GM Anon! This is the last M6 Labs Bitcoin Weekly report of the year. We’ll be back the week of the 8th of January. It is likely that we’ll see each other in a new crypto world, the ETFs will have been confirmed and the market will have changed forever. Are you ready for what is coming? The money printers have been turned back on, and we’re likely to see a bull market unlike anything seen before.

I hope you’re all set for what is coming. See you on the other side, Anon.

L1s, L2s & DeFi

State Of The Market: Market Exploding Pre-ETF

TLDR

- Market resilience amid anticipation of Bitcoin ETF approvals.

- Minor outflows in digital assets, with regional variations and significant altcoin inflows.

- Surge in transaction fees due to increased Ordinals minting.

- Record low annualized BTC volatility, indicating maturity.

- Significant collaborations and increasing crypto acceptance in mainstream finance.

- Growth in Layer 1 blockchains, AI crypto projects, meme coins, and BitcoinFI tokens.

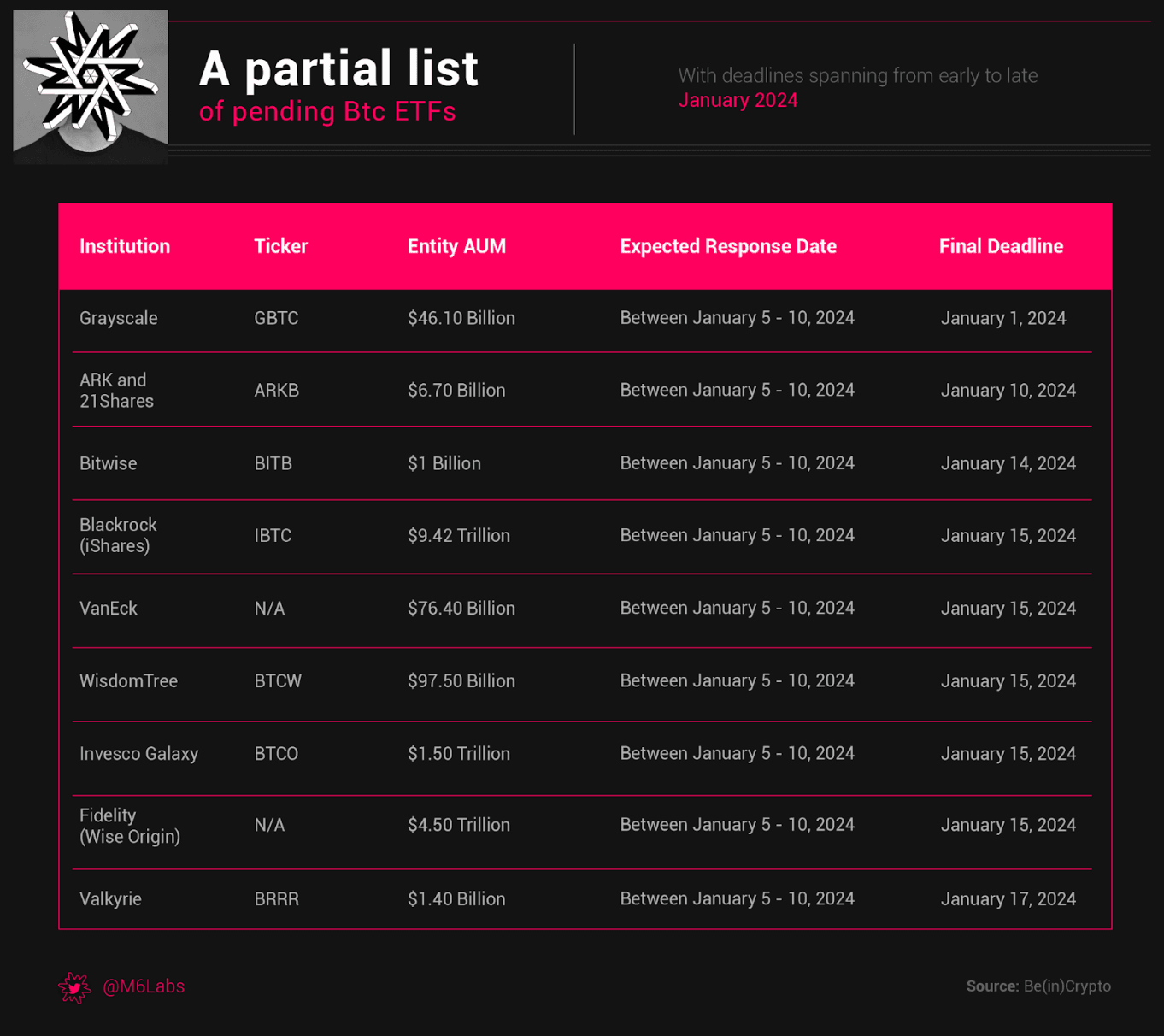

ETF Approval and Market Resilience: Despite occasional fluctuations, the market has demonstrated remarkable resilience. The anticipation of ETF approval has kept investors keenly focused, with many closely monitoring market movements. The SEC's recent postponement of several Ethereum ETH ETFs and updates from major players like BlackRock on their Bitcoin ETF filings have only heightened this anticipation. Industry leaders, including VanEck's CEO, predict a simultaneous approval of multiple ETFs, a move that could significantly impact the market.

