Dogecoin (DOGE) has had one of the most unusual journeys in the history of cryptocurrency. What started as a joke based on a Shiba Inu meme in 2013 is today a household crypto name, known to both retail investors and casual internet users. Despite its funny, non-serious origin, the market now sees DOGE as a real digital asset with active trading markets, merchant adoption, and a community that continues to fuel its momentum.

For anyone curious about getting started with Dogecoin, the process is easier than ever. You don’t need to be a seasoned trader or a blockchain developer. With regulated exchanges, payment apps, and brokerages offering DOGE support worldwide, most people can purchase it within minutes.

This guide explains exactly how you can buy DOGE, while also giving context on Dogecoin’s background, its risks, and best practices for safe storage.

TL;DR — Buying Dogecoin in 2025

- You can buy DOGE in under 5 minutes on major exchanges and apps like Binance, Coinbase, Kraken, Revolut, PayPal, or MoonPay. Simply sign up, verify, deposit, search “DOGE,” and place a buy order.

- For low fees: Binance (~0.1% spot) is the most cost-effective choice, while Coinbase and PayPal charge more but offer simplicity and strong regulatory standing.

- For flexibility: Kraken supports PayPal and Apple Pay; Revolut and Robinhood integrate DOGE with banking or equities; MoonPay delivers DOGE straight to self-custody wallets.

- Centralized vs P2P: CEXs offer liquidity and ease, while peer-to-peer markets like Binance P2P or LocalCoinSwap provide privacy and local currency support (always use escrow for safety).

- Storage matters: Exchanges are fine for purchases, but move long-term holdings to non-custodial wallets (hardware for security, hot wallets for convenience).

- Understand DOGE’s nature: It’s inflationary (5B new DOGE yearly), meme-driven, and best treated as a speculative payment coin — not a capped, store-of-value asset like Bitcoin.

- Regulation & taxes: KYC is required on most platforms, and every sale or spend can trigger capital gains tax; track transactions carefully with crypto tax tools.

- Best practice: Test small transfers first, use 2FA and withdrawal allowlists, back up your recovery phrase offline, and never invest more than you can afford to lose.

Bottom line: Buying DOGE is quick and easy. Pick the platform that fits your needs, secure your coins in the right wallet, and approach it as a fun but speculative part of your crypto journey.

Quick Start Summary

Before diving into the details, it helps to see the essentials at a glance. This section sets the baseline on where to buy, what it costs, and how fast you can get it done.

Dogecoin can be purchased in under 5 minutes on most platforms, with global support across exchanges, payment apps, and brokers. The process is as simple as signing up, depositing funds, and clicking “buy.”

Dogecoin (DOGE) Live Price

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

Let’s take a look at some of the best places to buy DOGE.

Exchange | Payment Methods | Fees | Best For |

|---|---|---|---|

Bank Transfer, Debit/Credit Card, Wallets | 0.1% spot trading | Mobile users, lowest fees | |

Card, Bank, PayPal | 0.05–0.6% + spread | Beginners, strong security | |

Card, Bank, PayPal, Apple Pay | 0.25–0.4% spot | High liquidity, reliability | |

Revolut | Card, Bank, Revolut Pay | Varies, usually low | Quick mobile purchases |

MoonPay | Card, Bank, Apple/Google Pay | Varies by region | Instant delivery, self-custody |

The bottom line: If speed is your priority, most exchanges and apps let you buy DOGE in 5 minutes.

Why Dogecoin Has Gained Popularity

Dogecoin’s Popularity Driven By Memes, Community, And Celebrity Endorsements.Image via Wall of Traders

Dogecoin’s Popularity Driven By Memes, Community, And Celebrity Endorsements.Image via Wall of TradersDogecoin didn’t become famous for its technology; rather, it became famous because of its culture. In late 2013, two engineers, Billy Markus and Jackson Palmer, created DOGE as a parody of the speculative mania surrounding Bitcoin clones. They chose the “doge” meme, which is a picture of a Shiba Inu dog with funny captions, as the face of the coin.

Surprisingly, people loved it. It wasn’t just a token; it was a social experiment in internet fun. Communities on Reddit and Twitter quickly adopted DOGE as a tipping currency. You could send someone a few DOGE just for posting a clever comment. That culture of lighthearted generosity distinguished DOGE from more “serious” coins.

