Founded in 2017, Solana operates as an open-source platform to host decentralized, scalable applications. It is run by the Solana Foundation, while the blockchain was built by Solana Labs.

Like many other third-generation blockchains, Solana too has been dubbed “Ethereum killer,” a moniker given to projects looking to improve upon Ethereum's shortcomings, mainly its scalability bottleneck. Here's an example: At the time of writing, Ethereum's TPS stood at 13.7, while Solana's topped 3,000.

Solana also has a thriving DeFi ecosystem, as evidenced by a spike in its TVL in 2023. According to DefiLlama, Solana's TVL stood at $1.43 billion at the end of 2023, up from $210.4 million as of Jan. 1, 2023.

In this guide, we'll show you how to buy Solana, where to store it and highlight some of the best exchanges.

Before we go any further, feel free to check out our picks for the best crypto exchanges and the best decentralized exchanges.

Best Exchanges to Buy Solana

Here are our top picks if you're looking to buy Solana.

eToro

eToro, a traditional financial investment firm, expanded into the crypto market back in 2014, a full six years before the emergence of Solana. At the close of 2014, Bitcoin, the flagship cryptocurrency, was valued at a modest $320.19.

eToro Branched Out Into Crypto Investments in 2014. Image via eToro

eToro Branched Out Into Crypto Investments in 2014. Image via eToroToday, eToro boasts a user base of over 30 million individuals. Alongside Solana, users have access to a diverse range of cryptocurrencies, including Bitcoin, Ethereum, Ripple and Cardano. All in all, the platform supports over 70 cryptoassets.

A flat 1% fee is applied to crypto asset transactions. Additionally, there's a monthly inactivity fee for dormant accounts after 12 months, although deposit fees are waived due to the platform's extensive payment options.

Turning to security measures, eToro utilizes SSL encryption to safeguard personal data and the option to enable two-factor authentication. Educational resources cater to investors of all levels, offering insights into investment terminology, market analysis, and more. Furthermore, eToro provides a $100,000 virtual portfolio for hands-on practice before real investment commitments.

👉 Sign up for eToro and diversify across assets!

Based in the USA? Use our eToro US sign-up link and receive a free $10 crypto airdrop bonus!

Disclaimer: Don't invest unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more. Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS:1769299) and is not FDIC or SIPC insured. Investing involves risk.

Binance

Binance is the largest crypto exchange by volume. Its 24-hour volume, according to CoinGecko, is over $10 billion.

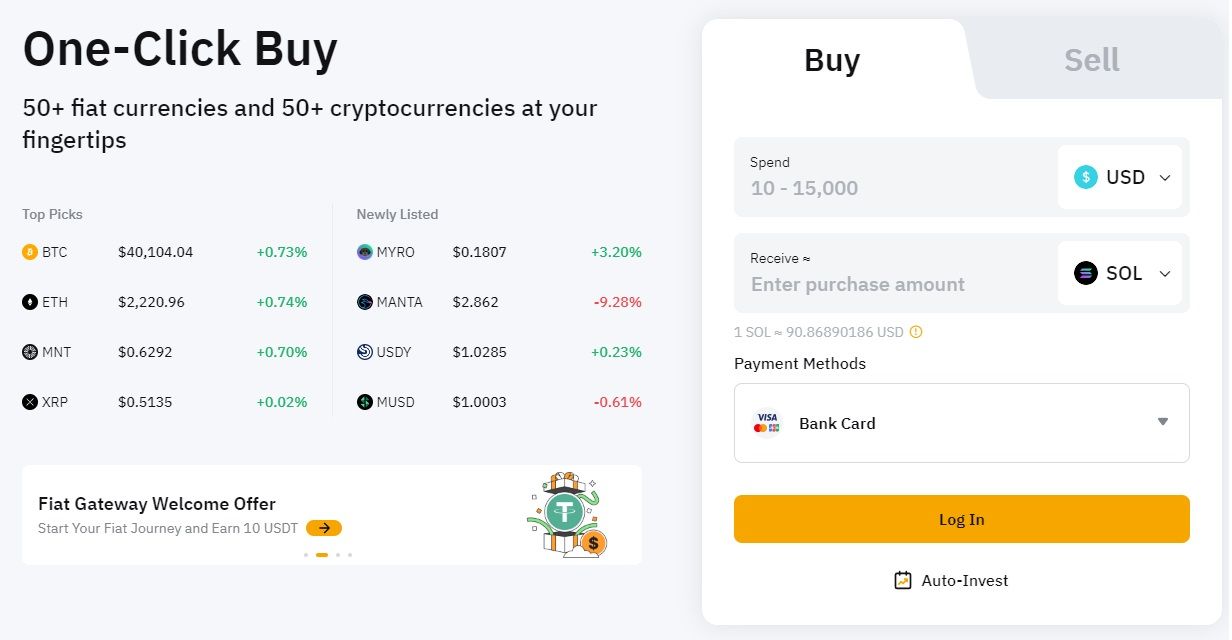

Binance is the Largest Crypto Exchange by Volume. Image via Binance

Binance is the Largest Crypto Exchange by Volume. Image via BinanceIn addition to trading, users can engage in several activities within the cryptoverse, including:

- Earning interest on their crypto with Binance Earn.