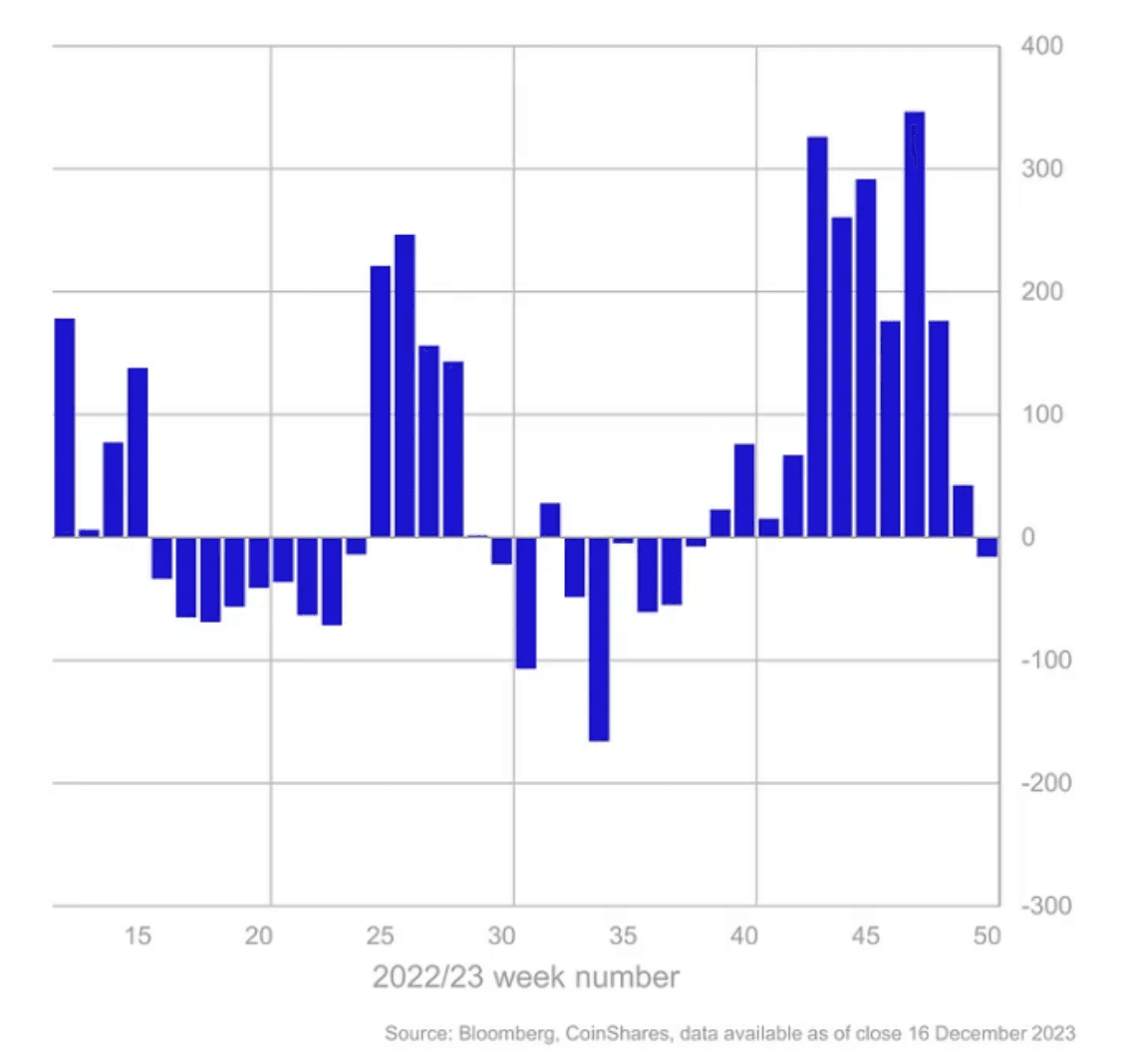

Inflows & Outflows: Digital asset investment products experienced minor outflows of $16M, ending an 11-week streak of inflows. Despite the outflows, trading activity remained high for the week, totaling US$3.6B, significantly above the year average.

- The outflows were mainly concentrated in the US, with $18M in outflows, while Germany saw minor outflows of $10M. However, Canada and Switzerland continued to receive inflows of $6.9M and $9.1M, respectively. These mixed regional flows suggest that the outflows were driven more by profit-taking than a shift in sentiment.

- Altcoins, including Solana, Cardano, XRP, and Chainlink, defied the trend by attracting $21M in inflows. Among them, Solana received the highest inflow at US$10.6M.

- Bitcoin experienced the most significant outflows, with $33M leaving the asset. Short-bitcoin also saw minor outflows totaling US$0.3M.

- Ethereum and Avalanche saw minor outflows of US$4.4M and US$1M, respectively.

- Blockchain equities continued to attract positive sentiment, with substantial inflows totaling US$122M for the week. This brought the cumulative inflows over the past 9 weeks to a record-high of $294M.

Source: CoinShares

Source: CoinSharesRegulatory Developments: Regulatory milestones have been a defining feature of the past year. Tether's collaboration with the FBI, DOJ, and Secret Service marks a significant moment, reflecting the growing importance of crypto in the financial system, despite the controversy it stirs within the crypto community.

- On another front, Ripple's whitepaper on CBDCs indicates steady progress in this area. Furthermore, the Bank of International Settlements' announcement allowing central banks to hold up to 2% of their reserves in crypto from January 1st, 2025, underscores the increasing acceptance of digital assets in mainstream finance.

