GM Anon! Last time we connected anticipation was building for the ETF and now it’s here! The suits have formally arrived in crypto. How will this play out? Many crypto natives view this as a negative thing for the long-term health of the space, especially when one considers crypto was meant to build an alternative to the traditional financial system.

Only time will tell how this all plays out, but in the meantime enjoy your bags getting pumped to the moon! Let’s dive into this week’s content!

L1s, L2s & DeFi

State Of The Market: A New Era

There’s no denying that crypto will never be the same following this monumental event. Let’s take a look at how the market is reacting.

TLDR

- Bitcoin spot ETFs saw $4.6B in trading volume on their first day.

- Grayscale, BlackRock, and Fidelity led in trading volumes.

- Bitcoin futures open interest on CME reached an all-time high of $5.4B.

- Asset managers increased long futures interest.

- Digital asset products received $151M in inflows in the first week of 2024.

- Ethereum surged following ETF news.

- Several testnets for various protocols are emerging, offering opportunities for users to earn rewards.

The launch of BTC spot ETFs has made a significant impact on the crypto industry, with approximately $4.6B in trading volume recorded on their inaugural day of trading, based on data from LSEG.

- This milestone marks the commencement of trading for eleven spot bitcoin ETFs, featuring industry giants like BlackRock's iShares Bitcoin Trust and Grayscale Bitcoin Trust. Leading the charge in trading volumes are Grayscale, BlackRock, and Fidelity, highlighting the substantial appetite for these new investment products.

- The approval by the SEC represents the culmination of a decade-long struggle between regulators and the crypto industry. Despite concerns expressed by some executives about the inherent risks associated with Bitcoin.

Following the ETF launch, issuers engaged in intense competition by aggressively reducing fees for their products, even before their official market debut. The fee structures for these new bitcoin ETFs range from 0.2% to 1.5%, with many firms offering fee waivers for specific durations or asset thresholds.

- The conversion of Grayscale's existing bitcoin trust into an ETF solidified its position as the world's largest BTC ETF, amassing over $28B in assets under management overnight.

- While analysts' estimates regarding the potential inflow of funds into spot bitcoin ETFs vary, projections range from $10B in 2024, as suggested by Bernstein analysts, to a more optimistic outlook of $50B to $100B for this year alone, as posited by Standard Chartered analysts.

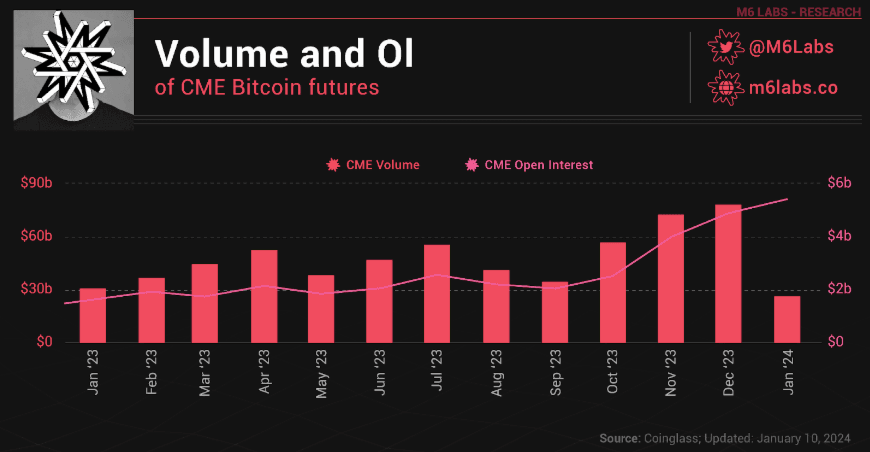

Bitcoin futures open interest on the Chicago Mercantile Exchange surged to an unprecedented level this past week, marking a significant milestone for the crypto market.

- Multiple data sources confirmed this development, with Bitcoin futures open interest reaching an impressive $5.4B on CME.

- This surge in open interest surpasses the previous all-time high of $4.5B, observed in November 2021 during Bitcoin's peak price surge beyond $68K.

