At first glance, the crypto and forex markets appear to have many similarities. Both are global, highly liquid markets that operate around the clock. Both center on the exchange of currencies — fiat in the case of forex, and digital assets in the case of crypto. Both attract traders seeking to profit from price movements and market inefficiencies.

It’s only natural for an FX trader to look at crypto, or for a crypto trader to eye forex, and wonder whether the other market is a logical next step. On the surface, these arenas appear adjacent in style and structure.

But beneath that surface, there are striking differences in market depth, volatility, accessibility, and regulatory dynamics. This article unpacks those differences to help beginner traders understand where each market shines, where the risks lie, and which might be the better fit for their goals and experience level.

Key Takeaways

- Crypto and forex trading both involve 24/7 global currency markets, but differ significantly in structure, volatility, and regulatory oversight.

- Forex markets are more stable and governed by macroeconomic forces, while crypto markets are more volatile, speculative, and driven by narratives, innovation, and community trends.

- Crypto trades 24/7, while forex is limited to five days a week, making crypto more accessible but also riskier due to continuous exposure.

- Security and regulation differ: Forex is tightly regulated with investor protections, while crypto varies—DEXs offer more autonomy, but less formal oversight.

- Beginners may find crypto more approachable with smaller capital, easier access, and user-friendly platforms, while forex suits those with a stronger grasp of global economics and risk control.

What is Forex Trading

Forex (foreign exchange, or FX) is a global, decentralized over-the-counter (OTC) marketplace where participants buy, sell, and exchange national currencies. Being OTC means there is no central exchange or clearinghouse — rates are determined through direct trades between parties worldwide.

Imagine this in the U.S.: a mid‑sized import firm uses a bank’s trading desk (or an electronic network like Reuters or EBS) to convert USD to EUR to pay a European supplier. That desk may match the firm with another institution that wants to exchange EUR for USD, thus creating the rate, without any centralized exchange being involved.

Global Market & Trading Hours

Unlike stock markets, which close after trading hours, the forex market operates 24 hours a day, five days a week, spanning major financial centers such as Sydney, Tokyo, London, and New York. For retail traders, this means round-the-clock access from homes, mirroring crypto’s continuous availability but with deeper institutional participation.

Market Size and Liquidity

The forex market dwarfs all others—about $7 trillion is traded daily across spot, swaps, forwards, and options.

Most liquid currency pairs (so‑called “majors”) include:

- EUR/USD (~23–30%)

- USD/JPY (~13–14%)

- GBP/USD (~9–11%)

- Others: AUD/USD, USD/CAD, USD/CHF.

Example: EUR/USD alone sees around $1.7 trillion in daily volume.

This extraordinary scale yields tight bid-ask spreads, deep liquidity, and rapid execution, particularly during busy session overlaps.

Forex Is An OTC Marketplace Where Participants Buy, Sell, And Exchange National Currencies. Image via Shutterstock

Forex Is An OTC Marketplace Where Participants Buy, Sell, And Exchange National Currencies. Image via ShutterstockKey Players In The Forex Market

Below is a breakdown of the key market participants and their typical daily volume contributions:

| Participant | Share of Market Volume | Role |

|---|---|---|

| Commercial banks | Backbone—interbank market (~50%+) | Provide liquidity; trade for clients and proprietary use |

| Central banks | Varies, but large when active | Intervene to stabilize currency (e.g., rate adjustments) |

| Institutional funds | Hedge funds, pension, etc. (~10%) | Speculative trades, carry strategies |

| Corporations | Small but regular flows | Hedging trade/currency exposure—imports, payroll |

| Retail traders | ~5–10% of spot volume ($300B+) | Access market via brokers; margin-based speculative trading |

Competitiveness for Retail Traders

Retail traders now enjoy access via online platforms, but they face stiffer competition:

- They trade against brokers/market makers who often quote slightly wider spreads, meaning each trade costs more to enter and exit.

- They don’t access interbank pricing directly—retail quotes are aggregated from institutional liquidity providers.