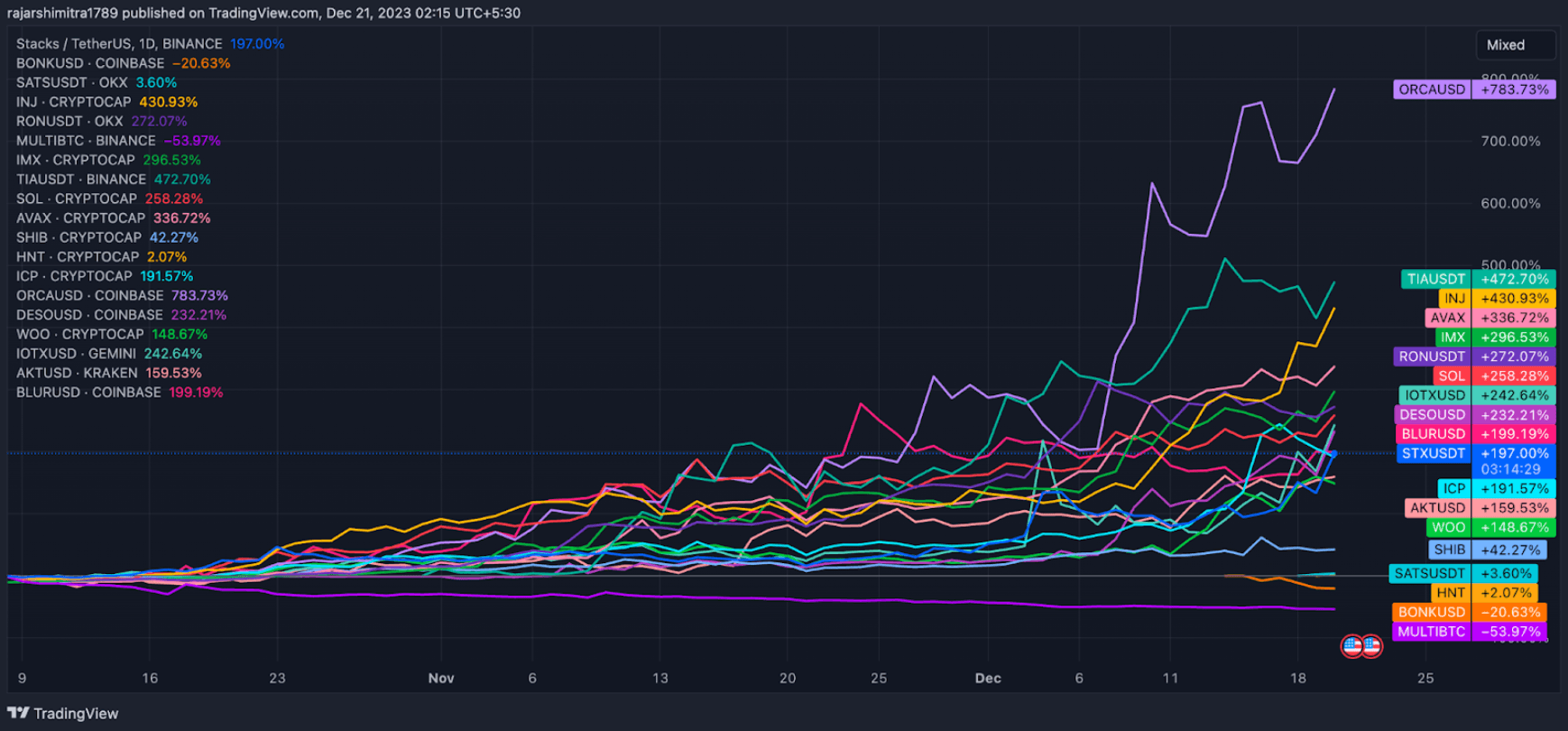

Layer 1 Blockchains and AI-Related Projects: Layer 1 blockchains like Solana, Avalanche, and Cosmos-related projects have maintained strong market positions, witnessing significant price movements. Additionally, AI-related crypto projects continue to capture the market's imagination, reflecting the growing intersection of advanced technology and finance.

The Meme Coin Phenomenon: Meme coins have emerged as a market sensation, with tokens like $BONK, $COQ, $TOSHI, and $HUSKY on Solana and Avalanche chains experiencing exponential growth.

- These coins, often seen as a blend of humor and investment opportunity, have attracted a diverse range of sentiments from investors. Their popularity underscores a unique aspect of crypto culture and hints at the potential development of robust ecosystems around these projects.

The Rise of Inscriptions and BitcoinFI Tokens: Inscriptions, initially a feature unique to the Bitcoin ecosystem, have gained traction across various chains. BitcoinFI tokens such as $MUBI, $DOVA, $BSSB, and $TURT have seen remarkable gains. This area of the market is a new addition and is likely to be a major part of the next bull market.

Dive Deeper

- SocialFi will be one of the biggest narratives in the next bull run. Dive into this thread by @MoneyCrptBunny

- If you are bullish on EigenLayer, then you need to be paying attention to Kelp DAO. This great read by @jake_pahor will take you through it.

- Arbitrum TVL and zkSync use continue to explode. @defiinfant has you covered with these developments with this thread.

- @ayyyeandy discusses the shift from onchain to offchain governance in DAOs, highlighting issues with onchain voting such as high costs and low voter participation in this great write-up.

Opportunity

GRVT, the first official appchain of zkSync Hyperchain, offers a high-performance orderbook with self-custody features. It has raised $7.1 million from investors like Matter Labs, Delphi Digital, CMS Holdings, and Matrix VC, and boasts partnerships with over 30 institutions. The team includes professionals from Goldman Sachs, Facebook, and OKX. GRVT is currently inviting users to join its waitlist, which offers opportunities like earning points for referrals, potential airdrops, and a zkSync mystery box. The GRVT token is expected to launch in 2024. Sign up here.

Blue Chip and Majors Overview

Bonk

BONK has experienced a significant surge, peaking at a valuation of over $2B following its listing on Coinbase, which led to over $500M in BONK being traded on Coinbase, doubling its value since the initial confirmation. BONK has since retraced, and the market cap is currently around $1.16B. The hype behind BONK has also boosted the sale of the Solana Saga phones in anticipation of a free airdrop.

Husky

HUSKY faced a sharp retracement this week as the price dropped by more than 36%. Overall marketcap is trending above $7.5M, while the price has dropped to the $0.000000085 support level. HUSKY has been the best-performing memecoin of the Avalanche ecosystem.

- Sats (SATS) have jumped by 45% following the OKX listing and are currently trending around $0.00000070.

- Coq Inu (COQ) is an Avalanche memecoin that exploded by 640% this past week before retracing below $0.000003. A lucky trader turned $450 into $2M betting on COQ.

- Injective (INJ) soared to an all-time high of $39.15 on Tuesday, marking a 3,000% increase in 2023. Despite having only $18M in total value locked, Injective has seen a substantial $600M trading volume over the past 24 hours.

- Multibit (MULTI) jumped by over 150% this past week, with marketcap approaching $265M.

- Celestia (TIA) has seen a significant 45% increase in the past week, reaching a price of $13.481 and a market capitalization of $2.025M. With a 24-hour trading volume of $350.696M, TIA's performance is drawing considerable interest from investors and crypto enthusiasts.

