Editors Note: This article was written in collaboration with the dappOS team to bring the Coin Bureau community information about the dappOS Intent-Centric operating protocol.

We’ve all heard the criticisms from skeptics and even those of us who have been kicking around the blockchain for a while agree that the most significant hurdle to mass crypto and Web3 adoption is the complicated and clunky user experience and unfamiliar processes that exist in DApps and DeFi protocols.

Navigating around different DApps, bridging tokens, signing transactions, paying gas fees, even the act of setting up a Web3 wallet like MetaMask, backing up recovery phrases and having a little fox pop up on your screen is not a natural or familiar process. It is an understatement to say that DApps and DeFi do not exactly provide a seamless user experience. User intent execution shouldn’t be a ten-step process to get from point A (the intent) to point B (the successful execution of the intent).

Today, we are looking at a project that is looking to solve all that. dappOS is an innovative evolution, long-awaited in the crypto space and a pioneer within intent-centric operating protocols that has garnered the attention of Binance Labs and is collaborating with leading protocols such as QuickSwap, Lido, GMX, Perpetual Protocol, KyberSwap, and others.

In this dappOS analysis piece, we'll delve into the nitty-gritty of a platform that is looking to make the lives of both developers and end users easier and how intent-centric protocols may revolutionize the decentralized application landscape for the better, forever.

From Account Abstraction to Chain Abstraction

As Web3 technology moves towards mass adoption, ensuring a user-friendly experience is crucial. Unlike the early days of blockchain, where users struggled with technical complexities, Web3 should empower users to interact seamlessly with decentralized systems. Learning from Web2's evolution with user-friendly tools like search engines and chatbots, Web3 needs to offer a similar blend of simplicity and power.

Using current Web3 dApps on different chains is often complicated and time-consuming. Users must navigate diverse infrastructures and understand technical details, leading to frustration and a higher potential for exploitation. This complexity arises from the standard method of crafting and signing transactions, which demands specifying every detail for blockchain execution.

As mentioned in an article by technology investment firm Paradigm a few months ago, one of the dominant topics recently has been the discussion around “intents’ and their applications.

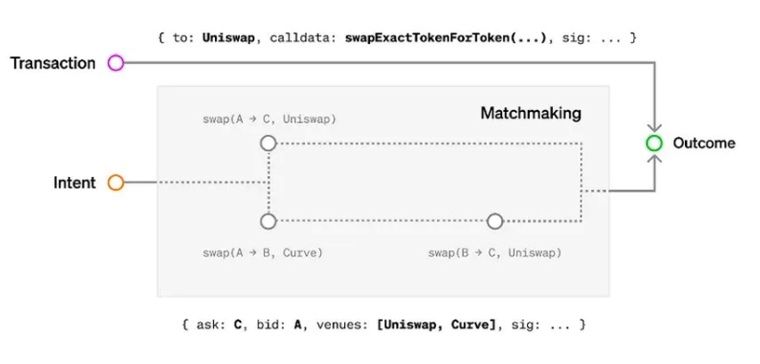

Whereas transactions specify "how" an action should occur, intents focus on "what" the desired outcome should be. For instance, while a transaction might say, "do A then B, pay exactly C to get X back," an intent simply expresses, "I want X and I'm willing to pay up to C." This declarative approach promises exciting UX and efficiency improvements. With intents, users express their goals, leaving the task of achieving them to sophisticated third parties. This differs from today's imperative transaction paradigm where users specify every parameter.

Caption: Image via Paradigm

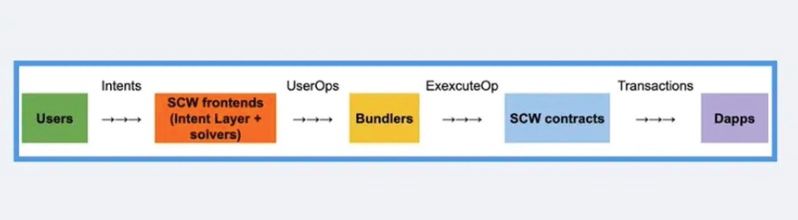

Caption: Image via ParadigmIntents are gaining popularity and are a part of broader UX improvements, including account abstraction. They empower users to define on-chain outcomes and delegate the technical work to third-party solvers. Ultimately, this abstraction layer will make Web3 apps as user-friendly as traditional apps, reducing the steep learning curve and attracting millions of new users. This shift towards intents means future users won't need to worry about technical tasks like transaction submissions and managing network fees. In essence, intents are declarative expressions of "what" users want to happen, rather than prescriptive instructions on "how" it should happen.

Web3's future hinges on user-friendliness and the adoption of concepts like intents. Simplifying complex processes, such as specifying execution paths, is essential to improve user experiences and security in the decentralized world.

For DApps that only deploy on a single chain, trying to gather the attention and use from users on other blockchains is very difficult and costly, which is why many projects choose to launch on multiple chains. The problem with this approach is that expenditures of providing liquidity on multiple chains and maintaining operations while providing support for each chain is burdensome.

dappOS identifies the biggest barrier to Web3 adoption as a lack of an intent-centric approach.

DApps are hard to use. Looking at liquidity farming as an example, users need to go through 5 contract interactions (approve token A/B, add liquidity, approve LP token, deposit) just to participate in liquidity farming. User intent needs to be as seamless in Web3 as it is in Web2. With an intent-centric operating protocol like dappOS, complex transactions will be achievable with one click.

Then there is the issue of trying to access different chains, a process that can take over 10 steps, signing transactions in different wallets and bridging tokens, while also needing to access different DApps. Here is an illustration showing how the process of intent realization works

Caption: Image via twitter.com/TheDeFiSaint

Caption: Image via twitter.com/TheDeFiSaintdappOS was created with the intention of removing the current complexities and making the lives of crypto users and developers easier by making DApps as user-friendly as possible. dappOS creates an intent-centric middle layer between users and infrastructure so that users only need to interact with dappOS and the platform handles all the infrastructure interactions on the backend to execute seamless workflows for the user.

We all understand that in order for DeFi to thrive, it needs to be as easy to use as traditional CeFi platforms like exchanges or online banks.

The primary reason trading volume is considerably higher on CEXes like Binance and Coinbase than on DEXes, is, to put bluntly, because DeFi UX/UI is terrible. Also, a CEX allows users to swap assets across different networks like Cardano to Ethereum in one click and with low fees, something not possible in today’s DeFi ecosystem without jumping through several hoops and paying the transaction fees.

Typically, a user doesn’t care about how a transaction gets done, they just want it done in the most efficient way possible. This is where user intent (intent-centricity) comes in. Say the user intent is to swap BNB for AVAX. On a CEX, it is easy, one click and it's done instantly as the CEX provides the liquidity needed to make this happen and takes care of the dozen or so steps that actually need to make that happen on the back end, and the user is none-the-wiser.

And this is where dappOS comes in building the first Intent-Centric operating protocol.

What is an Intent-Centric Approach?

Intent-centricity represents putting user intent at the forefront of focus. It's not just about understanding their actions; it's about comprehending what they are trying to achieve. This methodology prioritizes the "what" over the "how," striving to provide users with personalized, pertinent, and efficient solutions that cater to their individual needs.

In various sectors, including blockchain technology, this approach is seen as a game-changer. Here, intent-centric protocols are emerging, promising to elevate the user experience to new heights. The Intent-centric model is gaining traction, offering a more accurate understanding of user behaviour and what end goal they are trying to achieve. Ultimately, intent-centricity revolves around placing the user's needs and objectives at the core of design and development while removing the need for the user to understand the infrastructure that is working behind the scenes.

