Don't worry, Anon! Number will still go up, SIGNIFICANTLY! We just have a few minor challenges to navigate first. Let's take a closer look at our current situation.

Source

SourceL1s, L2s & DeFi

State Of The Market

Just over one week has passed since the official confirmation of the BTC ETF, and the initial market response has left some underwhelmed. However, it's essential for both users and market participants to understand that short-term fluctuations and volatility were anticipated outcomes of this event, which still holds true.

To gain a more accurate perspective, it's crucial to adopt a long-term outlook. The influx of billions of dollars into the crypto sphere via institutional investments is anticipated to propel Bitcoin to new price heights. The ETF has already seen significant positive activity,

With the BTC ETF event behind us, attention now turns to the forthcoming Bitcoin Halving and the anticipated ETH ETF, which could materialize in May. Larry Fink of BlackRock has expressed optimism about Ethereum ETFs, hinting at a potential price surge leading up to this event. For an in-depth exploration of this development, check out Virtual Bacon's informative video. Additionally, the prospect of a world filled with various crypto ETFs, including XRP ETFs, SOL ETFs, ADA ETFs, and more, appears to be on the horizon.

TLDR

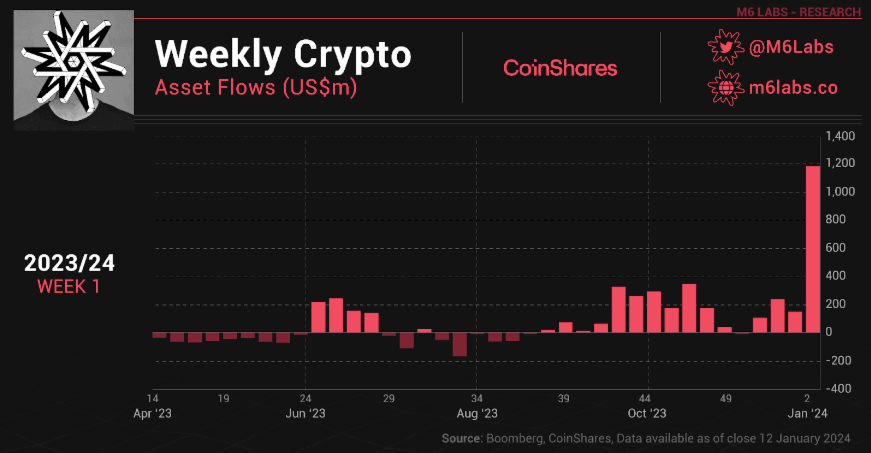

- Digital asset investment products received $1.18B in inflows last week, although this didn't break the record set by Bitcoin ETFs in 2021.

- Trading volumes for these products reached a record high of $17.5B, indicating increased market activity.

- Grayscale's decision to sell Bitcoin holdings is driven by high fees and investor withdrawals. Grayscale's 1.5% annual fee for its flagship product, GBTC, led investors to seek lower-cost alternatives.

- Bitcoin futures contracts worth billions could be liquidated if the price drops below $34K, posing a potential risk.

- USDT faced scrutiny from the UN, while South Korea considered sanctions on coin mixers. Regulatory frameworks in the crypto industry are expected to advance as governments seek control and taxation mechanisms.

- TrueUSD (TUSD) struggled to maintain its $1 peg, with its value dropping to $0.984.

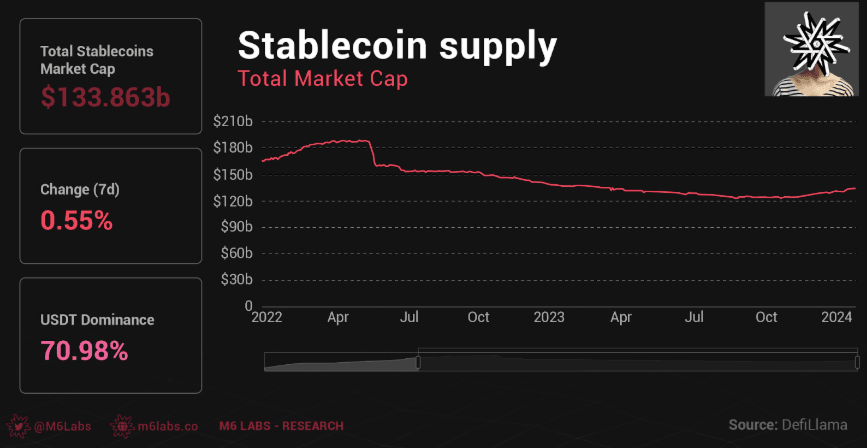

- Overall stablecoin supply in the market has increased but not significantly.

