Let us begin our discussion with a little thought experiment. Imagine a primitive world where technology limits the mode of communication and transportation to within continents. Countries within the continents function as interconnected economies and share their resources, money, and information to grow cohesively.

Our hypothetical world has a catch. No matter how far the individual continents may advance within their economies, they will never establish contact with one another.

How different would such a world look from our reality? Each continent would be limited to its natural and human resources. They would individually solve all the questions about science and technology. Every continent would progress at a different pace, limited by the resources at their disposal.

Our hypothetical world is an analogy for the state of Web3 today. Like the continents, each ecosystem in Web3, including Ethereum, Solana, Cardano, or Polkadot, is essentially evolving as a closed economy, each ecosystem secured by its individual staked assets. With the limited exchange of information and liquidity, each chain is solving the scalability trilemma by itself.

In June 2023, Polygon proposed “The Value Layer of the Internet” as a solution that facilitates a blockchain economy resembling a version of our hypothetical world where continents are indeed interconnected like in reality, evolving rapidly with the global exchange of knowledge and resources. Polygon 2.0 aims to achieve this threshold of value exchange between individual blockchains.

This updated review of Polygon 2.0 is all you need to know about the evolving Polygon ecosystem. We will also cover some of the more significant implications of this technology and compare it with Ethereum’s evolving roadmap.

What is Polygon?

The answer to this question has evolved since Polygon was known as the Matic Ecosystem. Polygon began as a Proof of Stake Sidechain connected to Ethereum. The sidechain would periodically attest to the mainchain with anchor points the state could revert to against an attack. The sidechain design did not inherit any security guarantees from Ethereum.

What is Polygon Today?

Polygon 2.0 | Image via Polygon Blog

Polygon 2.0 | Image via Polygon BlogPolygon is more than a layer-2 scaling solution in 2024. With the transition to Polygon 2.0, Polygon is a suite of blockchain solutions applicable at different layers of the blockchain stack. Polygon serves multiple roles today:

- As a blockchain ecosystem, Polygon offers three distinct platforms for building high-performance Dapps:

- Polygon PoS – A POS sidechain on Ethereum, soon to evolve to zkEVM Validium (more on that later).

- Polygon zkEVM Rollup is a Zero-knowledge proofs-powered, EVM-capable layer-2 network on Ethereum.

- Polygon Miden is a zero-knowledge proofs-powered, non-EVM layer-2 network with a novel execution environment.

- As a development kit, the Polygon CDK helps developers construct customizable EVM-compatible ZK proofs powered layer-2 chains suited to their specific use case.

- Polygon ID helps build on-chain, self-sovereign digital identity systems.

With Polygon 2.0, the team introduces several infrastructural upgrades to achieve the following two broad goals between the networks in its ecosystem:

- The collective demand for block space can scale linearly with demand to improve scalability, just like factories add new assembly lines to multiply output.

- The same liquidity can continue to offer all necessary security guarantees to every new chain joining the network without additional security assumptions.

Polygon 2.0 aims to establish a network of ZK-powered layer-2 chains united by a cross-chain coordination protocol, collectively branding it as the Value Layer of the Internet. So, let’s unwrap this massive undertaking.

Key Features of Polygon 2.0:

- Scalability – All networks within the Polygon ecosystem will leverage ZK technology to offer high throughput smart contract execution and economic gas fees.

- Interoperability – The networks would seamlessly share liquidity and information to operate as a unified network, forming the basis for building cross-chain decentralized applications.

- Customizability – The Polygon CDK is a set of modular blockchain layers. Developers can simply plug in the desired layers and build new interoperable chains in the Polygon ecosystem.

- Security – All chains offer some commitment to Ethereum for security. The Polygon POS, zkEVM, and Miden are proprietary Polygon chains, while CDK is available to build new ones.

Pros of Polygon

- Ethereum-enabled qualities - Polygon leverages the Ethereum mainnet for security and finality.

- Developer friendly - Extensive EVM support enables easy developer onboarding in the Polygon ecosystem.

- The Polygon also leverages Ethereum’s robust liquidity and decentralization it has cultivated over the years.

Cons of Polygon

- Untested - Polygon 2.0 defines a complete system overhaul. The performance of these upgrades has yet to be tested by users in the real world.

A Brief History of Polygon

The Polygon network would not have come about if it weren’t for the NFT project CryptoKitties. In 2017, it was the most talked-about project on the Ethereum blockchain and within the crypto community. Its popularity caused terrible network congestion on the Ethereum blockchain and traders had to pay exorbitant fees. Jaynti Kanani, a data scientist in India working for Housing.com, noticed this issue and saw an opportunity for improvement. He contacted Sandeep Nailwal, a blockchain developer, and Anurag Arjun, a business consultant, for help. They drafted a white paper and called their project MATIC network, with Mumbai as their operations center.

Later, in April 2019, the Polygon team sold about 1.9 billion MATIC tokens to raise funds for developing the project through the Binance launchpad in an IEO (Initial Exchange Offering). The MATIC network successfully launched in Q2 of 2020.

In February 2021, the team rebranded itself as Polygon. The rebrand represents a shift in the team’s focus from developing Plasma chains to expanding the project’s services, including using multiple scaling solutions. Mihailo Bjelic joined the team with his software engineering expertise during this transition.

Since then, the project's strength has grown by leaps and bounds. Its mission is to be the top aggregator of Ethereum-compatible blockchains by providing them with superior interoperability capability while processing transactions made on the Ethereum network to help speed up the process.

In October 2023, Kanani said he stepped down from “the day-to-day grind” of working at Polygon. He will not contribute “from the sidelines.”

Polygon 2.0

In 2023, Polygon announced that its MATIC token will begin a multi-year transition to the POL token as a part of the Polygon 2.0 Initiative. It is a roadmap to organically integrate all the layers and networks operating in exclusive environments with limited interoperability in the Polygon ecosystem.