To illustrate this complexity in Web3, let’s consider a simple situation in which a new Web3 user wishes to interact with a dApp on the Arbitrum network, but his/her funds are currently stored on the Ethereum blockchain:

- Visit the dApp’s website

- Attempt to connect your wallet to Arbitrum but discover there are no funds available

- Open a new tab to explore the best way to bridge your funds

- Go to the bridge website

- Connect your wallet to another blockchain (Ethereum)

- Initiate the bridging process to transfer funds from Ethereum to Arbitrum

- Wait for the bridging transaction to complete

- Return to the original tab

- Switch your wallet back to Arbitrum

- Finally, use the dApp on Arbitrum with the bridged funds

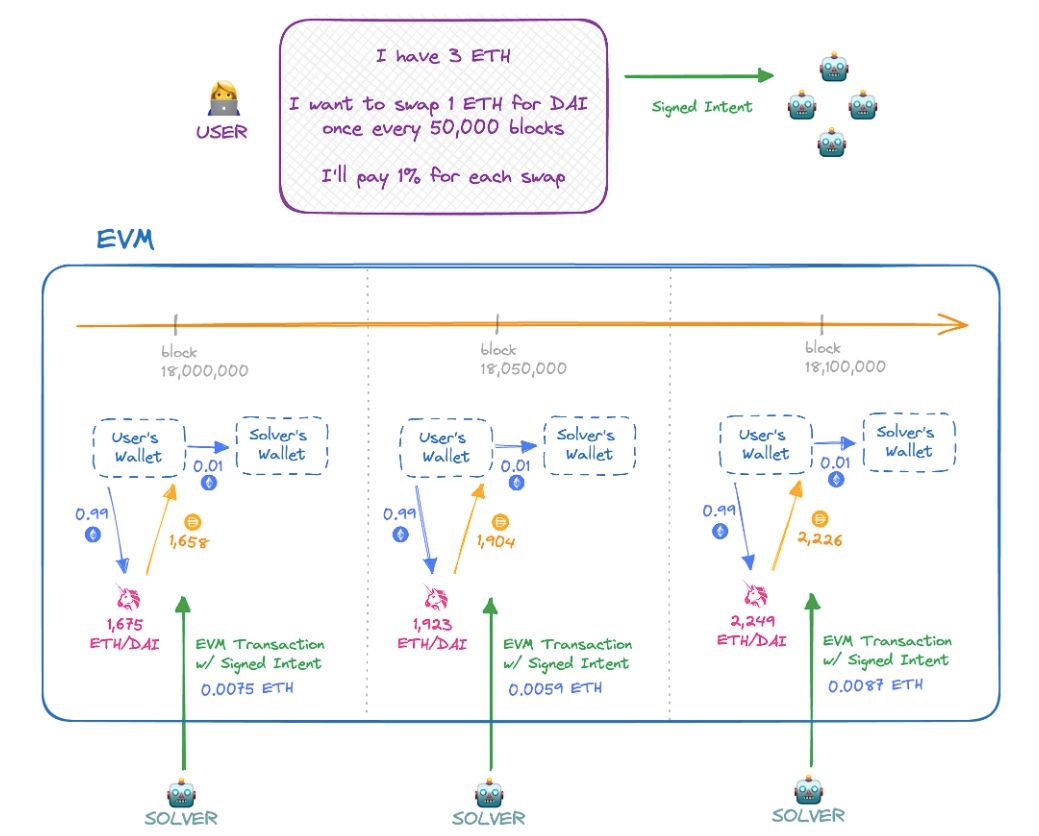

In its current form, DeFi users need to get involved in every step of the process. Here is a great image from Brink that illustrates the complex steps involved with a user who simply wants to DCA 1 ETH for DAI every 50,000 blocks:

Cost-Averaging Intent Architecture. Image via brink.trade

Cost-Averaging Intent Architecture. Image via brink.tradeIf we compare DeFi in its current form to the convenience of a Web2 app like a food delivery app, where the user simply needs to place an order and not get involved with the preparation or transport of the food, or understand the process behind the payment processing or mechanics running within the app, we can see that Web3 DApps have a long way to go. dappOS is bringing that same level of convenience and intent-centricity to Web3 and DApps.

dappOS is bringing the convenience of user-intent-focused transactions that traditionally could only exist on centralized platforms to the world of decentralized applications and Web3.

You can learn more about the technical explanations on intent-centricity in Brink's 3-part series on Intents in Web3.

What is dappOS?

dappOS is a pioneer in intent-centric operating protocols. It was one of the 12 finalists in the Binance Labs Incubation Program Season 5 in November 2022, beating out over 900 other projects that were competing for a spot at the exclusive and elite podium of projects looking for the Binance spotlight.

Image via dappOS

Image via dappOSBinance Labs is highly selective and the world’s leading launchpad and incubator, so when projects make it past the Binance team’s exclusive vetting process, people pay attention.

Image via twitter.com/bsc_daily

Image via twitter.com/bsc_dailyTo quote Yi He, Co-Founder of Binance and Head of Binance Labs:

“Binance Labs has always been actively looking for scalable and downturn-resilient projects that we believe are crucial to the growth of the Web3 industry. Our incubation program aims to empower early-stage Web3 founders and help them reach their full potential, regardless of market conditions” (Source)

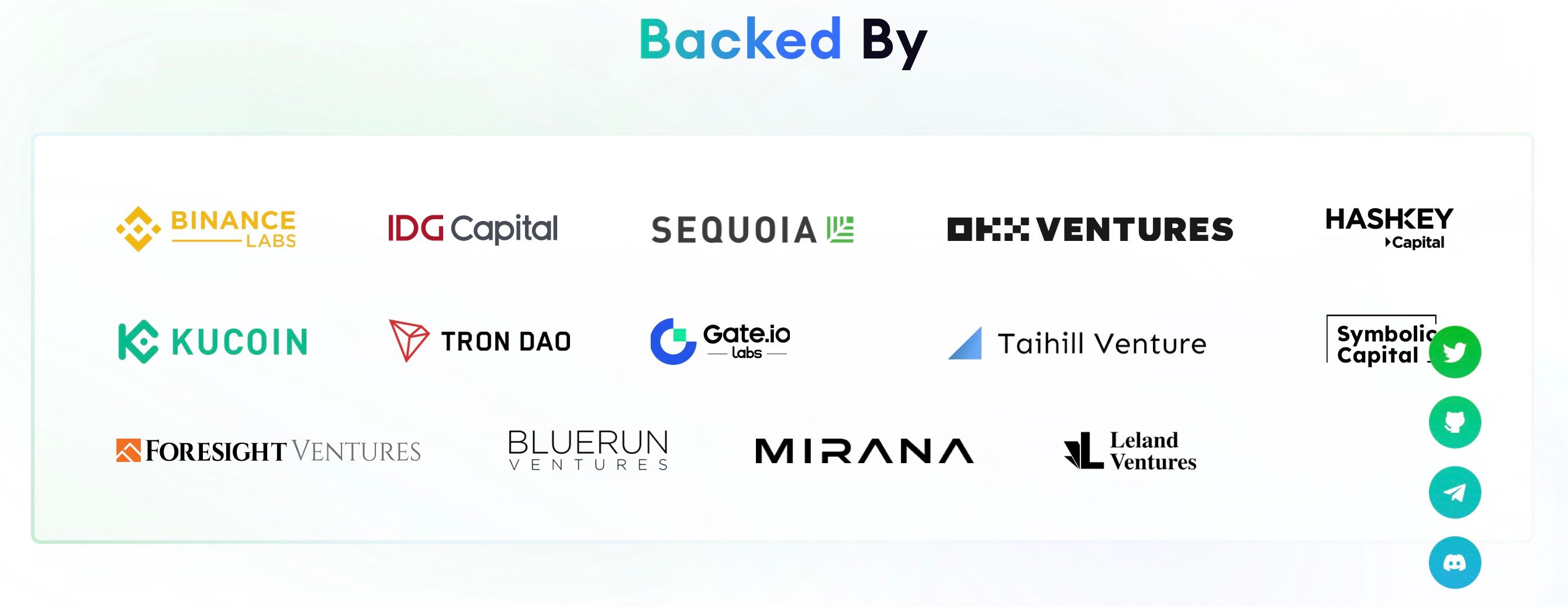

By creating the first intent-centric operating protocol, users will be able to construct valid transactions based on intent, rather than being transaction-specific. This concept has raised enough excitement that dappOS recently closed a seed funding round co-led by IDG Capital and Sequoia China, following the pre-seed funding round by Binance Labs.