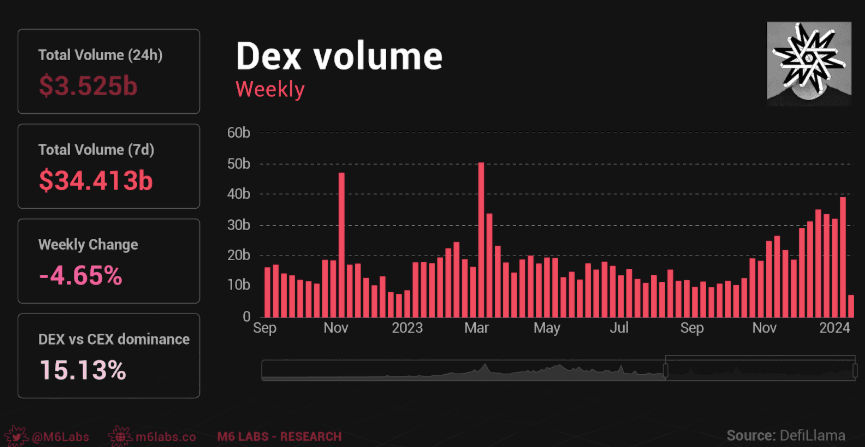

- Dex volume remains robust despite the recent market pullback, indicating healthy core metrics and on-chain activity.

Digital asset investment products received significant inflows of $1.18B last week, although this did not break the previous record set by futures-based Bitcoin ETFs in October 2021, which totaled $1.5B.

- Trading volumes for digital asset investment products reached a record high of $17.5B last week, a substantial increase compared to the 2022 weekly average of $2B. These volumes accounted for nearly 90% of daily trading volumes on trusted exchanges, indicating heightened activity.

- The United States dominated the inflow activity with US$1.24B, while Switzerland received $21M in inflows.

- However, Europe and Canada experienced minor outflows, possibly driven by basis traders shifting their assets from Europe to the United States.

- Bitcoin attracted significant inflows of $1.16B, equivalent to 3% of the total assets under management. Short Bitcoin products also saw minor inflows of $4.1M.

- Ethereum received inflows of $26M, and XRP saw $2.2M in inflows. Notably, Solana had only $0.5M in inflows.

- Blockchain equities witnessed substantial inflows of $98M, contributing to a total of $608M in inflows over the past seven weeks.

ETF Updates and Market Slump

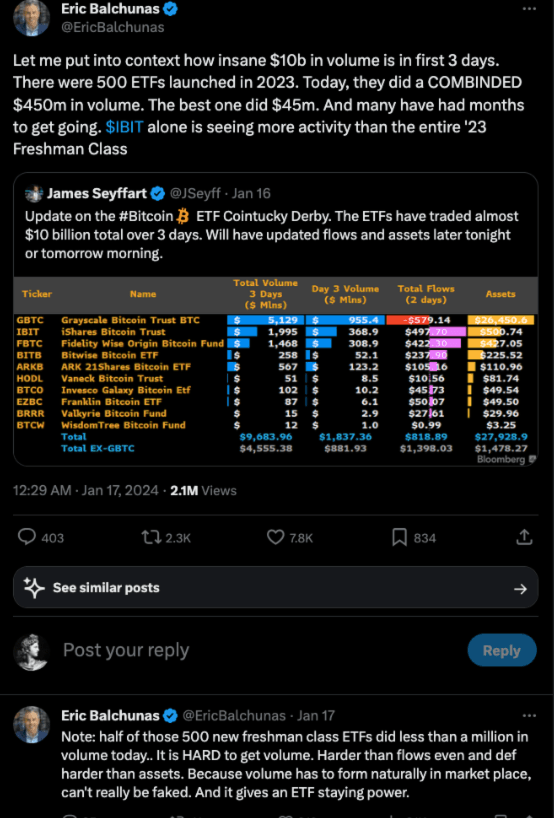

Bitcoin has now claimed the position of the second-largest commodity ETF in the United States, surpassing Silver. Spot Bitcoin ETFs have reached an impressive $27.9B in assets, securing ownership of 647,651 Bitcoins. Despite the market slump the ETF is still a huge success.

source

sourceThe Grayscale Situation

Grayscale's decision to offload Bitcoin holdings has raised questions and eyebrows across the crypto community. This move comes as a response to several factors that have put Grayscale in a challenging position.

