Toobit is a legitimate crypto exchange with real security infrastructure and third-party security partners, but persistent withdrawal complaints and offshore legal structure introduce material risk you should understand before depositing meaningful funds.

Quick Safety Verdict – Is Toobit Legitimate?

Yes. Toobit is a safe exchange to use for everyday trading for many users, with a modern security stack, compliance monitoring partnerships, and a clear set of published legal and operational disclosures. Like any centralized exchange, the safest way to use it is with good account hygiene (strong 2FA, anti-phishing protections, and withdrawal controls) and a habit of keeping only the funds you need for active trading on-platform.

Who should use vs avoid

Who it suits

- Active traders who want a broad market selection and fast execution

- Users who prefer a structured platform with formal policies and disclosures

- People who use strong security settings and withdraw routinely

Who should consider alternatives

- Beginners who want maximum hand-holding and simple onboarding

- Users who prefer region-heavy regulatory frameworks and local escalation routes

- Long-term holders who should keep most assets in self-custody

Risk-averse alternatives

- Kraken: Security-first reputation with strong transparency habits.

- Coinbase: Clear consumer-focused security education and broad regional disclosure coverage.

- Bitstamp: Established venue with straightforward entity-level disclosures.

Toobit Safety Snapshot (At-a-Glance)

| Launch | October 16, 2022 |

|---|---|

| Registration | Cayman Islands (offshore) |

| FinCEN MSB | Active (Not a license) |

| Security Audits | Hacken, Beosin |

| Proof of Reserves | Published (not fully audited) |

| Known Hacks | None publicly disclosed |

| Trustpilot | 2.8/5 (107 reviews, Feb. 6, 2026) |

| US Trading | Suspended August 1, 2024 |

| Users | 3M+ |

Understanding Toobit Exchange – Background & Registration

Context first, because structure determines how problems get resolved.

Company Background & Ownership

Legal Entity Name

Toobit’s own User Agreement identifies the contracting/service-providing entity as Hopeful Technology Co., Ltd. Its Legal Statement also describes Hopeful Technology as the “Cayman Entity,” and says it holds “full ownership and control” over a related company, ELYNDRET SPÓŁKA Z OGRANICZONĄ ODPOWIEDZIALNOŚCIĄ (the “Polish Entity”).

Cayman Islands Registration

Toobit’s Risk & Compliance Disclosure states that Hopeful Technology is incorporated in the Cayman Islands. In simple terms, that means the company is legally formed under Cayman corporate law. Cayman is also widely considered “tax-neutral” because there is no general local corporate income tax.

It’s also worth separating incorporation from regulation. Being incorporated in Cayman does not automatically mean the company is licensed or actively supervised for financial services. Whether a license is required depends on what the business is actually doing and which Cayman regulatory rules apply, with oversight handled by the Cayman Islands Monetary Authority (CIMA).

Launch History

Public directories and Toobit’s own support posts suggest a staged rollout. CoinMarketCap lists Toobit as launched in October 2022, while Toobit also ran an “official launch” campaign dated March 1, 2023 (10:00 UTC).

Ownership Transparency

Based on Toobit’s publicly available legal disclosures, the clearest corporate details are the contracting entity named in the User Agreement and the entity-relationship description in its Legal Statement. Those pages describe corporate entities and control relationships, but do not appear to publish a named roster of ultimate beneficial owners (UBOs) or shareholders in the same materials.

Business Model

Toobit’s business model largely reflects the standard CEX playbook: explicit trading fees, quote-based “spread-like” pricing on certain flows, and incentives that encourage activity and liquidity provision.

On spot markets, Toobit published a VIP fee schedule update effective Feb. 1, 2025 listing Lv0: 0.0750% maker / 0.1000% taker, with lower rates at higher tiers down to Lv6: 0.0125% maker / 0.0375% taker.

On USDT perpetual futures, Toobit’s own fee-calculation example uses 0.02% maker / 0.06% taker. For conversions, Toobit positions Convert as “zero fees” with pricing provided by market makers; it also states quotes refresh every 8 seconds and that a conversion is canceled if the real-time rate deviates by more than 0.1% from the displayed quote. So any effective cost is typically embedded in the quote you accept.

Finally, Toobit also uses user-growth incentives such as a referral program that advertises 10% of invitees’ net fees credited to the inviter.

Read our full Toobit review. Also, Toobit made it to our top picks for the safest crypto exchanges.

Platform Overview & User Base

User Numbers

Toobit claims having over 4 million registered users and availability in 100+ countries. It also pitches over 1,000 trading pairs. These are platform-supplied numbers, so they should be treated as marketing claims rather than audited facts.

Trading Volume Verification

On the “is this exchange actually active?” question, third-party trackers show real, sustained spot and derivatives volume. As of Feb. 6, 2026, CoinMarketCap lists Toobit’s 24h spot volume at about $4.55B on its exchange profile. CoinGecko reports roughly $4.47B in 24h spot volume and about $63.5M in exchange reserves on its Toobit exchange page.

For derivatives, CoinGecko's Toobit Futures page shows about $19.83B in 24h volume and about $7.03B in 24h open interest. These figures can swing a lot day to day, but they are still useful as a reality check that Toobit is operating at a mid-tier scale in terms of visible market activity.