- This increase in outstanding futures contracts on CME reflects heightened participation from institutional traders within the crypto space.

- Notably, the open interest volume of Bitcoin futures on CME overtook that of Binance Futures in November 2023, signifying growing demand from institutional investors.

- Furthermore, asset managers have seen a substantial increase in Bitcoin long futures' open interest on CME, soaring from $2.45B at the end of December to a current value of $2.52B.

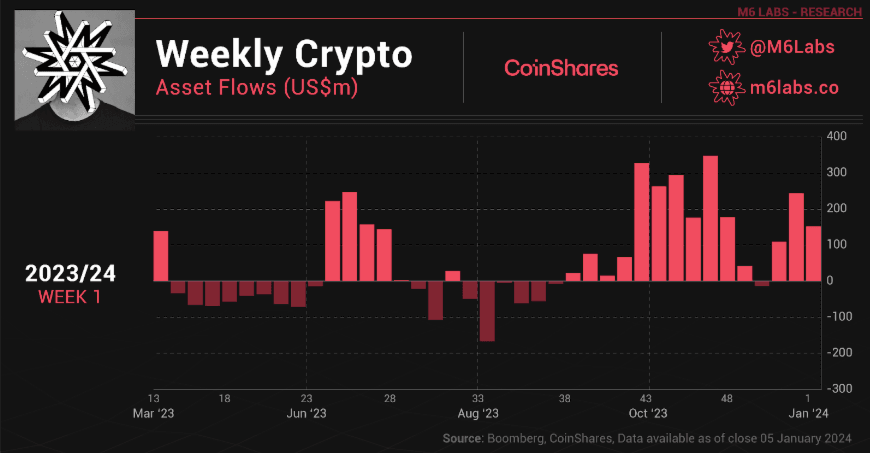

In the first week of 2024, digital asset investment products received $151M in inflows, bringing the total inflows since the Grayscale vs. SEC lawsuit to $2.3B, accounting for 4.4% of total assets under management. 55% of these inflows came from US exchanges, while Germany and Switzerland accounted for 21% and 17% respectively.

- Bitcoin received the most substantial share of inflows at $113M, representing 3.2% of AuM over the past nine weeks. In contrast, short-bitcoin products experienced outflows totaling $1M during the first week of the year.

- Notably, despite expectations of a "buy the rumor, sell the news" scenario with the ETF launch, short-bitcoin ETPs have seen outflows of $7M over the last nine weeks.

- Ethereum witnessed inflows of $29M, with total inflows over the past nine weeks amounting to $215M, signifying a positive shift in sentiment.

- Conversely, Solana faced challenges at the start of the year, with outflows totaling $5.3M.

- Additionally, blockchain equities had a promising start to the year, attracting $24M in inflows over the past week.