- Solana (SOL) has reached a 20-month high, surpassing XRP as the fifth-largest cryptocurrency with a market cap of $33.7B, driven by a thriving DeFi ecosystem and meme coin popularity. This week, its total value locked (TVL) exceeded $1B for the first time since FTX's collapse.

- BitStable Finance (BSSB) is currently priced at $7.19, experiencing a 7.20% decrease in the last 24 hours, yet it has witnessed a notable 159.10% rise over the past week. The crypto has seen a 24-hour trading volume of >$5.5M.

- Turt (TURT) has jumped by 170% this past week and over 1200% this past month. Currently, TURT is trying to break past the $0.10 resistance level.

- ORDI (ORDI), after a striking 2370% surge from $2.82 in September to a peak of $69.76 in early December. It has since retreated to below $55.

- Avalanche (AVAX) has emerged as a major force in the crypto market, with the AVAX token's recent rise above $40 highlighting increasing investor trust in its ecosystem. This is mostly due to the rise of AVAX-based memecoins.

- Shiba Inu (SHIB) has experienced a significant influx of 4.8 trillion SHIB into the wallets of major investors, marking a 375% increase in 24 hours, as reported by IntoTheBlock's Large Holders Inflow metric. Additionally, Shiba Inu is introducing a new '.shib' domain specifically for SHIB holders.

- Helium (HNT) has seen a remarkable increase of over 80% in the past week, approaching the $10 mark, a price point last reached in June 2022. This surge is largely attributed to the heightened interest in the newly launched Helium Mobile, which provides US users unlimited access to the Helium network for $20 per month.

- Bounce (AUCTION) is currently trading at $44, witnessing a significant 118% rise over the past week. The token has a market cap of ~$285M and is undergoing a 1:100 token swap from its original Bounce "BOT" token.

- Aleph Zero (AZERO) is trading at $1.77, up 37% over the past week, with a current market capitalization of ~$445M. The token has rallied due to its focus on privacy.

- Orca (ORCA) has reached $8, marking an increase of over 1,821% from its lowest point this year, largely driven by its association with the rapidly expanding Solana ecosystem. Orca TVL is also nearing $175M.

- ALEX Lab (ALEX) has experienced an 80% rise over the past week, bringing its price to $0.466 and a market cap of approximately $300M. This growth coincides with the recent listing of ALEX on Bitget's BTC Ecosystem Zone on December 15.

- Akash Network (AKT) has seen a 5.30% rise in its price to $2.38 in the last 24 hours and a 13.30% increase over the past week. Market capitalization has crossed $530M.

- IoTeX (IOTX) has experienced significant growth, with almost a 100% rise over the past week, bringing its price to $0.061778 and its market cap to a little less than $585M.

- NEAR Protocol (NEAR) has risen by 23.5% this past week, trading at $2.85 and a market capitalization of about $2.88B. This price surge, along with a 300% increase in derivatives market volume to $1.27B and a 40% rise in open interest to $144.70M, reflects growing investor interest and a positive market sentiment.

- Stacks (STX), a Bitcoin layer two blockchain, has experienced a significant 26.72% increase in its price over the last 24 hours. This surge in value follows billionaire investor Tim Draper's endorsement of the protocol, which has resonated positively with the market and social media, leading to its current price momentum.

Smart Money Movements

- Smart money is anticipating the launch of Pontem Network. The network aims to bring performance benefits of alternative systems, such as Aptos and Sui, to Ethereum. It focuses on decentralization, trustlessness, and resistance to censorship. The long-term vision of the network is to enhance Ethereum's capabilities by integrating the performance of these alternative systems. This development is important as it signifies a major step towards improving Ethereum's infrastructure, potentially leading to wider adoption and more efficient blockchain operations.

- Smart Money is detected in $ROKO, an AI layer play. Investors are keenly observing potential advancements and opportunities within this artificial intelligence-focused project.

- Moreover, Smart Money has been accumulating $HIGH, showcasing interest in a metaverse project that seeks to redefine retail experiences within the virtual world. The growing attention towards metaverse projects is evident in this strategic move.

- Another intriguing detection is in $Nola, a new memecoin on Arbitrum. The token has garnered significant attention, and tracking Smart Money movements provides insights into emerging trends within the Arbitrum ecosystem.

- Continuing the trend, Smart Money is actively accumulating $EMP, a leading project in the Account Abstraction narrative. This reflects a strategic investment approach aligned with the narrative's potential growth.

- Furthermore, $MAP is under the radar of Smart Money. As a new Bitcoin L2 and a p2p omnichain infrastructure, its appeal to investors is evident. Tracking Smart Money movements in such projects provides valuable insights for market participants.

- Notably, $AUCTION has attracted Smart Money attention as a launchpad project, gaining increased visibility after BSSB's launch on their platform.

Interesting Onchain Movements:

- Shifting focus to onchain movements, the $INSP team has executed a significant move, transferring 13.5% of the circulating supply to two new addresses. Monitoring such transactions can provide clues about the project's future developments. Transaction 1 / Transaction 2.

- In a significant acquisition, GSR acquired $9.4 million worth of $BEAM from CitizenX, depositing half of it into Binance. The involvement of GSR in previous GameFi tokens, such as $BIGTIME, resulting in a substantial price increase, adds to the intrigue. Transaction Link.

- The $Pendle team's movement of tokens into a new Gnosis Safe raises questions about potential incentives, with Smart Money also showing interest in this particular movement.

- Observing buy pressure on $TRB from fresh wallets, sourced from Coinbase and withdrawn, highlights significant market activity. The 16% pump in TRB today suggests potential correlations with these movements.

- Fresh wallets accumulating $STORJ on a notable scale indicate a growing interest in this particular token, warranting further investigation into potential catalysts.

Yield Farms

- Shifting towards yield farming strategies, Smart Farmers are increasingly engaging in rsETH farming on Kelp Dao. The platform offers opportunities to earn EigenLayer points and Kelp miles simultaneously, showcasing the multifaceted appeal of this ETH restaking platform.