- That said, high overall liquidity, especially in majors, means tight spreads and fast execution, making forex accessible yet still challenging for beginners who must learn to trade with discipline and risk control.

Overall, the forex market is an incredibly competitive space for individual traders, as they compete directly with institutions that can execute trades more quickly than retail traders and often at more favorable rates.

What is Crypto Trading

Crypto trading involves buying, selling, or exchanging cryptocurrencies. It takes place via two main channels:

- On‑chain, peer‑to‑peer (P2P) trading through DEXs (decentralized exchanges), where smart contracts match trades directly between users without intermediaries, uses smart contract-managed liquidity pools to facilitate swaps.

- Centralized exchanges (CEXs) such as Binance or Coinbase, where users deposit funds and trade via an order book, similar to a brokerage system.

Contrast with forex: Unlike the OTC structure of forex, on-chain trading is fully transparent and executed peer-to-peer, whereas CEXs operate as intermediate platforms.

Unlike The OTC Structure Of Forex, On-Chain Trading Is Fully Transparent. Image via Shutterstock

Unlike The OTC Structure Of Forex, On-Chain Trading Is Fully Transparent. Image via ShutterstockMarket Traits & Accessibility

- Crypto markets, like forex, operate 24/7—no weekends or overnight stops —unlike traditional stock markets.

- It’s a global market—anyone can trade instantly with anyone anywhere in the world.

- Trading pairs include BTC/USD, ETH/USD, and many altcoin-stablecoin combinations like USDT, USDC, with stablecoins acting as digital, tokenized U.S. dollars, offering a global medium for trade and liquidity.

Common Trading Pairs

- BTC/USDC, ETH/USC, SOL/USDT appear across platforms.

- On DEXs: ETH/USDC, DAI/USDC are hugely popular, and coin-to-coin swaps like UNI/ETH, CAKE/BNB occur frequently.

- Stablecoin pairs (e.g., USDC/USDT) dominate many DEX volume charts, serving as the crypto world’s de facto fiat equivalent.

Evolution Of Crypto Markets

- Early phase: simple P2P setups, followed by the first centralized exchanges, such as Mt. Gox (~2010) and Coinbase (~2012), which established custodial order-book trading.

- Rise of DEXs: Uniswap was launched in 2018 as the first major Automated Market Maker (AMM) and has become a leading platform for liquidity pools.

- Liquidity improvements: Initial pools on Uniswap v1/2 were evenly distributed and thin. Uniswap v3 introduced concentrated liquidity, allowing LPs to allocate funds within custom price ranges, boosting efficiency and tightening spreads to rival traditional venues.

Market Participants & Volume Share

| Participant | Role & Volume Contribution |

|---|---|

| Retail traders | Millions on CEXs (e.g., 300M+ on CEXs globally); they trade via CEXs and DEXs, generally smaller size |

| Institutional traders | Use CEXs and OTC desks for larger orders |

| Liquidity providers (LPs) | On DEXs, provide tokens into pools and earn fees; retail LPs lead in number |

| OTC desks | Handle large off‑exchange trades for institutions and whales |

Retail Competitiveness

- Much like forex, crypto retail traders can access low spreads and deep markets, especially on major tokens.

- But they face gas fees in on-chain trades and slippage during volatile moves.

- CEXs improve efficiency but may include withdrawal delays or custodial risks.