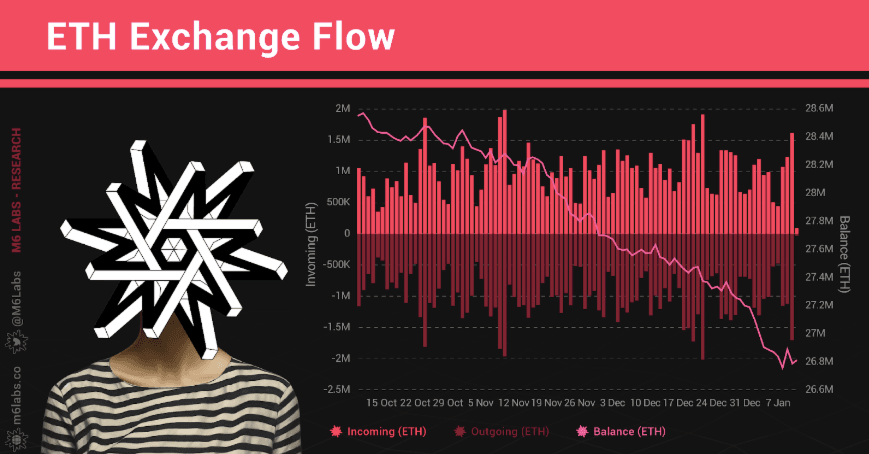

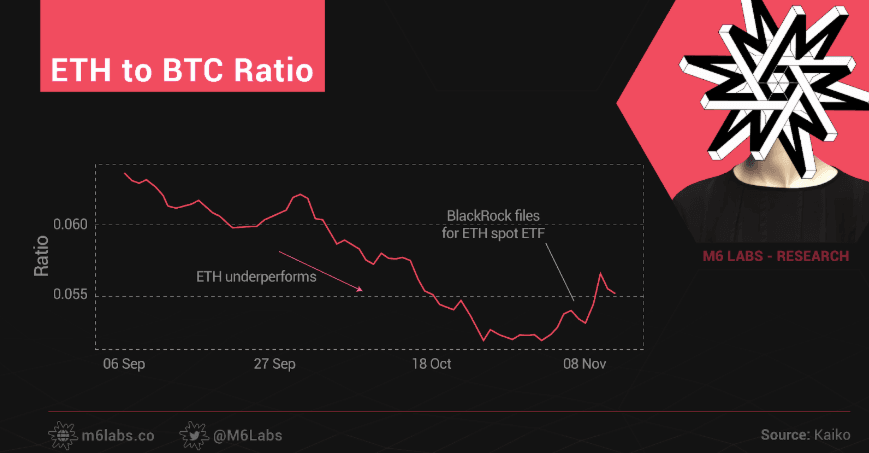

Ethereum has experienced a surge in price following the ETF announcement. After lagging behind the rest of the market, it seems that the ETH season is once again upon us.

- ETH is being withdrawn from exchanges as users become more active in the ecosystem. It's likely that many DeFi protocols, which have seen little activity up until now, will once again become vibrant, with lending, borrowing, and yield farming regaining significant traction.

- Additionally, many anticipate that an ETH ETF will receive approval by May of this year.

- Interestingly, Vitalik recently supported a gas limit increase on ETH by approximately 33%.

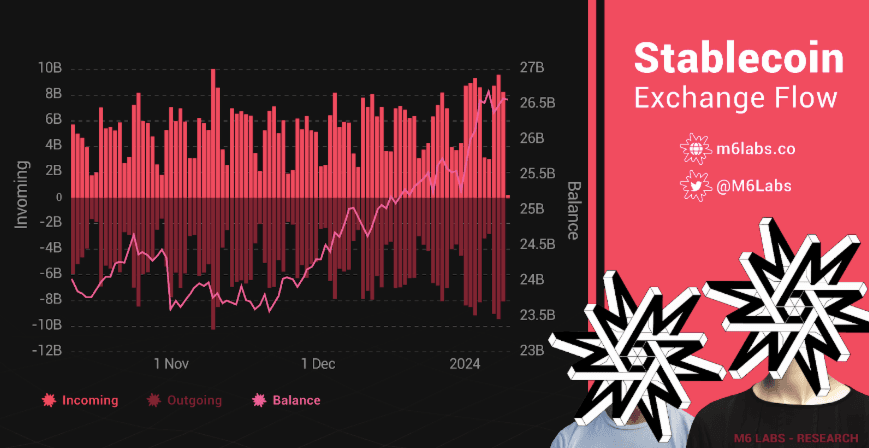

The influx of stablecoins into crypto exchanges is surpassing outflows, and this can be attributed to several factors. Traders are taking advantage of arbitrage opportunities and utilizing increased leverage on these platforms, contributing to the growing volume of stablecoin deposits.

After months of continuous decline, the ETH/BTC ratio has broken out significantly, signaling potential substantial gains for the Ethereum ecosystem.

- These gains have already been witnessed in coins like Arbitrum and Optimism, which serve as high-beta plays on Ethereum.

- It will be intriguing to observe how projects emphasizing real-world asset narratives and other novel developments fare and how established ones like Maker, Aave, and Compound perform in the forthcoming bull market.

