best DEXs in 2025 on the Coin Bureau.

AMM Standards Through the Years

Since its inception, Uniswap has led the way in Automated Market Maker design. Its pool contracts are the most widely forked and replicated across the DeFi ecosystem. Each new version of Uniswap didn’t just improve the protocol—it often set the standard for the entire AMM landscape.

Let’s look at how these standards evolved through Uniswap V2, V3, and the upcoming V4, and what each brought to the table.

Uniswap V2: The First Breakout Model

Uniswap V2 was the first AMM design to achieve mass adoption. It used the constant product formula (x * y = k), and its simplicity made it cheap to operate even on gas-heavy blockchains like Ethereum. V2 made DeFi trading accessible, decentralized, and composable.

But it had one major flaw: inefficient liquidity distribution.

In most traditional markets, if you open the order book, you’ll notice a clear pattern—most orders are stacked close to the current market price. This is because traders want their orders filled, so they naturally place them near where the action is.

If V2’s liquidity model were visualized as an order book, it would look bizarre: orders equally spread out from $0.01 to $100,000 regardless of the actual market price. That means only a small portion of the pool’s liquidity is actually useful at any given moment, while the rest sits idle at irrelevant price levels. The result? Significant slippage, especially for larger trades.

Uniswap V3: Concentrated Liquidity Pools

Uniswap V3 introduced a powerful mechanic that redefined how AMMs manage liquidity—concentrated liquidity.

Instead of spreading liquidity across the entire price spectrum, V3 lets liquidity providers specify a price range in which their assets will be used for trades. Outside that range, the funds are inactive.

Think of it like customizing your own mini order book. LPs can “place their liquidity” right around the market price, where it’s most likely to be used and earn fees. This makes the pool dramatically more capital-efficient and reduces slippage across the board.

How Ranges Look on the Price Curve | Image via Finematics

How Ranges Look on the Price Curve | Image via FinematicsSome LPs even set wider ranges or place liquidity far from the current price to anticipate large price swings and capture long-tail volume. This design brought DeFi liquidity provisioning much closer to professional market-making.

V3 quickly replaced V2 as the go-to model and is still the most commonly used and forked AMM structure in 2025.

Uniswap V4: Customizable AMMs for a Modular Future

Uniswap V4 takes the evolution a step further—not by changing how pricing works, but by changing how pools behave.

The standout feature is the introduction of “hooks”—customizable logic that developers can add to a liquidity pool. Hooks allow for advanced functions like:

- Setting dynamic fees that change based on market conditions,

- Adding on-chain limit orders,

- Syncing pool logic with external events or oracle data.

Think of V4 like an app store for liquidity pools. Instead of being limited to one-size-fits-all pools, developers can now design bespoke trading experiences, all while sharing the same infrastructure and routing system.

V4 also introduces a singleton architecture, which drastically reduces gas costs by storing all pools in a single smart contract. This change improves composability and makes it cheaper to interact with multiple pools in a single transaction.

From V2’s foundational simplicity to V3’s liquidity precision and now V4’s customizability, AMMs have come a long way. Each version has made on-chain markets more efficient, more powerful, and increasingly aligned with how professional markets operate, without sacrificing the decentralization that makes DeFi distinct.

Risks and Challenges of AMMs

While Automated Market Makers (AMMs) have revolutionized decentralized trading, they come with inherent risks that both liquidity providers (LPs) and traders must navigate. Understanding these challenges is crucial for informed participation in DeFi ecosystems.

Impermanent Loss (IL)

Impermanent loss occurs when the price of assets in a liquidity pool diverges from their price at the time of deposit. LPs deposit equal values of two tokens; if one token's price increases or decreases significantly, the pool's algorithm adjusts the token ratios, potentially leading to a loss compared to simply holding the assets. This loss is termed "impermanent" because it may be mitigated if prices return to their original state. However, if an LP withdraws liquidity while prices are still divergent, the loss becomes permanent. Providing liquidity is profitable only when the fees earned outweigh the impermanent loss incurred. Therefore, LPs must assess potential IL against expected fee returns before committing assets to a pool.

Slippage Risk

Slippage refers to the difference between the expected price of a trade and the price at which it is executed. In AMMs, slippage is influenced by the pool's liquidity; low-liquidity pools are more susceptible to significant price changes from individual trades. Traders can mitigate slippage by selecting pools with higher liquidity and setting acceptable slippage tolerance levels when initiating swaps. Most decentralized exchanges (DEXs) provide tools to estimate slippage before trade execution, allowing users to make informed decisions.