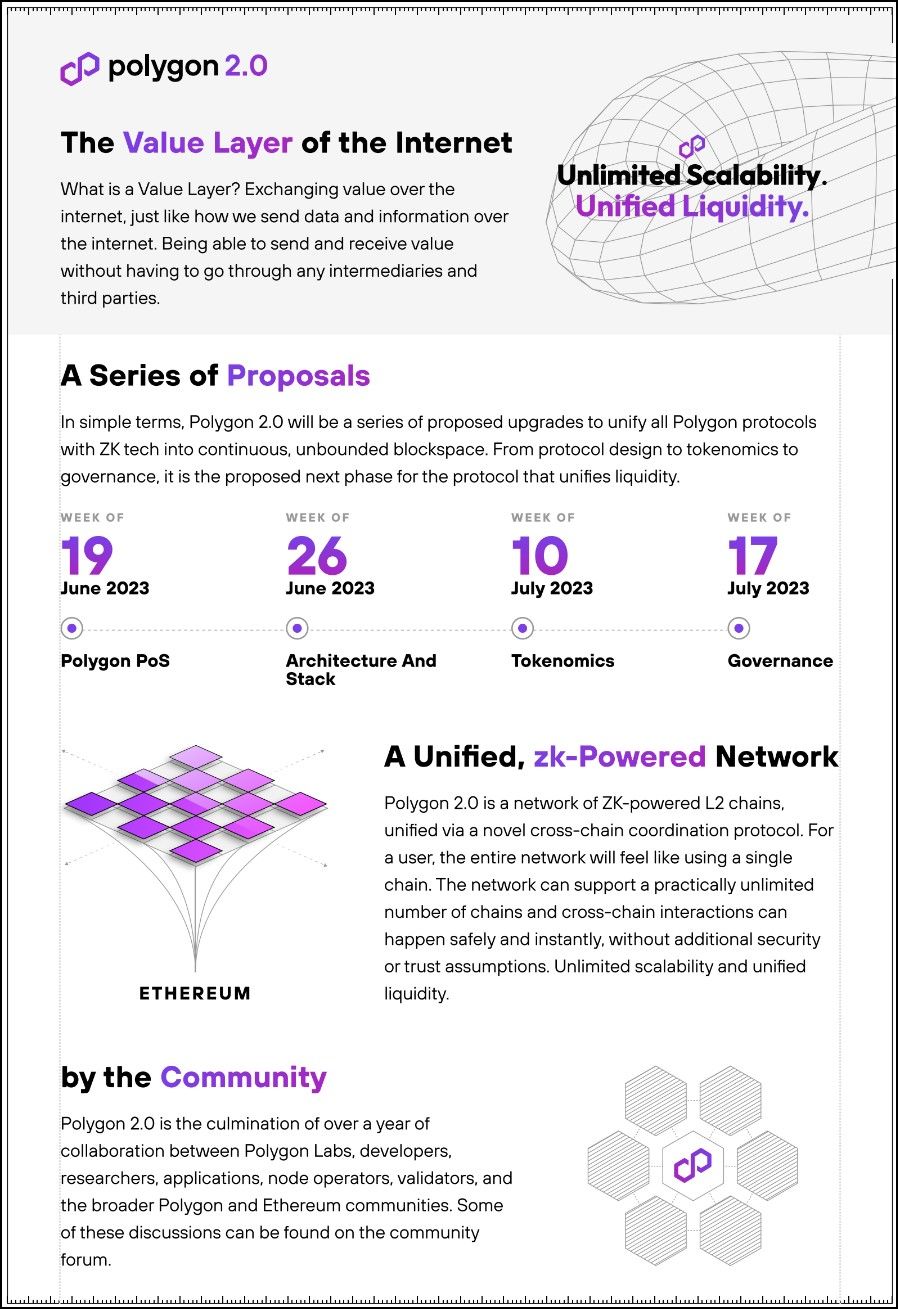

Polygon 2.0 One Pager

Polygon 2.0 One PagerThe Polygon Ecosystem Token (POL) will gradually replace the MATIC token over the next four years. The move aims to cement the zkEVM skeletal architecture on Polygon as the standard for efficient and economical construction of secure networks compatible with Ethereum.

Three Polygon Improvement Proposals (PIPs) kicked off the transition to Polygon 2.0:

PIP-17 POL Token

PIP-17 describes POL and the related contracts that handle emission and token migration. POL will allow for a one-to-one migration of the current MATIC token with an initial supply of 10B and a yearly emission of 2% distributed between validator staking rewards and a community treasury. The POL token will be able to support an ecosystem of ZK-based Layer 2 chains by enabling staking, ownership, and governance.

PIP-18 Polygon 2.0 Phase 0

PIP-18 provides a high-level outline for the upgrade. Phase 0 is designed so that no action will need to be taken from users and developers already on Polygon PoS and Polygon zkEVM chains. PIP-18 will implement changes to the Ethereum contracts on the following chains:

- Initiation of the upgrade from MATIC to POL.

- Upgrade from MATIC to POL as the native gas token for Polygon PoS.

- Upgrade from MATIC to POL as the staking token for Polygon PoS.

- Launch of the Staking Layer and migration of Polygon public chains.

PIP-19 Update PoS Native Token to POL

PIP-19 will upgrade the native gas token on Polygon PoS from MATIC to POL in a way that supports backward compatibility. The PIP upgrades the native MATIC Bridge Contract. The MATIC token will change from a claim on the Bridge's MATIC to one on the Bridge's POL. The upgrade will not change any of the contracts on Polygon PoS, but contracts on Ethereum expecting MATIC from the MATIC Bridge may be affected.

For more details about the upgrade to Polygon 2.0, check the POL Whitepaper and Polygon 2.0 Roadmap.

FYI: The rest of the article refers to Polygon synonymously as Polygon 2.0 unless stated otherwise.

What is the Polygon Network?

In English, “poly” is often used to talk about something multi-faceted. While a pentagon has five sides and a hexagon has six, a polygon has an arbitrary number of sides; this is the ethos of the Polygon network, a blockchain project with multiple facets to serve the Ethereum network.

The Polygon Network is a series of zk-powered layer-2 blockchain networks on Ethereum. The Network refers to a collective entity comprising network participants from Ethereum and Polygon layer-2s constantly interacting with one another, finally materializing on the Ethereum mainnet for security and finality.

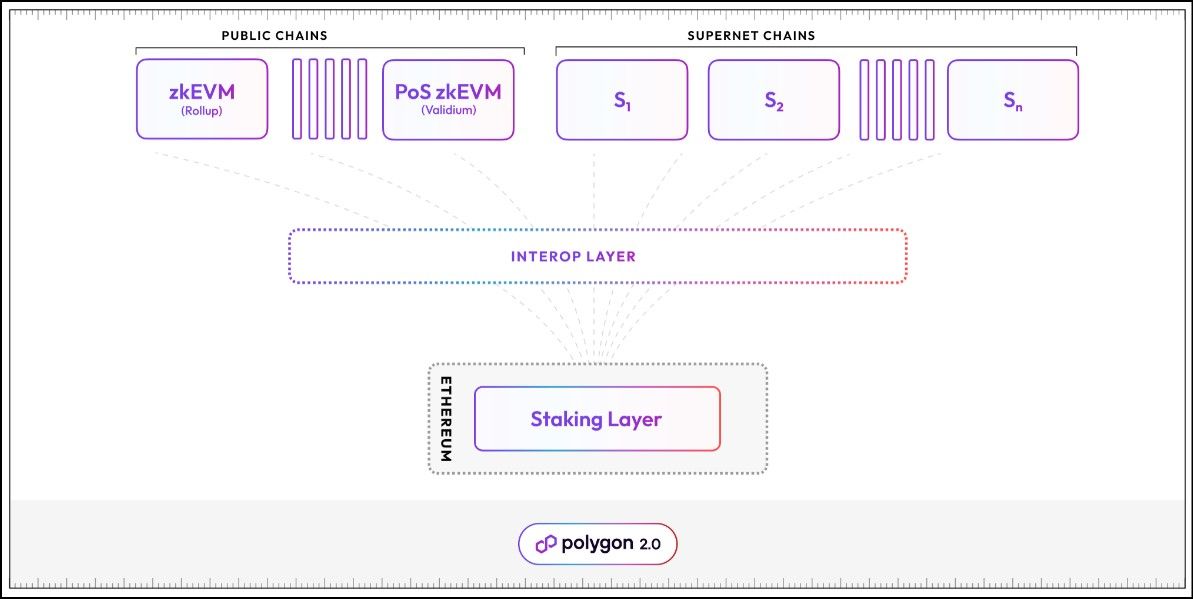

The updated Polygon Network design | Image via Polygon Blog

The updated Polygon Network design | Image via Polygon BlogThe Polygon Network layer-2 comprises Public and ‘Supernet Chains’:

- Polygon built the Public Chains. It includes the Polygon zkEVM Rollup and PoS zkEVM Validium (also known as Polygon PoS Chain before the 2.0 upgrade).