- The question remains whether traders will shift towards newer protocols or if these existing projects will further solidify their position within the Ethereum ecosystem.

- MakerDAO founder Rune Christensen has initiated a significant overhaul through the "Endgame" plan, aiming to rejuvenate and rebrand the operation. This plan involves introducing new subDAOs and transforming MakerDAO into a more autonomous entity using artificial intelligence. The plan, however, has faced mixed reactions within the community.

Airdrops

A plethora of exciting developments are currently unfolding in the crypto space, with numerous airdrops taking place or on the horizon. Among these, Layer0, Stark, and zkSync are some of the most highly anticipated ones, promising to introduce groundbreaking innovations to the crypto ecosystem.

These airdrops present an excellent opportunity for investors and enthusiasts to get involved in cutting-edge projects and potentially reap substantial rewards.

Moreover, the crypto landscape is undergoing a transformation with the introduction of various testnets for a wide range of protocols. What's particularly enticing is that many of these testnets are entirely free to access. For individuals looking to bolster their capital, engaging in these testnets can prove to be a lucrative endeavor.

These testnets serve as a testing ground for new projects, allowing users to participate and, in turn, earn rewards. As a result, they represent a pathway to exponential returns, especially as projects are eager to expedite their token launches and swiftly enter the market.

If you're keen on exploring these opportunities, several testnets are worth your attention. These include Berachain, Altlayer, Avantis Finance, and SatoshiVM, each offering a unique set of features and opportunities for those seeking to engage with emerging protocols.

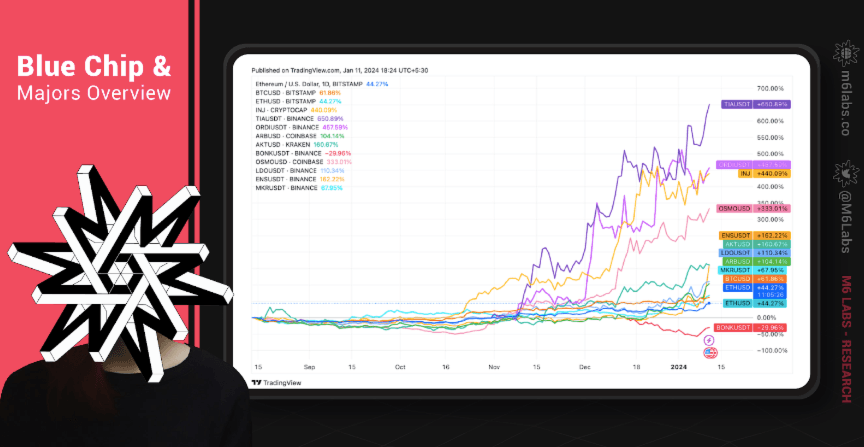

Blue Chip and Majors Overview

Bitcoin

Bitcoin has jumped by 7% this past week as the SEC finally approved the spot ETF applications. Some believe that the jump would have been even more pronounced had the SEC not bungled its announcement. Now, we need to wait and watch if the ETF application is a “sell the news” event or not.

Ethereum

With a 14% jump over the past seven days, ETH has broken past the $2,600 psychological barrier. Following Bitcoin ETF approval, all eyes are on the ETH ETF applications. Experts believe that these applications will also get approved with ease. Currently, ETH is trading at around $2,600. Will we see ETH at $2,700 before the week ends?

- Celestia: Over the last two months, TIA has almost 7X'd from $2.61 to $15.68. A week back, TIA hit its all-time high of $17.13

- Zorro: $ZORRO on zkSync has jumped by over 65% in the past 24 hours. It looks like meme coins on zkSync and other chains are going to pump in the near future.

- Ordi: $ORDI has jumped by >60% in the last seven days and is looking to break through the $75 resistance barrier.

- Stacks: With a 107% jump in the last 30 days, STX is looking to break past the $2 barrier.

- Arbitrum: With a 97% spike in valuation over the past 30 days, ARB is on an absolute tear. ARB hit is currently trending at $2.31, a shade below its ATH of $2.36.