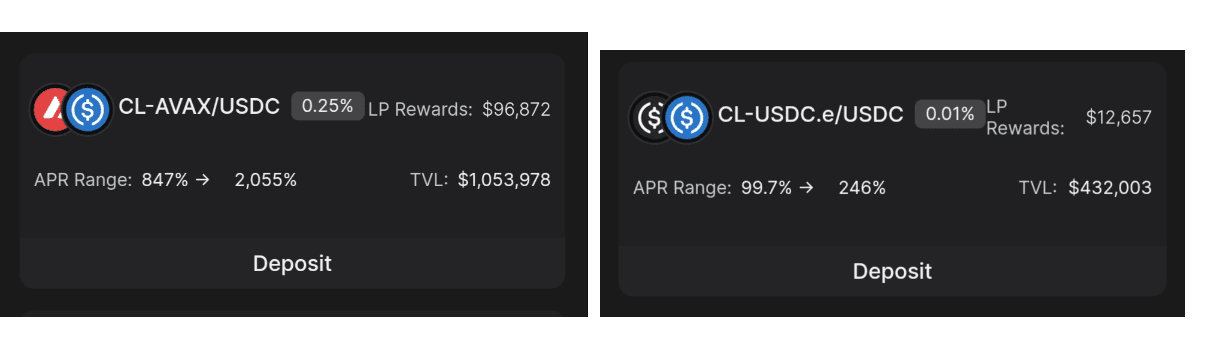

- In response to the growing interest in AVAX, Smart Farmers are employing various strategies on Avalanche. Farming in USDC and AVAX pools on Pharaoh with enticing APRs is one such approach.

- Additionally, using BENQ to borrow $AVAX against stablecoins and subsequently, farming on Pharaoh minimizes exposure to AVAX directly, providing a risk-mitigated strategy.

- Farming wstETH/LDO on Velodrome has become a popular choice among Smart Farmers, emphasising the diverse opportunities available within decentralized finance.

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here. Be sure to also check out our Bitcoin Weekly report here.

NFTs & Gaming

This week in the world of NFTs has been relatively subdued, with traditional collections showing minor movements or slight retracements. The spotlight is firmly on the Bitcoin ecosystem and inscriptions across different chains, offering intriguing investment opportunities.

Simultaneously, the crypto gaming sector is evolving rapidly, with frequent partnerships and new launches reshaping the landscape. As players position themselves strategically in this domain, it's an open question who will emerge as the next generation of millionaires in crypto gaming. Let's explore what's unfolding!

Project Updates

- NFT Trader platform hacked.

- Red Bull Formula 1 team drops NFTs after dominant season.

- The NFT fragmentation protocol Flooring Protocol was suspected of being attacked. 14 BAYC and 36 Pudgy Penguins were stolen and sold.

- Hong Kong Web3 Group Animoca Brands disclosed that as of November 30, 2023, Animoca Brands held a total of $172M in cash and stablecoins, $330M in third-party tokens, including SAND reserves, and $1.6B in off-balance sheet token reserves.

- 'Gods Unchained' returns to Epic Games store after play-to-earn policy change.

- Immutable launches interoperable tool across multiple video games and marketplaces.

- Illuvium’s Overworld founder announces compensation plan after their Incarna NFT mint suffered “overallocation, botting attacks, and general misalignment with the first wave of minters”.