- One of the primary reasons for Grayscale's BTC sales is the burden of high fees coupled with investor withdrawals. Grayscale's flagship product, the Grayscale Bitcoin Trust (GBTC), imposed a 1.5% annual fee, considerably higher than other ETFs available in the market.

- This substantial fee difference prompted many investors to seek alternatives.

- Furthermore, numerous investors initially acquired GBTC at a significant discount, up to 40%, which has since narrowed to zero. This narrowing of the discount prompted many investors to reconsider their positions and opt for more cost-effective options.

- In the absence of a Bitcoin ETF, Grayscale was instrumental in becoming a significant BTC holder, alongside the mysterious Satoshi Nakamoto. However, this position has been challenging to maintain, especially with the rise of low-fee ETFs in the market.

- The consequence of these factors is a wave of investors leaving GBTC, requesting redemptions of their shares. To fulfill these redemption demands, Grayscale is compelled to sell BTC holdings.

- This process could span weeks and may potentially result in fluctuations in the Bitcoin market.

- As Grayscale navigates this challenging period, some investors are considering moving their funds to low-fee ETFs once the situation stabilizes.

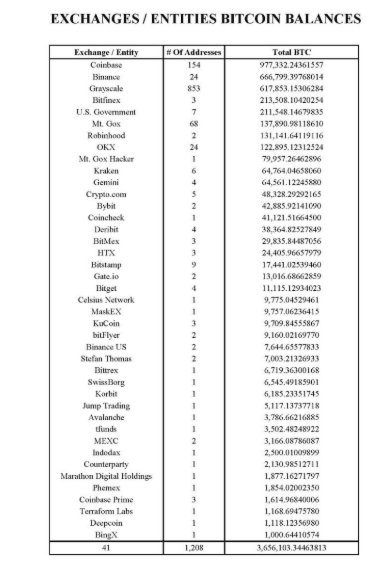

Largest BTC holders. Grayscale currently holds around 617K of BTC. Source

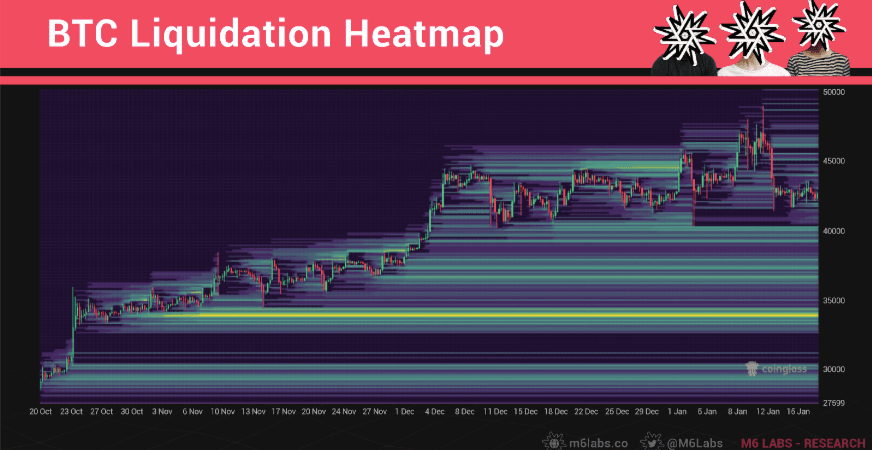

Largest BTC holders. Grayscale currently holds around 617K of BTC. SourceFurthermore, a situation is emerging as there's a risk of billions worth of Bitcoin futures contracts being liquidated if the price drops below the $34K mark. It’s likely with the right catalyst we see a pullback to these levels.