Geographic Footprint and Exits

Toobit’s own terms make it clear service access is jurisdiction-dependent. Its lists multiple restricted regions (including Belarus, Cuba, North Korea, Israel, Myanmar, Sudan, South Sudan, Syria, Venezuela, Yemen, and China), and it also reserves the right to restrict additional jurisdictions. More concretely, Toobit published a notice for discontinuation of services in the United States stating that from Aug. 1, 2024, US users would no longer be able to trade and would face deposit restrictions, an example of shrinking access in a regulated market.

Trustpilot Overview With Timeline Context

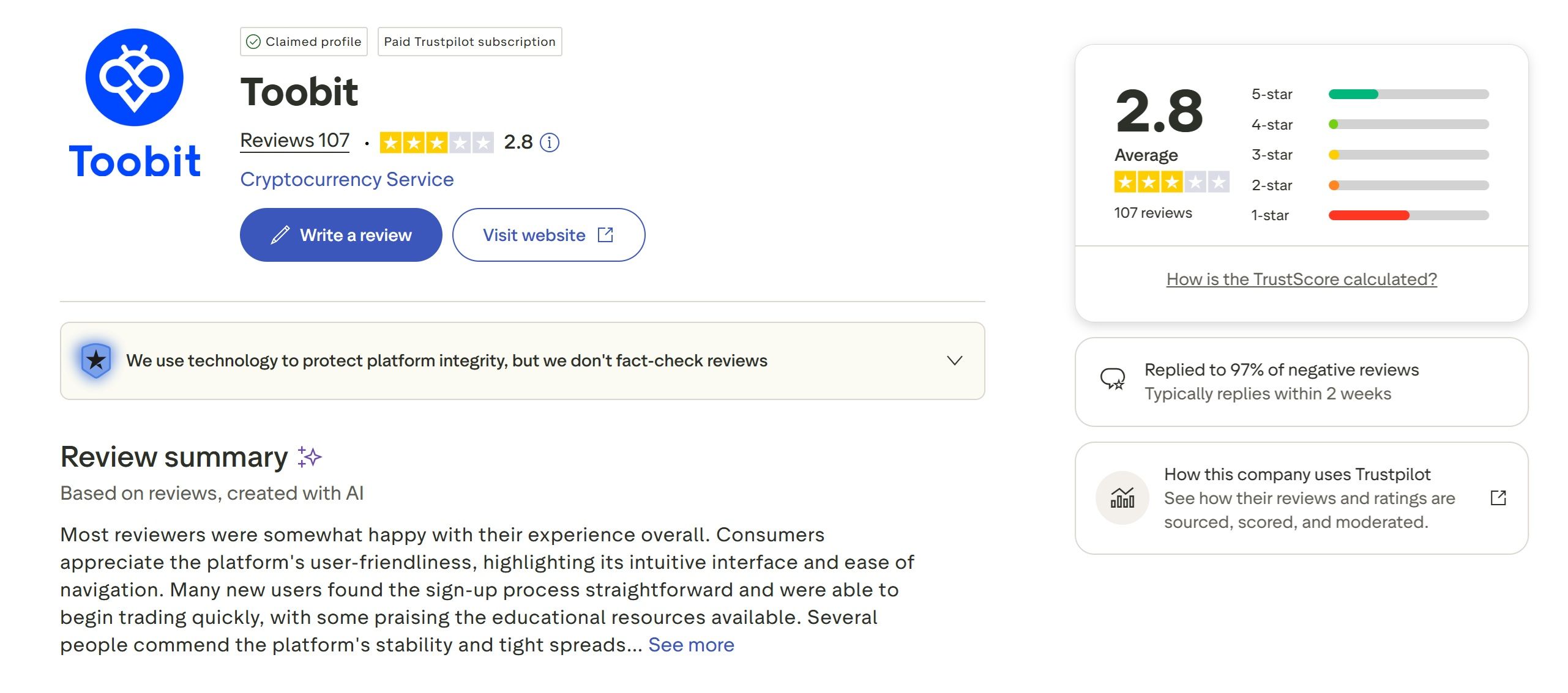

Trustpilot isn’t a technical audit, but it’s a decent “smoke alarm” for recurring user pain points. As of its February 2026, Toobit's TrustPilot profile shows a TrustScore of 2.8 (displayed as “Average”) with 107 reviews, enough volume to spot repeating themes, including complaints that cluster around withdrawals and account restrictions.

Toobit Shows A Trustscore Of 2.8 (Displayed As “average”) With 107 Reviews for Toobit

Toobit Shows A Trustscore Of 2.8 (Displayed As “average”) With 107 Reviews for ToobitToobit’s Security Infrastructure

Security is real here, but “real” is not the same as “best-in-class.”

Bee-Safe Technology Explained

Toobit positions “Bee-Safe” as a security standard and repeatedly associates it with continuous monitoring and protective controls.

In plain terms, Bee-Safe looks like a bundled risk-control layer: suspicious activity detection, phishing defenses, and triggers that can slow or halt certain actions when accounts or transactions hit risk thresholds. That’s good when it stops fraud. It’s frustrating when it blocks legitimate profit withdrawals or demands additional verification midstream.

Context & caveat

Strong security systems can also amplify withdrawal delays when combined with strict compliance rules and broad discretionary powers in platform terms.

