As many of you will know, blockchain technology promised a decentralized future—one where users could transact freely, own their assets outright, and build a more open financial system. But over the years, that vision has become fragmented. We now have a sprawling ecosystem of Layer 1s, Layer 2s, sidechains, and rollups, each operating in their own silos with limited communication between them. And while this explosion of innovation has brought us scalability and choice, it’s also introduced complexity, inefficiency and isolation.

Interoperability has long been considered the holy grail of Web3—and while cross-chain and multichain solutions have taken meaningful steps forward, they still fall short in one crucial area: seamlessness. This is where the concept of omnichain enters the picture. Not just another buzzword, but a fundamental rethinking of how blockchains should communicate, coordinate and coexist.

In this article, we’ll explore what omnichains are, how they differ from cross-chain and multichain approaches, the technology powering them, and why they could be the key to unlocking the full potential of a truly unified Web3.

The Problem with Web3 Today

To understand the need for omnichains, we first need to examine the fragmented state of the blockchain ecosystem as it exists today. Despite the rapid growth of blockchain networks, what we’re left with is less a cohesive system and more a patchwork of isolated digital islands—each with its own architecture, user base, and set of rules.

The source of this fragmentation lies in the very foundation of blockchain design. As many readers will be aware, the blockchain trilemma—the challenge of simultaneously achieving scalability, security, and decentralisation—has forced developers to make trade-offs. Bitcoin, for instance, offers unrivalled security and decentralisation but suffers in terms of transaction speed and throughput. Ethereum, while more flexible and programmable, has long grappled with congestion and high fees.

In response, we’ve seen the rise of Layer 2 networks, sidechains, and entirely new Layer 1s—each attempting to overcome these limitations in their own way. While this has led to innovation at breakneck speed, it’s also created a serious problem: interoperability. Most of these networks simply don’t speak the same language.

As a result, assets and data cannot move freely between chains. A token on Ethereum isn’t natively recognised on Solana. A smart contract deployed on Avalanche won’t function on Cosmos. Users must rely on third-party bridges, wrapped tokens, or centralised exchanges to move value across chains—often at the cost of speed, security, and decentralisation.

This fragmentation doesn't just create friction for users. It splinters liquidity, hampers composability, and limits the scalability of decentralised applications. In other words, it prevents the blockchain space from functioning as a unified digital economy.

You might be asking yourself: why hasn’t this been solved already? The truth is, developers have tried. Cross-chain bridges and multichain deployments have provided stopgap solutions. But as we’ll explore shortly, these approaches come with limitations.

Cross-Chain vs Multichain vs Omnichain

When discussing interoperability in crypto, three terms are often thrown around interchangeably: cross-chain, multichain, and omnichain. But despite sounding similar, they represent fundamentally different approaches—and understanding these differences is crucial if we want to grasp where the industry is heading.

The Cross-Chain Approach

Let’s start with cross-chain solutions. At their core, these rely on bridges—protocols that allow tokens or data to move between distinct blockchains. The mechanism typically involves locking or burning an asset on the source chain, and minting or unlocking a corresponding asset on the destination chain.

While this sounds simple enough, the underlying architecture can be quite complex—and, more importantly, vulnerable. Cross-chain bridges often rely on centralised intermediaries or limited validator sets to confirm transactions, creating a single point of failure. It’s no coincidence that some of the largest exploits in crypto history have involved cross-chain bridge failures.

Cross-Chain Bridge Hacks Have Cost the Crypto Industry Billions. Image via CoinTelegraph

Cross-Chain Bridge Hacks Have Cost the Crypto Industry Billions. Image via CoinTelegraphFrom a security standpoint, they remain one of the weakest links in the Web3 infrastructure.

The Multichain Approach

Then there’s the multichain model. Here, a decentralised application (or DApp) is deployed independently on several different blockchains—usually those that are compatible with the Ethereum Virtual Machine (EVM). Think of it as cloning the same app across multiple ecosystems: one version on Ethereum, another on Polygon, a third on Arbitrum, and so on.

The benefit? Broader market reach and lower transaction costs. But the downside? Fragmentation. Each version of the DApp operates in a silo, with separate liquidity pools, disconnected user bases, and duplicate logic. From a user experience and capital efficiency perspective, it’s far from ideal. Imagine having to switch networks every time you wanted to access a different part of the same application—it’s clunky, confusing, and inefficient.