BTC Liquidation Heatmap. Source: Coinglass

BTC Liquidation Heatmap. Source: CoinglassIn the realm of regulation, USDT recently faced scrutiny from the UN, while South Korea is considering imposing sanctions on coin mixers, aligning with actions taken by the US.

- Furthermore, Circle CEO Jeremy Allaire has indicated that 2024 may witness the enactment of concrete laws governing the stablecoin industry in the US. The stablecoin market, valued at $135.3B, continues to operate largely unregulated, despite its pivotal role in facilitating crypto trading.

- These instances represent just a glimpse of the ongoing discussions and debates surrounding crypto regulations. In the near future, we can anticipate substantial advancements in regulatory frameworks as governments aim to establish control and taxation mechanisms within the crypto sphere.

In other financial news, Barclays Bank has revised its outlook, now predicting that the FOMC will gradually reduce rates by 25 basis points at every other meeting, commencing in March. This adjustment deviates from their earlier projection of rate cuts beginning in June.

- The recalibration of nominal policy rates is expected to create a more favorable environment for crypto and risk-on assets in general. This improved environment will be further bolstered by the ongoing increase in global liquidity initiated by the Federal Reserve and the People's Bank of China.

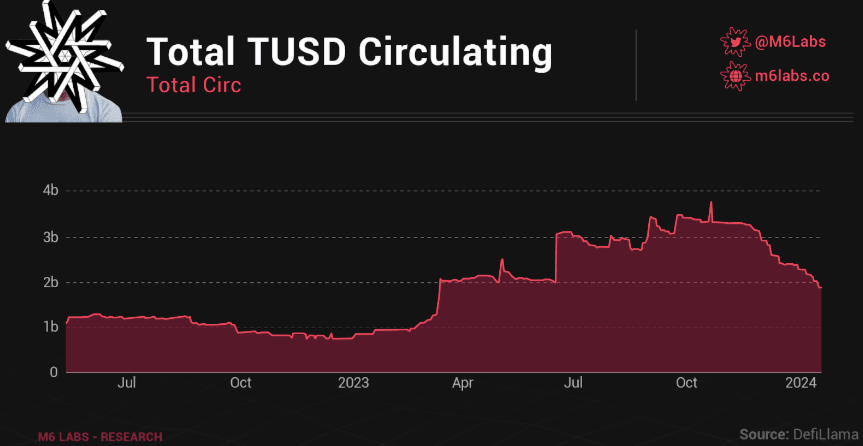

TrueUSD (TUSD) experienced significant volatility and struggled to maintain its $1 peg. TUSD's value fell to as low as $0.984 and has not yet regained its peg.

- Data from Binance indicates that about 60% of trading activity involving TUSD has been selling, leading to a deficit of approximately $155M.

- The absence of TUSD mining in Binance's latest launch pool is believed to have contributed to the sell-off.

- TUSD's Curve pool is imbalanced, with most traders preferring other stablecoins like Tether's USDT, Circle's USDC, and DAI.

- 54M TUSD tokens were burned as users converted their holdings into fiat.

- TUSD's supply has significantly decreased, falling below $2B, its lowest level since June 2023, after reaching a peak of $3.5B in September 2023.

TUSD circulating supply falls following struggles with deppeging. Source: DefiLlama.

TUSD circulating supply falls following struggles with deppeging. Source: DefiLlama.Overall stablecoin supply has picked up in the market but has not increased significantly.

Dex volume indicates that core metrics remain robust despite the recent market pullback. Volume has shown significant growth, and on-chain activity continues to exhibit strength.