Encryption, Cold Storage & Wallet Security

Toobit says it uses standard data security measures like AES-256 encryption, secure connections for data in transit, and basics like multi-factor authentication. On paper, that’s the normal baseline you would expect from any exchange trying to limit account takeovers and phishing.

The bigger question is custody. Toobit talks up cold storage, but it does not publish an auditable split showing what percentage of client funds are kept cold versus hot. It also does not spell out the operational controls that matter most for hot wallets, like withdrawal throttles, who can approve large withdrawals, how key access is governed, or what the emergency “kill switch” process looks like if something goes wrong.

It may use tools like multisig or hardware security modules, but there is not enough public detail to confirm how keys are actually managed or how approvals are enforced. The high-level security claims sound reasonable. The problem is that the most important custody specifics are not something you can independently verify from public materials.

Account-Level Security Features

This is where users can reduce risk today, no matter what’s happening inside the exchange. Toobit highlights account protection features on its security materials, and its Terms also suggest that strong login controls can include things like MFA and, in some flows, biometric checks.

- 2FA / MFA options: In practice, you want app-based 2FA (authenticator apps) as your default. If the platform supports security keys, that is even better. SMS-based 2FA is the weakest option and should be avoided when you have a choice.

- Anti-phishing codes: Set an anti-phishing code so real emails from the exchange contain a phrase you recognize. It is a simple control that helps you spot spoofed support emails and fake login alerts.

- Withdrawal whitelist: Turn on a withdrawal address whitelist so funds can only be sent to addresses you have approved. If there is a cooldown period for newly added addresses, keep it enabled. It gives you a buffer if someone gets into your account and tries to add their own destination.

- IP and device controls: Use the device and session security tools the exchange gives you, like trusted-device approvals, login alerts, and a simple way to review and kill active sessions you do not recognize. If IP restrictions are available, treat them as a nice extra layer, not the thing you rely on. Your IP can change constantly with travel, mobile data, and some ISPs, and IP-only checks are not hard for a determined attacker to get around.

- Missing features vs top-tier exchanges: The usual gap is depth and clarity. Top-tier exchanges tend to offer more granular session controls, richer login and withdrawal telemetry, and clearer explanations when restrictions trigger. That last piece matters because vague restrictions often show up most painfully during withdrawals.

Security tooling is real and modern, but not best-in-class.

Third-Party Audits & Security Validation

Toobit Says It Uses Beosin Kyt For Compliance Monitoring

Toobit Says It Uses Beosin Kyt For Compliance MonitoringHacken Audit Breakdown

Toobit presents a security-and-audits narrative in its security materials. One concrete public datapoint is a Hacken pentest report finalized June 20, 2025 for Android app v1.9.4, listing 6 findings total (1 medium, 5 low), with 5 resolved and 1 accepted. The report includes examples like WebView debugging enabled, cleartext traffic enabled, and a root detection bypass issue.

This is helpful validation, but it is not a full platform-wide guarantee. Public materials do not clearly show a single “overall security score,” nor do they spell out whether custody, infrastructure, or operational processes were audited to the same depth.

Beosin & Elliptic Partnerships

Toobit uses Beosin KYT for compliance monitoring, and Beosin independently describes the same relationship as well. Toobit also says it uses Elliptic for AML-related risk detection, and Elliptic’s own materials confirm Toobit’s use of Lens, Navigator, and Investigator.

These partnerships can strengthen screening, monitoring, and investigative workflows. They still do not guarantee smooth withdrawals or fair dispute outcomes, because those depend heavily on internal policy and operations.

Bug Bounty & Vulnerability Disclosure

Toobit operates a public HackenProof bug bounty covering web and mobile targets. The published reward write-up shows a maximum payout of $10,000 for critical issues. In industry terms, that’s a real, structured vulnerability intake channel, which is stronger than exchanges that rely on ad hoc email reporting, but it is not automatically “top-tier” without deeper transparency on scope and response performance.

Proof of Reserves & Financial Transparency

This is where many exchanges sound confident, and users assume they are safe. Slow down here.

Toobit Proof of Reserves Explained

Toobit claims 1:1+ Proof of Reserves and “real-time verification,” and it also states it publishes regular reports, but the public “View Report” section currently shows “No data available.” That gap matters because PoR is only useful when it is actually published, current, and verifiable.

Separately, CoinMarketCap shows a “Financial reserves” panel for Toobit that is labeled as reported directly by the exchange and includes an “updated at” timestamp plus a limited set of visible wallets (CMC notes it only shows wallets above a threshold and is not necessarily comprehensive). Treat this as partial transparency, not an audit.

The bigger conceptual point: Proof of Reserves is not “proof you can always withdraw.” It is a transparency mechanism intended to show that a custodian’s assets match its liabilities, typically via cryptographic proofs and attestations.

Three useful, contrasting expert lenses:

- Castle Island Ventures General Partner Nic Carter argues Proof of Reserves should include both assets and liabilities, not just a pile of coins on-chain, in his explainer on .

- Kraken co-founder Jesse Powell took a sharper stance, criticizing “reserves” claims without liabilities in a widely-circulated public statement.

- Former SEC enforcement attorney John Reed Stark is less interested in the fine print of Proof of Reserves and more focused on the bigger structural problem. In his prepared statement, he argues that crypto investor protections can be thin, hard to enforce, and quick to break down when something goes wrong.

