Zcash (ZEC) is built for people who want real privacy when they move money online. Its shielded transactions hide the sender, the receiver, and the amount, making it one of the strongest privacy-focused cryptocurrencies available.

Whether you’re new to crypto or already experienced, you can get ZEC through several easy methods. This guide walks you through everything you need: how to buy it, what each method costs, where it’s available, and how to keep your coins safe.

If you’re looking for private digital cash or want to add ZEC to your portfolio, the steps here will help you make your purchase confidently and securely.

Buy Zcash in 3 Simple Steps

You can use these three quick steps to get ZEC fast:

Select an exchange that lists Zcash. Coinbase is beginner-friendly, Kraken offers lower fees, and Binance provides many payment options.

Use a credit or debit card for instant purchases, or a bank transfer for cheaper deposits. Cards are faster but cost more, while bank transfers take longer but have lower fees.

Search for “ZEC,” enter the amount you want, and confirm the purchase. If you use a card, your ZEC usually appears in your exchange wallet within seconds.

Which Buying Method Is Best For You?

Pick The ZEC Buying Method That Fits Your Style. Image via Shutterstock

Pick The ZEC Buying Method That Fits Your Style. Image via ShutterstockThere are five main ways to buy Zcash (ZEC), and each is suited to a user's focus on speed, cost, and privacy:

- Credit/Debit Card Purchase: This is the fastest and simplest way to buy, great for new users who want ZEC right away. Payment is generally instant, but fees are higher, usually between 1.8% and 4%.

- Bank Transfer (ACH, SEPA, Wire): This method is the least expensive for buying large amounts. Transfers take more time, from one day to a few business days, but the fees are noticeably lower than card payments.

- Crypto-to-ZEC Trading: This is the best option for users who already own other digital currencies (Bitcoin, Ethereum, USDT). Converting existing crypto to ZEC often results in the lowest fees and is quite fast.

- Peer-to-Peer (P2P) Marketplaces: Offers privacy and freedom by letting users trade directly with each other. These platforms typically use escrow services to secure transactions for both parties. Fees and speed vary, but this method is good for users focused on anonymity and custom deals.

- Decentralised Exchanges (DEX): This requires the user to have a crypto wallet with other digital currencies and some network fees. DEX offers resistance to censorship and more privacy, but is more complex and involves managing smart contracts and transaction fees.

Check out our top picks for the best decentralised exchanges.

Decision Tree

Beginner → Use a credit or debit card for instant access

Large purchase → Use bank transfer for lower fees

Privacy-focused → Use P2P markets or decentralised exchanges (DEX)

Mini Comparison Table

| Method | Speed | Fees | Difficulty |

|---|---|---|---|

| Credit/Debit Card | Instant | High | Easy |

| Bank Transfer | Hours–Days | Low | Moderate |

| Crypto Trading | Minutes | Low | Moderate |

| P2P Marketplaces | Hours | Medium | Moderate |

| Decentralized Exch | Minutes | Variable | Advanced |

Recommendations by User Type

- Newcomers or quick buyers benefit from card purchases on platforms such as Coinbase or Binance.

- Cost-aware buyers planning large transactions should consider bank transfers on Kraken or Binance for better rates.

- Experienced users who prioritise privacy or self-custody should choose P2P platforms or DEXs like Uniswap or SushiSwap.

Step-by-Step Buying Guide (All Methods)

Alright, time to get practical. Here are the simplest and speediest ways to buy Zcash.

Method 1: Buy Zcash with Credit/Debit Card (Fastest)

Buying Zcash (ZEC) using a credit or debit card is the quickest and simplest way, making it best suited for new buyers or anyone who needs ZEC without delay. After creating an account on a major exchange like Coinbase or Binance, the purchase can be finished in about 10-15 minutes.

Pros

- Immediate purchase and credit to your wallet

- The interface is straightforward for new users

- Widely available on large exchanges

Cons

- Higher transaction fees (often 1.8%–4%)

- Purchase limits may be enforced

- Requires KYC checks, which can be a concern for users seeking privacy

Full 5-step walkthrough:

- Sign up: Create an account on your preferred exchange (Coinbase, Binance, Kraken, etc.)

- Complete KYC: Verify your identity using required documents (ID, selfie)

- Add card: Input your credit or debit card information for payment

- Buy ZEC: Find “ZEC,” enter the desired amount, and confirm the transaction

- Check transaction: Look at your wallet balance to confirm the ZEC has been added

- Fee Information: Card purchases usually have higher fees compared to other methods because of card processing costs.

Screenshots of the user interface vary by platform but generally show clear options for “Buy Crypto,” card entry fields, and a final confirmation screen.

This method is chosen for speed and ease, not for keeping costs low or maximising anonymity.

Follow Practical, Step-By-Step Instructions To Buy ZEC. Image via Shutterstock

Follow Practical, Step-By-Step Instructions To Buy ZEC. Image via ShutterstockMethod 2: Buy Zcash with Bank Transfer (Cheapest)

Buying Zcash (ZEC) using a bank transfer is one of the lowest-cost ways to purchase, especially when buying larger amounts. This method supports ACH (Automated Clearing House) in the US, SEPA (Single Euro Payments Area) in Europe, and wire transfers globally. Each has different processing times and costs:

- ACH Transfers: Common in the US, often free or low cost, but may take 1-3 business days to finalise.

- SEPA Transfers: Used across Europe; typically fast and low-cost, usually settling within 24-48 hours.

- Wire Transfers: Used internationally, reliable for large sums, but they frequently have higher fees and may take several days.

Pros

- Fees are much lower than using credit or debit cards

- Good for large purchases ($500 to $10,000 and more)

- Direct fiat transfer without using third-party payment companies

Cons

- Longer waiting time for the money to arrive

- Requires verified accounts with full KYC due to financial rules

- Not immediate, making it less convenient for urgent trades

Step-by-step walkthrough:

- Create account: Sign up on an exchange like Kraken or Binance

- Link bank: Follow the platform's steps to connect your bank for ACH, SEPA, or wire transfers

- Deposit funds: Start a transfer from your personal bank account to your exchange wallet.

- Buy ZEC: After the funds arrive, search for ZEC, select the amount to buy, and complete the purchase

- Confirm receipt: Check your exchange wallet to see the ZEC balance

This approach offers both security and cost savings for serious buyers who can wait for their deposits to clear.

Method 3: Buy ZEC Using Existing Crypto (BTC/ETH/USDT)

For users who already own other digital assets, exchanging them (like Bitcoin, Ethereum, or USDT) for Zcash (ZEC) is a common and cheap choice. This method benefits from the lower fees often linked to crypto-to-crypto trades compared to purchases made with standard currency.

Why it’s inexpensive:

Crypto-to-crypto trades generally have lower fees than those charged by bank or card payment processors, especially if the conversion happens on the same exchange. There is no need for a currency conversion, which reduces exchange and deposit fees.

How it works:

Transfer your Bitcoin, Ethereum, or USDT from your external wallet or another exchange to a platform that supports ZEC trading (e.g., Binance, Kraken). Trade the deposited crypto for ZEC using the available spot trading pairs (e.g., BTC/ZEC, ETH/ZEC).

Pros

- Low trading fees compared to fiat transactions

- Settlement is quicker than bank transfers

- An effective way to use existing crypto holdings

Cons

- Requires you to already possess crypto assets

- There is some risk of market change during the conversion process

- Slightly harder than direct fiat buys for beginners

Step-by-step walkthrough:

- Transfer crypto: Send BTC/ETH/USDT to your exchange account if it's not there yet

- Find trading pair: Go to the trading section and find the ZEC trading pair for your crypto

- Place order: Use a market or limit order to exchange your crypto for ZEC

- Confirm balance: Check your ZEC balance in your exchange wallet after the trade is complete

This is the preferred choice for experienced crypto holders looking for the lowest cost and quick access to ZEC.