The Omnichain Vision

Finally, we arrive at omnichain.

Unlike cross-chain and multichain models, omnichain systems are built from the ground up to support native communication between blockchains, regardless of their underlying architecture. This means assets and data can move seamlessly—not through wrappers or duplicate deployments, but via a unified messaging layer that spans multiple networks.

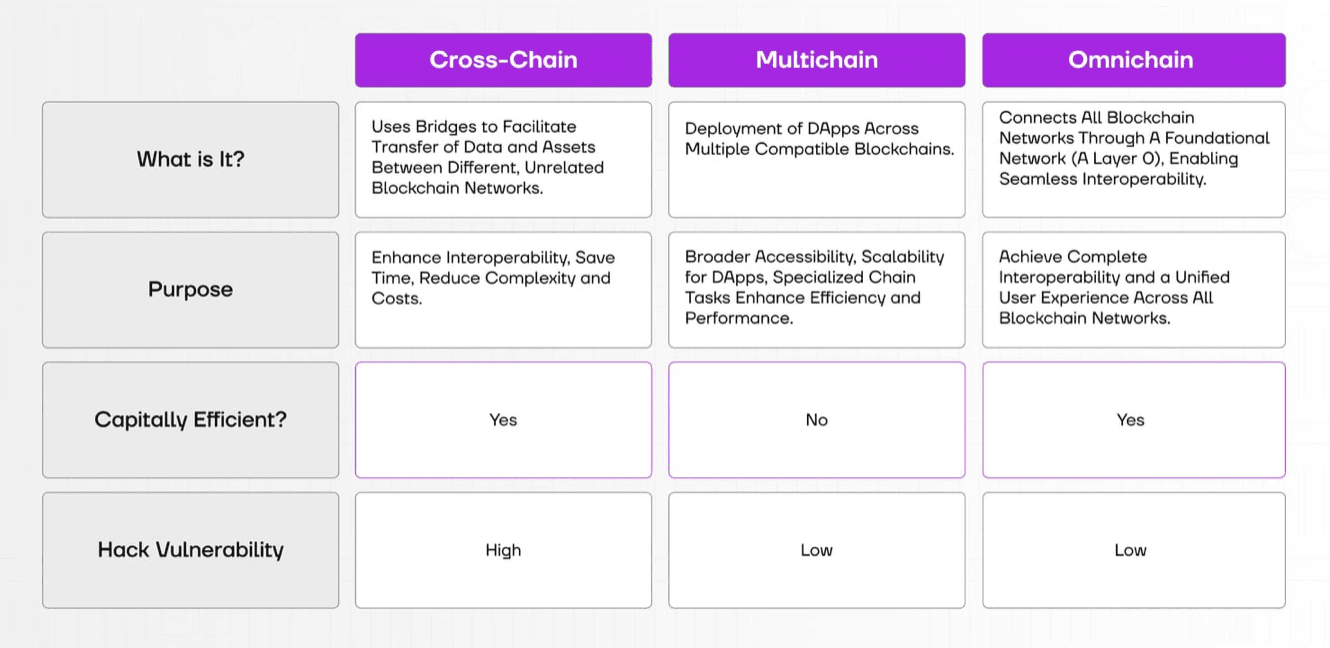

A Side-by-Side Comparison of Multichain, Cross-Chain, and Omnichain. Image via Entangle

A Side-by-Side Comparison of Multichain, Cross-Chain, and Omnichain. Image via EntangleThink of it as the internet of blockchains: an infrastructure where chains are no longer isolated silos, but interconnected nodes in a cohesive, permissionless web. Omnichain technology allows a single smart contract to interact with multiple blockchains simultaneously—without having to compromise on security, composability, or user experience.

It’s a powerful concept—and as we’ll see next, the underlying mechanics are just as fascinating.

How Omnichain Technology Works

Now that we’ve defined what omnichain means, it’s time to unpack how it actually works under the hood. While the mechanics can vary slightly between implementations, the underlying principles remain the same.

The Messaging Layer – The Heart of the Omnichain

At the core of any omnichain system is a cross-chain messaging layer—an infrastructure protocol that allows smart contracts on separate blockchains to communicate, coordinate, and operate as a single application.

