Welcome to this week's Crypto Market Watch by M6 Labs. In this edition, we'll delve into key developments, market movements, and emerging opportunities that are shaping the crypto landscape.

Narratives of the Week

Spot Bitcoin ETF

Many are anticipating the same effects on Bitcoin as were experienced by gold after its ETF approval. Source

Many are anticipating the same effects on Bitcoin as were experienced by gold after its ETF approval. Source

In light of the false announcement of a spot BTC ETF by Cointelegraph and the momentary surge it caused in the market, understanding why this is important is crucial. The introduction of a spot Bitcoin ETF holds immense importance in the crypto market, as it could pave the way for wider adoption and acceptance of Bitcoin as a legitimate investment asset.

- ETFs, a $7 trillion industry, are a significant part of exchange-traded products. The crypto industry is keen on launching spot Bitcoin ETFs, which directly hold Bitcoin, unlike futures-backed Bitcoin ETFs.

- According to CryptoQuant, the approval of Bitcoin spot ETFs could potentially add $1 trillion to the overall crypto market cap. Institutional adoption of Bitcoin has already commenced, as institutions have begun adding Bitcoin to their balance sheets.

- If these ETF issuers allocate just 1% of their Assets Under Management (AUM) to Bitcoin ETFs, it could result in approximately $155 billion flowing into the Bitcoin market, equivalent to nearly one-third of Bitcoin's current market capitalization.

- Historical data suggests that during previous bull markets, Bitcoin's market capitalization typically grew 3-5 times more than its realized capitalization for every $1 of new money entering the market. Recent market activity saw a brief surge to $30,000 in response to false reports of a spot Bitcoin ETF approval.

In conclusion, the introduction of spot Bitcoin ETFs are crucial for the crypto market's growth and wider adoption. It has the potential to add a substantial $1 trillion to the crypto market cap, bringing institutional investors into the fold and further solidifying Bitcoin's legitimacy as a valuable investment asset. This development will reshape the industry and signal a new era for crypto.

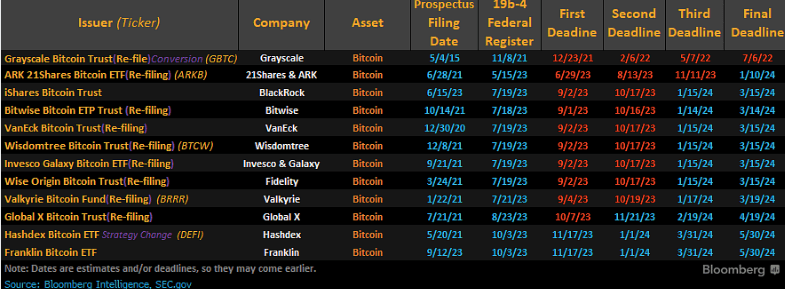

Current Spot BTC ETFs waiting approval by the SEC, it is likely many of these will be approved all at once by the SEC. Source: Bloomberg

Current Spot BTC ETFs waiting approval by the SEC, it is likely many of these will be approved all at once by the SEC. Source: BloombergRevisiting New Friends, LRTs

Liquid Restaked Tokens were the new DeFi trend of early 2023, offering a way to earn higher yields on your Ethereum holdings without locking them up.

- Restaking allows you to secure multiple protocols while also supporting Ethereum, increasing capital efficiency