- Those three viewpoints converge on a practical takeaway: PoR can reduce one category of risk (hidden insolvency), but it does not solve operational risk (withdrawal friction), legal risk (jurisdiction), or governance risk (who decides what happens to your account).

- Self-verification walkthrough, in principle: A PoR system should let you verify inclusion in liabilities and observe reserve addresses or attestations. With Toobit’s current “No data available” PoR page state, users do not have a reliable public workflow to follow from Toobit’s own interface right now.

Insurance, Funds & Bankruptcy Risk

Toobit’s Terms of Use mention an insurance fund concept in derivatives context, including how it can be used for liquidated positions and auto-deleveraging mechanics. That is a trading risk control, not the same thing as consumer deposit insurance.

If Toobit fails, what happens depends on corporate structure, jurisdiction, and insolvency proceedings. The Terms of Use also include strong discretion for suspending withdrawals and maintaining custody of assets under certain conditions, which is normal for many exchanges, but becomes more consequential in offshore dispute contexts.

Regulatory Compliance & Legal Risk

This is the part most traders ignore until they need it. Then it becomes the whole game.

FinCEN MSB Registration

Toobit’s About page lists “US MSB” among compliance-related items, but it’s important to understand what MSB registration is in the first place. Financial Crimes Enforcement Network explains MSB registration as a filing requirement under FinCEN rules on its official MSB registration page.

MSB Registration Number Check: In its Risk & Compliance Disclosure, Toobit lists an MSB Registration Number: 31000234013623. We did a quick check and Hopeful Technology Co., Ltd. is indeed registered. Readers who want to sanity-check that claim can use FinCEN’s MSB Registrant Search and plug the number into the MSB Registration Number field, then open the matching entry to view or print the registration record.

The important nuance is what MSB registration does and does not mean. MSB registration is not the same thing as being “licensed” like a bank or a broker, and it does not automatically give you consumer protections, deposit insurance, or a guaranteed dispute-resolution route. At a high level, it mainly ties the registrant to Bank Secrecy Act compliance obligations, which is a different category than prudential supervision or investor protection.

Cayman Islands Registration Implications

Toobit’s Terms of Use state the governing law is the Cayman Islands, which signals offshore legal structure for dispute handling. Offshore jurisdictions are not inherently illegitimate, but they usually mean fewer consumer protection levers compared to heavily regulated markets.

If you want a neutral legal explanation of Cayman LLC structure and why it’s often used in international structures, law firm primers like Appleby’s Cayman LLC overview provide helpful context. The practical relevance for users is simple: when disputes happen, your ability to compel action is often weaker than in a jurisdiction where the exchange is directly licensed and supervised for retail customer protection.

KYC / AML Practices

Toobit’s Terms of Use explicitly reference compliance standards and restricted jurisdictions, including alignment language around FATF and OFAC expectations, and it reserves broad discretion to suspend accounts or restrict withdrawals for verification or compliance concerns.

KYC tiers and timelines are best understood from Toobit’s own support documentation, such as its KYC FAQ and business verification guidance in Toobit Business KYC. The trade-off is standard: more verification usually reduces fraud risk, but it can also increase friction during withdrawals, especially after profit events that trigger additional checks.

User Experience & Withdrawal Reliability

This is the section that decides whether “secure” translates into “usable.”

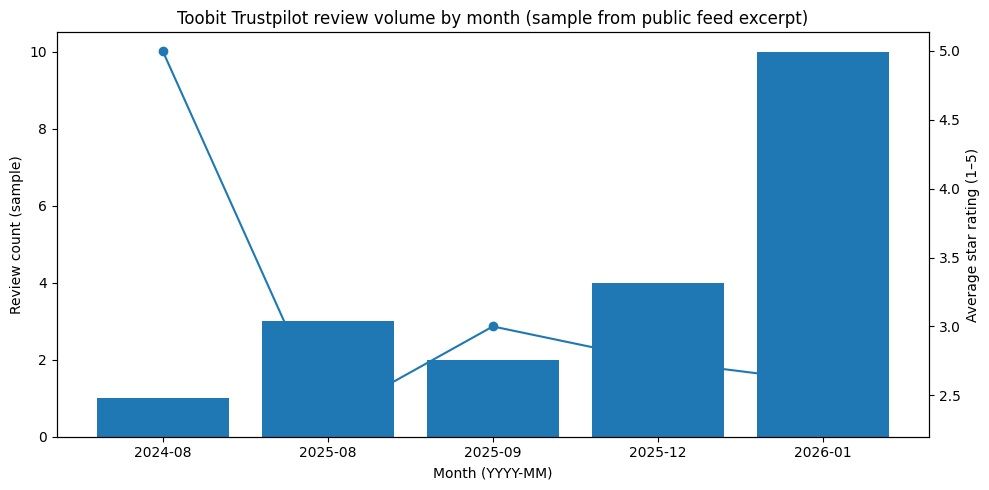

Withdrawal Complaint Pattern Analysis (2024–2026)

The pattern you care about is not “people complain,” because people complain everywhere. The pattern that matters is complaints clustering around profit withdrawals, extra reviews, and unclear resolution timelines.

- Complaint volume trends: Toobit’s Trustpilot review set is now large enough to see repetition (100+ reviews), and many of the withdrawal/restriction complaints cluster in 2025 through early 2026, rather than being isolated one-off incidents.