And that’s it, the community’s energy soon translated into real-world actions. Dogecoin users raised money to send the Jamaican bobsled team to the 2014 Winter Olympics. They funded clean water projects in Kenya. They sponsored NASCAR driver Josh Wise, who drove a “Dogecoin car” during major races. These events gave Dogecoin a reputation as the crypto of the people.

What truly catapulted DOGE into the mainstream, however, was the influence of celebrities. Elon Musk famously tweeted about it multiple times, calling it “the people’s crypto.” Each tweet had an effect on DOGE’s price, according to a study published in the International Conference on Advances in Computing, Communication and Applied Informatics (ACCAI).

TikTok campaigns also played a role. One viral challenge saw DOGE's price spike by 35%.

Unlike many altcoins that faded away, DOGE sustained its presence because it had become part of an internet culture. A culture that was filled with the positive energy of its community and the ease of buying and selling. And that, friends, is how Dogecoin gained popularity in a world of speculative tokens.

Understanding Dogecoin Before You Buy

Dogecoin Explained With Speed, Fees, And Supply Compared To Btc And Eth. Image via Shutterstock

Dogecoin Explained With Speed, Fees, And Supply Compared To Btc And Eth. Image via ShutterstockWith the cultural context in place, the next step is to understand the mechanics. Dogecoin runs on its own blockchain, secured through Proof-of-Work mining using the Scrypt algorithm (the same as Litecoin). Blocks are processed every minute, making DOGE faster to confirm than Bitcoin, which takes roughly 10 minutes per block.

One key distinction is its inflationary supply. While Bitcoin has a hard cap of 21 million coins, Dogecoin has no maximum supply. About five billion DOGE are added to circulation every year. This constant supply dilutes scarcity but keeps transaction costs low, making DOGE more practical for small payments and tipping.

DOGE vs BTC vs ETH

| Feature | DOGE | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|---|

Speed | 1 min/block | 10 min/block | ~15 sec/block |

Fees | Very low | High | Moderate |

Supply Model | Unlimited | 21M capped | Capped + burn |

Main Usage | Payments, tipping, fun | Store of value | Payments, smart contracts |

This comparison shows why DOGE is often viewed as a “transactional coin” rather than a store of value like Bitcoin or a platform for decentralized applications like Ethereum.

Regulations and Taxes

Equally important is the regulatory environment. Buying DOGE through regulated exchanges almost always requires Know Your Customer (KYC) verification. This means providing government-issued identification and proof of address. It’s standard in the US, UK, EU, and most other markets.

Tax obligations are another important factor. In many countries, selling or even spending DOGE is a taxable event, subject to capital gains tax. Investors are advised to track every transaction carefully. Crypto tax tools like CoinTracking, Koinly and CryptoTaxCalculator can help simplify this process.

Experts often suggest treating DOGE as a high-risk, speculative asset. Most recommend keeping DOGE (and other meme coins) under 10% of an investment portfolio.

Where to Buy Dogecoin

With the basics understood, the next decision is where to execute your first purchase. Your choice here affects fees, convenience, and custody options.

Centralized Exchanges

Top Platforms And Exchanges That Offer Direct Dogecoin Purchases. Image via Shutterstock

Top Platforms And Exchanges That Offer Direct Dogecoin Purchases. Image via ShutterstockCentralized exchanges act as regulated marketplaces where users can buy, sell, and trade DOGE with strong liquidity and security features. Some of the best options are listed below.

Binance

Binance is the world’s largest crypto exchange by trading volume and one of the most cost-effective places to buy DOGE. Its spot trading fees start as low as 0.1%, and users who pay fees with Binance’s native token (BNB) can get additional discounts. The platform supports hundreds of fiat currencies, meaning buyers from nearly any region can use bank transfers, debit/credit cards, or third-party payment processors to add funds.

The Binance app has become especially popular among mobile users thanks to its simplified “Lite” mode, which allows beginners to buy DOGE with just a few taps. More advanced users can switch to “Pro” mode to access trading charts, limit orders, and additional features. Binance also emphasizes security, offering two-factor authentication, withdrawal address whitelisting, and fund protection through its Secure Asset Fund for Users (SAFU).