This messaging layer enables data and transaction logic to move fluidly across blockchains, supporting functions such as cross-chain token transfers, inter-chain contract calls, asset rebalancing, and even on-chain governance actions. Crucially, it allows developers to maintain one unified application logic that spans multiple chains—rather than duplicating code and fragmenting state.

Execution Without the Wrapping

What truly sets omnichain apart is its ability to support native asset movement without wrapping. In traditional cross-chain setups, assets often need to be wrapped—essentially a synthetic version of the original—before they can function on a new chain. This adds layers of complexity and risk.

Omnichain systems eliminate that. Using a unified framework, a token can be minted on one chain and recognised across others, with liquidity, ownership, and metadata intact. No wrappers. No bridges. No roundabout workarounds.

While Omnichain Architectures Differ Under the Hood, Their Core Mechaincs Remains the Same. Image via Shutterstock

While Omnichain Architectures Differ Under the Hood, Their Core Mechaincs Remains the Same. Image via ShutterstockModular Security

Omnichain also takes a different approach in how it handles security. Instead of depending on a single bridge or central group of validators—which, as we’ve seen, can be risky—developers now have far more control. They can choose from a range of independent verifiers, set their own gas rules, and even run their own infrastructure if they want to.

If one of these verifiers goes offline, or turns out to be unreliable, the system doesn’t break. The message just waits to be delivered until another verifier picks it up. No lost funds. No frozen dApps. Just a pause—until it’s safe to proceed.

Composability Across Chains

Just as DeFi earned its “money Lego” nickname for composability within Ethereum, omnichain brings that same principle across chains. Smart contracts can trigger follow-up actions not only on the same chain but across multiple networks—mint on Ethereum, stake on Arbitrum, airdrop on Avalanche, and even route back to Ethereum—all in one transaction.

This unlocks a new design space for developers and sets the stage for what can only be described as a truly unified multichain experience.

Use Cases of Omnichain Technology

As omnichain infrastructure continues to evolve, it’s opening the door to a variety of practical applications across the Web3 landscape. While the technology is still maturing, early implementations are already showing promise in several key areas—from decentralised finance to NFTs and cross-chain smart contracts.

Let’s explore where omnichain is making an impact.

Decentralized Finance (DeFi)

One of the most immediate beneficiaries of Omnichain infrastructure is DeFi, where liquidity, composability, and efficient capital movement are critical.

Omnichain liquidity pools offer a more flexible alternative to traditional, siloed pools. Rather than fragmenting capital across multiple chains, liquidity can be shared or aggregated, helping reduce slippage and improving price discovery. This is particularly useful for decentralised exchanges (DEXs) looking to offer competitive trading experiences across ecosystems.

In lending and borrowing, interoperable protocols allow users to supply collateral on one chain and borrow against it on another—eliminating the need for bridging or moving assets manually. This creates more capital-efficient systems and gives users access to a broader range of markets and opportunities, without locking them into a single chain’s economy.

NFTs & Digital Asset Ownership

Non-fungible tokens (NFTs) have become one of the more visible parts of Web3, but ownership and functionality are often limited by the chain they were minted on. Omnichain infrastructure seeks to address that.

With Omnichain NFTs, ownership can extend across multiple blockchains simultaneously. This allows for a more fluid experience—whether that means showcasing assets across different marketplaces, accessing NFT-gated content on various chains, or integrating assets into multichain gaming environments.

Omnichain messaging also enhances authentication and verification, making it easier to confirm provenance and enforce royalties across ecosystems. For creators and collectors alike, this expands utility while helping maintain control over how assets are used and transferred.

Omnichain is Already Making an Impact in Multiple Areas. Image via Shutterstock

Omnichain is Already Making an Impact in Multiple Areas. Image via ShutterstockCross-Chain Smart Contracts

Smart contracts are the backbone of decentralised applications—but until recently, their scope has been limited to the blockchain they were deployed on. Omnichain messaging layers are changing that.

With cross-chain smart contracts, developers can coordinate logic across multiple blockchains—allowing one contract to trigger actions on another, or enabling different parts of an application to live on different chains while maintaining a shared state.

In practice, this opens up a wide range of possibilities: from cross-chain DAOs managing proposals and votes across ecosystems, to real-time asset transfers, lending platforms, and omnichain DEXs. Projects like LayerZero, Entangle, and others are already enabling these types of applications, setting the stage for a more connected and composable Web3.

