The DAI coin is one of the older stablecoins, having been released in December 2017 by Maker. If you don’t know what a stable coin is, it is a cryptocurrency designed to keep its value pegged to another currency. In the case of DAI this is the USD, with each DAI worth $1.

DAI differs from other stablecoins however, because it is decentralized. Rather than having a centralized authority that backs the value of DAI with holdings of actual U.S. dollars, like Tether (USDT), DAI is backed by collateralized cryptocurrency debt, in this case Ether. This is critical because it means that like other cryptocurrencies DAI can never be shut down, and there is no trust in a central authority required.

This is an important distinction, and explains why DAI is needed. Unlike other stablecoins that are backed by physical fiat currency, DAI is not vulnerable. There’s no way Maker can steal your funds, no way for a government entity to tax or steal your funds, and no way for a human error to compromise your holdings of DAI.

It is fully blockchain based, living on the Ethereum blockchain and within smart contracts.

What is DAI?

In the simplest terms DAI is nothing more than a loan taken against Ethereum. Anyone who has some ETH and the ability to use a decentralized application (through MetaMask or similar) can create DAI.

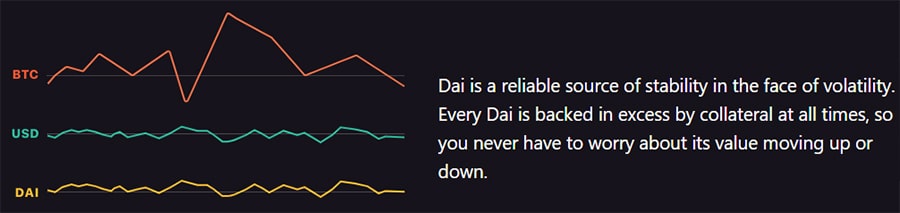

USD Stability in a Cryptocurrency

USD Stability in a CryptocurrencyWhat goes on behind the scenes to create DAI and to keep it pegged to the U.S. dollar is quite complex, which has caused some detractors to say DAI will never be a viable stablecoin. The truth is that just like fiat currency, most users will never need to know how DAI is created, and they won’t need to create their own DAI.

Most users will buy DAI on an exchange, and as long as it holds its $1 value and users can spend it and convert it as needed they will be happy to accept and use DAI. Trust will come from the fact that DAI holds its value and can be used.

How DAI is Made

The Maker team realized that the complexity of keeping DAI pegged was complicated by complexity in the process of creating DAI. Previously you had to go through steps of first turning your ETH into wETH (wrapped ETH) and then use that to make pETH (pooled ETH). Only then could you create a collateralized debt position (CDP) that would generate DAI.

Now there’s an app for that!

All of the above steps still happen, but the process has been simplified. The Maker team has created this dApp to generate DAI from your ETH holdings. By connecting a wallet to the dApp you can more easily create CDPs and generate DAI to spend and trade freely as you like.

It is easier to make DAI now, but why would anyone want to? There are actually three good answers to that question:

- You are interested in getting a loan and have ETH you can use as collateral.

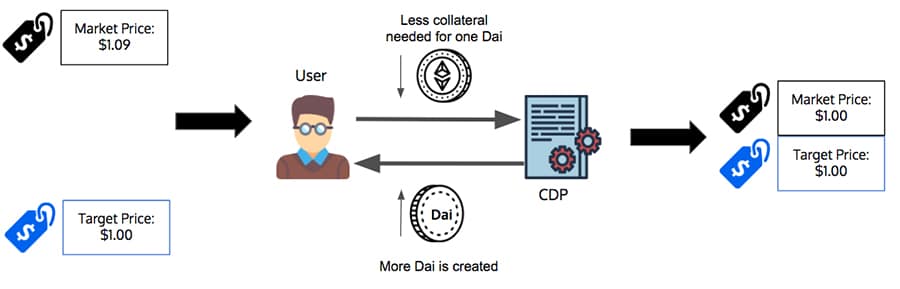

- DAI is worth more than $1. The way DAI creation works is that any DAI created costs just $1, which means you can create DAI for $1 and then immediately sell it on an exchange for more than $1. This type of arbitrage is actually one method Maker uses to keep the price of DAI pegged to $1.

- You are speculating ETH is going to rise in value. When you lock up your ETH in a CDP you receive DAI in return, and if you think ETH is going to rise in value you can use that DAI to buy more ETH on an exchange, which can then further increase the size of the CDP, etc. This is basically buying ETH on margin without needing a centralized exchange to do so.

How DAI Keeps the Peg

It’s actually very interesting how Maker created a stablecoin that uses economic incentives to maintain a peg to the U.S. dollar. There are mechanisms to both increase and decrease the price of DAI to keep it always striving to reach $1. These mechanisms work because users are always able to make money when DAI isn’t worth $1. The further from $1 it strays, the more incentive there is to create or burn DAI.

When the price of DAI rises above $1 ETH holders are able to create DAI for just $1 and sell it for more than $1. This incentive ensures DAI will be created, and that the price of DAI won’t rise much above $1.