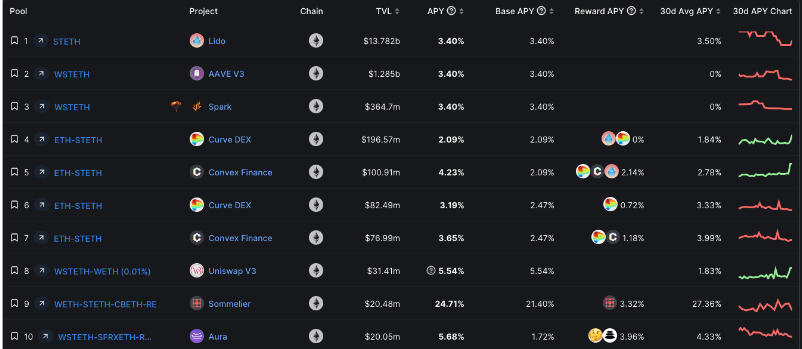

- With Lido offering a 3% APY for staking ETH and Liquid Restaked Tokens promising much higher yields, they're poised for success and a new frontier of capital efficiency soon to be unlocked

- Be sure to check out projects like: EigenLayer, Astrid Finance, Tenet, Rio Network and Stader Labs

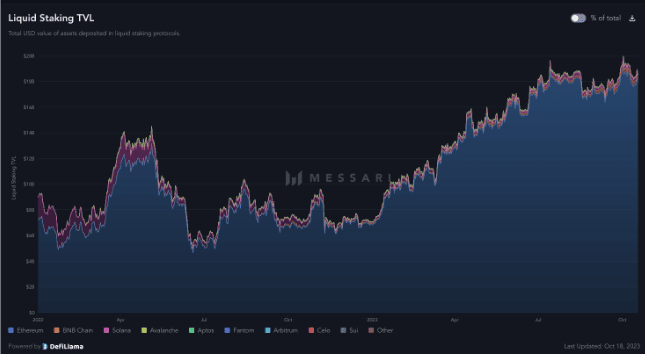

The size of the LST market is enormous, hinting at the unlocked potential of the restaking market. Source: Messari

The size of the LST market is enormous, hinting at the unlocked potential of the restaking market. Source: MessariDeFi

The crypto market continues undergoing major shifts, with new protocols emerging as early leaders falter. Savvy investors must identify these changes early to capitalize on new opportunities.

Recent developments highlight the challenges facing even top platforms:

- Lido paused Solana staking due to funding shortages, despite being a leading staking service

- Binance's $450M BNB coin burn provided only temporary upside, as regulatory troubles loom for the exchange

- Uniswap initiated swap fees on select tokens, indicating stress in balancing sustainability and growth

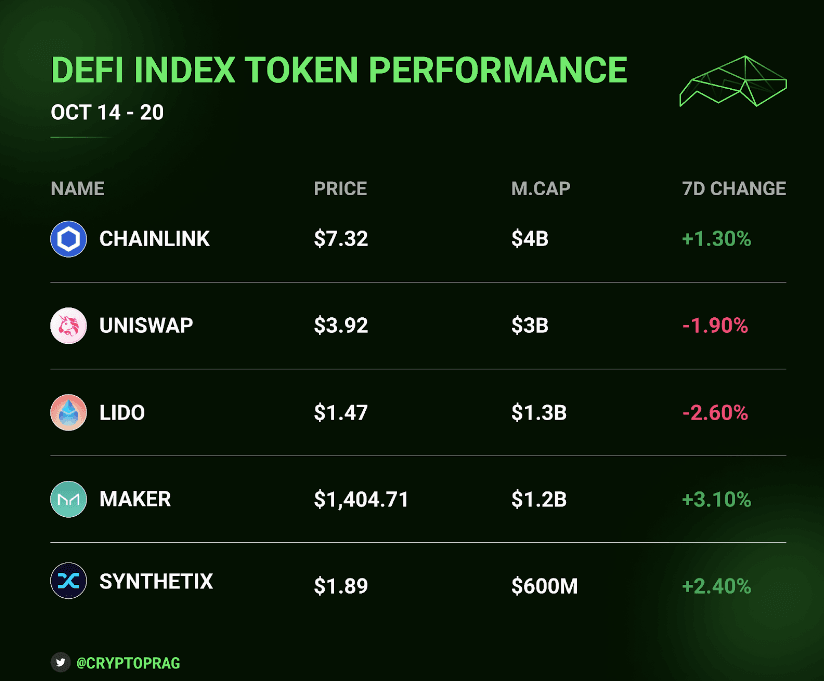

Source: CoinGecko

Source: CoinGeckoThese struggles have created openings for new entrants:

- Diva is going to execute a vampire attack on Lido to bootstrap Diva's growth by draining Lido's liquidity. Many support this development in order to counter Lido’s hold over staking and the dangers of centralization

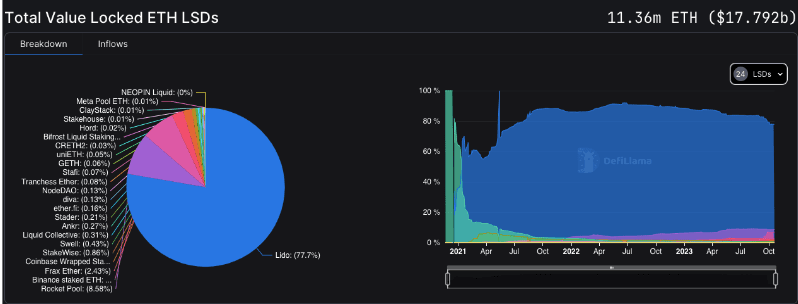

Lido dominance indicated in blue. Source: DeFiLlama

Lido dominance indicated in blue. Source: DeFiLlama- Cipher.fan delayed its airdrop to prioritize fair distribution over hype

- Stars Arena has relaunched after resolving issues and trading has been activated

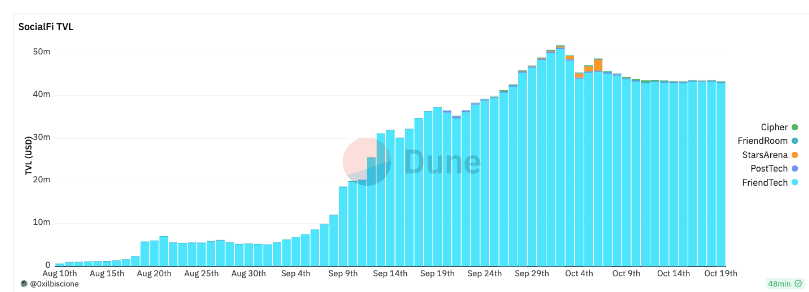

Friendtech continues to dominate Socialfi despite the success of recent projects such as StarsArena. Source: Dune

Friendtech continues to dominate Socialfi despite the success of recent projects such as StarsArena. Source: DuneBlue Chip Tokens

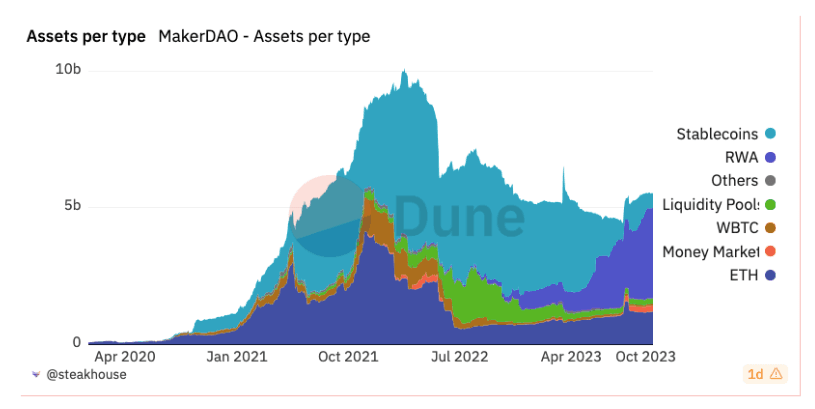

The market struggles have extended to former blue-chip DeFi tokens like Uniswap and Synthetix, which continue to decline despite ongoing development. Their faltering shows the fleeting nature of first-mover advantage in crypto. Maker remains an exception, through its integration of real-world assets. RWAs have come to become Maker’s largest assets group as seen below.