Blue Chip and Majors Overview

Source: Tradingview

Source: TradingviewBTC, ETH, and SOL Ranging

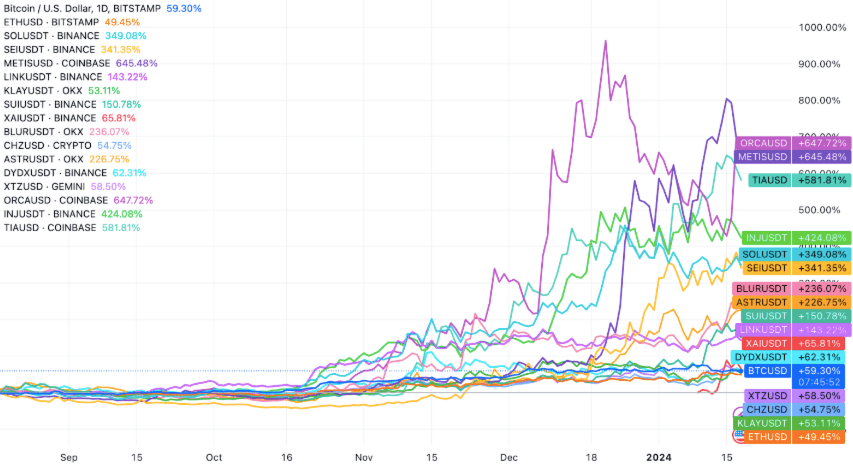

This past week has been pretty bearish for the market, with BTC, ETH, and SOL all suffering losses. BTC, ETH, and SOL dropped by 9%, 3.5%, and 2.5% this past seven days. Bitcoin is currently sitting on top of crucial support at $41K. Meanwhile, ETH is sitting around $2,500, while SOL is trending below $100. It seems like the market is moving in a range prior to a breakout. Some believe that the spot ETF approval was a “sell the news” event, while others believe that the market is gathering steam before exploding. Let’s see how the next seven days pan out.

- Sei - The SEI token recently hit its all-time high just after the new year, rising to $0.87 on the back of an impressive 70% surge in seven days. However, the token’s price has dropped by 13% since then, currently trading at $0.7628.

- Metis - METIS fell below the $100 mark after registering a drop of nearly 7% over the past 24 hours. While the token has been in the red over the past week, it has registered a staggering increase of 267% during the past month.

- Chainlink - Most technical indicators are bullish when it comes to LINK. The token has registered an increase of 128% over the past year.

- Klatyn - Klatyn has been in the news after the token’s price surged by 35% on the back of a merger proposal with Finschia, supported by Kakao and LINE.

- Sui - SUI has registered remarkable gains over the past three months, with the token rising by a staggering 300%. This increase coincides with a 2200% surge in SUI’s total value locked (TVL).

- Blur - The BLUR token has maintained its upward trajectory despite the unlocking of 50 million tokens, rallying by over 14%. The token went up by over 6% in the past 24 hours.

- Chillz - The Chillz price rally on the 16th saw it become one of the biggest gainers, rising by 18% in a day. However, the token is down by over 8% over the past 24 hours.

- dYdX - dYdX recently became the largest decentralized exchange by volume, surpassing Uniswap as trading volumes on dYdX v4 went past $600M. The token has registered a 13.7% increase over the past two weeks.

- Astar - The ASTR token has registered an increase of 5.4% over the past week. However, its long-term gains are more impressive, with the token registering a 77% increase over the past 30 days.

- Unibot - Telegram’s trading bot recently hit record use on Solana. Unibot’s UNIBOT token has seen its price rise by over 63% over the past month. However, the token is currently trading in the red, down by just over 12% in the past 24 hours.

- Tezos - Tezos (XTZ) is currently trading at a price of $1.05, a decline of 3.67% in the last 24 hours and an increase of almost 2.5 % over the past week.

- Orca - ORCA has registered an increase of over 15% after Bitget announced it was launching a spot P2P market that would allow traders to get early access to tokens not yet listed on major exchanges. The project features ORCA, BRC-20 token BTCS, and Depin project DIMO.

Solend - Solana’s Solend (SLND) token has seen a considerable rebound after its price dropped to $1.76 at the end of the first week of January. The token has significantly recovered since, rising by 45% over the past week. SLND is currently trading at $2.97.

Smart Money Movements

- Recently, Roko has once again garnered the keen attention of smart money, marking a resurgence in interest over the past few days.

- In anticipation of a promising 10% yield come June 2024, smart money has been diligently accumulating PT-eETH, strategizing for future gains.

- An intriguing observation unfolds as smart money demonstrates notable accumulation in plsARB, prompting speculation about an imminent peg.

- The maneuvers of smart money extend to USDR as well, strategically playing the RFV game plan through calculated accumulation.

- A substantial $32M worth of $Blur has been unlocked and seamlessly dispatched to Coinbase, constituting 4% of the circulating supply. Check out the transaction details here.