The Maker Target Rate Feedback Mechanism. Image via Medium

The Maker Target Rate Feedback Mechanism. Image via MediumWhen the price of DAI drops below $1 those who already have a CDP can pay down their debt at less than $1. This gives them a discount on their loan, and ensures DAI will be destroyed when necessary to keep the price approaching $1.

How DAI Reacts to ETH Crash

Because of the way the system has been designed to balance itself, as long as ETH is worth more than $0 and it doesn’t become so volatile that it changes by 50% in 5 minutes DAI will remain viable. There are many forces at play to ensure this happens, but the primary reason is the one addressed above – users are incentivized to keep DAI always moving towards $1.

If ETH were to crash the CDP owners would have two incentives to pay off their debt, thus removing DAI supply and pushing price higher. One reason is they could pay off their debt at a discount. The other is to avoid the 13% liquidation penalty imposed if their CDP would fall below the collateralization threshold and need to be liquidated.

We actually saw the balancing mechanism in action in the January-April 2018 timeframe, when the price of ETH dropped from $1,400 to $400, but the price of DAI remained pegged to $1, proving the checks and balances put in place to keep DAI at $1 work even when the price of ETH is falling.

How MKR Token works with DAI

DAI was created by the Maker DAO, and that organization uses its own token called MKR. The MKR token has also been incorporated into the DAI system in two ways:

- Holders are able to vote on a “global settlement” of DAI in case of an attack on the token or some other failure. This is a way to shut the system down and return ETH to the CDP holders in a graceful manner. So, for example, if global settlement is triggered, you hold 110 DAI and ETH is worth $110, you will get 1 ETH back.

- All CDPs come with an annual interest rate of 0.5% of the loan amount. This interest can only be paid for using MKR, and that MKR is then burned. This encourages an increase in the value of MKR since the supply of MKR is always falling, but demand should be increasing as more CDPs (and DAI) are created.

With regards to the Global Settlement, a trusted group of individuals hold the global settlement keys and can initiate it should the voters choose to do it. This may at first glance look like too centralised for some. However, the only thing that the global settlement can do is give back collateral. No one can access your DAI or interact with the system on your behalf. The only risk you face is volatility in collateral until it is exchanged again.

ETH Collateral & USD Peg

The fact that DAI uses Ethereum and pegs its price to USD is mostly base on their preeminence. The Maker developers chose to use ETH because it is the most important asset on the Ethereum blockchain. Similarly, the USD is the global reserve currency, so it made sense to peg to the USD.

Technically, any asset could be used as collateral, as long as it resides on the Ethereum blockchain. In the future Maker has plans to include support for other assets, and eventually it should be possible to use any ERC-20 asset to create a CDP.

Similarly, DAI can be linked to the price of any other Fiat currency or asset for that matter. The Maker team has plans to eventually peg DAI to Digix (DAO) which is a token that is backed by physical gold. In the future other stablecoins pegged to other major currencies, commodities or even equities can and will be created.

DAI Stablecoin Markets

DAI is available for trading on a number of different exchanges which include both the centralized and decentralised variety. They have most of their volume on Fatbtc with over 35% of the volume. This is followed by HitBTC with 16% of the volume. The rest is made up of a range of other exchanges and it was recently added on Coinbase Pro.

In terms of historical performance, DAI has adjusted dynamically to maintain its 1:1 peg with USD. However, local market conditions on particular exchanges are likely to have impacted the price at certain times. It takes time for all of the exchanges to reflect the fixed peg and as such, there has been volatility of about 3% above and below the peg.

DAI Price Performance on CMC

DAI Price Performance on CMCSince the issuance of DAI back in December of 2017, the market cap has been increasing steadily. Given that this is a stablecoin, this growth in Market Cap is a strong indication of adoption. Exchanges and traders would prefer to use a stablecoin that is protocol defined and verifiable over some vague promise of USD in bank accounts.

Stablecoin Competition

Of course most of us will know of the Tether stablecoin but there have been a number of other coins that have tried to fill the void and have launched their own solutions over the past year. However, none of them have used a comparable mechanism to that of Maker and the DAI.

You have Paxos (PAX) which is issued by the Paxos Trust and is backed 1 for 1 with US Dollars and is a New York regulated trust company. Launched not long after that, you have Gemini dollars (GUSD) which is issued by the Gemini exchange and is also regulated and backed by USD in a bank account.

You also have solutions from the likes of Coinbase and Circle with their USD Coin (USDC) and the TrustToken's TrueUSD. These solutions have a similar setup to the two below and have full collateralization of US dollars in a bank account.

Conclusion

Dai has already proven that its decentralized approach to creating a stablecoin works by keeping the value of DAI at $1 since its inception in December 2017, even in the face of a significant drop in the price of Ether. As the price remains successfully pegged to the U.S. dollar the faith and trust from users will also increase, leading to greater usage of DAI.

The creation of DAI is huge as it allows for the transfer of wealth across borders instantly and without any fees or interference from third-parties. It’s a new paradigm for commerce, and since it is wholly blockchain based there is no way to shut it down. This is something that could only be imagined 10 years ago, before the advent of blockchain technology.