From meme coins that moon overnight to serious contenders building decentralized financial ecosystems, the altcoin universe is packed with excitement and confusion. Beyond the headlines dominated by Bitcoin and Ethereum, there's a whole galaxy of niche coins vying for attention, each promising to be the “next big thing.” But navigating the crypto wild west requires more than just FOMO-fueled instincts; it calls for curiosity and research.

One of the more recent talked-about names in this space is Pi Coin, the native token of the Pi Network, a project that has built a sizable user base while being ignored by some of the largest crypto exchanges. Its mobile-first mining approach and emphasis on accessibility have attracted attention, though not without skepticism. Now, with the Open Mainnet live, many are wondering: Can I actually buy Pi Coin? And if so, how?

In this guide, we’ll walk you through everything, from what Pi Coin is and where it stands in the market, to the safest ways to buy, store, and even sell Pi Coin.

TL;DR — Buying Pi Coin

- You can buy Pi Coin on select centralized exchanges after migrating to the Open Mainnet and completing KYC, then follow a simple flow: create an account, fund with fiat or USDT, and place a PI/USDT order.

- Supported venues include OKX, Bitget, Gate and MEXC, while Binance and Coinbase do not list PI at this time.

- Use a clear step sequence: sign up and enable 2FA, verify identity, deposit fiat or USDT, search PI/USDT, choose Market or Limit, confirm the trade.

- Avoid unofficial markets and old IOU listings, stick to verified exchange pairs and double-check you are trading mainnet PI.

- Expect thinner liquidity and higher volatility than major altcoins, split larger orders and prefer Limit orders on deeper venues to reduce slippage.

- Regulatory and fiat on-ramp options vary by region, most exchanges require full KYC for bank transfers and card purchases, keep basic tax records for cost basis and fees.

- Pi is a speculative asset with growing ecosystem activity but mixed views and limited tier-one listings. Start small, secure your keys, and only risk what you can afford to lose.

👉 Quick start: open an account on a supported exchange, complete KYC, fund with USDT or fiat, buy PI on the PI/USDT pair, and move it to your Pi Network Wallet for long-term storage.

Is Pi Coin Available for Purchase?

With the launch of the Open Mainnet in February 2025, Pi Network has enabled external transactions, allowing users to trade Pi Coin on several centralized exchanges.

If you're ready to trade PI, our guide to the best Pi Coin exchanges covers everything you need to know.

Current Status: Tradable and Transferable On Some Exchanges

As of now, Pi Coin is tradable and transferable on multiple centralized exchanges. Users who have completed the Know Your Customer (KYC) verification and migrated their Pi to the mainnet can deposit and trade their tokens on platforms such as OKX, Gate.com and Bitget. These exchanges offer PI/USDT trading pairs, providing liquidity and accessibility to a broader audience.

| Feature | Status |

|---|---|

| Tradable on exchanges | Yes ✅ (OKX, Bitget, Gate, MEXC) |

| Transferable (Mainnet) | Yes ✅ (after migration to Open Mainnet) |

| Listed on Binance | No ❌ |

| Listed on Coinbase | No ❌ |

| Available on DEXs | No ❌ (not supported yet) |

Why Pi Coin Isn’t on Binance or Coinbase?

Despite months of speculation, Pi Coin has yet to appear on leading exchanges like Binance or Coinbase. The buzz peaked earlier this year when Binance ran a community vote on a potential listing. More than 86% of voters backed the idea, and hopes for a debut surged again on Pi2Day. Instead of an announcement, however, the event passed quietly, leaving millions of Pi enthusiasts disappointed.

Analyst Kim H. Wong stepped into the debate with a detailed post on X, offering his take on why the token remains absent from major platforms. Wong pointed to a few things:

- The project’s blockchain code is not fully open source. That lack of transparency, he said, makes technical vetting harder and limits the trust required by large, regulated exchanges.

- The absence of an independently verified security audit, something Binance, Coinbase, and other tier-one exchanges typically demand before listing a new asset.

- A final possibility, Wong suggested, is that Pi Network has not yet submitted a formal application to be listed.