Coinbase

Coinbase is often the first stop for beginners in the United States and Europe. Its strength lies in simplicity. The signup flow is streamlined, and the interface makes buying DOGE as easy as entering an amount in dollars or euros and clicking “buy.” While fees are higher, typically 0.05–0.6% maker/taker plus spreads, users value the security and regulatory standing Coinbase offers as a publicly traded US company.

Beyond basic purchases, Coinbase also provides DOGE staking integration with wallets, educational resources for beginners, and insurance for custodial balances. The platform complies strictly with US and EU regulations, giving risk-conscious users peace of mind. For those new to crypto, the higher fees are often worth paying for a straightforward and safe experience.

Kraken

Kraken is another well-established exchange, known for its reliability and the best security features. With spot trading fees ranging from 0.25–0.4%, it offers a balance between affordability and advanced options. What sets Kraken apart is its support for alternative payment methods like PayPal and Apple Pay, which make buying DOGE more flexible for users who prefer modern digital payments over traditional banking.

Kraken is also favored by users who prioritize customer support. It offers 24/7 live chat assistance, something not all exchanges provide. Its interface caters both to beginners with simple “Buy Crypto” options and to professionals through Kraken Pro, which offers detailed charting and lower fees for high-volume traders.

Peer-to-Peer Options

P2P Marketplaces Enable Direct Dogecoin Trading Between Individuals. Image via Shutterstock

P2P Marketplaces Enable Direct Dogecoin Trading Between Individuals. Image via ShutterstockWhile centralized exchanges cover most needs, some buyers want more privacy or face access limits. In those cases, peer-to-peer (P2P) platforms offer a viable path.

Buying DOGE through peer-to-peer platforms appeals to those who value privacy and flexibility. P2P transactions allow you to purchase DOGE directly from another person, often using local currencies or unconventional payment methods that centralized exchanges may not support. Well-known P2P marketplaces include Binance P2P, LocalCoinSwap, and Paxful, each offering escrow services and wide payment method support.

However, the freedom comes with risk. Since you are dealing with individuals, scams are more common. The safest way to use P2P marketplaces is to choose platforms that include escrow services. With escrow, the DOGE is locked until the buyer’s payment is confirmed, reducing the chance of fraud. Always check seller ratings and reviews before engaging in trades.

P2P is especially useful in regions where regulations restrict centralized exchanges. For example, traders in certain countries with capital controls rely heavily on P2P options to bypass restrictions and gain access to DOGE. While it requires caution, for many users it’s the only viable pathway into the market.

Brokerage Apps & Payment Platforms

Mobile Apps And Payment Services That Simplify Dogecoin Access. Image via AU Small Finance Bank

Mobile Apps And Payment Services That Simplify Dogecoin Access. Image via AU Small Finance BankRevolut

Revolut has expanded beyond banking into crypto trading, allowing users to buy DOGE directly within its mobile app. It’s particularly attractive for people who already use Revolut for daily banking, as it allows seamless integration between fiat balances and crypto purchases. Buying DOGE can be done instantly with a debit or credit card, and fees are relatively low compared to other fintech apps.

The main drawback is custody. While Revolut allows you to hold and sell DOGE within the app, external withdrawals are limited. This means users don’t have full control over their private keys unless they transfer them to approved wallets later. For casual investors looking for quick exposure to DOGE, Revolut works well, but long-term hodlers may prefer exchanges that offer direct wallet control.

Robinhood

Robinhood helped popularize DOGE among retail traders during the 2021 boom. Its commission-free trading model made it attractive, and DOGE quickly became one of the most traded assets on the app. Robinhood is designed for mobile-first users and integrates DOGE alongside stocks and ETFs, making it accessible for those already familiar with traditional finance.

The limitation, once again, lies in custody. For a long time, Robinhood users couldn’t withdraw DOGE to external wallets. While the company has since introduced limited wallet support, DOGE bought on Robinhood often stays within its ecosystem. Still, for traders who value speed and integration with equities, Robinhood remains a popular choice.

PayPal

PayPal’s entry into the web3 world actually became a turning point for mainstream adoption. The platform allows US and select global users to buy DOGE using their PayPal balance, linked bank accounts, or debit/credit cards. Purchases are instant, and DOGE appears directly in the user’s PayPal account.

Like Revolut and Robinhood, PayPal’s system is custodial, meaning you don’t initially control the private keys. That said, PayPal has been rolling out limited transfer functionality, enabling withdrawals to self-custody wallets. For users who already trust PayPal for online payments, the convenience of buying DOGE within the same app is a major draw.