Maker’s assets: RWAs in purple. Source: Dune

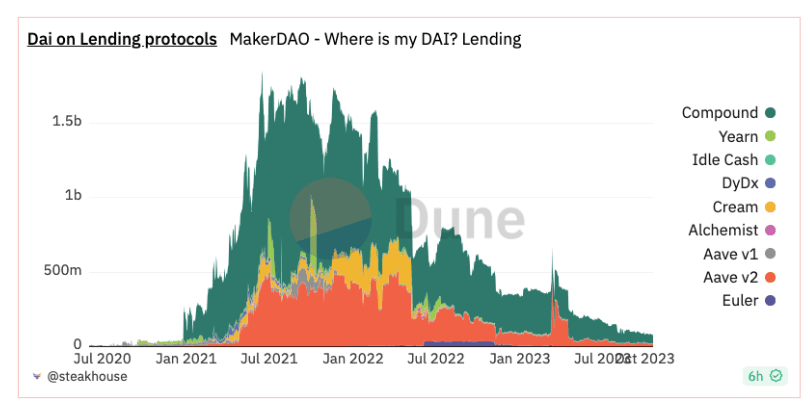

Maker’s assets: RWAs in purple. Source: DuneInterestingly the amount of Dai on major protocols available for lending has dropped significantly. This indicates users are holding other stables such as USDT and USDC in greater numbers.

Dai on Lending Protocols. Source: Dune

Dai on Lending Protocols. Source: DuneFrax has bucked the trend with its surge after launching sFRAX, a yield-bearing stablecoin backed by real-world US Treasuries. This cements Frax as a leader in bridging DeFi and real-world assets, alongside Maker. FXS's breakout shows new blue chips can emerge despite market volatility.

Meanwhile, ETH staking yields dropped from over 5% to 3.5% due to low activity, reducing a key reward for ETH holders. This signals declining allure for Ethereum amid rising competition.

Source: DeFiLlama

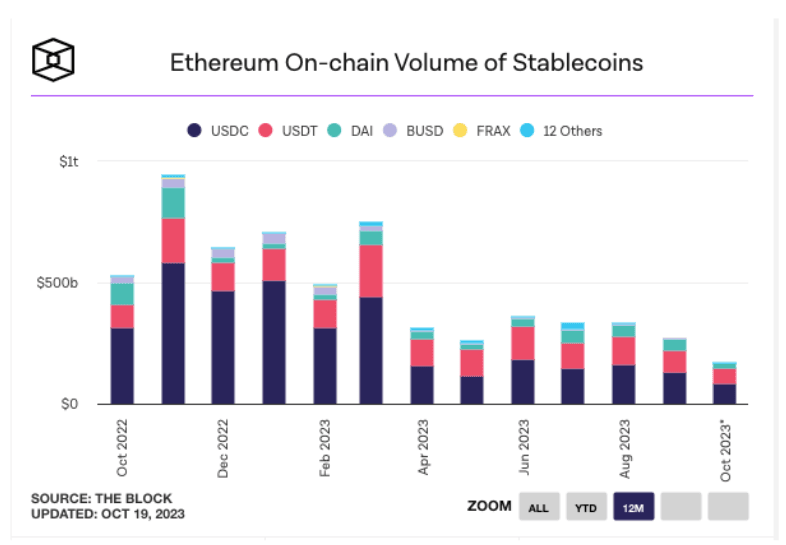

Source: DeFiLlamaStablecoin volumes have hit their lowest in over a year on Ethereum. This signals that capital is flowing to other networks such as Bitcoin as investors seek to hedge against risk. Another important point is that capital is leaving crypto entirely and being invested in other non-crypto asset classes.