- The third-party chains developed with the Polygon Chain Development Kit are dubbed Supernet Chains.

The Staking Layer exists on Ethereum as a Proof of Stake protocol built on Polygon’s native POL token. It is a network of 100 validators who serve many roles. Their roles may vary with each rollup to whom validators offer decentralization and security.

The Interop Layer exists between the layer 2 and the staking layer. It enables seamless interoperability and composability between all Polygon layer-2s.

Note: Composability in blockchain is the ability to use components for previous smart contracts together to build new applications and implement new use cases. For instance, the same token contract for USDT is applicable across all the dapps on Ethereum, like DEXs and Lending protocols, due to Ethereum’s ability to compose the same smart contract in different applications..

Therefore, the scope of ‘The Polygon Network’ has broadened in Polygon 2.0. It has evolved from a cluster of independent Ethereum scalability solutions to a unified network of multiple scalability and interoperability solutions on Ethereum.

Heimdall Node

Heimdall nodes work with Polygon’s stake manager contract on Ethereum to coordinate validator selection and updation. Heimdall nodes are responsible for checkpointing. These nodes create a checkpoint by aggregating layer 2 blocks into a single Merkel root and periodically publishing it to Ethereum. Once a checkpoint enters the Ethereum block records, it achieves Ethereum-secured finality.

Bor Node

Bor is the block production layer of the Polygon POS chain. Bor nodes are a subset of validators periodically shuffled by Heimdall validators. Block producers aggregate transactions to create the PoS Chain blocks.

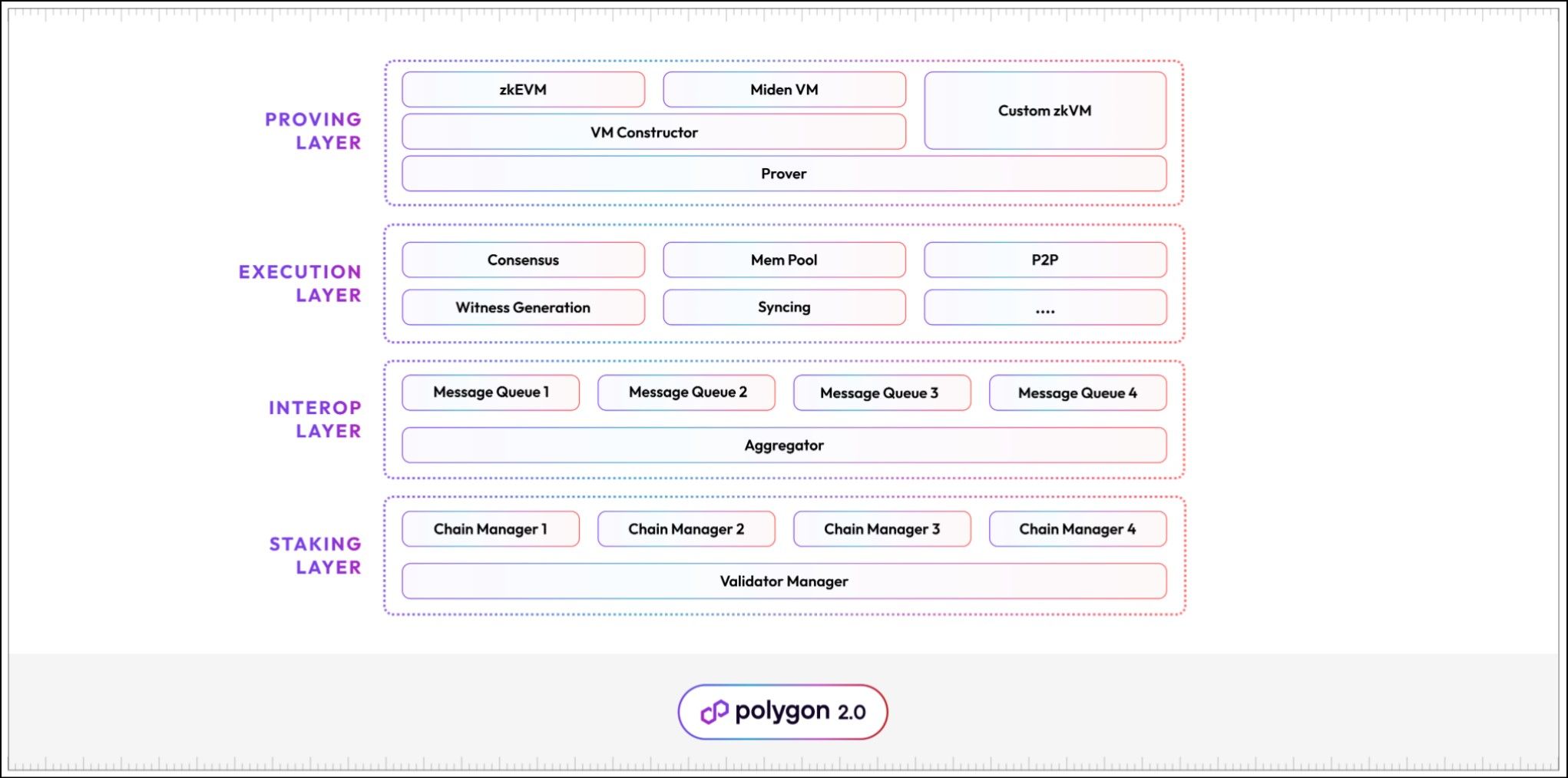

The Polygon 2.0 Architecture

The updated architecture of Polygon 2.0 represents a thorough restructuring of all Polygon products. The Ethos behind the new architecture is undoubtedly modularity. The Polygon Network stack abstracts the network’s core functions in four distinct protocol layers. Every layer-2 chain on Polygon is a collective happening of these layers interacting with one another. The four layers are:

- Staking Layer

- Interop Layer

- Execution Layer

- Proving Layer

Polygon 2.0 Architecture | Image via Polygon Blog

Polygon 2.0 Architecture | Image via Polygon BlogTo understand this architecture intuitively, let us focus on how it implements Polygon zkEVM, a ZK-powered layer-2 chain. The zkEVM is a ZK-proofs-based rollup. Zero Knowledge proofs in rollups are a special type of validity proof that proves the availability of certain data to the Ethereum chain without revealing the actual data. Here’s how they work:

- A sequencer on layer 2 orders, executes, and batches several transactions together to calculate the new state of the layer 2 chain.