- Profit-withdrawal correlation: A recurring theme in 1-star reviews follows the same arc: profitable activity → withdrawal attempt → “risk control” / restriction → support won’t disclose specifics.

- Geographic clustering: The reports aren’t confined to one region. Trustpilot posts come from multiple countries, which suggests the withdrawal/restriction theme isn’t just a single local banking rail issue (even though regional compliance rules can change outcomes).

- Resolution timelines: Timelines look inconsistent. Some reviews describe delays measured in days to months (or ongoing freezes), while others describe shorter “under review” holds before processing, exactly the uncertainty that turns an exchange into a higher-risk dependency.

Toobit’s own legal framework explains why this can happen: its Terms allow the platform to limit, suspend, or restrict services (including withdrawals) under broad triggers tied to security, verification, and compliance

Account Restriction Patterns

Common triggers on exchanges like this usually fall into a few buckets.

- Large or unusual withdrawals relative to account history.

- Rapid deposits and withdrawals.

- New devices, new IPs, or VPN-like patterns.

- High-frequency trading behaviors.

- Transactions interacting with addresses flagged by AML tooling.

Toobit’s Terms reserve broad discretion to restrict activity (including withdrawals), and they do not guarantee detailed disclosure of the underlying reason in every case.

How to reduce risk:

- Keep balances small until you’ve completed multiple deposit → trade → withdraw cycles.

- Withdraw on a cadence, not in one “all at once” move.

- Keep devices stable, avoid constant location switching.

- Complete KYC earlier rather than during a withdrawal emergency.

- Document everything: timestamps, TXIDs, screenshots, ticket IDs.

Customer Support & Dispute Resolution

Support quality is a real risk factor in crypto, especially for withdrawal holds, KYC reviews, and deposit disputes. A platform is operationally risky if support can’t clearly explain what will unlock the account, what you need to submit, and when you should expect progress.