For now, the exchanges are holding back, even as Pi Network continues to grow its ecosystem with efforts like a $100 million venture fund and the Pi App Studio. Wong believes those achievements show the project’s long-term potential, but the immediate reality is that Binance and Coinbase will wait until the technical, regulatory, and security boxes are all checked.

Until then, the listing rumors that once sent community hype soaring will remain just that — rumors.

Unofficial Listings and Associated Risks

Before the Open Mainnet launch, some platforms offered Pi Coin trading through IOUs (I Owe You), which were speculative contracts rather than actual token trades. Engaging in such unofficial listings poses significant risks, including a lack of buyer protection, potential scams, and price manipulation. Now that Pi Coin is officially tradable on recognized exchanges, it's advisable to avoid unofficial platforms and ensure that any trading activity is conducted through reputable channels.

Is short, avoid IOUs & unofficial Telegram sellers.

Updates from the Pi Network Team

The Pi Network team has been proactive in expanding the ecosystem post-Open Mainnet. They have introduced features like wallet activation through the Pi Browser, enabling users to interact directly with the mainnet blockchain, use Pi apps, and participate in events like the .pi Domains Auction. The team emphasizes the importance of KYC verification to ensure network integrity and compliance.

Where Can You Buy Pi Coin?

So you’ve heard the buzz, maybe mined some Pi from your phone, and now you're ready to make your move. The big question: where exactly do you go to get your hands on Pi Coin? Let’s break down your options.

Stick to Verified Exchanges, Check Official Pi Network Channels for Updates. Image via Freepik

Stick to Verified Exchanges, Check Official Pi Network Channels for Updates. Image via Freepik1. Centralized Exchanges (CEXs)

Centralized exchanges are currently the most reliable way to buy Pi Coin, and several platforms have stepped up to list it officially. Here’s a breakdown of some:

| Exchange | Spot Fee (Maker/Taker) | Liquidity | Fiat Off-Ramp | KYC Strictness |

|---|---|---|---|---|

| OKX | 0.08% / 0.10% | High | Yes (cards, bank, P2P) | Strict |

| Gate.com | 0.10% / 0.20% | Medium–High | Limited fiat (USDT swaps first) | Moderate |

| Bitget | 0.10% | Medium | Yes (Asia-focused) | Moderate |

| MEXC | 0% / 0.05% | Medium | Yes (varies by region) | Moderate |

- OKX: Best overall depth (spot ~0.08/0.10%; full KYC for fiat)

- Gate.com— Broad altcoin coverage (0.10/0.20%; active PI books)

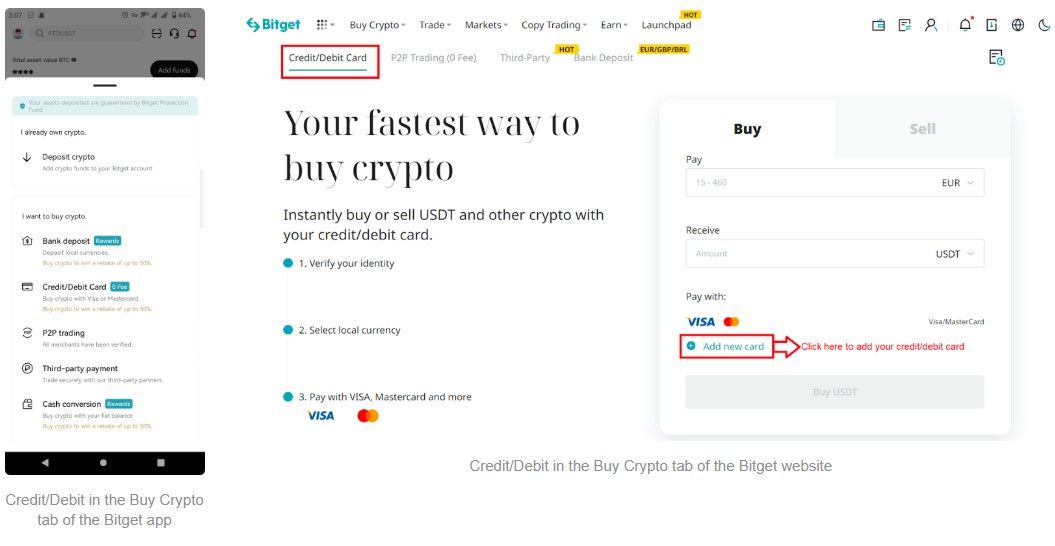

- Bitget: Asia-friendly on-ramps (0.10%; strong mobile UX)

