Welcome to this week's edition of the Crypto Market Watch by M6 Labs. In this comprehensive overview, we will explore key developments, market movements, and emerging opportunities currently shaping the cryptocurrency landscape during a notably exciting week in the sector.

Narrative Of The Week: Where Are We?

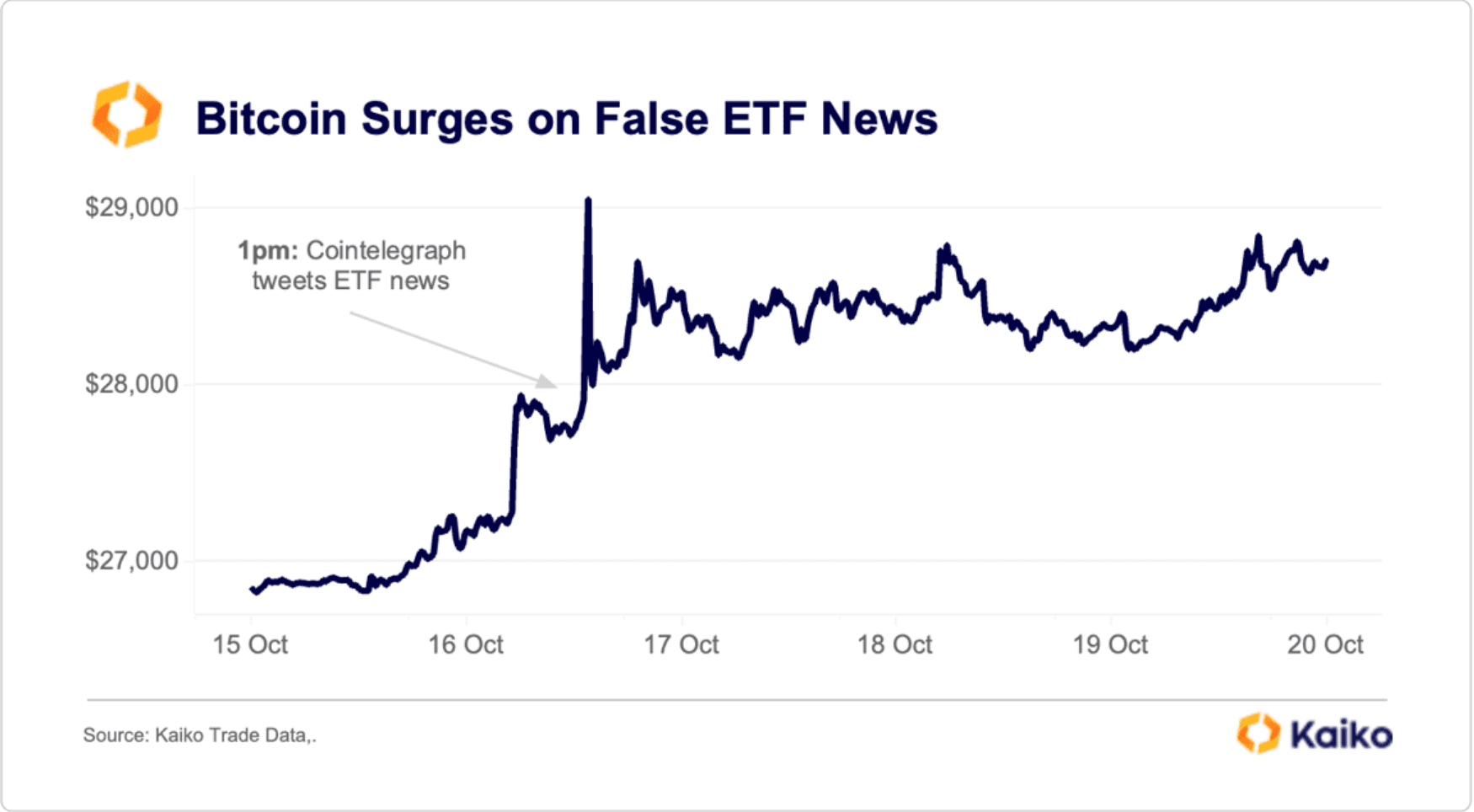

The recent market activity has showcased a significant rally in BTC’s value, pushing it to the $35,000 mark. This rally was initially triggered by an erroneous tweet from CoinTelegraph but was soon fuelled by growing speculation around the imminent approval of a Bitcoin spot ETF in the U.S. As optimism grew, the price of Bitcoin surged to $35K momentarily, marking a 16-month high and signalling a bullish trend in the crypto market.

The Famous Breakout. Source: Kaiko

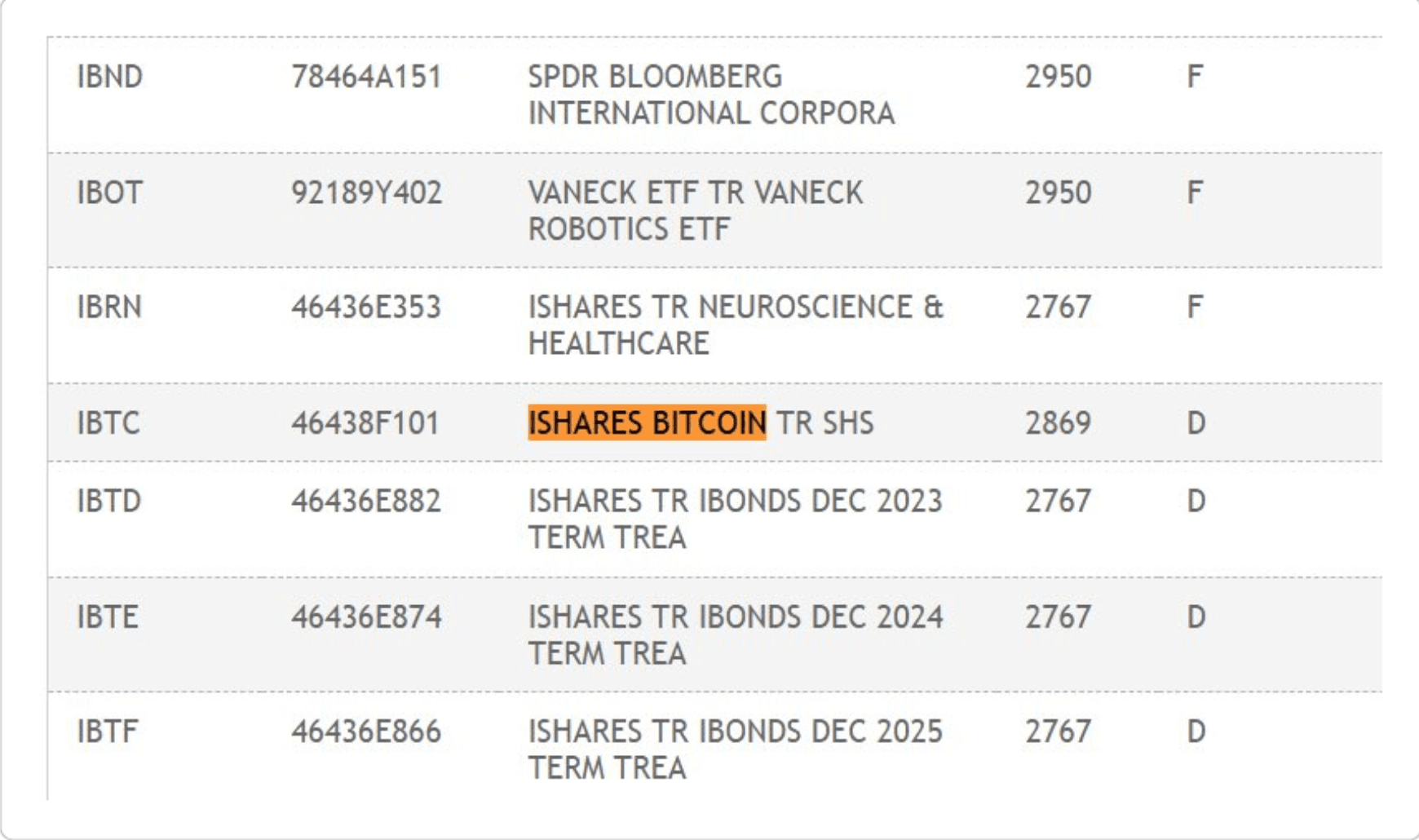

The Famous Breakout. Source: KaikoThe anticipation around the BTC spot ETF approval has been a notable driver of investor sentiment. A spot ETF would provide a structured and regulated avenue for investors to gain exposure to BTC, attracting a new wave of capital into the crypto sector. Particularly, BlackRock's application for a Bitcoin ETF stirred the market as its proposed product received a unique ID number on the Depository Trust & Clearing Corp. website, a step some interpreted as a positive sign, even though it didn't indicate approval.

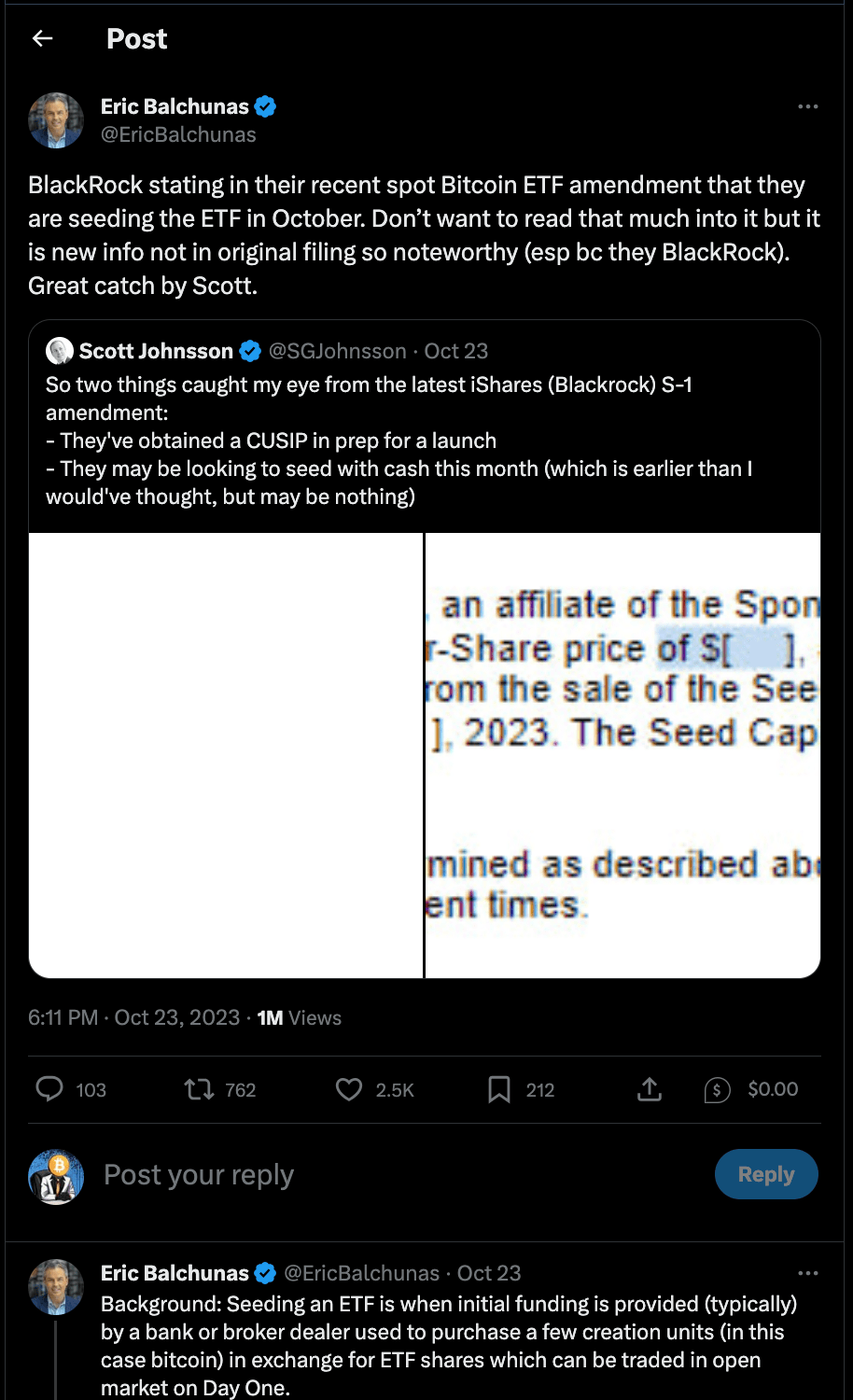

Source

SourceFurthermore, it also seems the ETF is being funded, allowing it to be traded from day one of launch.