- Participating in token purchases or earnings via Binance Launchpad.

- Trading, staking and lending NFTs through the Binance NFT marketplace.

Turning to fees, each trade carries a standard fee of 0.1% for regular users but you can pay for trading fees with Binance's native coin BNB to enjoy a 25% discount. You can find more information on the Binance Trading Fees page.

Security-wise, Binance is ranked 6th by CER, which assesses crypto exchange security, concluding that the exchange is fully certified with an approved penetration test, ongoing bug bounty and proof of funds.

In addition to giving our full Binance review a read, you'd do well to go through our other Binance content:

- How to Signup on Binance

- Binance Exchange Security

- Binance Trading Guide

- Binance Coin Review

- Binance App Review

- Binance USD Review

- Binance NFT Review

Bybit

Bybit is based in Dubai and supports over 1,000 cryptocurrencies. The exchange is regulated by the Virtual Assets Regulatory Authority in Dubai, the Cyprus Securities and Exchange Commission and the Astana Financial Services Authority in Kazakhstan. Bybit can be accessed in over 160 countries.

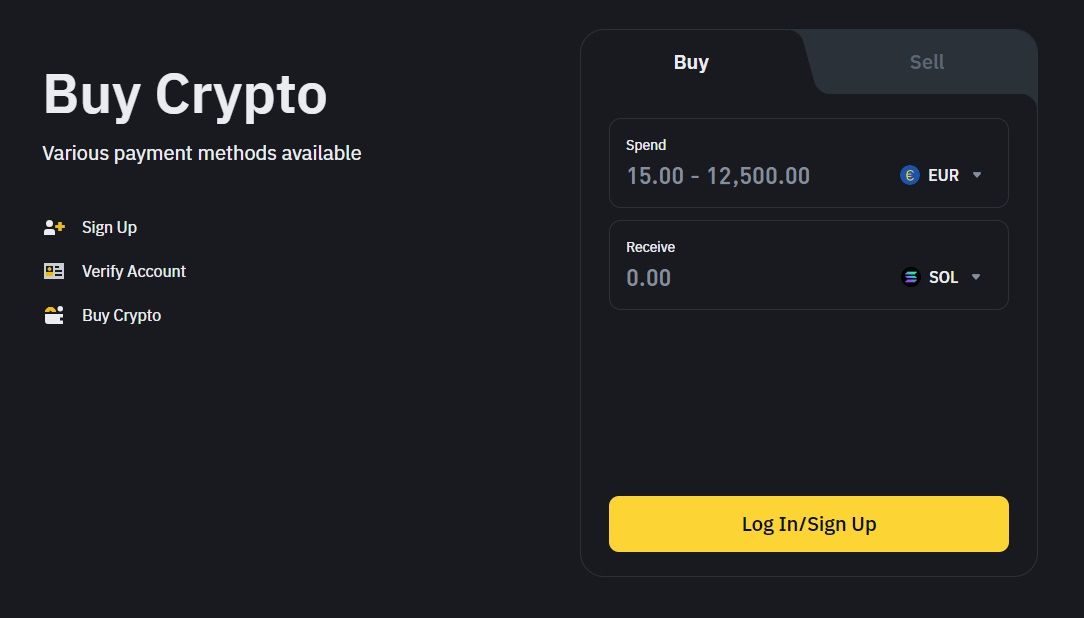

Bybit Supports Over 1,000 Cryptocurrencies. Image via Bybit

Bybit Supports Over 1,000 Cryptocurrencies. Image via BybitJust like Binance, Bybit too has a few tricks up its sleeves.

- A copy trading platform where you can mimic top traders' moves on autopilot.

- An earn program to generate yield on your crypto.

- Crypto loans

- Crypto lending

Bybit offers varying trading fees for both non-VIP and VIP users, with VIP members enjoying additional fee discounts depending on their VIP levels. The maker/taker fees are dependent on your 30-day spot trading volume. If you'd like to know more, you can check out the Bybit fees section.

According to CER, Bybit rounds out the top 10 crypto exchanges with a AAA rating, the highest awarded by CER.