- MEXC: Fast listings (promotional spot tiers vary; decent for smaller clips)

The first major platform to support Pi trading, OKX remains the most liquid venue for the token. Spot fees are competitive at 0.08% for makers and 0.10% for takers, and the exchange has a long track record of reliability. To cash out to fiat, however, you’ll need to go through a full KYC process. For traders looking for a globally recognized exchange with strong market depth, OKX stands out.

With a solid reputation as a go-to marketplace for altcoins, Gate maintains several Pi/USDT markets with steady daily volume. The fee structure (0.10% maker, 0.20% taker) is a bit steeper than OKX, but the breadth of trading pairs makes it appealing for those who want more flexibility in how they manage their Pi holdings.

The exchange has quickly expanded its footprint across Asia and become a favorite among Pi traders in the region. It supports Pi/USDT trading with straightforward fees and provides a user-friendly mobile app that makes buying and selling simple. Its support for regional fiat payment methods adds to its accessibility, making it an attractive choice for everyday users.

While its liquidity doesn’t match OKX, it delivers solid volume and is particularly popular with altcoin enthusiasts. The platform is known for its fast listings and wide selection of tokens, making it a practical option for Pi traders outside traditional Western markets.

That said, there are a few caveats to keep in mind:

- Limited Liquidity: Even on exchanges that list Pi, trading activity isn’t yet deep, compared to major altcoins. Placing a large buy order might move the market price upward, leaving you paying more than expected.

- Verification Needed: Most platforms won’t allow you to deposit fiat or complete card purchases until you pass KYC checks. This can slow down the process for new users.

Before you buy, always:

- Ensure the exchange supports mainnet Pi trading pairs (PI/USDT, for example)

- Fund your account with a reliable method like USDT or a fiat transfer

- Double-check that you’re buying the official Pi listing, not an IOU or fake token

Regional Options

Europe

For European users, Gate.com provides SEPA transfer support, making Euro deposits straightforward. Withdrawals may still require converting Pi into USDT or another crypto first, depending on local restrictions and the exchange’s withdrawal framework.

Asia

Headquartered in Singapore, Bitget has become a key player for traders across Asia. Its smooth fiat gateways and simple mobile app make it especially appealing to those seeking quick and familiar payment methods.

MEXC also serves the Asian market with its broad altcoin listings and early support for new tokens. However, its fiat access is inconsistent, often depending on the user’s specific country or payment provider.

Africa

In African markets, OKX is often the top choice thanks to its active peer-to-peer marketplace. This feature lets traders buy and sell Pi/USDT directly with others and settle transactions in widely used regional payment options.

2. Decentralized Exchanges (DEXs)

At the moment, Pi Coin isn’t available on popular DEXs like Uniswap or PancakeSwap. That’s because the Pi Network runs on its own native blockchain, which isn’t directly compatible with Ethereum or BNB chains (yet). Until a bridge or wrapped version of Pi is introduced, DEX trading isn’t on the table.

Risks of Using Unofficial Markets

Let’s be real: there will always be someone trying to sell you Pi on Telegram, Reddit, or some shady site you’ve never heard of. Here’s why you should steer clear:

- Scams and Fraudulent Listings: Fake Pi tokens, phantom wallets, and spoofed apps are out there. These scams often prey on users who aren’t keeping up with official announcements.

- Lack of Buyer Protection: If something goes wrong, there’s no customer service to help. It’s just you, your wallet, and your losses.

- Volatility and Price Manipulation: Unregulated markets are breeding grounds for price swings orchestrated by bad actors. You might think you’re getting a deal, only to realize the market was rigged from the start.