Blue Chip and Market Overview

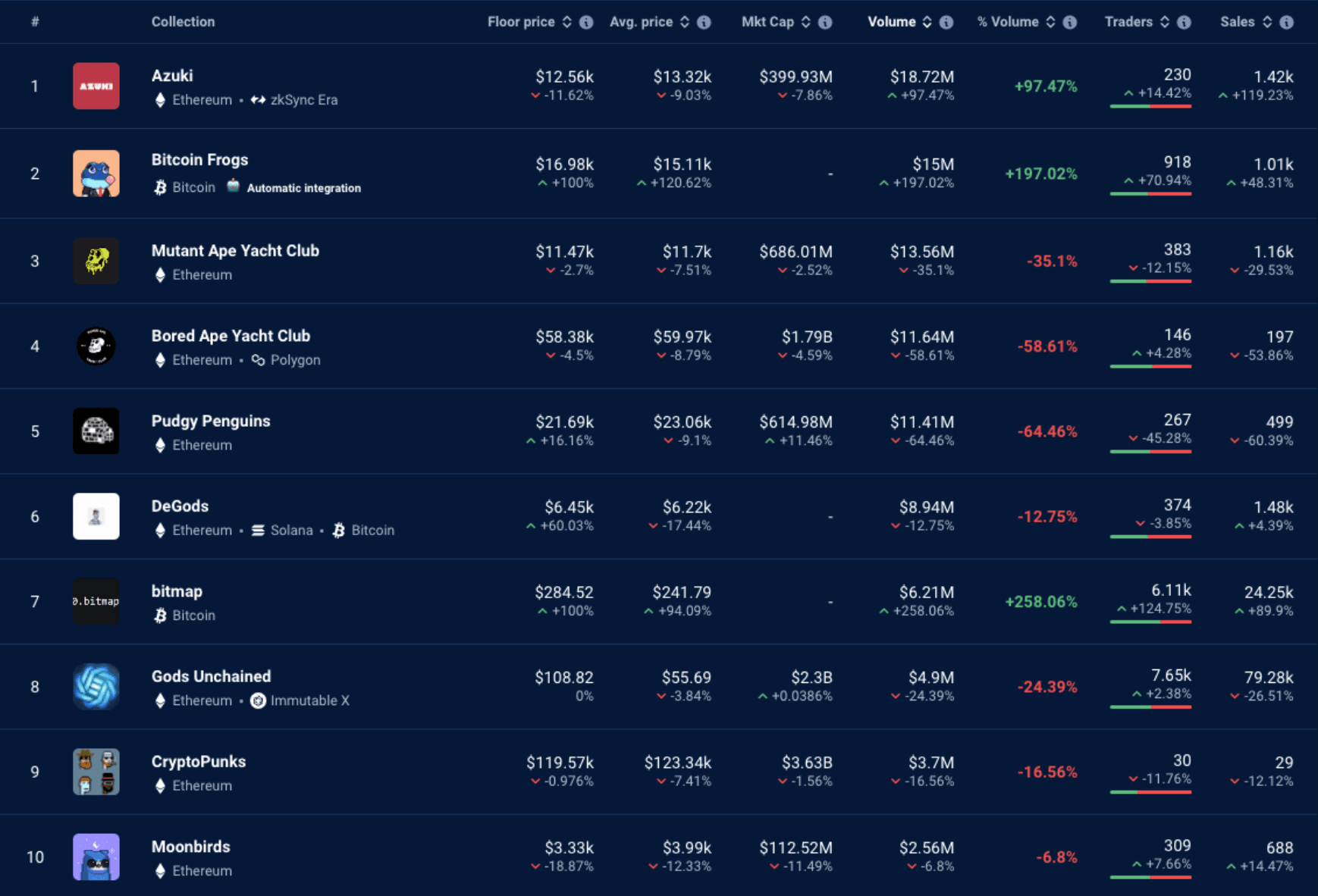

Bitcoin NFTs, particularly collections like Bitcoin Frogs, have gained significant attention, rising to second in volume. Meanwhile, Azuki's collection is experiencing a resurgence, witnessing a notable increase over the past week and ascending to the top spot in volume. Pudgy Penguins have retraced after dominating last week’s charts.

Top collections by volume over the last 7 days. Source: DappRadar.

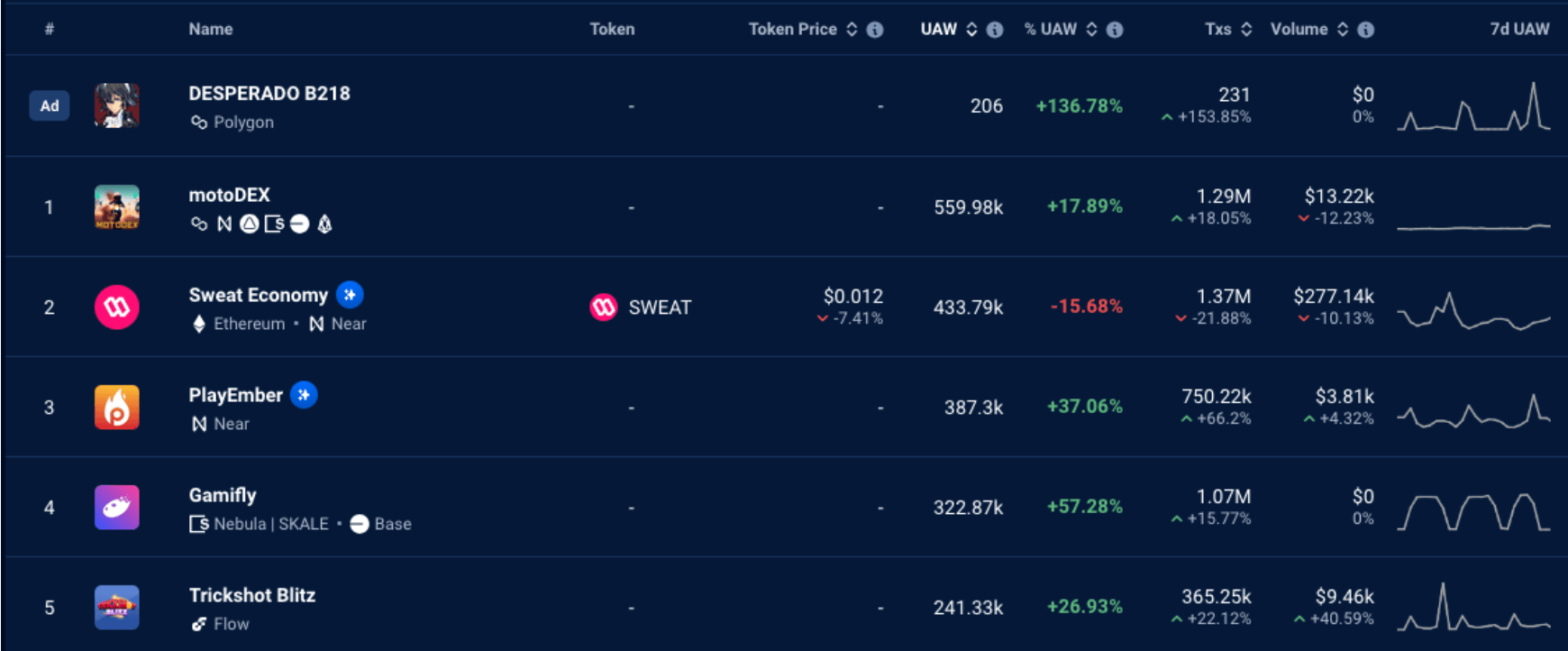

Top collections by volume over the last 7 days. Source: DappRadar.Motodex has dominated the crypto gaming sector recently, bumping Sweat Economy from first place. A new contender is Deperado B218 on Polygon, who catapulted to the top spot in the last few days.