Our full Bybit review covers all that and much more. You can also check out the following Bybit-related articles:

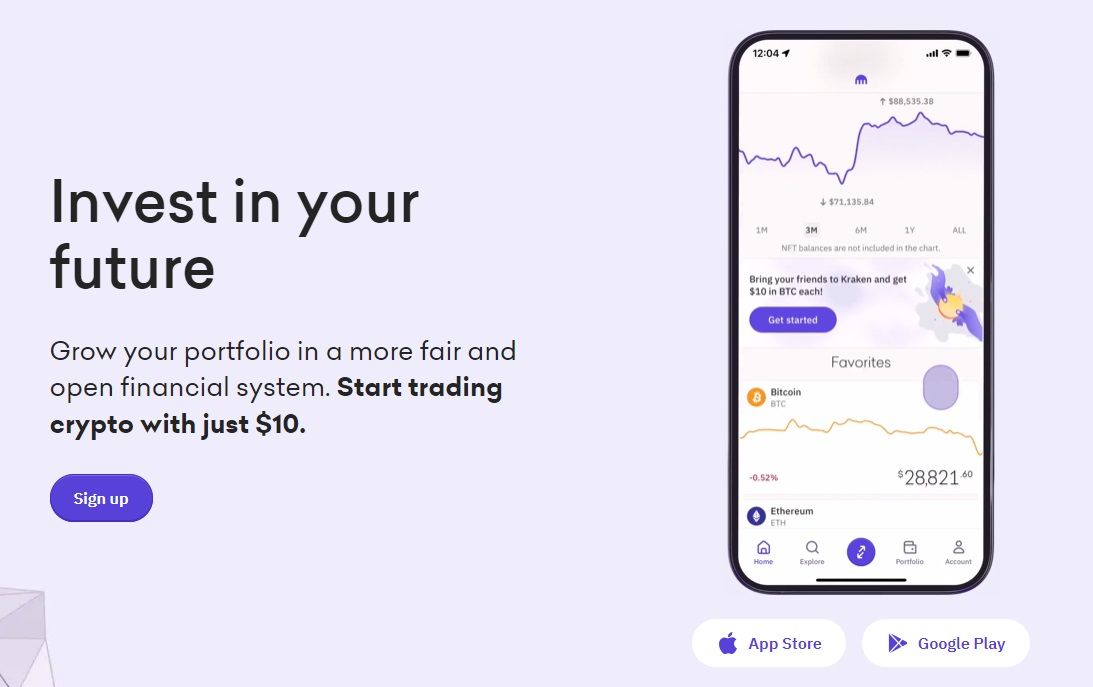

Kraken

Kraken boasts over 10 million customers and it is available in over 190 countries.

Unlike many other crypto exchanges, Kraken has chosen to keep things simple. It doesn't offer crypto loans or lending and doesn't have a crypto-earn product in place. It does, however, offer over 12 assets for crypto staking with up to 24% in yearly rewards. The exchange has thus far paid over $100 million in staking rewards to clients. It's important to note that Kraken targets a 15% commission based on the rewards you receive from the network.

CER ranks Kraken second in terms of security. Turning to fees, traders with a 30-day volume of up to $50,000 can expect to pay maker/taker fees of 0.16%/0.26%. As your trading volume gets higher, your trading fees get lower. You can find out more on the Kraken fees page.

Our full Kraken review also touches on the exchange's key features, deposits and withdrawals, KYC and much more.

How to Buy Solana

Here, we'll walk you through the process of buying SOL.

STEP 1: Open an Account

Now that you have an idea of the various crypto exchanges, you can create an account with an exchange that suits your needs. Most platforms offer a user-friendly registration process, typically requiring your email address or mobile phone number. Choose the option that is most convenient for you.

Following account creation, you'll undergo a verification process. This is a standard Know Your Customer (KYC) measure to verify your identity and ensure compliance with anti-money laundering regulations. In this stage, you'll submit documents like your driver's license or a passport.

STEP 2: Deposit Funds

After completing the account setup process, the next phase involves funding your newly created account. Your decision at this stage significantly impacts the efficiency and cost-effectiveness of your Solana investment.

Exchanges provide various options for depositing funds, catering to different preferences and convenience levels. Common deposit methods include linking your debit or credit cards, engaging in peer-to-peer (P2P) trading or making direct cryptocurrency deposits.

Many users commonly opt for credit and debit cards as their preferred method for cryptocurrency purchases due to the speed and convenience they offer. However, users should exercise caution and diligently monitor associated fees. Based on our experience, funding your cryptocurrency account through a bank transfer is a more cost-effective alternative. In certain instances, this method may even be free of charge. It's important to note, though, that utilizing bank transfers often comes with a trade-off in terms of processing time, typically ranging between 3 to 5 business days for the funds to fully reflect in your account.