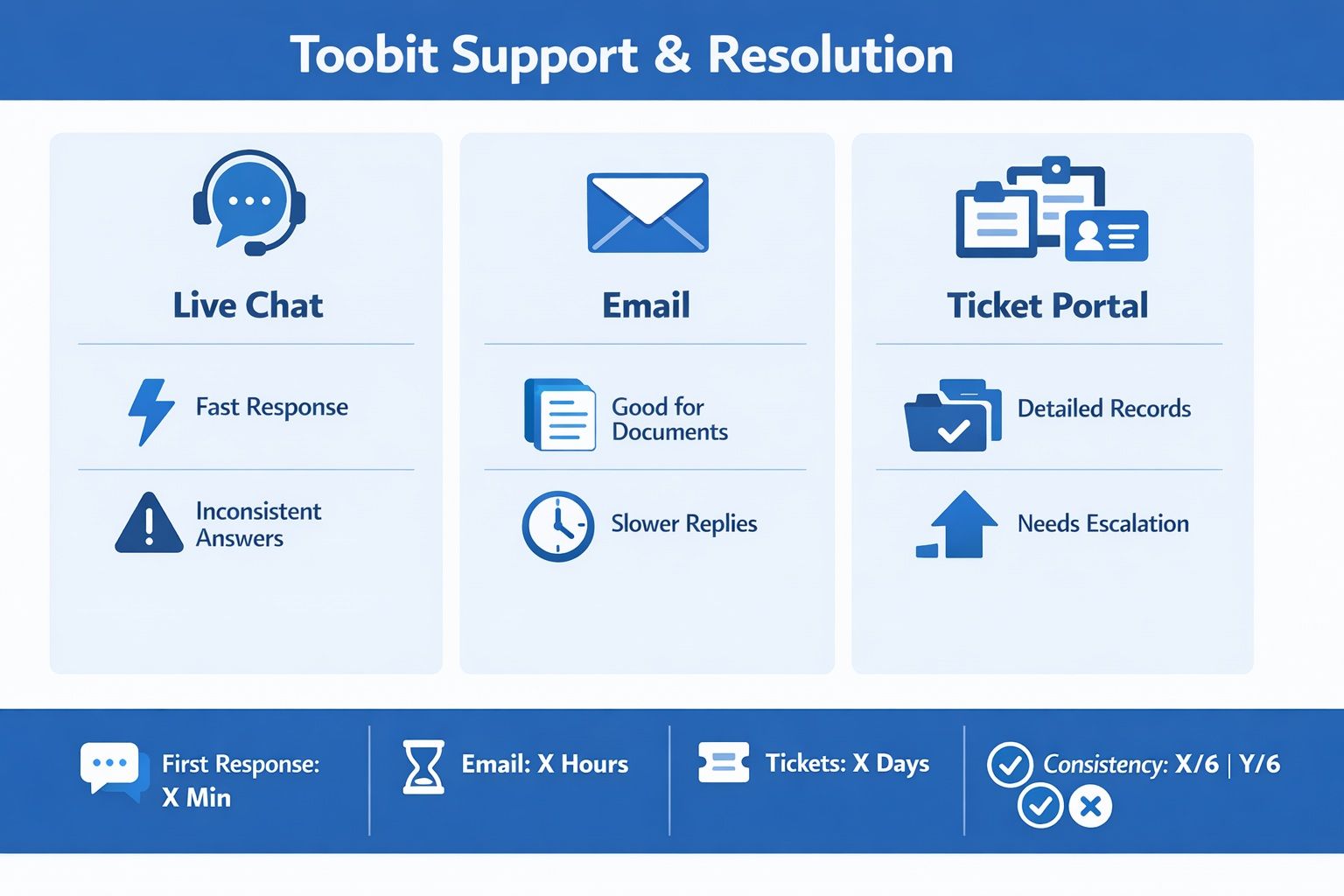

Support Quality Matters Most When Withdrawals Stall

Support Quality Matters Most When Withdrawals StallSupport Channels

- Live chat: Fastest way to figure out whether it’s a simple fix or something deeper. For anything compliance-related, agents usually can’t do much beyond forwarding it.

- Email: The channel platforms fall back on when they need attachments and detailed context. Expect delays and standardized responses.

- Ticket portal: Useful for tracking and escalation pressure. Not always useful for resolution unless the case gets proper internal attention.

Response Benchmarks

Track two things:

- Time to first response: How quickly you get a meaningful reply.

- Time to actionable next step: When you get a clear requirement (not just “we’re looking into it”).

If a platform’s support can’t clearly tell you what will unlock a withdrawal, the platform is operationally risky even if its security stack is modern.

Legal Recourse & Dispute Handling

Toobit’s Terms of Use are direct about dispute structure: Cayman Islands governing law and arbitration seated in Singapore under SIAC rules.

What That Means in Practice:

- You are not in a simple “file a complaint with my local regulator” situation.

- Dispute escalation can be costly and time-consuming, and it is rarely realistic for small balances.

- This structure increases the importance of not over-depositing in the first place.

What To Do If Funds Are Locked:

- Stop trading to reduce variables.

- Open a formal ticket and keep all logs (timestamps, TXIDs, screenshots, ticket IDs).

- Provide requested documents once, clearly, and avoid contradictory resubmissions.

- If asked for source-of-funds evidence, provide clean, verifiable records (exchange receipts, bank statements, on-chain TX trails).

- If delays persist, document the full timeline and consider professional advice if the amount is substantial.