Real-World Assets

Projects like Ondo Finance are leveraging omnichain architecture to bring tokenized Treasury bonds, gold, and other real-world assets to Web3 in a way that’s scalable, compliant, and secure.

By enabling RWAs to move freely across chains, Omnichain protocols allow institutions and individuals alike to interact with these assets wherever they’re needed—whether for staking, lending, or collateralization—without compromising on regulatory integrity or operational efficiency.

Projects Leading the Omnichain Charge

With the concept of omnichain gaining traction, a number of projects have stepped up to build the infrastructure necessary to make this vision a reality. While each takes a slightly different approach, they’re all working toward the same goal: a seamless, interconnected blockchain ecosystem where users and developers are no longer bound by the limits of a single chain.

Let’s take a look at some of the protocols that are working in this space.

LayerZero

LayerZero has arguably become the poster child for Omnichain infrastructure. Its core innovation lies in its modular messaging protocol, which enables smart contracts on one blockchain to send messages to and from contracts on other chains—securely and efficiently.

LayerZero Homepage. Image via LayerZero

LayerZero Homepage. Image via LayerZeroRather than relying on a single validator or bridge operator, LayerZero allows developers to choose their own decentralized verifier networks (DVNs), including Chainlink CCIP, zk-proofs, or their own custom setups. This creates a security model that is tailored, decentralised, and resilient.

Add to that the use of gas abstraction, permissionless execution, and composable message flows, and LayerZero effectively provides the plumbing for developers to build truly omnichain applications—from token transfers to NFT minting to fully interoperable DEXs.

Entangle

While LayerZero focuses on messaging, Entangle takes a more liquidity-centric approach. Its Photon Messaging Protocol enables real-time data exchange and asset movement across EVM and non-EVM chains, while its Liquid Vaults provide yield-generating mechanisms and composable token infrastructure.

Entangle also powers bridge-free asset deployment through its “burn-and-mint” model, allowing developers to issue native tokens on multiple chains without relying on synthetic or wrapped assets. The protocol’s broader vision includes omnichain GameFi, DeFi, and even on-chain governance mechanics.

Ondo Chain

Developed by Ondo Finance, Ondo Chain is a Layer 1 blockchain purpose-built to support the issuance, transfer, and management of tokenized real-world assets (RWAs)—but what sets it apart is how it weaves omnichain functionality directly into its architecture.

Ondo Chain is The Omnichain Network For RWAs. Image via Ondo.Finance

Ondo Chain is The Omnichain Network For RWAs. Image via Ondo.FinanceAt its core, Ondo Chain acts as an omnichain hub, enabling RWAs like tokenized Treasuries and ETFs to move seamlessly across multiple chains while remaining anchored to a single source of truth. This is achieved through native cross-chain messaging and bridging infrastructure, secured by permissioned validators and supported by oracles and proof-of-reserve mechanisms. In practice, this means an RWA issued on Ondo Chain can be used as collateral or deployed in DeFi protocols on other chains—without needing to wrap the asset or rely on third-party bridges.

Moreover, Ondo Chain allows gas fees to be paid in RWAs and enables cross-chain asset management, making it possible for institutions to interact with DeFi protocols across ecosystems—all while meeting stringent compliance requirements.

Cosmos

Though not always branded as “omnichain,” Cosmos deserves a mention. Its Inter-Blockchain Communication (IBC) protocol allows sovereign chains built using the Cosmos SDK to communicate and transfer assets natively, without relying on bridges or wrapping.

Cosmos shines in its ability to deliver high throughput, modularity, and a growing network of interconnected dApps. While IBC is mostly limited to Cosmos-native chains, it remains a compelling blueprint for what protocol-level interoperability can look like.

Challenges, Risks & Limitations

As with any emerging technology in crypto, Omnichain infrastructure comes with trade-offs. While the vision is bold and the possibilities immense, we’re still in the early innings—and it's important to separate ambition from implementation.

Every Technology Comes With It’s Own Set of Challenges. Image via Shutterstock

Every Technology Comes With It’s Own Set of Challenges. Image via ShutterstockLet’s take a closer look at some of the key challenges that still lie ahead.

Standardisation Issues

One of the most fundamental hurdles is the lack of a universal Omnichain standard.