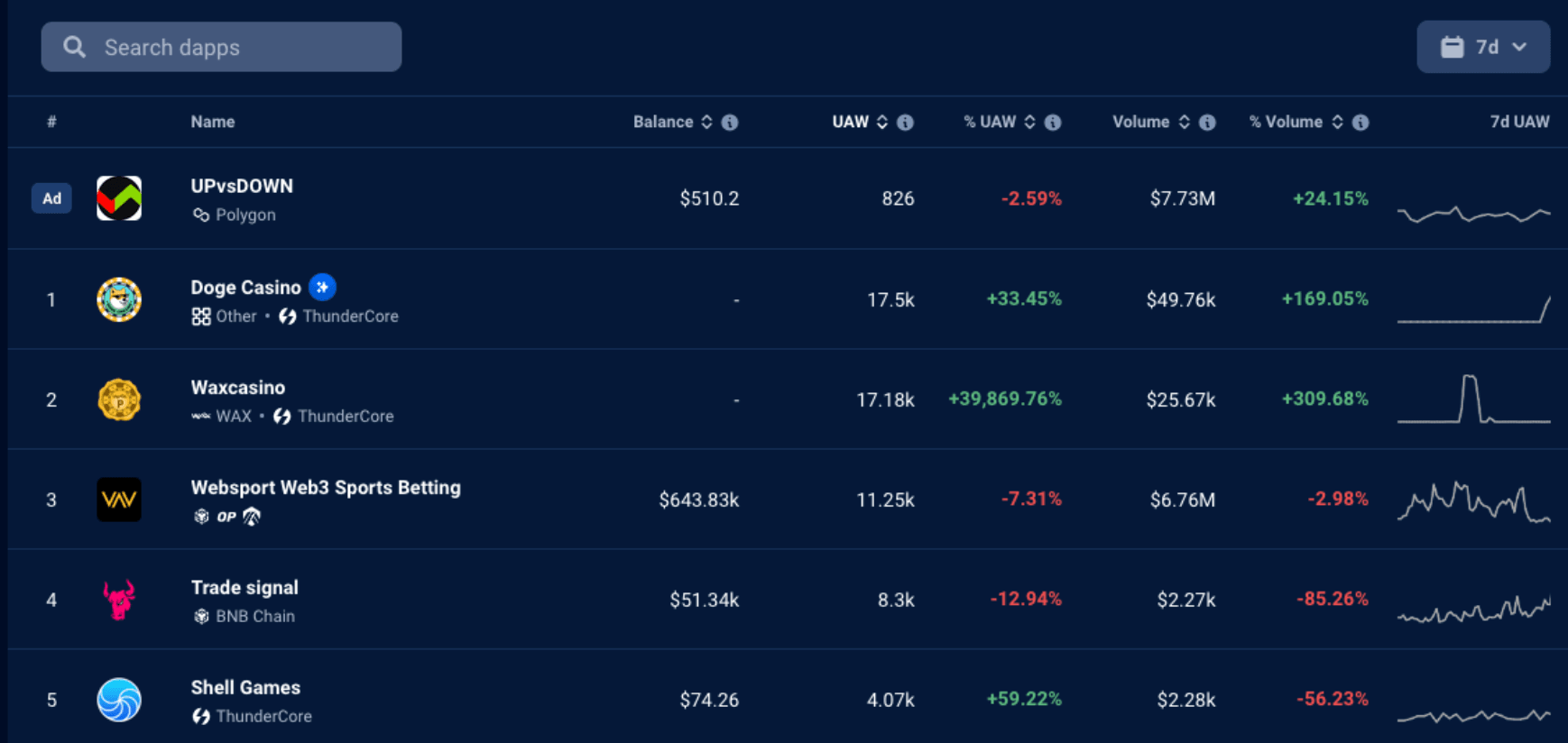

Top games over the last 7 days by users. Source: DappRadar.

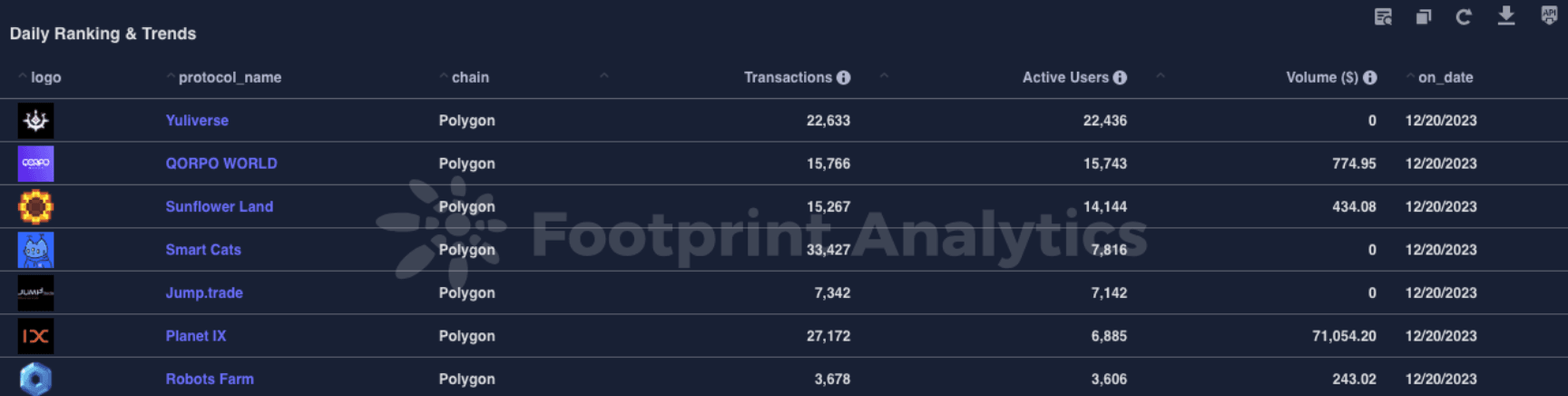

Top games over the last 7 days by users. Source: DappRadar.Polygon maintains its lead as the most active ecosystem in terms of user engagement, particularly in the gaming segment. While BNB and Ethereum also host a variety of games with considerable player activity, Polygon's user base for its available games remains notably higher, solidifying its position for the time being as the go-to ecosystem for active gaming participants.

Polygon’s ecosystem has the most active gaming community. Source: Footprint Analytics.

Polygon’s ecosystem has the most active gaming community. Source: Footprint Analytics.In the crypto gambling sector, there's been a noticeable shift in user preference away from Rollbit towards newer platforms. Waxcasino and Doge Casino have emerged as significant players, experiencing rapid growth in the last week. They have been particularly successful in drawing both high volumes and a large number of unique users, time will tell if they can sustain this success.

Top crypto gambling apps over the last 7 days. Source: DappRadar.