- The sequencer generates a ZK-proof, a type of validity proof that all the transactions included in the latest block are valid.

- The sequencer posts the ZK-proof to the rollup smart contract on Ethereum, along with the state commitment and relevant transaction data. A state commitment is typically a hash of the latest block, which ensures that the state cannot be tampered with later.

- ZK-rollups also post the minimum amount of transaction data required to calculate the rollup state to the Ethereum chain.

- Now, any validator on the Ethereum chain has access to the following information about the rollup:

- ZK-proofs of all the transactions included in the rollup state.

- A state commitment of the rollup state.

- Relevant transaction data to calculate the rollup state.

- The above-mentioned information is enough to calculate a snapshot of the rollup state on Ethereum. The ZK-proofs paired with the state commitments can prove the inclusion of transactions in the rollup state. At the same time, the available transaction data can verify the correct calculation of the rollup state.

- The Ethereum network lends security and finality by including this data in its blockchain.

The provision of transaction data on the Ethereum network is known as ‘Data Availability.’ By making transaction data available to Ethereum nodes, they make fewer security assumptions about the rollup state, thus providing more robust security. The downside to enhanced security is that transaction data incurs significant storage costs, increasing the cost of ZK rollups.

FYI: ZK-Rollups are still cheaper than Optimistic rollups, which require even more data on the Ethereum main chain, including full transaction (not the bare minimum) history and transaction signatures.

Now that we clearly understand how zkEVM works, we have the information to unpack the Polygon 2.0 architecture. Let’s dive in!

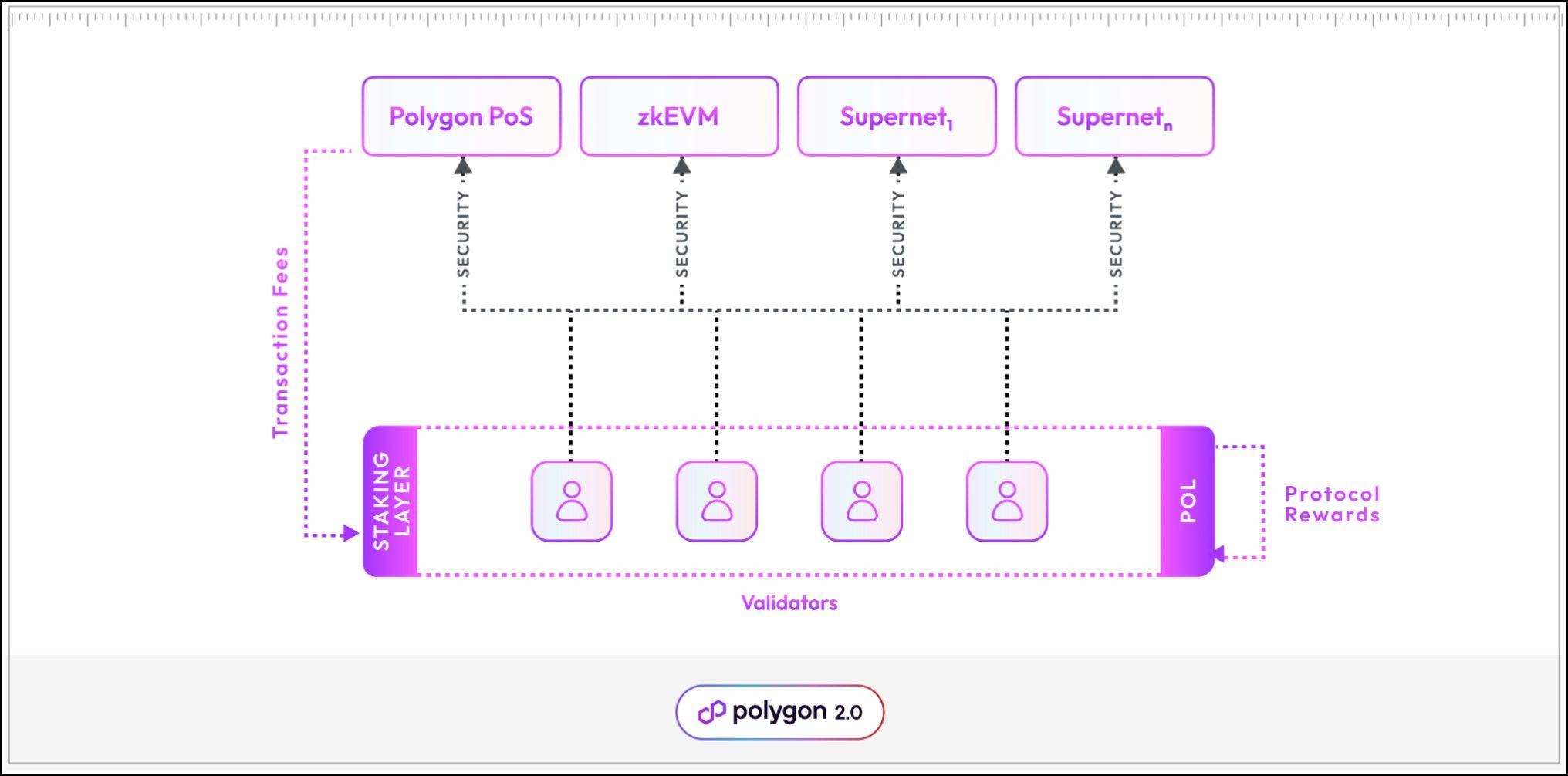

The Staking Layer

The Staking Layer is implemented on Ethereum. It is a PoS-based protocol running on Polygon’s native POL token. The Staking layer provides decentralization to the layer 2 chains in the Polygon ecosystem with a common, decentralized validator pool with a restaking model.

The Staking Layer is divided into two parts:

- The Validator manager smart contract keeps track of the common validator pool that can be leveraged by all Polygon chains.

- The Chain manager contract manages the validators' sets of individual chains.

Validators stake POL to join the validator set on Ethereum, providing decentralization to the entire layer 2 ecosystem. Validator staking on Ethereum is essential for the following:

- Preventing Sybil attacks, where the same person runs multiple node identities.

- Creates incentives for the validators.

- Enables slashing and punishments of malicious validators.

Once the validator stakes POL to enter the validator pool, they are eligible to join the validation activities of any chain. This is where the network’s restaking capabilities kick in. The validators have the following incentive schemes:

- Protocol rewards – The staking protocol emits predefined amounts of POL and distributes them to all active validators.

- Transaction fees – Validators collect transaction fees from the chains they choose to validate.