Play it smart. Stick to verified exchanges, check official Pi Network channels for updates, and always double-check you’re trading the real deal, not an IOU or fake token.

We have a lot more on risk management for you to check out in your bid to become a successful trader.

Current Pi Coin Price, Liquidity & Market Data (2026)

At the time of writing, Pi Coin trades below $1 with daily volumes topping $59 million, concentrated mainly on OKX, Gate.com, MEXC and Bitget. The most active pair across exchanges is PI/USDT, which handles the bulk of trading activity.

Pi initially surged toward the $3 mark after its open mainnet launch, but prices have since stabilized at lower levels. You can track the real-time Pi Coin price and trading data in the live widget below.

Figures auto-update via CoinGecko; always verify on your chosen exchange before trading.

Pi Coin Price Prediction (2026)

According to CoinCodex forecasts, Pi Network is projected to recover and potentially rally significantly in 2026:

- January 2026: Expected range of $0.265–$0.278, close to late-2025 levels.

- May 2026: Forecast average near $0.405, with highs up to $0.574.

- June 2026 (bullish peak): PI could surge between $0.586 and $1.01, averaging $0.831, a potential 170% increase compared to current prices.

- Full-Year 2026 Average: About $0.529, with prices moving between $0.265 and $1.008, suggesting a wide but upward-leaning channel.

Here's a month-by-month breakdown for 2026:

| Month | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| January | $0.265469 | $0.272787 | $0.277898 |

| February | $0.277546 | $0.288466 | $0.299678 |

| March | $0.288949 | $0.293838 | $0.300458 |

| April | $0.287350 | $0.304585 | $0.344947 |

| May | $0.331186 | $0.405439 | $0.573602 |

| June | $0.586299 | $0.830644 | $1.007698 |

| July | $0.623846 | $0.739096 | $0.890091 |

| August | $0.778050 | $0.808443 | $0.858755 |

| September | $0.580314 | $0.689514 | $0.803313 |

| October | $0.584381 | $0.641500 | $0.682181 |

| November | $0.492987 | $0.544115 | $0.618418 |

| December | $0.510731 | $0.534213 | $0.571914 |

Forecasts: CoinCodex, retrieved Jan. 13, 2026. Not financial advice; models can be wrong and may change.

Step-by-Step Guide: How to Buy Pi Coin Safely

Buying Pi Coin is straightforward once you know the process, but it’s important to follow each step carefully to avoid mistakes. Below is a clear path you can take:

1Create an exchange account

Sign up with a platform that lists mainnet Pi: OKX, Gate.com, Bitget, or MEXC.

2Complete KYC verification

Upload ID documents to unlock fiat deposits and withdrawals.

3Fund your account

Deposit fiat or stablecoins such as USDT for trading.

4Place buy order

Select the PI/USDT market and choose between Market (instant) or Limit (set your price).

5Secure your Pi

Transfer your purchased Pi to a non-custodial wallet such as the official Pi Wallet.

Start with a Reputable Cryptocurrency Exchange that Lists Pi Coin. Image via Shutterstock

Start with a Reputable Cryptocurrency Exchange that Lists Pi Coin. Image via ShutterstockSTEP 1: Create a Crypto Exchange Account

First things first, you'll need to select a reputable cryptocurrency exchange that lists Pi Coin. As of now, platforms like OKX, Bitget, Gate, and MEXC, among other exchanges, have officially listed PI for trading. These exchanges are known for their security measures and user-friendly interfaces, making them suitable for both beginners and seasoned traders.

STEP 2: Verify Your Identity (KYC Process)

All major exchanges require Know Your Customer (KYC) verification to unlock fiat deposits and withdrawals. You’ll need to provide a valid ID (passport, driver’s license, or national ID card) and sometimes a short video selfie. Completing KYC also increases your deposit, trading, and withdrawal limits.

Step 3: Fund Your Account with Fiat or Stablecoins

Once your account is verified, you’ll need to add funds before you can buy Pi.