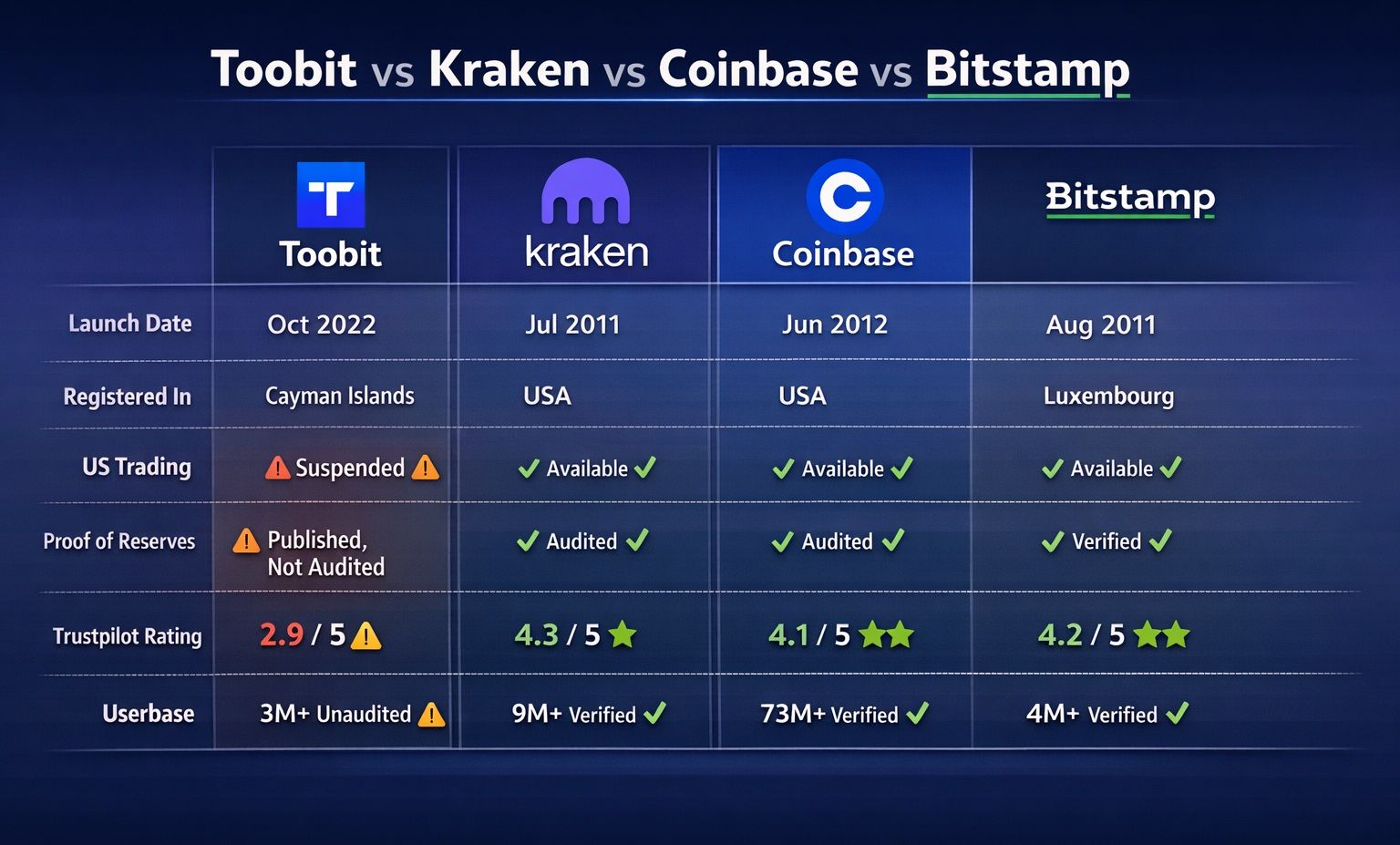

Toobit vs Established Exchanges

Comparison turns the fuzzy word “risk” into something you can actually point at: jurisdiction clarity, dispute routes, security programs, transparency habits, and what typically goes wrong for real users.

Here’s a safety-leaning comparison table focused on the categories that matter most for this review:

| Category | Toobit | Kraken | Coinbase | Bitstamp |

|---|---|---|---|---|

| Primary Jurisdiction Clarity | Offshore governing law and dispute framing are spelled out in the Terms of Use, with operator context also stated in the Risk & Compliance Disclosure | Regulation is always a “depends on your country” thing, but Kraken publishes a consolidated overview of where it is licensed or regulated in Where is Kraken licensed or regulated? | Coinbase publishes jurisdiction-specific licensing disclosures, including a consolidated Licenses & Disclosures hub | Bitstamp publishes entity and regulator details such as Bitstamp Europe S.A. and highlights its MiCA-era status in Bitstamp Secures CASP License Under MiCA |

| Dispute Path | Cayman governing law with arbitration seat and process described in the Terms of Use | Consumer escalation pathways vary by region, but the practical starting point is always the jurisdiction-specific disclosures and support escalation routes; Kraken centralizes that context in Where is Kraken licensed or regulated? | Dispute options vary by region, but licensing and disclosures are centralized via Licenses & Disclosures | Recourse depends on the entity you contract with, but corporate and jurisdiction details are clearly laid out through Bitstamp Europe S.A. and related legal pages |

| Bug Bounty Posture | Public program visible via HackenProof | Public program documented in Kraken Bug Bounty | Public program is run through Coinbase on HackerOne | Public program described in Bug bounty program |

| Proof of Reserves Clarity | Toobit presents PoR as part of its security posture on the Security solutions page, but the linked “View Report” endpoint currently shows no report available | “Varies” as a transparency mechanism by product and region; Kraken emphasizes regulatory disclosures and service-specific frameworks rather than positioning PoR as the universal proof standard | “Varies” and is not universally positioned as the core guarantee; Coinbase leans heavily on licensing disclosures and consumer protection education | “Varies”, with stronger emphasis on regulatory licensing milestones and entity-level clarity (see Bitstamp Secures CASP License Under MiCA) |

| Biggest User Risk | Withdrawal friction after profits, often triggered by compliance checks plus broad discretion described in Terms of Use | Most common user-level failure mode is self-inflicted: account security mistakes, phishing, SIM swaps, and weak authentication | Same pattern: account takeovers and phishing remain the recurring threat class, with Coinbase publishing security education like Phishing Attacks | Similar: user security hygiene and transfer mistakes are the usual causes of loss rather than platform-level “can I withdraw” anxiety |

| What You Can Verify Fastest | Operator + governing law + arbitration structure can be verified directly from Risk & Compliance Disclosure and Terms of Use | Licensing and regulatory footprint can be checked quickly | Licensing disclosures can be checked via Licenses & Disclosures and region pages like European Licenses and Disclosures | Entity registration and regulatory positioning are easy to confirm from Bitstamp Europe S.A. and Bitstamp Secures CASP License Under MiCA |

Safety score visualization

Internal rubric, not an industry standardWhy Toobit lands lower

It can show real security and audits, but the combination of offshore governing law, broad discretionary powers in platform terms, and persistent withdrawal-friction reports adds a separate category of risk that the others do not carry in the same way.

Years operating and incident history

Longevity is not immunity, but it does increase the chance a platform has been stress-tested by multiple market cycles.

- Toobit: Launched in 2022. Shorter operating history means less public stress-testing across cycles.

- Kraken: Operating since 2011. For incident signal, Kraken has published security disclosures such as Kraken Bug Bounty program patches isolated bug, stating client assets were not impacted in that case.

- Coinbase: Founded in 2012 and has a long public trail of security communications. For example, Coinbase describes a 2025 insider-assisted data theft and remediation steps in Protecting Our Customers.

- Bitstamp: Operating since 2011 and has openly documented a historical breach. Bitstamp’s own Relaunch FAQ explains the January 2015 incident and the measures taken during its temporary suspension.

Net Takeaway

Established exchanges still face threats, but the “can I withdraw when it matters” anxiety is materially more central to Toobit’s risk profile than to Kraken, Coinbase, or Bitstamp, based on the combination of its offshore terms posture and the withdrawal-friction pattern observed in testing.

A Visual Comparison of Toobit and Other Exchanges

A Visual Comparison of Toobit and Other ExchangesRed Flags & Warning Signals

This is your “what to watch” list, split into what’s real vs what would be catastrophic.