Method 4: Buy Zcash on P2P Marketplaces

Peer-to-peer (P2P) marketplaces offer a unique process to buy Zcash (ZEC) directly from other users without any company in between. This helps increase privacy and offers freedom. These platforms usually rely on escrow services to protect both the buyer and seller by holding the ZEC until the payment is confirmed.

How escrow works:

When you start a purchase, the seller's ZEC is held safely by the platform's escrow service. Once you send the money to the seller using the payment method you both agreed on, the ZEC is released to your wallet, making the transaction secure.

What to check in seller reputation:

- History of completed trades and total volume

- Ratings and reviews left by other buyers

- Speed of response and clear communication

Steps to buy on P2P:

- Look through the listed offers from ZEC sellers, and filter by payment type and price

- Start an offer and talk to the seller if you need to

- Send the payment using the agreed method (bank transfer, UPI, PayPal, etc.)

- When the seller confirms they received the payment, the platform releases the ZEC from escrow into your wallet

Leave feedback about the transaction

P2P buying is ideal for users who prioritise privacy or need payment methods not typically available on traditional exchanges.

Looking for recommendations? We have curated a list of the best P2P exchanges.

Method 5: Buy Zcash on Decentralised Exchanges (DEX)

Decentralised exchanges (DEX) allow you to acquire Zcash (ZEC) directly from your private crypto wallet without needing a central exchange or KYC identity checks. This provides maximum privacy and control but does require some familiarity with how crypto works.

Requirements:

- A compatible digital wallet (e.g., MetaMask, Trust Wallet)

- An existing holding of another cryptocurrency, like Ethereum or Binance Coin, for the exchange funds to cover network "gas fees," which change based on the blockchain network used

Popular supported DEXs:

- Uniswap

- SushiSwap

- PancakeSwap

- 1inch

Key considerations:

- Slippage: The difference in price that can happen during the swap due to market liquidity; you can adjust this setting to avoid surprise costs

- Gas fees: Network transaction fees; these can be high when the network is busy, which affects the total cost

- Contract risk: Interacting with smart contracts carries some risk, so only use exchanges with a good reputation

Step-by-step guide for wallet setup and swap execution:

- Set up a compatible crypto wallet and add funds using Ethereum or another supported token

- Connect your wallet to the DEX platform

- Select ZEC as the token you wish to receive

- Enter the amount of the token you want to exchange and execute the trade

- Confirm the transaction in your wallet, paying attention to gas fees and slippage settings

- Once confirmed, the ZEC arrives in your wallet. Check your new balance

- DEXs are best for users who value decentralisation and privacy, and who have experience managing crypto wallets and transaction fees.

Platform-Specific Buying Guides

Compare How Major Exchanges Handle ZEC Purchases. Image via Shutterstock

Compare How Major Exchanges Handle ZEC Purchases. Image via ShutterstockThis section breaks down how each major exchange handles Zcash. To kick things off, we’ll start with Coinbase because it’s the most beginner-friendly option and has one of the cleanest buying flows.

How to Buy ZEC on Coinbase (Beginner-Friendly)

Buy Zcash Easily On Coinbase Across Europe. Image via Coinbase

Buy Zcash Easily On Coinbase Across Europe. Image via CoinbaseCoinbase is one of the easiest exchanges for purchasing Zcash (ZEC), particularly for those new to cryptocurrency. The platform has a clear design, simple navigation, and strong security.

Exact UI Labels:

- Begin at “Buy/Sell” on the desktop or mobile app

- Search for “Zcash” or “ZEC” in the search box

- Use the “Buy” button next to the ZEC listing

Mobile & Desktop Differences:

The mobile app allows for biometric login and a fast KYC setup

The desktop site supports more detailed portfolio views and trading tools

Full Screen-by-Screen Steps:

- Log in or create an account, completing the KYC verification process

- Add payment methods, including debit/credit cards or bank accounts

- Go to Buy/Sell, find “ZEC,” and tap or click Buy

- Enter the amount you wish to purchase and select the payment method

- Check the purchase details and complete the transaction

- See your ZEC balance immediately in your Coinbase wallet

- Time Required: About 10-15 minutes for setup and purchase

- Fees: Card payments have fees of approximately 3.99%; bank transfers are cheaper but slower

Coinbase’s ease of use makes it a preferred option for new crypto buyers looking to buy ZEC without complications.

How to Buy ZEC on Kraken (Lowest Fees)

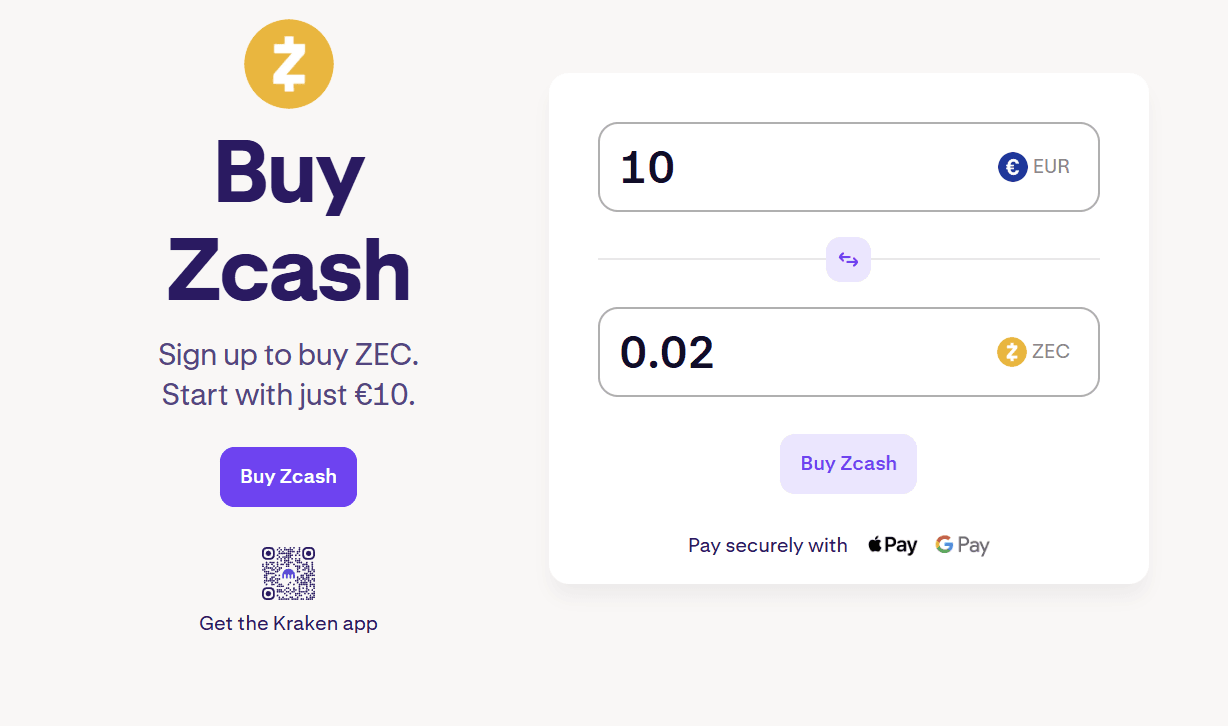

Use Kraken When You Want Low-Fee ZEC Purchases. Image via Kraken

Use Kraken When You Want Low-Fee ZEC Purchases. Image via KrakenKraken is known for offering some of the lowest fees among large cryptocurrency exchanges, which makes it a great choice for Zcash (ZEC) buyers focused on saving money.