Place An Order For Pi Network. Image via Bitget

Place An Order For Pi Network. Image via BitgetAvailable methods vary by region:

- India: UPI/INR deposits are supported on some platforms, or you can use P2P to purchase USDT.

- Europe: SEPA/EUR transfers and debit/credit card deposits are widely available.

- United States: ACH bank transfers are limited; most users rely on debit/credit cards.

For smoother trades, funding with USDT is recommended, since Pi is most commonly paired with USDT (PI/USDT).

Transaction Fees to Be Aware of

Be mindful of transaction fees associated with deposits. These can vary depending on the exchange and the payment method used. Always check the fee structure beforehand to avoid surprises.

STEP 4: Place Your Buy Order on the PI/USDT Market

Navigate to the PI/USDT trading pair on your chosen exchange. You can choose between:

- Market Order: Buys instantly at the current price. Fast and simple, but may result in slippage if liquidity is low.

- Limit Order: Lets you set the exact price you want to pay; the trade executes only when the market reaches that level.

After selecting your order type and entering the amount of PI you wish to purchase, review the details carefully. Once everything looks good, confirm the transaction. Your Pi Coins will then be credited to your exchange wallet.

Step 5: Secure Your Pi Coins in a Safe Wallet

After your purchase, don’t leave your Pi sitting on the exchange if you intend to hold it long term. Transfer your coins to the official Pi Network Wallet, available via the Pi Browser app. This is a non-custodial wallet, meaning you are the only one who controls the private keys. Write down your 24-word passphrase and store it safely offline; if you lose it, you lose access to your Pi permanently.

We have a lot more on securing your cryptocurrencies with affordable hardware wallet options if you are interested in the ultimate security for your funds.

What is Pi Coin and How Does it Work?

Imagine mining cryptocurrency without the need for expensive hardware, high electricity bills, or a deep understanding of complex algorithms. That’s the idea behind Pi Network, a project that purports to make crypto mining accessible through everyday smartphones.

Pi Coin — Quick Facts

- Launch Date

- March 14, 2019

- Founders

- Dr. Nicolas Kokkalis, Dr. Chengdiao Fan

- Mining Method

- Mobile, energy-light; SCP-inspired

- Community

- “Pioneers”

- Native Asset

- Pi Coin (PI)

- Core Uses

-

- Peer-to-peer payments

- Marketplace purchases

- DApps in ecosystem

A Brief Overview of Pi Network and Its Origins

Launched on March 14, 2019, by a team of Stanford graduates, Pi Network set out to lower the barrier to entry in the world of cryptocurrency. Its concept centers around allowing users, called "Pioneers," to mine Pi Coin (PI) on their mobile devices without significant energy use or data consumption. The goal has been to appeal to a broader, less tech-savvy audience and encourage more inclusive participation in the digital economy.

For an in-depth analysis of Pi Coin's legitimacy, including its network structure, decentralization claims, and investment risks, check out Coin Bureau's comprehensive article: Is Pi Coin Legit?

The Role of Pi Coin Within the Ecosystem

Pi Coin functions as the native currency of the Pi Network. It’s intended for use in transactions such as purchasing goods and services, accessing decentralized applications (DApps), and enabling peer-to-peer payments. The broader vision includes building an internal marketplace and economy, though much of this is still in development.

Pi Mining vs. Traditional Crypto Mining

Mining Bitcoin or other traditional cryptocurrencies typically requires powerful hardware and high electricity usage, often operating under a Proof-of-Work (PoW) system that demands intensive computations. Pi Network, however, uses a model inspired by the Stellar Consensus Protocol (SCP), focusing on social trust and user engagement rather than raw processing power.