- Akash Network: AKT has surged 6X since July, breaking past the key psychological barrier at $3. However, it is still ways off from its all-time high of $8.07.

- Bonk: BONK has jumped by almost 1000% this past year. The coin is looking to break past the $0.00002 psychological level.

- Osmosis: OSMO has nearly doubled in price over this past month. OSMO is currently looking to break past the $2 psychological line.

- Lido: Lido has been riding the bullish Ethereum wave as well. LDO has jumped by 66% over the past 30 days.

- Rocket Pool: RPL has exploded by over 20% in the past 24 hours as it looks to touch the $40 line. Rocket Pool is riding the liquid staking narrative.

- Ethereum Name Service: ENS has been on a tear, jumping by 160% this past month. In December, ENS has registered 23.4k new names.

- SSV Network: SSV is looking to break past the $40 resistance line, having jumped by over 60% this past month.

- Maker: MKR has jumped by 50% over the past 30 days and broken past the $2,000 resistance level. Currently, Maker is going all in on its Endgame proposal.

- Optimism: Having jumped by 14% this past week, OP is looking to break past $4. As per L2Beat, the total value locked in Optimism has crossed $6.50B.

- Injective: Injective had a tremendous year wherein the price jumped by almost 3000%. Over the year, INJ jumped from $1.27 to $41.50, with the marketcap breaking past $3.5B.

- Autonolas: OLAS dumped by over 20% this past week. However, they have recently finished and the protocol has gotten a lot of mech requests. OLAS is currently sitting slightly below $6.

Smart Money Movements

- One notable project catching the attention of Smart Money is $METAL, a gamefi venture on the Polygon network, backed by Animoca. The strategic accumulation of $METAL tokens suggests a bullish outlook among informed investors.

- As the Ethereum season makes a resurgence, Smart Money is turning its gaze towards $UNIBOT. Improved metrics of Unibot and heightened anticipation in the ETH market are driving the accumulation of $UNIBOT, signalling confidence in its potential for growth.

- In the realm of perpetual protocols, Smart Money has strategically chosen $GMX as one of its targets. The increasing volume of perpetual swaps in general has prompted informed investors to place their bets on perp protocols, and $GMX stands as a beneficiary of this trend.

- Expanding its portfolio, Smart Money has made a move on $VKA, a perpetual project on Arbitrum. Viewed as an $ARB beta just like $GMX.

- Staking has become a strategic play for Smart Money, with a focus on $GTC. The prospect of receiving airdrops from various projects by staking $GTC has enticed informed investors to stake their $GTC.

- $MND, a programming language tailored for both AI and humans, has also piqued the interest of Smart Money.

Yield-Farms

- Turning to yield farming, Smart Money has identified promising opportunities in various platforms. Merchant Moe on Mantle has become a notable choice, offering attractive APRs that have captured the attention of savvy farmers.

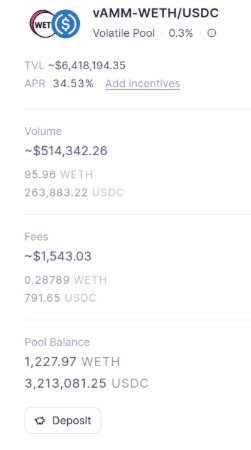

- Aerodrome, with its WETH/USDC farming pool boasting a 34.5% APR and a TVL of 6.4 million, has become a favored destination for Smart Farmers seeking robust returns.

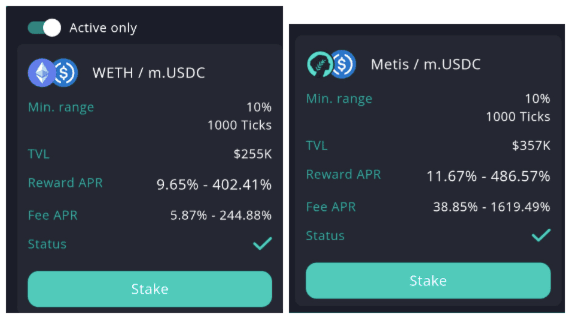

- Maia V3 on Metis is gaining traction among Smart Farmers due to its competitive APRs.