Trading Hours and Market Accessibility

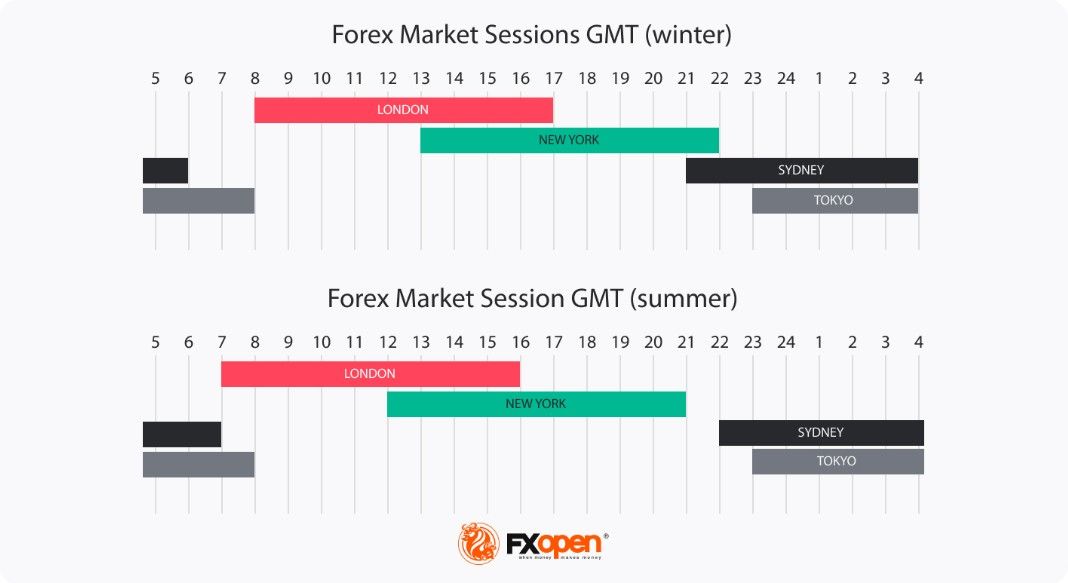

Forex operates through four major trading sessions—Sydney, Tokyo, London, and New York. These sessions overlap to create peak activity periods. However, the forex market closes on weekends, typically shutting late Friday (U.S. time) and reopening early Monday. This window leaves traders exposed to weekend news risks without the ability to adjust positions in real time.

FX Market Trading Hours | Image via FX Open

FX Market Trading Hours | Image via FX OpenCrypto markets, by contrast, are open 24/7, with continuous trading on both centralized and decentralized platforms. There are no breaks—crypto markets trade through holidays and weekends. This constant accessibility draws comparisons to the always-on nature of the internet itself.

These structural differences affect strategy. Forex traders must manage positions around weekend gaps and illiquidity at session starts. Crypto traders must prepare for round-the-clock volatility and potential fatigue. Risk management becomes critical in crypto, where sudden overnight moves can trigger liquidations or slippage at odd hours. Automation tools (bots, alerts) are often used to help mitigate this.

For beginners, the 24/7 nature of crypto may appear attractive, but it also demands more discipline to avoid burnout and overexposure.

Volatility and Price Movements

Volatility is viewed very differently in forex and crypto. In forex, market moves are often seen as bugs, signaling risk and requiring caution. In crypto, however, volatility is often treated as a feature, an intentional source of opportunity. But what volatility means varies significantly between the two: crypto’s swings happen in a self-reinforcing echo chamber, while forex volatility typically stems from major macroeconomic events.

Volatility in Crypto

Crypto is inherently more volatile than forex:

- Lower capital thresholds mean it takes less money to move prices by a percentage point.

- High concentration of holdings and smaller market size amplify moves.

- Smaller overall liquidity compared to FX makes sharp moves easier.

For many traders, volatility is a feature, not a flaw. Crypto volatility has gradually eased with mass adoption and institutional inflows, but remains high due to its speculative nature. Market participants tend to “buy the rumor, sell the news,” creating sharp spikes and quick reversals. Furthermore, crypto is highly sensitive to fear, uncertainty, and doubt (FUD), especially after macro events.

A compelling use case has emerged: crypto’s round-the-clock trading and volatility make it a hedge asset—traders use it to offset after-hours geopolitical risk. During the recent escalation in the Middle East, Bitcoin dropped ~6%, the crypto market cap fell by around 1.5%, and $650 million in liquidations occurred—proof of the ecosystem’s sensitivity.

Classic flashpoints include the 2017 peak (~$20K → 45% correction) and the 2022 Terra collapse, where BTC dropped over 30% in days.

Volatility in Forex

Forex moves are generally more muted:

- Massive market size and deep liquidity dampen price swings.