MoonPay

MoonPay distinguishes itself by focusing on simplicity and global accessibility. It supports a wide range of payment methods, including Apple Pay, Google Pay, bank transfers, and credit cards. Unlike most brokerage apps, MoonPay delivers DOGE directly to self-custody wallets, which makes it more appealing to users who want control over their assets.

Transactions on MoonPay are fast, often completing in minutes, though fees vary depending on region and payment method. It has become especially useful for users in countries underserved by major exchanges. By bridging fiat and crypto directly into personal wallets, MoonPay provides a unique mix of convenience and security.

Step-by-Step Guide to Buying Dogecoin

Once you’ve chosen a platform, the rest is procedural. Follow these steps to go from zero to your first DOGE with minimal friction.

STEP 1: Pick Your Platform

Decide based on fees, supported payment methods, and security. If you want low fees, choose Binance.

If you value simplicity, Coinbase or PayPal may be better.

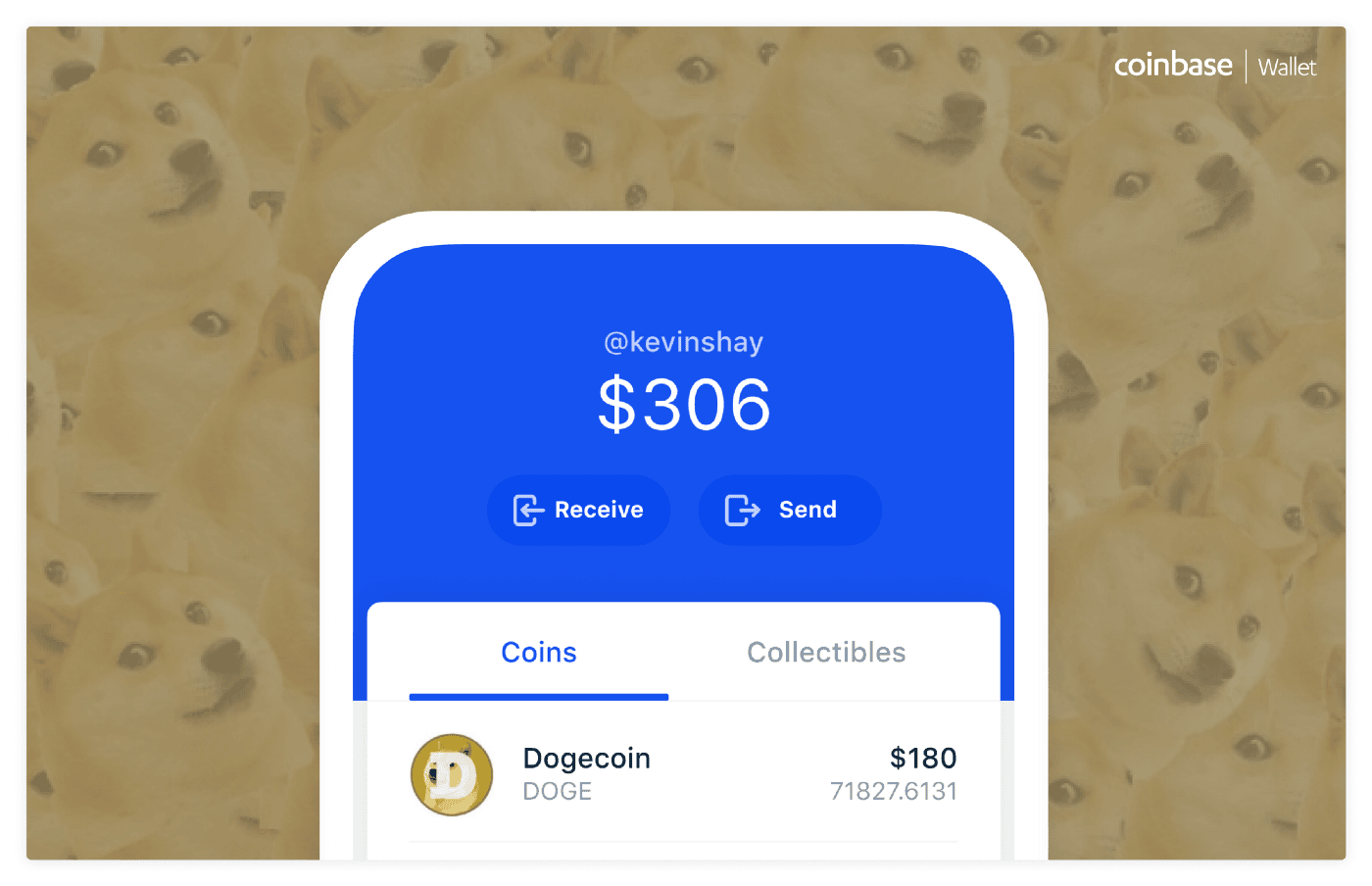

Clear Steps To Create An Account, Fund It, And Buy Dogecoin Safely. Image via Coinbase

Clear Steps To Create An Account, Fund It, And Buy Dogecoin Safely. Image via CoinbaseSTEP 2: Create and Verify Your Account

Sign up with your email and password. Complete the KYC process by uploading a government ID and proof of residence. This step usually takes a few minutes to a few hours, depending on the platform.

STEP 3: Deposit Funds

Add money to your account using bank transfers, debit/credit cards, or supported apps like Apple Pay. Bank transfers are slower but cheaper. Cards and PayPal are instant but come with higher fees.