Source: The Block

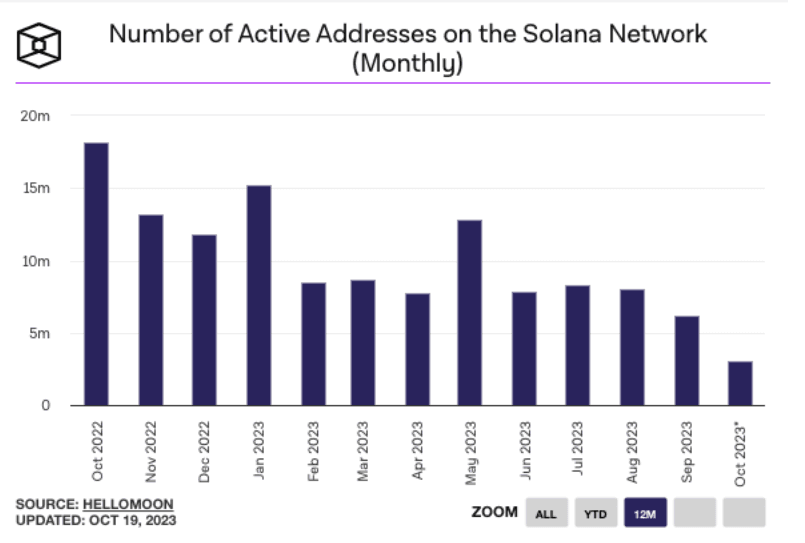

Source: The BlockDespite the rise in NFT activity on Solana and its positive price action recently, the number of addresses continues to decline.

Source: Hellomoon

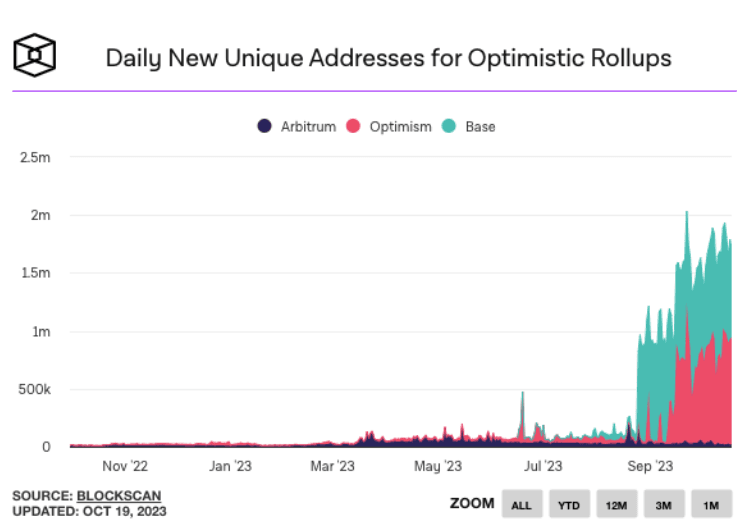

Source: HellomoonConcerning major L2 networks, Base is still in the lead with daily new unique addresses.

Source: The Block

Source: The BlockProject Spotlight: Liquity

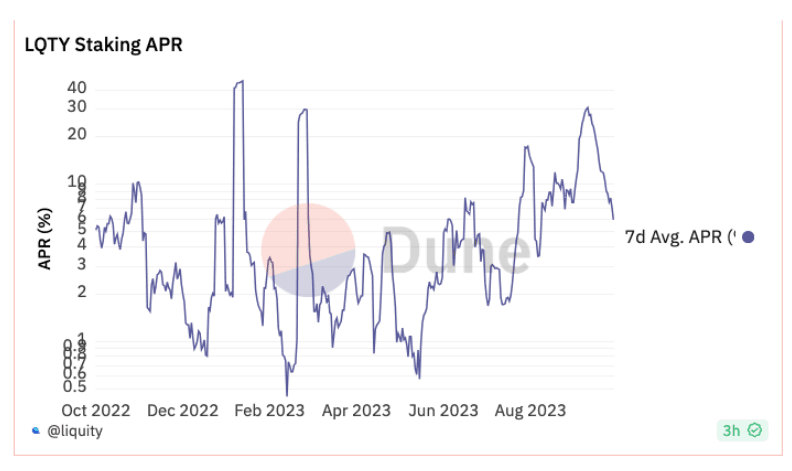

Liquity, a decentralized lending protocol, has seen its governance token LQTY surge lately as investors recognize its unique stability advantages.