- For those inclined towards lower risk, Spark remains a popular choice among Smart Farmers.

- Kelp Dao's rsETH farming has proven to be a prudent play for Smart Farmers, aligning with their strategic approach to maximise returns.

- Venturing into higher risk territories, Smart Money has also cast its gaze upon Vivacity, a stablecoin farm with a high-risk profile.

This is just a preview of our L1, L2 and DeFi Weekly report, be sure to check out the full version of this report here.

NFTs & Gaming

The crypto market has entered a new era following the approval of multiple spot Bitcoin ETFs. As for NFTs, they are likely to find themselves in an advantageous position. It's anticipated that NFTs will develop new use cases that were previously unimagined.

We are living in an exciting time where the future of finance and crypto is just beginning to unfold, and it's probable that NFTs will play a significant role in this new paradigm. The focus over the last few weeks has primarily been on the ETF, but that doesn't mean NFT projects and games haven't seen movement. Let's dive in and see how things are looking!

Project Updates

- Futureverse, a metaverse and AI company, has partnered with the creators of "Ready Player One" to develop The Readyverse, an interoperable metaverse inspired by the novel and film. The project, set to launch in 2024, has secured rights from Warner Bros.

- Gateway Miami exhibition, in partnership with Christie's, has significantly impacted the world of digital art. The event showcased diverse artworks in Christie's "Next Wave: The Miami Edit" auction, realizing over 104 ETH ($231,357) in sales.

- The digital art market, particularly on the Ethereum blockchain, showed signs of recovery in 2023, closing the year with a market value of $5B, according to a report by Grail Capital. This figure marks a significant rebound from its low point in August 2023, despite still being lower than its peak in spring 2022. The influx of institutional capital, with investments from private banks, venture capitalists, and family offices, has been a key driver of this growth.

- Mickey Mouse Tokens gained popularity as “Steamboat Willie” becomes part of the public domain.

- X to phase out support for NFTs.

- Logan Paul announces he will buy back NFTs from CryptoZoo.

- Xai, a layer-3 gaming network on Arbitrum, launched its initial airdrop, distributing around $70M worth of XAI tokens to eligible users who own certain Xai NFTs and operate Sentry Nodes.

- An artificial tweet that caused a drop in Bitcoin's value has been forever memorialized in the form of digital art by Degens, commemorating the SEC chair's reaction to the incident.

Blue Chip and Market Overview

Blur continues to rank as the number one NFT marketplace. Opensea has been overtaken by rising giants Magic Eden and OKX NFT Market Place. Many believe OpenSea will drop a token this coming cycle in order to encourage user activity in an attempt to gain back market share from its competitors. OpenSea seems to have lost its first-mover advantage which made it the centre of NFTs last cycle.

Top 7 marketplaces over the last 30 days. Source: DappRadar.

Top 7 marketplaces over the last 30 days. Source: DappRadar.Traditional blue-chip NFT collections continue to dominate volume with newer collections such as Mad Lads and others rotating in and out of the top 10. Azuki has seen an impressive performance over the last 30 days, seeing an increase of nearly 250%. Pudgy Penguins has solidified itself as a mainstay of the top five through clever marketing and continuous project developments.

Top collections by volume over the last 30 days. Source: DappRadar.