Kraken Buy Crypto Module:

- Go to the “Buy Crypto” tab on Kraken’s website or mobile app

- Search for Zcash (ZEC) in the list of available cryptocurrencies

Spot Trading Steps:

- Deposit standard currency using bank transfer options like ACH (US) or SEPA (Europe)

- Go to the ZEC trading pair that matches your deposit (e.g., ZEC/USD)

- Select market or limit orders to purchase ZEC at your chosen price

- Execute the trade and confirm your ZEC balance in your Kraken wallet

SEPA/ACH Instructions:

- Connect your bank account by providing the necessary details and completing KYC

- Start a bank transfer to your Kraken currency wallet, which can take 1-3 business days

- Deposit fees are often low or free with SEPA and ACH, making Kraken suitable for larger investments

Fees:

- Trading fees are generally between 0.16% and 0.26%, much lower than card-based purchases

- Deposits via SEPA usually have no fees; ACH deposits are either free or have minimal charges

Time Considerations:

- Creating an account and completing KYC can take from a few minutes to a few hours

- Bank transfers typically clear within 1-3 business days

- Trades happen instantly once the funds are available

Kraken’s combination of low fees and good banking options makes it a top choice for serious ZEC buyers who want to minimise costs.

How to Buy ZEC on Binance (Most Options)

Use Binance For The Most Ways To Buy ZEC. Image via Binance

Use Binance For The Most Ways To Buy ZEC. Image via BinanceBinance provides many ways to buy Zcash (ZEC), serving users with different experience levels and local availability. It is notable for offering multiple payment choices, including cards, bank transfers, P2P trading, and crypto exchanges.

Binance Express Buy:

- A quick and easy option for beginners

- Supports credit/debit card payments and immediate bank transfers

- Accessed through the “Buy Crypto” tab on desktop or mobile

Binance convert allows fast conversion from one cryptocurrency to ZEC without using the main trading page. Makes purchasing easier if you already own crypto

Payment Methods Supported:

- Card payments for immediate ZEC purchase (fees apply, generally 1.8%–4%)

- Bank transfers with options that vary by country (ACH, SEPA, Faster Payments) for lower-cost deposits

- P2P marketplace for direct trades with other users, which improves privacy and offers payment freedom

- Crypto-to-ZEC trading pairs for users who want to exchange existing digital assets

Step-by-step simplified flow:

- Create and verify your Binance account with KYC

- Add your preferred payment method (card or bank transfer)

- Use “Buy Crypto” or “Convert” to choose ZEC and enter the amount

- Review transaction details, including fees, and finish the payment

- Receive ZEC immediately in your Binance wallet for card payments or after your bank transfer clears

How to Buy ZEC on Bybit (International Buyers)

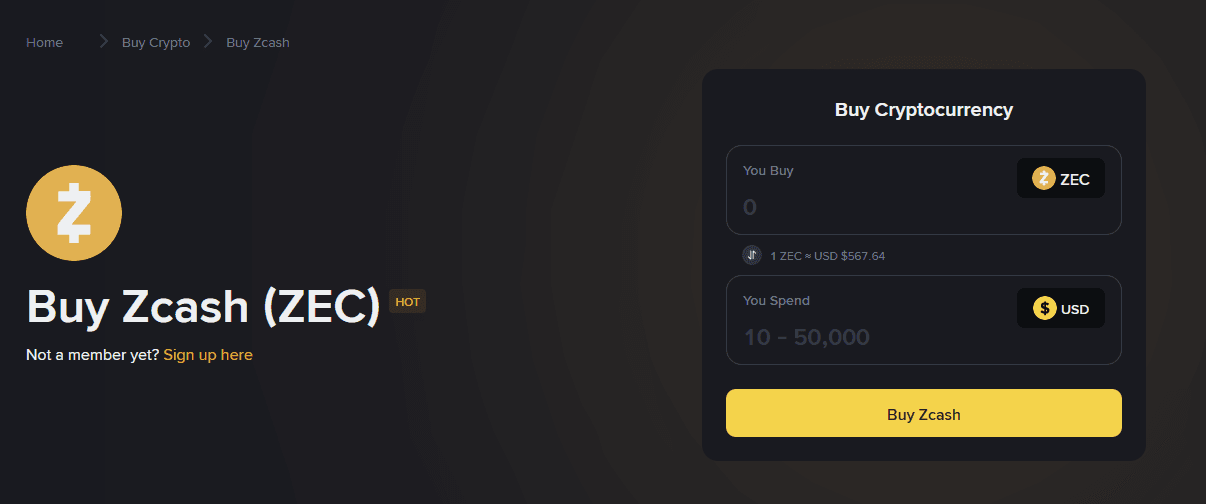

Bybit Gives Global Buyers Flexible Ways To Get ZEC. Image via Bybit

Bybit Gives Global Buyers Flexible Ways To Get ZEC. Image via BybitBybit is a global exchange that is popular among international users for its multiple buying methods and good features.

Express Buy:

- Enables fast purchases of ZEC using credit/debit cards without needing advanced trading knowledge

- Supports many standard currencies for global users

- Available on the Bybit website or mobile app under the “Buy Crypto” section

P2P Trading:

- Allows buyers to connect directly with sellers in many countries

- Offers a variety of payment methods, including bank transfer, PayPal, and local payment systems

- Uses escrow to protect both parties during transactions

Crypto Swaps:

Allows users with existing crypto to immediately swap assets for ZEC within the platform, and reduces the need for multiple transactions and resulting in lower fees

Step-by-step for Express Buy:

- Register and complete KYC verification

- Select “Buy Crypto” and choose ZEC

- Select credit/debit card as the payment method and enter the amount

- Review the fees and confirm the purchase

- ZEC is added to your Bybit wallet instantly

- Bybit's mix of express buy, P2P options, and crypto swaps makes it a flexible platform suitable for global buyers with different preferences and payment needs.

Learn how to trade on Bybit in just a few easy steps.

Mobile App Buying Guide (iOS & Android)

Buy ZEC End-To-End Straight From Your Phone. Image via Shutterstock

Buy ZEC End-To-End Straight From Your Phone. Image via ShutterstockIf you prefer buying crypto from your phone, this is the section to follow. Let’s start with the Coinbase app, which gives you a straightforward path to buying ZEC.

Coinbase Mobile Guide

The Coinbase mobile app provides a simple experience for buying Zcash (ZEC) with features designed for ease of use and security. After opening the app, you can log in using biometric verification (Face ID or fingerprint), making regular access fast and safe.

Navigating the app:

- Tap the “Trade” button at the bottom

- Search for “Zcash” or “ZEC” in the search bar

- Select ZEC and tap “Buy”

Mobile-specific KYC flow:

New users can complete the identity check directly in the app by taking and uploading photos of their ID and a selfie

The process is easy and smooth for use on a mobile device

Buying steps:

- Add a payment method, such as a debit card or bank account

- Input the exact purchase amount for ZEC

- Confirm the payment method and transaction fees

- Authorise purchase with biometric or password verification

- View purchased ZEC in your mobile wallet immediately

Coinbase’s mobile app balances ease of use with security, appealing to both new users and frequent traders. And if you are already on Coinbase, then here are the steps to cash out seamlessly.

Kraken Mobile Guide

Kraken’s mobile app is just as good as its desktop site while improving convenience for mobile use, perfect for buying Zcash (ZEC) when you are not at your computer.

Navigating Kraken Mobile:

- Open the app and tap the “Funding” tab to deposit standard currency through ACH (US) or SEPA (Europe)

- After funds are available, tap “Trade” to look for ZEC trading pairs

- Select “ZEC” and your preferred quote currency, then choose “Buy”

Mobile-specific KYC flow:

The identity check (KYC) is smoothly integrated, letting you upload and confirm identity documents using your phone's camera

Biometric login is supported for secure and fast access

Step-by-step buying process:

- Deposit standard currency through your linked bank accounts using ACH or SEPA

- Once the money settles, go to the ZEC/USD or ZEC/EUR trading pair

- Place a market or limit buy order for ZEC

- Confirm the transaction and check your new ZEC balance

- Kraken’s mobile app helps users make purchases with low fees in a reliable, easy-to-use way, suitable for all types of traders looking to save money.