Liquity is a decentralized lending protocol built on Ethereum that offers a unique dual token model for zero-interest loans. Borrowers deposit ETH as collateral and take out loans denominated in LUSD, Liquity's stablecoin.

A minimum 110% collateral ratio is required. Unlike other lending platforms, borrowers only pay a one-time fee to incentivize the network - there are no recurring interest payments. Liquidity providers can deposit LUSD into Stability Pools to earn LQTY token rewards and safeguard against debt liquidations.

LQTY holders can also stake their tokens to earn a portion of fees from new loans and LUSD redemptions. LUSD maintains its soft peg to $1 through an arbitrage mechanism that allows redemption of LUSD for discounted ETH when it drops below $1. Through its zero-interest, dual token model, Liquity offers a novel way for decentralized lending and borrowing while incentivizing participants.

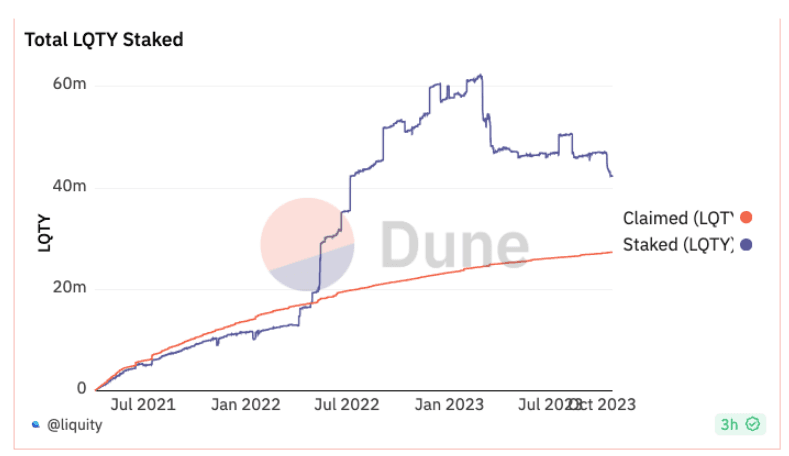

Yields on LQTY have been steadily rising throughout this year, and users have been locking their tokens indicating confidence in the project.

Source: Dune

Source: Dune Source: Dune

Source: DuneNew Opportunities

- Anticipation is building around one of the latest bots on the scene, NerdBot. Learn about them more in this thread, their public sale is on October 23rd.

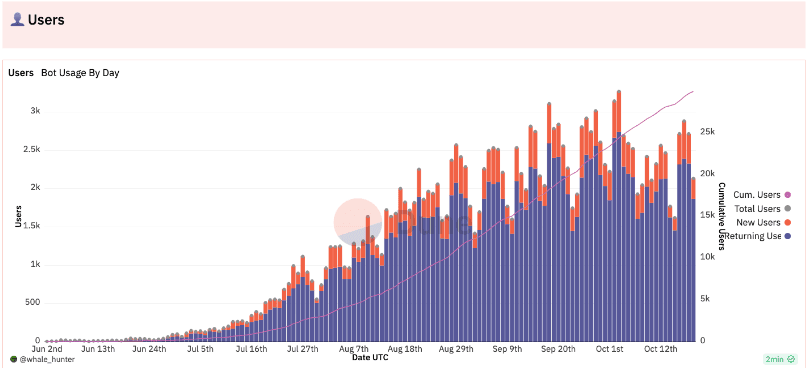

- Be sure to monitor Banana Gun Bot, a Telegram tool for fast crypto trading and presale sniping, continues to gain traction with smart money investors despite early bugs requiring a contract relaunch. The bot's convenience for presales and trading makes it appealing to sophisticated crypto buyers. Returning users making use of the bot has remained consistent as can be seen below.