- Additional rewards – Individual chains can introduce more rewards through their token emissions to attract more validators to their network.

Polygon Staking Layer Incentives | Image via Polygon Blog

Polygon Staking Layer Incentives | Image via Polygon BlogThis model creates a free market for security, where validators follow incentives to secure the layer 2 networks on Polygon, ensuring all networks receive adequate validators to ensure their individual security. It is noteworthy that Polygon staking validators perform broader duties than a typical POS validator.

Apart from standards consensus operations, validators fill in other chain-specific roles, where they might also generate zero-knowledge proofs or participate in Data Availability Committees on the Polygon chains. DACs independently calculate the state of the ZK-Rollups using transaction data to secure the network (see the process described above).

Interop Layer

The Interop layer makes the whole Polygon ecosystem work like a single unit. The cross-chain connectivity across EVM chains these days is very fragmented. Cross-chain bridges are built between two chains on a need basis, making the network fragmented. Furthermore, Polygon cannot rely on relaying every cross-chain message through Ethereum because of its high fees and slow network time, making seamless connectivity impossible.

To tackle these challenges, the Polygon team developed the Interop Layer, which abstracts the complexity of cross-chain communication for the entire Polygon ecosystem. It enables the following:

- A shared bridge to Ethereum allows seamless cross-chain transfers without minting synthetic assets.

- It can support fast atomic cross-chain transactions, an essential infrastructure for cross-chain applications.

How Does The Interop Layer Work?

Every Polygon chain maintains a local queue of outbound messages called Message Queues, which are included in the ZK proofs that the chain generates. Once a particular message queue is secured by consensus in Ethereum, any recipient Polygon chain can safely consume its cross-chain messages.

To ensure the programmable scalability of the Polygon ecosystem, the Ethereum layer mustn't be burdened by having to accept an increasing number of ZK-proofs from a growing number of Polygon chains.

The situation above is mitigated via Aggregators. Aggregators are the distributed network of Polygon validators on Ethereum from the validator pool in the Staking Layer. Aggregators provide two essential services:

- Accepting ZK proofs and message queues from the Polygon chains.

- Aggregate the ZK-proofs into a single ZK-proof and submit it to Ethereum for verification.

Aggregating ZK proofs ensures that the cumulative weight of the proofs remains the same, no matter how many ZK-proofs are aggregated to create a single ZK-proof, reducing the gas consumption significantly. Once the Aggregator accepts the proofs, the recipient chain starts to optimistically accept inbound messages, knowing that Ethereum guarantees global consistency. This process is how the Interop Later facilitates seamless cross-chain interactions within the Polygon ecosystem.

Execution Layer

The Execution layer is where the Polygon Network layer 2s execute their smart contracts, calculate state transitions, and produce a sequenced batch of blocks. The Execution layer comprises multiple components, such as:

- P2P layer – Enables network operators to discover one another and communicate.

- Consensus – Enables validators to reach an agreement on a single order of transactions.

- Mempool – Collects transactions submitted by users and synchs them with all the validators.

- Database – Stores transaction history.

- Witness generator – Generates witness data required by ZK provers.

Proving Layer

The proving layer is a ZK proving protocol that generates proofs for all transactions for every Polygon chain. This layer is essential for ZK-proof generation and verification, proof aggregation, implementation of ZK state machines, and efficient cross-chain communication. The Proving layer comprises the following components:

- Common Prover: A polygon-developed ZK prover designed to support arbitrary transaction types. Using a single prover makes proof aggregation and verification straightforward and efficient.

- State machine constructor: A framework for defining state machines. Developers can use the constructors to define their own state machines. State machines are the execution environments on the blockchain. For instance, the Ethereum state machine is known as the Ethereum Virtual Machine (EVM)

- State machine: Polygon offers two state machine implementations – zkEVM and MidenVM.

The updated Polygon design abstracts the core blockchain architecture into distinct layers. The zkEVM rollup, for instance, is an execution layer 2 that leverages the proving layer to prove ZK-Proofs. Then, the Interop layer relays any cross-chain requests from zkEVM to other rollups and combines the ZK-proofs from all rollups to submit to the staking layer. The Polygon Network stack works with the help of independent layers that perform basic functions to facilitate a unified network.

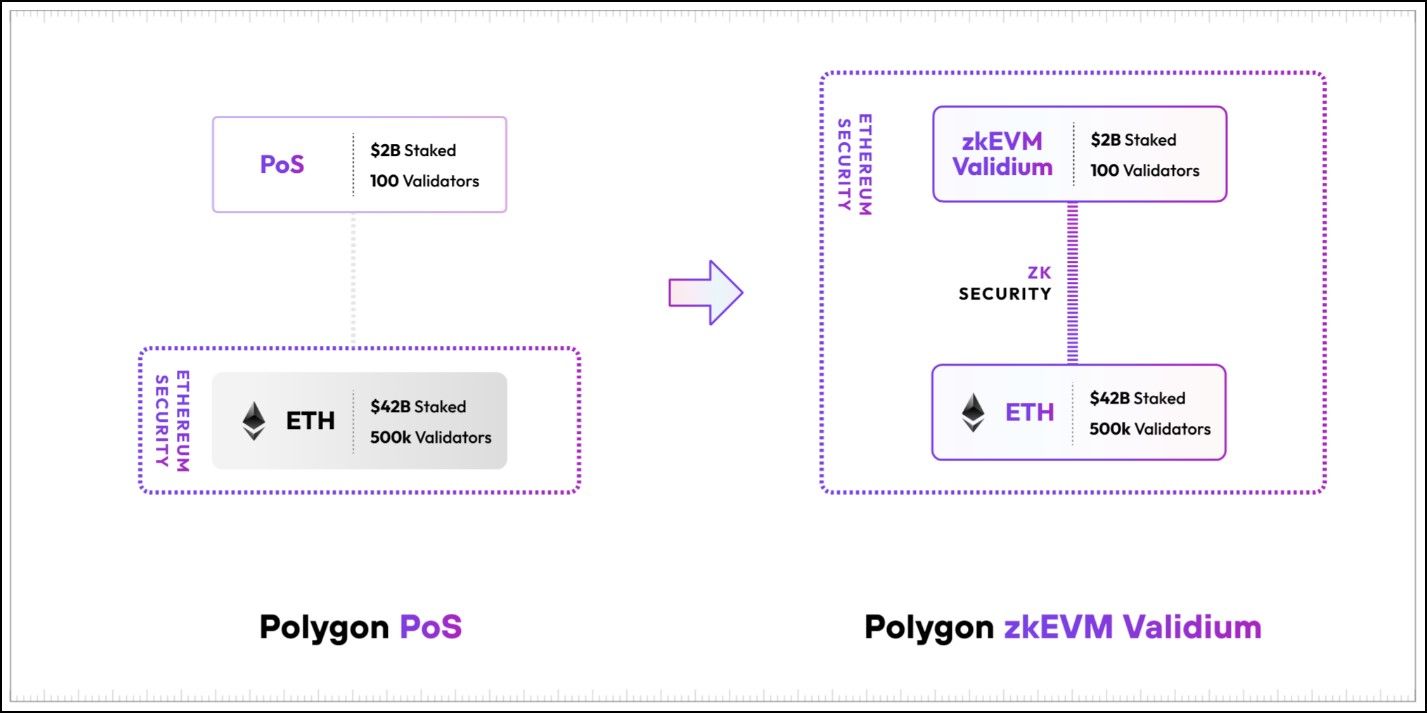

The Redesigned PoS Chain

The Polygon POS chain was the Polygon team’s first scaling solution in the Ethereum ecosystem. The POS Chain worked on a technology called Sidechains. The update will redesign the POS chain to implement the zkEVM Validium model to align the POS chain with the Polygon 2.0 narrative. Let us break this update down.