Binance Mobile Guide

Binance’s mobile app offers full functionality to buy Zcash (ZEC) with multiple payment options and simple navigation.

Navigating the app:

- Open the Binance app and tap “Buy Crypto” on the main screen

- Choose your preferred payment method: credit/debit card, bank transfer, P2P, or existing crypto balance

- Search for “ZEC” in the token list and select it

Mobile-specific KYC flow:

- Finish the KYC verification by scanning your ID and taking a selfie within the app

- Biometric login supports Face ID or fingerprint authentication for convenience and security

Step-by-step buying process:

- Select “Buy Crypto” and choose the payment method (card, bank, or P2P)

- Enter the amount of Zcash you want to buy

- Review the fees and the exchange rate details

- Confirm the payment and complete any required security checks

- ZEC tokens will appear in your Binance wallet immediately for card payments or after bank transfers clear

- The Binance mobile app includes all major buying methods in one place, making it flexible for many users in various regions.

Regional Payment Options

Match Your ZEC Purchases To Local Payment Rails. Image via Fabrick

Match Your ZEC Purchases To Local Payment Rails. Image via FabrickDifferent regions support different payment rails, so your buying experience can vary a lot depending on where you live. Let’s start with the US, since it offers the widest set of options for Zcash buyers.

United States (ACH, Wires, Cards, Apple Pay)

In the US, buyers can get Zcash (ZEC) using ACH bank transfers, wire transfers, credit/debit cards, and increasingly Apple Pay.

- Fees & speed: ACH is often free or low cost, takes 1–3 days; wires are faster but can cost $20–$25 per transfer; card fees are around 2%–4% and instant; Apple Pay fees are similar to cards and instant.

- Exchange availability: All major exchanges, including Coinbase, Binance, and Kraken, are fully operational in the US.

- Local restrictions: Users must complete KYC; crypto rules are always changing, especially for privacy coins like ZEC, always check the exchange’s current rules.

Europe (SEPA, SOFORT, iDEAL)

European users can use SEPA for quick, affordable cross-border transfers, SOFORT for immediate bank payments (Germany), and iDEAL for fast Dutch payments.

- Fees & speed: SEPA is free or less than $1, usually next-day; SOFORT and iDEAL are instant, with very small fees.

- Exchange availability: Kraken, Binance, and Bitstamp are all active across Europe, supporting local payment systems.

- Local restrictions: Identity proof is required; some exchanges focused on privacy have limits under EU money laundering rules.

United Kingdom (Faster Payments)

The UK’s Faster Payments system allows for near-immediate transfers for ZEC purchases.

- Fees & speed: Typically free; transactions clear in minutes.

- Exchange availability: Supported on Binance, Kraken, Bitstamp, and Coinbase.

- Local restrictions: KYC is required; privacy coins have been reviewed, but ZEC is still widely available.

Asia (UPI, PayNow, Local Bank Transfers)

UPI (India) and PayNow (Singapore) offer instant, low-fee local payments for ZEC.

- Fees & speed: Generally free or less than $1, takes seconds to minutes for settlement.

- Exchange availability: Binance, local exchanges like WazirX (India), and Huobi support these options.

- Local restrictions: Regional crypto laws vary; India’s stance is changing, and Singapore requires following regulatory rules.

LATAM (PIX, SPEI)

PIX (Brazil) and SPEI (Mexico) provide quick conversions from standard currency to crypto for ZEC.

- Fees & speed: Usually free or less than $1 per transfer, real-time or within hours.

- Exchange availability: Binance, Mercado Bitcoin (Brazil), Bitso (Mexico), and local platforms.

- Local restrictions: Rules change by country; KYC/AML may limit access to privacy coins.

Australia (POLi, OSKO)

Australians buy ZEC using POLi or OSKO for immediate and low-cost bank payments.

- Fees & speed: POLi/OSKO are usually free, with real-time settlement.

- Exchange availability: Kraken, Binance, and Independent Reserve support these methods. Local restrictions: Crypto rules are clear, and KYC is standard. Privacy coins are legal but monitored. Here is a complete list of the top crypto exchanges in Australia

In each region, the best mix of fees, transaction speed, and available exchanges depends on the payment method and the legal environment. Always use trusted platforms and confirm ZEC support before adding money to your account.

Exchange Comparison: Where to Buy ZEC

Side-By-Side Analysis Showing Which Exchanges Offer Best Zcash Access. Image via Shutterstock

Side-By-Side Analysis Showing Which Exchanges Offer Best Zcash Access. Image via ShutterstockHere is a side-by-side comparison of the best exchanges for buying Zcash (ZEC), highlighting fees, KYC rules, payment options, minimum purchase amount, and user ratings:

| Exchange | Trading Fees | KYC Requirement | Payment Methods | Minimum Purchase |

|---|---|---|---|---|

| Binance | 0.1%–0.2% | Yes | Card, bank, crypto, P2P | $10 equivalent |

| Coinbase | 3.99% (card), 0.5%–2% (spot) | Yes | Card, bank (ACH, wire, SEPA), crypto | $2–$10 |

| Kraken | 0.25% 0.40% | Yes | ACH, SEPA, card, crypto | $10 equivalent |

| Bybit | 0.1% | Yes | Card, P2P, crypto swap | $10 equivalent |

| Bitget | 0.1%–0.2% | Yes | Card, P2P, bank, crypto | $10 |

| KuCoin | 0.1%–0.2% | Optional | Card, crypto, P2P | $5 |

| Crypto.com | 0.250%/ 0.500% | Yes | Card, bank, crypto, wire | $1 |

| Gemini | 1.49% | Yes | ACH, card, bank wire, crypto | $5 |

| OKX | 0.08%–0.2% | Yes | Card, crypto, P2P | $10 |

| Gate.io | 0.2% | Yes | Card, crypto | $5 |

| Uphold | 1.5%–3% | Yes | Card, bank, crypto | $1 |

Notes:

- Fees can differ based on the payment method (card versus bank versus crypto, versus P2P)

- KYC is required on most major centralised exchanges

- The smallest purchase amounts are typically between $1–$10 USD worth

Fees & Speed by Region

- US: Quickest with cards; least expensive with ACH.

- Europe: SEPA transfers are the fastest and lowest cost; SOFORT/iDEAL are instant for supported banks.

- Asia (India, Singapore): UPI/PayNow are instant and low fee; bank transfers are the slowest but best for large amounts.

- LATAM: PIX/SPEI are the fastest for local users; fees are low.

- Australia: POLi/OSKO provide instant access.

Exchange Availability

Zcash (ZEC) is listed on most major global exchanges, including Binance, Coinbase, Kraken, KuCoin, Bybit, OKX, Bitget, and Crypto.com. Some exchanges (e.g., Coinbase, Binance) also allow withdrawals to shielded Zcash addresses as recommended.

Local Restrictions

Privacy coins may face extra review in some areas (such as the US, Europe, and Asia). ZEC remains widely listed because of its option for transparent transactions. Always check if ZEC is supported in your country and if there are any limits on withdrawals or use.

Real Cost Examples — What $100 Buys

See Exactly How Much ZEC You Get For $100. Image via Shutterstock

See Exactly How Much ZEC You Get For $100. Image via ShutterstockWhen you buy Zcash (ZEC), it's important to know how much money actually turns into ZEC after all the fees. Here are clear examples for card buys, bank transfers, and crypto conversions.

Card Purchase Cost Breakdown

Example: A $ 100 card purchase on Coinbase or Binance.

- Card purchase fee: Usually 3.99% on Coinbase or about 2%–4% on Binance.