Users earn Pi by contributing to the network's security and growth, such as by verifying transactions and building a reliable network of connections. On paper, this method is not only energy-efficient but also promotes active community participation.

| Aspect | Pi Network (SCP) | Bitcoin (PoW) |

|---|---|---|

| Consensus Mechanism | Stellar Consensus Protocol (trust-based) | Proof-of-Work (computational puzzles) |

| Mining Device | Smartphones | Specialized ASIC hardware |

| Energy Consumption | Very low (lightweight validation) | Very high (large-scale electricity use) |

| Participation | Anyone with a phone can join | Limited to miners with expensive rigs |

| Security Basis | Social trust & validation circles | Computational difficulty & hash power |

| Rewards | Earn PI by contributing to network trust | Earn BTC by solving cryptographic puzzles |

| Accessibility | Easy for beginners, no cost barrier | High technical and financial barrier |

Current Stage of Pi Coin Development and Network Phases

Pi Network's development has progressed through several distinct phases:

- Phase 1: Beta (March 2019) – The initial launch focused on user acquisition and testing the mobile mining application.

- Phase 2: Testnet (March 2020) – This phase involved extensive testing of the blockchain and consensus algorithm, with node operators invited to ensure network stability.

- Phase 3: Enclosed Mainnet (December 2021) – The mainnet became live but remained enclosed, with a firewall preventing external connectivity. This period allowed users to complete Know Your Customer (KYC) verification and migrate their Pi to the live mainnet blockchain while the community built applications within the enclosed network.

- Phase 4: Open Mainnet (Launched February 20, 2025) – The transition to the open mainnet marked a significant milestone, enabling external connectivity. This advancement allows Pi to interface with other compliant networks and systems, facilitating transactions beyond the Pi ecosystem and expanding Pi's utility and reach.

Currently in its post-Open Mainnet phase, the Pi Network is working on ecosystem development, infrastructure scaling, and broader platform integration. While community participation remains high, the network's long-term viability will depend on the actual utility created and adoption beyond its initial user base.

If you'd rather watch a video, check out our full Pi Network below:

Where to Store Your Pi Coins

Once you've acquired Pi Coin (PI), securing it is paramount. Unlike traditional currencies, cryptocurrencies require careful storage to prevent loss or theft. Let's explore the best options for storing your PI safely.

Always Ensure that any Third-Party Wallet you use is Reputable and Supports PI on the Mainnet. Image via Freepik

Always Ensure that any Third-Party Wallet you use is Reputable and Supports PI on the Mainnet. Image via FreepikOfficial Pi Network Wallet

Features, Security, and Access

The official Pi Network Wallet is the primary tool for storing and managing your PI. Accessible through the Pi Browser app, this wallet is designed specifically for the Pi ecosystem. It allows users to send and receive PI, interact with decentralized applications (DApps), and participate in the network's activities.

Security is a top priority. The wallet is non-custodial, meaning you have full control over your private keys. Upon setup, you're provided with a 24-word passphrase—your key to accessing your funds. It's crucial to store this passphrase securely; losing it means losing access to your PI permanently.

Compatibility with Mainnet

With the launch of Pi Network's Open Mainnet in February 2025, the wallet has been updated to support mainnet transactions. Users who have completed the Know Your Customer (KYC) verification can activate their wallets and fully engage with the Pi ecosystem. This includes sending and receiving PI, using DApps, and participating in events like the .pi Domains Auction.

Third-Party Wallets

Custodial vs. Non-Custodial Options

While the official Pi Wallet is the recommended choice, some third-party wallets have begun to offer support for PI. It's essential to understand the difference between custodial and non-custodial wallets:

- Custodial Wallets: These wallets are managed by third-party services that hold your private keys. While they often offer user-friendly interfaces and customer support, they require you to trust the provider with your funds.

- Non-Custodial Wallets: These wallets give you full control over your private keys. They offer greater security but require you to take full responsibility for safeguarding your access credentials.

Recommendations Based on Security and Usability

- Pi Network Wallet: Technically not third-party, but it’s worth reiterating. It's a non-custodial wallet integrated with the Pi Browser, designed specifically for storing and transacting PI on the Mainnet. Full control, direct network access, and support for Pi DApps make it the go-to choice for most users.

- Trust Wallet: A versatile non-custodial wallet that supports a wide range of tokens. While native support for Pi may be limited depending on the version, it’s generally easy to use and offers strong security features.