While proceeding through the funding process, it's advisable to contact your bank, especially when using a credit card for cryptocurrency purchases. Certain financial institutions may categorize these transactions as cash advances, subjecting you to high-interest rates and potentially eliminating an interest-free grace period.

STEP 3: Buy Solana

With your account funded, you're ready to buy Solana. During your adventures, you'll come across a few order types. We list the most common ones below:

- Market Order: Swift execution at the prevailing market price.

- Limit Order: Specify the exact price at which you are willing to buy Solana. Executed only when the predetermined price is reached.

- Stop-Loss Order: Designed to mitigate potential losses by triggering a market order to close a trade when the price falls to or below a predetermined stop price.

- Trailing-Stop Loss Order: Employs a "trailing" mechanism, automatically adjusting the stop price in response to market fluctuations. Unlike a fixed stop-loss order, it adapts to dynamic price movements.

If you are looking to get into crypto for the first time you may find our following guides helpful:

- How to Build a Crypto Portfolio

- How to Build a Crypto Portfolio Using Modern Portfolio Theory

- Beginner's Guide to Technical Analysis

What Are The Fees to Buy Solana

The fees associated with purchasing Solana can vary based on several factors.

- Exchange Fees: Most cryptocurrency platforms impose fees for buying, selling, and trading digital assets, including Solana. These fees may be presented as a percentage of the transaction amount or a fixed sum. It is crucial to review the fee schedule of the specific exchange you choose to ensure transparency in your transactions.

- Payment Method: The method you use to fund your account can significantly impact the fees incurred. Funding your Solana account with a credit card or through payment services like PayPal may result in higher fees compared to alternatives such as bank transfers or cryptocurrency deposits.

- Withdrawal Fees: If you plan to transfer Solana to a personal wallet, be aware of potential withdrawal fees on the exchange. Additionally, network fees, influenced by network congestion, may apply during the withdrawal process.

In addition, the following factors can also influence fees.

- Transaction Size: Certain exchanges may implement tiered fee structures based on the size of your Solana transaction. Larger transactions might incur higher fees, either as a percentage of the transaction amount or a fixed sum.

- Market Conditions: The cryptocurrency market is known for its volatility. During periods of heightened market activity, you may experience increased fees or wider spreads between buying and selling prices. Staying informed about prevailing market conditions is essential before executing any Solana transactions.

Best Places to Store Solana

As a newbie, I bought my first crypto through an exchange, and you'll likely follow that route too. Once you buy Solana through an exchange, it will be stored in your on-exchange wallet. While this may offer convenience, there are a few risks you should be aware of:

- Lack of Control: Storing Solana in an exchange wallet means using a custodial wallet, resulting in the relinquishment of control over private keys and, consequently, your funds. This lack of control makes users vulnerable to the policies and potential financial challenges of the exchange. This scenario was on full display during the collapse of the FTX crypto exchange, where millions of users lost access to their funds.

- Security Vulnerabilities: Exchange wallets, due to their centralized nature, become prime targets for hackers. Over the years, there have been notable instances of significant crypto exchange breaches, such as the $600 million hack of the now-defunct FTX on the day of its bankruptcy declaration and the $570 million loss suffered by Binance in October 2022. A compromised exchange could lead to the theft of your Solana holdings.

- Exchange Insolvency: If an exchange encounters insolvency or financial difficulties, the security of your Solana holdings is compromised. Retrieving assets under such circumstances becomes a convoluted and uncertain process. Exchange insolvency poses a significant risk of potential loss to your Solana holdings.

With these risks in mind, opting for an off-exchange, self-custodial wallet is a no-brainer. So, which one should you go for? You can choose from hardware wallets, desktop wallets, and mobile wallets, based on your preferences and needs.

Hardware wallets such as the Ledger Nano X, Ledger Nano S Plus, and Trezor (Model T and Safe 3) stand out because of their robust security features. These hardware wallets offer an enhanced level of security, making them a reliable option for protecting your Solana holdings. If you're still unsure, we've curated a list of the top Solana wallets.

You can learn more about wallets by reading about the types of crypto wallets available or how hardware wallets work before deciding on whether you need one.

We also go into far greater detail on the security strengths and weaknesses of crypto storage devices in our crypto safety guide.

How to Buy Solana: Closing Thoughts

This guide detailed the process of purchasing Solana, shining a light on platforms like eToro and exchanges such as Binance, Bybit and Kraken. Each of these platforms provides robust features, stringent security measures, and a diverse array of options tailored to meet the needs of both beginners and seasoned traders.

When acquiring Solana, individuals must take into account several factors, including setting up an account, depositing funds, and comprehending various order types available on these exchanges. Furthermore, understanding the fee structure associated with transactions, payment methods, and withdrawals is paramount to ensuring a cost-effective experience.