It isn’t just Binance Labs That Is Interested in dappOS. An Impressive List of Backers. Image via dappOS

It isn’t just Binance Labs That Is Interested in dappOS. An Impressive List of Backers. Image via dappOSThere are currently over 20 leading protocols and chains such as GMX, Lido, Perpetual, Swap, KyberSwap, Avalanche, Pangolin, MakerDAO, zkSync, KuSwap and others that have reached cooperation with dappOS and integrated dappOS technology.

dappOS V2 aims to provide a CeFi-like user experience with the decentralized nature of DeFi, bridging the two together with new features of unified account, support for task dependency, and the bidding system, making it easier for users to manage their on-chain assets and seamlessly execute complex transactions and take part in the dappOS network.

To put it simply, the complex operations between users and DApps can be handled by dappOS.

Let’s Look at an Example:

A user who primarily frequents the Ethereum ecosystem wants to check out an application in the BSC ecosystem. Unlike the old days, thanks to dappOS, there is no need to switch public chains as the dappOS operating system automatically provides that functionality.

In dappOS’s own words, they “want to take crypto from the millions to the billions by bringing intent-centric solutions to all Dapps.”

dappOS V2 Goes Live with Perpetual Protocol

dappOS isn’t just a theoretical concept, it is already in full swing and being utilized by many leading projects - Perpetual, Benqi, QuickSwap, KyberSwap, GMX, KuSwap, Pangolin and others. With dappOS V2 going live in early September, it already has a working use case with Perpetual Protocol.

dappOS V2 Goes Live with Perpetual Protocol. Image via Yahoo Finance

dappOS V2 Goes Live with Perpetual Protocol. Image via Yahoo FinanceThanks to the dappOS features including unified accounts, task dependency and the new bidding system, user experience on Perpetual Protocol has been greatly enhanced, outclassing the experience that exists on other decentralized trading protocols.

Perpetual is a decentralized perpetual trading protocol running on Optimism, but thanks to dappOS V2, users can now seamlessly connect with Perpetual Protocol across various chains like BNB and Polygon. Traders can settle gas and bridging costs using any tokens of their choice while effortlessly confirming both current and historical transaction information.

Before this integration, engaging with decentralized trading protocols entailed a complex transaction process, especially when attempting to trade between chains, as there were things like gas fees and bridging that needed to be taken into account. dappOS V2 on Perpetual Protocol certainly simplifies the complexity, and honestly, removes the annoyance, by condensing these steps into a single, user-friendly signature.

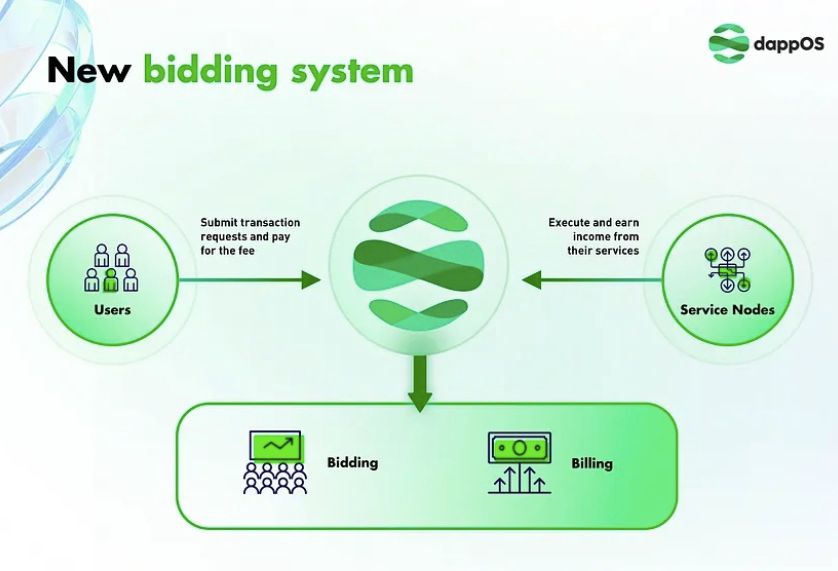

The dappOS V2 integration with Perpetual Protocol also enhanced the bidding system, with advanced features for bidding and billing. This innovative system empowers nodes to actively participate in the network, enabling them to generate revenue through their services. For users, this translates into heightened efficiency and cost-effectiveness as they have the freedom to select nodes that best suit their transaction needs.

How does dappOS V2 Work?

dappOS V2 represents a significant shift in terms of functionality and user experience that stands to revolutionize multi-chain operations, offering a host of advantages that include:

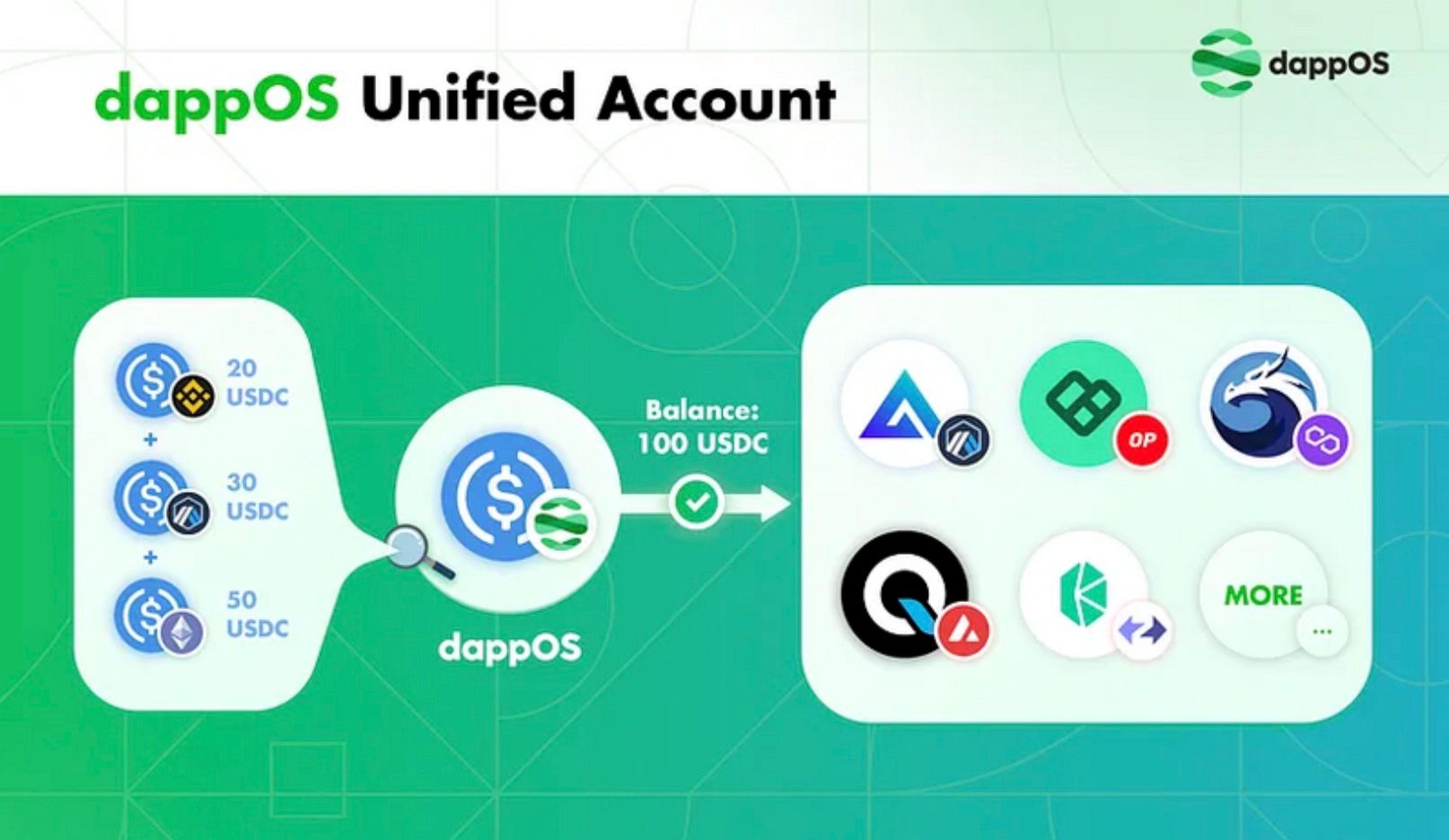

DappOS V2 Unified Account

dappOS V2 Unified Account is a contract wallet based on Account Abstraction. In blockchain, account abstraction is a way to separate the management of your funds from using smart contracts. In simple terms, it means you can use smart contracts to handle your money without having to hand over full control of your funds to the smart contract. This is important because it enhances user experience and security while still ensuring the user retains full access to their wallet.

Image via dappOS

Image via dappOSFor instance, consider MetaMask, a common browser-based wallet. It functions as an Externally Owned Account (EOA) and can't execute smart contracts directly. This limits its use to scenarios where users need to give up control of their accounts. In contrast, contract accounts can deploy smart contracts, making wallets more versatile and customizable.

Compared to the ordinary EOA, dappOS V2 unified account can realize gas payments and provide the basis for automating the execution of complex workflows that can be combined into a seamless flow in the workflow process. Virtual wallets will also be able to support batch processing without the need to deploy new contracts. It will automatically create these wallets for users the first time they interact with a new chain.

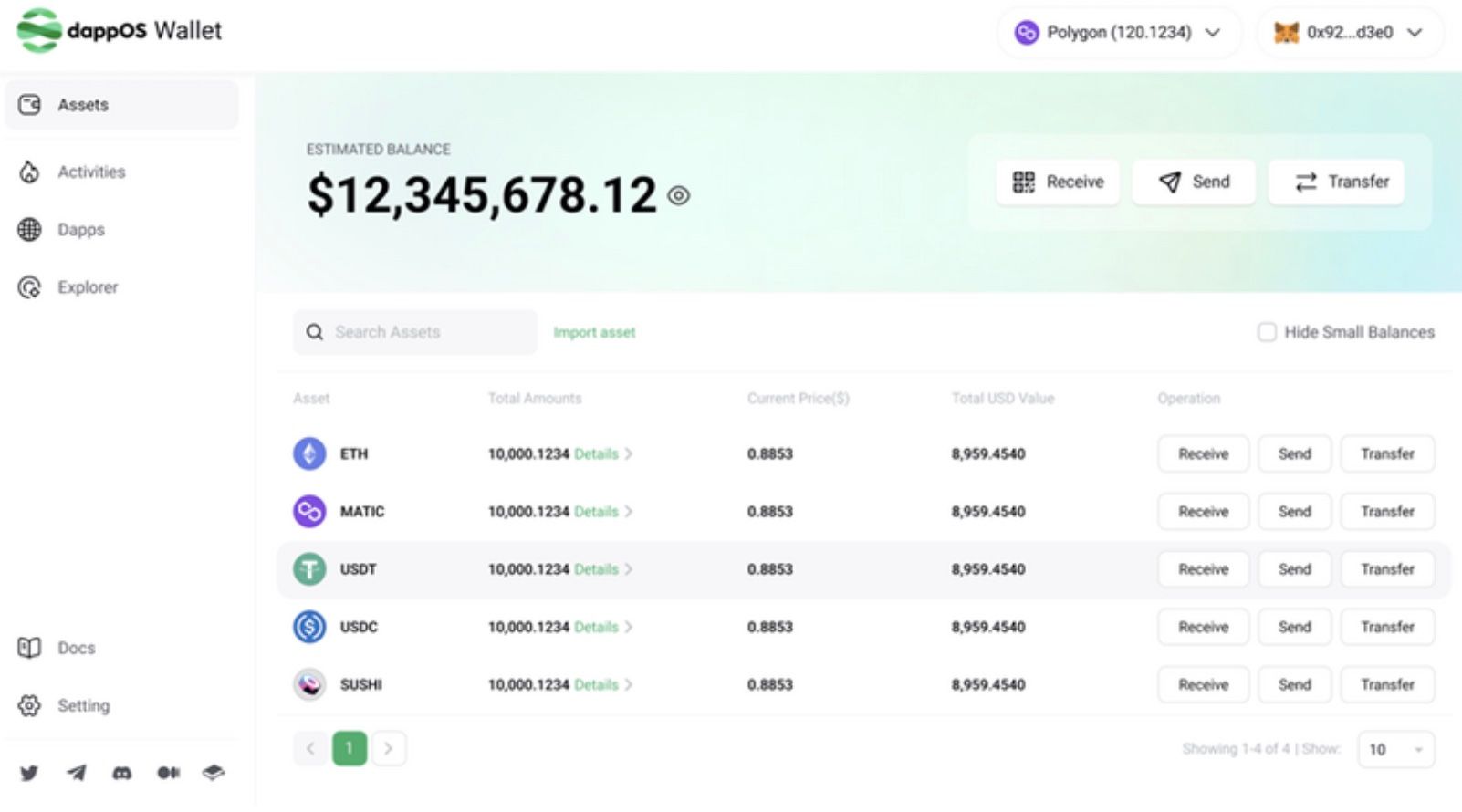

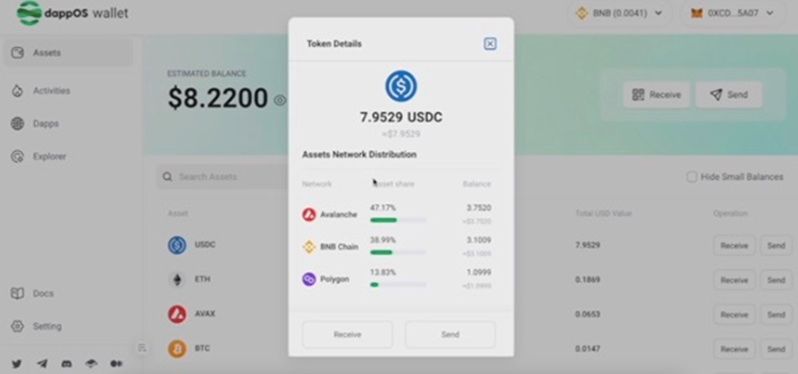

In the dappOS Wallet interface, users can view the total balance of their multi-chain assets in their unified account.

A Look at the dappOS Wallet. Image via dappOS

A Look at the dappOS Wallet. Image via dappOSUnder the specific asset balance display, the shown quantity represents the total amount of that asset across multiple blockchain accounts. For example, if it shows approximately 7.95 USDC, this is the combined balance of USDC across Avalanche, BNB Chain, and Polygon blockchains. Expanding this will reveal the actual amounts in each respective multi-chain account.

