Fiat currency was one the first major Real-World Asset (RWA) that was tokenized in the blockchain industry. Stablecoins are the cornerstone of value exchange in DeFi, and I have seen them in use for as long as I can remember hearing about blockchain technology.

As the name suggests, stablecoins are cryptocurrencies that maintain a stable value pegged to a central bank-issued fiat currency. USD-backed stablecoins are among the most prominently held and traded assets in DeFi.

We Use Stablecoins and Fiat Very Differently

For much of DeFi's history, stablecoins have solely transferred value from one address to another. Stablecoins are convenient for instant on-chain settlements, international transfers, and high-frequency trading. While we do all these activities with fiat alike, the difference lies in how we store the two assets.

If you observe your parent's banking history, you will find significant money parked in low-risk investments like fixed deposits and government debt. With a very slim chance of devaluation, these investments accrue interest and ensure money availability by selling bonds or breaking fixed deposits.

In contrast, stablecoins sit in exchange or cold wallets, often do not earn any interest, and gradually devalue due to inflation. Stablecoins do not have an inherent yield component. Yield-bearing stablecoins earn passive interest, bringing them closer to the true nature of fiat currencies.

This piece will analyze yield-bearing stablecoins, explain how they work, and discuss how they accrue interest. DeFi is getting as capable as traditional financial services, so learning about emerging asset classes in the space is essential for making the most out of your investments.

What are Yield-Bearing Stablecoins?

Yield-bearing stablecoins are functionally similar to fixed deposits and treasury notes in traditional finance. These low-risk and low-volatility assets have a yield component attached to them, accruing simply by holding the coin in your wallet. This asset class shares similarities with traditional fiat currencies.

Consider the money you have stored with your bank, for instance. When you deposit money in a bank, it updates a digital ledger that tracks all your transactions. While you can spend, transfer, or withdraw from the ledger as you like, the bank loans the actual money to individuals seeking debt. The debt earns interest, a portion of which is remitted to you for storing your money with the bank. Your bank account practically reflects a tokenized version of your fiat deposits that you can use while the assets earn interest elsewhere.

Similarly, yield-bearing stablecoins operate by having the bearer deposit funds into the stablecoin protocol. These deposits can be made using other stablecoins like USDC or tokens like BTC and ETH. The protocol then invests those resources in various yield strategies and mints a stablecoin to represent your deposit. Subsequently, the yield is distributed proportionately to the stablecoin holders.

The source of yield for these stablecoins varies. Some projects simply lend depositors' resources to earn interest, akin to traditional banks. However, recent developments in blockchain technology have introduced innovative yield-generation methods.

Why Do Yield-Bearing Stablecoins Matter?

While a relatively new asset class, yield-bearing stablecoins will become an essential component of DeFi. Here's why they are important:

Stablecoin Fiat Deposits as a Major Source of Yield

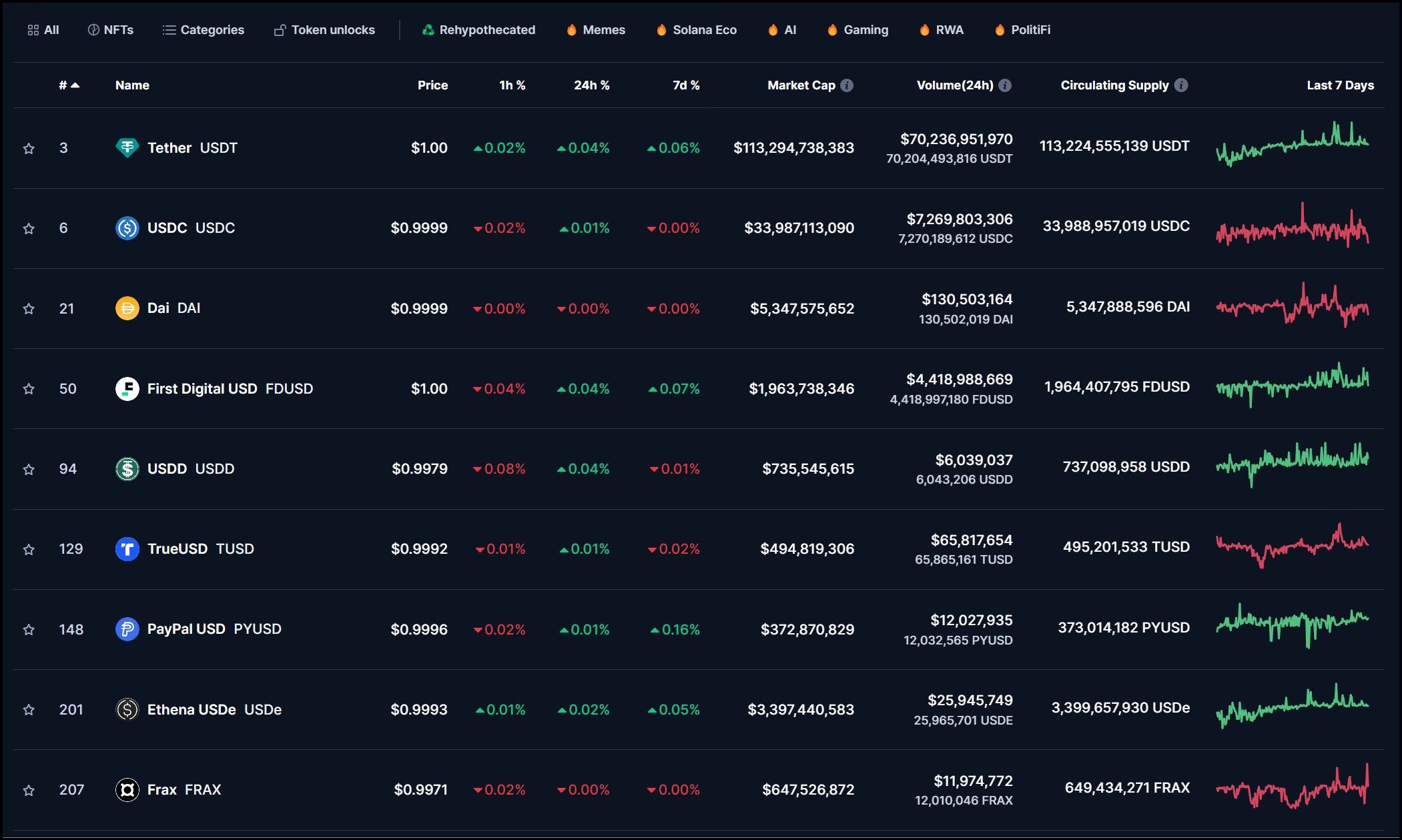

Stablecoins like USDC and USDT are pegged to fiat currencies and backed by reserves held in banks. These reserves, amounting to billions of dollars, generate significant yield. As of 2024, Circle, the issuer of USDC, holds $33.9 billion in reserves, while Tether, the issuer of USDT, holds $70 billion. These funds are stored in banks and invested in low-risk assets like treasury bills, which generate interest. However, this yield has not been passed on to USDC and USDT holders. Instead, it is retained by the issuing companies.

Stablecoin Marketcaps via CoinMarketCap

Stablecoin Marketcaps via CoinMarketCapThe potential for yield generation from these reserves is immense. For example, even a modest annual yield of 2% on $72.5 billion could generate $1.45 billion in interest, a substantial amount that, if distributed to stablecoin holders, could provide meaningful returns and increase the attractiveness of holding these assets.

Inflation and Erosion of Value

Between 2022 and 2024, inflation reached record highs, with the U.S. Federal Reserve raising interest rates significantly to combat it. The Consumer Price Index (CPI) in the U.S. saw annual increases of around 7% in 2022, with rates still elevated in subsequent years . While higher interest rates on government debt helped curb the loss in the value of fiat currency due to inflation, stablecoin holders did not benefit from these higher yields. The value of stablecoin holdings eroded faster than the same fiat currency, which would accrue interest in a traditional savings account or government bonds.

Yield-bearing stablecoins address this issue by providing interest that helps offset inflation, preserving the purchasing power of the assets over time, making them a more attractive option for storing value in a high-inflation environment.

Custody and Yield Generation

Users typically need to deposit their assets into yield farming protocols like Aave, Maker, or Compound to earn yield on their stablecoin holdings, which requires giving up custody of their assets and often involves lock-in periods. For instance, some protocols impose a minimum lock-in period to optimize yield generation, limiting the flexibility of asset holders.

Yield-bearing stablecoins eliminate this inconvenience by allowing users to earn interest on idle funds in their wallets. Users can maintain full custody of their assets while benefiting from yield generation. This function enhances security and flexibility, making it easier for users to manage their assets without sacrificing potential earnings.