Different protocols have taken varied approaches to messaging formats, security models, and execution logic. Some use external verifier networks; others rely on embedded oracles or custom bridges. While this diversity encourages innovation, it also leads to fragmentation at the interoperability layer—a paradox that slows down composability between chains and dApps.

Without common standards or shared interfaces, developers must choose between ecosystems, toolkits, and assumptions that may not align. Over time, the industry will likely need to converge around a set of best practices.

Security Considerations

While Omnichain systems are generally viewed as more robust than traditional cross-chain bridges, they are not immune to risk.

The messaging layer, verifier configurations, and execution endpoints all introduce potential attack vectors. If misconfigured or exploited, a vulnerability in one part of the system could have ripple effects across multiple chains—especially when high-value assets or protocol logic are involved.

Protocols like LayerZero and Entangle try to mitigate this through various ways—but rigorous auditing and stress testing remain essential as the stakes grow larger.

Adoption Barriers

Building and deploying Omnichain applications requires a new way of thinking—and a supporting infrastructure that not all teams are ready for.

Developers must learn how to manage cross-chain messaging, state synchronisation, and gas abstraction. Testing becomes more complex. Deployment pipelines must accommodate multiple networks. And even experienced teams may need to adapt their mental models when shifting from single-chain to omnichain architecture.

Onboarding also extends to users, who may be unfamiliar with cross-chain interfaces, security assumptions, or how omnichain logic works in practice. Until wallets, SDKs, and tooling mature, adoption may remain limited to more technically advanced teams and communities.

Why Omnichain Matters – And What It Means for Crypto’s Future

While it may still be early days, omnichain infrastructure represents a notable step forward in the evolution of blockchain interoperability. Rather than introducing yet another layer or network, omnichain aims to address one of the space’s more persistent limitations: fragmentation.

The Future of Omnichain Holds Immense Potential. Image via Shutterstock

The Future of Omnichain Holds Immense Potential. Image via ShutterstockFor years, crypto has expanded through a growing number of ecosystems—each bringing innovation, but often operating in isolation. The result has been a patchwork of chains, each with its own tools, liquidity, and user base. Omnichain infrastructure seeks to connect these environments more directly, offering a framework for smoother communication and cross-chain functionality.

Toward a More Cohesive Web3

From the user’s perspective, the ideal blockchain experience is one where the underlying chain fades into the background. Whether an application runs on Ethereum, Arbitrum, or another network shouldn’t matter. What matters is functionality, performance, and ease of access.

Omnichain designs bring us closer to that vision. By enabling dApps to operate across multiple networks without fragmenting state or liquidity, these systems improve scalability, flexibility, and efficiency—all while preserving the core principles of decentralisation.

Improving Capital Efficiency

In DeFi specifically, the benefits of Omnichain models are already becoming apparent. Liquidity can be pooled across chains, rather than split between them. Collateral can be managed and deployed more flexibly. And yield strategies can span ecosystems, opening up more efficient market opportunities.

For institutional participants, the appeal lies in secure and compliant access to onchain infrastructure—with the ability to engage with multiple chains through a unified interface. This is particularly relevant for tokenized securities, cross-chain stablecoin distribution, and real-world assets.

By enabling regulated institutions and crypto-native users to interact within the same framework, Omnichain could help bridge the growing divide between DeFi and TradFi.

A Base Layer for What Comes Next

Looking ahead, Omnichain may serve as the infrastructure backbone for the next wave of Web3 applications.

This could include cross-chain gaming economies, governance systems that span ecosystems, or real-time settlement layers capable of handling a broader range of asset classes. With composability no longer confined to a single chain, developers have the freedom to build applications that are network-agnostic by design—and collaborative by default.

Conclusion

In sum, Omnichain represents more than just a novel approach to blockchain interoperability—it offers a blueprint for the next era of crypto. One where applications aren’t confined to individual ecosystems. One where liquidity isn’t fragmented. One where users don’t have to think twice about what chain they’re using.

It’s a bold vision—and while it’s not without its challenges, the progress made by protocols like LayerZero, Entangle, Ondo Chain, and Cosmos shows that this future isn’t hypothetical. It’s being built—right now.

The shift toward omnichain infrastructure signals a maturing industry finally addressing its most persistent pain points: siloed chains, fragmented user experience, and inefficient capital allocation. And by doing so, it unlocks entirely new layers of functionality, security, and user empowerment.