- Net buy: With a 4% fee on a $100 transaction, $96 goes toward buying ZEC, plus a small markup on the exchange rate (the spread).

- If ZEC costs $533.68 (Nov 2025): $96 / $533.68 is about 0.18 ZEC (the actual amount is a little lower after the spread).

Bank Transfer Cost Breakdown

Example: A $100 bank transfer (ACH/SEPA).

- Bank transfer fee: Usually $0 on Coinbase/Kraken SEPA or ACH; rarely more than $1.

- Trading fee: 0.16%–0.5%.

- Net buy: For a $100 transfer, $99.80 goes toward buying ZEC. $99.80 / $533.68 is about 0.187 ZEC.

This is why we advise bank transfers to get the most ZEC per dollar. You save even more on larger buys (like $500 or $1,000).

Crypto Conversion Example

Example: Swapping $100 worth of Bitcoin or Ethereum for ZEC on Binance.

- Fee: Starts at 0.1% (for crypto-to-crypto spot trades), plus withdrawal fees if you move funds in or out.

- Net buy: $99.90 / $533.68 is about 0.187 ZEC.

Since crypto swaps avoid bank processing fees, they cost the least overall.

So how do we interpret this?

For every $100, you get up to 4% more ZEC using bank transfers or crypto swaps instead of cards. At $500 or $1,000, these small differences add up a lot, especially for people who buy often.

Fees Breakdown — What You Actually Pay

Understand Every Fee That Affects Your ZEC Purchase. Image via Shutterstock

Understand Every Fee That Affects Your ZEC Purchase. Image via ShutterstockWhen you buy Zcash (ZEC), your total cost includes more than just the listed price. Here is a clear breakdown of the different fees you find across exchanges and payment methods, along with tips to pay less:

Trading Fees

- Spot trading fees: These fees range from 0.1%–0.5% on major platforms like Binance and Kraken.

- Market versus limit orders: Some exchanges offer lower fees if you use limit orders, but the price difference is usually small (0.02%–0.1%).

Deposit/Withdrawal Fees

- Bank deposit fees: ACH and SEPA transfers are usually free; wire transfers might cost $20–$25.

- Card deposit fees: These are 2%–4% of the transaction amount.

- Crypto deposit: This is free or costs less than $1 in network fees.

- Withdrawal fees: Fees change depending on the exchange. ZEC withdrawals can range from 0.001 ZEC to 0.005 ZEC (typically $0.50–$2.50, depending on network load or the type of address you use).

Spread Costs

The “spread” is the difference between the price at which you can buy and the price at which you can sell. Major exchanges often charge a spread of 0.25%–1%, which is already included in the price quote. This cost is usually highest when you use instant-buy features and lowest in spot trading.

Conversion Fees

Platforms like Coinbase or Binance Convert may charge 0.5%–1% to swap one crypto for another, especially when you use instant or quick-buy tools. On the other hand, P2P exchanges and DEX platforms include their fees in the offer price or swap rates, sometimes adding slippage risks in DEXs (0.25%–2% based on network funds).

How to Minimise Fees

- Use bank transfers instead of cards to lower your deposit costs.

- Trade on spot markets, not instant buy/sell, to avoid higher spreads.

- Convert between cryptos on platforms that have low fee schedules.

- Withdraw larger amounts at once to save on fixed network fees.

Pay attention to slippage settings on decentralised platforms, and set limits to avoid unexpected price losses.

Understanding these fee types helps you get the most ZEC for your money and avoid unnecessary costs on every transaction. You should also check out our list of the top low-fee crypto exchanges.

After You Buy: How to Store ZEC Safely

Choose The Right Wallet Setup To Keep Your ZEC Safe. Image via Shutterstock

Choose The Right Wallet Setup To Keep Your ZEC Safe. Image via ShutterstockStoring Zcash (ZEC) in a secure way is key to protecting your money and privacy. ZEC has special privacy features, so picking the right wallet is important based on whether you want ease of use or full control.

Custodial Exchange Wallets

A custodial exchange wallet is where a third party, typically a cryptocurrency exchange, holds and manages the private keys to your digital assets on your behalf. Wallets managed by exchanges like Binance, Coinbase, Kraken, and Gemini are examples.

Pros

- Simple to use with fast access

- Password and 2FA recovery options

Cons

- You rely on a third-party exchange that controls your private keys

- Withdrawals may be limited during outages or new policy changes

Software Wallets (Zcash-specific wallets)

Software wallets are digital applications that allow users to manage, send, and receive cryptocurrencies by storing the private keys necessary to access their assets on the blockchain. They are typically free, easy to use, and run on internet-connected devices, which classifies them as "hot wallets". But, software wallets can be either custodial or non-custodial (self-custody), depending on the specific service or application you use.

- Nighthawk: A mobile wallet that supports both private (shielded) and public (transparent) addresses.

- ZecWallet: A full-node and lite desktop wallet that offers private features and reliable backup controls.

- YWallet: Focuses on privacy, works well on mobile and desktop, and has a simple screen.

- Zcash Official Wallet (Zashi): Has the latest privacy and security updates from Electric Coin Company, available for Android/iOS with strong shielded support.

Key benefits:

- You have full control of your private keys and backups.

- The wallet supports shielded addresses for private transactions.

- It offers extra features like seed backup, multi-device sync, and privacy options.

Hardware Wallets

Hardware wallets are physical electronic devices built solely to store a user's private keys offline, providing the highest level of security against online threats like malware and hacking. They require physical confirmation to sign transactions, ensuring keys never leave the secure environment of the device.

- Options: Ledger Nano S/X/Stax, Trezor, Ellipal.

- Security: Private keys stay offline, protecting them from online attacks.

- Compatibility: They work with ZecWallet, YWallet, and other apps for managing private or public ZEC.

- Best for: Long-term holders, larger portfolios, and maximum security.

Mobile Wallets

Mobile wallets are smartphone applications that store private keys on your phone, offering convenience for managing cryptocurrency on the go for daily transactions. They are more vulnerable to security risks if the phone is lost, stolen, or compromised by malicious apps or public Wi-Fi.

- Features: Support for shielded addresses, biometric login, and backup phrases.

- Options: Trust Wallet, MetaMask (with official Snap plugins), Zcash Official Wallet (Zashi app).

- Best for: Encrypted payments on the go and Web3 integration.

Unified, Transparent, Shielded Address Differences

Zcash uses different address types: Transparent (t-addresses) function like Bitcoin addresses, showing all transaction details publicly on the blockchain, while Shielded (z-addresses) use zero-knowledge proofs to completely obscure transaction amounts, sender, and recipient data for enhanced privacy. A Unified Address (UA) can receive funds from both transparent and shielded addresses, automatically routing them to the most private location the wallet supports for better usability.

- Transparent (t-address): Like Bitcoin, this is public and traceable, so use it if you need full transparency.

- Shielded (z-address): Hides the sender, receiver, and amount, best for privacy.

- Unified addresses: These combine both types; we recommend them for flexibility (all major Zcash wallets support them).

Full Withdrawal Walkthrough

- Log in to your wallet or exchange.

- Start a ZEC withdrawal to your chosen wallet address (pick “unified” or “shielded” for privacy).

- Check the address and network compatibility.

- Enter your password, 2FA, or biometrics.

- Check your ZEC balance in the wallet.

Pro tip: Always back up your seed phrase securely offline and never share private keys or recovery phrases. For the most safety, use hardware wallets for large amounts and software wallets for daily access.

If you're looking for a Zcash wallet, read our article highlighting our top picks.

Security Best Practices

Security starts at the account level, long before you think about hardware wallets or backups. Here’s what to tighten right away.

Account-Level Security

Two-Factor Authentication (2FA)

Always turn on 2FA for exchange accounts and important services. This usually means typing a code from an app (Authy, Google Authenticator) or using a physical device (YubiKey). It stops attackers from getting into your accounts even if they have your password.