Borderless Access to Risk-Free Returns

Risk-free returns, such as those provided by the U.S. Federal Reserve, are typically limited to U.S. nationals or entities with access to U.S. financial markets. There is a financial barrier for individuals outside the country who cannot easily access these secure yields. Yield-bearing stablecoins break down these jurisdictional limitations, allowing anyone around the globe to benefit from the risk-free rates of any currency they wish.

By tokenizing these yields, stablecoin protocols democratize access to secure, interest-bearing assets. They open up new opportunities for individuals in regions with less stable financial systems to earn reliable returns on their holdings, contributing to greater financial inclusion.

Yield-bearing stablecoins represent a significant advancement in the crypto space, addressing key issues faced by traditional stablecoins. By leveraging the substantial reserves of stablecoin issuers, these assets can generate meaningful returns for holders, offsetting inflation and preserving value. They also offer the benefits of maintaining custody and providing borderless access to risk-free returns. As the stablecoin market continues to evolve, yield-bearing variants are likely to play an increasingly important role in individuals' and institutions' financial strategies.

How Do These Stablecoins Generate Yield?

Yield-bearing stablecoins generate yield through various mechanisms, broadly categorized into three main sources: DeFi native yield, crypto derivatives, and traditional finance (TradFi) and real-world assets (RWAs). Each category leverages different financial strategies and assets to generate returns for stablecoin holders.

Here's a detailed explanation of each category and examples to illustrate how they work.

DeFi Native Yield

DeFi native yield is generated from decentralized finance (DeFi) platforms that leverage the supply and demand of crypto assets like DAI, Ethereum, and Bitcoin. These platforms use lending and borrowing protocols to generate interest, which is distributed to stablecoin holders.

- MakerDAO sDAI: MakerDAO's DAI Savings Rate (DSR) allows users to earn interest on their DAI holdings by depositing them into the DSR contract. sDAI is a yield-bearing stablecoin representing a deposit in DSR contract.

- Ethena Finance: Ethena Finance uses a delta-neutral hedging strategy to generate yields on Ethereum and stabilizes the value of its stablecoin.

Crypto Derivatives

Crypto derivatives involve the use of liquid staking tokens and restaking tokens to generate yield. These derivatives are financial instruments whose value is derived from the performance of underlying crypto assets, such as staked Ethereum (ETH).

- Prisma Finance mkUSD: Prisma Finance's mkUSD is backed by liquid staking derivatives. These derivatives earn staking rewards from underlying staked assets like ETH, which are then passed on to mkUSD holders.

- Davos Protocol DUSD: Davos Protocol's DUSD generates yield through restaking derivatives, which involve staking assets multiple times to maximize yield.

TradFi and RWAs

TradFi and RWAs involve tokenized versions of traditional financial assets to generate yield. These assets include treasury bills, corporate bonds, real estate, and other financial instruments traditionally used in conventional finance.

- Ondo Finance and Flux Finance: Ondo Finance and Flux Finance generate yield by investing in traditional financial instruments and RWAs. These investments are tokenized and managed on the blockchain, providing stable returns to stablecoin holders.

- Mountain Protocol: Mountain Protocol invests in a mix of traditional financial assets and RWAs to generate yield, offering a stable return to its token holders.

- stEUR: stEUR uses a tokenized BAKKT EU money market fund to generate yield, acting as a Euro-denominated stablecoin similar to MakerDAO's DAI.

- Angle.money: Angle.money generates yield by investing in a diversified portfolio of traditional financial assets, providing stable returns to its stablecoin holders.

- sUSDT and eUSDC: Tether's sUSDT and Circle's eUSDC generate yield through investments in fiat-backed assets and commodities, such as treasury bills and corporate bonds.

- Blackrock's BUILD Funds: Blackrock's BUILD funds invest in a wide range of traditional financial assets, generating stable returns that are tokenized and distributed to stablecoin holders.

- Paxos Lift Dollar: Paxos Lift Dollar uses investments in traditional financial instruments to generate yield, providing its holders with a stable and secure return.

Yield-Bearing Stablecoins Generate Yield Through Various Mechanisms. Image via Shutterstock

Yield-Bearing Stablecoins Generate Yield Through Various Mechanisms. Image via ShutterstockConclusion

Yield-bearing stablecoins leverage diverse financial strategies and assets to generate returns. Each category offers unique advantages and opportunities for stablecoin holders, allowing them to generate yield while maintaining exposure to stable assets. Each stablecoin category reacts to different market conditions, generating different yields and getting subjected to varied risk profiles. We will dedicate a separate article to understand the implications of varying yield strategies and how you can leverage them to optimize your holdings.