PoS chain economics | Image via Polygon Blog

PoS chain economics | Image via Polygon BlogThe Original Polygon PoS Chain Design

The Polygon PoS Network comprises three essential layers:

- The Ethereum layer – A set of smart contracts on Ethereum for validator record keeping.

- Heimdall layer – A set of Proof of Stake nodes running parallel to Ethereum that commit Polygon Network checkpoints to the mainnet.

- Bor layer – A set of block-producing nodes shuffled by Heimdall nodes.

Here is an overview of the block propagation process behind Polygon PoS:

- A subset of active polygon validators creates blocks and broadcasts them to other validators.

- A selected block proposer from the Heimdall layer is responsible for collecting all signatures for a particular checkpoint and committing the checkpoint to the Ethereum mainnet. Every checkpoint includes multiple blocks.

- The responsibility of creating blocks and proposing checkpoints varies on the validator’s stake ratio on the overall validator pool.

The network also supports a two-way bridge between the PoS chain and Ethereum, allowing users to move assets like POL (previously MATIC) and ETH between the networks.

The Polygon PoS network does inherit minimal security from Ethereum. The security stems from the checkpoints that Polygon nodes periodically commit to Ethereum. The network can fork to the last synced checkpoint in a breach and slash the colluding validators.

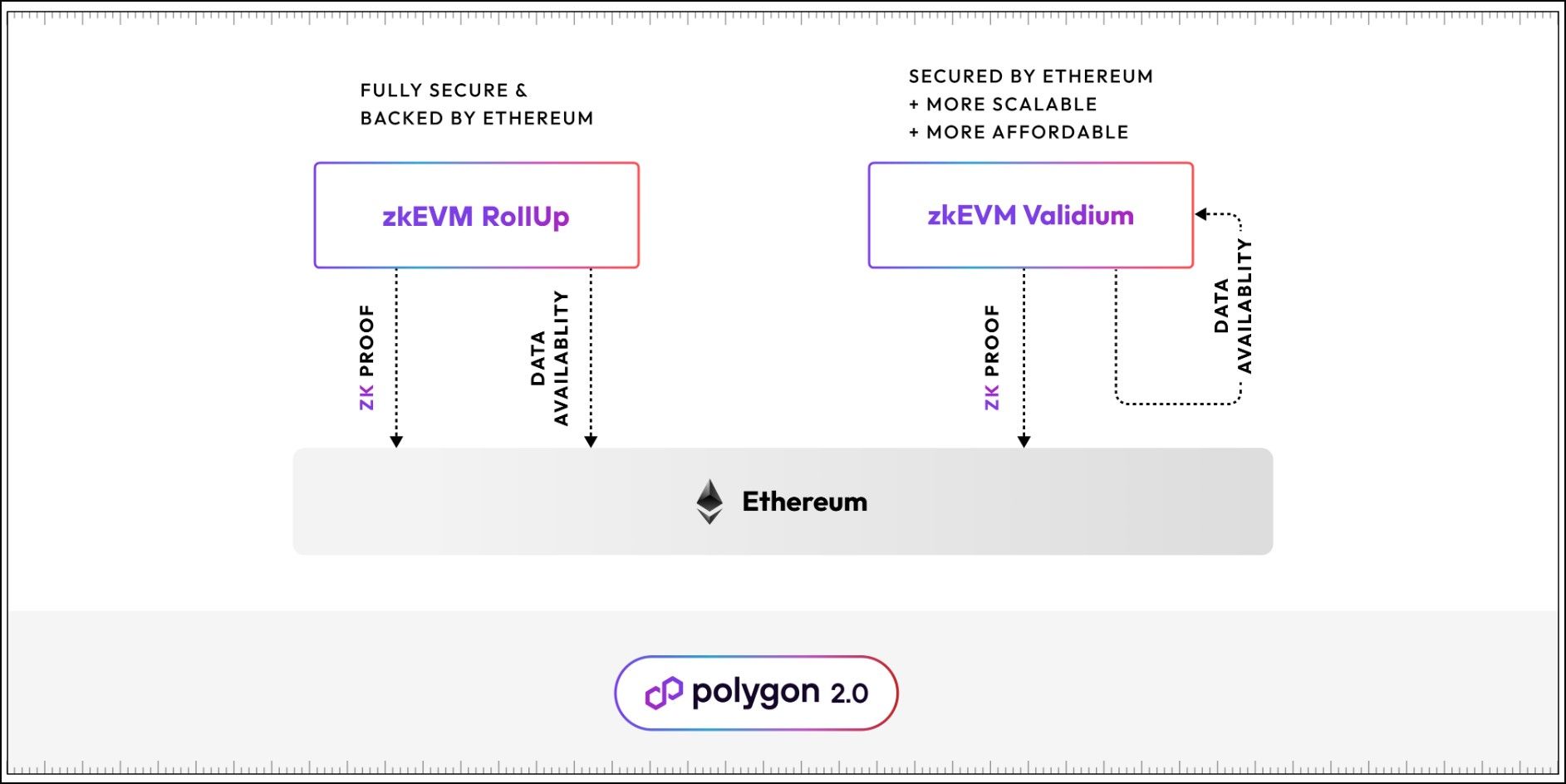

Polygon PoS Adopts zkEVM Validium

As intimidating as the name ‘zkEVM Validium’ may sound, we have already covered the background to understand this blockchain design. A Validium is a higher throughput, lower cost version of standard ZK-Rollups. Validium trades off some security guarantees offered by ZK-Rollups to achieve a higher throughput. To quickly recap, standard ZK-Rollup makes the following data available to the validators of the Ethereum network:

- ZK-proofs of all the transactions included in the rollup state.

- A state commitment of the rollup state.

- Relevant transaction data to calculate the rollup state.

The Ethereum validators can reconstruct the rollup state with this information, which enables them to verify if the new state was calculated correctly, here’s how it works:

- The ZK-proofs are checked against the state commitment to verify if all the transactions for which the proof was provided are indeed a part of the new state.

- Next, they use the provided transaction data to reconstruct the rollup state to confirm the validity of the state commitment itself.

- Therefore, Ethereum mainnet validators are able to verify rollup blocks with no trust assumptions, as they have access to all relevant data required for the verification.