Hardware-based 2FA (YubiKey) is safer than text messages or app codes and also protects password managers and email accounts you use for crypto.

Unique, Strong Passwords

Never use the same password for more than one account. Use a password manager like Bitwarden, 1Password, or Dashlane to create and store unique, long, complicated passwords.

Set your password manager to need a master password and, ideally, a hardware key for extra login protection.

Regular Software Updates

Update wallets (mobile, desktop, browser app), exchange apps, and hardware wallet software as soon as updates are out. Official releases fix security problems, add features, and fix bugs. Always download from official sites; check digital signatures if you can.

Tighten Your ZEC Security With Simple Habits. Image via Shutterstock

Tighten Your ZEC Security With Simple Habits. Image via ShutterstockSeed Phrase Security

Offline Storage

Your seed phrase (recovery phrase) allows access to your money. Write your phrase down with permanent ink on paper, or use special fireproof, waterproof metal wallets (e.g., Billfodl, Cryptosteel).

Never store your seed in emails, protected documents on the cloud, as it is easy for hackers to find.

Verifying Backups

Before you delete or reset your wallet app or hardware device, make sure your backup phrase is correct and complete. Practice restoring your wallet on a second device to confirm it works before you destroy old backups.

Physical Security

Store backup devices or written seed phrases in a safe, ideally split between two secure places to protect against disasters. Never share your seed phrase with anyone; exchange support staff will not ask for it.

Wallet Security

Shielded Zcash Addresses

Z-addresses on Zcash give you privacy as the sender, receiver, and transaction amount are hidden on the blockchain. Use shielded addresses whenever the wallet supports them, both for storing and sending ZEC. You help network privacy by keeping funds shielded when possible.

Encryption & Biometric Protection

Desktop wallets and many mobile apps (Nighthawk, ZecWallet, YWallet) have wallet encryption features. Turn them on and keep your device's disk or phone encrypted. Use Face ID, fingerprint scanning, or strong PINs so that unauthorised users cannot access your funds if your device is lost or stolen.

Network Safety

Never use public Wi-Fi for crypto transactions. VPNs encrypt your traffic and hide your activity from people watching; Mullvad and ProtonVPN are respected for privacy. On mobile, check the privacy settings and permissions for each app you install.

Transaction Safety

Address Whitelisting & Confirmation

On exchanges like Kraken, turn on withdrawal address whitelisting: only addresses you pre-approve (and time-lock) can receive funds, which stops attackers from changing the withdrawal destination.

With hardware wallets, the recipient address and payment details appear on a physical screen; confirm everything matches before clicking “Send.”

Address Rotation & Non-Reuse

Every new recipient should get a new address, ideally a shielded one. Do not use old addresses again, as this can create links between your transactions and hurt your privacy.

Additional Security Tools

- YubiKey: Adds hardware protection to exchanges, password managers, and email accounts. Even if your password is stolen, only someone with your physical key can log in.

- Malwarebytes/Antivirus: Check your computers and devices often for malware, trojans, and keyloggers that can steal passwords or track what you type.

- Password Managers: Keep all your login details and private notes organised, encrypted, and safe from browser problems or typical desktop hacks.

- VPN (Virtual Private Network): Encrypts all your internet traffic and hides your IP address, reducing targeted network attacks when you do crypto tasks.

Beginner Trading Strategies for ZEC

Start Trading ZEC With Simple, Beginner-Friendly Strategies. Image via Shutterstock

Start Trading ZEC With Simple, Beginner-Friendly Strategies. Image via ShutterstockTrading Zcash (ZEC) is simpler and safer when you use basic, proven strategies. Here are four key ways to start:

Dollar-Cost Averaging (DCA)

Invest a set amount of money in ZEC regularly (daily, weekly, monthly), no matter the price.

- Benefits: DCA helps lower the effect of price swings, smooths out your average purchase price over time, and takes away the stress of trying to “time the market.”

- Platforms like Kraken, Binance, and Coinbase offer automatic recurring buy tools. Set it up, pick your schedule, and let it work.

- Pro Tip: Use DCA calculators on exchanges to see how much you could have made if you had invested regularly in the past.

Buy and Hold (HODL)

Buy ZEC and simply hold it for months or years, ignoring short-term price changes.

- Benefits: This is a simple, low-stress strategy. Historically, people who held through price drops often made money from later price comebacks, especially with privacy-focused coins like ZEC.

- Pro Tip: Use shielded or hardware wallets for long-term holdings to ensure the best privacy and security.

Limit vs Market Orders

- Market Orders: These execute instantly at the best price available; they are simple for beginners and fast for high-volume trades.

- Risk: There is a chance of slippage in low-volume or volatile markets; you might buy higher or sell lower than you expected.

- Limit Orders: You set a specific price to buy or sell; the order only executes at your chosen price or better.

- Benefits: You have more control over the price, which is better for volatile assets like ZEC. It cuts down on unwanted surprises.

- Pro Tip: For larger buys or to catch big dips, use limit orders below recent support levels to get better deals.

Understanding Volatility

Zcash, like most cryptocurrencies, is very volatile; fast price spikes or drops can happen due to news, new rules, or large trades. Use stop-loss features (either manual or automatic) to limit possible losses. Do not invest more than you can afford to lose. And most of all, do not keep all your money in ZEC; hold a mix of assets to lessen the impact of a downturn.

Tax Considerations

Know The Basic Tax Rules Before You Trade Or Spend ZEC. Image via Shutterstock

Know The Basic Tax Rules Before You Trade Or Spend ZEC. Image via ShutterstockTax Treatment in US/EU/ROW

- United States: Zcash is treated as property; every trade, sale, or conversion is a taxable event. Gains are subject to short- or long-term capital gains tax. Income from staking or mining is taxed as regular income.

- European Union: Like other cryptocurrencies, Zcash is seen as a taxable digital asset. You must keep detailed records of all trades. In Germany, a key rule is that long-term gains (held for more than 12 months) are tax-free, even for privacy coins.

- Other Regions: Most active economies, like Australia, Canada, the UK, and Singapore, require reporting of crypto asset gains. Some countries (e.g., UAE, Portugal) have no or limited crypto taxes, but your residency status matters a lot.

Record-Keeping Requirements

- Detailed records: Users must document every buy, sell, conversion, transfer, and income source that involves ZEC, even between their own wallets if the value changes.

- Exchanges report activity: Global exchanges, especially those in the US/EU/UK, now regularly report user trading and withdrawal records to local authorities.

- Tools: Use crypto tax reporting platforms (Koinly, CoinTracker, CryptoTaxCalculator) to automatically sync transactions and create the required tax forms.

Common Mistakes to Avoid

Avoid The Classic Errors New ZEC Buyers Often Make. Image via Shutterstock

Avoid The Classic Errors New ZEC Buyers Often Make. Image via ShutterstockBefore you make your first Zcash purchase, it helps to know where people usually go wrong. The most common issues show up in security.

Security Mistakes

Some of the most common security mistakes are:

- Neglecting Shielded Transactions: Many people only use public (transparent) addresses and miss out on the privacy Zcash (ZEC) offers. Always use private (shielded) transactions when possible to get the most privacy and network security.

- Poor Seed Phrase Management: If you lose your recovery phrase or fail to back it up, you can permanently lose your money. Store seeds offline, test your backups, and never share them, even with support staff.

- Reusing Addresses Too Much: Using the same wallet address repeatedly or linking public and private funds by time/amount allows for tracing, rotating addresses and avoiding reuse for better privacy.

- Using insecure devices: Trading or storing coins on shared or public devices exposes you to malware and keyloggers. Always use dedicated, secure, and up-to-date hardware for crypto tasks.

Financial Mistakes

Security is not always the most common mistake made when it comes to crypto. Being aware of the fundamentals and giving into your emotions is equally important.