Injective Users. Source: Dune

Injective Users. Source: Dune- Injective has been one of the top performers in the Cosmos ecosystem, with minimal drawdowns compared to Bitcoin. This price stability makes it one of the most appealing Cosmos network assets for investors looking for safer holds in the current market, YTD Injective has seen a 321% price appreciation.

- Kujira appears poised for growth, one-year post-Terra's collapse given its strong community, solid tokenomics, dedicated team, rising TVL, and lack of major bagholders - the fundamentals and technicals point to it being a promising investment despite current limited marketing.

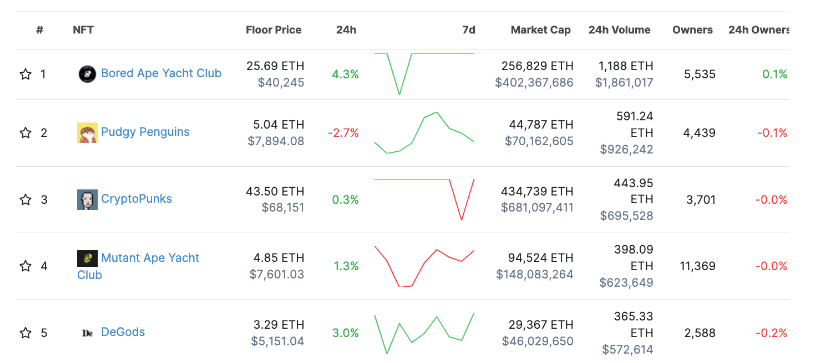

NFTs

Though the NFT market is experiencing a lack of interest and is trending down, several notable developments emerged

- Immutable extended its token vesting schedule, with rewards for developers now set to vest monthly beginning July 2024

- Reddit plans to discontinue its blockchain rewards system Community Points, showing waning interest in crypto from mainstream tech. This angered investors and users who had participated in the project since its inception

- Art technology startup Artfi generated over 25,000 signups for its Genesis Pass whitelist. Holders will get access to fractionalized art offerings when Artfi officially launches

- Arca initiated a proposal to activate fee switches on Blur, with governance voting resuming after a 180-day freeze

- Music platform Sound.xyz opened up tiered editions for all users, allowing artists to offer both limited and ongoing editions to balance scarcity and reach

- China Daily, a major state-owned newspaper, is developing its own metaverse and NFT platform, Zhongbao Shuzang. It is offering nearly $400,000 for a blockchain specialist to build it within three months, highlighting China's complicated embrace of crypto tech

Top 5 NFT Collections. Source: CoinGecko

Top 5 NFT Collections. Source: CoinGecko Popular NFT games this week. Source: Coingecko.

Popular NFT games this week. Source: Coingecko.You're Looking at Crypto Gaming the Wrong Way

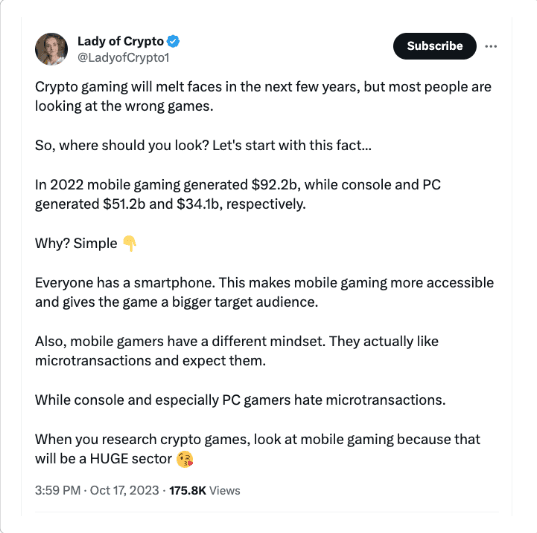

An insightful observation from Lady Of Crypto deserves exploration.