Source

SourceMoreover, the court's ruling in favor of Grayscale Investments' ETF application and the SEC's decision not to appeal further bolstered the likelihood of a BTC ETF coming to fruition. The market reacted positively to these developments, with the BTC price and the prices of certain altcoins experiencing significant upticks.

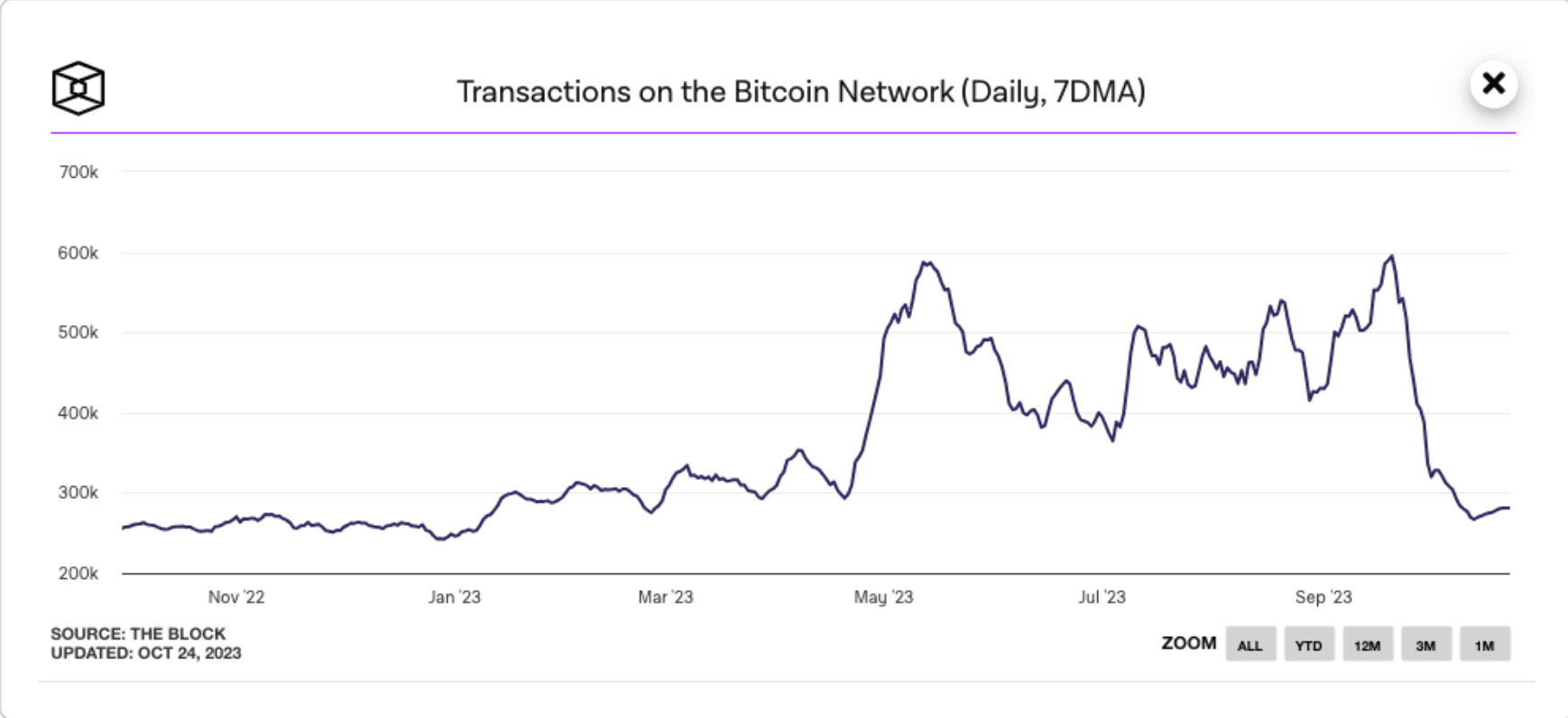

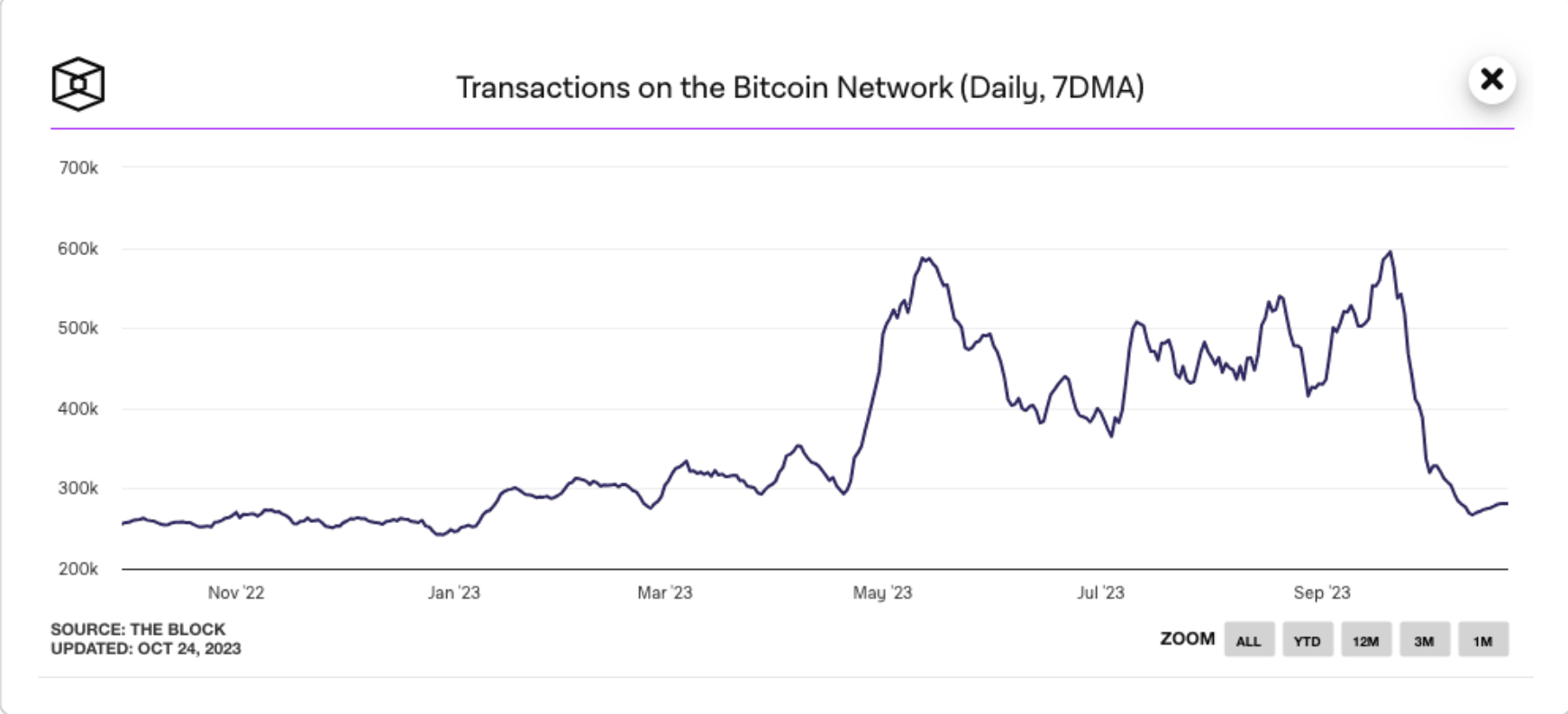

However, despite the price surge, there's a level of investor caution reflected in various market sentiment indicators. The transaction activity on the BTC blockchain also presents a more cautious outlook, with a notable drop in transaction numbers over a month. This suggests that the price surge is driven more by speculative trading and positive news anticipation rather than fundamental economic activity within the BTC network.

Transaction count on the BTC network still remains relatively low. Source: The Block

Transaction count on the BTC network still remains relatively low. Source: The Block The number of active addresses is seeing a slight uptick. Source: The Block.

The number of active addresses is seeing a slight uptick. Source: The Block.Furthermore, while BTC’s dominance is rising, indicating a significant influx of funds, the broader market dynamics do not appear to favor a sustained rally for altcoins. Certain regulatory hurdles and potential challenges from major platforms like Binance could also pose a threat to the ongoing rally. Nevertheless, market participants seem to be factoring in these potential impediments, adjusting their strategies to mitigate risks and capitalize on the unfolding market scenario.