STEP 4: Place Your Order

On the exchange, search for “DOGE.” Decide whether you want to place a market order (instant) or a limit order (set your own price). Review the order summary before confirming.

- Secure Your DOGE: Once purchased, your DOGE will appear in the platform’s wallet. For long-term storage, consider transferring it to a personal wallet (hot or cold).

- Track Your Investment: Use portfolio apps or exchange dashboards to keep an eye on your DOGE. Price alerts can help you react quickly to big moves.

Storing Your Dogecoin Safely

Buying DOGE is only half the story. The other half is safeguarding it. Your storage choice should match how often you transact and how long you plan to hold.

Check out our top picks for the best Dogecoin wallets.

Hot Wallets

Hot Wallets Provide Fast Access To Dogecoin But With Higher Risk. Iamge via Shutterstock

Hot Wallets Provide Fast Access To Dogecoin But With Higher Risk. Iamge via ShutterstockHot wallets are always connected to the internet, which makes them highly convenient but also more vulnerable. Examples include Trust Wallet, Coinbase Wallet, and the built-in wallets of exchanges like Binance. For someone who plans to make frequent transactions or trades, hot wallets are the easiest solution.

The added accessibility means you can move DOGE quickly, whether for trading, tipping, or sending payments. However, the same convenience comes with risks. Online wallets are susceptible to phishing, malware, and exchange hacks. Using strong passwords, enabling 2FA, and keeping backup phrases offline are essential precautions if you rely on hot wallets.