The difference between standard ZK-Rollups and Validium lies in the last step. It turns out that the transaction data, the puzzle piece essential for calculating the rollup state, is quite memory-heavy, making up the bulk of the ZK-Rollups data on Ethereum.

A Validium model works like a standard ZK-Rollup but skips sharing transaction data with Ethereum. The Ethereum validators still have access to zk-proofs and state commitments, enabling them to prove if all transactions were correctly included in the rollup state. However, they cannot verify the validity of the rollup state, a situation known as lack of data availability.

An Ethereum node must verify three crucial aspects of any layer 2 block:

- All transactions included are correct and provable via zk-proofs.

- The new rollup state includes all correct transactions, provable via zk-proofs and rollup state.

- The validity of the rollup state is verified by reconstructing the state with the transactions in the right order.

A Validium lacks the essential last component, transaction data required to verify the state, but why does that matter?

Polygon zkEVM and zkEVM Validium Deisgns | Image via Polygon Blog

Polygon zkEVM and zkEVM Validium Deisgns | Image via Polygon BlogThe most crucial element of a blockchain consensus process is agreeing upon the right order of transactions. A lack of consensus about the order could yield vastly different block states for the same pool of transactions. In Validium, the order guarantee is secured by the validators in layer 2, which are the existing validators of the PoS chain.

Polygon zkEVM Validium Design Summary

Let's summarize this section with some instances where sacrificing security in Valudium may be practically feasible:

- Low-value transactions have minimal effect on slippage, reducing the incentive of tampering with transaction ordering. Validium is helpful for such everyday transactions.

- It is also useful in enterprise networks where privacy is preferred. Hiding transaction data in these settings is more crucial for privacy than security and decentralization.

Therefore, with the Validium chain and the standard zkEVM rollup, Polygon addresses both user demand for scalability and security.

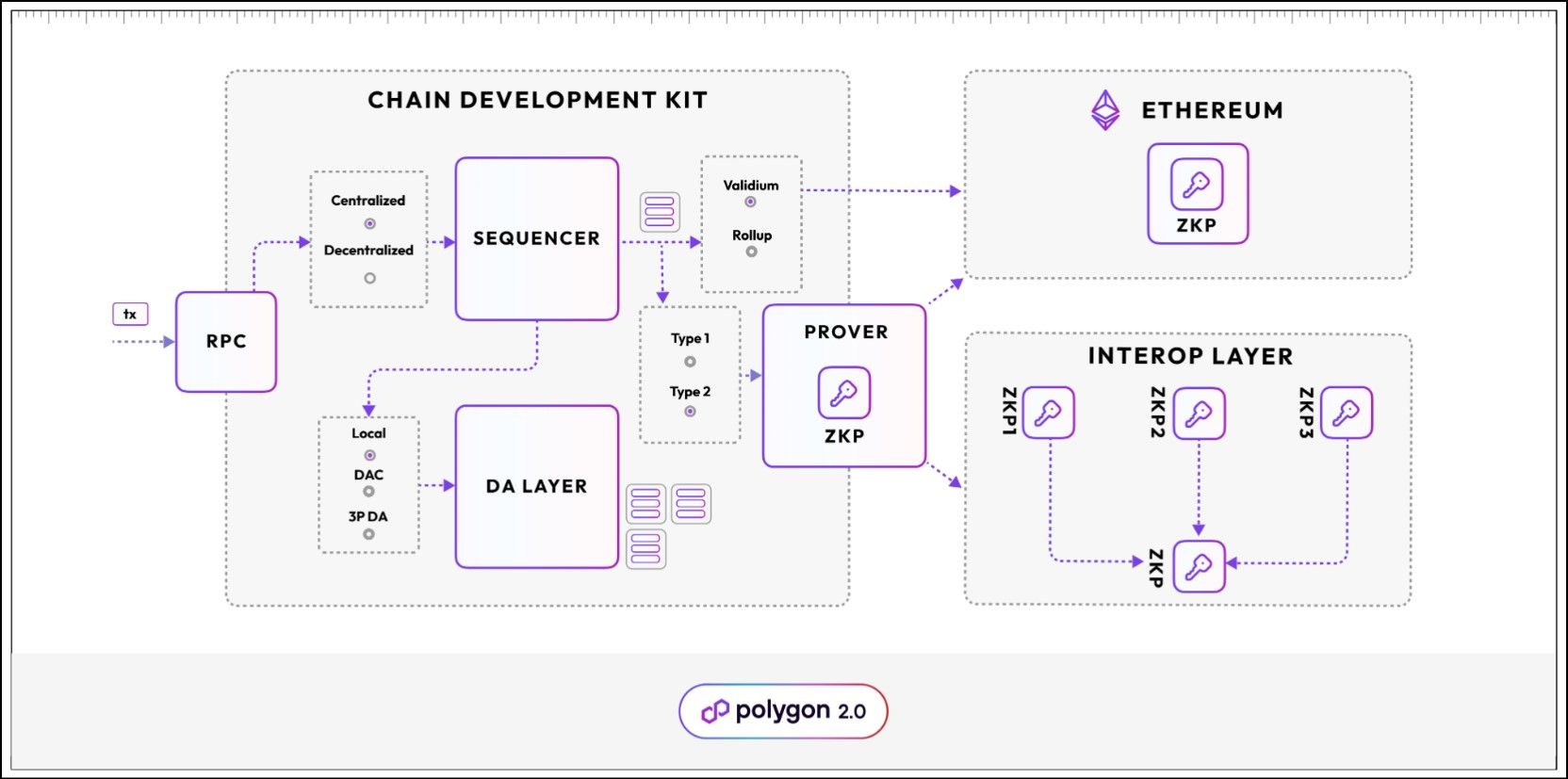

Polygon Chain Development Kit

Polygon CDK (Chain Development Kit) is an open-source, modular codebase to help developers launch ZK-powered Ethereum layer 2 chains that plug into the Polygon Network for interoperability. Developers that use the CDK to deploy new chains will automatically launch a ZK-powered layer 2 on Ethereum, interoperable with the rest of the Polygon Network via the Interop Layer by default.

With the CDK, developers can deploy custom layer 2 chains tailor-made for their use case. They may choose several components to build their chains. Some of them are:

- Data Availability – Rollup or Validium designs

- Execution environment – zkEVM or MidenVM

- Token – Native or custom gas token

- Sequencers – Centralized or Decentralized

Most essential features of the Polygon CDK:

- Modularity and Customizability – The ability to choose between different infrastructural components.

- Interoperability and shared liquidity – Shared liquidity and interoperability with the rest of the Polygon ecosystem.

- Access to Polygon’s ZK technology – Access to Polygon’s ZK-powered proof systems.

Polygon CDK Design | Image via Polygon Blog

Polygon CDK Design | Image via Polygon BlogHere are some projects building in the Polygon ecosystem with the help of the Polygon CDK:

- Immutable - Building Web3 games on Ethereum.