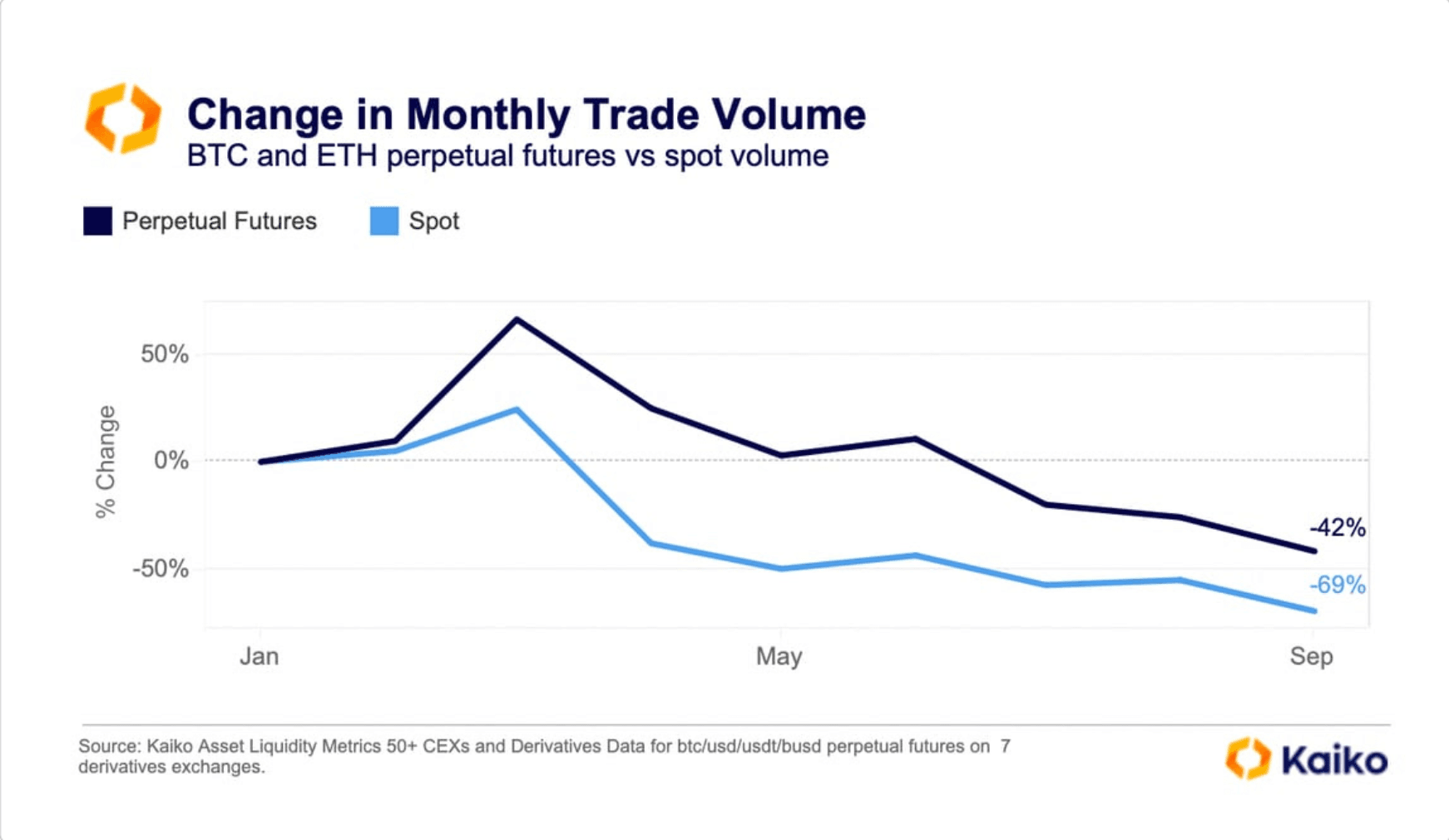

Other notable developments include the state of derivative contracts versus spot. Derivative contracts have traditionally held a strong appeal among crypto traders. Historically, the trading volumes for derivatives have consistently surpassed those of spot markets, a trend that is evident in the ongoing bear market scenario. Although there has been a global decline in trading volumes across all market types since January, perpetual futures have demonstrated a more resilient performance compared to spot markets, exhibiting a decrease of 42% as opposed to the steeper 69% dip observed in spot trading volumes.

Source: Kaiko

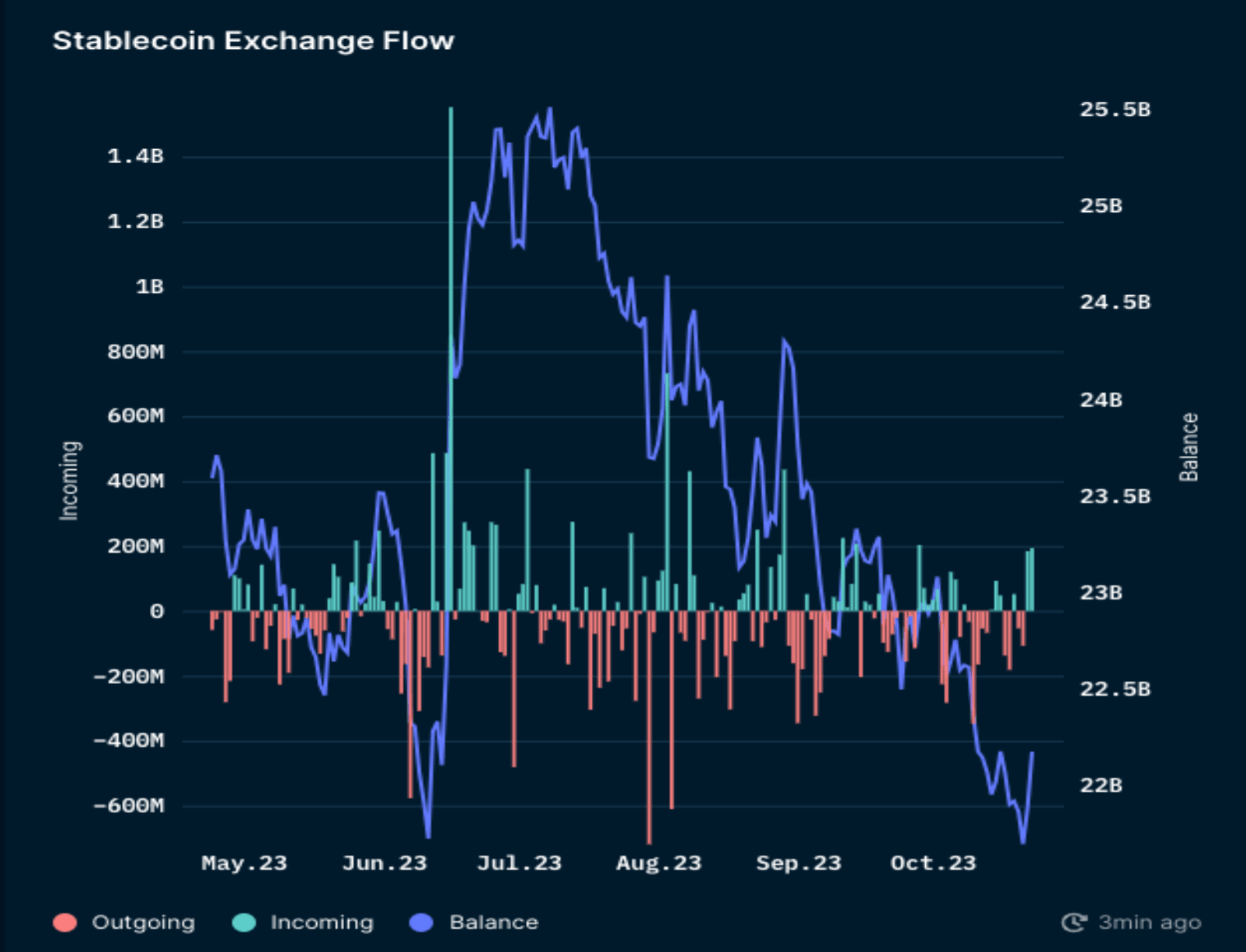

Source: KaikoLastly, some interesting movements by smart money. Smart money seems to be deploying its capital across the market, as the % holdings in stablecoins are beginning to decrease, indicating a risk-on appetite to accumulate positions early.

Source: Nansen

Source: Nansen Stablecoin flows have reverted and are now entering exchanges, this is likely to buy positions in BTC. Source: Nansen.

Stablecoin flows have reverted and are now entering exchanges, this is likely to buy positions in BTC. Source: Nansen.We are likely in the initial stages of a bull market, but due to the changing and chaotic nature of crypto, caution should prevail over FOMO. Stay safe out there! And for the sake of Satoshi avoid any excessive use of leverage or avoid it altogether.

DeFi, L1s & L2s

News

- Sam Bankman-Fried, former CEO of failed FTX exchange took the stand in court

- $HAY created by Uniswap founder five years ago has surged to nearly $4M, after founder burns burned 99.99% of the supply, leaving just 56 tokens in circulation.

- Evidence emerges of 3AC founders and founder of CoinFlex using creditor assets for personal use.

- Celestia airdrop recipients allocations to go up significantly after the redistribution of unclaimed tokens.

- SEC drops charges against Ripple's executives Brad Garlinghouse and Chris Larsen, but the case against Ripple continues.

- zkLend is now live.

- Yearn introduces major upgrades with veYFI.

- Gnosis Chain's total value locked has doubled to $150M since early October, driven by a surge in transactions and fees on the network.

- Lightning Labs has launched its Taproot Assets protocol on the main network.

- Maestro bot exploited.

- Infura token could be on the horizon, according to a recent blogpost.

- Gasless approvals are now available on Cow Swap.

- Bancor launched a proposal to buy and burn BNT tokens with protocol-owned ETH.

- Sam Altman's Worldcoin adjusts orb rewards strategy to increase WLD token supply.

- eToro partners with Index Coop.

- LBRY is winding down.

- Oath Foundation to launch oOath in December.

- Cipher Core, the Arbitrum competitor of Friendtech, sees soft rug as developers jump ship.

- Vitalik invests in Nocturne Labs, which aims to bring private accounts to Ethereum.

- Dydx to go open-source with V4 in upcoming Cosmos chain.

- Nansen report indicates that DeFi is still a focal point for new users.

Project Spotlight: Celestia

Celestia’s genesis block will launch on October 31st, and additionally, they have also recently introduced Blobstream. Why is the crypto community eagerly awaiting Celestia and how is it poised to redefine the playing field? Let's delve into it.

- Modular Design: Celestia uses a different design compared to traditional blockchains, separating tasks into different sections. This design can help solve common problems like slow transaction speeds, high security, and keeping things decentralized.

- Focus on Data and Consensus: Celestia takes care of two main tasks, making sure data is available and helping agree on the order of transactions. Other projects can build on top of Celestia, focusing on their specific tasks without worrying about these two aspects.

- Data Availability Proofs: Celestia uses a smart method to make sure all necessary data is there for everyone to see, without having to check every piece of it. This is like having a way to know a book's pages are all there without flipping through every page.

- Erasure Coding: This is a techy method that helps ensure even if some data is missing, the whole block of data can still be recovered. It's like having a puzzle where you can still see the full picture even if some pieces are missing.

- Validators and Rollups: In Celestia, some participants (validators) help agree on the order of transactions, while others (rollups) check if transactions are valid. This teamwork makes the process more efficient.

- Investor Support: With big investors backing it and a lot of funds raised, Celestia has strong financial support to continue its work and reach its goals.

In summary, Celestia is important as it addresses core challenges in the blockchain space. It provides solutions to improve how data is handled and accessed, making blockchain operations faster and more efficient. Moreover, its modular design encourages innovation and collaboration in the blockchain ecosystem, allowing for the development of more robust and user-friendly blockchain applications. This has the potential to accelerate the adoption and usability of blockchain technology across various sectors.

Blue Chip and Majors Overview

Source: Coingecko

Source: CoingeckoMaker annualized revenue hit a new all-time high of $203M, driven by a rise in deposits of tokenized real-world assets for minting its stablecoin DAI, higher yields attracting more collateral, and an uptick in U.S. treasury yields amid increased benchmark interest rates by the U.S. Federal Reserve.

Solana has been one of the top-performing majors in the last few days, seeing a rise by almost 40%. However, despite experiencing significant price appreciation, key fundamental metrics like DeFi TVL have not experienced a corresponding increase, resulting in a notable rise in relative pricing. What has seen a noticeable increase is the activity in its NFT and gaming ecosystem.