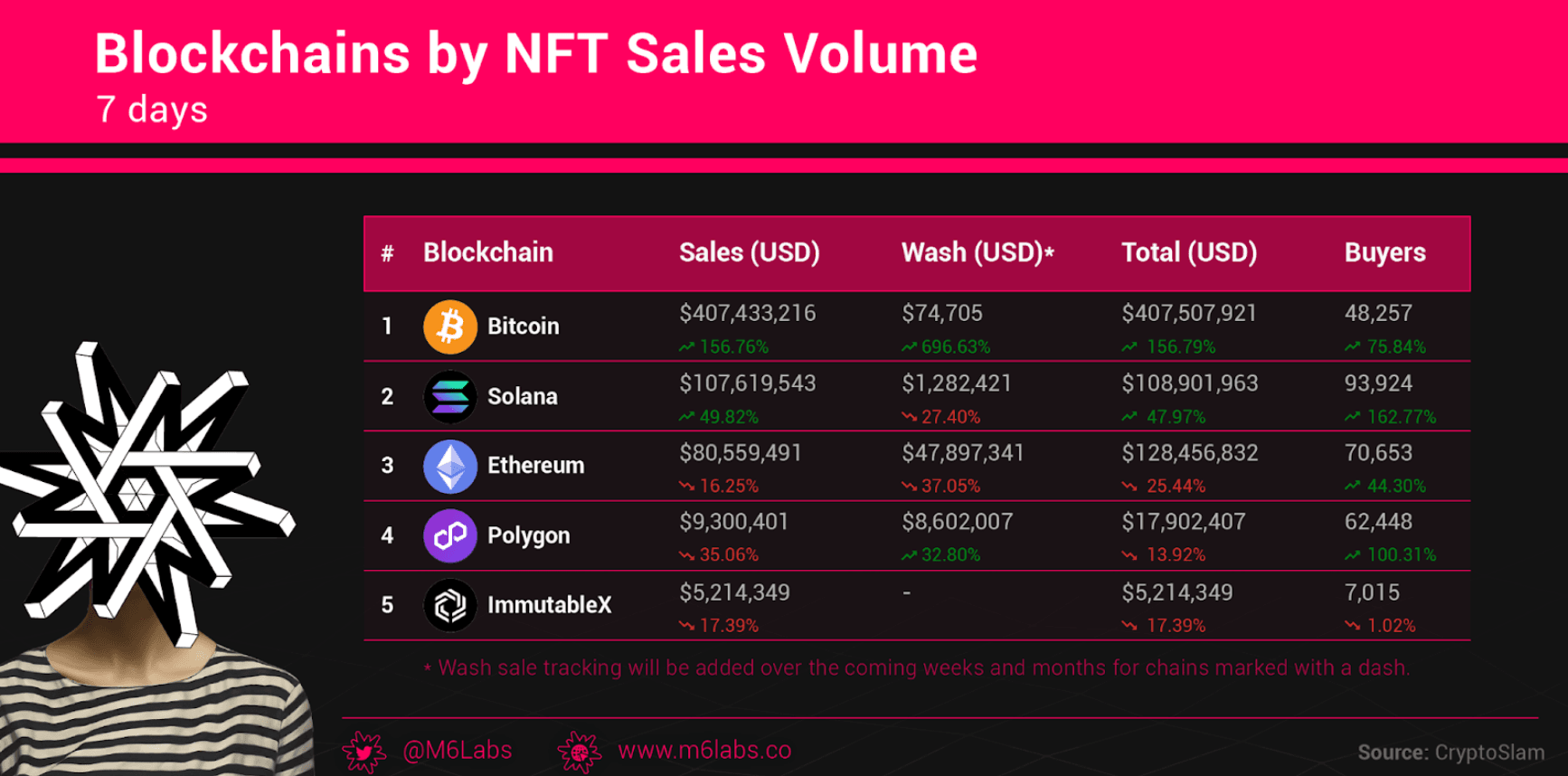

Top crypto gambling apps over the last 7 days. Source: DappRadar.Bitcoin NFTs have gained dominance, outperforming Ethereum with $426M in sales compared to Ethereum's $80M over 7 days. This surge is attributed to Inscriptions and Ordinals driving Bitcoin fees. BRC-20 tokens, notably SATS, RATS, and MICE, contributed significantly with $200M, Ordinals also performed impressively, generating $40m over the last 30 DAYS.

Degen Corner

- XAI Games, developed by Offchain Labs (founder of Arbitrum), is a Layer 3 gaming platform. It features XAI Sentry Nodes, and many users are interested in how to run these nodes. This useful guide by @BringMeCoins provides detailed instructions on setting up and monitoring the status of a node on XAI Games, catering to those unfamiliar with the process.

- MetaStrike is a blockchain-based role-play shooting game offering a collection of weapons and levels for players to complete missions. In-game activities allow players to earn NFTs and the native $MTS tokens. Its market cap is approximately $190,352. For other lucrative gaming related plays be sure to check out this thread by @defiinfant.

- Mojo Melee, a fantasy-themed auto-battler game on the Polygon blockchain, has launched a new season with updated features. The game offers a dynamic arena combat experience with various team-building strategies involving Mojos, Champions, and SpellStones. Despite the delay in NFT minting, players can still enjoy leveling up their Champions in preparation.

- Ronin (RON) has surged by over 95% this past month, and the overall marketcap is trending a hair below $40M. As per Nansen, Ronin saw a remarkable increase in active addresses in November, signaling rising activity.

- Immutable (IMX) marketcap crossed $3M as the token price jumped by 20% this past week.

- Decentralized Social (DESO) has seen substantial growth in its value, with a 19.40% increase in the last 24 hours and a 51.00% rise over the past week, bringing its price to $28.80 and its market capitalization to approximately $304.76M. DESO operates as a Layer 1 blockchain, uniquely designed to decentralize social media for a vast user base.

- Blur (BLUR) has exhibited a positive trend, with its price increasing by 7.5% to around $0.48 following recent token unlocks. Amidst these unlocks, about 49.8M tokens valued at approximately $23.2M were moved to Coinbase Prime.

Unsure on how to track and explore GameFi projects? Dive into this useful M6 Labs thread

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space