Risks of Yield-Bearing Stablecoins

Yield-bearing stablecoins offer the enticing prospect of earning yield while maintaining the stability of traditional stablecoins. However, they come with their own set of risks, similar to those faced by traditional stablecoins, as well as unique risks related to their yield-generating mechanisms. Here are the primary risks associated with yield-bearing stablecoins:

Inconsistent Yield

The yield generated by these stablecoins may not be consistent. Several factors can affect the yield, including:

- Market Volatility: Extreme market conditions can stress the yield-generating mechanisms, leading to reduced returns.

- DeFi Protocol Risks: If the yield comes from DeFi platforms, any issues with these platforms, such as smart contract bugs, hacks, or changes in protocol parameters, can impact the yield.

Devaluation of Collateral

The collateral securing the yield and the stablecoin peg could severely devalue, especially if it consists of volatile crypto assets. This devaluation can threaten both yield generation and stablecoin stability.

- Crypto Asset Volatility: If the collateral includes volatile assets like Ethereum or Bitcoin, sharp declines in their value can reduce the yield and destabilize the stablecoin peg.

- Liquidation Risks: In scenarios where the collateral value drops significantly, automatic liquidation mechanisms in DeFi protocols might trigger, leading to potential losses for stablecoin holders.

Regulatory Risks

Yield-bearing stablecoins could attract regulatory scrutiny for several reasons:

- Competition with Traditional Banks: If these stablecoins offer better returns with the same risk assets, they could draw depositors away from traditional banks. This could disrupt the traditional financial system, prompting regulators to intervene.

- Compliance and Legal Issues: As with all financial products, yield-bearing stablecoins must comply with existing and future regulations. Any regulatory changes or legal challenges could impact their operation and viability.

Smart Contract and Security Risks

Smart contract risks are inherent in any blockchain-based financial product:

- Bugs and Vulnerabilities: Yield-bearing stablecoins that rely on smart contracts are susceptible to bugs and vulnerabilities. Exploits can lead to loss of funds or yield.

- Security Breaches: Hacks and security breaches in the platforms providing yield can compromise the assets backing the stablecoins, affecting both yield and stability.

Liquidity Risks

Yield-bearing stablecoins might face liquidity issues under certain conditions:

- Market Conditions: During periods of market stress, liquidity for these stablecoins might dry up, making it difficult for holders to sell or redeem their assets without significant slippage.

- Redemption Risks: If a large number of users try to redeem their stablecoins simultaneously, the underlying assets might not be liquid enough to meet the demand promptly, leading to delays or losses.

Yield Sustainability

The sustainability of the yield provided by these stablecoins is another crucial risk:

- Yield Source Reliability: The reliability of the sources generating yield can vary. If the sources of yield dry up or become less profitable, the stablecoin may fail to provide the expected returns.

- Economic Conditions: Broader economic conditions can affect yield sustainability. For example, lower interest rates in traditional finance can reduce the returns from real-world assets backing the stablecoin.

Conclusion

While yield-bearing stablecoins offer significant benefits, they come with various risks that potential investors must consider carefully. These risks include inconsistent yield, collateral devaluation, regulatory challenges, smart contract vulnerabilities, liquidity issues, and concerns about yield sustainability. Understanding and mitigating these risks is crucial for investing in or using yield-bearing stablecoins effectively. As the market evolves, ongoing due diligence and awareness of the changing regulatory landscape will be essential for managing these risks.

Final Thoughts

The consensus among common folk is that cryptocurrencies are high-risk investments and involve much volatility. Yield-bearing stablecoins challenge this notion by introducing risk-free returns for stable assets, offering a compelling alternative to traditional financial instruments. These innovative digital assets bridge the gap between the high-risk, high-reward world of cryptocurrencies and the stability and predictability that traditional investors seek.

Yield-bearing stablecoins add another dimension to digital asset investment, encouraging long-term participation in the Web3 domain. They provide a unique opportunity to earn yield while maintaining exposure to stable assets, making them an attractive option for both seasoned investors and those new to the crypto space. By offering a secure and consistent yield, these stablecoins promote financial inclusion and democratize access to investment opportunities previously limited to traditional finance.

We will cover a comprehensive range of yield-bearing stablecoin projects in a separate article. We will analyze how to make yields and explore how these stablecoins can be integrated into a broader investment strategy. Stay tuned as we delve deeper into the mechanisms, benefits, and potential risks of various yield-bearing stablecoins, providing you with the insights needed to make informed decisions in this evolving landscape.