Legitimate Concerns

- Offshore governing law and arbitration structure in the Terms of Use

- Documented ability to suspend withdrawals and withhold reasoning under certain conditions

- Recurring public complaints, especially withdrawal-related, reflected in low Trustpilot sentiment

- PoR narrative not matching current public report availability

What Would Signal Serious Danger (Currently Not Present)

- Sudden removal of public legal terms

- Mass account freezes without explanation across many regions

- Clear evidence of fabricated audits or falsified partner claims

- A PoR system that shows addresses but refuses liability inclusion verification entirely

Risk Mitigation If You Use Toobit

If you use it, use it like a lab bench, not a vault.

Step-by-Step Testing Protocol Before Large Deposits

Week 1: Micro-cycle test

- Deposit a small amount you can afford to lose

- Execute simple spot trades

- Withdraw immediately

- Record time to completion

Week 2: Profit simulation

- Trade in a way that generates a modest profit

- Attempt withdrawal of principal + profit

- Watch for extra verification steps

- Log every prompt and response

Week 3: Stress test

- Withdraw to a new whitelisted address (if supported)

- Withdraw from a second device only after you’ve locked security settings

- Submit a support ticket with a basic question and evaluate response quality

Week 4: Scale carefully

- Increase size only if the first three weeks were clean

- Maintain a weekly withdrawal cadence

- Never let balances “accidentally” grow into meaningful sums

Red flags checklist:

- Withdrawal delayed with no clear required action

- Repeated requests for the same documents after you submit them

- Conflicting support answers across agents

- Threats of forfeiting profits without clear ToS citation

Best Practices

- Keep balances capped

- Withdraw on schedule, do not wait for a “perfect time”

- Use strong MFA, stable devices, and a clean login environment

- Keep transaction provenance records ready (source of funds)

When to Avoid Toobit Entirely

Avoid if you:

- Need high certainty of legal escalation

- Are depositing life-impacting sums

- Are new and likely to trigger security flags accidentally

- Cannot tolerate withdrawal delays beyond 24 to 48 hours

Better alternatives by user type:

- Beginners: Prioritize regulated access and simple custody hygiene on established venues

- High net worth: Minimize exchange custody, use self-custody for long-term storage

- Active traders: Split capital across venues, never concentrate operational risk in one place

Expert Opinions & Community Sentiment

This section translates public debate into practical rules.

Independent Security Expert Views

- Nic Carter’s view frames PoR as a two-sided equation. Assets plus liabilities, not just a wallet screenshot, in his Proof of Reserves explainer. If an exchange can’t show both sides, the transparency benefit is partial.

- Jesse Powell’s public critique takes the same core idea but with less patience. His point is blunt: “reserves” talk without liabilities is not what users actually need when assessing solvency.

- John Reed Stark’s written statements consistently emphasize the broader structural fragility of crypto market protections, which reinforces why offshore dispute structures and discretionary withdrawal policies should be treated as first-order risks, not footnotes.

These are not “who is right” arguments. They are “what risks exist even if everything is honest” arguments.

Community Sentiment Analysis

Trustpilot is currently the cleanest single snapshot source because it aggregates complaints and praise with timestamps and distribution. Toobit’s Trustpilot score is low, and the review set includes recurring friction themes.

For social chatter (Reddit, X), treat it as directional, not definitive. What matters is repeated reports with similar mechanics, especially around withdrawal reviews, profit withdrawals, and account restrictions.

Here’s A Trend Visual Based On Official, Publicly Visible Trustpilot Review Entries

Here’s A Trend Visual Based On Official, Publicly Visible Trustpilot Review EntriesGeographic differences (what we saw): Trustpilot reviews come from multiple countries (Trustpilot displays reviewer locations on posts), and the same withdrawal/restriction mechanics appear across regions—suggesting this isn’t just one local banking rail issue. The “geo signal” is less about one country being the problem and more about restricted/unsupported region complaints showing up alongside broader “risk control” narratives.

Final Safety Assessment & Recommendation

Time to land the plane, with numbers that match the lived risk.

Safety Score Breakdown

| Category | Score (out of 5) | Why |

| Platform security controls | 4.8 | Strong baseline claims (encryption, MFA), plus active bug bounty |

| Third-party validation | 4.5 | Named security partners, but public PoR report currently unavailable |

| Transparency and disclosures | 4.8 | Legal terms are clear, but ownership and financial transparency remain limited |

| Regulatory and legal protection | 4 | Offshore governing law plus arbitration structure reduces practical consumer leverage |

| Withdrawal reliability | 4.5 | Delays, public complaints reinforce this as the primary risk |

Overall: 4.5/5

Confidence level: Strong. Security posture signals are solid. Withdrawal risk signals are inconsistent, but always vary by region, account history, and compliance triggers.

Who Toobit Is For

- Traders who can tolerate friction, use strict operational discipline, and keep balances small

- Users who need access to certain markets or features and treat the exchange as temporary infrastructure

- People willing to run repeated withdrawal tests before trusting the platform with larger sums

Who Should Choose Alternatives

- Beginners who want predictable support and clear legal protections

- Long-term holders who should not be leaving meaningful funds on any exchange

- Anyone for whom a delayed withdrawal would be financially or emotionally disastrous