Image via dappOS

Image via dappOSWhen using dappOS Wallet for on-chain transactions, users only need to focus on the displayed total multi-chain balance. When making transactions or payments, one-click payments can be executed based on the unified account, eliminating the need for complex multi-chain operations.

Support for Task Dependency

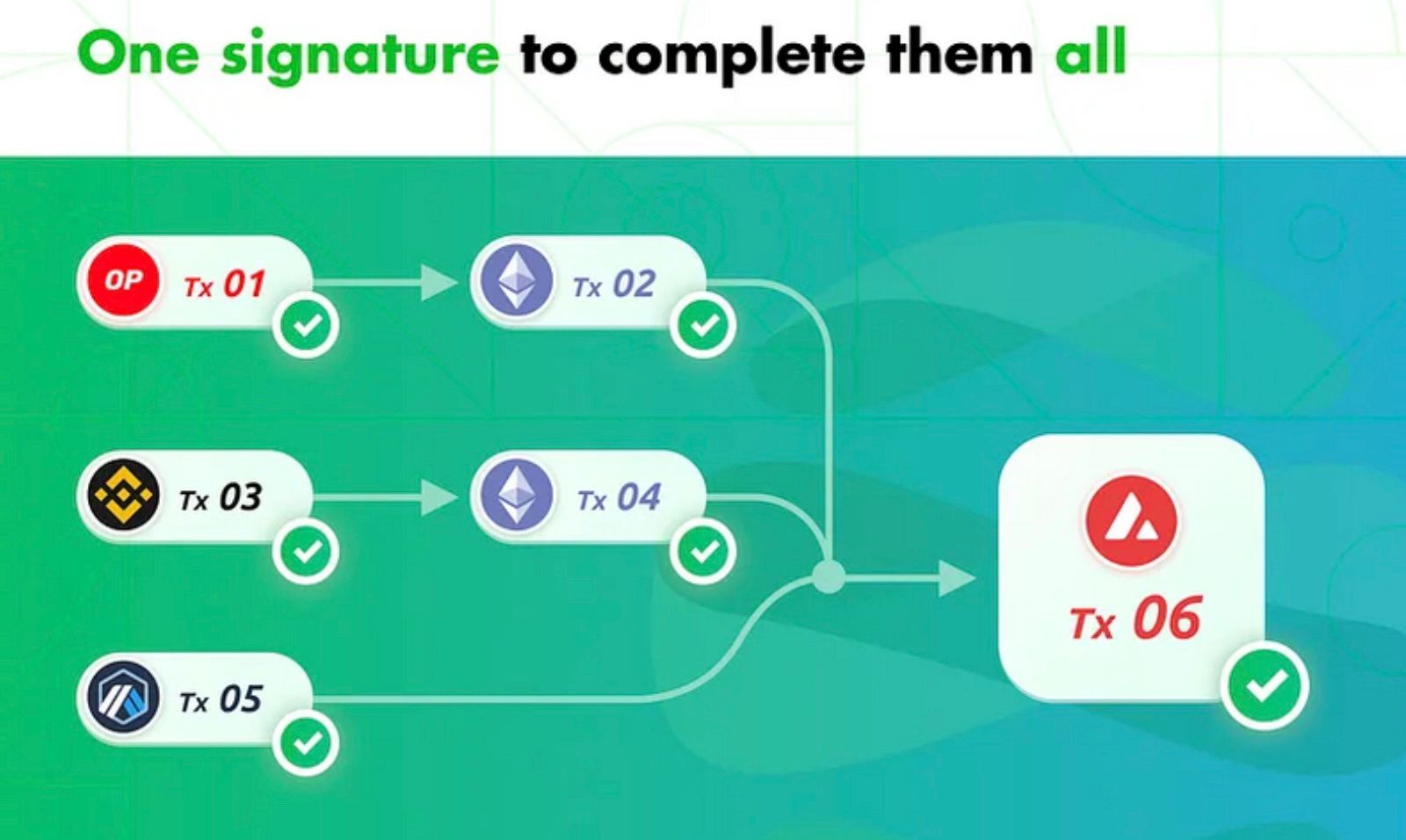

dappOS V2 enables users to validate intricate, interconnected transactions spanning various chains using a single signature, whether they occur sequentially or simultaneously.

Image via dappOS

Image via dappOSNew Bidding System

The bidding and billing system within dappOS V2 enables nodes to engage in the network and earn income from their services.