Yield Farms:

- Merchant Moe maintains its enduring popularity among smart farmers on the Mantle platform, offering a reliable avenue for yield generation.

- Cleopatra emerges as yet another preferred protocol on Mantle, capturing the allegiance of discerning smart yield farmers.

- Seamless Protocol celebrates increased adoption from the discerning realm of smart money, further solidifying its position among other DeFi protocols on BASE.

- The rise of KelpDAO continues unabated, with smart money recognizing its potential and contributing to its growing traction.

- Vertex, a standout protocol on Arbitrum, secures its position as one of the most favored choices among the Arbitrum smart money.

- Notably, Velocimeter on the Mantle network has become a focal point, drawing substantial attention and interest from the smart farmers.

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here.

NFTs & Gaming

So, price going up is taking a break, but that doesn't mean NFTs are going anywhere. As you'll see, update after update keeps getting released, and tomorrow’s blue-chip collections are busily truly building. Let's dive in!

Project Updates

- OpenSea is currently in the process of crafting a 2.0 platform enhancement. They are diligently focused on features such as showcasing calendar-based ticketing NFTs, monitoring the trending Solana NFTs, and introducing Ordinals.

- Sky Mavis launch Mavis store.

- Ubisoft, the creator of Assassin's Creed, lends support to yet another crypto-powered gaming network.

- Within its initial week, the new NFT leverage protocol, Wasabi, achieved a trading volume of $2M.

- Presail launches on Ronin.

- Looksrare launches on-chain games on Arbitrum.

- Bitcoin witnessed a rapid sellout of the Shadow Hats collection, created by the

Blue Chip and Market Overview

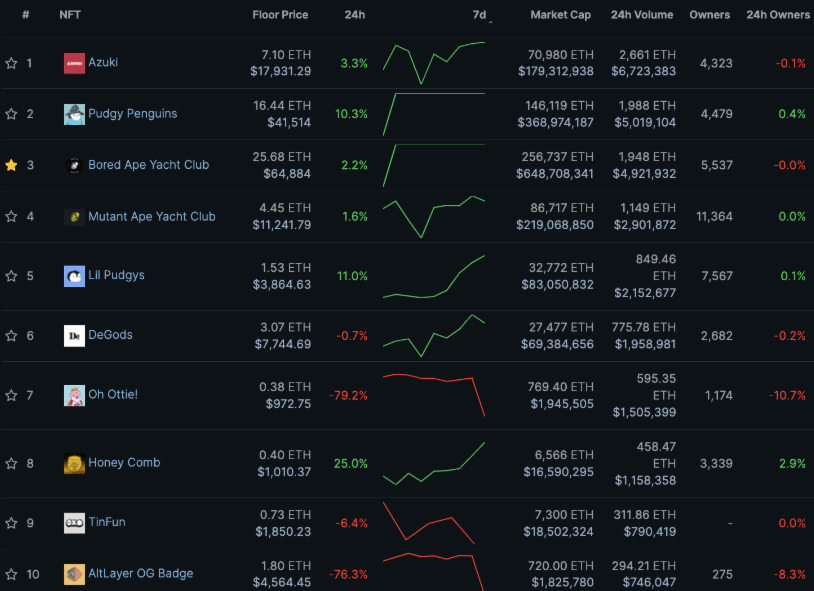

Pudgy Penguins and Azukis have been prominent performers in the NFT charts. Despite a recent dip in the whole NFT market, these projects are poised to grow stronger as they maintain their resilience and introduce new developments. It's advisable to keep a close eye on them during the bull market.

Now, let's delve deeper and explore the exciting developments these projects have in store and how the NFT ecosystem as a whole is holding up.

Top NFT collections over the last 7 days. Source: Coingecko

Top NFT collections over the last 7 days. Source: CoingeckoRevisiting Pudgys and Azukis

For those who are unaware of the project, Pudgy Penguins is an NFT collection on Ethereum that features 8,888 unique penguin NFTs, each with randomly generated traits.

- Luca Netz leads the Pudgy Penguins project as CEO, focusing on community engagement and value addition.

- Pudgy Penguins stands out in the NFT world due to its inclusive art and emphasis on community, bridging the gap between the tangible and digital with Pudgy Toys and Pudgy World.