- Ledger Hardware Wallets: For maximum security, Ledger's devices offer cold storage, keeping your private keys offline. Advanced users can manually add Pi if the Mainnet is compatible, but it’s not plug-and-play—some setup effort is needed.

- Bitget Wallet: A custodial solution with a growing reputation in the Pi ecosystem. It offers seamless integration with the Bitget exchange, in-app trading, and easy access to features like staking and token management. It's great for convenience, but users should be aware they’re trusting Bitget with their keys.

When choosing a wallet, consider your specific needs—whether it's ease of use, security, or compatibility with other cryptocurrencies. Always ensure that any third-party wallet you use is reputable and supports PI on the mainnet.

We have extensive coverage on the Best Wallets For Pi Network. Do check it out.

Can You Sell Pi Coin?

Yes, you can sell Pi Coin (PI), but it's essential to understand the current landscape to do so safely and effectively.

A listing on a Major Exchange could Significantly Enhance Pi Coin's Liquidity and Market Reach. Image via Pi Network

A listing on a Major Exchange could Significantly Enhance Pi Coin's Liquidity and Market Reach. Image via Pi NetworkTo sell your Pi Coin, follow these steps:

- Ensure Mainnet Migration: Verify that your PI has been migrated to the Open Mainnet. Only mainnet tokens are transferable and tradable on exchanges.

- Complete KYC Verification: Most exchanges require Know Your Customer (KYC) verification. Prepare your identification documents to complete this process.

- Transfer PI to an Exchange: Choose a reputable exchange that supports PI trading, such as OKX, Bitget, or MEXC. Transfer your PI from your Pi Network Wallet to your exchange wallet.

- Place a Sell Order: Once your PI is in your exchange wallet, navigate to the trading section, select the appropriate PI trading pair (e.g., PI/USDT), and place a sell order—either at the market price for immediate execution or set a limit order at your desired price.

- Withdraw Funds: After the sale, you can withdraw your funds in USDT or other supported currencies to your bank account or another crypto wallet.

You can check out our detailed guide on selling Pi Coin for more information.

Regional and Legal Considerations When Buying Pi Coin

Buying Pi isn’t the same experience everywhere. Local regulations, KYC rules, and fiat on-ramp options differ significantly by country, and overlooking these details can result in failed deposits, frozen accounts, or compliance risks.

Tax Implications

- United States: The IRS treats crypto purchases with fiat as a non-taxable event. However, swapping one crypto for another (e.g., BTC → PI) triggers a capital gains/loss calculation on the asset you sold. If you later dispose of Pi, that’s when tax applies.

- United Kingdom: Simply buying crypto with GBP is not a taxable event. But disposing of any other crypto to acquire Pi (e.g., selling ETH for PI) can crystallize a Capital Gains Tax liability.

- Canada: Buying Pi with CAD is not immediately taxable. As in the UK/US, converting one crypto to Pi (e.g., USDT → PI) is a disposition of the crypto you sold and may create a gain/loss.

Tip: Keep transaction records like date, amount, cost basis and fees for future reporting, as tax obligations apply when you sell or swap Pi later.

KYC Differences by Country

- European Union: Under MiCA and the AML framework, expect full identity verification when opening an account with a crypto-asset service provider (CASP). Proof of ID, proof of address, and sometimes a source of funds may be required before you can deposit fiat.

- India: Exchanges offering INR/UPI deposits must comply with RBI and FIU-IND guidelines, meaning Aadhaar/PAN-based KYC is mandatory. Non-compliant platforms are often geo-blocked.

- Singapore: Digital Payment Token (DPT) providers licensed by MAS enforce robust AML/KYC. A verified account is essential before any SGD deposits or card payments are accepted.

- Africa/LatAm: Practices vary by jurisdiction, but major exchanges apply FATF standards globally, requiring KYC before enabling fiat deposits. Unregulated platforms offering “no-KYC” Pi purchases are high risk.

Tip: Full KYC is almost always required for fiat deposits. If a platform claims you can buy Pi without identity checks, it’s a red flag.