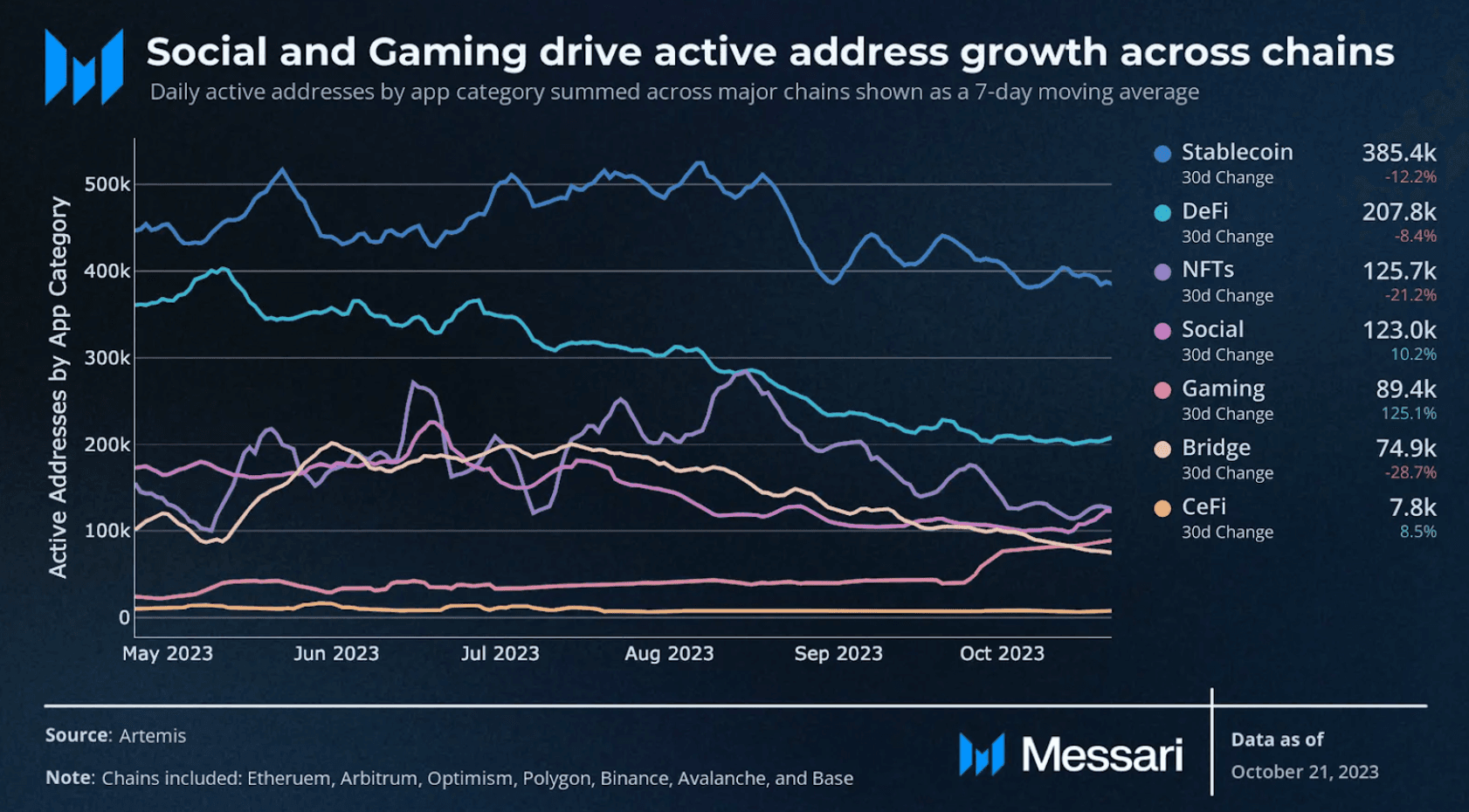

Source: Messari

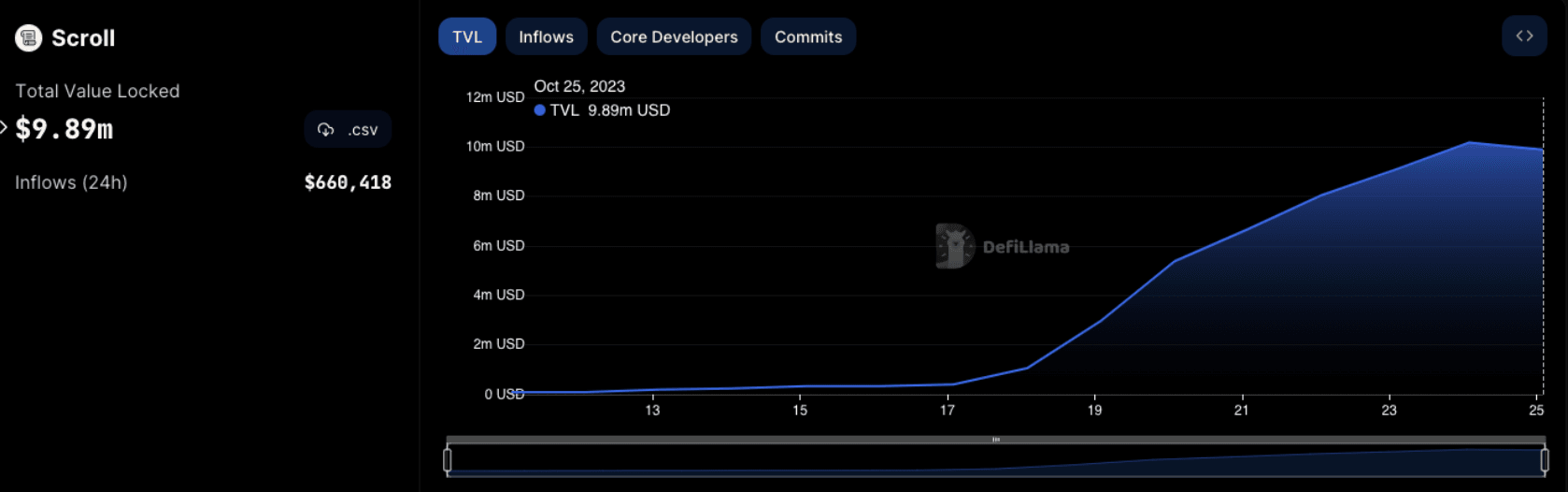

Source: MessariInflows to Scroll have slowed down. In comparison to the launch of previous L2s, the TVL has been disappointing. This could be a great time to bridge and use some of Scroll’s protocols for the planned future airdrop.

Source: DeFiLlama

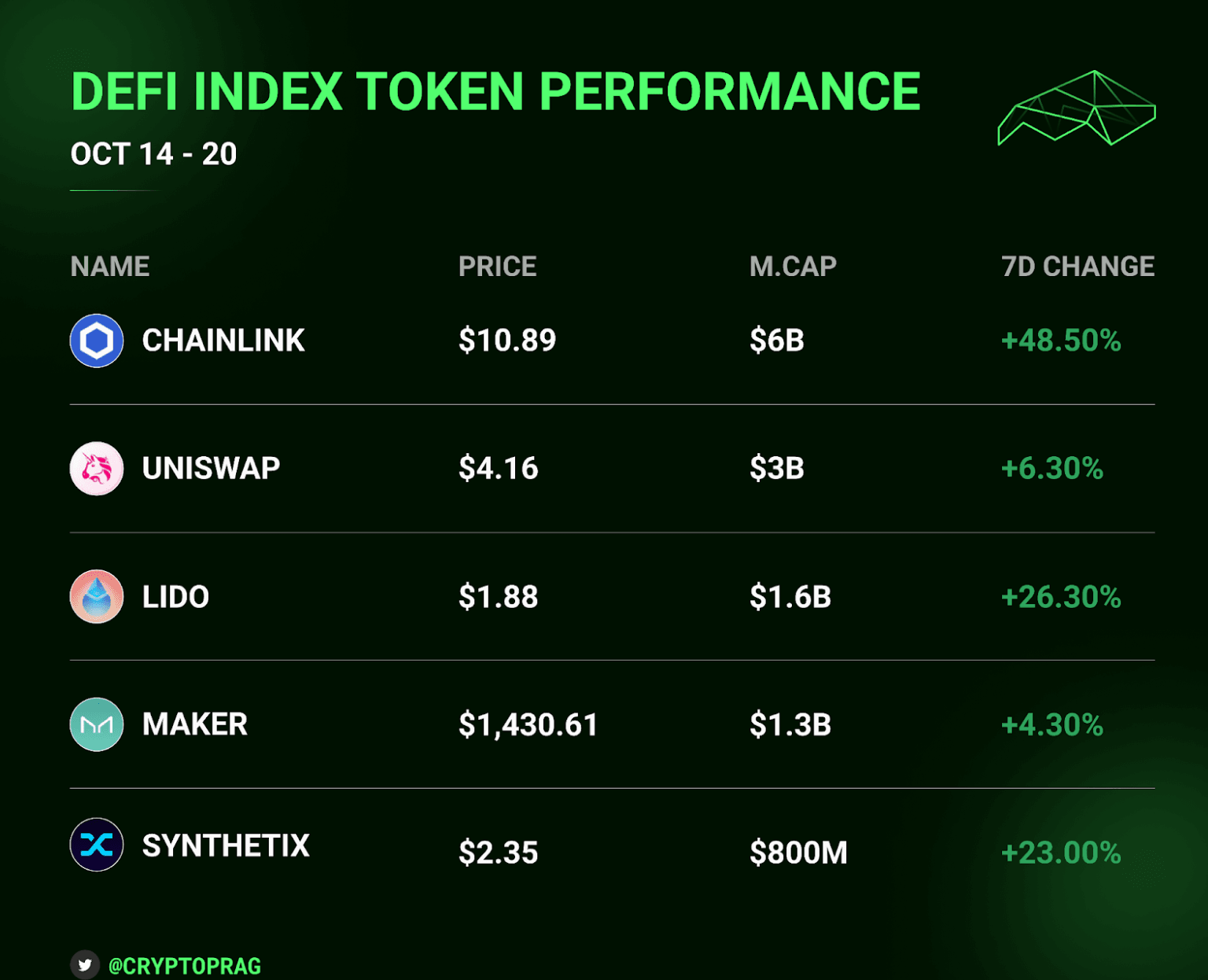

Source: DeFiLlama$LINK has experienced a resurgence in the last few days, with its market cap surging to $6B and its token price appreciating around 48%.

The SEC has recently dismissed the charges against Ripple's executives Brad Garlinghouse and Chris Larsen. This development has contributed to a positive price movement in the $XRP token, up 13% in the last week.

It appears that Polygon 2.0 is on the horizon, marked by the token migration and rebranding from $MATIC to $POL. Bybit has revealed that $POL will be featured in their upcoming LaunchPool project, which commenced on October 25th.