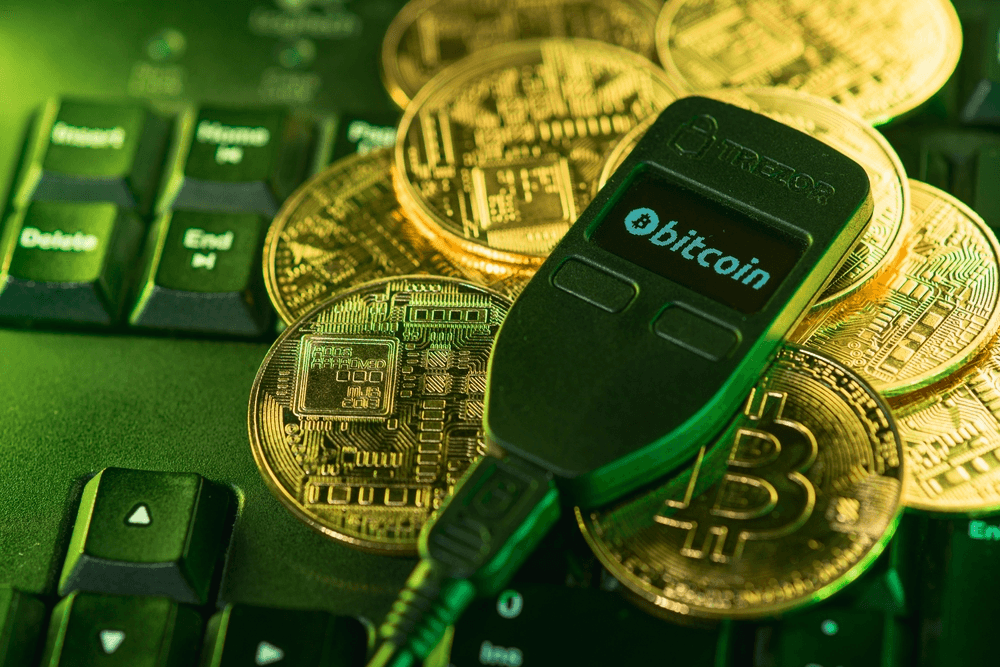

Cold Wallets

Cold Wallets Store Dogecoin Offline For Maximum Security And Control. Image via Shutterstock

Cold Wallets Store Dogecoin Offline For Maximum Security And Control. Image via ShutterstockCold wallets, by contrast, keep your coins offline, away from hackers. Hardware wallets like the Ledger Nano X or Trezor Model T are the most common examples. Once your DOGE is stored on such a device, it can only be accessed physically with the hardware in your possession.

This makes cold wallets the gold standard for long-term investors. They’re less convenient for daily transactions but provide unmatched security. Cold wallets are particularly recommended if you’re holding large amounts of DOGE or if you intend to store your investment for years.

Here is the list of the best cold wallets to secure your crypto.

Hybrid Approach

Some users combine both strategies, keeping smaller amounts of DOGE in a hot wallet for everyday use and the bulk in a cold wallet for safekeeping. This hybrid method balances convenience with security.

5 Practical Storage Options

- Trust Wallet (hot): Mobile-friendly, supports DOGE, easy for beginners.

- Coinbase Wallet (hot): Integrated with Coinbase, simple interface, insured balances.

- Binance Wallet (hot): Best for frequent traders who keep funds on Binance.

- Ledger Nano X (cold): Premium hardware wallet with Bluetooth support.

- Trezor Model T (cold): Highly secure hardware wallet with touchscreen interface.

With storage settled, shift focus to risk and reward. This section frames DOGE in market terms, so you enter with realistic expectations.

Key Investment Considerations

Factors Like Price Trends, Adoption, And Taxes That Impact Dogecoin Investment. Image via Shutterstock

Factors Like Price Trends, Adoption, And Taxes That Impact Dogecoin Investment. Image via ShutterstockLike all cryptocurrencies, Dogecoin is highly volatile. Its price is often influenced more by social media trends and celebrity mentions than by technical fundamentals.

Historically, DOGE has surged during waves of online hype and then corrected sharply. For example, in May 2021, it hit an all-time high of around $0.70, only to lose over 70% of its value within months.

And so Analysts remain divided. Some believe DOGE will continue to play a role as a community-driven payments coin. Others see it as purely speculative. The Dogecoin Foundation’s efforts to formalize development, such as launching a DOGE reserve fund, are its steps toward credibility.

Another key factor is taxation. Selling DOGE at a profit triggers taxable events in most countries. Even using DOGE for purchases can create small capital gains or losses, depending on your local regulations.

Tips for Trading and Long-Term Holding

If you decide to allocate capital, the next question is how to manage it. A few simple rules go a long way.

- Use stop losses and take profits: Automate your exit points to avoid emotional decisions.

- Don’t Chase Pumps: Buying during a hype cycle often leads to losses once momentum fades.

- Dollar-Cost Averaging (DCA): Buy small amounts over time instead of making one big purchase.

- Stay Updated: Follow the Dogecoin Foundation’s official announcements rather than relying on rumor-driven hype.

- Track Your Portfolio: Use alerts and apps to monitor price changes without being glued to charts.

Final Thoughts: Is Dogecoin Right for You?

By now, you have the full picture, right from why DOGE matters to how to buy and store it. The final step is to determine if it aligns with your risk profile.

Dogecoin is not a “blue-chip” crypto like Bitcoin or Ethereum. It’s a hybrid of internet culture and real-world usability, making it a fascinating but risky asset.

It’s best suited for those who understand its speculative nature, enjoy its meme-driven culture, or want to experiment with small-scale payments and tipping. For risk-averse investors or those seeking stable long-term returns, DOGE may not be the best fit.

The guiding rule is simple: always invest responsibly, use secure storage, comply with your local tax rules, and never risk more than you can afford to lose.

Also Read