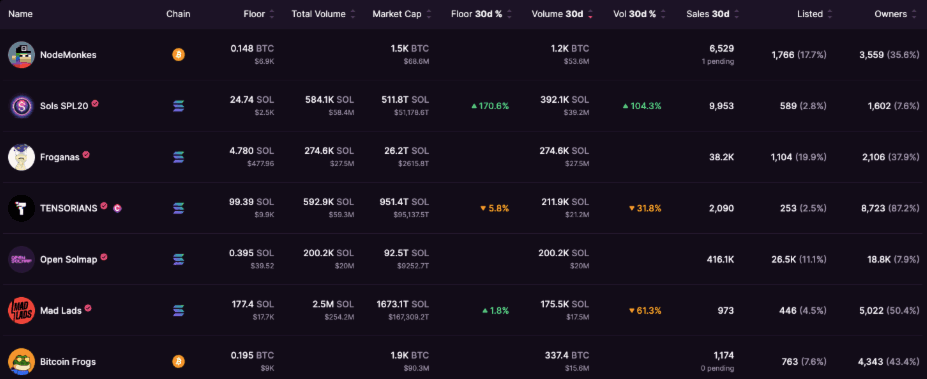

Top collections by volume over the last 30 days. Source: DappRadar. Checking in on Solana’s most popular NFT marketplace reveals that the Solana NFT ecosystem has pulled back since its highs towards the end of last year. Magic Eden’s pivot into the Bitcoin ecosystem has started to yield positive results with some of its most important collections being from the Bitcoin ecosystem. Take note that NodeMokes currently holds the top spot for most volume, overtaking native Solana collections on the platform.

Trading volume over the last 30 days on Magic Eden. Source: Magic Eden.

Trading volume over the last 30 days on Magic Eden. Source: Magic Eden.Interesting developments on the gaming front. Ronin has secured itself the number one spot for most popular crypto games, following the recent migration of Pixels. A few weeks ago, Polygon-based games dominated the top 10, but this has dramatically changed. Other chains such as Near, Wax, and Flow are becoming increasingly popular options for the launch of new games.

Top crypto games. Source: Footprint Analytics.

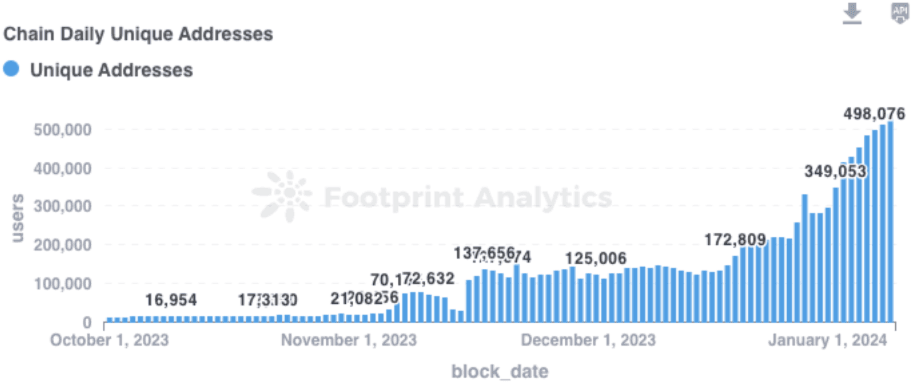

Top crypto games. Source: Footprint Analytics.Users are encouraged to keep tabs on Ronin. After overcoming challenges, including a huge exploit, Ronin has made a remarkable comeback, driven by significant advancements in the Axie Infinity gameplay experience and its role as a destination for non-Axie games.

With a surge in daily active users, total value locked, token value, daily transactions, and monthly active users, Ronin's growth in 2023 has been impressive. Some core features and notes worthy of mention include:

- The Pixels Web3 game migrated from Polygon to Ronin in late October 2023, marking a resurgence for Ronin after a hacking incident in March 2022.

- Ronin is a blockchain designed specifically for gaming, aiming to provide a fast and cost-efficient platform for gaming transactions.

- Ronin has successfully scaled Axie Infinity, gaining valuable experience in blockchain game development.

- Ronin's strategic partnership with ACT Games is set to bring additional gaming titles into its ecosystem, diversifying its offerings.

Unique users on the Ronin Chain. Source: Footprint Analytics.