- Astar Network - A smart contract platform on Polygon.

- Palm Foundation - Democratizing Art with the Palm Network on Polygon.

- Acentrik - Enterprise Web3 solutions.

- OKX- Announced they will be launching their Layer 2 on Polygon

The POL (Matic) Token

POL (formerly MATIC) is the native token in the Polygon ecosystem. It is the default mode of paying gas for transactions in the PoS chain. It also fuels security guarantees of layer 2 networks on Polygon that deploy Polygon stakers in their infrastructure. POL is also the governing token in the ecosystem, essential for the democratic implementation of improvement proposals in the ecosystem.

POL owners can also stake their holdings to help secure the Polygon POS chain and earn rewards. Staking POL (Matic) through Ledger is one of the safest ways to do so as it combines the security of a hardware wallet with the flexibility to choose your own validator. You can find other staking tokens in our Top Staking Tokens article.

Migration to POL:

The POL token will replace MATIC to become the major tool for coordinating and growing the Polygon ecosystem. POL makes two “game-changing” improvements, as Polygon put it:

- Validators can validate multiple chains, i.e. as many chains as they want.

- Every chain can offer multiple roles (and corresponding rewards) to validators.

Essential features of the POL token include:

- Restaking: POL stakers will secure the network and receive rewards. After staking a specified amount of POL tokens to run a validator node, the consensus algorithm affirms the validator's commitment to protecting the network, and as an incentivization system, validators will be rewarded with POL tokens. Restaking refers to the POL token powering the security of other chains that operate under the Polygon Supernet structure as well. Validators on the Polygon network will also be able to validate other chains, earning rewards from transaction fees generated on the secondary networks.

- Ecosystem security: The decentralized pool of Proof-of-Stake validators can secure the Polygon chain.

- Parallel scalability: The validators of the staking layer can theoretically secure an unlimited number of layer 2 chains with the same POL liquidity.

- Community ownership: With decentralization as its core value, Polygon is meant to be governed by its community. POL should be enabled to hold governance rights, i.e., be utilized in governance frameworks.

- Every Polygon chain’s community can decide which token their chain will use for gas fees.

The upgrade to POL from MATIC would require a simple technical action, sending MATIC to the upgrade smart contract, automatically returning the equivalent amount of POL. Token holders would be given ample time to upgrade, such as four years or more. However, if the community consensus is gathered supporting this proposal, the migration could start within months. If it piques your interest, you can check out the POL whitepaper.

Where to Buy Matic/POL

Exchanges are still offering the Matic brand of the token as POL is rolled out, but as Polygon is one of the crypto industry's leading projects, it is available on most reputable exchanges. We recommend SwissBorg, Kraken, OKX, Bybit, Crypto.com , etc.

Guy has a few centralized exchanges to recommend if you want to buy it with cash. There are also decentralized exchanges, but you will need some form of cryptocurrency to exchange for it. The most common types used are stablecoins.

Where to Store MATIC Tokens

Most of the wallets in the market can store your MATIC tokens safely. Hot wallets such as MetaMask, Exodus and Trust Wallet are popular options for ease of use. If you plan to hold on to them for a while, then cold wallets aka hardware wallets are your best bet. Ledger, Trezor, and Ellipal are solid cold wallet choices for the storage of MATIC.

Is Polygon good for Ethereum?

Polygon is beneficial for Ethereum because it accentuates the most vital element of the Ethereum blockchain – security and decentralization. Polygon may benefit Ethereum in two broad ways:

- Promoting the EVM ecosystem – As more services are built on EVM and more users enter the ecosystem, it reduces the incentive to build on non-EVM ecosystems.

- By increasing gas use – Increased on-chain activity leads to more demand for ETH to pay for gas.

Ultimately, Polygon benefits Ethereum organically by contracting the supply of ETH and burning more gas, deflating ETH supply and potentially increasing its value.

Does the Ethereum Roadmap Make Polygon Obsolete?

The answer to this question is more nuanced than a simple yes or no. The Ethereum 2.0 upgrade transitioned the protocol consensus to Proof of Stake and introduced gas management efficiencies to the network. All layer 2 networks achieve finality on the Ethereum blockchain by paying to have their transactions included in the mainnet. Therefore, improving the base layer efficiency improves performance on the above layers.

After Ethereum 2.0, the rollup-centric roadmap is also set to introduce Danksharding to the network, a novel scaling solution dramatically reducing commitment costs for layer 2 networks. As it turns out, the post-Danksharding design for the standard rollup is very similar to Validium, but with fewer security guarantees. If standard rollup designs achieve near-Validium throughput but with relatively higher security, the update could reduce the incentive to use the Polygon POS Validium chain.

However, it is worth mentioning that much of the analysis above is speculation, as the technologies we have compared have not yet been implemented, and their effects have not been realized fully, so a lot remains to be seen.

Top Projects on Polygon

Being the multipurpose chain that it is, Polygon, long known for being home to some of the top DeFi dApps, is also now known as the no. 2 gaming platform for Web3 games. The rise in gaming ranks is attributed to the formation of Polygon Studios in July 2021. In this section, we briefly look at some of the top dApps on the network just to give you an idea of the network’s capabilities.

- AAVE – A top DeFi protocol with one of the highest TVL, according to DeFi Llama, is on Polygon.

- Aavegotchi – This project was launched by AAVE, and features NFTs of ghosts, similar to the AAVE ghost icon. These ghosts live in the Gotchiverse, and can be procured in two ways: summoning an Aavegotchi or picking one up at the Aavegotchi bazaar.

- Uniswap V3 – The top decentralized exchange in the crypto space has been available on Polygon by popular consensus since December 2021. Trading volume for the exchange on the Polygon network is around $38 million, according to CoinMarketCap, compared to the $99.88 million for the exchange across all the networks.

- OpenSea – the top NFT marketplace, has a presence on the Polygon network. Cheap gas fees and fast transaction speed are a definite plus for NFT traders.

- Decentraland – the project that popularised the term “Metaverse” has a footprint on Polygon.

Polygon 2.0 Review – Closing Thoughts

Modularity, Composability, and Interoperability are vital pillars of the Internet. Modularity is the ability to abstract different elements of the tech stack. Composability is the ability to combine different modular components in various configurations to build new products or systems efficiently, and interoperability is the ability for such different systems to communicate and interact with each other seamlessly and efficiently. These abilities facilitate Polygon’s Value Layer of the Internet.

Polygon 2.0 is a significant move by a major ecosystem towards implementing global modularity, composability, and interoperability. In an ideal world, Polygon’s Value Layer will thrive not only on Ethereum but also on other Layer 1 networks. The tech stack’s modularity can make this transition easier than before by only updating the necessary components rather than building the stack again from the ground up.

Polygon 2.0 is the most ambitious experiment in layer 2. It makes big bets on several novel technologies, including zero-knowledge proofs, restaking, and the appchain thesis. If the experiment proves successful and sustainable, it has the potential to establish itself as the gold standard for layer 2 architecture.