A Look at the dappOS Bidding System. Image via medium.com@dappos

A Look at the dappOS Bidding System. Image via medium.com@dapposdappOS Network

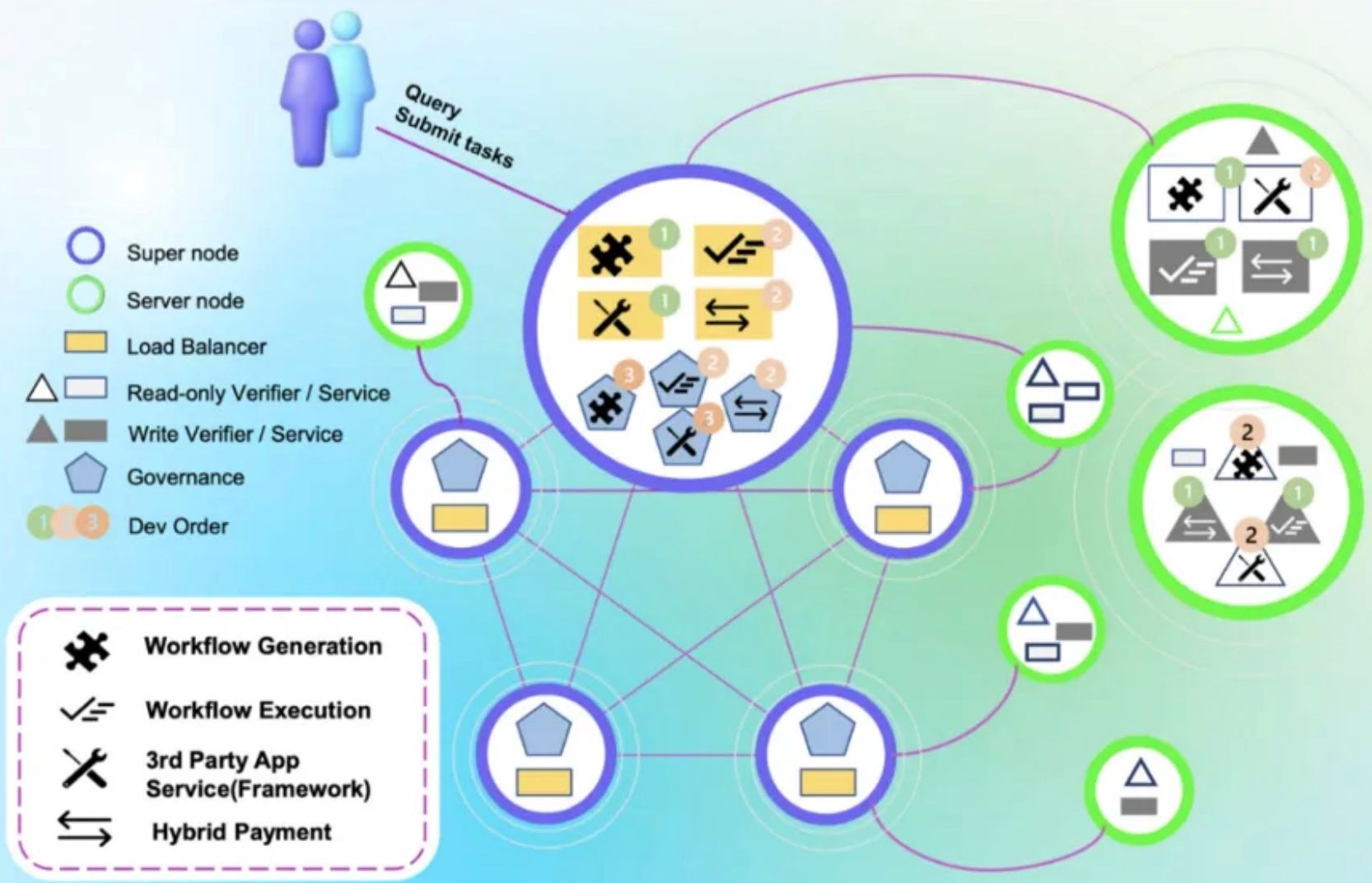

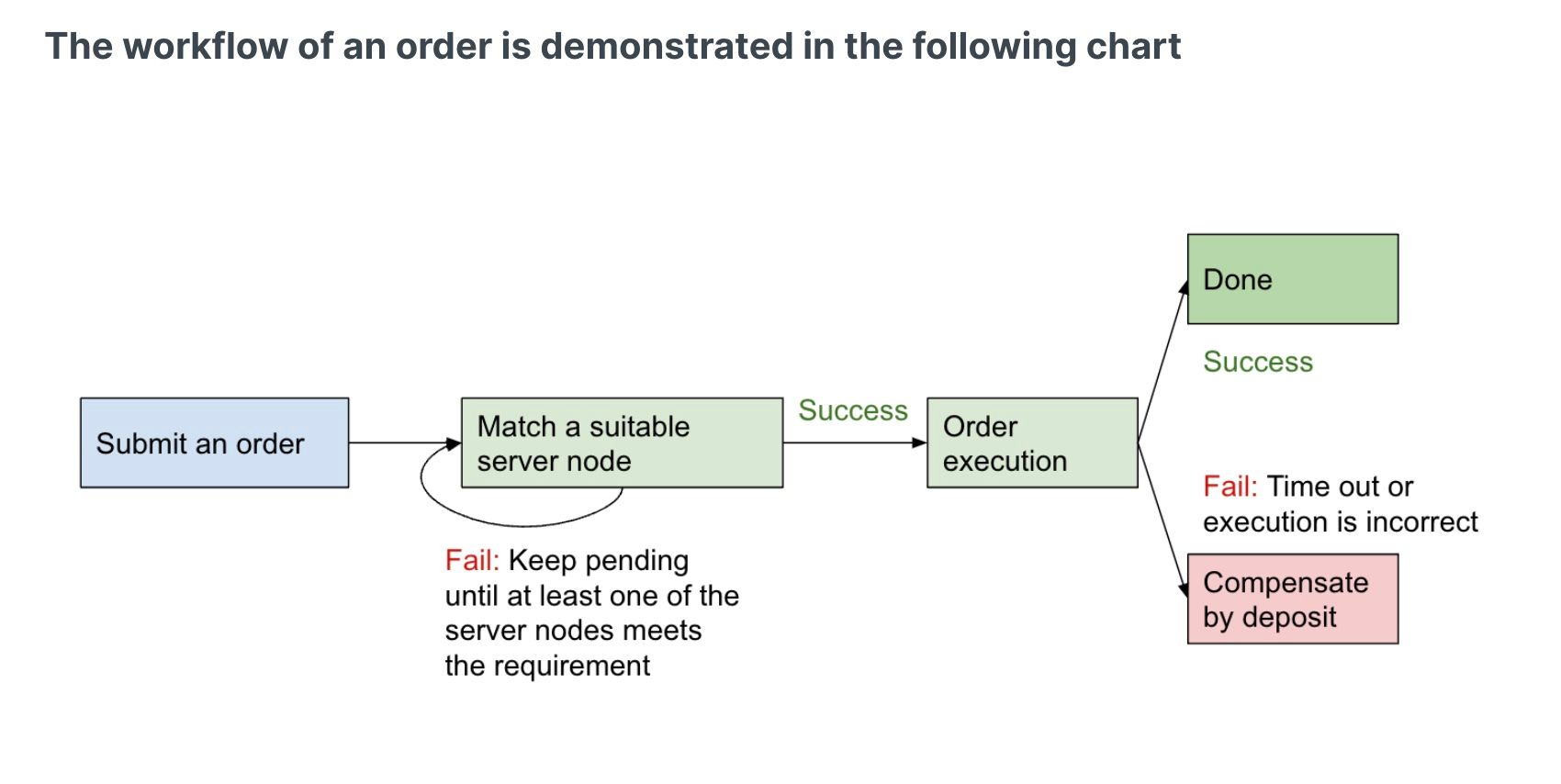

The consensus mechanism of dappOS is implemented through nodes, which consist of 2 types:

Super Nodes: Delegate orders to server nodes and handle rewards and punishments.

Service Nodes: Responsible for receiving orders from the Super Nodes and executing them.

As users submit requests, the Super Node will assign them and the Server Node will return the request to the user after it is completed. If the Server Node cannot execute, the Super Node will use the funds staked by the Service Node to compensate the user.

Image via medium.com/@dappos

Image via medium.com/@dapposIn order to enhance speed and achieve more favourable rates, the dappOS Network will accommodate a diverse array of third-party Service Nodes, inviting them to partake in competition within the network. Simultaneously, security takes center stage, as Service Nodes are fortified with collateral, instilling confidence in the system. Before consensus is reached, a preliminary assessment of execution success takes place, effectively curtailing user wait times.

Super Nodes operate using the DPOS consensus mechanism. These Super Nodes necessitate staking platform coins. Every transaction conducted triggers the distribution of fee revenues, delivered in the form of platform coins, to the Super Node.

What Makes dappOS Revolutionary?

In the realm of Web 3.0, infrastructure takes on a crucial role, encompassing the tools, services, and architectures essential for deploying, constructing, and utilizing dApps at scale.

dappOS is leading three narratives, from "Account Abstraction", to "Chain Abstraction", and finally to "Intent Centric"

The process of how dappOS is evolving in these 3 stages has also shown a growing understanding in the industry about the concepts of "Abstract". Fundamentally, it's about making Web3 as easy as accessible as Web2 (providing CeFi-like user experience and complete decentralization at the same time)

Account Abstraction leads to no longer needing a recovery phrase, chain abstraction hides the Gas fee and leads to users not needing to understand gas-fee intricacies, and then the intent-centric approach hides the whole intermediate process and complexities all the way from point A to point B.

What dappOS is doing is bringing all the competing blockchains and DApps together under one roof and simplifying user intent, benefitting both the user and the project teams. Just as users don’t need to know the technical jargon regarding the streaming protocols needed to watch a YouTube video, dappOS is creating an ecosystem where users don’t need to be DeFi wizards to swap and trade assets cross-chain.

With dappOS, users will be able to access DApps without needing to understand complicated workflows or have previous crypto knowledge, something that currently isn’t possible in the decentralized space.

As dappOS cracks this major infrastructural and foundational hurdle, it stands a real chance of being the first platform to bridge the gap between Web2 and Web3 and onboard billions of users into Web3 applications.

dappOS Fees

There will be some small fees involved in order to use the dappOS network. Fees provide the income of the dappOS Network and are shared between Super Nodes and Server Nodes.