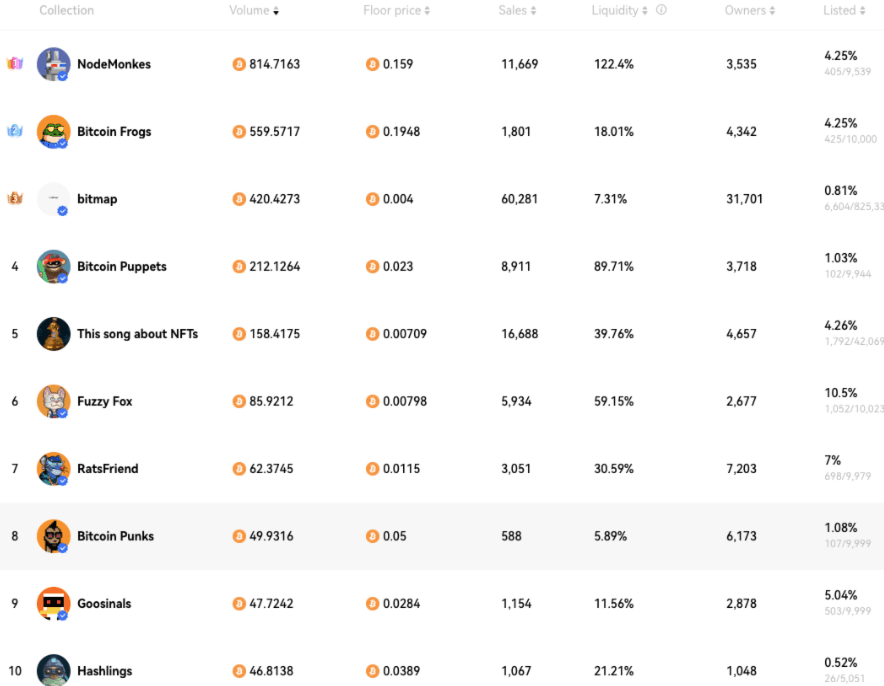

Unique users on the Ronin Chain. Source: Footprint Analytics. Checking in on the Bitcoin ecosystem, it seems the solid blue chip collections have started emerging for both NFTS and BRC-20 inscriptions. These ecosystems are still in their infancy and if this interests users, they should investigate the lesser-known collections building traction on twitter for when the market narrative once again swings back to Bitcoin ecosystem projects.

Top Bitcoin NFT collections by volume over the last 30 days. Source: OKX NFT Market Place.

Top Bitcoin NFT collections by volume over the last 30 days. Source: OKX NFT Market Place. Degen Corner

- Xai: Following the much-hyped airdrop, the value of $XAI dropped from $0.77 to $0.56. However, there is still considerable buzz around the project.

- Axie Infinity: $AXS has jumped recently by >10% as the GameFi continues to shine. AXS is looking to break past the $9 resistance and reach $10.

- Pixels, a popular game on Axie Infinity's Ronin sidechain, announced its airdrop plans. Players who complete challenging tasks or contribute to the ecosystem may earn tokens. The top 7,000 players on the leaderboard and 1,000 random players qualify for tokens.

- Portal, a multi-chain gaming token, plans to bridge Web3 games across blockchains. Users can earn credits for the airdrop by interacting with Twitter content.

- Saga, designed for gaming, initiated a "play-to-airdrop" campaign, rewarding top leaderboard finishers in games running on testnet with SAGA tokens. Some players may receive double airdrops as games may launch their own tokens.

- Mojo Melee is commencing a fresh season of their imaginative and tactical auto-battler game. Alongside this, they're rolling out new functionalities that empower players to personalize their Mojo's look and create NFTs using in-game Champions.

- Solana gaming platform Mixmob intends to airdrop its MXM token following the release of Racer 1, a mobile racing game. Tokens will be distributed to active community members, players, and MixBot NFT owners.

- Notcoin, a gaming project on Telegram, has gained over 5M users in a short time. Users have been "mining" Notcoin, accumulating over 1T tokens. While it's not a real crypto yet, the TON Foundation suggests a token launch and a potential airdrop for early users in the future.

- Bitcoin developers have introduced a Super Nintendo Entertainment System (SNES) emulator into the Bitcoin blockchain through a project called Pizza Ninja, which utilizes Ordinals for its implementation. Check out the gameplay here.

This is just a preview of our NFT Weekly report, be sure to check out the full version of this report here.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space