- FOMO and Emotional Investing: Buying just because of price spikes, hype, or fear of missing out often leads to bad entry points and regret. Base your decisions on your own research, not market trends.

- All-In Bets on ZEC: Holding only Zcash or putting too much money into one token exposes you to higher risk. Diversify among different cryptos and asset types.

- Ignoring Stop-Losses: Crypto prices move fast. Failing to set stop-loss orders can cause quick, heavy losses in market drops.

- Complicated Strategies Without Experience: Avoid leverage, margin, options, or new, untested platforms as a beginner. Stick to simple buy, hold, dollar-cost averaging, and straightforward swaps until you are proficient.

Technical Mistakes

And of course, never forget to double-check the software aspects.

- Typos and Wrong Addresses: Sending ZEC to a wrong or invalid address is usually final. Always copy-paste and double-check wallet addresses, especially on mobile.

- Falling for Scams: Do not buy ZEC through social media, random direct messages, or unknown websites. Scams and fake tokens are common, so confirm contract addresses and check token symbols on official Zcash pages.

- Not Updating Wallet Software: Old wallet apps can be incompatible or unsafe. Update regularly and follow Zcash.org’s security announcements.

- Not Using Test Transactions: For large amounts, send a small test transaction first to confirm the process and network are working correctly.

Platform & Withdrawal Mistakes

- Ignoring Listing Risk: Privacy coins like ZEC are sometimes removed from major exchanges due to policy or rule changes. Withdraw regularly and spread your holdings across self-custody wallets and reliable exchanges.

- Blind Trust in Centralised Exchanges: Identity checks and regulatory pressure can lead to sudden freezes or data leaks. Always have a self-custody wallet as a backup.

Avoiding these common errors will help you secure your ZEC, protect your privacy, and get safer long-term results.

Troubleshooting Common Issues

Fix The Most Common Problems When Buying Or Moving ZEC. Image via Wavex Technology

Fix The Most Common Problems When Buying Or Moving ZEC. Image via Wavex Technology This section helps you fix the problems that disrupt the buying process. The most frequent one is a simple but annoying payment rejection.

Purchase Declined

Causes: Your card or bank rejected the purchase, identity verification failed, you went over exchange limits, or regional rules blocked the buy.

Fixes:

- Double-check your funding source and make sure international use is enabled on your card.

- Confirm your ID verification is complete and up-to-date.

- Try buying smaller amounts or using a different payment method.

- Contact the exchange support team for the specific error codes.

- On decentralised platforms, confirm your wallet is connected and you have enough money for the minimum buy.

Verification Rejected

Causes: ID details do not match, document photos are blurry, or the type of ID is not supported.

Fixes:

- Use documents that meet the exchange's requirements (passport, national ID, driver’s license).

- Retake photos in good light, avoiding reflections.

- Make sure selfies and details clearly match your documents.

- If rejected, repeat the identity check step or contact the exchange directly.

Withdrawal Not Arriving

Causes of this could be:

- Exchange wallet problems.

- The blockchain network is slow.

- Withdrawal is stopped for legal or technical reasons.

- You tried to send an unconfirmed or incorrect transaction.

Fixes:

- Check the exchange wallet and network status pages for alerts (Binance and Kraken post up-to-date notices).

- Confirm you sent the money to the correct address, and if it was a shielded transaction, that both the sender and receiver support it.

- Wait for blockchain confirmations, as Zcash needs at least one confirmation before the funds can be spent.

- For stuck withdrawals, contact exchange support with your transaction ID.

Wallet Not Showing ZEC

Causes of this could be:

- Wallet software is not synced.

- Wallet version is old.

- You mistakenly sent money to an unsupported address type.

- Wallet files are damaged, or blockchain data is missing.

Fixes:

- Rescan your wallet or restart the app to force a blockchain sync.

- Update to the latest wallet version; some wallets, like Brave and Nighthaw, have reported screen balance errors after updates. Also, use special troubleshooting panels to reload the balance.

- Verify you used the correct deposit address (private vs. public).

- Check a blockchain explorer to confirm the transaction exists on the chain.

By checking identity, payment channels, blockchain confirmations, wallet versions, and exchange announcements, most issues are solved quickly. If all else fails, escalate to technical support or official Zcash forums with all the details.

Disclaimer: Cryptocurrency is highly volatile and inherently risky. You should conduct your own research (DYOR) and consult a qualified financial advisor before making any investment decisions. You may lose some or all of your invested capital. The author and publisher are not responsible for any losses incurred.

Advanced Buying Options

Explore VPN, OTC, And Mining As Advanced Ways To Get ZEC. Image via Shutterstock

Explore VPN, OTC, And Mining As Advanced Ways To Get ZEC. Image via ShutterstockAdvanced buyers sometimes need methods that bypass regional limits or tighten privacy. That’s where VPN-based purchasing comes in.

Buying with VPN

A Virtual Private Network (VPN) encrypts your internet traffic and hides your IP address. This makes your exchange activity and network location private, even from your internet company or possibly strict local authorities.

Advantages:

- Protects privacy against location tracking and data profiling.

- Let's you access exchanges or decentralised platforms that are not available in your region.

- It is essential in countries with limited or monitored internet access.

How to do it right:

- Use paid services with a proven policy against logging your data: e.g., Mullvad, ProtonVPN.

- Always confirm DNS/IP leak protection is active before logging in to exchanges.

- Avoid VPNs that exchanges sometimes flag (these may trigger extra identity checks).

Caveats:

- Do not use VPNs to break local laws (know the legal limits).

- Using a VPN does not bypass full identity checks or platform rules for large trades.

Buying with Leverage (Not Recommended)

Leverage lets you borrow money to make your bet on ZEC’s short-term price bigger (e.g., 2x, 5x, 10x). This is offered on platforms like Binance Futures and Bybit.

Why not recommended?

- Leverage greatly increases risk; a market move of 10–20% can close your position and make you lose your money.

- Volatile assets like ZEC have sharp swings, automatic closures and margin calls are frequent.

- This is only suitable for experienced traders who use strict stop-loss rules and proper position sizing.

Risks:

- You can lose more money than you deposit on margin.

- Interest and funding fees reduce profit (or add to losses) over time.

- Forced liquidations can finalise big losses.

Pro Tip: Stick to spot trading and dollar-cost averaging instead, as leverage is not for most investors.

Mining/Earning ZEC

Earn through staking reward programs on some exchanges, decentralised finance (DeFi) liquidity pools (if you want on-chain exposure), or directly as payment for goods or services. Freelancers can also accept ZEC for payments on privacy-focused gig platforms.

Mining

- Zcash mining uses the Equihash algorithm, which still works well for GPUs (it is not resistant to ASIC hardware).

- It requires a lot of money to start, a technical setup, and knowledge of mining pools.

- Block rewards (currently 1.5625 ZEC per block as of 2025), plus transaction fees.

- And how profitable mining is depends on your hardware, power cost, and the current price.

OTC Purchases ($100K+)

Over-the-counter (OTC) trades are direct, off-exchange deals made for purchases of $100,000 or more.

Why use OTC:

- It stops large orders from changing the market price.

- It provides personal support, settlement, and custody options.

- It offers better privacy for wealthy individuals or large organisations.

How to access:

- Contact the OTC desks of exchanges (Binance, Kraken, Cumberland, FalconX).

- You need an institutional account setup, advanced identity checks, and large wire transfers.

- Negotiate rates and confirm the settlement speed.

Zcash Price & Market Analysis

To understand where Zcash stands today, here’s a clear look at the latest market conditions.