Source: X@LadyofCrypto1

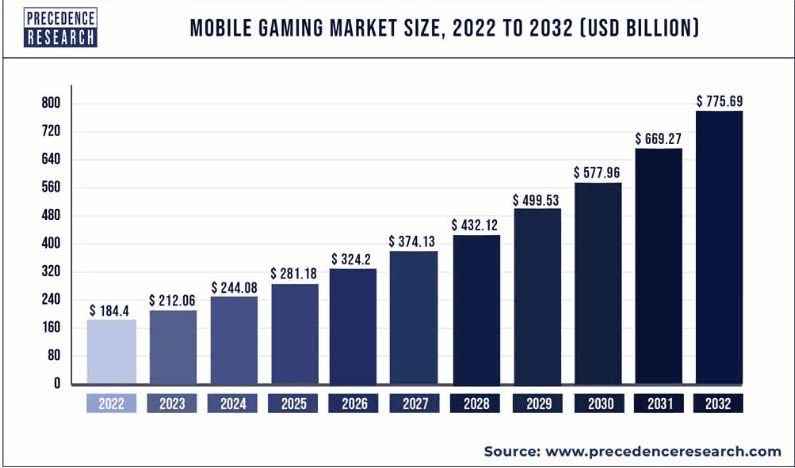

Source: X@LadyofCrypto1The mobile gaming sector is witnessing substantial growth driven by technological advancements, particularly the integration of Augmented Reality and Virtual Reality technologies into mobile gaming experiences.

AR enriches gameplay by blending virtual data with the real world, while VR immerses players in computer-generated environments that simulate reality, often accessed through VR headsets.

Crypto-gaming convergence holds immense potential, though the catalyst for its true breakthrough remains uncertain. Early questionable experiments like Axie Infinity illustrate the possibilities. Integrating crypto into mobile tech, as Solana mobile, aims to do, adds another dimension.

Individuals should closely track crypto game developers and early successes for potential opportunities in the next bull market, especially for mobile. Be sure to closely follow companies such as Playkey, Immutable, Sky Mavis, Wax, Upland and Mythical Games who will be at the forefront of these developments. While the path forward is unclear, the building blocks are emerging for a future where crypto and gaming are seamlessly integrated in interactive experiences, and it is likely Lady Of Crypto is correct in her thinking given the size of the mobile game market.

The potential of the mobile gaming market is enormous, and it is likely crypto technology will be at the center of these developments. Source: Precedenceresearch.

The potential of the mobile gaming market is enormous, and it is likely crypto technology will be at the center of these developments. Source: Precedenceresearch.Emerging Opportunities

- The World Engine under development by Argus aims to enhance on-chain game scalability through a sharded rollup stack. Its base shard and customizable game shards, potentially including "location-based" shards, intend to optimize performance

- Magic Eden introduced tokenized digital collectibles, starting with 100 tokenized and physically-backed Pokemon cards. Iconic cards like Blaine's Charizard and Flareon-Holo are included in the first drop, presenting a profitable prospect for interested collectors

- On October 25th, Zien is launching a new platform with a Zien Pass for early art drop access, a $AURA loyalty token, and Expanded NFTs integrating digital and physical art. Monitoring this launch could uncover compelling art investment prospects

- Keystone, created by the Curio team, is a rollup framework tailored for high-performance real-time strategy games like Age of Empires. It supports different data availability layers, starting with Celestia

In summary, major improvements to crypto gaming scalability and new integrations of real-world collectibles present potential opportunities. The World Engine, Magic Eden's Pokemon NFTs, Zien's upcoming platform expansion, and Keystone's performance optimizations for strategy games are worth tracking.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space