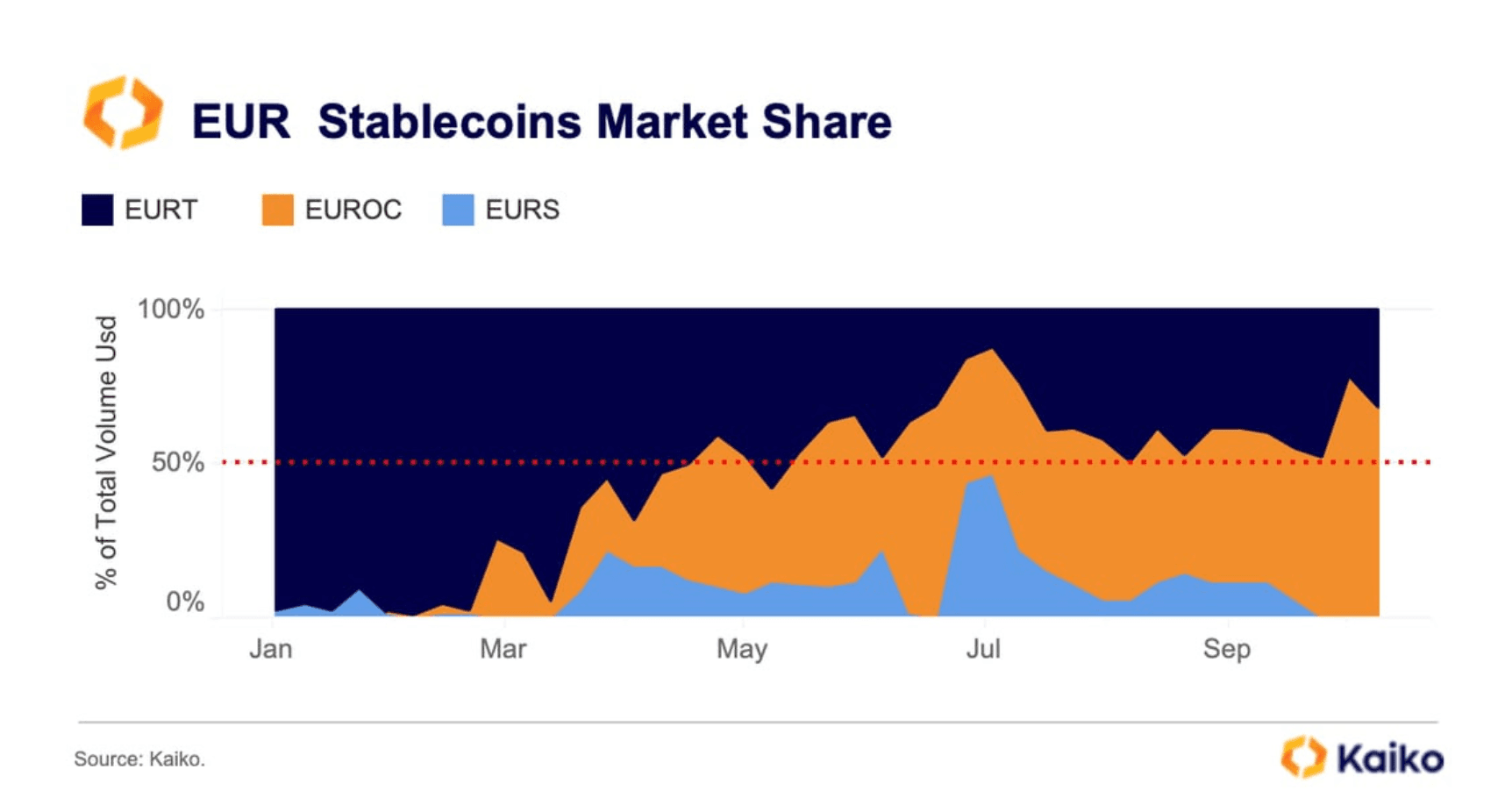

In the month of June 2022, Circle unveiled a stablecoin pegged to the euro, named EURC, broadening its spectrum beyond its already established dollar-anchored stablecoin, USDC. EURC has managed to capture the most substantial share of trade volume on centralized exchanges when compared to EURT, the equivalent stablecoin offering from Tether.

Source: Kaiko

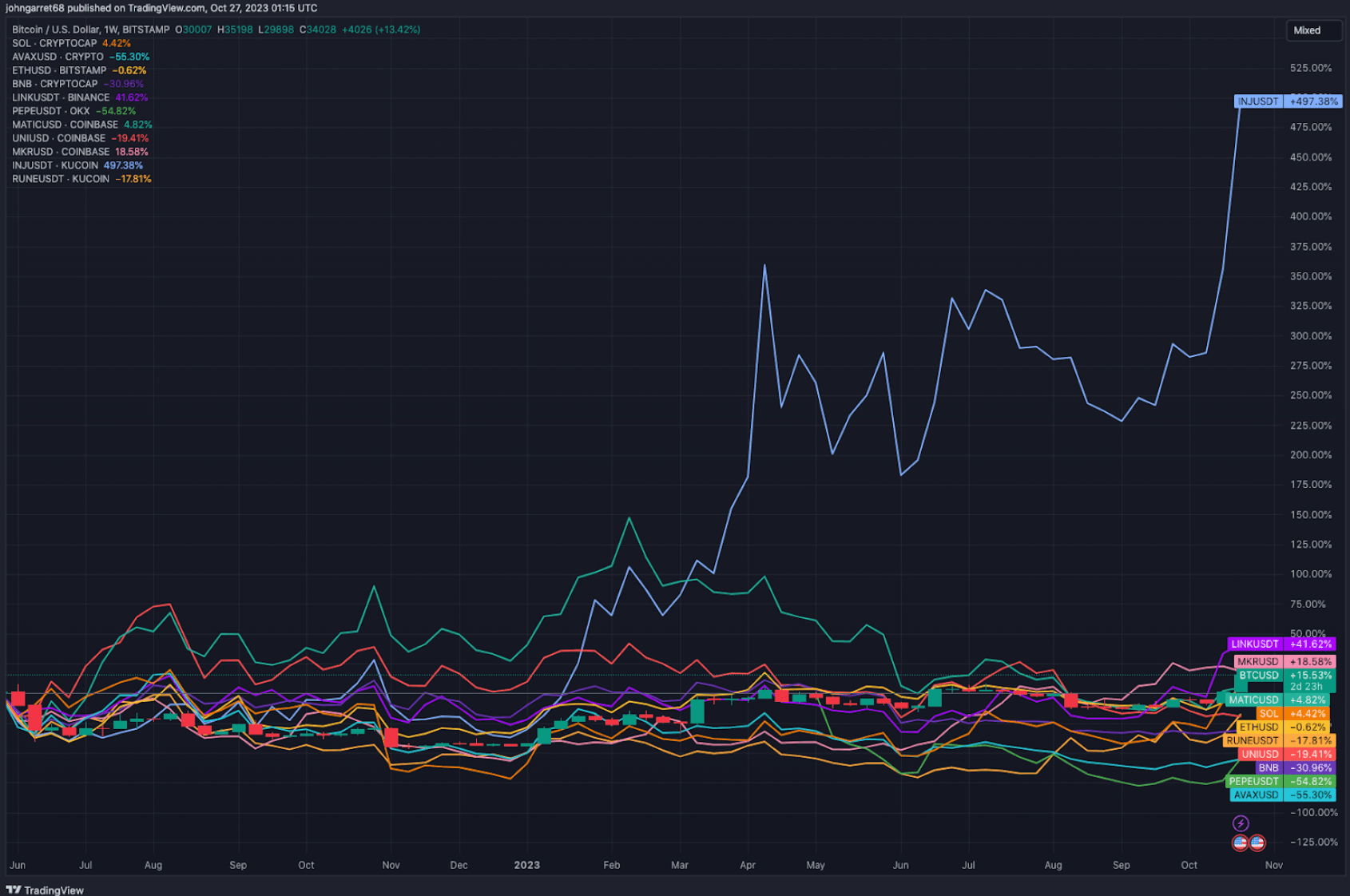

Source: KaikoINJ has had an incredible run-up this year, and particularly in the last few days with the recent rally. Other great performers include LINK, SOL and MKR, while tokens such as AVAX and BNB have underperformed.