- Currencies serve as everyday mediums of exchange, fostering stability.

- Price moves are often isolated—one country’s event rarely derails all FX pairs.

- Participants are large, informed, and quick to price in new data.

Still, forex can experience shock events, like the 2015 Swiss Franc unpegging, which caused the USD/CHF to gap by ~30% overnight. However, even such events pale in comparison to crypto’s routine daily swings of 5–20%.

Volatility Is Viewed Very Differently In Forex And Crypto. Image via Shutterstock

Volatility Is Viewed Very Differently In Forex And Crypto. Image via ShutterstockRegulation and Security

When comparing forex and crypto trading, one of the biggest differences lies in regulation and security. Traditional forex markets are tightly regulated with well-established safeguards, while the crypto space remains fragmented and risk-prone, especially for newer investors.

Forex Market Oversight

A robust global regulatory framework governs forex trading. Key principles are outlined in the FX Global Code, which promotes integrity, transparency, and the effective functioning of the wholesale foreign exchange market. Regulatory bodies like the U.S. Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) enforce compliance, ensuring investor protection through strict licensing, capital requirements, and regular audits.

Crypto Market Challenges

Crypto regulation varies significantly. Centralized exchanges (CEXs) are subject to regulatory oversight, requiring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. However, decentralized exchanges (DEXs) operate without centralized control, often lacking formal regulation and investor protection.

Security in crypto trading depends on the platform and user practices. While CEXs offer user-friendly interfaces, they have been targets of significant hacks, such as the $234.9 million WazirX breach in 2024. DEXs, being non-custodial, reduce certain risks but require users to manage their own security measures.

The crypto market has also witnessed numerous scams and rug pulls. Notable incidents include the OneCoin Ponzi scheme, which defrauded investors of approximately $4 billion.

Liquidity and Market Depth

Liquidity plays a crucial role in trading efficiency and execution. While the forex market leads with unmatched depth and volume, the crypto market presents a more fragmented and dynamic landscape. Let’s explore how liquidity and market depth differ between the two.

Liquidity Plays A Crucial Role In Trading Efficiency And Execution. Image via Shutterstock

Liquidity Plays A Crucial Role In Trading Efficiency And Execution. Image via ShutterstockForex Market

The forex market is the most liquid financial market globally, with an average daily trading volume exceeding $7 trillion. Major currency pairs like EUR/USD, USD/JPY, and GBP/USD dominate trading, accounting for over 90% of daily volume. This immense liquidity results in tight bid-ask spreads, often less than 1 pip, and minimal slippage, even for large orders.

However, liquidity varies across currency pairs. While major pairs offer deep liquidity, minor and exotic pairs, such as USD/SGD or EUR/TRY, exhibit lower liquidity, leading to wider spreads and higher slippage. Traders should be cautious when dealing with these pairs, as market depth can be significantly thinner.

Crypto Market

In contrast, the crypto market's liquidity is more fragmented. Centralized exchanges like Binance report average daily volumes around $65 billion, while decentralized exchanges like Uniswap V3 handle significantly less volume. Major cryptocurrencies like BTC and ETH enjoy higher liquidity, resulting in tighter spreads and lower slippage. However, less popular tokens often suffer from low liquidity, leading to wider spreads and increased slippage.

On DEXs, liquidity is provided through automated market makers (AMMs), where users supply token pairs to liquidity pools. While this model offers decentralized trading, it can result in higher slippage, especially for large orders or less liquid tokens.

Tools, Platforms, and Trading Costs

Both markets offer cheap and accessible trading. Retail traders face institutional manipulation in both, but crypto’s growing platform diversity now makes holding and strategic trading cheaper than forex on the right venues.

Forex Trading Infrastructure

Forex trading remains highly accessible, as many brokers allow users to start with as little as $10 in micro-lot accounts. Traders benefit from high leverage (up to 1:500), tight spreads, and low slippage, especially on major pairs. Platforms offer advanced charting and execution tools comparable to those found in equity markets, and registration barriers are relatively low. Geopolitical restrictions are limited in most countries, and access to foreign currencies is straightforward.