Banking and Fiat On-Ramps

- SEPA (EU): Eurozone users can usually deposit EUR via SEPA transfers, which are low-cost and widely supported.

- ACH (US): Support depends on the exchange; many users rely on cards or P2P USDT where ACH isn’t available.

- UPI (India): UPI/IMPS rails allow fast INR deposits on compliant platforms.

- SWIFT (Global): For non-local deposits, SWIFT remains the default, though fees and settlement times vary.

- Cards/PayPal (select regions): Some exchanges allow instant purchases of Pi through Visa/Mastercard or PayPal, but these methods usually carry higher fees.

Tip: For lower costs, bank transfers (SEPA/UPI/ACH) are best. Cards and PayPal are faster but pricier. Compare options in your region before funding your account.

Is Pi Coin a Good Investment?

Pi Coin (PI) has garnered significant attention in the crypto community, but the question remains: is it a worthwhile investment? Let's delve into the various facets that influence its investment potential.

Potential Investors should Conduct thorough Research and Consider their Risk Tolerance. Image via Pi Network

Potential Investors should Conduct thorough Research and Consider their Risk Tolerance. Image via Pi NetworkOpportunities

- Massive, engaged community: Pi Network claims over 60 million users worldwide, creating a built-in audience and awareness base that few projects can match.

- Mobile-first mining makes crypto accessible: Anyone with a smartphone can participate, lowering entry barriers and encouraging grassroots growth.

- Ongoing ecosystem development: Beyond mining, the network is rolling out features like .pi domains, DApp support, and developer toolkits to foster real utility.

Risks

- Centralization concerns remain: A January 2025 report by CNN reveals that despite decentralization claims, the Pi Core Team continues to control network nodes and decision-making, raising questions about true decentralization.

- Not yet listed on major exchanges: Pi is absent from giants like Binance and Coinbase, limiting visibility and market access and dampening liquidity.

- Mandatory KYC raises privacy questions: Even simple transactions require identity verification, a step critics say undermines privacy and freedom, especially at scale.

Expert Opinions

- Justin Bons (CyberCapital founder) has been openly critical, calling Pi “a straight‑up scam,” pointing to its centralized structure and referral-based growth model. He argues the design resembles a Ponzi scheme more than a decentralized network.

- Ben Zhou (Bybit CEO) echoed this skepticism, calling Pi “more dangerous than meme coins,” citing concerns over unrealistic promises, reports of fraud targeting the elderly, and warning that it feeds on people without crypto background.

- Dr. Nicolas Kokkalis (co-founder of Pi Network) offers a different view. He describes Pi as “not just a coin, it’s a mission to build a decentralized future, powered by everyday people.” He emphasizes vision over hype, encouraging developers and users to build meaningful utility inside the Pi ecosystem

Overall, while Pi Coin presents intriguing possibilities, it also carries significant risks. Potential investors should conduct thorough research and consider their risk tolerance before investing.

Final Thoughts: Should You Buy Pi Coin Now?

So, should you take the plunge and buy Pi Coin? Well, that depends on your goals, your risk tolerance, and how much faith you place in the project's long-term vision.

To recap: Pi Coin is now officially tradable on several centralized exchanges like OKX, Bitget, Gate, and MEXC. If you're new to crypto, the steps are straightforward—create an account on one of these platforms, verify your identity, fund your wallet (usually with USDT), and place your buy order. From there, it's all about how and where you store your PI.

But avoid unofficial sources like the plague. Before the Open Mainnet, there were plenty of shady IOUs and fake listings floating around. Even now, some scammy platforms and P2P setups still lure in hopeful buyers. Stick to verified exchanges and always double-check what you’re buying.

If you’re a beginner, start small. Watch how the market reacts post-mainnet, keep an eye on developments, and never invest more than you can afford to lose. Pi’s concept is ambitious, but it’s still early days in many ways.

The real value of Pi Coin will become clearer as the ecosystem evolves. If the developers deliver on the roadmap and decentralization efforts, and if major exchanges like Binance eventually hop on board, we might be looking at something big. Until then, Pi remains a cautiously interesting bet with both promise and pitfalls.