Source: Tradingview

Source: TradingviewMarket Metrics

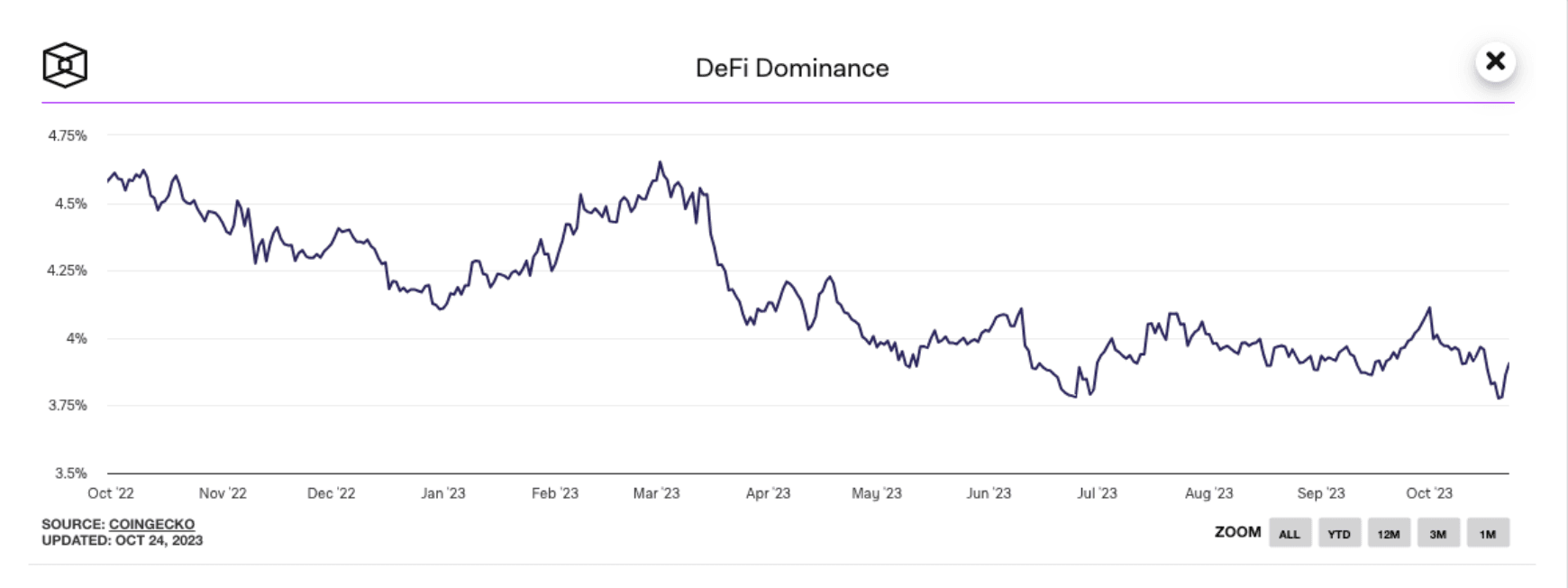

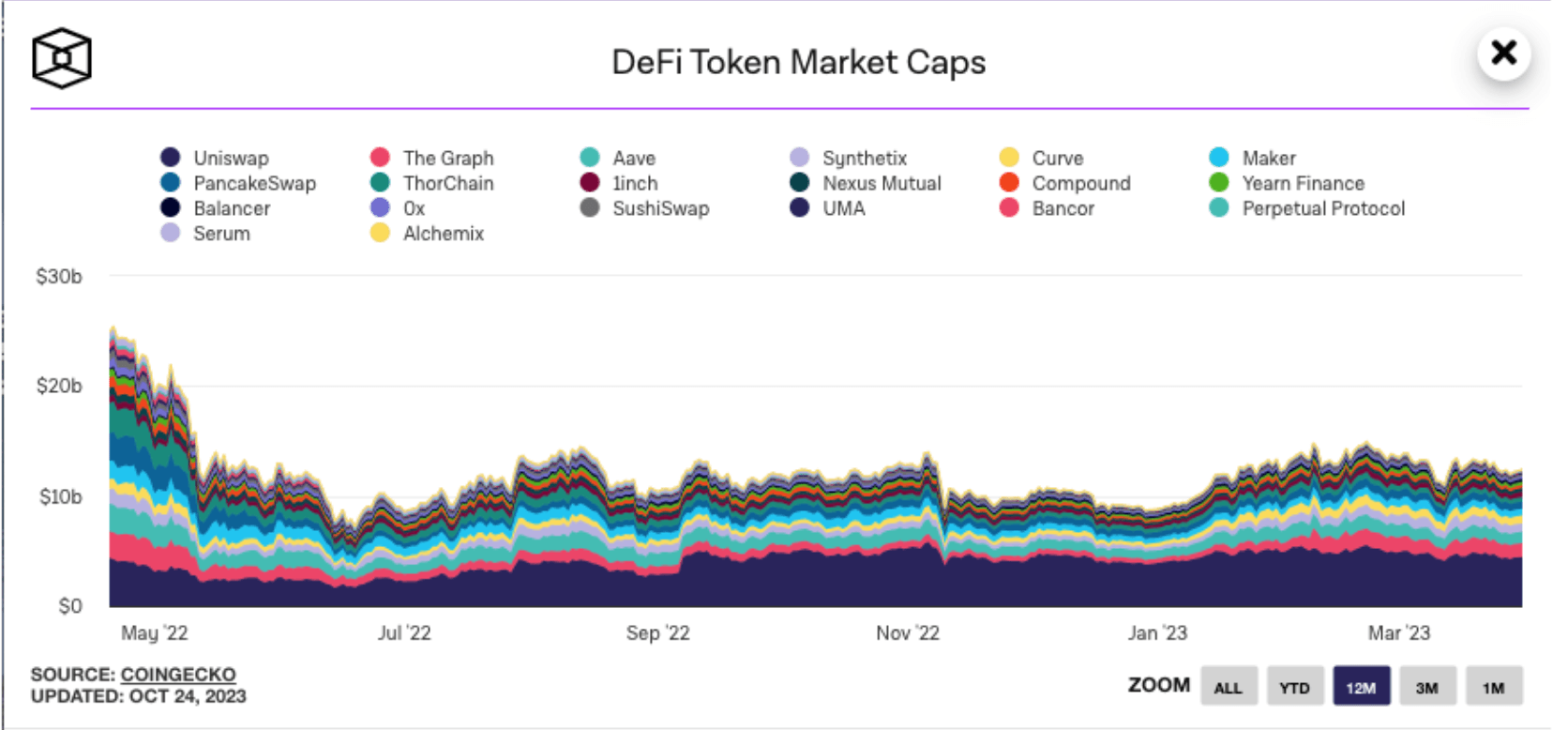

Defi dominance has seen a slight uptick following the recent rally.

Source: The Block

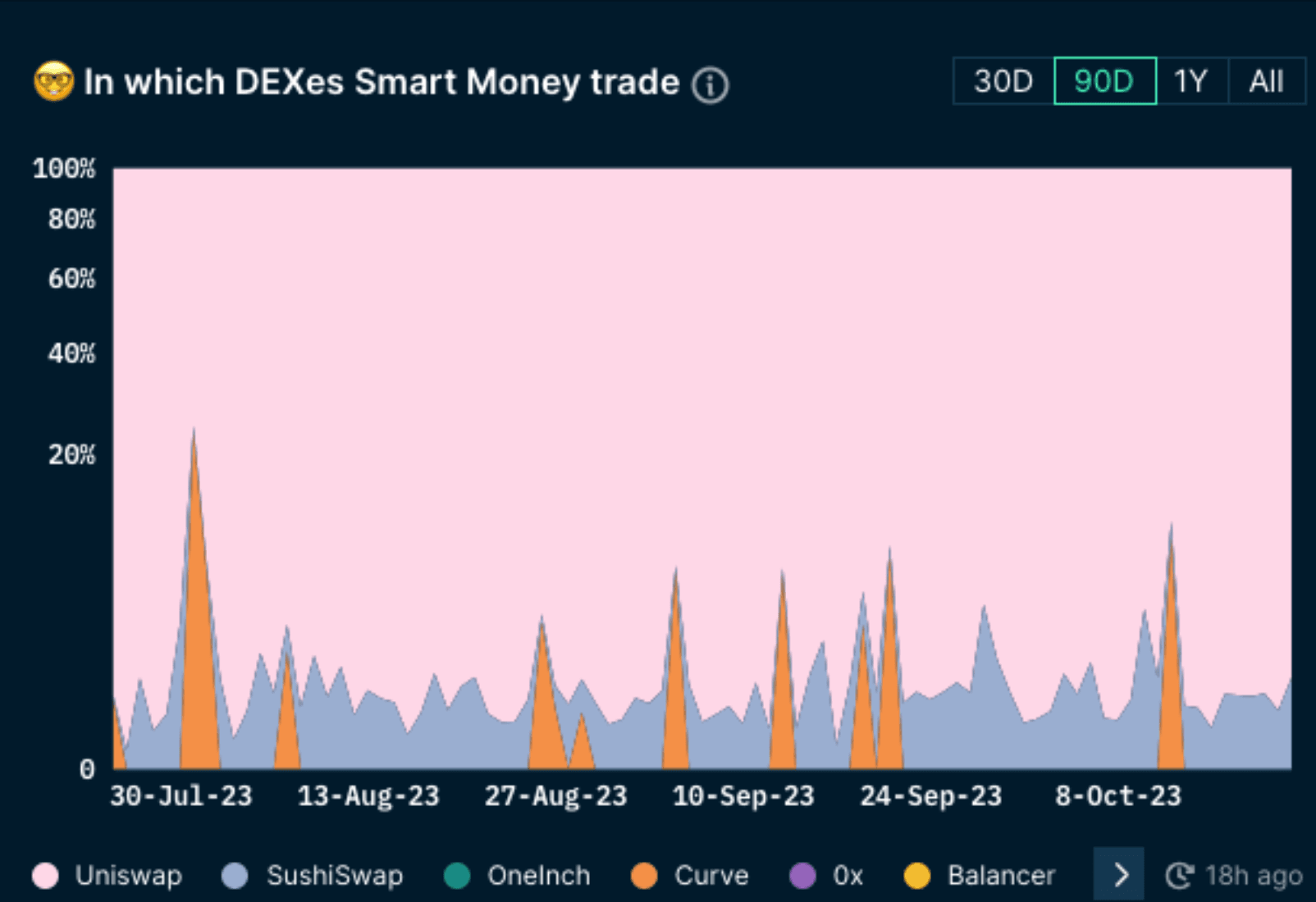

Source: The BlockUniswap continues to dominate the DEX market, smart money seems to also prefer using Uniswap. It remains to be seen if Uniswap will retain its position as market leader with the recent controversy over its new fee structure, and future introduction of KYC on certain pools.

Source: The Block

Source: The Block Source: Nansen

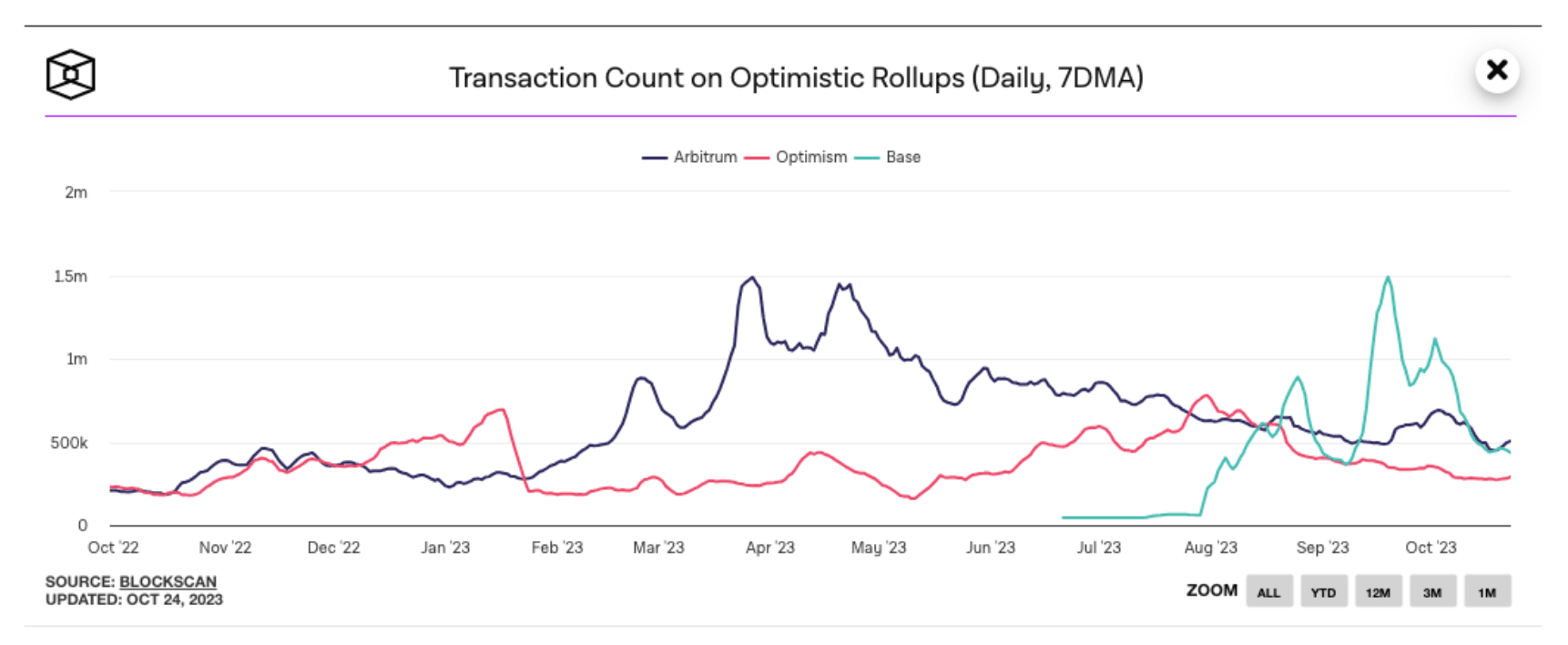

Source: NansenActivity on Base has slowed down. Arbitrum and Base now both seem to be leading the way in terms of daily activity, while activity on Optimism has dragged behind the other two.