- Pudgy Toys, the first mass-market NFT product, were introduced in May 2023 and sold in major stores like Amazon and Walmart, making blockchain experiences accessible to a broader audience.

- Pudgy World is a digital playground accessible through Pudgy Toys, introducing users to NFTs and providing a marketplace for trading NFT traits.

- Pudgy Penguins NFT holders enjoy exclusive benefits, including access to experiences, events, IP licensing opportunities, and community engagement.

- The Pudgy Penguins universe includes other collections like Lil Pudgys and Pudgy Rods, each with its unique characteristics and perks.

- Pudgy Penguins introduced Soulbound tokens (SBTs), including truePengu and penguPins, to empower the community and commemorate licensing deals.

- The project has ambitious plans for the future, aiming to become a leading IP company in Web3, offering opportunities for licensing deals and brand partnerships.

Azuki has faced past controversies, including accusations of fraud against its founder and the unsuccessful launch of the Elementals collection. However, despite these setbacks, the project has maintained its position in the top 10 and remains committed to strengthening its ecosystem. Let's take a closer look at the project's future plans.

- Azuki has partnered with acclaimed director Gorō Taniguchi to create an anime anthology series, aiming to expand its reach and introduce Japanese animation to new audiences while providing opportunities for talented Japanese anime creators.

- This partnership reflects Azuki's broader plan to offer a variety of content to diverse audiences, emphasizing web3-driven storytelling.

- In a recent Twitter Space discussion, Azuki co-founder Dan and Karma from ZTX explored various aspects of the Web3 landscape. They discussed Azuki's Collector Status release, which gamifies the NFT collection experience for long-term collectors. Overall, the discussion provided insights into Azuki's approach and broader trends in the Web3 space.

- Azuki, recently experienced concerns about the project's future.

- Some critics suggest Azuki should have followed ApeCoin's path by launching its tokens earlier, and there are apprehensions about potential legal issues with the SEC due to Azuki's U.S. operations.

Moving on to some metrics…

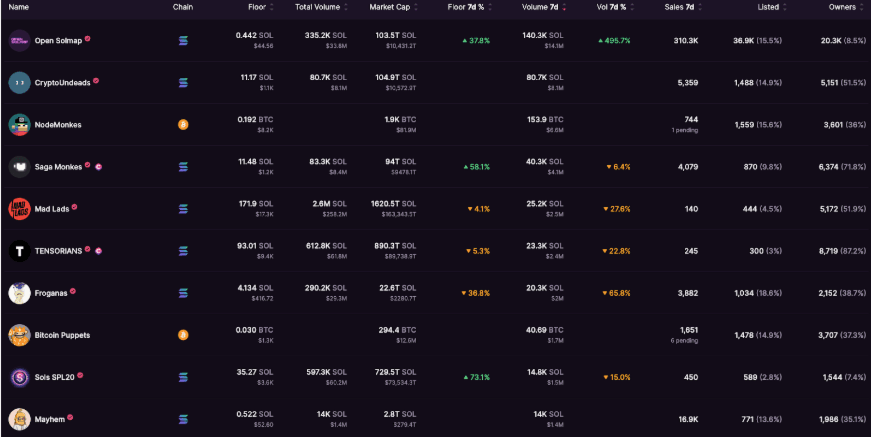

Solana collections have regained their top position on the Magic Eden charts. NodeMonkes remains within the top 5, and the recent rise of the new project, Bitcoin Puppets, has propelled it into the top 10.

Top NFT collections on Magic Eden over the last 7 days. Source: Magic Eden.

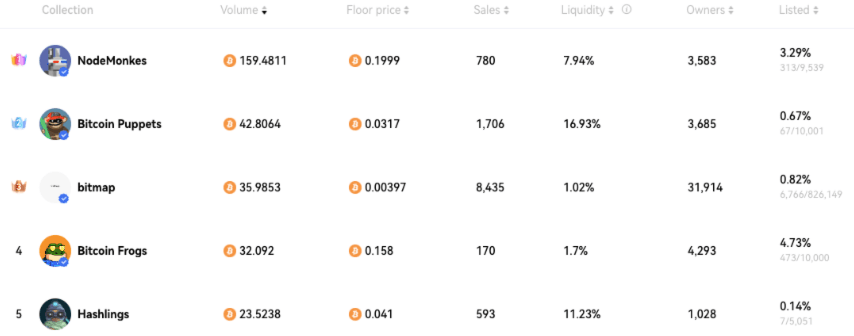

Top NFT collections on Magic Eden over the last 7 days. Source: Magic Eden.OKX’s NFT marketplace for ordinals is seeing substantial volume for NodeMonkes and Bitcoin Puppets as well.