Loss Versus Rebalancing (LVR)

LVR quantifies the loss LPs experience when arbitrageurs rebalance a pool to align its prices with external markets. For instance, if ETH trades at $2,000 on a centralized exchange but remains at $1,900 in an AMM pool, arbitrageurs will buy ETH from the pool at the lower price and sell it on the centralized exchange, profiting from the price difference. While this activity restores price parity, LPs incur a loss because their assets are sold below market value. LVR is an inherent cost of providing liquidity in AMMs and must be considered when evaluating the profitability of liquidity provision.

MEV Risks

Maximal Extractable Value (MEV) represents the profit that can be extracted by reordering, including or excluding transactions within a block. Both traders and LPs are vulnerable to MEV strategies, such as sandwich attacks.

- For Traders: An attacker observes a pending large trade, places a buy order before it to drive up the price, and then sells after the trade executes, profiting from the price movement. This results in the trader receiving a worse price than anticipated.

- For LPs: An attacker temporarily adds liquidity just before a large trade to earn a disproportionate share of the fees, then withdraws immediately after, leaving long-term LPs with less fee revenue and exposure to market volatility.

These strategies exploit the transparent nature of blockchain transactions and can erode the profitability of both trading and liquidity provision.

Smart Contract Risks

AMMs operate through smart contracts, which, while eliminating intermediaries, introduce technical risks. Vulnerabilities in smart contract code can be exploited by malicious actors, leading to significant financial losses. For example, the pETH/ETH pool exploit resulted from a flaw in the smart contract's implementation, allowing an attacker to manipulate the pool and extract funds. Such incidents underscore the importance of rigorous code audits and the inherent risks of interacting with complex smart contracts.

Understanding these risks is essential for anyone participating in AMMs, whether as a trader or liquidity provider. While AMMs offer innovative solutions for decentralized trading, they also require users to be vigilant and informed about the potential challenges involved.

The Future of AMMs in DeFi

As decentralized finance (DeFi) matures, Automated Market Makers (AMMs) are evolving beyond their foundational designs to meet the demands of a more interconnected and sophisticated financial ecosystem. Several key innovations are steering this transformation

1. Chain Abstraction and Cross-Chain Liquidity

The rise of chain abstraction is redefining user interaction with AMMs. Solver networks now facilitate seamless token swaps across multiple blockchains, allowing users to trade assets without concerning themselves with the underlying chains. These networks orchestrate complex transactions by routing through various liquidity pools and decentralized exchanges (DEXs) across different platforms, effectively making AMMs integral components of a broader, cross-chain liquidity infrastructure. This development enhances accessibility and efficiency in DeFi trading.

2. Layer 2 Advancements and On-Chain Order Books

Layer 2 (L2) scaling solutions are significantly improving blockchain throughput and reducing transaction costs. These enhancements are making it feasible to implement more complex trading mechanisms, such as on-chain order books, which were previously impractical due to scalability constraints. AMMs are adapting by incorporating features like "hooks"—customizable logic that allows for dynamic fee structures, on-chain limit orders, and integration with external data sources. This evolution brings AMMs closer to the functionalities of centralized exchanges while maintaining decentralization.

3. Hybrid AMM Models

Innovations are emerging that combine the strengths of traditional order book models with AMMs. For instance, Proactive Market Makers (PMMs) utilize oracle data to adjust prices proactively, aiming to reduce impermanent loss and offer better pricing. Hybrid AMMs blend features from different models to cater to specific asset characteristics or trading pairs, enhancing flexibility and efficiency in liquidity provision.

Final Thoughts

Automated Market Makers have redefined how assets are traded on the blockchain. From Uniswap’s early liquidity pools to today’s cross-chain, modular ecosystems, AMMs have evolved into one of DeFi’s most powerful building blocks.

We’ve explored how they work, the different designs they’ve gone through, the risks they carry, and how they continue to push the boundaries of decentralized finance. Whether it’s enabling 24/7 liquidity, lowering barriers for new tokens, or powering complex trading strategies, AMMs are at the core of on-chain market infrastructure.

If you're new to AMMs, consider experimenting with a platform like Uniswap, Curve, or PancakeSwap using small amounts. And if you're ready to dive deeper, explore our dedicated protocol guides on Coin Bureau to learn how to make the most of DeFi's evolving toolkit.