Source: The Block

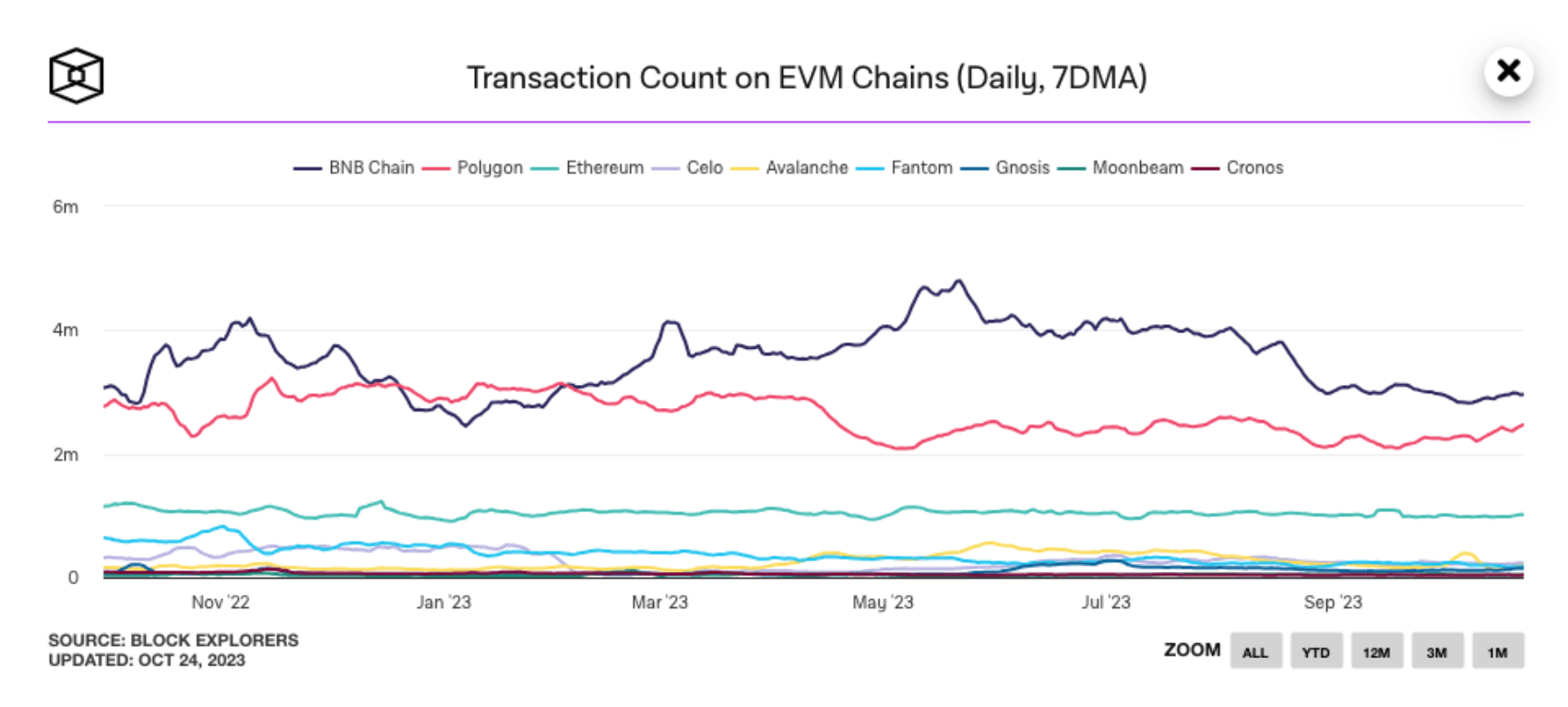

Source: The BlockDespite the growth in L2s such as Base, the overwhelming majority of transactions in crypto are occurring on BNB chain. Readers should keep their finger on the pulse of BNB chain, it’s likely many projects choose to launch on or incorporate the chain due to the amount of activity and retention of users due to its ease of use and low fees. However, the risks of it as a centralized chain should always be kept in mind. One recent project of note that launched on BNB was Thena.

Source: The Block

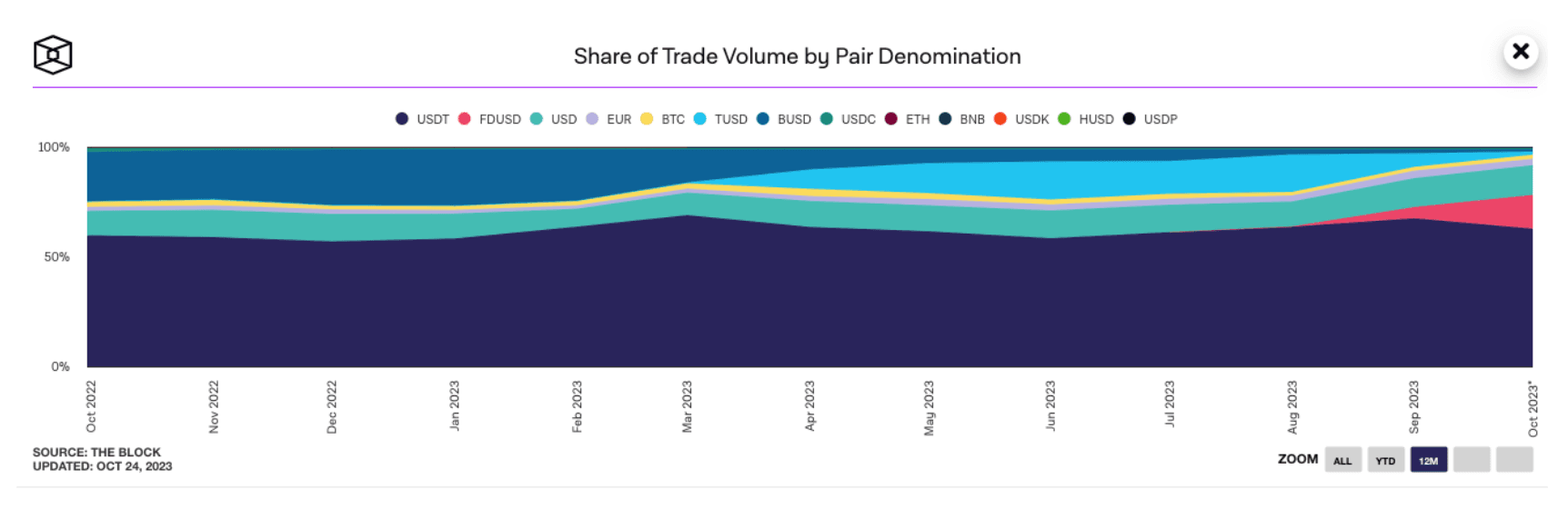

Source: The BlockIt’s worth noting that despite the hurdles and controversy surrounding USDT in the past, USDT is dominating the trading market, with most coins being paired with USDT for trading.

New Opportunities

Liquidity is flowing into the market, with smart money actively taking positions and implementing strategies to maximize their earnings. There are valuable lessons to be gleaned from studying these strategies and familiarizing yourself with the mechanics of DeFi strategies and the tools employed by traders, including bots.

- Patrick details a great yield strategy on JitoSOL for Solana. A simple yet effective DeFi strategy for Sol holders.

- A major part of the next bull market will be quick entries and exits as coins pump and dump. Users should become familiar with the tools the pros are using to perform these trades, check out the latest upgrades from Unibot.

- Pendle Intern details a useful strategy to hold assets such as wstETH, WBTC and tBTC but still earn yield Pendle and crvUSD.

- Tokens such as SPX, JOE, and Starlink have seen their market caps increase substantially in the last few weeks. Smart money has been taking positions in these tokens in varying sizes. A great platform to follow these developments is Chain Edge, developed by On-Chain Wizard.

- In the upcoming launch of oOATH in December, users will be able to buy OATH at a 50% discount. The revenue generated from these purchases will be directed to $bOATH stakers, creating a "pay to earn" mechanism where yield farmers of $ERN pay $bOATH stakers directly for their yield.

- Fan.tech has been built on Mantle and currently has a tiny TVL of $100K. This protocol is worth monitoring in case Mantle gains substantial traction.

- Canto continues to put in new recent highs, increasing 48.9% in the last two weeks. The ecosystem has seen a lot of attention turn to it with the introduction of RWAs. Canto's migration to Ethereum as a Layer 2, coupled with its adoption of neofinance to support off-chain assets natively, presents a strategic pivot aimed at securing a competitive advantage in the fierce Layer 2 landscape, with the ultimate goal of achieving an enhanced position through a robust backing of its stablecoin, NOTE.

The State Of NFTS

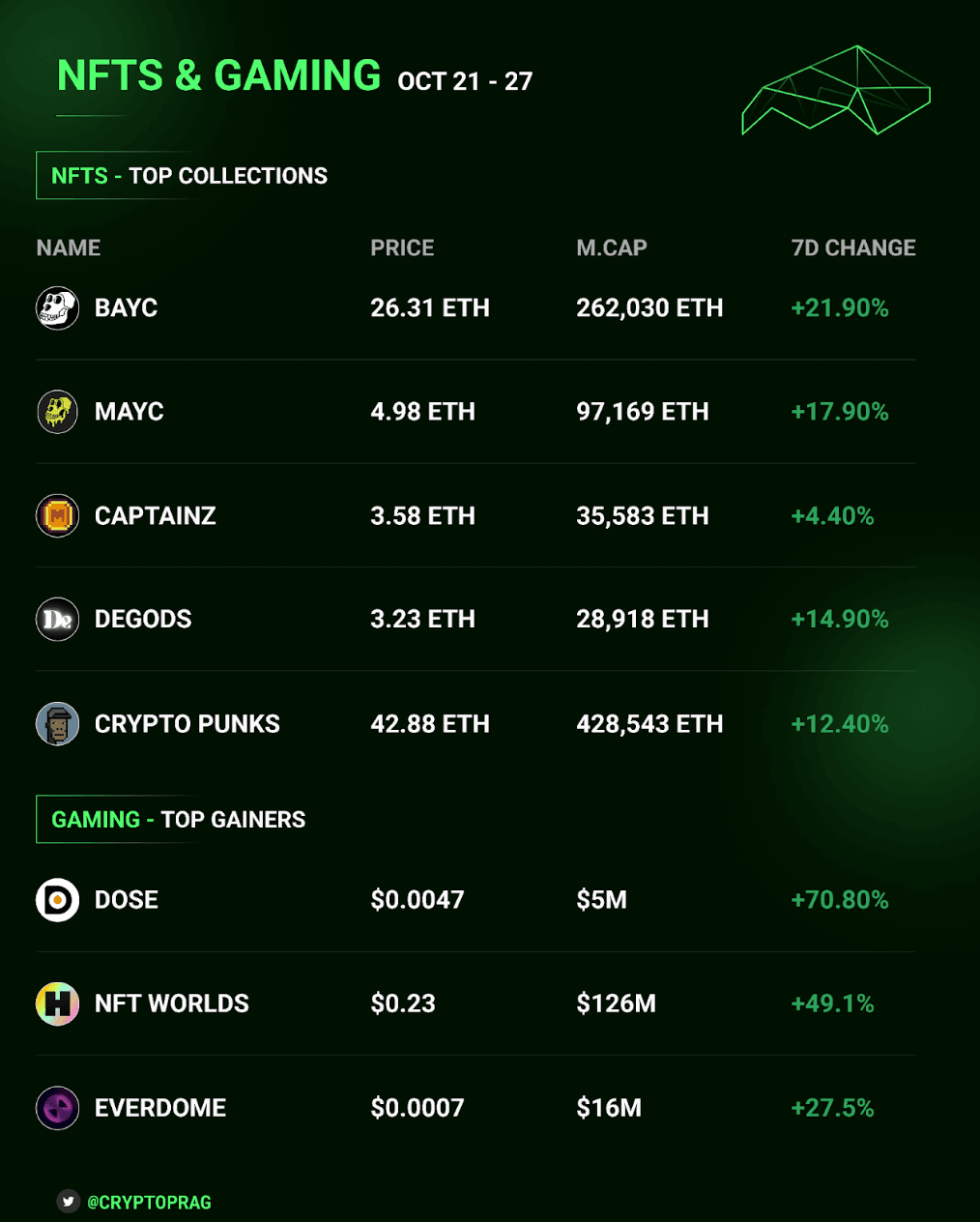

The recent market surge has given a notable lift to the NFT market. Yet, there is still uncertainty regarding whether NFTs will experience comparable gains in the forthcoming days and weeks, especially as more investors enter the crypto space. Nonetheless, the NFT space is evolving continuously, and it's probable that NFTs will play a substantial role in the later stages of this cycle if we are indeed in the early stages of the next bull market

Source: CoinGecko

Source: CoinGeckoNews

- Royal is evolving its mission to bring artists and fans closer together through shared music ownership. They plan to explore new technologies and decentralization to enhance this connection.