Top Ordinals collections on OKX. Source: OKX NFT Marketplace.

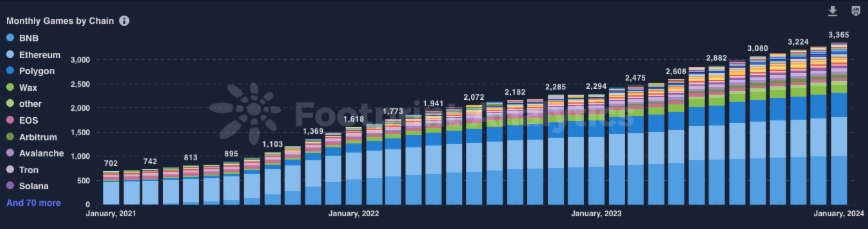

Top Ordinals collections on OKX. Source: OKX NFT Marketplace.Checking in on gaming activity by chain. Ethereum, BNB, and Polygon continue to dominate.

Monthly Active Games by Chain. Source: Footprint Analytics.

Monthly Active Games by Chain. Source: Footprint Analytics.Despite these chains dominating gaming activity, the most popular games are on other lesser-used chains such as NEAR, WAX, and Ronin. Ronin has made a comeback with Pixels and activity on Axie is once again picking up after many upgrades.

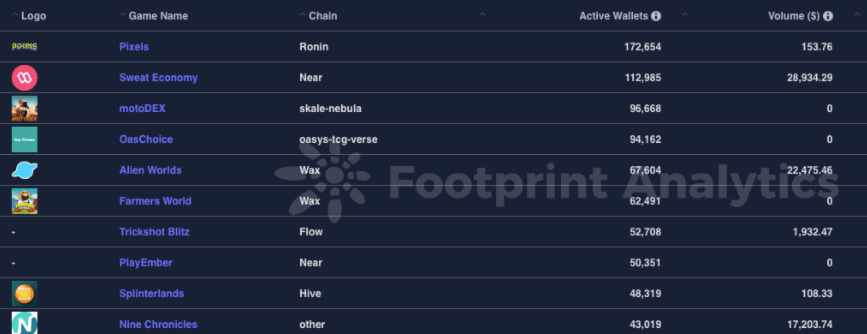

Top crypto games. Source: Footprint Analytics.

Top crypto games. Source: Footprint Analytics.Degen Corner

- NFT Worlds - The WRLD token is an ERC-20 token built on the Ethereum blockchain. It is the primary utility token when interacting with NFT Worlds. While trading volumes are low, the token has registered an increase of nearly 60% over the past 30 days.

- Xai - The XAI token has been on an upward trajectory since the recent airdrop. The token surged by 35% following the airdrop and hit its all-time high of $1.21 on the 17th of January, 2024.

- Genopets has introduced a player-to-player (P2P) marketplace in both the browser and app versions of its move-to-earn game. This marketplace allows players to buy, sell, and trade Genopets items seamlessly. Users of the mobile app can make purchases using in-game currency (Qbits), while those preferring crypto can use the web interface.

- Last Remains, a competitive stealth shooter game set in a zombie-infested world, is starting 2024 with exciting developments. They introduced a mobile-based mini-game called "Search and Rescue" on January 16th, allowing players to combine their Last Remains characters with item skins to compete for rewards, including NFTs and tokens.

- Heroes of Mavia is gearing up for an exciting token airdrop as part of its Pioneer Program. In this program, approximately 7.5M MAVIA tokens will be distributed to eligible participants.

- Be sure to check out the two latest games to launched on Immutable, Second World and Space Mavericks.

- Bitcoin Ninjas deploy a Super Nintendo emulator on Bitcoin. Read more about it here.

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space