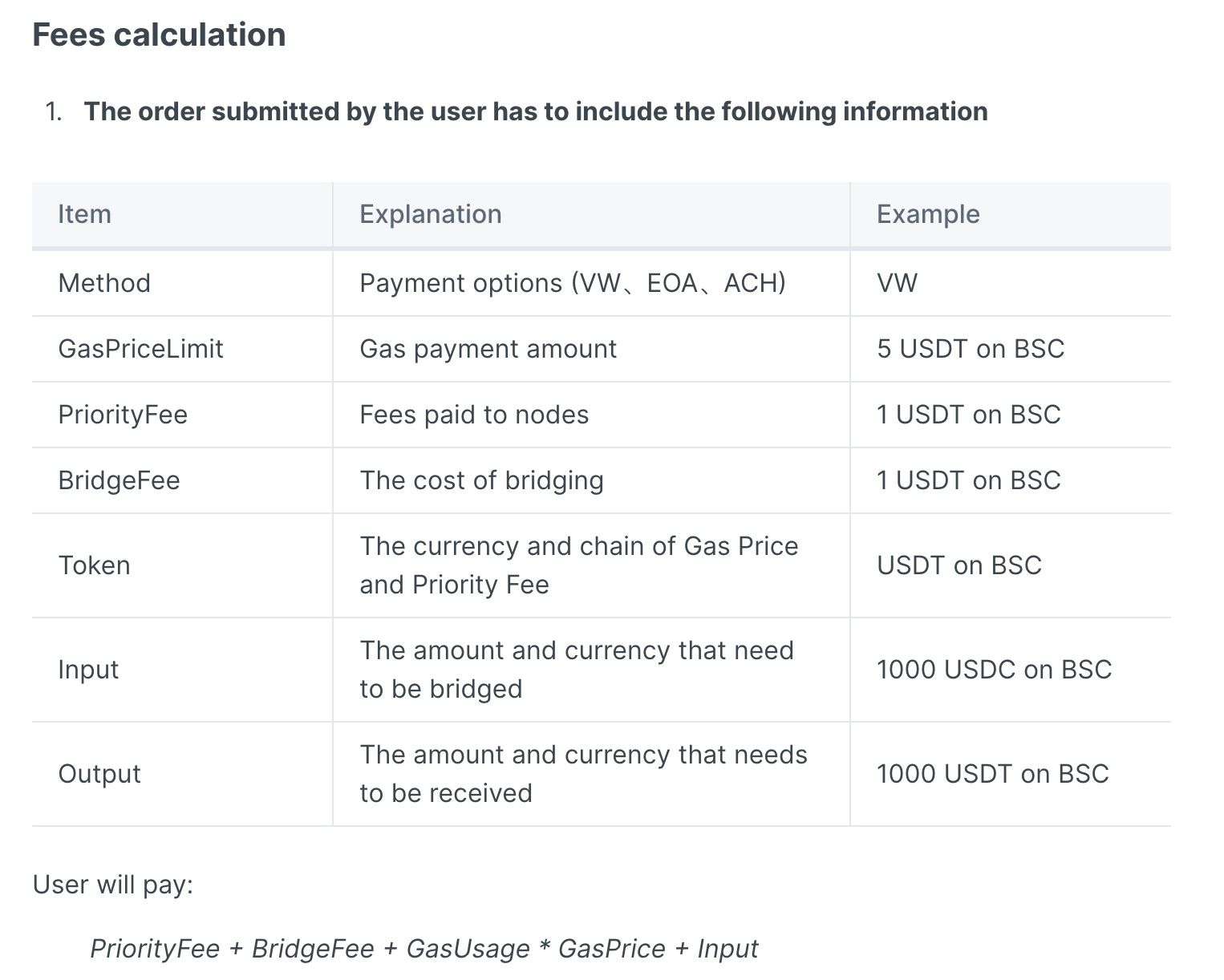

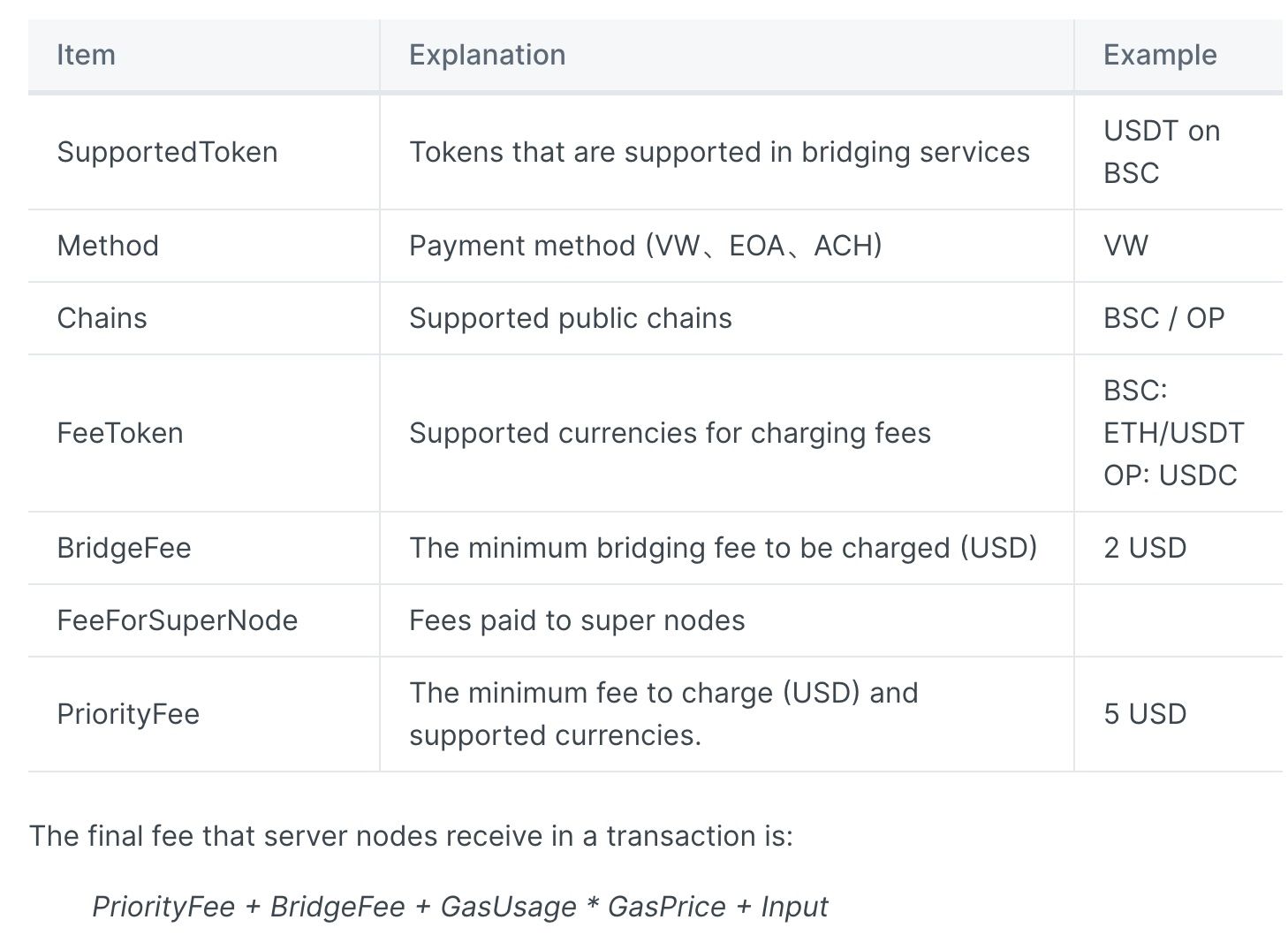

Taken straight from the dappOS Gitbook, here is what users can expect in terms of fees:

Image via dappos.gitbook

Image via dappos.gitbookThen the user will receive Output plus GasRefundFee. The GasRefundFee is the refund of the overpaid part when paying via EOA or ACH.