- Night Run has launched on the Epic Game store for free.

- Pepe Memecoin sees $5.5M burnt tokens, resulting in 31% spike.

- Sudoswap introduce Sudoshort.

- The AI World Fair, organized by Verse Digital, took place in Decentraland from October 25-27. It featured experts from various fields like Web3, gaming, fashion, art, and robotics who discussed AI-related ideas and opportunities.

- The Y00ts Ethereum bridge is now live.

- Axie Infinity the Rare Era in Lunacia has concluded, and the Epic Era is now live

- The French National Assembly has voted to declare NFT games as non-gambling activities, pending approval by the Constitutional Council.

- The Rainbow app now allows users to easily mint NFTs without leaving the platform, making it more convenient to discover and collect trending NFTs.

- Avant Arte and Yuga Labs have collaborated on CryptoPunks print editions.

- Cool Cats launch their customizable Avatars.

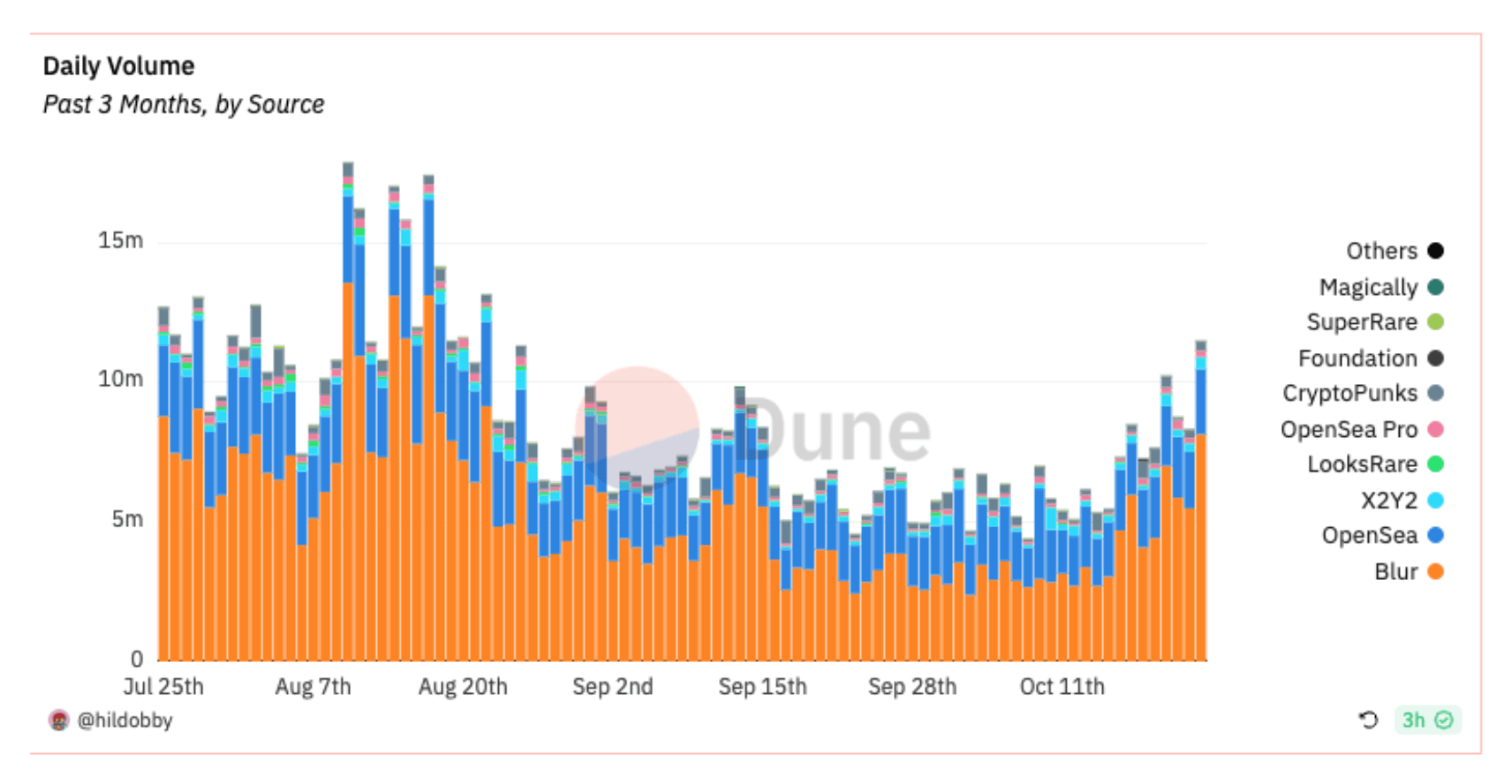

- Blur continues to dominate NFT trading volume, likely due to the anticipated airdrop in November.

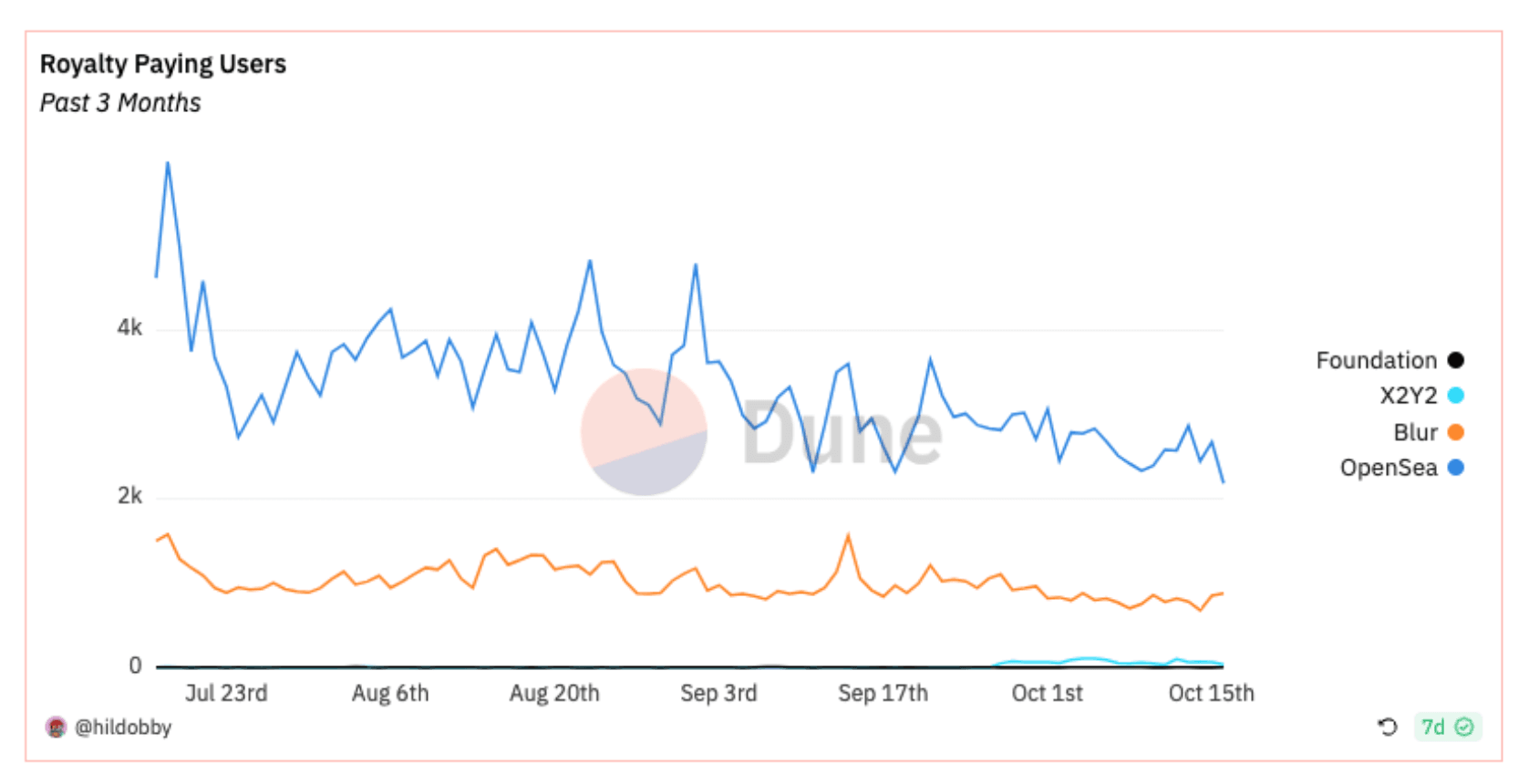

Source: Dune

Source: DuneDespite Blur controlling most of the NFT market volume, royalty-paying users are using Open Sea.

Source: Dune

Source: DuneProject Spotlight: Forge

Forge, a budding gaming platform has successfully raised $11M in a seed funding round, demonstrating strong backing from entities like Makers Fund, BITKRAFT Ventures, and Animoca Brands, along with other investors. Forge emerges with a promise of redefining player engagement and community growth in the gaming realm.

- Users can seamlessly link their gaming and social profiles on Forge, unlocking rewards based on gaming activity.

- Offers a unique seasonal Battle Pass with quests to earn rewards, enhancing in-game experience through partner games.

- The platform is in beta phase with a special offer of a limited edition founders badge to early joiners, indicating an encouraging start towards building a community.

Forge is well-positioned with substantial financial backing, a seasoned founding team, and an innovative approach towards boosting player engagement. The platform's initial moves to partner with game developers and the beta launch show a promising trajectory toward achieving its mission of enhancing the gaming ecosystem.

Source: Forge

Source: ForgeEmerging Opportunities

- Party.app now allows party creators to earn a share of the ETH contributed to their parties, with this feature available for all new parties created on the platform.

- Starter Packs, Web3's Storytelling Incubator, is seeking 20 music artists interested in sharing their stories on the blockchain, providing a platform for blockchain-based storytelling support. Artists are encouraged to apply now for this opportunity.

- Follow this thread to learn how to become eligible for the Memecoin airdrop.

- The inaugural book archiving CryptoPunks is set to launch in Fall 2023, in a collaborative effort with Zakgroup. This book aims to uncover the unexplored narratives of the collection by engaging the enthusiastic community to contribute towards documenting the legacy of Punks. Check it out here.

- Animoca Brands, in collaboration with Amber, is launching the first official web3 Formula E video game, "Formula E: High Voltage," on the Flow blockchain. The game features strategic gameplay where players manage race conditions and assets, which are represented as NFTs, allowing true digital ownership. The game launched Oct. 19, and offers players iconic global race tracks and a sale of 17,500 crate NFTs available for minting, adding a layer of collectability and investment potential within the gaming experience.

- Check out this thread by Raiden that details how to prepare for five potential future airdrops from upcoming NFT games.

In summary, while NFTs may not be dominating the market currently, experimenting and undertaking various actions could potentially lead to significant gains in the future.

Enjoyed this article?

- Subscribe to Crypto Pragmatist by M6 Labs newsletter for crypto-native industry insights and research read by 30k+ subscribers

- Follow us on Twitter for Tweets providing top-notch insights and bridging the gap between users, builders, and leaders in the crypto space