That said, institutional dominance in forex markets often drives manipulation during periods of thin liquidity. Swap costs on long-term holds further discourage position trading.

Crypto Trading Platforms

Crypto trading tools have matured rapidly. Centralized exchanges provide simple access to spot and derivatives markets. Dedicated on-chain trading platforms like Hyperliquid now offer high-speed, low-cost perps trading with forex-like leverage, avoiding the gas costs of older DEX swap models. Meanwhile, AI trading bots and custom automation are gaining traction, especially in the less-regulated crypto space.

Trading costs are now comparable to forex — CEX commissions are low, while modern on-chain platforms have greatly reduced gas friction. Importantly, crypto long-term holding often avoids swap costs entirely.

Both Markets Offer Cheap And Accessible Trading. Image via Shutterstock

Both Markets Offer Cheap And Accessible Trading. Image via ShutterstockProfit Potential and Risk Management

Forex trading typically offers modest returns, with successful traders aiming for annual gains of 5–15% through disciplined strategies and leverage. In contrast, crypto trading can yield substantial profits during bull markets, with certain coins delivering returns exceeding 1,000% annually. However, these extraordinary gains come with significant risks, including the potential for devastating losses during market downturns.

Capital Requirements

Forex trading often requires a larger capital base due to its relative stability. Traders may need substantial funds to achieve meaningful profits, especially when targeting small price movements. Conversely, crypto markets, characterized by higher volatility, allow traders to start with smaller capital and still realize significant gains. However, this also means that losses can be equally substantial.

Diversification Strategies

Diversification is crucial in both markets. In forex, traders diversify by engaging in various currency pairs, balancing exposure across different economies. In crypto, diversification involves holding a mix of established coins like BTC and ETH, alongside emerging tokens. This approach helps mitigate risks associated with individual asset volatility.

Risk Management

Effective risk management is essential. Forex traders often employ stop-loss orders and position sizing to control exposure. Crypto traders must be vigilant due to the market's susceptibility to rapid price swings, regulatory changes, and technological vulnerabilities. Utilizing tools like automated trading bots and staying informed about market developments are key strategies for managing risk in both arenas.

Which Market is Best for Beginners?

Choosing between forex and crypto starts with understanding your profile as a trader:

Factor | Forex | Crypto |

|---|---|---|

| Capital requirement | Higher for practical profits | Lower entry viable |

| Interest alignment | Economics, macro | Tech, innovation |

| Learning curve | Tied to global macro | More speculative/narrative |

| Trading hours | 24/5 | 24/7 |

Capital Requirements: Forex often requires larger capital to produce meaningful gains, since currency pairs move within tight ranges. Low capital accounts are harder to scale meaningfully in forex, despite leverage. Crypto’s higher volatility enables traders to start smaller and still see measurable returns, though risks are amplified.

Personal Interest: Tech enthusiasts may naturally gravitate toward crypto, given its blockchain-driven ecosystem, innovation cycles, and 24/7 pace. Economics-driven traders with an interest in macro trends and monetary policy may find forex more intellectually rewarding.

Learning Curve: Both markets require ongoing research and learning. However, forex is more deeply tied to complex global economic forces—GDP data, central bank policy, geopolitics—whereas crypto often follows its own speculative and narrative-driven cycles, which may be easier to grasp for newer traders.

Final Thoughts

While crypto and forex markets share key traits—global reach, 24-hour activity, and currency-based trading—they differ sharply in structure, volatility, and accessibility.

Forex offers deep liquidity, tight spreads, and strong regulatory protections, but typically requires larger capital to generate meaningful returns. For experienced traders who understand global macroeconomics, it can be highly lucrative.

For shorter-term retail traders, especially those already familiar with crypto markets, sticking to crypto, like spot or derivatives, often makes more sense. If you’re seeking a higher-stakes experience, crypto derivatives platforms now offer leveraged trading with market dynamics comparable to FX.

Also Read