Server Nodes issue their own quotation to the Super Nodes, which contains the following information:

Image via dappos.gitbook

Image via dappos.gitbookUsers can choose any type of payment while Server Nodes can decide what is accepted.

Overall, this fee structure will create a substantially lower financial burden when interacting with DApps and remove multiple signature requests and steps, especially when cross-chain bridging is involved.

Key Benefits of dappOS for Users and DApps

We have already covered most of the benefits offered by this next-generation DApp platform, but to put a nice little bow on it, here is a summation:

Seamless Interaction With Any dApp on Any Chain

Users will save fees on complex transactions such as bridging assets and utilize lower-fee networks, regardless of the network or DApp they wish to use.

As an example, a user can use the GMX decentralized perpetual exchange without needing to hold any ARB if they wish to trade on AVAX using assets they hold on BNB Chain. This is possible now for the first time thanks to dappOS. Let’s switch gears and look at how dappOS benefits developers and project teams.

In traditional cross-chain bridges, liquidity is deployed and the daily transaction volume limit needs to cover the rate of return for the entire liquidity pool. Traditionally, project teams would need to ensure there was sufficient liquidity on more than one chain, which could easily cost millions in reserve funds. This led to a significant financial burden and resulted in slower scalability as there was a limit to how many users could use the service at a given time.

dappOS utilizes a shared liquidity pool, adding benefits for partners like exchanges and payment systems as the cost of providing services is now substantially lower.

Performance

As users can tap into the efficiencies of different networks and have multi-step transactions completed with one click, transactions on dappOS will be executed in a much quicker and more efficient manner.

What is unique is that the Server Node can make its own judgment without waiting for the entire network to reach a consensus, improving the performance of apps built using dappOS. The number of block confirmations will also be flexible, with the Server Node being able to decide according to the volume of the transactions and its own risk control mechanism.

This process will significantly improve the performance and transaction speeds of apps built with the dappOS stack.

Security

The locked value of the network only contains the deposit. The deposit only needs to be higher than the total volume of incomplete orders within a time period. This means that even under the most dire circumstances, the network will be able to compensate for any loss, ensuring security for the users. This will effectively avoid the horror stories we hear of multi-million dollar DApp hacks that completely wipe out user funds and project liquidity pools.

Strategic Growth Opportunities for Public Chains

As an increasing number of dApps integrate dappOS V2, the projects stand to attract new users and TVL available from within the dappOS ecosystem. Cooperation with dappOS facilitates public chains to onboard new users by providing an intent-centric UX to reduce the barrier of adopting public chain DApps, which will improve TVL and growth in an impactful manner.

dappOS has just recently announced a partnership with Manta Network to launch an Ecosystem Growth Program. Manta Network is a modular ecosystem for zero-knowledge (ZK) applications that supports on-chain privacy.

dappOS and Manta will work together to enhance the Manta ecosystem and make it more accessible for everyone. They will integrate Manta assets into the dappOS unified account, simplifying interactions for mainstream users. Additionally, Manta will run a dappOS Server Node for faster and cheaper asset transfers. Both will provide $10M in liquidity to boost Manta DApps and collaborate on global branding and marketing for increased adoption. Strategic partnerships often lead to significant user growth and a stronger market presence, and this Manta Network Partnership is surely the first of many.

This Ecosystem Growth Program will act as a foundational building block for DApp builders as they will be exposed to the entire dappOS ecosystem and help boost project DApps to scale in a secure, efficient manner with lower overheads and complexities that existed in the traditional method. The program highlights include:

- Intent-Centric user experience, reducing the barrier to DApp user adoption

- Non-Profit Node to boost assets flowing into DApps

- Liquidity Support to help bootstrap applications

- Branding and Marketing

dappOS Security

dappOS has developed a robust security approach that is evident in every working mechanism of the platform, as well as undertaken multiple security audits by Certik, Bits of Trail and Secure3. Perhaps what is most impressive is the fact that the dappOS team has not only managed to build all this but has done so in a decentralized, non-custodial manner, speaking to the true ethos of crypto and Web3.

Let’s take a look at the security of the different working parts.

dappOS Account Security

dappOS Accounts are decentralized and non-custodial. The security depends on the users’ private keys and the underlying public blockchain network itself. This is pretty robust in itself but it is important to note that the recovery method a user chooses will also affect the level of security. For example, if the user uses email as a recovery method, the email server could be a potential point of weakness.

Each Virtual Wallet can only be accessed by providing the correct signature and is bound to an immutable virtual wallet manager contract that records the owner’s address when deployed. A signature is required to be verified in every transaction from the wallet, removing the possibility of unauthorized access.

dappOS Network Security

For client users, the only way a user can lose assets is to send assets to a Server Node that fails to execute the proper service, but these cases are addressed by over-collateralization. The dappOS network ensures that the node that receives input has locked more assets than what is entered into the input. By over-collateralization, the dappOS network guarantees that either an order is executed as intended, or the Server Node refunds the cost of the transaction.

Image via dappos.gitbook.io

Image via dappos.gitbook.ioNetwork Node Security

The network security for dappOS is handled by the DPOS consensus mechanism, a battle-tested and proven consensus that also secures protocols such as EOS, Cosmos, and Tron.

Super Nodes do not have access to the Server Nodes’ assets, removing a potential vulnerability. 2023 has been a particularly bad year for bridge hacks, with dappOS, the risk exposure is much smaller as dappOS only needs to lock the same volume of ongoing transactions instead of funding an entire pool.

dappOS Roadmap

dappOS has an aggressive and ambitious roadmap, with well-defined goals and an understood strategic direction.

The current roadmap is laid out in three stages:

Stage 1- Super Stable

This stage will focus on the testing and verifying of the system's security, stability, and versatility.

The dappOS team is partnering with selected dApp collaborators, service nodes, and users to assess the capabilities and effectiveness of dappOS V2.

Whitelisted dApps and service nodes now have the freedom to autonomously integrate dappOS V2, while client users can access supported dApps without needing prior permission.

Stage 2- Permissionless Access

This is an important step in decentralization. Permissionless access will allow DApps and service nodes to integrate independently without permission.

The front-end SDK is now open-source, allowing any dApp to integrate the SDK on its own and introducing a platform for service nodes to independently integrate with open-source solutions.

Stage 3- Fully Decentralized

This stage will see the full decentralization of Super Nodes and governance.

The dappOS token will aim to attain decentralization in transaction verification and implement a robust slash mechanism. The team will also work on decentralizing the bidding and order distribution system and a DAO will be established to oversee protocol revenue, system upgrades, and the integration of new public chains.

dappOS Review: Closing Thoughts

The dappOS team are building something that is truly unique and much needed in the DApp space. By providing a user-friendly front-end interface for the end user that offers a seamless Web3 experience, while also creating a supportive ecosystem for DApp builders to benefit from in a multitude of ways, dappOS is simultaneously overcoming two major hurdles that currently exist in the crypto industry.

dappOS seeks to silence the most pronounced criticisms against Web3 adoption, putting to rest the narrative about how DApps offer a complicated and complex user experience, while also addressing the shortcomings that result from siloed blockchain networks. It is no wonder that Binance Labs took an immense interest in dappOS and the project has found no shortage of supporters and backers.

Disclaimer: This is a paid article, and as such, the views and opinions expressed within it do not reflect those of the Coin Bureau. The inclusion of this content on the Coin Bureau platform should not be interpreted as an endorsement or recommendation of the project or product being discussed. The Coin Bureau assumes no responsibility for any actions taken by readers based on the information provided within this article. Readers are encouraged to conduct their own research and due diligence before making any investment decisions.