Current Market Overview

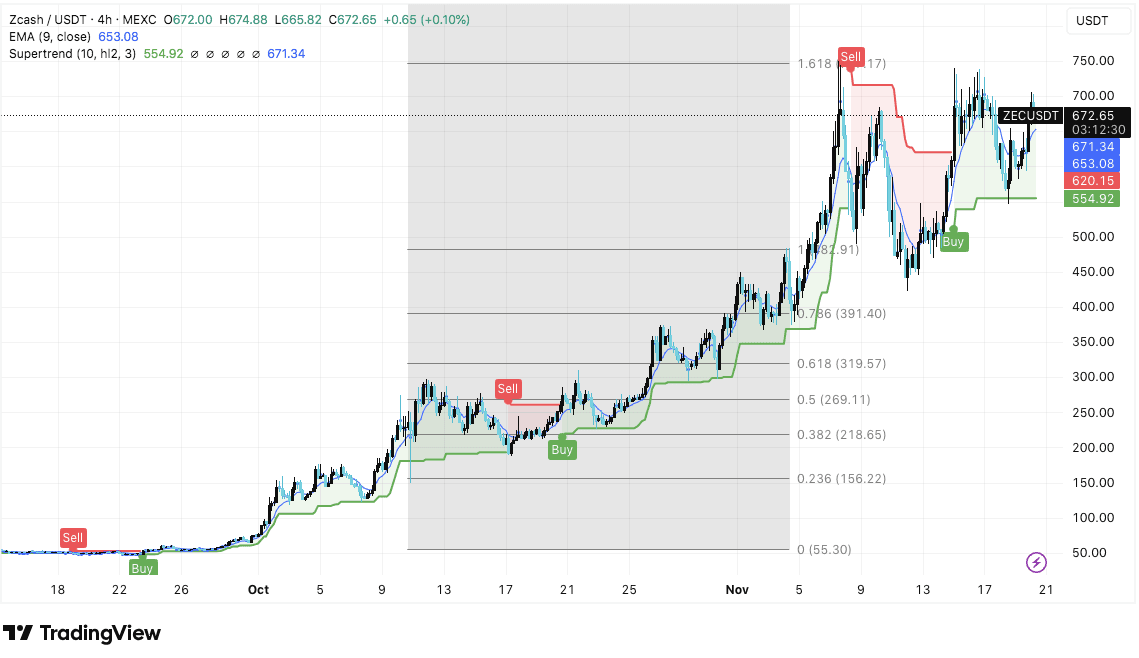

Analytical Summary Explaining Zcash Market Behavior And Price Trends. Image via TradingView

Analytical Summary Explaining Zcash Market Behavior And Price Trends. Image via TradingViewAs of November 2025, Zcash (ZEC) trades within the band of $630–$670, after a huge 1,100%+ rise in 2025. The coin has been one of the top performers in the privacy and layer-1 categories. It’s been one of the strongest performers in both the privacy-coin and layer-1 categories, helped by the autumn halving and a clear pickup in institutional interest.

Overall sentiment leans positive. ZEC is still volatile day-to-day, but it’s holding above key technical levels and has closed green on roughly 73% of the past month’s trading days.

Trading activity has also climbed since the halving. Supply has tightened, and shielded transactions now make up nearly 30% of all circulating ZEC. Liquidity on major exchanges remains healthy for both spot and OTC trades, with only brief withdrawal pauses during peak volatility.

Note: This live ZEC price ticker from CoinGecko auto updates.

Price Drivers

The primary drivers of the crypto market are a combination of supply and demand dynamics, highly influenced by market sentiment, regulatory developments, and broader macroeconomic conditions. Let's take a look at how they affect the price of ZEC.

- Halving Event: The second Zcash halving occurred on November 23, 2024, which cut block rewards by 50% from 3.125 ZEC to 1.5625 ZEC per block. Historically, halvings push the price up for months as scarcity increases.

- Privacy Demand: Clearer rules in regions like the U.S. and E.U., combined with new privacy tech (like the Zashi wallet), have accelerated adoption by institutions and everyday users. Approximately 28% of ZEC in circulation is now held privately in shielded pools, which significantly reduces the available supply and puts upward pressure on prices.

- Institutional Accumulation: Firms and funds are actively buying ZEC as a strategic reserve and a hedge against inflation. Cypherpunk Technologies, backed by Winklevoss Capital, has purchased $18M more in Zcash, aiming to raise its ZEC holdings to at least 5% of the total supply.

- Macro Volatility & Bitcoin Correlation: Zcash's price has become increasingly independent from Bitcoin's price moves, often rallying when Bitcoin is in a downturn. This negative correlation positions ZEC as a potential hedge during broader market volatility.

Price Prediction Considerations

Many experts predict that ZEC could reach $1,000 this year, based on several factors.

- Short-term (2025): Analysts at FXstreet expect a potential breakout above the $700 resistance zone, with targets set toward $800 and as high as $1,000 by year-end if bullish momentum and institutional interest hold. Support is firm near the $600 level.

- Medium-term (2026): Forecasts remain positive, projecting potential sustained growth if new technical features and privacy utility gains persist. Average price targets mentioned in various models range between $700 and $820.

- Long-term (2027+): Key drivers include regulatory adaptability, the upcoming halving event, and a potential shift to Proof-of-Stake. Highly speculative long-term targets mentioned in positive cases reach as high as $4,000–$5,800.

Timing Your Entry

Best practices to time your entry are:

- Avoid buying large amounts after fast price surges, wait for the price to settle or drop slightly.

- Use dollar-cost averaging (DCA) to lower the risk of bad timing

- Watch support and resistance zones ($600 is a main support, $700–$960 is resistance).

- Monitor major news: protocol upgrades, rule changes, and privacy adoption trends.

- Periods of high liquidity (after the halving, institutional quarterly reporting) can create both buying opportunities and quick corrections.

Zcash is currently in a period of high movement and new ideas. Successful buying comes from patience, staged buying, and watching the overall privacy tech and regulation landscape; do not chase price spikes.

What to Do After Buying Zcash

Once you’ve purchased ZEC, your next steps matter just as much as the buy itself. Here’s how to lock things down, stay organised, and start using Zcash the right way.

First hour checklist

Right after your purchase, your goal is simple: secure what you just bought. Move your ZEC to a wallet you control, save your recovery phrase in a safe offline location, and enable two-factor authentication everywhere it’s supported. This sets a strong foundation before you take the next steps.

Week 1 setup

Once the basics are in place, spend the first week getting familiar with how ZEC actually works. Test a small transfer, set up your preferred wallet features, and explore backup options so you know you can restore your funds if anything goes wrong. This is the stage where you shift from “I bought ZEC” to “I’m comfortable managing it.”

Long-term ZEC strategy

After the initial setup, it’s time to think long term. Decide whether you want to accumulate slowly through Dollar-Cost Averaging, trade actively, or simply hold for the privacy benefits. Whatever your plan, keep it realistic and consistent. Successful ZEC holders focus on security, steady buying habits, and avoiding emotional decisions during volatility.

Using shielded transactions

Once you’re confident with the basics, you can start using Zcash’s privacy tools. Shielded transactions hide the sender, receiver, and amount, giving you the full privacy ZEC is known for. Try a small shielded transfer first to understand the workflow, then make it your default method when privacy is a priority.

Wrapping Up: Your Zcash Journey

Buying, storing, and using Zcash (ZEC) in 2025 is simple now that major exchanges support it and the rules are more predictable. You can choose the method that fits your style: quick card purchases, low-fee bank transfers, or more private P2P and DEX options. Just make sure you complete KYC on centralised platforms and understand the fees before you start.

Once you’ve bought ZEC, the real work is in how you protect and manage it. To get the most out of Zcash’s privacy features, move your coins to a self-custody wallet and use shielded transactions. If you’re thinking long term, strategies like Dollar-Cost Averaging can help smooth out market swings. The people who do best with ZEC are the ones who take security seriously: good backups, strong 2FA, and a well-balanced portfolio. Staying informed and organised goes a long way.